Door Trends

Door Trends

Door Trends

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

4Housing Boom HangoverIn 2006, 47%of housing startswere multi-familyin Canada ascompared to18.5% for the US.The trend to multi-family also changes thedecision making landscape for all products. Twonew decision makers are added to the business fornew construction and renovation. Manufacturersmust come up with strategies to serve these newdecision makers.1. Builders and professional renovators(existing)2. Owners (existing)3. Developers (new)4. Strata Councils (new)Opportunities• There is opportunity to develop and marketa solid core wood door for quality andacoustical performance in smaller spaces.• Flexible floor plans are crucial to condo andtownhouses so pocket doors and otherinnovative ways to create flex spaces willcontinue to be important.• Townhouse entry doors can be wood and areoften signature pieces of a development.Threats• Condominium style multi-family buildingsgenerally have only one entry door thatopens to a common interior corridor. Thesedoors are subject to fire code restrictions andare not generally wood.• Multi-family units generally have fewerrooms, hence fewer interior doors.Trend: Demand for building materials fornew starts and remodeling will be suppressedfor 2 to 3 years.DiscussionNew residential starts generally follow the cyclicalnature of the US and Canadian economies,however, the current downturn in US housing isan extraordinary event. Prolonged low interestrates in the US has caused a multitude of marketdistortions in both the boom and now the bust.During the boom part of the cycle, rapidly risingcosts, trade shortages and material backorderswere common. Housing starts in the US werevery high and market speculation raised realestate prices. With prolonged low interest ratesthose who could afford to buy did so. With fewqualified buyers left to market to, lenders beganrelaxing mortgage criteria. This prolonged thehousing start boom and the price speculation.Renovation was also high during the housingboom. With rapidly escalating real estate values,homeowners took advantage of equity loans toimprove their homes.In 2007 interest rates and failed renewals ofunconventional mortgages moved real estateinto a bust. In the fall of 2007 it was estimatedthat the US had an excess inventory of 700,000homes. Real estate prices stalled then receded. Itis projected that single-family housing starts maybe as low as one million in 2008, after approachingtwo million in 2006. With new start demandcut almost in half, building material markets aredirectly affected.Under normal economic conditions, renovationand remodeling expenditures are on a two-yearlag in relation to new building activity. However,renovation and remodeling demand is followingnew starts in a more immediate manner in thisdownturn. First, there were a lot of renovationand remodeling activities during the housingboom and there is little pent up demand. Second,renovation and remodeling is often financedthrough equity loans but in this time of realestate deflation, equity is decreasing. This makesless money available for renovation loans.Given all of this, building materials in both newstarts and renovation will experience a 2 to 3year time period of suppressed demand while themarket corrects.Threats• <strong>Door</strong> producers will feel price pressure asthey compete for fewer transactions.• Suppliers of offshore and US doors will seekout the relatively healthier Canadian market.• Fewer new starts means fewer doors,especially interior doors that are notcommonly replaced in renovations.It is projectedthat single-familyhousing startsmay be as low asone million in2008, afterapproaching twomillion in 2006.

7 8Adding Inspiration to Market DominationIs That Real Wood?North Americanhomes’ interiordoors areseldom used toproduce designstatements.Trend: Wood interior doors hold close to 99%market share but the majority are lower valuehollow core doors.DiscussionThree types of wood doors hold close to 99%market share in the interior door market. Stileand rail doors make heavy use of middle to highgrades of wood and have 7% market share. Solidcore flush doors make heavy use of low to midgradewoods in the core and have a decorativeveneer on the finished surface. Solid core flushdoors also hold 7% market share. The mainproduct used is a hollow core door at 85% marketshare. Hollow core doors come in several finishedformats, but all make relatively low use of wood.As they are repeated elements in constructionthere is constant price pressure on the item.In North American homes interior doors areseldom used to produce design statements. Theyare more often employed not to draw attentionto themselves, but to provide continuity in thehome.Design and marketing can change this trend.Interior doors can be marketed for design,security and acoustical performance. Thiswill require new products and new marketingapproaches to segment the market.Some likely markets to target are:• Higher-end multi-family developments• Multi-family and single-family renovation• Urban infill homes that are smaller but of ahigher level of finish.Opportunities• Leverage wood market share in this segmentto sell higher value doors:o Solid flusho Stile and railo Flush hollow core door with veneer.• Offer new designs in stile and rail doors tobridge classic with contemporary.• Market solid flush doors for quality, security,design (in Europe doors are marketed likefurniture) and privacy (acoustics).• Market solid interior doors as remodellingitems. This is especially appropriate formulti-family homes where only interiorand non-structural changes can be made toa unit.Trend: Natural looking wood as a materialis enjoying a revival of sorts. The demandfor clear finished wood doors is growing.Consumers at the high end are willing topay for the prestige and luxury of naturalwood doors.DiscussionThere are several factors contributing to this:• A more favorable environmental profile sincesustainable harvesting and awareness of itsability to reduce CO2 emissions by: thecarbon sink effect of the forests, the carbonstorage effect of wood products and as asubstitution for carbon-intensive materials.• An awareness of the health and psychologicalbenefits of using wood in interior spaces.• A renewed interest in the warm, naturalaesthetic wood offers to an environment.This is due to the overload of plastics, steeland other less organic materials that havebeen so prominent for the last 20 years.This trend is quite strong among architects andinterior designers and these influencers have aneventual impact on the choices that consumersmake. Natural wood interior and exterior doorsare poised to capture additional market share.Opportunities• Include naturally finished doors in marketingmaterials.• Use the growing research on the health andpsychological benefits of wood to promoteclear finished wood doors.• Some manufacturers of door and windowsare partnering with coating companies toprovide a maintenance service. Themanufacturer undertakes a system specifiedby the coating company who then providesa maintenance service for the life of thewindows or doors.Threats• As clear finished doors become morecommon, exterior finish failure could causeconsiderable damage to consumer confidencein wood. Many clear finishes are prone toearly failure. In order to avoid this situationmanufacturers selling natural finished doorsshould be aware of current wood finishtechnologies.• To improve clear finish durability consider:o Using water-based coatings since theyhave improved to the point of being atleast as durable as oil-based ones if notoffering improved durability,o Pre-treating wood with UV absorbersto provide improved UV resistance,o Using heartwood for doors to improvethe durability of coatings since heartwoodhas less fungi friendly nutrientsand more fungi unfriendly toxins.Certain species lend themselves betterto this option, such as Douglas-fir andcedar.o Use of water repellents and mildewcidesare a must.Natural woodinterior andexterior doorsare poisedto captureadditionalmarket share.

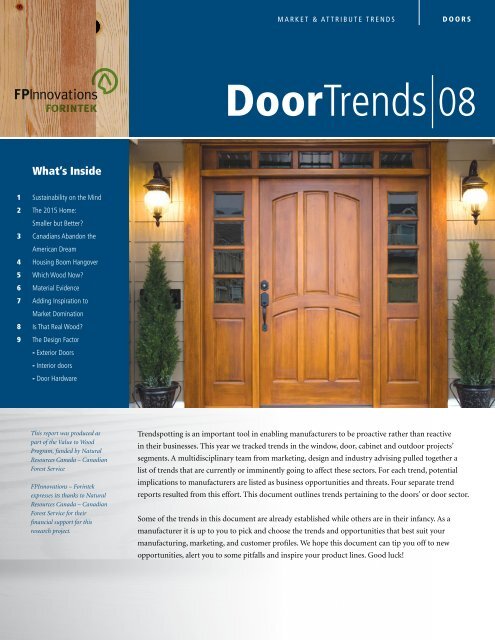

9The Design FactorMarket and Attribute <strong>Trends</strong>“Market and Attribute <strong>Trends</strong>” is a series offact sheets aimed at improving awarenessand information on market trends that shapethe demand for wood products. Market andAttribute <strong>Trends</strong> is complemented by a “Factson Wood” series that provides technicalinformation on the various commercial woodspecies in Canada.Through the Value to Wood program,Canadian wood product manufacturers haveaccess to the expertise and information theyneed to extract greater value from woodresources. To download the Market andAttribute <strong>Trends</strong>, visit www.valuetowood.caFPInnovations works towards optimizing theforest sector value chain. It capitalizes onCanada’s fibre attributes and it develops newproducts and market opportunties within aframework of environmental sustainability.As a world-leading provider of technologydevelopment, application and knowledgetransfer, the not-for-profit forest researchinstitute helps implement innovative manufacturingsolutions that provide the industry withlong-term competitive advantage.How to contact us:Roland Baumeister2665 East Mall, Vancouver, BCV6T 1W5Tel: (604) 224-3221Fax: (604) 222-5690Gerald Beaulieu319, rue Franquet, Québec, QCGIP 4R4Tel: (418) 659-2647Fax: (418) 659-2922www.valuetowood.cawww.solutionsforwood.cawww.fpinnovations.caTrend: There is a definite trend towardinnovation in the door and window industries.A survey conducted by Window & <strong>Door</strong>s in2008 indicated that 44% of its readers expectthat new products and innovation will be thekey to competitiveness in the next year.Discussion“In many instances, consumers are moving awayfrom the commodity mentality that has previouslydominated the door and window industry towardan expectation for quality and performance.”(john stephenson, president of great lakes window)It is becoming increasingly important formanufacturers to stay abreast of design trendsand be able to translate these trends into productsthat make sense for their particular brand andcustomer. The following is a summary of some ofthe trends influencing the door market.Exterior <strong>Door</strong>sThe front door is being seen more and moreas an important architectural statement. Entrydoors are getting larger, both in height and width.Wood, as a higher-end option for front doors isthus experiencing considerable interest. Thesedoors are quite elaborate and range from rusticto classical to contemporary in styling.Traditional front doors are being finished inelaborate multi-layer old-world finishes toachieve the look and feel of antiques. Some areactually finished then stripped and varnished toreplicate vintage woodwork. Many companies areoffering internal mini-blinds for sidelights (someare even motorized).Interior <strong>Door</strong>sInterior doors are experiencing a creativeoverhaul with innovations like chalkboardfinishes and custom images printed on them. Inaddition, wood doors are starting to deviate fromthe standard hollow core and standard style andrail to include more variation. Specialty doors likethose with acoustical properties are being soughtout for media rooms.As interior spaces are becoming more flexiblein design, pocket doors and other ways ofpartitioning off rooms are becoming popular.The quiet close and magnetic latches that haverevolutionized the cabinet industry in the last fewyears are starting to appear on interior doors inEurope and may well be something to keep an eyeon for the future in the North American market.<strong>Door</strong> Hardware<strong>Door</strong> security is important and influences doorhardware. Multipoint locking solutions arebecoming the standard in homes and businessesacross the US. While this hardware has been usedextensively for patio doors it is only recently beingused in entrance doors. Keyless entry technologyis moving to finger scanners and even facescanners in combination with voice recognition.While these innovations are still at the beginningstages they have the ability to elevate the frontdoor to a new level which is worth keeping an eyeon for the high-end niche market.The wide variation of decorative hardware fordoors–both interior and exterior–is indicative ofthe range in consumer style preferences.