Chapter 6 - SME Corporation Malaysia

Chapter 6 - SME Corporation Malaysia

Chapter 6 - SME Corporation Malaysia

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

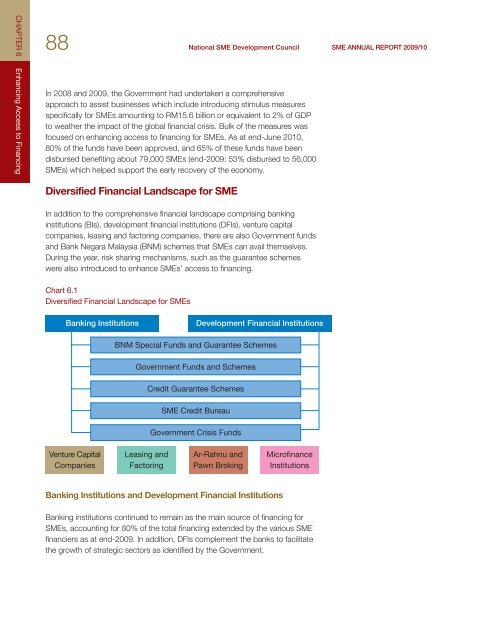

CHAPTER 688 National <strong>SME</strong> Development Council <strong>SME</strong> ANNUAL REPORT 2009/10Enhancing Access to FinancingIn 2008 and 2009, the Government had undertaken a comprehensiveapproach to assist businesses which include introducing stimulus measuresspecifically for <strong>SME</strong>s amounting to RM15.6 billion or equivalent to 2% of GDPto weather the impact of the global financial crisis. Bulk of the measures wasfocused on enhancing access to financing for <strong>SME</strong>s. As at end-June 2010,80% of the funds have been approved, and 65% of these funds have beendisbursed benefiting about 79,000 <strong>SME</strong>s (end-2009: 53% disbursed to 56,000<strong>SME</strong>s) which helped support the early recovery of the economy.Diversified Financial Landscape for <strong>SME</strong>In addition to the comprehensive financial landscape comprising bankinginstitutions (BIs), development financial institutions (DFIs), venture capitalcompanies, leasing and factoring companies, there are also Government fundsand Bank Negara <strong>Malaysia</strong> (BNM) schemes that <strong>SME</strong>s can avail themselves.During the year, risk sharing mechanisms, such as the guarantee schemeswere also introduced to enhance <strong>SME</strong>s’ access to financing.Chart 6.1Diversified Financial Landscape for <strong>SME</strong>sBanking InstitutionsDevelopment Financial InstitutionsBNM Special Funds and Guarantee SchemesGovernment Funds and SchemesCredit Guarantee Schemes<strong>SME</strong> Credit BureauGovernment Crisis FundsVenture CapitalCompaniesLeasing andFactoringAr-Rahnu andPawn BrokingMicrofinanceInstitutionsBanking Institutions and Development Financial InstitutionsBanking institutions continued to remain as the main source of financing for<strong>SME</strong>s, accounting for 80% of the total financing extended by the various <strong>SME</strong>financiers as at end-2009. In addition, DFIs complement the banks to facilitatethe growth of strategic sectors as identified by the Government.