Performance!

Performance!

Performance!

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

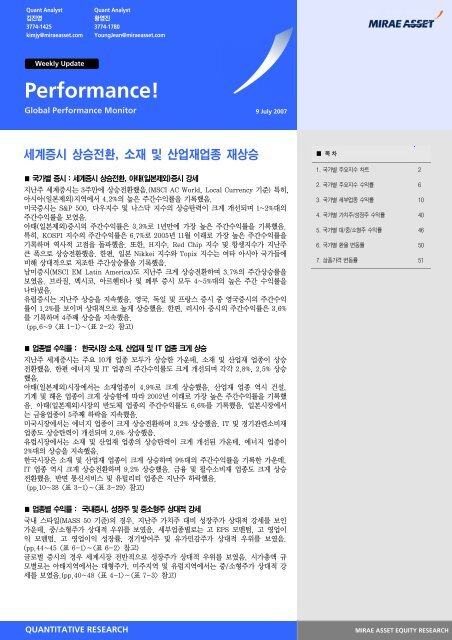

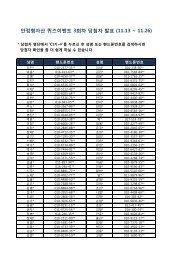

<strong>Performance</strong>!Quant Analyst 김진영 • 3774-1425 • kimjy@miraeasset.com 국가별 주요지수 수익률 : Local Index 기준 (최근 1주일 수익률 순)Current<strong>Performance</strong>Country Index 7/6 1W 1M 3M 6M 12M YTD52-wk.High52-wk.Low 2Y 3Y 5Y(pt) (%) (%) (%) (%) (%) (%) (%) (%) (%) (%) (%)Thailand SET 832.4 7.16 9.61 20.20 32.50 20.82 22.44 0.00 34.96 26.14 25.23 107.52Korea KOSPI 1,861.0 6.73 6.82 25.39 34.30 47.24 29.74 0.00 50.88 82.63 145.36 136.22Turkey ISE National 100 49,895.3 5.95 8.80 8.83 29.82 39.77 27.55 0.00 52.57 79.60 173.58 433.57Hong Kong HS China Enterprise 12,681.4 5.67 14.99 28.62 23.90 86.57 22.64 0.00 93.40 158.00 187.91 471.13Egypt Hermes Financial 72,679.4 4.32 4.30 13.25 15.50 51.83 18.58 0.00 67.81 68.17 400.64 1,267Korea KOSDAQ 811.1 4.16 8.13 21.78 34.65 42.27 33.81 -1.09 50.45 57.06 116.08 24.82Indonesia Jakarta Composite 2,227.1 4.10 5.93 17.48 21.53 66.20 23.35 0.00 73.92 99.23 189.88 351.94Russia RTS 1,974.7 4.06 8.28 1.45 2.74 28.57 2.74 -1.68 35.95 166.76 249.58 423.48Mexico IPC 32,411.8 4.05 2.30 10.35 24.01 61.67 22.55 0.00 76.84 135.04 220.24 401.51Slovenia SBI 20 10,961.7 3.79 13.70 35.27 63.54 108.19 71.77 -0.05 112.51 145.85 145.38 279.24Brazil Bovespa 56,443.0 3.77 8.44 21.00 33.61 54.50 26.92 0.00 62.20 130.23 166.39 436.38Hong Kong Red Chip 4,279.9 3.59 16.32 22.57 26.80 82.31 28.52 0.00 88.33 160.34 213.13 252.17Romania BET Index 10,010.0 3.56 15.20 16.08 16.06 35.25 24.35 -1.60 36.47 102.00 207.08 760Hong Kong Hang Seng 22,531.7 3.49 8.23 11.49 11.48 37.05 12.86 0.00 40.44 59.24 83.42 108.51Taiwan TWSE 9,188.3 3.43 10.51 14.79 17.26 37.98 17.44 0.00 46.83 47.67 60.25 74.84Greece Athex Composite 5,001.3 3.25 2.63 6.56 9.67 38.73 13.82 0.00 42.62 61.22 113.89 127.55South Africa JSE All Share 29,218.3 3.11 2.38 6.06 20.43 37.54 17.27 -0.99 44.79 102.98 189.75 177.26Argentina Merval 2,249.0 2.65 1.94 5.71 8.97 31.18 7.58 -0.15 41.41 65.83 131.88 487.59Israel ISRAEL TA 100 1,134.2 2.62 1.45 10.83 20.79 35.90 23.05 -0.09 48.59 72.66 89.25 220.75Philippines PSE Composite 3,758.8 2.55 5.28 14.10 25.45 68.72 26.03 -1.14 72.80 107.32 136.26 235.69Peru Lima General 22,936.1 2.55 8.91 26.43 81.39 168.97 78.02 -0.26 170.00 464.73 698.49 1,944.10Denmark OMX 487.7 2.44 2.39 8.25 14.76 38.68 15.17 0.00 43.89 50.78 101.60 142.99US NASDAQ 2,666.5 2.43 3.07 7.90 9.54 23.73 10.40 0.00 31.98 28.90 35.81 84.11Finland OMX Helsinki (OMXH) 11,621.6 2.42 2.24 10.72 23.56 34.58 20.74 -0.07 42.00 57.84 101.55 87.06Poland WIG 67,568.5 2.26 6.36 16.13 36.34 60.91 34.03 0.00 62.78 133.73 185.88 380.98US Russell 2000 852.3 2.23 1.32 4.79 9.85 18.27 8.21 -0.33 26.84 31.47 48.90 93.30India Sensex 14,964.1 2.14 4.97 16.40 7.96 38.97 8.54 0.00 49.53 105.34 203.62 349.29Austria ATX 4,971.4 2.10 3.99 6.14 12.44 29.28 11.38 0.00 39.53 61.19 150.14 303.65Czech Rep. PX50 1,897.6 2.07 3.21 8.17 18.61 37.94 19.43 0.00 43.66 55.44 138.27 365.33US S&P 500 1,530.4 1.80 0.86 6.00 8.56 20.12 7.91 -0.57 23.97 28.08 37.11 54.74Sweden Stockholm All Share 417.3 1.73 -0.68 3.07 11.97 34.59 11.44 -1.48 44.61 61.26 99.36 127.81Ireland Overall Index 9,451.2 1.56 -0.26 0.35 0.19 24.66 0.46 -5.31 31.53 44.41 75.02 109.33Pakistan KSE 100 13,985.9 1.55 5.86 19.99 37.83 41.04 39.29 0.00 47.15 85.73 159.45 676.79Canada S&P/TSX Composite 14,118.7 1.53 1.27 5.17 13.15 21.69 9.38 -0.41 23.65 39.62 66.40 98.51US DJ Industrial 13,611.7 1.51 1.08 8.37 9.79 21.26 9.22 -0.47 26.75 32.53 33.20 45.12Malaysia KLP Composite 1,373.8 1.44 0.11 7.42 22.74 49.33 25.32 -1.27 52.19 52.19 61.29 84.50Lituania OMX Vilnius 540.3 1.39 8.25 7.97 7.06 38.94 9.68 -0.21 47.59 31.36 165.97 545.31Netherlands AEX All Share 853.5 1.28 2.95 6.92 14.41 28.15 13.98 0.00 32.71 45.75 74.07 36.74UK FTSE 100 6,690.1 1.24 2.57 4.58 7.56 13.58 7.54 -0.63 17.75 27.93 53.07 44.94Australia ASX 6,383.0 1.15 0.24 5.27 15.01 25.70 13.09 -0.59 30.76 50.75 79.73 101.72Norway Oslo All Share 593.5 1.12 6.44 12.90 21.22 34.61 18.13 -0.41 46.45 80.94 177.59 295.77Colombia CSE 10,746.6 1.02 5.58 -1.41 0.23 32.58 -3.71 -4.23 37.55 92.92 260.64 796.48Spain MSE General 1,657.2 1.02 0.60 -0.02 4.99 31.41 6.58 -2.88 36.67 56.03 95.92 124.21Italy MIB 30 42,664.0 1.02 0.64 0.70 2.63 16.87 2.63 -3.75 21.41 30.27 52.65 51.95Venezuela Venezuela General 40,081.4 0.97 3.80 -16.48 -32.54 29.83 -23.27 -35.37 29.83 82.91 60.00 462.81Hungary BUX 29,173.2 0.84 10.01 21.75 20.97 32.81 17.42 -0.91 40.26 48.89 150.62 276.65Portugal PSI General 4,356.3 0.84 5.10 16.55 24.36 47.57 24.98 0.00 49.81 90.67 106.92 141.95Slovakia SAX 413.2 0.82 4.63 -1.62 -0.58 10.94 -0.58 -3.34 10.94 -6.02 107.23 282.50France CAC 40 6,102.7 0.79 2.09 6.29 10.61 22.88 10.12 -1.06 28.90 42.59 66.71 57.97China Shanghai B 256.9 0.76 -9.46 37.75 92.50 174.30 97.44 -29.74 190.78 311.12 181.93 62.82Switzerland Swiss market index 9,264.0 0.59 -0.15 1.81 4.09 20.24 5.44 -2.81 24.16 46.84 66.92 53.78Germany Dax 30 8,048.3 0.51 4.12 13.36 22.07 41.31 22.00 -0.52 49.13 74.38 104.02 79.53Morocco MASI 11,524.7 0.48 -3.52 1.00 16.02 54.60 21.58 -9.42 63.72 149.31 160.81 269.43China Shenzhen B 675.2 0.45 2.32 25.14 52.81 131.52 55.82 -12.05 140.69 219.83 162.61 157.40Singapore Straits Times 3,562.0 0.39 -0.05 6.46 17.59 45.50 19.30 -2.13 53.52 59.43 90.01 116.99Kenya NSE 20 5,160.9 0.28 1.88 -1.04 -12.46 21.54 -8.59 -16.24 21.65 25.35 96.07 378.18Japan TOPIX 1,779.7 0.27 0.07 3.65 6.23 13.19 5.87 -2.05 20.63 50.36 54.89 70.64Belgium BSX All Share 14,384.2 0.23 1.06 2.00 6.61 24.78 6.63 -1.97 29.48 51.07 99.46 102.07Jordan Amman SE 5,774.6 0.23 -0.49 -4.48 4.65 -6.24 4.65 -11.75 8.33 -24.76 101.27 204.36Latvia OMX Riga 701.6 0.12 4.72 5.46 4.60 22.37 7.03 -3.42 22.37 44.21 114.39 249.21Japan Nikkei 225 18,140.9 0.01 0.55 3.75 6.14 18.40 5.31 -0.54 25.65 56.34 58.09 67.57Luxembourg LuxX Index 2,519.6 -0.48 0.15 5.21 15.62 40.70 15.64 -2.18 42.21 83.17 145.84 149.12New Zealand NZX 1,170.1 -0.48 -2.50 0.35 2.33 13.52 1.75 -3.83 19.22 13.43 29.55 55.73Chile IGPA General 14,961.7 -1.04 4.17 10.01 19.99 51.08 20.92 -1.64 55.33 58.06 97.77 203.15China Shanghai A 3,968.1 -1.04 0.21 13.60 42.82 116.68 40.96 -12.68 144.02 265.61 160.63 120.81China Shenzhen A 1,112.9 -1.14 -1.97 19.75 91.34 141.06 95.39 -17.75 182.09 337.21 190.56 109.05Vietnam Ho Chi Minh 1,010.5 -1.38 -3.33 -2.26 23.76 100.00 34.42 -13.68 152.76 308.96 308.67 404.00Croitia Crobex 4,759.7 -1.56 -3.20 8.60 47.24 75.11 48.30 -7.37 75.11 165.19 310.39 310.14Sri Lanka CSE All Share 2,524.0 -1.88 -1.21 -9.50 -7.87 19.27 -7.29 -16.33 19.27 33.44 85.56 248.30주 : 수익률 산정은 7/6일 기준임.자료 : Factset, 미래에셋증권 리서치센터9 July 2007 MIRAE ASSET QUANTITATIVE RESEARCH7

<strong>Performance</strong>!Quant Analyst 김진영 • 3774-1425 • kimjy@miraeasset.com 국가별 주요지수 수익률 : MSCI Index (Local Currency) 기준Country Weight # Co's <strong>Performance</strong> 12mth Fw.PER1W 1M 3M 6M 12M YTD52-wk. 52-wk.Rel.2Y 3Y 5Y 7/6High Lowto Mkt.(%) (%) (%) (%) (%) (%) (%) (%) (%) (%) (%) (%) (X) (X)AC World 100.0 2,721 1.65 1.71 5.91 9.93 22.41 9.39 0.00 27.24 39.06 55.66 67.13 15.08 1.00World 90.6 1,882 1.43 1.18 5.13 9.00 20.83 8.56 -0.32 25.52 36.00 51.31 61.57 15.23 1.01EAFE 43.8 1,145 1.00 1.43 4.43 8.92 21.22 8.87 -0.19 27.09 45.00 66.90 63.42 14.60 0.97Pacific 13.2 560 0.76 0.44 4.22 8.49 19.05 7.91 -0.38 25.87 55.85 66.93 78.07 17.48 1.16North America 46.8 737 1.82 0.96 5.82 9.10 20.46 8.31 -0.51 24.35 29.16 39.91 58.59 15.85 1.05Europe 30.6 585 1.11 1.89 4.54 9.17 22.32 9.35 -0.68 27.74 40.47 66.87 57.68 13.63 0.90EM 9.4 839 3.91 7.03 14.05 19.90 40.81 18.10 0.00 47.55 82.60 129.30 179.85 13.73 0.91EM Asia 5.1 500 4.55 8.24 18.91 22.26 46.88 21.14 0.00 53.21 77.75 111.66 140.91 15.09 1.00EM Latin America 1.9 126 3.69 6.10 15.23 26.51 49.49 22.54 0.00 59.36 111.82 177.04 336.49 12.42 0.82EM Europe 1.4 91 3.58 8.91 5.30 7.42 21.20 6.21 0.00 29.08 84.94 154.50 303.33 11.86 0.79AC Asia-Pacific 18.3 1,060 1.78 2.48 7.84 11.92 25.36 11.21 0.00 32.14 61.54 76.20 89.66 16.75 1.11AC Asia-Pac. ex. Jp. 9.1 678 3.29 5.08 12.18 18.00 37.44 16.96 0.00 43.41 63.17 95.68 116.26 15.56 1.03AC Asia ex. Jp. 6.3 581 4.22 7.20 16.12 20.18 45.01 19.57 0.00 51.05 71.29 104.41 129.99 15.45 1.02Australia 2.7 87 1.29 0.64 4.22 13.88 22.89 11.92 -0.69 28.77 48.76 80.53 96.30 15.65 1.04Hong Kong 0.8 44 4.63 5.43 6.06 9.05 31.56 10.07 0.00 35.62 44.00 74.04 91.73 16.91 1.12Japan 9.2 382 0.33 0.03 3.99 6.76 16.16 6.31 -1.70 23.52 58.59 62.89 73.48 18.13 1.20New Zealand 0.1 10 -0.68 -1.65 1.15 2.50 12.61 1.39 -3.53 19.48 6.96 21.34 49.64 15.38 1.02Singapore 0.5 37 0.20 -0.35 6.48 18.78 50.43 20.12 -2.51 58.91 64.47 93.79 113.81 17.19 1.14China 1.2 87 4.68 13.89 25.53 26.44 83.81 26.41 0.00 89.76 152.59 189.65 293.90 18.40 1.22India 0.6 63 1.84 4.67 16.90 8.05 40.44 8.70 0.00 51.34 103.32 194.74 322.81 18.44 1.22Indonesia 0.1 24 5.30 7.68 15.04 16.89 56.56 18.55 0.00 65.37 91.15 194.10 386.13 14.07 0.93Korea 1.5 96 6.86 6.06 21.29 31.15 40.67 26.98 0.00 44.91 75.89 121.26 118.86 13.07 0.87Malaysia 0.3 55 1.85 -0.17 6.75 23.84 51.91 26.58 -1.16 55.54 56.67 62.18 85.76 16.46 1.09Pakistan 0.0 14 -0.61 1.28 16.15 34.96 35.57 37.77 -1.24 42.79 68.93 137.23 396.50 12.21 0.81Philippines 0.1 17 2.84 5.01 14.60 25.59 71.74 26.35 -1.35 76.21 109.79 135.59 213.81 18.06 1.20Sri Lanka 0.0 9 -2.14 -0.84 -8.99 -9.06 26.56 -8.74 -17.41 29.02 33.56 79.42 226.40 6.88 0.46Taiwan 1.2 110 3.15 9.58 14.19 14.08 31.47 14.14 0.00 40.53 40.14 49.67 56.61 14.08 0.93Thailand 0.1 34 8.71 10.73 20.24 35.21 22.99 23.73 0.00 38.03 30.86 34.29 141.31 11.94 0.79AC Americas 48.7 863 1.90 1.15 6.15 9.68 21.34 8.79 -0.33 25.37 30.98 42.33 62.04 15.71 1.04Canada 3.5 109 1.22 1.35 4.58 12.53 22.30 8.83 -0.80 24.24 41.12 68.79 100.24 15.77 1.05US 43.3 628 1.87 0.92 5.91 8.86 20.34 8.27 -0.53 24.42 28.44 38.37 56.51 15.83 1.05Argentina 0.1 11 4.77 2.75 8.56 10.86 35.97 9.11 0.00 49.36 140.86 300.90 646.81 NA NABrazil 1.1 52 4.17 8.04 18.10 28.29 44.98 21.75 0.00 54.33 112.38 172.03 349.60 10.40 0.69Chile 0.1 27 -1.72 3.74 10.75 22.41 55.36 23.25 -2.10 61.26 57.36 101.70 205.76 20.28 1.34Colombia 0.0 6 0.79 7.65 4.13 1.67 13.34 -3.17 -3.66 21.56 84.78 204.61 718.82 20.74 1.37Mexico 0.6 25 4.05 2.91 11.18 23.89 55.27 22.89 0.00 70.62 124.60 204.50 359.22 15.10 1.00Peru 0.1 5 5.87 12.02 32.04 78.53 107.52 71.33 0.00 119.15 227.74 258.31 605.69 15.55 1.03Venezuela 0.0 4 0.52 0.29 -21.39 -36.91 -1.49 -33.77 -38.56 6.77 17.53 13.18 298.24 NA NAAC Europe 32.0 676 1.21 2.17 4.58 9.11 22.29 9.24 -0.34 27.74 41.45 68.46 60.26 13.54 0.90Austria 0.3 16 0.47 0.50 1.79 7.98 25.10 7.82 -2.18 33.30 52.37 126.88 240.20 13.04 0.86Belgium 0.5 20 0.10 1.16 -0.64 3.82 21.74 4.07 -2.83 26.56 40.86 79.94 67.99 12.25 0.81Denmark 0.4 21 2.60 1.78 6.38 13.52 38.33 13.91 -0.63 43.94 64.55 104.72 126.04 16.78 1.11Finland 0.7 23 2.23 1.84 12.99 27.39 34.90 24.31 -1.08 43.48 55.82 94.28 61.68 14.38 0.95France 4.5 64 0.84 1.71 5.19 9.57 22.44 9.23 -1.39 28.44 42.27 66.91 55.89 13.46 0.89Germany 3.7 52 0.81 4.21 10.73 19.72 38.85 19.73 -0.26 46.93 66.42 90.54 63.10 13.88 0.92Greece 0.3 16 2.83 1.31 4.69 5.51 32.25 10.44 -1.27 35.78 49.84 106.47 125.55 13.90 0.92Ireland 0.4 15 1.84 1.45 3.01 0.86 22.66 0.73 -4.44 30.06 41.25 60.67 83.09 13.10 0.87Italy 1.7 33 0.73 -0.32 -1.01 0.45 13.15 0.72 -4.95 17.34 24.17 48.50 50.28 12.74 0.84Netherlands 1.5 24 0.93 1.95 4.27 12.81 28.28 13.11 -0.38 33.98 43.43 69.18 25.38 13.87 0.92Norway 0.5 23 1.37 6.51 9.59 19.25 33.61 15.68 -0.41 46.51 64.00 130.60 198.81 13.96 0.93Portugal 0.2 11 0.17 4.69 11.54 17.03 37.87 17.64 -0.54 39.67 71.01 74.76 87.09 17.42 1.16Spain 1.8 31 1.04 0.51 0.77 4.58 28.91 6.15 -2.94 34.43 49.72 82.17 105.35 13.26 0.88Sweden 1.2 46 1.89 -0.71 3.82 13.27 36.53 12.74 -1.34 47.52 55.42 93.12 128.42 14.77 0.98Switzerland 2.9 35 0.74 0.04 1.96 4.27 21.01 5.56 -2.61 25.10 47.74 68.31 58.60 14.31 0.95UK 10.1 155 1.31 2.46 4.09 7.34 13.95 7.42 -0.63 18.41 27.27 51.45 44.22 12.96 0.86Czech 0.1 7 2.64 5.71 12.56 24.09 43.29 23.22 0.00 48.99 74.40 182.27 413.17 16.59 1.10Hungary 0.1 4 0.43 11.01 21.83 21.77 32.63 16.81 -1.70 41.40 42.21 139.87 266.88 12.65 0.84Poland 0.2 25 3.69 5.82 9.78 21.53 34.93 19.40 0.00 37.91 73.12 125.08 215.59 15.62 1.04Russia 0.9 25 3.58 9.55 2.03 -0.09 14.42 -0.76 -0.91 24.73 121.04 171.47 317.91 10.87 0.72Turkey 0.1 30 6.23 8.87 7.55 28.88 37.70 26.54 -0.11 52.72 71.92 151.68 395.76 10.98 0.73Israel 0.2 32 0.87 3.24 9.59 20.62 25.74 21.72 -0.16 34.79 34.27 36.61 133.39 15.06 1.00South Africa 0.7 47 1.62 -0.21 0.09 14.03 28.73 10.21 -4.84 36.73 83.97 154.47 127.30 11.83 0.78Egypt 0.1 19 4.71 4.29 12.72 13.87 52.77 17.09 0.00 68.07 60.87 468.63 1,564.76 12.63 0.84GCC Countries 0.5 132 3.01 2.54 11.52 11.67 -14.77 12.46 -14.77 19.82 -25.44 NA NA NA NABahrain 0.0 6 0.63 0.29 10.09 -2.41 11.88 -2.23 -6.29 12.87 -16.46 NA NA NA NAKuwait 0.2 46 2.85 7.49 21.94 40.61 49.01 40.61 0.00 58.72 50.74 NA NA NA NAOman 0.0 9 0.30 0.41 15.48 5.47 13.86 6.94 -0.53 20.23 -20.80 NA NA NA NAQatar 0.0 16 4.96 5.62 27.74 12.96 -3.20 13.32 -8.59 33.89 -30.84 NA NA NA NASaudi Arabia 0.2 30 3.25 -2.57 -2.11 -4.30 -43.88 -4.30 -43.88 5.78 -46.39 NA NA NA NAUnited Arab Emirates 0.1 25 2.44 2.95 19.53 5.35 0.49 9.53 -13.19 24.34 -38.14 NA NA NA NA주 1) 수익률 및 1년 예상 PER 산정은 7/6일 기준임. MSCI Benchmark Index별 구성국가는 p.45 Appendix 참고.주 2) GCC 국가들의 시가총액 비중은 GCC Countries Index 시가총액 대비 국가 비중임.자료 : MSCI, Factset, I/B/E/S, 미래에셋증권 리서치센터9 July 2007 MIRAE ASSET QUANTITATIVE RESEARCH8

<strong>Performance</strong>!Quant Analyst 김진영 • 3774-1425 • kimjy@miraeasset.com 국가별 주요지수 수익률 : MSCI Index (USD) 기준Country Weight # Co's <strong>Performance</strong> 12mth Fw.PER1W 1M 3M 6M 12M YTD52-wk. 52-wk.Rel.2Y 3Y 5Y 7/6High Lowto Mkt.(%) (%) (%) (%) (%) (%) (%) (%) (%) (%) (%) (%) (X) (X)AC World 100.0 2,721 2.05 2.05 6.70 12.07 25.45 10.92 0.00 31.39 45.33 61.37 87.33 15.08 1.00World 90.6 1,882 1.81 1.47 5.79 10.99 23.59 9.96 0.00 29.37 41.86 56.09 80.26 15.23 1.01EAFE 43.8 1,145 1.67 1.93 5.02 12.08 26.51 10.87 -0.02 34.62 56.52 75.01 105.86 14.60 0.97Pacific 13.2 560 1.19 -0.36 2.40 7.80 16.65 7.27 -0.45 25.04 49.84 59.03 91.13 17.48 1.16North America 46.8 737 1.95 1.04 6.53 10.00 20.99 9.13 -0.44 25.08 30.60 41.98 61.87 15.85 1.05Europe 30.6 585 1.88 2.96 6.19 14.03 31.26 12.50 0.00 39.19 59.83 82.84 112.99 13.63 0.90EM 9.4 839 4.37 8.00 16.36 23.72 47.55 21.18 0.00 55.70 95.58 157.60 239.05 13.73 0.91EM Asia 5.1 500 4.87 8.66 20.67 24.31 51.42 22.98 0.00 59.41 88.69 135.69 173.82 15.09 1.00EM Latin America 1.9 126 4.41 8.01 20.53 36.10 63.49 30.85 0.00 75.17 142.06 268.85 444.72 12.42 0.82EM Europe 1.4 91 4.02 9.99 6.52 10.61 28.26 8.61 0.00 36.74 95.52 174.26 371.48 11.86 0.79AC Asia-Pacific 18.3 1,060 2.18 1.98 6.83 11.88 24.38 11.18 -0.14 32.71 58.76 73.56 107.32 16.75 1.11AC Asia-Pac. ex. Jp. 9.1 678 3.85 5.99 14.71 22.82 46.49 21.18 0.00 53.42 77.32 120.90 172.72 15.56 1.03AC Asia ex. Jp. 6.3 581 4.53 7.59 17.42 21.79 48.85 20.99 0.00 56.23 80.88 123.72 156.27 15.45 1.02Australia 2.7 87 2.39 2.55 9.08 25.29 41.36 21.77 -0.13 47.59 71.83 116.71 202.03 15.65 1.04Hong Kong 0.8 44 4.63 5.35 6.03 8.67 30.77 9.50 0.00 34.89 43.18 73.63 91.28 16.91 1.12Japan 9.2 382 0.58 -1.72 0.06 2.89 8.56 2.83 -4.97 17.65 43.95 44.44 69.25 18.13 1.20New Zealand 0.1 10 0.81 2.73 9.61 16.76 45.79 12.76 -0.79 46.35 24.03 46.14 141.55 15.38 1.02Singapore 0.5 37 0.82 0.52 5.99 20.02 56.53 21.24 -1.45 66.77 83.37 118.51 148.66 17.19 1.14China 1.2 87 4.68 13.80 25.50 25.99 82.70 25.75 0.00 88.70 151.14 188.97 292.97 18.40 1.22India 0.6 63 2.55 5.29 24.07 18.37 60.25 18.95 0.00 75.84 119.08 235.23 410.26 18.44 1.22Indonesia 0.1 24 5.19 6.01 15.74 16.48 57.85 17.88 0.00 69.21 106.75 192.31 376.18 14.07 0.93Korea 1.5 96 7.36 6.92 23.01 33.26 45.30 28.42 0.00 50.95 100.55 177.87 186.76 13.07 0.87Malaysia 0.3 55 1.96 -1.01 6.81 26.12 61.49 29.48 -2.47 66.39 72.61 78.69 104.67 16.46 1.09Pakistan 0.0 14 -0.47 1.65 16.84 36.29 35.31 38.90 -1.27 42.54 66.85 128.74 394.36 12.21 0.81Philippines 0.1 17 3.23 4.67 19.51 33.15 96.54 34.40 -1.14 101.73 155.55 185.98 245.48 18.06 1.20Sri Lanka 0.0 9 -2.30 -1.55 -11.61 -11.40 17.96 -12.10 -19.49 20.27 19.64 64.93 181.36 6.88 0.46Taiwan 1.2 110 3.31 10.28 15.13 13.31 30.01 13.34 0.00 40.71 36.35 53.16 60.25 14.08 0.93Thailand 0.1 34 10.29 12.50 23.33 42.98 37.92 31.43 0.00 46.63 59.95 60.97 195.14 11.94 0.79AC Americas 48.7 863 2.04 1.30 7.02 10.84 22.23 9.85 -0.25 26.49 32.94 45.37 66.32 15.71 1.04Canada 3.5 109 2.87 2.47 14.88 26.40 29.68 21.00 0.00 35.05 66.60 114.21 191.74 15.77 1.05US 43.3 628 1.87 0.92 5.91 8.86 20.34 8.27 -0.53 24.42 28.44 38.37 56.51 15.83 1.05Argentina 0.1 11 4.20 1.79 8.35 9.93 35.12 7.74 -0.60 49.16 123.66 280.02 760.92 NA NABrazil 1.1 52 5.35 11.33 26.06 44.62 66.45 36.49 0.00 79.84 166.19 334.79 577.06 10.40 0.69Chile 0.1 27 -0.80 4.78 13.83 27.00 60.48 25.71 -1.42 68.77 76.05 145.15 306.42 20.28 1.34Colombia 0.0 6 0.79 3.86 15.43 15.59 48.57 10.76 -2.93 57.82 121.30 315.82 916.99 20.74 1.37Mexico 0.6 25 4.10 3.48 13.33 25.56 59.61 23.35 -0.01 74.44 124.29 224.42 321.60 15.10 1.00Peru 0.1 5 5.91 12.09 32.28 79.03 109.57 71.87 0.00 120.96 229.30 276.61 651.63 15.55 1.03Venezuela 0.0 4 0.52 0.29 17.08 -1.95 15.21 3.12 -11.33 72.80 43.02 35.22 138.41 NA NAAC Europe 32.0 676 1.97 3.25 6.21 13.91 31.14 12.36 0.00 39.06 60.56 84.34 115.82 13.54 0.90Austria 0.3 16 1.41 1.53 3.27 13.28 33.72 11.45 -1.10 45.45 74.14 152.00 376.44 13.04 0.86Belgium 0.5 20 1.04 2.21 0.80 8.92 30.13 7.58 -2.57 38.10 60.98 99.87 135.27 12.25 0.81Denmark 0.4 21 3.57 2.91 8.12 19.29 48.24 17.97 0.00 57.22 88.40 127.22 216.00 16.78 1.11Finland 0.7 23 3.18 2.89 14.63 33.65 44.20 28.51 -0.14 56.31 78.09 115.80 126.42 14.38 0.95France 4.5 64 1.79 2.76 6.72 14.95 30.88 12.92 0.00 40.15 62.60 85.39 118.31 13.46 0.89Germany 3.7 52 1.75 5.28 12.34 25.60 48.42 23.77 -0.19 60.33 90.20 111.64 128.42 13.88 0.92Greece 0.3 16 3.79 2.35 6.21 10.69 41.36 14.17 0.00 47.85 71.25 129.33 215.87 13.90 0.92Ireland 0.4 15 2.79 2.49 4.50 5.81 31.11 4.13 -2.97 41.91 61.43 78.46 156.41 13.10 0.87Italy 1.7 33 1.67 0.71 0.43 5.38 20.95 4.12 -3.99 28.04 41.91 64.95 110.46 12.74 0.84Netherlands 1.5 24 1.87 3.00 5.78 18.35 37.13 16.93 -0.19 46.10 63.92 87.91 75.59 13.87 0.92Norway 0.5 23 3.22 10.01 14.65 30.88 43.56 24.17 0.00 65.94 87.73 173.39 286.58 13.96 0.93Portugal 0.2 11 1.10 5.77 13.16 22.77 47.38 21.61 -0.48 52.40 95.44 94.11 162.01 17.42 1.16Spain 1.8 31 1.98 1.54 2.23 9.71 37.79 9.73 -1.40 46.69 71.11 102.35 187.58 13.26 0.88Sweden 1.2 46 3.99 2.30 6.69 17.64 46.18 14.82 0.00 62.81 82.05 115.31 218.59 14.77 0.98Switzerland 2.9 35 1.38 0.02 1.56 6.03 22.29 5.81 -3.00 28.76 58.02 70.91 96.17 14.31 0.95UK 10.1 155 1.65 3.56 6.27 12.10 24.91 10.49 0.00 30.57 45.75 65.73 90.85 12.96 0.86Czech 0.1 7 3.96 5.98 11.20 25.66 52.31 22.44 0.00 59.80 109.48 247.91 637.13 16.59 1.10Hungary 0.1 4 1.35 15.44 23.63 31.83 62.21 23.51 -1.16 75.28 63.60 171.53 423.59 12.65 0.84Poland 0.2 25 4.76 9.03 13.70 31.44 54.71 25.78 0.00 61.42 114.14 200.31 377.45 15.62 1.04Russia 0.9 25 3.64 9.67 2.19 0.37 15.08 -0.33 -0.49 25.38 124.40 174.91 323.19 10.87 0.72Turkey 0.1 30 7.46 11.56 13.79 43.60 66.86 38.84 0.00 88.20 79.57 180.86 520.74 10.98 0.73Israel 0.2 32 1.12 0.58 7.13 20.39 29.74 21.14 -2.73 42.13 43.98 43.47 159.25 15.06 1.00South Africa 0.7 47 2.56 2.94 2.25 18.09 32.19 11.21 -5.23 46.61 79.89 128.11 227.88 11.83 0.78Egypt 0.1 19 4.60 4.34 12.66 14.08 54.22 17.36 0.00 69.42 63.29 520.95 1,253.39 12.63 0.84GCC Countries 0.5 132 3.00 2.53 11.64 11.80 -14.68 12.58 -14.68 19.96 -25.19 NA NA NA NABahrain 0.0 6 0.63 0.29 10.09 -2.41 11.88 -2.23 -6.29 12.87 -16.46 NA NA NA NAKuwait 0.2 46 2.83 7.47 22.36 41.10 49.53 41.07 0.00 59.27 52.75 NA NA NA NAOman 0.0 9 0.30 0.41 15.46 5.46 13.85 6.93 -0.53 20.22 -20.81 NA NA NA NAQatar 0.0 16 4.96 5.61 27.75 13.00 -3.19 13.34 -8.58 33.92 -30.87 NA NA NA NASaudi Arabia 0.2 30 3.25 -2.57 -2.11 -4.31 -43.88 -4.31 -43.88 5.78 -46.39 NA NA NA NAUnited Arab Emirates 0.1 25 2.43 2.94 19.48 5.35 0.49 9.53 -13.20 24.31 -38.14 NA NA NA NA주 1) 수익률 및 1년 예상 PER 산정은 7/6일 기준임. MSCI Benchmark Index별 구성국가는 p.45 Appendix 참고.주 2) GCC 국가들의 시가총액 비중은 GCC Countries Index 시가총액 대비 국가 비중임.자료 : MSCI, Factset, I/B/E/S, 미래에셋증권 리서치센터9 July 2007 MIRAE ASSET QUANTITATIVE RESEARCH9

<strong>Performance</strong>!Quant Analyst 김진영 • 3774-1425 • kimjy@miraeasset.com3. 지역별 / 국가별 세부업종 수익률 지역별 세부업종 지수 수익률 : 세계 (MSCI AC World)Industry Weight # Co's <strong>Performance</strong> 12mth Fw.PER1W 1M 3M 6M 12M YTD 52-wk.High52-wk.Low2Y 3Y 5Y 7/6Rel.to Mkt.(%) (%) (%) (%) (%) (%) (%) (%) (%) (%) (%) (%) (X) (X)Market 100 2,721 1.7 1.7 5.9 9.9 22.4 9.4 0.0 27.2 39.1 55.7 67.1 15.1 1.0Energy 10.4 162 2.8 6.0 14.5 20.8 18.9 15.9 0.0 31.0 40.7 95.6 107.4 12.6 0.8Materials 7.5 289 3.3 5.5 13.0 29.1 40.6 24.9 0.0 47.7 89.7 117.3 127.7 13.8 0.9Chemicals 2.4 96 1.3 6.1 10.4 20.1 36.8 19.2 0.0 42.2 59.0 83.8 85.9 16.4 1.1Metals & Mining 4.1 113 5.1 6.4 15.9 39.9 45.7 31.9 0.0 60.4 134.7 180.6 213.9 12.2 0.8Paper & Forest Products 0.4 26 0.5 -0.1 3.7 8.9 22.4 8.4 -1.4 26.5 32.7 14.9 7.8 19.3 1.3Industrials 11.0 439 1.9 3.0 11.4 18.7 29.9 18.0 0.0 37.9 55.6 73.1 90.0 16.8 1.1Building Products 0.4 19 1.6 3.2 7.5 18.5 30.8 16.9 0.0 42.5 56.1 69.2 86.8 16.9 1.1Construction & Engineering 0.7 47 3.7 3.0 10.0 27.7 47.5 25.4 0.0 57.1 93.9 172.3 215.8 19.6 1.3Electrical Equipment 0.8 29 1.9 4.7 14.8 21.7 37.8 19.9 -0.4 50.2 100.4 126.3 132.2 18.8 1.2Machinery 2.0 82 2.6 4.4 18.8 34.7 45.8 32.0 -0.3 59.4 101.4 128.0 173.0 17.0 1.1Trading Companies & Distrib 0.6 20 2.4 0.8 16.8 34.0 37.3 30.9 -1.2 49.0 95.0 153.9 187.2 13.1 0.9Commercial Services & Supp 0.8 47 1.4 1.7 5.8 7.0 16.3 6.8 -0.1 22.4 25.6 32.2 33.0 18.6 1.2Airlines 0.2 27 0.8 0.8 1.8 5.4 40.3 8.9 -2.1 49.4 63.7 56.8 53.4 12.5 0.8Marine 0.3 25 4.3 3.8 25.2 46.3 84.4 46.5 -0.3 95.7 79.6 132.8 270.9 14.2 0.9Road & Rail 0.8 31 1 -1 4.5 15.2 19.2 15.1 -3.2 27.3 67.1 85.5 94.7 17.0 1.1Consumer Discretionary 10.7 434 1.7 1.7 3.9 7.7 25.0 7.6 0.0 32.1 34.5 44.4 56.5 17.6 1.2Auto Components 0.5 28 1.1 5.8 10.6 19.1 38.8 16.9 -0.6 48.7 58.0 63.4 84.5 15.6 1.0Automobiles 1.7 31 1.1 6.1 10.4 11.4 40.1 11.1 -0.1 47.1 71.2 65.6 77.4 14.7 1.0Household Durables 1.2 63 1.6 -1.8 1.8 6.5 17.6 6.1 -3.7 26.4 25.0 39.0 25.9 16.5 1.1Textiles, Apparel & Luxury G 0.6 34 1.1 1.6 3.1 11.8 33.1 11.1 -1.0 41.8 47.8 73.1 109.5 18.3 1.2Hotels, Restaurants & Leisur 1.3 59 3.7 1.1 3.0 7.5 25.2 7.3 -0.8 34.4 38.4 61.1 91.7 20.3 1.3Media 2.7 100 1.0 0.6 2.5 4.3 21.4 4.6 -1.2 26.6 26.2 30.6 38.2 20.3 1.3Retailing 2.3 97 2.3 1.0 1.1 6.4 19.4 6.5 -1.0 27.6 23.7 38.3 58.8 17.0 1.1Consumer Staples 7.6 205 0.7 -0.1 1.6 7.0 18.3 7.2 -1.7 19.8 31.0 38.3 37.2 17.9 1.2Food & Staples Retailing 2.0 50 1.0 -0.8 0.0 7.0 15.5 8.0 -2.6 18.5 22.7 31.4 12.2 17.8 1.2Food, Beverage & Tobacco 4.4 131 0.5 0.6 2.9 8.6 20.7 8.4 -1.2 21.8 36.9 46.0 46.8 17.8 1.2Household & Personal Produ 1.2 24 0.7 -1.7 -0.4 2.0 14.4 1.7 -2.9 15.9 25.1 25.0 42.0 18.9 1.3Health Care 7.9 140 0.7 -0.9 1.1 2.3 10.0 3.5 -3.1 11.9 15.9 25.4 33.4 16.4 1.1Biotechnology 0.7 14 -0.2 -2.6 0.1 -3.1 4.4 -0.5 -7.4 8.6 20.0 35.9 115.5 21.1 1.4Pharmaceuticals 4.8 45 0.2 -1.3 0.4 -0.5 5.1 1.2 -4.3 7.4 12.9 16.0 14.6 15.1 1.0Financials 24.7 554 1.2 -1.0 1.5 2.0 15.6 2.0 -2.5 20.2 36.7 53.5 62.4 12.3 0.8Banks 11.1 211 1.2 -0.7 1.1 0.5 11.5 1.0 -2.5 15.3 30.2 48.0 55.7 11.8 0.8Capital Markets 2.9 56 2.3 -0.2 5.1 6.5 25.3 6.5 -2.5 34.3 63.3 84.4 NA 12.2 0.8Insurance 4.8 92 0.5 -0.3 3.2 4.2 20.4 4.2 -1.8 25.0 37.4 48.0 44.0 11.3 0.8Information Technology 10.9 276 2.5 4.6 10.0 10.4 27 11.4 0.0 35.8 34.0 36.9 59.7 19.5 1.3Internet Software & Service 0.7 12 2.5 3.6 5.4 7.7 15.0 13.3 0.0 34.4 36.4 56.0 364.7 31.1 2.1IT Services 0.9 40 0.8 1.2 1.2 6.6 20.6 6.7 -0.2 28.6 40.0 42.2 17.5 20.5 1.4Software 1.8 31 1.9 1.0 6.7 5.9 28.4 6.1 -0.2 35.4 30.6 34.8 46.0 19.5 1.3Communications Equipment 2.0 25 1.9 4.8 10.9 10.2 26.7 12.2 0.0 38.6 33.7 30.5 85.7 19.4 1.3Computers & Peripherals 2.1 40 3.7 6.0 16.1 15.3 41.3 16.8 0.0 53.1 50.0 60.4 87.1 18.4 1.2Electronic Equip. & Instr. 1.0 60 1.2 5.7 8.9 11.4 26.0 12.1 -0.1 36.7 38.3 33.0 39.8 19.4 1.3Office Electronics 0.3 7 1.1 2.2 10.7 13.0 28.3 10.8 -0.9 37.4 68.8 61.5 109.3 17.3 1.1Semiconductors 2.1 61 3.8 8.3 12.2 11.4 22.1 11.6 0.0 32.0 17.3 20.6 29.8 18.6 1.2Telecom. Services 5.1 96 0.8 1.3 6.4 10.8 35 11.7 -0.5 40.4 39.1 53.7 68.0 15.7 1.0Diversified Telecom. Service 3.2 61 0.2 -0.4 2.7 7.1 30.4 7.7 -2.0 35.2 34.9 44.5 47.5 14.5 1.0Wireless Telecom. Services 1.9 35 1.7 4.3 13.1 17.5 42.3 19.0 -0.3 50.0 47.8 74.0 122.7 18.0 1.2Utilities 4.2 126 0.2 -0.5 0.0 9.2 28.1 7 -3.4 29.9 44.0 81.8 90.2 15.9 1.1Electric Utilities 2.3 53 0.2 -0.3 0.6 10.4 31.1 8.6 -3.5 33.2 46.5 84.9 105.7 16.1 1.1Gas Utilities 0.2 15 -0.3 -0.2 2.8 11.9 26.9 10.4 -1.6 29.8 44.1 62.9 79.2 17.8 1.2주 : 수익률 산정은 7/6일 기준임. 주가지수는 Local Currency기준임.자료 : MSCI, Factset, 미래에셋증권 리서치센터9 July 2007 MIRAE ASSET QUANTITATIVE RESEARCH10

<strong>Performance</strong>!Quant Analyst 김진영 • 3774-1425 • kimjy@miraeasset.com 지역별 세부업종 지수 수익률 : 선진국 (MSCI World)Industry Weight # Co's <strong>Performance</strong> 12mth Fw.PER1W 1M 3M 6M 12M YTD 52-wk.High52-wk.Low2Y 3Y 5Y 7/6Rel.to Mkt.(%) (%) (%) (%) (%) (%) (%) (%) (%) (%) (%) (%) (X) (X)Market 100 1,882 1.4 1.2 5.1 9.0 20.8 8.6 -0.3 25.5 36.0 51.3 61.6 15.2 1.0Energy 9.8 118 2.6 5.2 14.5 22.6 19.2 17.3 0.0 31.2 37.0 89.7 97.1 12.9 0.8Materials 6.8 168 3.0 5.5 12.5 27.4 38.4 23.4 0.0 45.3 83.9 109.6 117.9 14.6 1.0Chemicals 2.4 63 1.2 5.8 9.3 18.5 34.6 17.6 0.0 40.0 57.6 82.3 81.6 16.9 1.1Metals & Mining 3.5 62 4.8 6.6 16.7 38.8 43.6 30.7 0.0 58.0 129.2 174.2 215.1 12.9 0.8Paper & Forest Products 0.3 17 0.5 -1.4 2.4 8.1 19.3 7.8 -2.7 23.5 27.8 10.9 2.8 19.9 1.3Industrials 11.2 316 1.5 2.5 10.1 16.8 27.0 16.2 0.0 35.0 51.8 68.1 83.5 16.7 1.1Building Products 0.4 15 1.4 2.9 6.5 17.2 28.6 15.6 -0.4 40.4 53.2 65.2 81.3 16.8 1.1Construction & Engineering 0.5 29 1.5 -0.1 1.5 18.3 33.9 16.7 -3.5 43.4 73.3 139.3 171.5 18.9 1.2Electrical Equipment 0.8 21 1.8 4.2 14.3 21.2 36.6 19.3 -0.5 49.3 99.2 124.5 129.5 19.0 1.2Machinery 2.1 71 2.1 3.6 16.2 31.0 41.1 28.3 -0.2 54.8 92.8 117.0 159.9 17.0 1.1Trading Companies & Distrib 0.6 17 2.1 0.6 15.9 33.2 35.9 30.1 -1.6 47.9 91.4 150.9 183.3 12.8 0.8Commercial Services & Supp 0.8 45 1.4 1.7 5.7 6.9 16.3 6.8 -0.1 22.4 25.6 32.0 32.8 18.6 1.2Airlines 0.2 13 0.9 0.3 -2.4 0.8 39.3 4.5 -5.2 46.6 63.6 58.9 54.2 12.1 0.8Marine 0.2 10 3.8 2.2 24.5 43.0 82.7 43.5 -0.2 93.6 82.4 141.4 268.4 14.0 0.9Road & Rail 0.9 29 1 -2 4.3 15.0 18.2 14.9 -3.5 26.5 65.9 84.1 93.1 16.8 1.1Consumer Discretionary 11.1 336 1.6 1.5 3.7 7.4 24.5 7.2 -0.2 31.6 33.6 42.5 53.9 17.8 1.2Auto Components 0.5 21 0.8 5.5 10.3 19.4 39.6 17.4 -0.7 49.8 60.7 64.2 81.9 16.0 1.0Automobiles 1.8 14 0.9 5.9 10.2 11.7 42.7 11.4 -0.2 49.3 75.1 65.6 76.0 14.9 1.0Household Durables 1.2 42 1.5 -2.5 1.3 5.6 16.3 5.2 -4.4 25.1 23.6 36.7 23.3 16.8 1.1Textiles, Apparel & Luxury G 0.7 27 1.0 1.4 2.4 11.1 32.4 10.6 -1.4 41.2 46.7 72.6 108.4 18.6 1.2Hotels, Restaurants & Leisur 1.4 48 3.7 0.9 2.8 6.9 24.0 6.6 -1.1 33.6 36.9 59.5 90.8 20.4 1.3Media 2.9 84 1.0 0.7 2.7 4.2 20.8 4.4 -1.1 25.8 25.0 28.7 35.7 20.3 1.3Retailing 2.4 81 2.2 0.9 0.7 5.7 18.1 5.9 -1.2 26.3 22.0 35.7 55.0 17.1 1.1Consumer Staples 7.9 129 0.6 -0.2 1.1 6.6 17.3 6.9 -1.8 18.8 29.0 35.1 33.4 17.9 1.2Food & Staples Retailing 2.1 35 0.9 -0.8 -0.3 6.7 14.2 8.1 -2.8 17.1 19.9 27.6 8.6 17.7 1.2Food, Beverage & Tobacco 4.6 78 0.4 0.6 2.3 8.0 19.7 7.8 -1.3 20.7 34.9 42.6 42.1 17.8 1.2Household & Personal Produ 1.3 16 0.7 -1.8 -0.6 1.8 14.3 1.7 -3.3 15.6 24.3 23.6 41.1 18.8 1.2Health Care 8.5 118 0.7 -1.0 0.9 2.1 9.8 3.2 -3.3 11.7 15.7 25.2 32.7 16.3 1.1Biotechnology 0.8 13 -0.2 -2.6 0.1 -3.1 4.4 -0.5 -7.4 8.6 20.0 35.9 115.5 21.1 1.4Pharmaceuticals 5.2 29 0.2 -1.5 0.1 -1.0 4.7 0.7 -4.7 7.0 12.6 15.6 13.5 15.0 1.0Financials 25.0 384 1.1 -1.6 0.7 0.9 13.7 1.1 -3.1 18.2 33.6 49.1 57.5 12.1 0.8Banks 10.6 115 0.9 -1.4 0.2 -0.9 8.7 -0.3 -3.6 12.3 25.8 41.5 47.8 11.6 0.8Capital Markets 3.1 43 2.1 -0.6 4.1 5.5 24.1 5.5 -2.8 33.0 61.7 82.0 NA 12.1 0.8Insurance 5.0 76 0.4 -0.9 2.4 3.7 18.6 3.8 -2.4 23.1 34.0 43.9 40.4 11.1 0.7Information Technology 10.7 185 2.2 4.2 9.7 10.4 28 11.6 0.0 36.6 33.2 34.9 58.4 20.3 1.3Internet Software & Service 0.7 10 2.5 3.8 4.7 6.8 13.7 12.3 0.0 33.3 32.9 53.1 362.5 31.3 2.1IT Services 0.9 33 0.6 1.2 1.5 9.4 20.2 9.2 -0.3 29.1 37.2 35.6 9.9 20.5 1.3Software 1.9 26 1.9 1.0 6.7 5.7 28.2 6.0 -0.2 35.2 30.6 35.0 45.8 19.5 1.3Communications Equipment 2.1 16 1.9 4.8 10.9 10.1 26.7 12.1 0.0 38.6 33.8 30.5 85.9 19.4 1.3Computers & Peripherals 2.2 19 3.5 5.5 15.5 15.8 42.7 17.4 0.0 54.9 50.5 60.5 89.7 19.0 1.3Electronic Equip. & Instr. 0.8 36 0.5 3.4 4.6 8.2 20.3 9.0 -0.5 31.6 34.9 26.5 33.4 20.5 1.3Office Electronics 0.4 6 1.0 2.2 10.7 13.1 28.3 10.8 -0.9 37.5 69.2 61.9 110.1 17.3 1.1Semiconductors 1.7 39 2.8 8.6 13.8 12.4 23.9 13.3 0.0 36.7 12.9 13.3 22.4 21.6 1.4Telecom. Services 4.6 47 0.1 0.0 4.6 8.2 29 9.5 -2.2 35.0 30.4 41.9 51.6 15.8 1.0Diversified Telecom. Service 3.2 31 -0.1 -0.8 2.0 6.1 29.1 6.8 -2.6 33.9 33.3 41.9 41.7 14.7 1.0Wireless Telecom. Services 1.4 16 0.5 1.8 10.7 13.3 30.5 15.8 -1.2 37.8 25.9 43.9 83.5 18.9 1.2Utilities 4.3 81 0.1 -1.0 -1.0 8.4 26.5 6 -4.1 28.1 41.2 78.1 83.9 15.9 1.0Electric Utilities 2.3 36 0.1 -0.9 -0.3 9.8 29.7 7.9 -4.2 31.6 43.4 80.5 97.9 16.2 1.1Gas Utilities 0.2 8 -0.2 -0.4 2.5 12.4 28.4 11.0 -1.5 31.0 42.1 59.7 75.2 18.4 1.2주 : 수익률 산정은 7/6일 기준임. 주가지수는 Local Currency 기준임.자료 : MSCI, Factset, 미래에셋증권 리서치센터9 July 2007 MIRAE ASSET QUANTITATIVE RESEARCH11

<strong>Performance</strong>!Quant Analyst 김진영 • 3774-1425 • kimjy@miraeasset.com 국가별 세부업종 지수 수익률 : MSCI EAFEIndustry Weight # Co's <strong>Performance</strong> 12mth Fw.PER1W 1M 3M 6M 12M YTD 52-wk.High52-wk.Low2Y 3Y 5Y 7/6Rel.to Mkt.(%) (%) (%) (%) (%) (%) (%) (%) (%) (%) (%) (%) (X) (X)Market 100 1,145 1.0 1.4 4.4 8.9 21.2 8.9 -0.2 27.1 45.0 66.9 63.4 14.6 1.0Energy 7.7 42 2.5 9.0 16.5 18.1 12.1 14.4 0.0 25.1 18.0 57.9 42.0 12.3 0.8Materials 9.6 115 2.9 6.5 14.1 29.5 40.6 25.4 0.0 48.1 96.5 135.7 135.6 14.0 1.0Chemicals 3.1 47 1.0 6.7 8.8 17.5 33.2 17.0 0.0 39.4 71.1 98.5 82.3 16.7 1.1Metals & Mining 5.2 39 4.8 8.0 20.1 44.6 50.0 35.9 0.0 63.7 142.5 215.6 263.3 12.5 0.9Paper & Forest Products 0.4 11 -0.3 -3.4 -3.3 -1.5 9.7 -1.3 -7.8 12.5 19.5 9.1 -7.0 14.9 1.0Industrials 12.1 243 1.3 2.5 9.2 20.5 36.5 19.6 -0.2 46.6 73.8 105.3 102.9 16.9 1.2Building Products 0.7 13 1.2 3.4 5.6 18.2 31.8 16.6 -0.4 44.9 67.9 82.8 98.0 17.0 1.2Construction & Engineering 0.9 26 1.0 -1.2 -1.6 14.7 33.9 13.5 -5.0 43.7 70.1 136.9 167.3 18.0 1.2Electrical Equipment 1.2 17 1.4 4.7 13.6 23.6 46.9 21.5 -0.9 61.6 127.6 161.6 127.9 19.6 1.3Machinery 2.4 53 2.0 3.1 16.1 31.4 51.5 28.5 -0.6 68.0 126.3 170.9 177.6 18.6 1.3Trading Companies & Distrib 1.1 14 2.3 0.4 15.8 33.9 37.1 30.6 -1.8 48.2 95.9 164.4 197.9 12.3 0.8Commercial Services & Supp 1.0 30 1.1 1.7 2.0 6.2 18.0 6.0 -0.6 25.1 37.3 60.3 26.1 18.8 1.3Airlines 0.3 11 0.6 -0.5 -3.0 -0.2 44.7 3.8 -6.0 51.7 70.1 67.8 61.0 11.8 0.8Marine 0.4 10 3.8 2.2 24.5 43.0 82.7 43.5 -0.2 93.6 80.4 145.5 279.9 14.0 1.0Road & Rail 0.8 21 -1 -1 -1.5 8.1 15.8 9.9 -5.2 19.6 51.1 49.1 63.7 19.7 1.4Consumer Discretionary 11.8 207 0.9 1.6 3.6 8.7 26.4 8.6 -0.3 34.0 48.6 57.7 62.8 16.2 1.1Auto Components 0.8 18 0.9 6.2 9.0 17.4 41.1 15.5 -0.6 52.6 67.1 83.9 122.1 16.3 1.1Automobiles 3.3 11 1.1 5.5 10.4 12.2 44.9 11.9 0.0 51.8 88.5 87.4 105.4 13.7 0.9Household Durables 1.7 26 1.3 -2.6 -0.3 7.4 18.5 7.5 -4.3 26.9 43.9 48.6 29.0 16.5 1.1Textiles, Apparel & Luxury G 0.9 19 -0.1 0.4 2.3 9.7 25.3 8.3 -2.7 33.0 50.2 75.5 100.5 18.3 1.3Hotels, Restaurants & Leisur 1.1 29 2.3 0.1 -0.5 7.0 22.4 7.5 -3.8 30.5 32.0 50.9 60.8 19.1 1.3Media 2.1 50 -0.2 -1.0 1.7 6.1 15.2 6.7 -3.1 22.0 19.0 28.5 32.2 16.7 1.1Retailing 1.5 43 1.2 0.7 -2.4 3.6 16.4 4.7 -3.4 23.3 38.0 48.2 57.2 18.3 1.3Consumer Staples 7.7 87 0.2 0.6 0.8 8.7 22.9 9.2 -1.6 24.5 42.5 54.8 46.5 18.4 1.3Food & Staples Retailing 1.9 21 0.7 -0.1 -1.9 9.1 22.2 11.2 -4.1 24.4 42.3 51.8 35.8 18.9 1.3Food, Beverage & Tobacco 5.0 56 0.0 0.8 1.5 8.4 22.9 8.0 -1.3 24.8 41.0 56.4 51.1 17.8 1.2Household & Personal Produ 0.8 10 0.8 0.6 3.4 9.7 23.9 11.5 -1.2 24.2 53.2 52.4 40.2 22.8 1.6Health Care 6.3 51 0.0 -1.1 -1.9 -3.2 0.2 -1.2 -6.1 2.1 19.5 37.3 31.1 16.0 1.1Biotechnology 0.1 2 1.4 2.5 3.7 32.7 60.3 32.5 -5.8 76.3 103.2 146.3 123.6 29.7 2.0Pharmaceuticals 5.3 21 -0.1 -1.4 -2.4 -5.1 -3.3 -2.9 -8.5 1.2 15.7 32.8 22.1 15.2 1.0Financials 28.7 240 0.8 -1.5 0.2 1.5 14.3 2.4 -3.0 20.6 43.3 68.2 59.2 12.1 0.8Banks 15.6 76 0.9 -1.3 0.1 -0.2 9.5 1.0 -3.1 14.7 34.8 58.6 55.3 11.5 0.8Capital Markets 3.1 25 1.2 -1.5 2.0 4.5 17.1 4.9 -4.6 28.4 60.3 80.3 NA 11.8 0.8Insurance 5.1 38 0.3 -0.9 1.4 3.2 20.5 4.5 -3.2 27.7 48.2 68.8 33.1 11.1 0.8Information Technology 5.5 86 1.0 4.4 8.7 10.2 21 10.2 -0.1 32.0 41.6 42.4 41.5 19.9 1.4Internet Software & Service 0.1 4 3.5 -0.6 -2.3 -13.6 -31.8 -11.4 -31.8 8.7 -3.3 -5.0 27.3 69.8 4.8IT Services 0.3 13 -0.8 1.9 -7.2 -1.6 5.9 -0.7 -7.4 18.9 21.6 26.0 3.0 18.6 1.3Software 0.8 10 2.3 6.2 15.4 12.9 23.7 11.5 0.0 40.2 50.3 56.3 78.9 23.9 1.6Communications Equipment 1.6 5 1.9 3.2 14.8 15.6 23.6 16.8 -0.6 35.9 27.9 44.4 51.5 16.5 1.1Computers & Peripherals 0.4 7 -1.2 8.0 9.3 14.2 24.5 16.4 -1.8 37.4 65.4 47.9 31.0 24.5 1.7Electronic Equip. & Instr. 1.1 25 -0.1 4.5 3.2 7.4 18.8 7.9 -0.7 30.1 38.5 33.9 34.2 23.4 1.6Office Electronics 0.6 5 0.6 2.5 10.7 12.8 26.9 10.4 -1.2 37.1 75.8 68.0 104.0 17.7 1.2Semiconductors 0.7 17 1.7 6.4 5.5 4.2 21.1 2.6 0.0 30.3 35.5 22.3 -8.1 20.0 1.4Telecom. Services 5.3 31 -0.3 -0.1 2.3 2.0 24 5.4 -3.3 30.4 17.3 30.1 45.9 14.5 1.0Diversified Telecom. Service 3.5 23 0.4 -1.3 -1.4 -2.2 19.9 1.3 -4.1 24.8 14.8 25.9 43.6 14.0 1.0Wireless Telecom. Services 1.8 8 -1.5 2.3 9.9 10.9 31.9 14.0 -1.6 42.2 22.8 38.3 49.4 15.7 1.1Utilities 5.3 43 -0.6 -1.2 -0.4 7.1 28.9 5 -4.3 32.5 53.1 86.7 95.2 15.8 1.1Electric Utilities 3.1 22 -0.6 -1.1 0.5 8.7 29.9 6.7 -4.3 33.5 51.6 82.0 99.5 16.0 1.1Gas Utilities 0.4 6 -0.6 0.2 0.7 7.6 25.3 7.5 -1.4 27.6 40.9 56.1 83.0 18.0 1.2주 : 수익률 산정은 7/6일 기준임. 주가지수는 Local Currency 기준임.자료 : MSCI, Factset, 미래에셋증권 리서치센터9 July 2007 MIRAE ASSET QUANTITATIVE RESEARCH12

<strong>Performance</strong>!Quant Analyst 김진영 • 3774-1425 • kimjy@miraeasset.com 국가별 세부업종 지수 수익률 : 이머징 (MSCI EM)Industry Weight # Co's <strong>Performance</strong> 12mth Fw.PER1W 1M 3M 6M 12M YTD 52-wk.High52-wk.Low2Y 3Y 5Y 7/6Rel.to Mkt.(%) (%) (%) (%) (%) (%) (%) (%) (%) (%) (%) (%) (X) (X)Market 100 839 3.9 7.0 14.0 19.9 40.8 18.1 0.0 47.5 82.6 129.3 179.8 13.7 1.0Energy 15.4 44 4.1 11.1 14.7 10.3 17.3 7.6 0.0 29.5 85.1 172.3 316.2 11.0 0.8Materials 14.4 121 4.6 5.8 14.9 37.7 52.2 32.4 0.0 61.5 124.4 163.7 192.9 10.8 0.8Chemicals 2.1 33 2.3 9.3 24.2 42.5 67.5 41.8 -0.9 73.3 73.9 104.1 163.4 12.3 0.9Metals & Mining 9.8 51 6.0 5.6 13.0 44.2 53.9 36.6 0.0 70.7 157.7 203.9 213.1 10.1 0.7Paper & Forest Products 0.6 9 0.8 7.5 11.7 12.9 43.8 11.1 -1.3 49.3 70.1 42.9 61.2 15.9 1.2Industrials 9.3 123 6.3 9.0 29.3 47.1 80.0 45.5 -0.2 88.3 127.7 183.3 281.8 17.7 1.3Building Products 0.2 4 6.9 10.7 37.1 60.3 96.9 54.3 0.0 105.5 151.4 227.9 323.9 19.6 1.4Construction & Engineering 2.1 18 9.8 11.6 41.5 60.9 105.7 54.9 0.0 112.6 197.7 370.1 617.8 21.3 1.6Electrical Equipment 0.4 8 3.0 13.7 24.9 33.0 64.6 32.5 -0.3 73.7 123.0 168.9 226.1 15.8 1.2Machinery 1.7 11 9.8 13.9 61.2 101.2 143.7 100.6 -2.4 145.0 318.5 558.7 666.7 16.5 1.2Trading Companies & Distrib 0.3 3 7.6 3.1 35.0 51.1 67.6 47.5 -0.2 71.4 202.7 214.7 290.6 22.8 1.7Commercial Services & Supp 0.0 2 2.2 9.7 26.4 14.5 22.7 10.3 -0.5 32.6 23.7 97.5 123.7 16.4 1.2Airlines 0.5 14 0.4 2.2 17.3 23.0 43.0 25.2 -1.9 58.6 63.7 45.6 52.9 14.3 1.0Marine 0.7 15 5.5 8.3 26.5 56.5 88.2 55.3 -0.5 100.9 67.5 103.0 326.2 14.6 1.1Road & Rail 0.2 2 3 10 10.2 22.9 88.2 22.2 0.0 105.4 94.8 144.5 269.3 47.6 3.5Consumer Discretionary 5.9 98 3.0 5.2 7.5 15.0 35.3 14.8 0.0 43.6 57.3 105.1 163.6 14.9 1.1Auto Components 0.4 7 5.5 11.3 14.5 15.1 27.9 11.0 -0.3 34.5 23.6 59.4 216.2 11.7 0.9Automobiles 1.2 17 4.3 8.3 13.1 6.8 9.7 7.6 0.0 21.0 29.6 72.0 125.3 12.3 0.9Household Durables 1.0 21 2.5 5.8 8.1 17.9 36.6 17.1 -0.2 44.3 46.0 87.4 99.6 13.8 1.0Textiles, Apparel & Luxury G 0.3 7 3.9 6.3 21.2 29.5 55.6 25.8 -0.2 62.0 83.4 84.7 111.4 11.5 0.8Hotels, Restaurants & Leisur 0.6 11 2.9 6.9 7.7 26.3 63.6 26.2 -2.2 68.6 87.2 115.9 113.4 19.1 1.4Media 1.2 16 0.7 0.3 -3.3 9.3 40.6 9.8 -3.8 50.0 75.2 134.2 200.5 19.4 1.4Retailing 1.1 16 4.3 3.9 8.8 21.8 55.3 22.4 0.0 62.2 84.6 169.0 326.1 15.8 1.2Consumer Staples 5.0 76 2.1 0.6 8.7 14.7 35.8 12.4 -0.5 40.7 75.7 127.8 176.3 18.7 1.4Food & Staples Retailing 1.3 15 2.4 -0.2 3.9 11.0 39.3 7.1 -1.5 46.4 87.2 144.5 154.1 20.3 1.5Food, Beverage & Tobacco 3.2 53 2.3 0.9 11.0 17.9 37.1 16.8 -0.5 40.8 74.1 127.4 198.5 17.9 1.3Household & Personal Produ 0.5 8 0.3 1.1 8.0 5.4 18.8 0.3 -1.5 27.2 57.3 92.4 66.3 21.0 1.5Health Care 1.8 22 -0.1 4.3 8.2 18.1 20.0 16.5 -0.2 27.4 29.5 36.2 130.8 17.7 1.3Biotechnology 0.0 1 -0.5 -1.0 -8.5 14.2 23.9 15.3 -17.6 32.2 -0.2 NA NA 47.2 3.4Pharmaceuticals 1.6 16 0.0 4.9 8.7 18.8 18.4 17.7 -0.2 25.6 27.0 32.5 124.8 17.3 1.3Financials 21.2 170 3.3 6.1 11.8 15.6 45.7 14.1 0.0 52.7 91.5 148.3 179.4 14.5 1.1Banks 15.2 96 3.1 4.2 7.9 11.7 36.6 10.6 0.0 43.4 78.5 138.6 192.7 13.4 1.0Capital Markets 1.0 13 10.5 15.5 50.0 53.7 81.2 49.7 -3.9 93.7 149.4 247.7 NA 16.1 1.2Insurance 2.6 16 1.5 11.5 21.3 15.6 67.6 14.2 -0.7 73.0 143.7 189.9 166.0 21.2 1.5Information Technology 13.0 91 4.9 7.9 12.0 9.5 26 9.5 0.0 32.3 41.6 61.3 71.1 15.1 1.1Internet Software & Service 0.3 2 3.2 -0.9 25.3 40.1 69.4 50.7 -2.3 93.8 312.6 234.9 349.0 28.4 2.1IT Services 1.2 7 2.3 1.5 -0.6 -10.6 25.1 -9.1 -14.3 28.0 69.0 157.5 226.0 20.8 1.5Software 0.2 5 0.3 -0.6 8.6 16.5 45.8 17.1 -1.9 57.6 28.5 17.4 26.9 17.5 1.3Communications Equipment 0.2 9 2.4 4.8 10.0 19.7 30.5 21.2 -0.9 45.1 24.7 33.8 46.4 18.6 1.4Computers & Peripherals 2.0 21 5.5 11.4 22.6 8.3 23.7 9.2 0.0 37.1 44.1 54.0 34.1 13.6 1.0Electronic Equip. & Instr. 2.8 24 3.2 11.8 21.3 19.8 44.3 20.6 0.0 52.8 47.5 64.0 72.0 17.3 1.3Office Electronics 0.0 1 4.1 8.1 12.4 9.4 18.5 8.1 0.0 29.6 2.3 -0.7 -9.6 NA NASemiconductors 6.3 22 6.4 7.4 7.9 8.6 17.4 7.3 0.0 23.4 32.6 51.6 60.1 13.6 1.0Telecom. Services 10.4 49 3.7 7.4 14.9 23.4 62 22.2 0.0 70.3 92.8 137.1 215.2 15.3 1.1Diversified Telecom. Service 3.5 30 2.9 3.3 8.9 16.9 44.0 15.3 0.0 48.7 50.4 71.5 130.1 13.4 1.0Wireless Telecom. Services 6.9 19 4.2 9.6 18.1 26.9 73.0 26.0 0.0 84.4 128.0 203.0 304.7 16.4 1.2Utilities 3.5 45 0.9 5.8 13.5 19.4 50.4 19 -0.4 56.8 91.5 148.3 249.3 15.8 1.2Electric Utilities 2.2 17 0.8 6.1 10.7 16.7 46.6 15.3 0.0 52.7 96.2 158.6 263.0 15.4 1.1Gas Utilities 0.2 7 -1.1 1.1 6.3 7.5 13.1 4.8 -2.8 20.1 70.1 120.9 247.3 13.6 1.0주 : 수익률 산정은 7/6일 기준임. 주가지수는 Local Currency 기준임.자료 : MSCI, Factset, 미래에셋증권 리서치센터9 July 2007 MIRAE ASSET QUANTITATIVE RESEARCH13

<strong>Performance</strong>!Quant Analyst 김진영 • 3774-1425 • kimjy@miraeasset.com 국가별 세부업종 지수 수익률 : 아시아-태평양 (MSCI Asia-Pacific)Industry Weight # Co's <strong>Performance</strong> 12mth Fw.PER1W 1M 3M 6M 12M YTD 52-wk.High52-wk.Low2Y 3Y 5Y 7/6Rel.to Mkt.(%) (%) (%) (%) (%) (%) (%) (%) (%) (%) (%) (%) (X) (X)Market 100 1,060 1.8 2.5 7.8 11.9 25.4 11.2 0.0 32.1 61.5 76.2 89.7 16.7 1.0Energy 4.1 40 2.9 7.3 25.8 31.7 40.5 28.2 0.0 49.3 88.4 161.3 290.7 14.7 0.9Materials 11.1 118 3.0 5.0 15.0 29.2 37.0 25.1 0.0 46.7 94.8 128.3 175.0 13.7 0.8Chemicals 3.3 51 1.4 5.6 10.5 14.6 22.3 13.8 0.0 31.6 62.1 80.0 109.5 15.4 0.9Metals & Mining 6.8 41 4.1 5.1 18.7 43.0 48.6 35.6 0.0 62.1 132.2 190.3 272.5 12.7 0.8Paper & Forest Products 0.2 5 -1.1 -0.9 -1.4 -2.2 6.0 0.0 -7.9 15.2 23.5 -5.3 -13.1 21.4 1.3Industrials 15.4 207 2.1 3.1 13.7 25.4 37.0 24.3 -0.2 46.2 80.5 102.4 117.1 17.8 1.1Building Products 0.7 9 2.7 5.7 2.6 13.9 17.2 11.6 -0.5 29.3 46.0 40.3 77.4 20.1 1.2Construction & Engineering 1.4 24 6.5 6.4 22.5 40.7 53.5 37.1 0.0 63.6 106.2 143.7 195.2 21.1 1.3Electrical Equipment 1.0 16 0.1 4.1 3.5 6.1 19.6 5.9 -1.1 31.3 76.7 89.3 100.4 17.3 1.0Machinery 3.5 38 3.2 6.0 24.8 39.8 55.5 37.1 -1.0 71.5 152.7 192.0 197.3 20.5 1.2Trading Companies & Distrib 2.4 12 3.2 1.5 22.6 47.4 49.4 42.1 -1.0 62.6 132.2 206.8 245.2 12.8 0.8Commercial Services & Supp 0.8 11 -1.9 -2.3 -6.2 -7.3 -1.2 -7.3 -10.2 3.1 9.7 20.9 3.9 21.3 1.3Airlines 0.5 15 1.3 0.8 8.5 13.3 44.7 16.0 -0.7 54.6 50.6 40.5 37.4 14.4 0.9Marine 1.0 19 4.5 3.6 30.1 53.5 102.1 53.4 -0.3 113.9 108.5 158.2 353.7 14.1 0.8Road & Rail 1.6 17 -2 -2 -1.6 8.1 13.6 9.8 -7.0 17.2 49.0 41.1 54.1 20.5 1.2Consumer Discretionary 13.2 153 0.8 2.4 4.8 4.2 21.3 3.7 -0.9 29.1 51.1 56.1 70.1 16.4 1.0Auto Components 1.3 18 0.9 6.9 8.0 6.9 25.0 4.7 -1.1 34.8 52.0 59.6 106.0 16.8 1.0Automobiles 5.0 19 0.6 3.5 6.7 -1.2 25.9 -1.9 -4.7 33.0 68.3 69.4 121.9 13.4 0.8Household Durables 2.8 22 0.4 -3.6 0.8 9.8 14.5 10.6 -4.4 23.1 41.4 41.6 26.7 18.4 1.1Textiles, Apparel & Luxury G 0.4 14 1.1 2.3 7.8 13.3 22.7 11.8 -0.6 31.7 44.4 51.4 76.3 15.3 0.9Hotels, Restaurants & Leisur 0.7 16 2.2 2.1 0.7 8.7 29.4 9.3 -0.9 33.5 39.0 64.7 62.2 19.8 1.2Media 0.7 21 -0.5 -0.4 -1.7 0.8 12.5 0.8 -3.6 15.9 19.4 17.6 30.2 21.6 1.3Retailing 1.5 31 2.7 8.0 7.6 8.5 19.5 9.9 0.0 30.9 45.6 65.2 79.3 21.7 1.3Consumer Staples 4.8 80 1.4 0.3 2.8 5.0 17.2 5.1 -0.7 20.4 47.5 60.5 67.6 21.6 1.3Food & Staples Retailing 1.7 14 1.2 0.5 0.3 3.8 12.6 4.5 -2.5 15.1 41.5 41.5 42.5 21.5 1.3Food, Beverage & Tobacco 2.5 55 1.3 -0.1 4.5 6.1 21.5 6.3 -0.5 25.8 53.2 80.4 102.8 20.8 1.2Household & Personal Produ 0.6 11 1.9 1.1 3.1 3.9 13.6 2.2 -0.9 16.6 43.3 47.3 29.2 25.8 1.5Health Care 3.2 32 0.3 -1.7 0.2 0.2 18.3 -1.2 -3.5 19.3 48.5 64.1 72.2 19.8 1.2Biotechnology 0.2 1 0.0 0.8 2.3 37.0 62.5 34.3 -8.4 88.4 151.8 258.3 NA 25.4 1.5Pharmaceuticals 2.3 20 0.5 -2.5 -0.8 -3.4 14.4 -4.9 -6.5 14.4 42.4 54.9 59.8 19.0 1.1Financials 27.1 224 1.6 0.1 4.6 6.9 17.6 6.8 -1.0 23.8 60.3 78.7 92.5 16.7 1.0Banks 14.0 82 1.2 0.1 2.6 2.3 7.8 2.1 -2.6 12.8 49.0 66.0 82.9 14.3 0.9Capital Markets 1.9 22 3.6 1.6 9.9 17.8 19.4 16.6 -3.1 33.5 77.7 81.8 NA 17.2 1.0Insurance 3.5 18 0.4 2.2 8.9 7.6 26.6 8.4 -1.4 32.4 79.8 91.8 130.2 22.1 1.3Information Technology 13.5 136 2.6 6.5 10.0 10.3 25 9.8 0.0 33.3 50.2 52.0 55.1 18.2 1.1Internet Software & Service 0.3 6 3.4 -0.8 11.3 7.1 -3.9 11.9 -3.9 27.8 49.4 45.5 218.0 43.0 2.6IT Services 0.9 13 0.0 1.0 -3.1 -8.7 16.4 -7.4 -12.0 20.9 48.3 75.2 84.3 21.3 1.3Software 0.8 6 6.8 11.7 31.0 52.3 98.6 44.4 0.0 107.4 177.5 149.8 66.2 30.8 1.8Communications Equipment 0.2 5 0.7 2.5 -0.8 3.3 32.9 0.8 -6.5 45.8 4.6 -4.3 -36.5 16.2 1.0Computers & Peripherals 2.0 26 1.9 10.0 16.4 12.3 23.0 14.1 0.0 35.1 54.8 43.6 27.2 17.7 1.1Electronic Equip. & Instr. 3.8 43 1.0 7.5 9.6 12.2 27.1 13.0 -0.2 37.8 43.0 42.7 48.1 21.0 1.3Office Electronics 1.4 4 0.2 2.5 10.9 12.2 27.0 9.7 -1.7 37.3 77.5 69.5 106.1 17.5 1.0Semiconductors 4.0 33 5.3 6.6 7.3 6.1 16.3 4.4 0.0 22.8 32.4 44.0 38.7 14.5 0.9Telecom. Services 4.3 28 1.4 2.4 3.1 7.9 32 9.2 -0.7 36.7 44.2 43.1 34.9 16.3 1.0Diversified Telecom. Service 1.8 16 1.5 -0.6 -0.8 1.4 21.4 1.9 -2.9 23.3 20.6 21.1 40.4 14.3 0.9Wireless Telecom. Services 2.5 12 1.3 4.8 6.0 12.8 40.1 14.8 -0.7 47.5 68.9 65.6 27.5 18.3 1.1Utilities 3.5 42 -0.2 -2.3 -3.4 0.0 21.0 1 -10.1 23.6 37.5 56.6 72.7 16.6 1.0Electric Utilities 2.3 16 -0.4 -3.0 -5.9 -2.9 18.4 -2.5 -14.4 21.2 30.8 48.8 61.9 16.1 1.0Gas Utilities 0.5 8 -0.7 -2.5 -3.0 -1.1 7.4 -1.4 -5.9 10.4 31.4 54.3 79.3 17.6 1.1주 : 수익률 산정은 7/6일 기준임. 주가지수는 Local Currency 기준임.자료 : MSCI, Factset, 미래에셋증권 리서치센터9 July 2007 MIRAE ASSET QUANTITATIVE RESEARCH14

<strong>Performance</strong>!Quant Analyst 김진영 • 3774-1425 • kimjy@miraeasset.com 국가별 세부업종 지수 수익률 : 아시아-태평양(일본제외) (MSCI Asia-Pacific ex. Japan)Industry Weight # Co's <strong>Performance</strong> 12mth Fw.PER1W 1M 3M 6M 12M YTD 52-wk.High52-wk.Low2Y 3Y 5Y 7/6Rel.to Mkt.(%) (%) (%) (%) (%) (%) (%) (%) (%) (%) (%) (%) (X) (X)Market 100 678 3.3 5.1 12.2 18.0 37.4 17.0 0.0 43.4 63.2 95.7 116.3 15.6 1.0Energy 7.0 33 3.5 8.7 27.8 31.6 44.8 28.3 0.0 53.3 96.5 183.0 381.8 14.5 0.9Materials 12.1 71 4.9 7.9 20.0 39.3 44.3 34.7 0.0 58.5 91.7 139.8 211.9 12.2 0.8Chemicals 2.0 23 1.9 8.2 24.4 44.3 64.5 42.5 -1.0 69.7 77.0 96.4 178.9 12.3 0.8Metals & Mining 8.6 27 6.3 8.5 21.0 46.4 42.8 40.0 0.0 61.6 106.2 169.2 246.8 11.7 0.8Paper & Forest Products 0.2 3 0.4 4.2 4.3 20.0 69.6 16.5 -1.1 80.2 89.3 39.1 48.0 19.5 1.3Industrials 11.9 119 4.3 6.7 22.0 35.7 60.0 35.5 0.0 65.2 83.7 133.7 155.5 18.0 1.2Building Products 0.1 2 8.2 13.5 44.5 56.7 75.3 47.4 -1.0 82.1 113.5 174.9 236.1 21.0 1.4Construction & Engineering 1.9 13 9.9 11.0 43.5 69.3 110.6 62.1 0.0 112.8 218.0 334.9 459.4 21.7 1.4Electrical Equipment 0.4 8 2.6 11.4 21.2 27.1 53.6 27.3 -0.5 62.0 91.2 115.8 122.6 15.9 1.0Machinery 1.8 12 9.4 13.6 61.4 101.8 140.3 101.3 -2.2 141.8 308.5 568.3 660.4 16.6 1.1Trading Companies & Distrib 0.4 4 7.3 4.0 32.4 52.8 67.6 48.9 0.0 71.5 157.8 167.2 231.6 22.1 1.4Commercial Services & Supp 0.6 4 -2.0 -6.1 -9.0 -5.0 7.7 -5.3 -12.8 14.2 38.9 93.0 40.1 19.4 1.2Airlines 0.8 13 1.5 1.1 10.7 14.2 59.5 17.1 -0.5 68.7 62.3 52.8 48.6 13.6 0.9Marine 0.9 16 6.8 12.6 29.4 64.3 110.2 64.7 -0.8 123.3 83.8 137.7 405.9 13.0 0.8Road & Rail 0.4 5 0 -4 3.5 18.4 42.0 20.5 -5.8 46.3 59.6 103.0 150.6 23.7 1.5Consumer Discretionary 6.3 82 3.2 5.2 8.1 12.0 28.6 11.9 0.0 34.8 35.9 61.0 87.0 16.2 1.0Auto Components 0.4 6 5.8 11.4 14.2 14.2 26.5 10.0 -0.3 33.1 23.2 63.8 225.7 11.7 0.8Automobiles 1.2 15 4.4 8.6 13.1 6.3 9.0 7.3 0.0 20.1 28.2 71.9 121.5 12.4 0.8Household Durables 0.5 9 0.6 3.8 12.5 22.3 21.5 22.3 -4.2 27.0 -4.7 12.8 20.9 13.1 0.8Textiles, Apparel & Luxury G 0.4 8 2.4 4.2 11.8 18.2 36.3 15.1 -0.7 41.7 49.6 65.4 91.1 12.7 0.8Hotels, Restaurants & Leisur 1.2 14 2.2 2.0 1.5 10.3 36.0 11.0 -0.4 40.6 45.8 86.3 104.1 19.3 1.2Media 1.0 14 -0.4 -0.5 -1.9 1.5 17.4 1.3 -4.4 18.3 14.5 13.0 30.0 19.6 1.3Retailing 1.5 12 6.5 9.1 14.2 24.4 60.2 25.0 0.0 71.6 75.3 138.0 176.8 21.3 1.4Consumer Staples 4.7 48 1.9 -0.6 5.0 14.4 31.7 12.7 -1.2 35.9 61.8 99.7 120.1 19.2 1.2Food & Staples Retailing 1.9 7 2.1 -1.2 1.3 17.7 38.7 15.0 -4.6 45.1 76.9 118.9 133.3 21.5 1.4Food, Beverage & Tobacco 2.4 35 1.9 -0.5 7.1 12.6 28.7 12.3 -0.5 32.8 50.9 86.3 119.1 17.2 1.1Household & Personal Produ 0.4 6 0.9 1.5 13.6 9.9 16.8 3.7 -2.8 26.7 62.0 103.2 61.1 23.1 1.5Health Care 1.3 17 0.6 0.2 3.3 12.0 33.4 10.8 -3.1 40.8 61.9 122.8 139.4 21.6 1.4Biotechnology 0.5 1 0.0 0.8 2.3 37.0 62.5 34.3 -8.4 88.4 151.8 258.3 NA 25.4 1.6Pharmaceuticals 0.4 10 1.7 1.1 6.0 -2.1 24.3 -3.1 -3.8 29.7 35.4 74.4 124.5 17.3 1.1Financials 34.3 166 2.6 3.1 7.3 11.8 34.0 10.8 0.0 39.9 62.6 89.4 93.3 15.9 1.0Banks 17.7 61 2.1 1.9 4.2 8.3 24.7 7.3 0.0 31.0 50.7 69.7 75.7 13.9 0.9Capital Markets 1.6 13 7.8 8.5 28.1 35.0 54.9 32.0 -3.2 65.7 86.6 191.9 NA 15.9 1.0Insurance 4.6 14 1.4 5.7 9.5 6.4 44.2 5.6 -0.8 48.9 98.0 129.9 95.6 18.8 1.2Information Technology 13.7 85 4.8 7.8 11.5 9.5 26 9.4 0.0 32.8 41.2 61.6 68.1 15.1 1.0Internet Software & Service 0.4 3 5.8 1.1 27.1 42.2 71.9 52.9 0.0 97.4 362.0 282.9 329.4 31.6 2.0IT Services 1.3 6 1.2 0.7 -0.7 -8.4 26.3 -7.1 -13.0 29.0 70.8 172.1 275.9 20.8 1.3Software 0.0 1 -7.0 7.5 28.6 55.7 101.9 54.2 -7.1 120.0 87.4 97.1 4,340.8 24.8 1.6Communications Equipment 0.3 5 0.7 2.5 -0.8 3.2 38.8 0.3 -6.7 52.0 16.2 14.8 -23.6 16.2 1.0Computers & Peripherals 2.0 21 5.5 11.4 22.3 8.1 22.8 9.0 0.0 36.2 42.3 49.3 28.7 13.6 0.9Electronic Equip. & Instr. 3.0 24 3.2 11.6 21.5 20.6 46.8 21.7 0.0 55.3 44.4 58.5 68.5 17.1 1.1Office Electronics 0.0 1 4.1 8.1 12.4 9.4 18.5 8.1 0.0 29.6 2.3 -0.7 -9.6 NA NASemiconductors 6.6 24 6.4 7.3 7.7 8.8 17.6 7.6 0.0 23.5 32.2 50.5 57.4 13.6 0.9Telecom. Services 5.8 24 1.9 5.5 10.4 11.1 45 11.3 -0.5 49.6 56.1 71.4 84.6 15.4 1.0Diversified Telecom. Service 2.9 15 1.7 -0.3 2.7 5.0 29.6 4.5 -0.7 34.0 21.0 32.4 60.2 13.9 0.9Wireless Telecom. Services 2.9 9 2.0 11.7 18.7 17.6 63.1 18.5 -0.5 67.5 112.5 134.8 121.6 17.2 1.1Utilities 2.9 33 0.7 1.5 4.3 7.4 28.6 8 -0.5 30.5 40.1 61.7 96.6 14.4 0.9Electric Utilities 1.3 10 -0.1 -0.7 -0.6 0.4 19.7 0.7 -3.9 21.7 24.7 41.6 71.0 12.3 0.8Gas Utilities 0.5 6 0.6 2.0 4.1 5.3 6.1 3.7 -2.5 13.2 28.0 58.3 97.0 16.0 1.0주 : 수익률 산정은 7/6일 기준임. 주가지수는 Local Currency 기준임.자료 : MSCI, Factset, 미래에셋증권 리서치센터9 July 2007 MIRAE ASSET QUANTITATIVE RESEARCH15

<strong>Performance</strong>!Quant Analyst 김진영 • 3774-1425 • kimjy@miraeasset.com 국가별 세부업종 지수 수익률 : 이머징 아시아 (MSCI EM Asia)Industry Weight # Co's <strong>Performance</strong> 12mth Fw.PER1W 1M 3M 6M 12M YTD 52-wk.High52-wk.Low2Y 3Y 5Y 7/6Rel.to Mkt.(%) (%) (%) (%) (%) (%) (%) (%) (%) (%) (%) (%) (X) (X)Market 100 500 4.6 8.2 18.9 22.3 46.9 21.1 0.0 53.2 77.7 111.7 140.9 15.1 1.0Energy 9.8 26 4.5 10.3 32.2 33.6 56.4 30.6 0.0 61.5 114.7 200.8 484.0 13.7 0.9Materials 9.4 56 4.7 8.6 24.5 45.4 73.8 41.7 0.0 83.6 109.6 135.6 235.7 11.5 0.8Chemicals 3.0 22 2.5 10.9 26.7 47.6 71.5 46.5 -1.0 78.0 79.3 95.9 173.8 11.9 0.8Metals & Mining 4.8 18 7.2 5.6 22.3 52.1 78.3 46.3 0.0 93.7 134.9 171.3 282.1 10.5 0.7Paper & Forest Products 0.2 2 3.1 12.1 13.0 36.4 108.8 32.4 0.0 129.1 119.8 54.4 97.2 25.1 1.7Industrials 12.5 87 7.5 10.8 38.1 59.2 91.5 57.2 -0.3 98.3 145.5 200.9 290.5 18.6 1.2Building Products 0.2 2 8.2 13.5 44.5 56.7 75.3 47.4 -1.0 82.1 113.5 174.9 236.1 21.0 1.4Construction & Engineering 3.0 12 10.6 12.9 46.4 65.8 108.6 57.9 0.0 111.6 213.4 333.6 527.0 21.6 1.4Electrical Equipment 0.7 7 2.9 13.5 24.9 33.1 64.8 32.4 -0.4 74.2 126.9 173.5 235.2 16.0 1.1Machinery 3.1 11 9.8 13.9 62.5 104.7 144.7 104.1 -2.4 145.9 326.6 572.7 690.7 16.5 1.1Trading Companies & Distrib 0.6 3 7.6 3.1 35.0 51.1 67.6 47.5 -0.2 71.4 202.7 214.7 290.6 22.8 1.5Commercial Services & Supp 0.1 2 2.2 9.7 26.4 14.5 22.7 10.3 -0.5 32.6 20.7 92.8 118.3 16.4 1.1Airlines 0.6 10 2.9 2.8 20.3 29.9 65.6 37.0 -1.3 78.2 64.0 46.9 54.2 15.6 1.0Marine 1.3 13 6.1 9.3 25.8 57.4 88.8 55.9 -0.4 102.4 64.5 99.8 319.6 15.4 1.0Road & Rail 0.1 1 -4 -5 18.8 12.1 101.7 13.2 -13.2 116.2 112.4 166.7 302.7 22.9 1.5Consumer Discretionary 6.3 58 3.9 7.6 13.2 16.6 29.2 16.3 0.0 36.9 42.8 77.1 102.6 14.2 0.9Auto Components 0.7 6 5.8 11.4 14.2 14.2 26.5 10.0 -0.3 33.1 23.2 63.8 225.7 11.7 0.8Automobiles 2.2 15 4.4 8.6 13.1 6.3 9.0 7.3 0.0 20.1 28.2 71.9 121.5 12.4 0.8Household Durables 0.7 7 0.4 5.5 13.8 27.4 30.0 27.3 -4.5 36.4 8.5 24.8 17.1 13.3 0.9Textiles, Apparel & Luxury G 0.5 6 4.7 9.2 24.1 31.2 57.2 26.9 -0.2 63.1 89.4 92.8 117.7 11.6 0.8Hotels, Restaurants & Leisur 0.9 9 3.1 7.6 7.0 25.2 61.3 24.9 -2.5 65.8 81.6 110.4 106.3 18.9 1.3Media 0.3 7 1.3 3.6 6.4 19.5 48.1 15.2 0.0 49.8 56.3 62.9 53.8 25.2 1.7Retailing 0.8 5 7.9 5.6 19.8 29.2 55.1 31.6 0.0 63.5 85.2 137.4 158.3 18.5 1.2Consumer Staples 4.3 38 3.2 -0.8 12.4 16.1 32.0 13.9 -0.8 35.5 69.9 115.2 150.2 18.4 1.2Food & Staples Retailing 0.7 4 5.1 -4.3 15.3 18.4 39.3 12.5 -4.4 42.1 81.6 76.4 104.1 20.0 1.3Food, Beverage & Tobacco 2.8 28 3.3 -0.4 11.6 17.0 33.9 16.9 -0.5 37.3 68.7 118.9 182.3 17.1 1.1Household & Personal Produ 0.7 6 0.9 1.5 13.6 9.9 16.8 3.7 -2.8 26.7 62.0 103.2 61.1 23.1 1.5Health Care 0.7 10 1.7 1.1 5.8 -1.4 20.8 -2.5 -3.3 25.8 32.9 70.7 121.3 17.3 1.1Biotechnology NA NA NA NA NA NA NA NA NA NA NA NA NA NA NAPharmaceuticals 0.7 10 1.7 1.1 6.0 -1.8 20.6 -3.0 -3.8 25.6 33.9 72.5 123.6 17.3 1.1Financials 23.5 104 4.2 8.4 15.7 17.2 48.7 15.4 0.0 54.6 92.5 126.5 124.4 15.8 1.0Banks 14.5 50 3.9 5.1 8.3 9.8 32.3 8.9 0.0 37.5 67.1 101.7 113.2 13.6 0.9Capital Markets 1.5 11 11.5 17.3 59.1 63.0 88.1 57.8 -4.8 101.8 148.9 231.7 NA 17.0 1.1Insurance 4.0 9 2.0 14.5 24.8 16.1 73.3 13.9 -0.7 78.9 158.9 185.8 169.4 25.5 1.7Information Technology 23.3 78 5.0 8.2 12.3 9.6 26 9.6 0.0 32.3 42.2 62.8 70.0 15.0 1.0Internet Software & Service 0.5 2 3.2 -0.9 25.3 40.1 69.4 50.7 -2.3 94.5 355.3 277.4 323.1 28.4 1.9IT Services 2.1 5 2.1 1.3 -0.6 -11.1 25.4 -9.5 -14.5 28.3 69.6 166.3 267.9 20.8 1.4Software 0.1 1 -7.0 7.5 28.6 55.7 101.9 54.2 -7.1 120.0 87.4 97.1 4,341 24.8 1.6Communications Equipment 0.2 4 2.2 5.9 10.3 27.8 44.0 30.6 -2.2 59.6 30.7 27.5 -17.8 14.2 0.9Computers & Peripherals 3.6 21 5.5 11.4 22.6 8.3 23.2 9.2 0.0 36.6 43.1 51.5 30.3 13.6 0.9Electronic Equip. & Instr. 5.0 22 3.3 12.2 22.3 20.8 46.0 21.8 0.0 54.8 47.0 60.9 68.3 17.5 1.2Office Electronics 0.0 1 4.1 8.1 12.4 9.4 18.5 8.1 0.0 29.6 2.3 -0.7 -9.6 NA NASemiconductors 11.7 22 6.4 7.4 7.9 8.6 17.4 7.3 0.0 23.4 32.6 51.6 60.1 13.6 0.9Telecom. Services 7.7 18 2.4 9.1 14.6 14.1 52 14.4 -0.4 56.9 78.4 98.2 108.3 15.8 1.0Diversified Telecom. Service 2.6 10 3.1 3.5 6.5 5.6 32.6 4.4 -0.6 37.9 37.3 54.1 101.8 14.0 0.9Wireless Telecom. Services 5.1 8 2.0 12.0 19.0 18.7 64.1 19.9 -0.5 68.4 111.8 133.1 119.9 17.0 1.1Utilities 2.7 25 0.3 3.2 12.1 11.4 39.3 14 -0.8 43.8 58.8 87.4 119.0 13.6 0.9Electric Utilities 1.2 6 -1.2 0.7 6.2 0.9 24.1 2.5 -3.9 27.7 37.5 65.5 92.1 11.8 0.8Gas Utilities 0.4 5 -1.3 0.6 3.7 3.8 5.8 0.9 -4.2 16.9 69.1 127.6 219.4 13.6 0.9주 : 수익률 산정은 7/6일 기준임. 주가지수는 Local Currency 기준임.자료 : MSCI, Factset, 미래에셋증권 리서치센터9 July 2007 MIRAE ASSET QUANTITATIVE RESEARCH16

<strong>Performance</strong>!Quant Analyst 김진영 • 3774-1425 • kimjy@miraeasset.com 국가별 세부업종 지수 수익률 : 이머징 남미 (MSCI EM Latin)Industry Weight # Co's <strong>Performance</strong> 12mth Fw.PER1W 1M 3M 6M 12M YTD 52-wk.High52-wk.Low2Y 3Y 5Y 7/6Rel.to Mkt.(%) (%) (%) (%) (%) (%) (%) (%) (%) (%) (%) (%) (X) (X)Market 100 126 3.7 6.1 15.2 26.5 49.5 22.5 0.0 59.4 111.8 177.0 336.5 12.4 1.0Energy 15.5 4 6.5 15.8 18.4 19.0 28.3 11.5 0.0 45.1 111.4 221.2 422.5 10.0 0.8Materials 27.0 26 4.7 5.0 17.4 42.8 57.3 36.0 0.0 72.1 131.0 201.6 424.1 9.9 0.8Chemicals 0.6 3 1.3 7.4 15.8 26.3 56.1 23.6 -0.8 71.6 25.8 95.8 166.8 15.9 1.3Metals & Mining 19.8 14 6.1 7.2 19.3 59.6 74.7 49.2 0.0 100.4 175.8 270.5 657.7 9.3 0.7Paper & Forest Products 1.5 4 1.1 8.9 14.1 7.9 27.7 7.6 -0.6 34.6 50.9 39.0 152.5 17.2 1.4Industrials 6.5 16 1.6 5.5 9.7 20.8 52.6 18.6 0.0 63.9 75.7 89.4 234.9 17.7 1.4Building Products 0.4 1 5.9 7.1 32.1 79.3 189.8 77.1 0.0 207.9 506.2 771.0 1,251.7 20.6 1.7Construction & Engineering 0.5 2 9.9 21.5 30.3 41.8 69.8 37.1 0.0 85.9 NA NA NA 29.9 2.4Electrical Equipment 0.1 1 5.5 17.2 23.9 30.1 59.6 36.2 0.0 62.0 45.0 NA 428.9 11.7 0.9Machinery NA NA NA NA NA NA NA NA NA NA NA NA NA NA NATrading Companies & Distrib NA NA NA NA NA NA NA NA NA NA NA NA NA NA NACommercial Services & Supp NA NA NA NA NA NA NA NA NA NA NA NA NA NA NAAirlines 1.0 3 -3.2 0.1 11.9 10.5 13.2 6.7 -5.5 32.2 81.2 NA NA 13.3 1.1Marine 0.1 1 -5.3 0.5 34.6 44.6 66.3 49.4 -9.4 75.4 NA NA NA NA NARoad & Rail 0.9 1 4 14 7.9 25.5 84.8 24.3 0.0 102.6 NA NA NA 61.1 4.9Consumer Discretionary 6.0 14 3.2 4.5 1.7 13.6 53.2 14.6 0.0 66.1 104.3 156.6 314.6 21.6 1.7Auto Components NA NA NA NA NA NA NA NA NA NA NA NA NA NA NAAutomobiles NA NA NA NA NA NA NA NA NA NA NA NA NA NA NAHousehold Durables 1.8 6 6.4 7.1 7.4 15.2 59.5 15.2 0.0 73.6 132.8 245.2 621.4 18.7 1.5Textiles, Apparel & Luxury G 0.1 1 -6.5 -23.3 -9.2 11.8 39.4 14.1 -23.7 64.4 41.0 25.1 70.8 NA NAHotels, Restaurants & Leisur NA NA NA NA NA NA NA NA NA NA NA NA NA NA NAMedia 2.7 3 1.1 0.3 -8.5 5.0 39.1 6.3 -8.7 52.4 80.7 129.2 209.7 19.7 1.6Retailing 1.4 4 4.0 12.3 20.7 32.3 79.5 34.0 0.0 95.7 148.8 176.6 492.3 35.0 2.8Consumer Staples 10.1 23 0.8 0.9 4.7 10.9 38.1 8.1 -1.8 45.7 77.4 125.1 193.3 20.2 1.6Food & Staples Retailing 3.0 5 0.3 0.0 -5.5 0.9 33.5 -2.7 -7.3 46.3 82.9 138.9 153.2 22.4 1.8Food, Beverage & Tobacco 6.5 16 1.2 1.5 11.4 18.1 41.5 15.9 -0.9 46.8 77.9 125.2 206.6 19.7 1.6Household & Personal Produ 0.6 2 -1.5 0.1 -4.3 -4.8 24.6 -7.4 -7.9 33.6 46.9 68.4 88.1 16.3 1.3Health Care 0.1 1 1.5 -6.0 -4.7 0.8 3.2 -5.3 -14.4 16.4 39.5 NA NA 41.4 3.3Biotechnology NA NA NA NA NA NA NA NA NA NA NA NA NA NA NAPharmaceuticals NA NA NA NA NA NA NA NA NA NA NA NA NA NA NAFinancials 12.8 16 0.9 2.0 12.2 13.0 41.4 11.1 -2.3 54.2 120.0 236.0 407.7 13.4 1.1Banks 12.6 14 0.9 2.0 12.2 12.7 40.8 10.8 -2.3 53.7 120.5 236.6 409.5 13.4 1.1Capital Markets NA NA NA NA NA NA NA NA NA NA NA NA NA NA NAInsurance NA NA NA NA NA NA NA NA NA NA NA NA NA NA NAInformation Technology NA NA NA NA NA NA NA NA NA NA NA NA NA NA NAInternet Software & Service NA NA NA NA NA NA NA NA NA NA NA NA NA NA NAIT Services NA NA NA NA NA NA NA NA NA NA NA NA NA NA NASoftware NA NA NA NA NA NA NA NA NA NA NA NA NA NA NACommunications Equipment NA NA NA NA NA NA NA NA NA NA NA NA NA NA NAComputers & Peripherals NA NA NA NA NA NA NA NA NA NA NA NA NA NA NAElectronic Equip. & Instr. NA NA NA NA NA NA NA NA NA NA NA NA NA NA NAOffice Electronics NA NA NA NA NA NA NA NA NA NA NA NA NA NA NASemiconductors NA NA NA NA NA NA NA NA NA NA NA NA NA NA NATelecom. Services 15.9 11 6.2 6.8 25.1 43.1 76 41.4 0.0 93.4 134.7 181.5 381.7 16.0 1.3Diversified Telecom. Service 5.4 8 6.5 5.2 20.1 43.7 74.8 40.8 0.0 82.6 78.2 90.1 154.0 12.8 1.0Wireless Telecom. Services 10.5 3 6.0 7.6 27.9 42.5 76.9 41.5 0.0 100.9 197.3 314.3 1,035.8 18.4 1.5Utilities 6.1 15 -0.3 7.3 20.8 25.7 48.8 22 -1.6 55.7 85.9 147.3 229.6 15.3 1.2Electric Utilities 3.4 7 -0.7 8.8 21.5 23.3 39.7 18.1 -2.0 46.2 80.9 138.7 208.6 13.6 1.1Gas Utilities 0.1 1 1.4 1.0 18.7 27.5 73.5 26.0 -2.7 75.4 80.2 125.1 878.0 NA NA주 : 수익률 산정은 7/6일 기준임. 주가지수는 Local Currency 기준임.자료 : MSCI, Factset, 미래에셋증권 리서치센터9 July 2007 MIRAE ASSET QUANTITATIVE RESEARCH17

<strong>Performance</strong>!Quant Analyst 김진영 • 3774-1425 • kimjy@miraeasset.com 국가별 세부업종 지수 수익률 : 이머징 유럽 (MSCI EM Europe)Industry Weight # Co's <strong>Performance</strong> 12mth Fw.PER1W 1M 3M 6M 12M YTD 52-wk.High52-wk.Low2Y 3Y 5Y 7/6Rel.to Mkt.(%) (%) (%) (%) (%) (%) (%) (%) (%) (%) (%) (%) (X) (X)Market 100 91 3.6 8.9 5.3 7.4 21.2 6.2 0.0 29.1 84.9 154.5 303.3 11.9 1.0Energy 42.2 11 3.1 10.3 2.5 -6.2 -2.9 -6.6 -9.8 17.2 77.2 147.9 243.3 10.1 0.9Materials 9.2 15 7.5 11.6 9.5 34.5 43.6 31.4 0.0 61.2 216.0 280.6 793.4 9.1 0.8Chemicals 0.4 3 1.7 3.0 19.6 40.1 51.7 37.6 0.0 53.4 72.7 175.6 411.9 14.9 1.3Metals & Mining 8.5 8 7.9 12.4 9.3 35.5 42.9 32.3 0.0 64.2 253.6 304.5 874.1 8.9 0.8Paper & Forest Products 0.1 1 0.0 0.7 -5.7 1.0 58.7 -3.8 -11.5 58.7 111.0 63.9 227.9 14.5 1.2Industrials 1.2 6 3.4 1.4 8.4 31.9 30.1 31.1 -5.5 40.8 50.7 86.4 178.3 13.7 1.2Building Products 0.1 1 1.3 8.6 11.1 19.4 40.4 23.1 -0.4 58.9 36.2 86.0 296.8 10.2 0.9Construction & Engineering 0.4 2 -0.7 -6.9 10.5 51.4 103.2 50.4 -37.0 103.2 138.9 155.1 248.3 41.9 3.5Electrical Equipment NA NA NA NA NA NA NA NA NA NA NA NA NA NA NAMachinery NA NA NA NA NA NA NA NA NA NA NA NA NA NA NATrading Companies & Distrib NA NA NA NA NA NA NA NA NA NA NA NA NA NA NACommercial Services & Supp NA NA NA NA NA NA NA NA NA NA NA NA NA NA NAAirlines 0.1 1 2.6 17.9 27.7 58.4 83.3 62.3 -5.7 98.0 31.1 NA NA 8.3 0.7Marine NA NA NA NA NA NA NA NA NA NA NA NA NA NA NARoad & Rail NA NA NA NA NA NA NA NA NA NA NA NA NA NA NAConsumer Discretionary 2.3 12 1.7 4.8 2.7 21.6 32.3 20.5 -0.5 44.9 57.6 84.1 210.6 15.6 1.3Auto Components 0.1 1 -3.0 9.2 27.3 71.9 119.8 69.3 -3.0 138.2 51.1 -3.3 -54.3 NA NAAutomobiles 0.3 2 0.1 0.8 10.7 22.1 38.7 17.4 -3.0 59.6 87.7 78.8 318.4 11.0 0.9Household Durables 0.4 3 3.6 7.2 9.8 21.8 23.5 20.9 -0.8 31.1 24.3 50.6 210.0 8.8 0.7Textiles, Apparel & Luxury G NA NA NA NA NA NA NA NA NA NA NA NA NA NA NAHotels, Restaurants & Leisur 0.2 1 0.6 1.0 -2.9 29.1 86.7 33.1 -11.6 90.5 255.9 242.9 382.8 22.8 1.9Media 1.4 5 1.9 5.4 -0.3 19.0 26.5 18.1 -2.2 40.4 55.6 123.7 181.9 21.4 1.8Retailing NA NA NA NA NA NA NA NA NA NA NA NA NA NA NAConsumer Staples 1.4 5 1.2 12.3 18.9 31.9 56.4 29.6 -1.5 67.2 113.7 200.3 347.3 21.4 1.8Food & Staples Retailing 0.4 1 -0.9 16.6 19.8 24.6 67.7 19.1 -0.9 92.9 128.6 230.6 397.1 24.5 2.1Food, Beverage & Tobacco 1.0 4 2.0 10.9 18.5 34.4 52.8 33.3 -2.3 68.3 107.5 187.6 329.0 20.5 1.7Household & Personal Produ NA NA NA NA NA NA NA NA NA NA NA NA NA NA NAHealth Care 1.3 4 2.3 1.2 4.1 0.7 4.5 -2.4 -8.5 11.3 35.7 102.6 179.0 19.0 1.6Biotechnology 0.2 1 -0.5 -1.0 NA NA NA NA -5.0 1.6 NA NA NA 47.3 4.0Pharmaceuticals 1.0 2 2.6 0.4 2.4 -1.3 2.0 -4.2 -11.2 9.5 32.8 105.6 181.0 17.0 1.4Financials 25.4 19 3.1 6.0 6.9 17.6 55.3 16.8 0.0 66.4 98.7 191.8 425.9 14.5 1.2Banks 24.0 14 3.3 6.3 7.5 17.6 55.1 16.6 0.0 65.9 96.9 192.2 434.5 14.7 1.2Capital Markets NA NA NA NA NA NA NA NA NA NA NA NA NA NA NAInsurance 0.2 1 -4.4 3.4 5.6 41.1 64.8 41.1 -4.4 86.0 164.9 308.1 696.0 24.4 2.1Information Technology 0.4 3 6.9 5.4 10.6 25.1 40 29.1 0.0 54.0 72.7 34.4 42.9 24.3 2.0Internet Software & Service NA NA NA NA NA NA NA NA NA NA NA NA NA NA NAIT Services 0.2 2 9.2 10.0 0.7 10.3 13.8 11.0 -12.1 31.3 49.5 -4.0 10.3 19.4 1.6Software 0.2 1 4.7 1.2 29.3 58.9 134.8 77.3 -2.2 140.5 228.4 351.8 277.1 32.4 2.7Communications Equipment NA NA NA NA NA NA NA NA NA NA NA NA NA NA NAComputers & Peripherals NA NA NA NA NA NA NA NA NA NA NA NA NA NA NAElectronic Equip. & Instr. NA NA NA NA NA NA NA NA NA NA NA NA NA NA NAOffice Electronics NA NA NA NA NA NA NA NA NA NA NA NA NA NA NASemiconductors NA NA NA NA NA NA NA NA NA NA NA NA NA NA NATelecom. Services 10.9 12 4.2 10.6 8.6 25.0 71 19.6 0.0 77.9 81.6 128.0 203.4 14.3 1.2Diversified Telecom. Service 4.2 8 0.9 6.6 3.5 11.2 38.2 7.4 -1.3 40.4 44.8 83.5 130.5 15.4 1.3Wireless Telecom. Services 6.7 4 6.4 13.3 11.9 35.3 100.2 28.7 0.0 113.7 115.8 214.0 661.9 13.7 1.2Utilities 5.7 4 3.5 8.4 7.0 26.0 77.2 25 -0.2 87.8 220.1 446.8 1,229 23.3 2.0Electric Utilities 5.6 3 3.6 8.4 6.8 25.8 77.3 24.4 -0.2 87.9 224.2 461.5 1,273 23.6 2.0Gas Utilities 0.1 1 -0.9 10.0 33.1 44.5 61.7 43.1 -2.7 85.8 101.8 103.1 229.7 12.3 1.0주 : 수익률 산정은 7/6일 기준임. 주가지수는 Local Currency 기준임.자료 : MSCI, Factset, 미래에셋증권 리서치센터9 July 2007 MIRAE ASSET QUANTITATIVE RESEARCH18

<strong>Performance</strong>!Quant Analyst 김진영 • 3774-1425 • kimjy@miraeasset.com 국가별 세부업종 지수 수익률 : 선진국 유럽 (MSCI Europe)Industry Weight # Co's <strong>Performance</strong> 12mth Fw.PER1W 1M 3M 6M 12M YTD 52-wk.High52-wk.Low2Y 3Y 5Y 7/6Rel.to Mkt.(%) (%) (%) (%) (%) (%) (%) (%) (%) (%) (%) (%) (X) (X)Market 100 585 1.1 1.9 4.5 9.2 22.3 9.3 -0.7 27.7 40.5 66.9 57.7 13.6 1.0Energy 10.1 28 2.7 9.7 16.7 17.4 11.8 13.8 0.0 25.4 16.2 55.5 38.2 12.1 0.9Materials 8.7 53 3.3 8.0 15.1 32.4 48.8 28.3 0.0 54.5 100.1 142.3 118.9 13.7 1.0Chemicals 2.9 18 0.9 8.2 10.2 24.0 48.3 23.7 0.0 51.4 79.6 112.9 76.3 16.6 1.2Metals & Mining 4.2 16 5.8 10.5 21.9 47.8 56.3 38.3 0.0 71.2 153.5 240.5 251.1 11.9 0.9Paper & Forest Products 0.4 8 0.2 -3.0 -2.6 1.1 15.6 0.5 -6.6 17.4 23.3 19.8 -0.2 14.1 1.0Industrials 10.2 123 1.8 3.5 9.8 22.1 44.4 21.3 -0.4 55.1 78.0 121.2 108.6 16.6 1.2Building Products 0.6 6 0.6 2.5 9.2 22.7 46.4 21.4 -0.6 59.8 90.2 129.4 124.2 15.6 1.1Construction & Engineering 1.0 14 1.3 -0.7 -1.8 14.6 42.0 13.3 -5.8 50.9 78.6 181.0 211.2 17.3 1.3Electrical Equipment 1.3 8 2.2 5.8 20.2 35.1 67.3 31.9 -0.9 84.3 165.4 225.4 142.9 20.4 1.5Machinery 1.9 26 2.6 2.7 16.0 35.5 63.9 32.4 -0.7 79.7 125.8 188.2 200.5 16.3 1.2Trading Companies & Distrib 0.3 5 -0.1 -3.2 -4.5 -3.9 4.2 -2.6 -10.7 11.2 15.4 60.0 82.4 12.4 0.9Commercial Services & Supp 1.0 21 2.6 3.9 7.0 14.6 30.2 14.2 -0.1 39.4 55.7 90.0 40.9 17.8 1.3Airlines 0.2 6 0.6 -0.8 -7.5 -4.8 52.2 1.0 -10.7 59.0 96.7 101.7 93.9 10.5 0.8Marine 0.2 4 4.2 5.0 13.0 29.9 49.4 30.6 0.0 59.8 25.6 92.3 173.7 15.1 1.1Road & Rail 0.2 5 4 4 -0.2 8.1 33.7 9.9 -4.0 42.4 67.1 127.0 174.4 16.6 1.2Consumer Discretionary 10.0 112 1.3 1.5 3.6 13.8 31.5 14.0 -2.0 39.0 45.8 60.6 59.3 15.8 1.2Auto Components 0.6 6 1.9 6.1 11.6 35.8 68.7 34.0 0.0 82.3 81.4 125.5 156.9 14.5 1.1Automobiles 2.1 7 2.4 9.0 17.3 41.6 78.1 43.3 0.0 85.0 111.2 119.8 79.7 13.8 1.0Household Durables 1.0 11 2.9 0.1 -0.6 5.7 27.6 4.8 -3.6 37.5 43.7 59.2 32.3 13.8 1.0Textiles, Apparel & Luxury G 1.1 11 0.0 0.6 2.5 10.3 27.7 8.8 -2.9 35.4 53.6 82.8 109.5 18.4 1.3Hotels, Restaurants & Leisur 1.3 22 2.5 0.3 -0.1 8.4 23.8 8.8 -4.2 33.0 34.1 52.3 65.1 18.9 1.4Media 2.6 36 -0.1 -1.0 2.3 7.1 16.1 7.7 -3.3 23.4 19.5 30.6 31.2 16.2 1.2Retailing 1.4 17 0.8 -3.4 -6.7 2.4 17.1 3.4 -8.8 21.4 36.8 43.7 57.3 16.6 1.2Consumer Staples 8.9 45 0.1 0.6 0.9 10.5 25.5 10.8 -1.8 26.8 42.6 56.0 44.7 17.6 1.3Food & Staples Retailing 1.9 11 0.7 -0.8 -2.1 12.4 28.8 14.9 -4.9 30.8 44.1 59.4 36.4 17.8 1.3Food, Beverage & Tobacco 6.2 29 -0.1 1.0 1.4 9.6 24.0 9.0 -1.4 25.8 40.0 54.5 46.6 17.1 1.3Household & Personal Produ 0.8 5 0.3 0.5 4.5 12.4 28.1 15.0 -1.9 29.1 59.1 58.3 47.5 21.7 1.6Health Care 7.2 29 -0.1 -0.9 -2.4 -4.0 -3.8 -1.2 -8.0 1.6 13.3 31.5 23.5 15.2 1.1Biotechnology 0.0 1 13.8 18.8 15.1 23.8 53.3 27.5 0.0 59.7 61.3 77.0 69.3 -93.5 -6.9Pharmaceuticals 6.3 11 -0.3 -1.1 -2.6 -5.3 -6.6 -2.3 -10.0 1.4 10.9 28.7 16.2 14.6 1.1Financials 28.9 120 0.9 -1.1 -0.4 0.5 16.0 1.7 -3.8 22.5 39.7 68.2 50.7 10.7 0.8Banks 16.3 44 1.2 -1.1 -0.1 -0.1 13.3 1.6 -3.9 18.9 32.3 59.7 48.9 10.6 0.8Capital Markets 3.6 14 1.0 -1.4 2.3 3.3 19.8 3.9 -5.1 30.3 59.3 85.0 NA 10.9 0.8Insurance 5.9 29 0.4 -0.4 1.1 3.0 22.8 4.0 -3.3 30.5 45.8 69.4 21.1 10.0 0.7Information Technology 3.8 28 1.5 3.7 9.6 9.7 17 10.7 -0.2 29.8 25.6 35.6 31.9 17.5 1.3Internet Software & Service NA NA NA NA NA NA NA NA NA NA NA NA NA NA NAIT Services 0.3 5 1.6 3.1 -7.6 1.6 5.7 2.3 -8.6 27.0 18.5 29.4 -6.4 16.3 1.2Software 0.6 5 -1.3 2.3 5.6 -6.4 -5.5 -5.6 -9.5 12.9 7.1 19.7 45.0 20.3 1.5Communications Equipment 2.2 4 2.0 3.3 15.5 16.4 23.3 17.9 -0.7 35.8 28.7 45.7 52.5 16.5 1.2Computers & Peripherals 0.1 2 2.1 3.4 -1.9 3.4 40.5 2.9 -2.4 55.0 72.6 149.8 102.8 19.4 1.4Electronic Equip. & Instr. 0.1 4 1.8 -4.9 -5.6 -3.6 14.8 -3.3 -8.5 23.0 9.9 -11.7 -58.3 16.8 1.2Office Electronics 0.1 2 6.2 1.7 8.8 21.7 24.5 21.8 0.0 35.7 45.2 36.0 52.1 20.0 1.5Semiconductors 0.5 6 2.5 9.1 6.0 11.8 31.9 11.9 0.0 41.2 39.8 21.4 -12.4 20.1 1.5Telecom. Services 6.3 21 -0.4 0.6 4.3 1.9 26 5.6 -2.9 32.8 17.2 34.0 58.5 14.1 1.0Diversified Telecom. Service 4.3 17 0.4 -1.0 -0.8 -2.4 20.7 1.4 -4.1 26.5 15.4 29.5 48.4 13.9 1.0Wireless Telecom. Services 2.0 4 -2.1 4.5 17.5 12.8 37.6 16.1 -2.1 48.6 22.3 43.6 75.6 14.6 1.1Utilities 5.9 26 -0.7 -0.5 1.6 10.4 32.9 7 -4.5 37.5 60.5 101.5 105.3 15.3 1.1Electric Utilities 3.2 12 -0.7 -0.2 4.2 14.5 35.7 11.3 -4.4 40.5 62.3 101.7 123.0 15.6 1.1Gas Utilities 0.2 3 -0.6 4.2 6.3 20.0 52.6 19.4 -1.6 56.9 51.8 60.2 94.2 17.1 1.3주 : 수익률 산정은 7/6일 기준임. 주가지수는 Local Currency 기준임.자료 : MSCI, Factset, 미래에셋증권 리서치센터9 July 2007 MIRAE ASSET QUANTITATIVE RESEARCH19

<strong>Performance</strong>!Quant Analyst 김진영 • 3774-1425 • kimjy@miraeasset.com 국가별 세부업종 지수 수익률 : Austria (MSCI Australia)Industry Weight # Co's <strong>Performance</strong> 12mth Fw.PER1W 1M 3M 6M 12M YTD 52-wk.High52-wk.Low2Y 3Y 5Y 7/6Rel.to Mkt.(%) (%) (%) (%) (%) (%) (%) (%) (%) (%) (%) (%) (X) (X)Market 100 87 1.3 0.6 4.2 13.9 22.9 11.9 -0.7 28.8 48.8 80.5 96.3 15.6 1.0Energy 5.0 6 -0.2 3.3 14.0 25.3 14.1 21.3 -2.4 39.5 49.5 133.1 204.6 19.3 1.2Materials 22.4 14 5.1 7.7 17.3 35.9 28.2 30.6 0.0 47.3 79.9 139.3 199.9 12.7 0.8Chemicals 0.9 1 -1.5 -6.4 10.8 25.8 29.6 20.8 -13.4 41.1 66.2 100.4 213.7 16.1 1.0Metals & Mining 19.8 9 5.9 9.9 20.4 43.9 30.2 37.1 0.0 51.7 94.0 164.3 234.4 12.4 0.8Paper & Forest Products 0.2 1 -6.2 -12.3 -13.4 -8.6 6.1 -11.2 -20.7 15.2 18.7 -29.2 -29.9 12.9 0.8Industrials 8.2 11 -2.3 -1.5 0.4 9.9 25.3 10.0 -4.5 33.3 31.3 70.6 72.8 21.4 1.4Building Products NA NA NA NA NA NA NA NA NA NA NA NA NA NA NAConstruction & Engineering 0.6 1 3.6 -5.0 20.2 109.0 134.1 111.3 -8.0 149.5 271.5 373.6 311.2 23.2 1.5Electrical Equipment NA NA NA NA NA NA NA NA NA NA NA NA NA NA NAMachinery NA NA NA NA NA NA NA NA NA NA NA NA NA NA NATrading Companies & Distrib NA NA NA NA NA NA NA NA NA NA NA NA NA NA NACommercial Services & Supp 2.0 2 -2.4 -7.3 -11.2 -6.3 6.9 -6.4 -15.1 14.8 43.6 95.2 32.1 19.7 1.3Airlines 0.5 1 -0.2 -1.2 6.5 6.3 79.2 7.1 -4.1 90.8 70.9 NA NA 11.9 0.8Marine NA NA NA NA NA NA NA NA NA NA NA NA NA NA NARoad & Rail 0.5 1 2 -4 4.3 26.5 57.5 26.3 -9.5 75.5 84.5 115.5 NA 39.8 2.5Consumer Discretionary 4.6 11 0.1 -2.4 -3.2 1.9 18.1 1.4 -6.4 22.9 18.8 21.6 45.6 18.6 1.2Auto Components NA NA NA NA NA NA NA NA NA NA NA NA NA NA NAAutomobiles NA NA NA NA NA NA NA NA NA NA NA NA NA NA NAHousehold Durables NA NA NA NA NA NA NA NA NA NA NA NA NA NA NATextiles, Apparel & Luxury G 0.3 1 -1.1 -0.8 5.1 4.7 18.5 2.1 -4.1 37.7 28.8 NA NA 18.5 1.2Hotels, Restaurants & Leisur 1.9 3 0.4 -2.9 -4.2 2.3 19.4 2.9 -8.1 23.7 17.1 60.1 87.2 18.3 1.2Media 1.8 4 -0.4 -3.1 -6.5 -3.6 13.8 -5.5 -9.4 13.8 10.3 4.0 27.1 19.7 1.3Retailing 0.5 2 2.9 3.4 11.2 37.8 46.4 40.5 -0.1 65.5 87.0 59.4 66.8 17.4 1.1Consumer Staples 7.4 7 0.5 -0.5 -2.0 11.9 30.1 10.7 -4.9 39.6 52.4 82.4 89.1 19.8 1.3Food & Staples Retailing 5.0 2 1.3 -0.2 -2.1 16.8 37.3 15.2 -6.3 48.4 73.6 114.5 127.7 21.7 1.4Food, Beverage & Tobacco 2.4 5 -1.1 -1.1 -1.9 3.1 17.5 2.5 -3.9 27.2 20.1 38.4 39.0 16.7 1.1Household & Personal Produ NA NA NA NA NA NA NA NA NA NA NA NA NA NA NAHealth Care 2.8 5 0.5 0.4 2.4 21.9 46.1 20.7 -4.9 64.1 84.5 160.7 140.4 23.6 1.5Biotechnology 1.6 1 0.0 0.8 2.4 37.3 63.3 34.6 -8.5 90.5 159.1 271.5 NA 25.4 1.6Pharmaceuticals NA NA NA NA NA NA NA NA NA NA NA NA NA NA NAFinancials 46.0 28 0.7 -1.7 0.6 5.7 18.6 4.3 -3.7 24.7 40.1 62.7 64.8 15.0 1.0Banks 23.3 4 0.3 0.0 1.6 7.2 14.4 5.9 -3.9 22.5 37.5 52.4 51.9 13.7 0.9Capital Markets 2.5 2 3.9 -0.2 4.1 12.4 28.1 10.8 -8.0 43.1 44.5 147.3 NA 14.9 0.9Insurance 7.8 5 0.9 -1.6 -2.1 0.1 23.0 0.9 -7.5 27.0 56.6 87.5 61.0 15.0 1.0Information Technology 0.5 1 -5.1 -3.1 -0.8 22.7 36 20.3 -7.6 47.1 84.0 235.7 5,629 20.6 1.3Internet Software & Service NA NA NA NA NA NA NA NA NA NA NA NA NA NA NAIT Services 0.5 1 -5.1 -3.1 -0.8 22.7 36.3 20.3 -7.6 47.1 84.0 235.7 NA 20.6 1.3Software NA NA NA NA NA NA NA NA NA NA NA NA NA NA NACommunications Equipment NA NA NA NA NA NA NA NA NA NA NA NA NA NA NAComputers & Peripherals NA NA NA NA NA NA NA NA NA NA NA NA NA NA NAElectronic Equip. & Instr. NA NA NA NA NA NA NA NA NA NA NA NA NA NA NAOffice Electronics NA NA NA NA NA NA NA NA NA NA NA NA NA NA NASemiconductors NA NA NA NA NA NA NA NA NA NA NA NA NA NA NATelecom. Services 1.7 2 0.7 -5.2 -1.9 13.9 26 12.8 -7.7 37.0 -5.1 -5.5 -1.9 13.7 0.9Diversified Telecom. Service 1.7 2 0.7 -5.2 -1.9 13.9 26.1 12.8 -7.7 37.0 -5.1 -5.5 -1.9 13.7 0.9Wireless Telecom. Services NA NA NA NA NA NA NA NA NA NA NA NA NA NA NAUtilities 1.4 2 1.1 0.9 -0.2 11.0 41.3 11 -3.3 41.6 67.3 100.7 146.4 20.3 1.3Electric Utilities NA NA NA NA NA NA NA NA NA NA NA NA NA NA NAGas Utilities NA NA NA NA NA NA NA NA NA NA NA NA NA NA NA주 : 수익률 산정은 7/6일 기준임. 주가지수는 Local Currency 기준임.자료 : MSCI, Factset, 미래에셋증권 리서치센터9 July 2007 MIRAE ASSET QUANTITATIVE RESEARCH20

<strong>Performance</strong>!Quant Analyst 김진영 • 3774-1425 • kimjy@miraeasset.com 국가별 세부업종 지수 수익률 : China (MSCI China)Industry Weight # Co's <strong>Performance</strong> 12mth Fw.PER1W 1M 3M 6M 12M YTD 52-wk.High52-wk.Low2Y 3Y 5Y 7/6Rel.to Mkt.(%) (%) (%) (%) (%) (%) (%) (%) (%) (%) (%) (%) (X) (X)Market 100 87 4.7 13.9 25.5 26.4 83.8 26.4 0.0 89.8 152.6 189.6 293.9 18.4 1.0Energy 21.4 5 6.1 13.0 36.2 26.8 62.8 23.1 0.0 68.2 121.6 211.6 508.7 14.0 0.8Materials 6.3 11 3.3 12.8 32.0 59.6 112.8 57.4 -0.9 126.7 272.0 277.8 899.0 16.5 0.9Chemicals 0.9 3 0.3 6.1 32.4 55.2 59.6 57.0 -10.3 89.3 122.1 131.2 343.7 19.0 1.0Metals & Mining 3.9 6 6.7 14.4 30.9 59.0 107.3 56.6 0.0 126.0 281.3 294.3 1,170.3 14.0 0.8Paper & Forest Products 0.8 1 3.6 13.1 13.9 44.6 NA 40.9 0.0 173.2 NA NA NA 25.2 1.4Industrials 13.2 22 6.9 18.4 36.7 59.4 107.2 61.6 0.0 120.0 134.5 165.4 268.5 23.0 1.2Building Products NA NA NA NA NA NA NA NA NA NA NA NA NA NA NAConstruction & Engineering 2.4 1 24.1 56.9 83.7 114.8 NA NA 0.0 122.5 NA NA NA 44.5 2.4Electrical Equipment 0.6 2 1.3 5.8 1.2 24.4 62.1 23.3 -2.9 71.7 59.7 12.9 NA 15.9 0.9Machinery 0.7 2 -2.7 7.8 23.4 43.9 146.4 48.8 -3.5 156.1 188.9 NA NA 16.1 0.9Trading Companies & Distrib NA NA NA NA NA NA NA NA NA NA NA NA NA NA NACommercial Services & Supp NA NA NA NA NA NA NA NA NA NA NA NA NA NA NAAirlines 0.9 3 1.0 6.4 23.9 37.5 138.9 61.3 -1.1 163.9 142.8 95.4 86.2 25.8 1.4Marine 2.3 3 7.8 19.0 59.2 116.2 221.6 114.2 -1.9 248.4 199.7 240.5 853.8 18.5 1.0Road & Rail 0.3 1 -4 -5 18.8 12.1 101.7 13.2 -13.2 116.2 112.4 166.7 302.7 22.9 1.2Consumer Discretionary 4.2 9 6.5 10.1 14.1 37.7 84.2 47.1 0.0 91.2 99.6 92.9 171.7 19.3 1.1Auto Components NA NA NA NA NA NA NA NA NA NA NA NA NA NA NAAutomobiles 1.2 3 3.2 7.4 3.9 6.2 37.8 21.5 -3.6 53.9 42.8 17.8 147.8 12.5 0.7Household Durables NA NA NA NA NA NA NA NA NA NA NA NA NA NA NATextiles, Apparel & Luxury G 0.2 1 2.1 -0.1 34.6 72.1 85.5 70.8 -4.7 107.4 65.7 49.8 NA 9.8 0.5Hotels, Restaurants & Leisur 0.6 2 9.3 15.4 15.3 66.4 139.6 64.8 0.0 148.3 75.3 200.7 172.8 29.5 1.6Media NA NA NA NA NA NA NA NA NA NA NA NA NA NA NARetailing 1.7 2 9.8 12.0 18.5 48.6 103.4 58.7 0.0 107.0 158.0 197.6 212.5 26.0 1.4Consumer Staples 2.5 7 -0.5 -4.1 10.3 24.1 91.1 30.2 -4.8 111.9 150.2 136.8 331.9 18.6 1.0Food & Staples Retailing NA NA NA NA NA NA NA NA NA NA NA NA NA NA NAFood, Beverage & Tobacco 2.0 6 0.8 -3.9 10.3 24.1 91.1 30.2 -4.5 112.0 150.2 136.8 332.0 17.0 0.9Household & Personal Produ 0.5 1 -5.0 -4.9 NA NA NA NA -8.2 3.7 NA NA NA 29.3 1.6Health Care NA NA NA NA NA NA NA NA NA NA NA NA NA NA NABiotechnology NA NA NA NA NA NA NA NA NA NA NA NA NA NA NAPharmaceuticals NA NA NA NA NA NA NA NA NA NA NA NA NA NA NAFinancials 30.8 18 4.4 14.9 19.7 11.6 81.7 9.9 0.0 86.5 234.7 265.6 247.8 22.3 1.2Banks 14.9 5 5.4 12.8 10.5 -1.3 39.0 -0.2 -5.8 46.2 NA NA NA 19.5 1.1Capital Markets NA NA NA NA NA NA NA NA NA NA NA NA NA NA NAInsurance 9.8 3 1.7 17.7 30.5 18.1 136.5 15.1 -1.4 140.4 407.1 455.0 NA 33.4 1.8Information Technology 1.6 5 0.3 1.9 15.2 11.1 23 17.7 -5.5 27.9 19.9 18.0 -23.1 19.1 1.0Internet Software & Service NA NA NA NA NA NA NA NA NA NA NA NA NA NA NAIT Services 0.1 1 -2.1 2.8 -2.1 8.3 47.2 10.5 -10.5 56.9 100.0 147.2 NA 17.7 1.0Software NA NA NA NA NA NA NA NA NA NA NA NA NA NA NACommunications Equipment 0.2 1 1.3 -0.7 0.9 10.6 55.1 5.3 -11.0 67.9 67.6 NA -76.5 21.5 1.2Computers & Peripherals 0.8 2 0.6 3.9 38.6 28.0 29.3 33.9 -8.8 49.1 55.9 72.9 29.0 13.4 0.7Electronic Equip. & Instr. NA NA NA NA NA NA NA NA NA NA NA NA NA NA NAOffice Electronics NA NA NA NA NA NA NA NA NA NA NA NA NA NA NASemiconductors 0.6 1 0.0 0.0 0.0 -7.0 2.9 5.9 -17.1 23.0 -33.5 -36.3 NA 42.8 2.3Telecom. Services 16.5 2 3.2 16.6 21.4 24.1 91 26.3 -0.5 96.1 176.5 219.6 245.5 18.6 1.0Diversified Telecom. Service 2.2 1 4.6 4.6 22.7 20.9 92.4 12.9 -1.6 98.4 71.8 74.9 NA 15.1 0.8Wireless Telecom. Services 14.3 1 3.0 18.7 21.2 24.6 90.8 28.6 -0.4 96.0 204.4 264.8 269.4 19.3 1.0Utilities 3.4 8 3.2 10.5 29.9 35.3 104.8 45 -0.3 114.8 109.4 67.2 169.8 18.1 1.0Electric Utilities NA NA NA NA NA NA NA NA NA NA NA NA NA NA NAGas Utilities 0.2 1 0.6 5.7 23.5 25.9 34.4 12.3 -8.7 43.8 NA NA NA 17.5 1.0주 : 수익률 산정은 7/6일 기준임. 주가지수는 Local Currency 기준임.자료 : MSCI, Factset, 미래에셋증권 리서치센터9 July 2007 MIRAE ASSET QUANTITATIVE RESEARCH21

<strong>Performance</strong>!Quant Analyst 김진영 • 3774-1425 • kimjy@miraeasset.com 국가별 세부업종 지수 수익률 : Hong Kong (MSCI Hong Kong)Industry Weight # Co's <strong>Performance</strong> 12mth Fw.PER1W 1M 3M 6M 12M YTD 52-wk.High52-wk.Low2Y 3Y 5Y 7/6Rel.to Mkt.(%) (%) (%) (%) (%) (%) (%) (%) (%) (%) (%) (%) (X) (X)Market 100 44 4.6 5.4 6.1 9.1 31.6 10.1 0.0 35.6 44.0 74.0 91.7 16.9 1.0Energy NA NA NA NA NA NA NA NA NA NA NA NA NA NA NAMaterials NA NA NA NA NA NA NA NA NA NA NA NA NA NA NAChemicals NA NA NA NA NA NA NA NA NA NA NA NA NA NA NAMetals & Mining NA NA NA NA NA NA NA NA NA NA NA NA NA NA NAPaper & Forest Products NA NA NA NA NA NA NA NA NA NA NA NA NA NA NAIndustrials 14.5 7 5.8 4.2 5.2 3.8 18.4 5.3 0.0 21.9 21.1 52.0 42.4 12.4 0.7Building Products NA NA NA NA NA NA NA NA NA NA NA NA NA NA NAConstruction & Engineering NA NA NA NA NA NA NA NA NA NA NA NA NA NA NAElectrical Equipment 0.3 1 -1.2 -13.2 -16.7 -24.9 -25.4 -19.5 -38.5 0.0 -42.8 -44.3 -54.1 13.7 0.8Machinery NA NA NA NA NA NA NA NA NA NA NA NA NA NA NATrading Companies & Distrib NA NA NA NA NA NA NA NA NA NA NA NA NA NA NACommercial Services & Supp NA NA NA NA NA NA NA NA NA NA NA NA NA NA NAAirlines 1.4 1 1.2 -3.2 -3.7 4.9 43.8 2.7 -9.6 47.6 38.7 34.5 58.2 13.2 0.8Marine 1.0 1 17.9 18.9 35.8 98.5 249.7 98.5 -1.8 258.6 197.8 374.1 NA 4.9 0.3Road & Rail 1.3 1 0 -3 -6.1 -10.4 -1.3 -4.9 -15.6 1.3 24.8 59.0 78.8 18.0 1.1Consumer Discretionary 13.6 8 6.1 8.7 9.1 16.4 50.6 16.9 0.0 60.0 50.4 117.0 156.1 22.5 1.3Auto Components NA NA NA NA NA NA NA NA NA NA NA NA NA NA NAAutomobiles NA NA NA NA NA NA NA NA NA NA NA NA NA NA NAHousehold Durables 0.6 1 2.9 -2.0 13.3 5.5 -1.5 6.5 -12.8 18.0 -45.5 -13.4 NA 12.0 0.7Textiles, Apparel & Luxury G 0.7 1 -1.9 -7.0 -12.6 -2.4 5.3 -3.7 -16.6 10.7 -3.6 14.0 NA 11.3 0.7Hotels, Restaurants & Leisur 1.2 1 10.8 4.8 4.8 -0.9 40.1 4.5 -8.7 47.0 71.0 179.3 219.8 29.8 1.8Media 0.8 1 1.5 1.9 11.0 14.8 19.5 17.6 -3.7 33.3 18.8 42.5 38.0 18.0 1.1Retailing 10.3 4 6.7 11.9 11.3 21.8 67.7 21.4 0.0 81.3 82.1 174.4 269.0 25.3 1.5Consumer Staples 0.8 1 2.3 4.1 NA NA NA NA 0.0 7.8 NA NA NA 34.0 2.0Food & Staples Retailing NA NA NA NA NA NA NA NA NA NA NA NA NA NA NAFood, Beverage & Tobacco 0.8 1 2.3 4.1 NA NA NA NA 0.0 7.8 NA NA NA 34.0 2.0Household & Personal Produ NA NA NA NA NA NA NA NA NA NA NA NA NA NA NAHealth Care NA NA NA NA NA NA NA NA NA NA NA NA NA NA NABiotechnology NA NA NA NA NA NA NA NA NA NA NA NA NA NA NAPharmaceuticals NA NA NA NA NA NA NA NA NA NA NA NA NA NA NAFinancials 53.7 18 4.9 6.6 8.2 12.2 37.0 13.8 0.0 41.3 60.4 89.7 112.5 17.9 1.1Banks 11.6 4 1.5 -0.7 -4.6 -0.3 21.7 -2.9 -7.4 23.1 31.0 39.1 78.5 15.2 0.9Capital Markets NA NA NA NA NA NA NA NA NA NA NA NA NA NA NAInsurance NA NA NA NA NA NA NA NA NA NA NA NA NA NA NAInformation Technology 5.6 4 3.5 4.2 1.8 1.3 40 0.8 -4.2 48.5 12.8 68.0 172.0 18.8 1.1Internet Software & Service 1.6 1 11.1 5.4 NA NA NA NA 0.0 16.1 NA NA NA 40.9 2.4IT Services NA NA NA NA NA NA NA NA NA NA NA NA NA NA NASoftware NA NA NA NA NA NA NA NA NA NA NA NA NA NA NACommunications Equipment 2.4 1 -0.2 0.7 -6.3 -7.6 36.3 -12.2 -18.9 49.0 NA NA NA 17.7 1.0Computers & Peripherals NA NA NA NA NA NA NA NA NA NA NA NA NA NA NAElectronic Equip. & Instr. 1.1 1 2.6 9.6 10.8 13.0 63.1 20.9 -1.5 68.3 47.8 165.8 NA 11.6 0.7Office Electronics NA NA NA NA NA NA NA NA NA NA NA NA NA NA NASemiconductors 0.6 1 2.1 6.6 11.1 10.8 13.0 21.8 -5.2 30.7 6.8 23.5 95.5 18.0 1.1Telecom. Services 1.7 2 0.2 -1.5 3.9 -6.3 9 -7.8 -9.3 20.0 41.6 36.3 -14.8 21.1 1.2Diversified Telecom. Service 1.0 1 0.0 -0.6 2.1 -0.6 -13.3 1.7 -13.3 4.3 -1.8 -10.9 -46.9 16.3 1.0Wireless Telecom. Services 0.7 1 0.4 -2.7 5.3 -10.0 33.9 -13.6 -15.7 45.4 103.5 122.6 NA 34.9 2.1Utilities 10.1 4 1.4 -0.7 -3.1 1.0 12.7 0 -5.5 13.6 17.1 30.3 62.5 13.6 0.8Electric Utilities 7.0 3 1.0 -2.3 -6.0 -1.2 15.1 -1.8 -8.3 16.1 17.0 25.5 56.9 12.2 0.7Gas Utilities 3.1 1 2.2 3.1 4.7 6.6 6.8 5.9 -2.6 11.7 16.9 42.5 76.4 18.7 1.1주 : 수익률 산정은 7/6일 기준임. 주가지수는 Local Currency 기준임.자료 : MSCI, Factset, 미래에셋증권 리서치센터9 July 2007 MIRAE ASSET QUANTITATIVE RESEARCH22