RNLI ANNUAL REPORT AND ACCOUNTS 2011

RNLI ANNUAL REPORT AND ACCOUNTS 2011

RNLI ANNUAL REPORT AND ACCOUNTS 2011

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

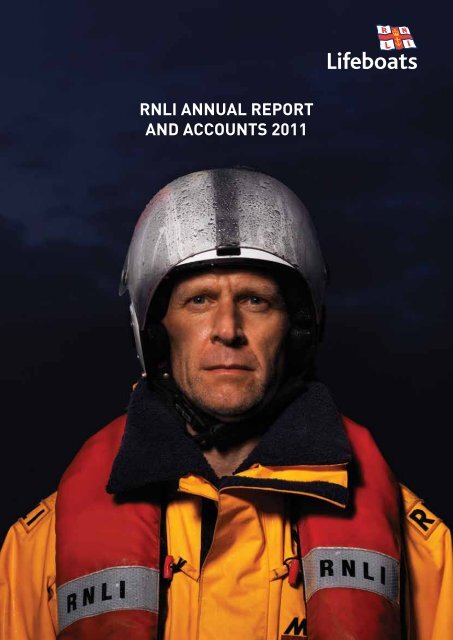

<strong>RNLI</strong> <strong>ANNUAL</strong> <strong>REPORT</strong><strong>AND</strong> <strong>ACCOUNTS</strong> <strong>2011</strong>

Atlantic 85 inshore lifeboatHarold Baines with her crewduring a training exercise3

Annual Report of the Trustees of theRoyal National Lifeboat InstitutionFOR THE YEAR ENDED 31 DECEMBER <strong>2011</strong>The 21st century continues to be the busiest since the <strong>RNLI</strong>’s foundation in 1824, withdemand for our services around the coasts of the United Kingdom and Republic of Irelandgrowing almost every year. <strong>2011</strong> was the <strong>RNLI</strong>’s second busiest year ever for lifeboatlaunches after 2009, taking second place from 2010. Our lifeboats and hovercraft werelaunched operationally on 8,905 occasions, an average of 24 times a day. We continued toexpand our <strong>RNLI</strong> lifeguard service, and were on a further 11 beaches in <strong>2011</strong>. In the Summermonths we now patrol 163 beaches around the coasts of England and Wales, and for thefirst time this year, started guarding beaches in Jersey and Northern Ireland. In <strong>2011</strong> the<strong>RNLI</strong> rescued or assisted 25,647 people and saved 438 lives. We were also active in tryingto stop people getting into difficulties in the water. Our Coastal Safety Teams delivered seasafety and beach safety messages directly to over 48,000 individuals, and indirectly throughoutdoor media, the internet, and radio and magazine adverts to as many as 20M people.After 2 years of decline in our total income, this year saw an increase of 5.6%.It was a good year for legacies, boosted in <strong>2011</strong> by a small number of very generousbequests, while raised voluntary income saw a modest increase of 1.4%. This is anextraordinary achievement in a difficult economic environment, and was only possible dueto the hard work and dedication of our volunteer fundraisers and staff.Spending was down for the second consecutive year as we maintained our Leanefficiency and cost-reduction programme launched in May 2010. Significant savings wereachieved in Operational Maintenance through Lean initiatives, including the major ConditionBased Maintenance programme for lifeboats, together with other savings in unplannedrepairs and maintenance. Total charitable expenditure was down 3.8% on 2010, and ourinvestment portfolio achieved modest growth, in spite of a number of stock market falls inthe year. Overall we generated a positive contribution to reserves in the year of £28.6M.However, a lifeboat service could not function without a capital expenditure programme,and we spent £33.5M of accumulated reserves in <strong>2011</strong> on new lifeboats, lifeboat stations,and other assets for the future. Our expenditure on lifeboat stations was down on 2010,as we experienced a number of planning delays and other issues beyond our control.Nevertheless these are being overcome, and we are now confident that our capitalexpenditure programme will catch up and become more predictable as we stabilise the buildprogramme for the 25-knot lifeboat fleet and modify our lifeboat stations accordingly.The western world continues to struggle with its recovery from the events of 2008,and in this tough economic environment the funding that we receive from our generous andcommitted supporters is more important than ever. We are deeply grateful for this supportand will continue to ensure both that the money is spent wisely and carefully, and that the<strong>RNLI</strong> operates as efficiently and effectively as possible.On behalf of the Trustees, may I once again extend our deepest thanks to all of the<strong>RNLI</strong>’s operational volunteers, fundraisers and supporters who give so generously of theirtime, money and enthusiasm to support us in saving lives at sea.Admiral the Lord Boyce KG GCB OBE DLChairmanRoyal National Lifeboat Institution4 April 2012The Annual Report and Financial Statements of the Royal National Lifeboat Institution (<strong>RNLI</strong>) for theyear ended 31 December <strong>2011</strong> have been prepared in accordance with applicable accounting standards,the Charities Act <strong>2011</strong>, and the Statement of Recommended Practice (SORP) ‘Accounting and Reportingby Charities’ (revised 2005) (second edition 2008) and comply with the charity’s trust deed.In July 2009, the <strong>RNLI</strong>’s priorities for the 5 years from 1 January 2010 were published in the<strong>RNLI</strong> Plan 2010–14 (the Plan). Extracts from the Plan, together with key achievements and performanceduring <strong>2011</strong>, are included within this report. The Plan was revised and replaced during <strong>2011</strong> by the<strong>RNLI</strong> Plan 2012–16. Extracts from that plan, setting out the <strong>RNLI</strong>’s priorities for 2012 and beyond, arealso included within this report. Full versions of both plans are available from the <strong>RNLI</strong>’s registeredoffice or may be downloaded from the website at <strong>RNLI</strong>.org.1

Annual Report of the Trustees of theRoyal National Lifeboat InstitutionFOR THE YEAR ENDED 31 DECEMBER <strong>2011</strong>PURPOSEThe <strong>RNLI</strong> saves lives at sea.VISIONTo end preventable loss of life at sea.VALUESOur work is based on and driven by our values.Our volunteers and staff strive for excellence and are…Selfless: willing to put the requirements of others before ourown and the needs of the team before the individual, able to seethe bigger picture and act in the best interests of the <strong>RNLI</strong>, andto be inclusive and respectful of others. Prepared to share ourexpertise with organisations that share our aims.Dependable: always available, committed to doing our part insaving lives with professionalism and expertise, continuouslydeveloping and improving. Working in and for the communityand delivering on our promises.Trustworthy: responsible, accountable and efficient in the use ofthe donations entrusted to us by our supporters, managing ouraffairs with transparency, integrity and impartiality.Courageous: prepared to achieve our aims in changing andchallenging environments. We are innovative, adaptable anddetermined in our mission to save more lives at sea.THINGS WE WILL NOT CHANGEVolunteer ethosOur lifesaving service is provided wherever possible by volunteers,generously supported by voluntary donations and legacies.Independent of GovernmentWe do not seek funding from central Government.Major charity, community basedWe operate through local teams, centrally directed and resourced.MaritimeOur exceptional expertise is in the preservation of life at sea andon the water through prevention and rescue, together with thedelivery of coordinated safety, research and education programmes.HeritageWe are proud of our history and tradition and of the <strong>RNLI</strong>’sachievement of saving lives over nearly 2 centuries.HOW WE FULFIL OUR PURPOSEThe <strong>RNLI</strong>, through our Concept of Operations, saves lives at seathroughout the United Kingdom (UK) and the Republic of Ireland(RoI) by providing:• a strategically located fleet of all-weather lifeboats, which areavailable at all times, and tactically placed inshore craft, whichare subject to weather limitations• a lifeguard service on a seasonal basis• safety education and accident preventionto a defined standard of performance, commensurate with theresources available, using trained and competent people who,wherever possible, are volunteers.STRATEGIC PERFORMANCE ST<strong>AND</strong>ARDSWe aim to:Achieve an average launch time of 10 minutes from notificationto the <strong>RNLI</strong>.> > An overall average launch time of 10.3 minutes was achievedin <strong>2011</strong> (2010: 10 minutes). There was an increase in call outsto incidents during the core working day in the year, withcrew having to travel from work rather than home, whichmay have resulted in this slight increase in launch times.Reach all notified casualties where a risk to life exists, in allweathers, out to a maximum of 100 nautical miles.> > Lifeboats launched on service 8,905 times in <strong>2011</strong> (2010:8,713), rescuing 7,976 people (2010: 8,313), and saving 354lives (2010: 309).Reach at least 90% of all casualties within 10 nautical miles ofthe coast within 30 minutes of launch in all weathers.> > The performance standard achieved in <strong>2011</strong> was 92.9%(2010: 92.5%). The improvement on the 2010 figure probablyresulted from the periods of relatively good weather in theSpring and Autumn of <strong>2011</strong>.Reach any beach casualty up to 300m from shore within theflags, on <strong>RNLI</strong> lifeguard-patrolled beaches, within 3½ minutes.> > In <strong>2011</strong>, <strong>RNLI</strong> lifeguards attended 15,625 incidents on<strong>RNLI</strong>-patrolled beaches (2010: 16,664), aided 17,671 people(2010: 18,779) and saved 84 lives (2010: 107). It is not costeffective to measure the average response time but ourrisk assessment process, fitness standards and operationalconfiguration of the lifeguard service are all designed toachieve this strategic performance standard.Deliver clear straightforward safety advice that positivelyinfluences behaviour, measured against agreed benchmarks.> > In <strong>2011</strong>, key marine safety messages and advice aroundlifejackets and safety equipment were delivered throughroadshows, presentations and face-to-face communications,reaching a total audience of well over 48,000 people.2

Beach safety advice has also been delivered through thekey face-to-face programmes of Beach to City, Meet theLifeguards and Hit the Surf, and reached a combined audienceof over 90,000. Key safety messages were also disseminatedthrough a multi-channel approach, including outdoormedia, the internet, and radio and magazine adverts – withestimated potential audiences of up to 20M people.PRINCIPAL ACTIVITIESThe <strong>RNLI</strong> operates 234 lifeboat stations around the coasts of theUK and the RoI, served largely by volunteers (branch officials,coxswains/helms, crew, shore crew and supporters). The <strong>RNLI</strong> alsoprovides lifeguards to 29 local authorities and 6 other landownersproviding access to the public, with 163 beach lifeguard unitsin England, Wales, Northern Ireland and Jersey (2010: 27 localauthorities, 4 other landowners, 152 units).The <strong>RNLI</strong> operates throughout the UK and the RoI. Lifesavingoperations are headquartered in Poole and based on sixoperating divisions (numbers of lifeboat stations in brackets):the North (33), East (42), South (35) and West (36) of England;Scotland (45) and Ireland (43) – Northern Ireland (9) and theRepublic of Ireland (34). Fundraising is also managed centrallyfrom the <strong>RNLI</strong>’s Headquarters in Poole, supported by communityfundraising teams strategically located across England, Wales,Scotland, Northern Ireland and the Republic of Ireland.<strong>RNLI</strong> lifeguards currently operate on beaches throughout thesouth, south west and north east of England, in northern EastAnglia, in south Wales, Northern Ireland and Jersey.The <strong>RNLI</strong> also provides three fully trained and equipped floodrescue teams, each comprising 20 core members, most of whomare drawn from volunteer lifeboat crew. In total there are over300 trained flood rescue team members.As well as lifesaving and lifeguarding, the <strong>RNLI</strong> has a muchbroader impact with its sea safety, beach safety and fishingsafety initiatives, ranging from educational activities withschoolchildren to the free safety checks offered to pleasurecraftusers and safety advice provided to fishermen. Through theoperation of the lifeboat service, the <strong>RNLI</strong> supports coastalcommunities throughout the UK and the RoI, invests heavilyin new boats and boathouses and, through its crew trainingprogrammes, delivers training courses to thousands of crewmembers each year. Training is delivered either at or close tolifeboat stations, or at <strong>RNLI</strong> College in Poole.The <strong>RNLI</strong> is almost entirely reliant upon voluntary contributionsfor its funding. Legacies remain our largest single source of incomeand the Trustees continue to be deeply indebted to the legators fortheir extraordinary generosity. The <strong>RNLI</strong> is also hugely dependenton the fundraising activities of a substantial number of dedicatedvolunteers in some 1,000 fundraising branches and guilds, as well as<strong>RNLI</strong> Governors, other members and donors. The Trustees remainsincerely grateful for their generosity and for their time.The <strong>RNLI</strong>’s popular business in gifts, souvenirs and Christmascards, operated by <strong>RNLI</strong> (Sales) Limited, also supports our workof saving lives at sea, through <strong>RNLI</strong> shops and branches, mailorder, and the <strong>RNLI</strong>shop website.The <strong>RNLI</strong> provides public benefit as a charity through thesaving of lives at sea and the Trustees have complied withtheir duty in accordance with the Charities Act <strong>2011</strong> to havedue regard to the Charity Commission’s guidance on theoperation of this public benefit. There are no alternative nationalorganisations to undertake the role the <strong>RNLI</strong> performs and bothHM Coastguard and the Irish Coast Guard rely on the <strong>RNLI</strong> forits resources to save lives at sea. The <strong>RNLI</strong> continues to workindependently of Government and relies on its fundraisingabilities to meet the cost. The public benefit of its activities isdemonstrated by the number of rescues carried out and thenumber of lives saved.Additionally, the public are protected on an increasingnumber of beaches by the <strong>RNLI</strong>’s equipment, lifeguards, otheremployees and volunteer lifesavers.VOLUNTEER ETHOSThe charity relies on some 4,600 volunteer lifeboat crew and3,000 volunteer shore crew for the delivery of its lifesavingservice. Its fundraising activities are also carried out by a networkof a further 24,000 or so registered volunteers, together with theGovernors, members, donors and other supporters backed upby full-time staff.THE <strong>RNLI</strong> CONTINUOUS IMPROVEMENT PROGRAMME (LEAN)<strong>2011</strong> has seen good progress in the second year of the <strong>RNLI</strong>’senterprise-wide continuous improvement programme. We arelooking at all major areas of activity and run improvement eventswhere there is capacity for us to do things more efficiently,ranging from support to the coast, to fundraising processes andto back-office systems. Our confirmed actual, annually recurringcost savings to the end of <strong>2011</strong> were £8.4M. A further £2.9Min one-off savings has also been realised. The programme hasachieved these excellent results by engaging with the majority ofthe staff, with over two thirds of staff trained in the programmeto date. As a result, Lean skills and knowledge are becomingnormal practice within the <strong>RNLI</strong>.THE FUNDRAISING ST<strong>AND</strong>ARDS BOARDThe <strong>RNLI</strong> is a member of the Fundraising Standards Boardand maintains a formal complaints procedure. The <strong>RNLI</strong> fullysupports the self-regulation of fundraising and is committed toproviding its supporters with the best possible level of service.3

each casualty up to 300m from shore within the flags, on<strong>RNLI</strong> lifeguard-patrolled beaches, within 3½ minutes. Whileboth cost and operationally effective means have not beenfound to measure performance against this standard, therisk assessment process, fitness standards and operationalconfiguration of the lifeguard service are all designed toachieve this goal.Continue with the lifeguard rollout programme.> > The lifeguard service was delivered on 163 beaches in <strong>2011</strong>,including 11 new beaches in the year in Northern Ireland andJersey. A further 20 new beaches are planned for 2012.PREVENTIONSecure the people and infrastructure to run theprevention service.Priorities 2010–14Delivery of a cost-effective, coordinated prevention service basedon activities defined through appropriate research, theeffectiveness of which can be verified.> > A new framework has been established for the developmentand delivery of Coastal Safety initiatives, which gives greaterprominence to safety as the third strand of the Conceptof Operations.SUPPORTING ACTIVITY PROGRAMMESFUNDRAISING <strong>AND</strong> AWARENESSObtain sufficient funds to finance the <strong>RNLI</strong> plans, andawareness and support of who we are and what we need.Priorities 2010–14Maintain a positive public perception of the <strong>RNLI</strong>.> > The <strong>RNLI</strong>’s reputation remains high and the organisationtopped the Reputation Institute’s Annual Charity Surveyfor the second year running. High-profile TV programmeslike ITV1’s Mayday Mayday series and History Channel’sLifeboat Heroes documentary, reinforced by improved TVnews coverage from our lifeboat cameras, have contributedsignificantly to maintaining public trust and admiration forour lifesavers. They have been instrumental in maintainingthe public’s propensity to support us.Maintain awareness and propensity to support.> > The independent Ipsos survey reported total awarenessof the <strong>RNLI</strong> in the UK at 77% (2010: 75%), spontaneous(unprompted) awareness at 11% (2010: 9%), and propensityto give at 55% (2010: 54%).Develop and adapt a portfolio of fundraising mechanisms tooptimise income.> > The continuous improvement programme has led to asignificant change to the processes and structure of theFundraising and Communications Department during theyear. This will lead to greater stability in future incomegeneration and allow us to become more agile in responseto any influencing factors.DESIGN, CONSTRUCTION <strong>AND</strong> MAINTENANCEProvide affordable and appropriate operational plant,equipment and facilities that are properly maintained.Priorities 2010–14Lifeboats, launching equipment and other plant.Design – progress new boat/equipment projects.> > The prototype for the new Shannon class is approachingcompletion. The pre-production launch and recovery equipmentfor the boat was trialled successfully and the boat trials in early2012 will be followed by full-scale production.> > Boat 1 of the E class replacement River Thames lifeboatproject was delivered to the <strong>RNLI</strong> in Autumn <strong>2011</strong>. A periodof crew training and repair work under warranty followed,and she became an operational lifeboat in February 2012.Boats 2 and 3 were being completed in parallel, with deliverydates scheduled for early March 2012 and May 2012 respectively.A number of structural components for all three boats werebuilt at the <strong>RNLI</strong> subsidiary, SAR Composites Limited.Supply – plant and equipment to agreed plan.> > Four Tamar all-weather lifeboats, eight Atlantic 85 and sevenD class inshore lifeboats, including all necessary launch andrecovery and support equipment, were delivered to plan in <strong>2011</strong>.Support – plant and equipment (refit/repair/refurbish).> > Condition-based maintenance of Severn, Trent and Merseyclass lifeboats was successfully introduced in <strong>2011</strong>,delivering a substantial financial saving while improvingreliability. Other classes of lifeboats and launch and recoveryequipment will be introduced to the programme in 2012.Improvement – develop a quality management system andthrough-life management approach.> > A second audit of the Engineering function’s ISO9000 qualitymanagement system was successfully completed in <strong>2011</strong>.Shore facilitiesStation rebuild programme for the 25-knot fleet programme.> > Deployment of the Tamar lifeboat continued with the officialopenings of the new slipway boathouses at Bembridge andShoreham Harbour and the completion of a challenging project atThe Lizard that saw the ninth boathouse in the programmebrought into operation in Church Cove. Detailed design andcontract preparation on the remaining five projects is welladvanced in readiness for completion of the programme by 2014.Provision of lifeguard beach and area support centres.> > <strong>2011</strong> saw the further refinement and standardisation ofbeach units, with all requirements being met at our 163beaches and unit costs reduced. A new Area Support Centrewas established in Northern Ireland in support of the5

The <strong>RNLI</strong> is always ready tolaunch to help those in need7

<strong>RNLI</strong> Plan 2012–16The <strong>RNLI</strong> Plan 2010–14 was revised and replaced in <strong>2011</strong> by<strong>RNLI</strong> Plan 2012–16. This is available from the <strong>RNLI</strong>’s registeredoffice or may be downloaded from the website at <strong>RNLI</strong>.org.Extracts from the Plan, setting out the <strong>RNLI</strong>’s prioritiesfor the next 5 years, are reproduced below:HOW WE SAVE LIVES AT SEAEverything works back from the casualty. He/she defines thelifesaving need, which in turn requires boats, equipment, buildingsand capable people. This in turn requires funding, but fundingalso can only be achieved with strong cases for support.OVERVIEWThis document sets out how we plan to fulfil our purpose ofsaving lives at sea by stating, within the context of our longtermstrategy, how we intend to deliver the required people,equipment and other resources to provide capacity to:• meet an annual demand of up to 10,000 operationallifeboat launches• attend up to 35,000 lifeguard incidents• deploy flood rescue teams in the UK or RoI with the capabilityonce every 2 years to be tasked further afield• operate a comprehensive maritime safety and data collectioncentre for the UK and RoI• enhance the capabilities of emerging/developing SAR-relatedorganisations overseas, funded by international sales ofconsultancy, equipment and training.Our key long-term priorities are to:• deliver a 25-knot all-weather lifeboat fleet• provide lifeguard coverage at identified locations• maintain our position as a leading organisation incoastal safety.Over the next 5 years our key objective is to work steadilytowards our key priorities while containing overall expenditureand ensuring that our lifesaving service can be provided in themost efficient way.The key themes running through the plan are:Stability of the capital expenditure requirements: this will beachieved primarily through the implementation of the long-termall-weather lifeboat strategy (20+ years). In practical terms thiswill involve balancing the operational needs with the capacity todeliver the programme, available funding and reserves.IMPROVEMENT TARGETSIn delivering our rescue service, and everything that contributestowards it, we will continuously improve how we work until thefollowing aspirations are met and we end preventable loss of lifeat sea. These targets are expressed throughout the <strong>RNLI</strong> as:PeopleEveryone believes they canimprove the <strong>RNLI</strong> and strivesto do so.QualityRight first time, every time.Asset deployment continues to be determined by a riskbasedapproach: the planning assumptions for total fleet sizeand lifeguard deployment are based on the assessment ofcasualty potential around the coast.Demonstrable efficiency and a continuous improvementculture: the culture change will be achieved through theadoption of Lean thinking throughout the organisation.Tight expenditure control: costs have been constrained toa level below inflation (other than for the direct cost of theexpanding service delivery – lifeguarding and new lifeboat fleet).Challenging fundraising targets: we are planning to increaseincome at a time when others in the charity sector are predictingdifficulty in maintaining current income levels.CostMaximum value atminimum cost.TimeOn time, every time.8

Station ALBs (%)1008060Total stations with 25-knot all-weather lifeboats402004 2008 2012 2016 2020 2024YearActual 25-knotALB station fleetPlanned 25-knotALB station fleetLifesavingThe operation of the <strong>RNLI</strong>’s lifeboat, lifeguard and coastalsafety services to meet the agreed strategic performancestandardsLifeboat servicePriorities 2012–16:• continued deployment of the 25-knot all-weather lifeboatfleet• ensure training provision meets operational need• maintain and develop the volunteer ethos• promote the work of the <strong>RNLI</strong> through increased media exposure.100Lifeguard programmeLifeguard servicePriorities 2012–16:• expansion of the lifeguard service in accordance with therollout programme.Lifeguard units (%)5002004 2008 2012 2016 2020 2024YearActual lifeguard units Planned lifeguard unitsCoastal Safety servicePriorities 2012–16:• deliver cost-effective, coordinated coastal safety activities• further develop the management information used to drivefuture activities• continue to influence safety standards in the beach andmarine environment.Lifeguards at Watergate Bay9

IncomeRevenue Expenditure£162.9M £140.6M £31.8MIncomeIncome• Legacies 61%• Raised voluntary income 32%• Net investment income 2%• Net merchandising andother trading 3%• Lifeguarding and other income 2%revenue expenditureRevenue Expenditure• Rescue 47%• Operational maintenance 32%• Cost of generating voluntaryincome 15%• Prevention 3%• Innovation 3%capital expenditureMissing/found - age ranges• Lifeboat stations 35%• Lifeboats and launchingequipment 53%• Other equipment andproperty 12%Note: Income and expenditure are shown net of the cost of merchandising and other trading (£8.9M) and investment fees (£0.9M).Capital expenditure excludes movements in lifeboats and lifeboat stations under construction.Restricted reserves, which are reserves only available forexpenditure in accordance with the donors’ directions. Where thosereserves have been expended on fixed assets, the reserves financingRevenue Expenditurethe book value of those assets will continue to be accounted asrestricted reserves, reflecting the source of funds and the <strong>RNLI</strong>’scontinued obligations in respect of the use of those assets.Designated reserves, which are set aside at the discretion of theTrustees and comprise:• fixed assets, which finances those fixed assets of the <strong>RNLI</strong>funded other than by restricted donations,• planned capital expenditure, which sets aside funds to ensurethat the <strong>RNLI</strong> can meet its planned capital expenditure. Thisis expenditure to which the <strong>RNLI</strong> is committed over the next3 years in order to maintain the operation of the lifeboat andMissing/foundlifeguard-service,age rangesprincipally new lifeboats and lifeboat stations.The total amount set aside excludes projects to be funded byrestricted reserves.All the above reserves are Committed reserves.Missing/found - age rangesFree reserves, which are retained to enable the Trusteesto provide assurance to those at sea, the public and thegovernments of the UK and the RoI that the <strong>RNLI</strong> will be ableto sustain its commitment to provide the lifeboat and lifeguardservice. The reserves are set at a level to withstand any shorttermsetback, whether operational, in the investment markets orin key sources of income, such as legacies.If free reserves fall outside the range of 6–18 months’charitable expenditure cover, the Trustees will review thestrategic plan, and make such changes as they considerappropriate. One month’s charitable expenditure is defined asthe annual charitable expenditure divided by 12 months.For the purposes of the above calculation, free reserves arecalculated prior to the deduction of negative pension reserves,which are shown within net free reserves as required by FRS17.Investment policyThe <strong>RNLI</strong>’s reserves (excluding fixed asset reserves) are held ininvestments.The <strong>RNLI</strong>’s investment policy was last significantly revisedin 2009 and is reviewed annually. It seeks to adopt a cautious,prudent and well-diversified investment stance to balancepotential return with appropriate risk. At the same time, theTrustees are conscious that some level of volatility is inevitable ifgood investment use is to be made of the sums involved. Risk isspread across different asset classes and between different stylesof investment management.As at 31 December <strong>2011</strong>, the assets were divided on theadvice of the investment advisers between a number of differentinvestment managers and pooled investment funds, achievinga much greater diversification of investment than in prior years.Investments are held centrally by an independent custodian,Northern Trust, who also measured performance during the year. Asat 31 December <strong>2011</strong>, the strategic asset allocation was as follows:• Absolute return funds 44%• Fixed interest 31%• Equities 20%• Property unit trusts and cash 5%Several of the pooled investment funds held by the <strong>RNLI</strong> usederivative products within their portfolios to reduce market riskin line with their investment strategies. No derivative productsare held directly by the <strong>RNLI</strong>.The Trustees have considered carefully the requirements ofthe SORP and the Charity Commission’s revised guidance noteCC14 (issued in October <strong>2011</strong>) and continue to conclude thatthey do not believe there to be any listed investment adverse tothe purpose of the charity, saving lives at sea, and therefore theydo not apply any specific ethical constraint to the investmentpolicy. The <strong>RNLI</strong>’s investments are substantially held in pooledfunds, some of which are index tracking funds and notactively managed.The <strong>RNLI</strong> periodically reviews the policies of the managers ofthose funds and the managers of its remaining segregated assetswith reference to the United Nations Principles of ResponsibleInvestment, and the composition of both its pooled fund andsegregated investment portfolios, but would not seek to influencethe investment discretion of the investment manager or withdrawfrom any pooled fund unless an investment was identified thatconflicted with the charitable objectives of the <strong>RNLI</strong>.Both the investment policy and the performance of theinvestment advisers, pooled investment funds and investmentsheld by other investment managers are monitored closely by<strong>RNLI</strong> staff and the <strong>RNLI</strong>’s Investment Sub-Committee.13

GovernanceThe Royal National Lifeboat Institution (<strong>RNLI</strong>) was foundedin 1824, and incorporated under Royal Charter in 1860, withSupplemental Charters granted in 1932, 1986, 2002 and <strong>2011</strong>.The <strong>RNLI</strong> is established as a charity in England and Wales, number209603 and Scotland, number SC037736. It is registered as Charitynumber CHY 2678 in the Republic of Ireland. The address of theregistered office is West Quay Road, Poole, Dorset, BH15 1HZ.Following the updating and modernisation of our RoyalCharter and Bye-Laws in 2010, changes were approved by theGovernors at the <strong>RNLI</strong>’s Annual General Meeting in May. HerMajesty The Queen approved the changes to the Royal Charteron 1 November <strong>2011</strong>, with the new supplemental Royal Chartercoming into effect from that date. There were no major changesto the governing principles of the charity.The <strong>RNLI</strong> has five wholly-owned subsidiary companies:<strong>RNLI</strong> (Enterprises) Limited, <strong>RNLI</strong> (Sales) Limited, <strong>RNLI</strong> (Trading)Limited, <strong>RNLI</strong> College Limited (incorporated during the year toprovide training to the <strong>RNLI</strong> and approved third parties) and SARComposites Limited, a subsidiary of <strong>RNLI</strong> (Trading) Limited.In addition, there are a number of advisory committees,enabling experienced specialists to contribute to key aspects ofthe <strong>RNLI</strong>’s affairs, and an Audit and Risk Committee. The Auditand Risk Committee meets twice a year and reviews the workof the external and internal auditors, the Annual Report andAccounts and other financial information prior to publication.The <strong>RNLI</strong> also employs specialist advisers as shown on page 35.On appointment, new Trustees are given an inductionprogramme and a reference manual to familiarise themselveswith the work of the <strong>RNLI</strong> and their role. Periodic trainingsessions are also held for the Trustee body as a whole. TheChief Executive is responsible to the Trustees for the day-todayrunning of the <strong>RNLI</strong> and the execution of the strategy andpolicies decided by the Trustee Board.Names of <strong>RNLI</strong> Trustees who served at any time during <strong>2011</strong>and/or were Trustees of the charity as at the date of this report,together with the names of the Chief Executive, other membersof the Executive Team, and other relevant organisations andpersons are given on pages 34 and 35.THE TRUSTEES <strong>AND</strong> MANAGEMENTThe <strong>RNLI</strong> is controlled by a Trustee Board.The Trustees are a body of volunteers with distinguishedcareers in a wide variety of fields. They come from all parts ofthe UK and RoI and many have had a lifelong interest in the sea.Trustees are appointed from within and by the Council, which inturn provides broad advice and support to the Trustees. Membersof Council may be proposed to the Membership NominationCommittee by the Trustees or a Governor. This Committee,which comprises the Chairman, the Vice-Chairman, the DeputyChairmen and the Chairman of the Resources Committee,reviews the names proposed and submits its recommendationsto the Annual General Meeting for election by the Governors.Trustee Board Members serve a 3-year term, but may bere-elected for succeeding terms.RISK MANAGEMENTBy the <strong>RNLI</strong>’s very purpose, the crews, support staff andoperational assets are exposed to substantial risk. The Trusteeshave taken all appropriate steps to mitigate and manage theseoperational risks, principally through crew training, appropriateoperational procedures, stringent design and maintenance of thelifeboats and equipment, and insurance of third-party risks.The further development of competence-based training (CoBT)for lifeboat crew members, shore crew and lifeguards and the newdesigns of lifeboats are major elements of this continuing process.The <strong>RNLI</strong> actively seeks to manage the organisation’s keystrategic risks, which are formally reassessed by the ExecutiveTeam and Trustees biannually. The current key strategic risksrelate to loss of life, the maintenance of the <strong>RNLI</strong>’s reputationand our ability to raise funds.Shore crew recovering the Merseyclass lifeboat Leonard Kent14

These risks are analysed into key components in a riskregister where responsibility for the management of eachcomponent is assigned to a senior manager. The Audit and RiskCommittee monitors the resulting risk profile and reports to theTrustee Board.Although responsibility for risk management lies with<strong>RNLI</strong> management, the Internal Auditor facilitates theassessment process.FINANCIAL POSITIONThe Trustees consider that there is a reasonable expectationthat the <strong>RNLI</strong> has sufficient resources to continue in operationalexistence for the foreseeable future and, for this reason, theycontinue to adopt the going-concern basis in preparingthe accounts.KEY FACTORS INFLUENCING PERFORMANCEAchievement of the <strong>RNLI</strong>’s objectives is subject to a number offactors both within and outside of the organisation’s control.Factors include the continuity and availability of public support,both in funding and in volunteering, economic stability (includingthe marine industry, the costs of maritime infrastructure and theprice of fuel), the volatility of investment markets, continuity ofnational, regional and local government policy, and the stabilityof the sociological and geophysical coastal environment.STATEMENT OF TRUSTEES’ RESPONSIBILITIESThe Trustees are responsible for preparing the Trustees’ Reportand the financial statements in accordance with applicable lawand regulations.Charity law requires the Trustees to prepare financialstatements for each financial year in accordance with UnitedKingdom Generally Accepted Accounting Practice (UnitedKingdom Accounting Standards and applicable law).Under charity law the Trustees must not approve thefinancial statements unless they are satisfied that they give atrue and fair view of the state of affairs of the charity and thegroup, and of its, and the group’s, surplus or deficit for thatperiod. In preparing these financial statements, the Trustees arerequired to:• select suitable accounting policies and then applythem consistently• make judgements and estimates that are reasonable and prudent• state whether applicable accounting standards have beenfollowed, subject to any material departures disclosed andexplained in the financial statements• prepare the financial statements on the going-concern basisunless it is inappropriate to presume that the charity willcontinue to operate.The Trustees are responsible for keeping proper accountingrecords sufficient to show and explain the charity’s and thegroup’s transactions, and disclose with reasonable accuracy atany time the financial position of the charity and the group andenable them to ensure that the financial statements comply withthe Charities Act <strong>2011</strong>. They are also responsible for safeguardingthe assets of the charity and the group and hence for takingreasonable steps for the prevention and detection of fraud andother irregularities. Through specified financial procedures theyaim to ensure the security of <strong>RNLI</strong> property, safe receipt of allincome and appropriate review and controls over expenditure andexpenses such that they are relevant to the <strong>RNLI</strong>’s objectives, fitfor purpose, properly incurred and properly authorised.15

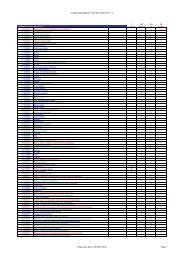

<strong>RNLI</strong> consolidated statement of financial activitiesfor the year ended 31 December <strong>2011</strong>NoteNet freereserves£MDesignatedreserves£MRestrictedreserves£MEndowmentreserves£MTotal<strong>2011</strong>£MTotal2010£MIncoming resourcesRaised voluntary income 43.2 - 9.0 - 52.2 51.5Legacies 73.1 - 24.6 - 97.7 90.6Merchandising and other trading 14.3 - - - 14.3 14.1Investment income 7c 4.6 - 0.3 - 4.9 4.5Lifeguarding and other income 3.6 - - - 3.6 2.8Total incoming resources 138.8 - 33.9 - 172.7 163.5Resources expendedCost of generating voluntary income (22.1) (0.7) - - (22.8) (23.0)Merchandising and other trading (8.8) (0.1) - - (8.9) (8.7)Investment fees (0.7) - (0.2) - (0.9) (1.2)Cost of generating funds (31.6) (0.8) (0.2) - (32.6) (32.9)Rescue (36.0) (5.6) (23.8) - (65.4) (64.2)Prevention (3.8) (0.1) (0.4) - (4.3) (4.0)Operational maintenance (32.1) (2.0) (8.9) - (43.0) (49.6)Innovation (4.3) (0.1) - - (4.4) (4.0)International (0.2) - - - (0.2) (0.1)Charitable expenditure (76.4) (7.8) (33.1) - (117.3) (121.9)Governance expenditure (0.5) - - - (0.5) (0.5)Total resources expended 5 (108.5) (8.6) (33.3) - (150.4) (155.3)Net incoming resources before transfers 30.3 (8.6) 0.6 - 22.3 8.2Transfers between reserves 1g (21.6) (19.4) 41.0 - - -Net incoming resources 8.7 (28.0) 41.6 - 22.3 8.2Gains on investments 7b 3.0 - 1.0 (0.5) 3.5 17.5Actuarial gains/(losses) on pension schemes 14d 2.8 - - - 2.8 (0.5)Net movements in reserves 14.5 (28.0) 42.6 (0.5) 28.6 25.2Reserves at 1 January 63.1 257.0 220.2 10.1 550.4 525.2Reserves at 31 December 77.6 229.0 262.8 9.6 579.0 550.4The notes on pages 21–33 form part of these accounts.17

<strong>RNLI</strong> consolidated balance sheetAS AT 31 DECEMBER <strong>2011</strong><strong>2011</strong> 2010Note £M £M £M £MAssets employedFixed assets 6Intangible assets 1.4 1.5Tangible assets 330.9 321.3332.3 322.8Investments 7 250.9 235.9Current assetsStocks 8 14.0 13.5Debtors 9 29.5 25.7Short-term deposits 2.4 7.1Cash 2.9 1.648.8 47.9CreditorsAmounts falling due within 1 year 10 (14.7) (12.1)Net current assets 34.1 35.8CreditorsAmounts falling due after more than 1 year 10 (4.9) (6.0)Net assets excluding pension liability 612.4 588.5Defined benefit pension liability 10 (33.4) (38.1)Net assets including pension liability 579.0 550.4The reserves of the Charity:Committed reservesEndowment reserves 9.6 10.1Restricted reserves: Fixed assets 179.2 143.8Other restricted reserves 75.3 76.4Accrued legacy reserve 8.3 -262.8 220.2Designated reserves: Fixed assets 153.1 179.0Planned capital expenditure 12 75.9 78.0229.0 257.0Net free reservesFree reserves 93.6 80.1Accrued legacy reserves 17.4 21.1FRS17 pension reserves (33.4) (38.1)77.6 63.1Total reserves 579.0 550.4The notes on pages 21-33 form part of these accounts. The accounts of the <strong>RNLI</strong> and the consolidated accounts were approvedand authorised for issue by the Trustees on 4 April 2012 and signed on their behalf.Admiral the Lord Boyce KG GCB OBE DLChairman4 April 2012Paul Boissier CB MA MScChief Executive4 April 201218

<strong>RNLI</strong> balance sheet*AS AT 31 DECEMBER <strong>2011</strong><strong>2011</strong> 2010Note £M £M £M £MAssets employedFixed assets 6Tangible assets 319.7 311.8319.7 311.8Investments 7 252.4 236.4Current assetsDebtors 47.1 44.0Short-term deposits 2.4 7.1Cash 2.2 1.351.7 52.4CreditorsAmounts falling due within 1 year (6.6) (6.9)Net current assets 45.1 45.5CreditorsAmounts falling due after more than 1 year (4.9) (6.0)Net assets excluding pension liability 612.3 587.7Defined benefit pension liability (33.4) (38.1)Net assets including pension liability 578.9 549.6The reserves of the Charity:Committed reservesEndowment reserves 9.6 10.1Restricted reserves : Fixed assets 179.2 143.8Other restricted reserves 75.3 76.4Accrued legacy reserves 8.3 -262.8 220.2Designated reserves : Fixed assets 140.5 168.0Planned capital expenditure 12 75.9 78.0216.4 246.0Net free reservesFree reserves 106.1 90.3Accrued legacy reserves 17.4 21.1FRS17 pension reserves (33.4) (38.1)90.1 73.3Total reserves 578.9 549.6The notes on pages 21-33 form part of these accounts. The accounts of the <strong>RNLI</strong> and the consolidated accounts were approvedand authorised for issue by the Trustees on 4 April 2012 and signed on their behalf.Admiral the Lord Boyce KG GCB OBE DLChairman4 April 2012Paul Boissier CB MA MScChief Executive4 April 2012* The <strong>RNLI</strong> balance sheet, showing the financial position of the charity excluding its subsidiaries, has been included withinthese accounts this year in accordance with the Charities (Accounts and Reports) Regulations 2008.19

<strong>RNLI</strong> consolidated cash flow statementFOR THE YEAR ENDED 31 DECEMBER <strong>2011</strong><strong>2011</strong> 2010Note £M £M £M £MNet cash inflow from operating activities (a) 33.7 18.3Returns on investmentsInvestment income 4.9 4.5Capital expenditurePayments to acquire fixed assets:Intangible assets - -Lifeboats (16.4) (13.8)Stations and shoreworks (10.9) (20.1)Launching equipment (0.6) (1.2)Depots, offices and training facilities 0.2 (1.8)Computer equipment, plant and vehicles (4.1) (4.2)Assets under construction movement (1.7) 3.6(33.5) (37.5)Receipts from sales of fixed assets 3.0 0.8Net cash outflow for capital expenditure (30.5) (36.7)Cash inflow/(outflow) after capital expenditure 8.1 (13.9)InvestmentsPurchase of investments (78.9) (230.4)Receipts from sale of investments 67.4 242.0Net cash (outflow to)/inflow from investments (11.5) 11.6Cash outflow before use of liquid resources (3.4) (2.3)Management of liquid resourcesTransfer from short-term deposits 4.7 1.8Increase/(decrease) in cash in the year (b) 1.3 (0.5)Notes to the consolidated cash flow statement <strong>2011</strong> 2010(a) Reconciliation of changes in net incoming resources £M £Mto net cash inflow from operating activitiesNet incoming resources 22.3 8.2Investment income (4.9) (4.5)Depreciation/amortisation 21.4 20.6(Profit)/loss on sale of tangible fixed assets (0.4) 0.2Increase in stock (0.5) (1.1)(Increase)/decrease in debtors (3.8) 2.7Decrease/(increase) in creditors 1.5 (5.1)Decrease in pensions liabilities (4.7) (2.2)Actuarial gains/(losses) on pension schemes 2.8 (0.5)Net cash inflow from operating activities 33.7 18.3(b) Reconciliation of net cash outflow<strong>2011</strong>£M2010£MIncreasein year£MCash 2.9 1.6 1.320

<strong>RNLI</strong> notes to the accountsFOR THE YEAR ENDED 31 DECEMBER <strong>2011</strong>1 ACCOUNTING POLICIESa) Basis of accountingThe accounts have been prepared under the historical costconvention, except that investments are stated at market value.The accounts have been prepared in accordance withapplicable accounting standards, the Charities Act <strong>2011</strong>, and theStatement of Recommended Practice (SORP), Accounting andReporting by Charities (revised 2005) (second edition 2008).b) Basis of consolidationAll subsidiary companies have been consolidated on a line-bylinebasis.c) DepreciationTangible fixed assets costing more than £10,000 are capitalisedand included at cost.Fixed assets are depreciated over their current anticipatedlives, which are assessed as follows:Goodwill andintellectual propertyLifeboat stationsand shoreworksOther freehold/leasehold buildingsLifeboatsLaunching equipmentOffice furnitureand depot plantComputer andelectronic equipmentMotor vehicles: straight line over 20 years: straight line over 50 years: straight line over50 years/period of lease: 13–25% reducingbalance per annum: 13% reducing balanceper annum: straight line over 5–10 years: straight line over 4 years: straight line over 4 years.d) Pension schemeThe <strong>RNLI</strong> operates a defined benefit pension scheme coveringits employees in the UK and the RoI. The scheme was closedto new entrants from 1 January 2007. A defined contributionpension scheme was established for new staff joining after thatdate. The defined benefit scheme assets are held in a separateTrustee-administered fund. The cost charged in the Statement ofFinancial Activities (SoFA) represents current service costs andgains and losses on settlements and curtailments calculated inaccordance with FRS17. Actuarial gains and losses are recognisedimmediately. Further details are shown in note 14.e) Incoming resourcesAll incoming resources are included in the SoFA when the <strong>RNLI</strong> islegally entitled to the income and the amount can be quantifiedwith reasonable accuracy. Pecuniary legacies are recognised asreceivable once probate has been granted and notification hasbeen received. Residuary legacies are recognised as receivableonce probate has been granted, on an estimated basis as follows:cash elements are recognised at monetary value, with propertyand other assets, including investments, valued at probate orestimated market value. Values are reviewed and adjusted atthe accounting date as required. The <strong>RNLI</strong> maintains a legacypipeline system which, in addition to forecast legacies, includesfurther estimated legacies of which the <strong>RNLI</strong> is aware, but whichdo not meet the above criteria, and which therefore have notbeen included within these accounts. Donations in kind arevalued at the value in use of the assets to the <strong>RNLI</strong>.f) Resources expendedAll expenditure is accounted for on an accruals basis and hasbeen classified under headings that aggregate all costs relatedto the category. Support costs representing expenditure ontraining, estates and administration, financial management,human resources administration and information systemsand infrastructure have been allocated to rescue, prevention,operational maintenance, innovation, governance and the costof generating voluntary income on the basis of cost. Governancecosts are those costs associated with the governance arrangementsrather than the day-to-day management of the <strong>RNLI</strong>.<strong>RNLI</strong> lifeguardteaching water safetyat a Manchesterjunior school21

<strong>RNLI</strong> notes to the accounts (continued)FOR THE YEAR ENDED 31 DECEMBER <strong>2011</strong>g) Reserves policyThe <strong>RNLI</strong>’s reserves fall into the following categories:Endowment reserves are capital sums, which are donated underthe restrictions that they are invested and that only the incomearising is available for expenditure in accordance with thedonors’ directions.Restricted reserves are reserves that are only available forexpenditure in accordance with the donors’ directions. Wherethose reserves have been expended on fixed assets, the reservesfinancing the book value of those assets will continue to beaccounted as restricted reserves, reflecting the source of fundsand the <strong>RNLI</strong>’s continued obligations in respect of the use ofthose assets. Other than fixed assets there are over 700 of thesereserves, all represented by investments, which are restricted toexpenditure on particular items of equipment and on particulartypes of service such as crew training or at particular stations.Accrued legacy reserves represent the restricted legacy valueaccrued on an estimated basis, in accordance with the policy onincoming resources detailed in this note.Designated reserves are set aside at the discretion of theTrustees and comprise:Fixed Assets, which finances the fixed assets of the <strong>RNLI</strong> fundedother than by restricted donations.Planned Capital Expenditure, which sets aside funds to assuresuppliers that the <strong>RNLI</strong> can meet its planned capital expenditure.This is expenditure to which the <strong>RNLI</strong> is committed over the next3 years in order to maintain the operation of the lifeboat andlifeguard service, principally new lifeboats and lifeboat stations.The total amount set aside excludes projects to be funded byrestricted reserves.All the above reserves are Committed reserves.Free reserves are retained to enable the Trustees to provideassurance to those at sea, the public and the governments of theUK and RoI, that the <strong>RNLI</strong> will be able to sustain its commitmentto provide the lifeboat and lifeguard service. The reserves areset at a level to withstand any short-term setback, whetheroperational, in the investment markets or in key sources ofincome, such as legacies. If free reserves fall outside the rangeof 6–18 months’ charitable expenditure cover, the Trustees willreview the Strategic Plan and make changes, as they considerappropriate. For the purposes of this calculation, free reserves arecalculated excluding FRS17 pension reserves.Accrued legacy reserves represent the legacy value accruedon an estimated basis once probate has been granted andnotification has been received, where the amount can bequantified with reasonable accuracy. The amount excludesrestricted legacies.FRS17 pension reserves represent the FRS17 accountingdeficit for the defined benefit pension scheme and dependants’pensions as at the year end. The FRS17 basis is a prescribedaccounting basis that requires the discount rate to be the returnon AA-rated (or equivalent) corporate bonds. Each year, theScheme Actuary assesses the financial position of the scheme,allowing for the returns expected to be generated by the assetsplanned to be held by the scheme in the future. These assetswould not typically consist of 100% in corporate bonds. Furtherdetails are shown in note 14.Transfers between reserves represent the application ofrestricted and designated funds to capital projects and transfersto maintain the committed value of restricted funds. In <strong>2011</strong>,there has been a review of restricted assets and a transferbetween designated and restricted funds to reflect this.h) Operating leasesRentals applicable to operating leases are charged to the SoFAover the period in which the cost is incurred.i) InvestmentsListed investments are stated at market value. Realised gains andlosses on sales of investments are calculated as the differencebetween the sale proceeds and original costs. Unrealised gainsand losses represent the movement in market values.j) StocksStocks are valued at cost or written-down value. Stocks arereviewed on a line-item basis at least annually and provisionis made against cost to reduce carrying value to estimatedrealisable value.k) Exchange gains and lossesTransactions in foreign currencies are recorded using the rate ofexchange ruling at the date of the transaction. Monetary assetsare translated at the rate of exchange ruling at the balance sheetdate. Gains and losses on exchange are included in the SoFAunder investment income.2 Subsidiary companiesThe <strong>RNLI</strong> has four directly, wholly owned subsidiaries, <strong>RNLI</strong>(Trading) Limited, <strong>RNLI</strong> (Enterprises) Limited, <strong>RNLI</strong> (Sales) Limitedand <strong>RNLI</strong> College Limited, all of which are registered in Englandand Wales. <strong>RNLI</strong> (Trading) Limited has a wholly owned subsidiary,SAR Composites Limited, that carries out hull construction. <strong>RNLI</strong>College Limited was incorporated on 14 July <strong>2011</strong> and exists toprovide training to the <strong>RNLI</strong> and approved third parties, primarilyin the emergency launching and operational use of lifeboats.The activities of <strong>RNLI</strong> (Trading) Limited and <strong>RNLI</strong> CollegeLimited relate directly to the charitable activities of the <strong>RNLI</strong>,although both companies have some external sales of sparecapacity if available. The other companies are used for noncharitableactivities to raise funds for the charity. <strong>RNLI</strong> (Enterprises)Limited raises funds through lotteries and other trading activities.<strong>RNLI</strong> (Sales) Limited sells gifts and souvenirs through the <strong>RNLI</strong>’snetwork of station branches, fundraising branches and guilds andoperates a mail-order and web-based catalogue.22

The internal supplies of <strong>RNLI</strong> (Trading) Limited representsupplies of lifeboats, lifeboat maintenance and lifeboat stationsto the <strong>RNLI</strong>. At 31 December <strong>2011</strong> this company owned fixedassets with a net book value of £4.6M (2010: £5.1M), and stockand other current assets of £17.7M (2010: £16.3M). It hasexternal and parent charity liabilities of £6.7M (2010: £5.2M)and £16.0M (2010: £15.2M) respectively. In total it has net assetsof £1.0M (2010: £1.0M). The assets and liabilities of the othersubsidiary companies are not material.In addition, <strong>RNLI</strong> Heritage Trust Limited, which is a subsidiarycharity of the <strong>RNLI</strong>, educates the public and promotes the workof the <strong>RNLI</strong> through historical archive collections. The operatingcosts of <strong>RNLI</strong> Heritage Trust Limited were £0.3M (2010: £0.3M)for the year.Summaries of the results for all subsidiary companies areshown below. The <strong>RNLI</strong>’s subsidiaries are all consolidated inthese accounts and there is, therefore, no requirement to reportrelated-party transactions under FRS8.<strong>RNLI</strong> (Enterprises)Limited<strong>RNLI</strong> (Sales)Limited<strong>RNLI</strong> CollegeLimited<strong>2011</strong>£M2010£M<strong>2011</strong>£M2010£M<strong>2011</strong>£M2010£MMerchandising and other trading 5.9 5.9 8.0 8.4 0.4 -Internal supplies - - 0.3 0.3 0.7 -Cost of sales - - (6.0) (6.2) (0.8) -Gross profit 5.9 5.9 2.3 2.5 0.3 -Operating costs (2.3) (2.0) (1.0) (1.0) (0.8) -Operating profit 3.6 3.9 1.3 1.5 (0.5) -Net profit/(loss) 3.6 3.9 1.3 1.5 (0.5) -Amount of covenant or Gift Aid to the <strong>RNLI</strong> (3.6) (3.9) (1.3) (1.5) - -Retained in subsidiary - - - - (0.5) -Amounts owed to the <strong>RNLI</strong> (0.3) (0.2) (1.4) (0.4) (0.4) -<strong>RNLI</strong> College Limited has not yet had a full year of operation and the costs for <strong>2011</strong> include some significant set-up costs thatwill be recovered in 2012. Its first accounting period will run from 14 July <strong>2011</strong> to 31 December 2012. Donations to the <strong>RNLI</strong>generated through the activities of <strong>RNLI</strong> (Enterprises) Limited and <strong>RNLI</strong> (Sales) Limited amounted to £1.7M in <strong>2011</strong> (2010: £1.8M).<strong>RNLI</strong> (Trading)LimitedSAR CompositesLimited<strong>2011</strong>£M2010£M<strong>2011</strong>£M2010£MInternal supplies 77.4 87.3 3.1 3.7New lifeboats (17.6) (14.4) (2.1) (2.6)Lifeboat maintenance (42.7) (48.5) - -New lifeboat stations (12.1) (18.3) - -Gross profit 5.0 6.1 1.0 1.1Operating costs (3.5) (4.6) (0.3) (0.3)Operating profit 1.5 1.5 0.7 0.8Net profit 1.5 1.5 0.7 0.8Amount of covenant or Gift Aid to the <strong>RNLI</strong> (1.5) (1.5) (0.7) (0.8)Retained in subsidiary - - - -Amounts owed to the <strong>RNLI</strong> (16.4) (15.7) (0.8) (0.5)The balance sheet of the <strong>RNLI</strong>, excluding the four subsidiary companies, has net assets, after pension liabilities, of £578.9M (2010:£549.6M). This is substantially the same as the group net assets after pension liabilities of £579.0M (2010: £550.4M). For this reason,while an <strong>RNLI</strong> balance sheet is presented on page 19, the notes to the financial statements show only the consolidated position.23

<strong>RNLI</strong> notes to the accounts (continued)FOR THE YEAR ENDED 31 DECEMBER <strong>2011</strong>3 Staff costsThe <strong>RNLI</strong> relies heavily on the work of volunteers to launch and crew the lifeboats, and to operate the large network of stationbranches, fundraising branches and guilds.Our volunteers are supported by full and part-time staff whose costs are as follows:<strong>2011</strong>£M2010£MWages and salaries 45.2 44.9Social security costs 4.1 4.0Pension costs 7.1 7.2Total 56.4 56.1Severance pay 1.0 0.7Total staff costs include £0.5M (2010: £0.6M) resulting from <strong>2011</strong> <strong>RNLI</strong> lifeguard expansion.The following number of employees received emoluments in excess of £60,000:<strong>2011</strong>Number2010Number£60,000–£69,999 19 20£70,000–£79,999 15 14£80,000–£89,999 1 3£90,000–£99,999 2 1£100,000–£109,999 2 1£110,000–£119,999 2 2£120,000–£129,999 - 2£130,000–£139,999 1 1Total 42 44Seven (2010: eight) employees who received emoluments in excess of £60,000 are members of the defined contribution schemeand received employer contributions of £82,393 (2010: £88,714) in total. The remaining 35 (2010: 36) employees are members of thedefined benefit pension scheme.The average number of employees, calculated on a full-time equivalent (FTE) basis, analysed by function was:<strong>2011</strong>Number2010NumberRescue 649 625Prevention 33 31Operational maintenance and construction 462 476Innovation 39 40International 1 -Support and governance 198 206Generation of voluntary income 212 208Merchandising and other trading 25 23Total 1,619 1,609The <strong>RNLI</strong> employs seasonal staff in the form of lifeguards and face-to-face fundraisers. Lifeguards are recruited and deployed onbeaches when required and have been included above in Rescue as FTE of 297 (2010: 281). The peak number of lifeguards employedduring the Summer months was 688 (2010: 664). Face-to-face fundraisers are also recruited and deployed on beaches during theSummer months and have been included in generation of voluntary income as FTE of 17 (2010: 14).The total number of FTE staff, excluding seasonal staff was 1,305 (2010: 1,314).24

<strong>RNLI</strong> notes to the accounts (continued)FOR THE YEAR ENDED 31 DECEMBER <strong>2011</strong>6 Fixed assetsa) Tangible assetsLifeboatsand lifeboatstations underconstruction£MLifeboats£MLifeboatstations andshoreworks£MLaunch andrecoveryequipment£MDepots,officesandtrainingfacilities£MComputerequipment,plant andvehicles£MCostAt 1 January <strong>2011</strong> 24.1 232.2 171.7 20.9 85.4 52.7 587.0Additions 29.6 - - - (0.2) 4.1 33.5Transfers (27.9) 16.4 10.9 0.6 - - -Disposals - (3.5) (0.2) (0.3) (1.4) (8.9) (14.3)At 31 December <strong>2011</strong> 25.8 245.1 182.4 21.2 83.8 47.9 606.2Total£MDepreciationAt 1 January <strong>2011</strong> - 157.2 39.6 15.4 12.4 41.1 265.7Charge for the year - 10.8 4.5 0.8 1.5 3.7 21.3Disposals - (2.8) (0.2) (0.2) (0.2) (8.3) (11.7)At 31 December <strong>2011</strong> - 165.2 43.9 16.0 13.7 36.5 275.3Net book amountAt 31 December <strong>2011</strong> 25.8 79.9 138.5 5.2 70.1 11.4 330.9At 31 December 2010 24.1 75.0 132.1 5.5 73.0 11.6 321.3The net book amounts include the following property:Freehold£MLeasehold£MTotal£MLifeboat stations and shoreworks 53.2 85.3 138.5Depots, offices and training facilities 60.4 9.7 70.1Total 113.6 95.0 208.6Baltimore lifeboat crew rescuinga crew of 21 from their yachtduring the <strong>2011</strong> Fastnet race

) Intangible assetsGoodwill£MIntellectualproperty£MCostAt 1 January <strong>2011</strong> 1.7 0.1 1.8Additions - - -Disposals - - -At 31 December <strong>2011</strong> 1.7 0.1 1.8Total£MAmortisationAt 1 January <strong>2011</strong> 0.2 0.1 0.3Charge for the year 0.1 - 0.1At 31 December <strong>2011</strong> 0.3 0.1 0.4Net book amountAt 31 December <strong>2011</strong> 1.4 - 1.4At 31 December 2010 1.5 - 1.5The accounting goodwill forms part of the purchase cost by SAR Composites Limited, a fully owned subsidiary of <strong>RNLI</strong> (Trading)Limited, of the lifeboat hull construction capabilities of Green Marine Limited in 2009. Green Marine Limited was the only companyoperating in this field in the UK, and this purchase was considered essential to ensure continuity of hull production for all-weatherlifeboats through an established operation and to retain staff expertise in this specialist field.c) Subsidiary company assetsThe consolidated schedule of fixed assets includes assets owned by the subsidiary companies with the following net book amounts:<strong>2011</strong>£M2010£MGoodwill 1.4 1.5Lifeboats and lifeboat stations under construction 4.3 3.3Lifeboats 0.6 -Depots, offices and training facilities 2.1 2.1Computer equipment, plant and vehicles 4.2 4.1Total 12.6 11.0

<strong>RNLI</strong> notes to the accounts (continued)FOR THE YEAR ENDED 31 DECEMBER <strong>2011</strong>7 InvestmentsFree anddesignatedreserves£MRestrictedreserves£MEndowmentreserves£Ma) Investment assetsEquities 50.4 - - 50.4 47.5Absolute return funds 26.0 75.3 9.1 110.4 111.5Fixed interest 76.4 - - 76.4 63.4Property unit trusts 12.7 - 0.5 13.2 12.8Deposits and cash 0.5 - - 0.5 0.7Market value at 31 December <strong>2011</strong> 166.0 75.3 9.6 250.9 235.9Total<strong>2011</strong>£MTotal2010£Mb) Analysis of movementMarket value at 1 January <strong>2011</strong> 149.4 76.4 10.1 235.9 230.0Additions 78.9 - - 78.9 230.4Disposals (65.3) (2.1) - (67.4) (242.0)Net realised gains 6.5 - - 6.5 17.0Net unrealised gains/(losses) (3.5) 1.0 (0.5) (3.0) 0.5Market value at 31 December <strong>2011</strong> 166.0 75.3 9.6 250.9 235.9Original cost 152.5 65.3 9.2 227.0 201.5c) Investment incomeEquities 0.8 - - 0.8 1.7Absolute return funds 1.3 0.3 - 1.6 0.9Fixed interest 2.0 - - 2.0 1.5Property unit trusts 0.5 - - 0.5 0.4Deposits and cash - - - - 0.1Foreign exchange losses - - - - (0.1)Total 4.6 0.3 - 4.9 4.5At the end of December <strong>2011</strong>, overseas investments amounted to £54.2M (2010: £49.3M).The <strong>RNLI</strong> holds 100% of the share capital of <strong>RNLI</strong> (Sales) Limited, amounting to £0.5M (2010: £0.5M), and <strong>RNLI</strong> College Limited,amounting to £1.0M (2010: nil).The <strong>RNLI</strong> held no derivative instruments as at 31 December <strong>2011</strong> (2010: none). Several of the pooled investment funds held by the<strong>RNLI</strong> use derivative products within their portfolios to reduce market risk in line with their investment strategies.8 Stocks Total<strong>2011</strong>£MOperational stock 12.6 12.2Gifts and souvenirs 1.4 1.3Total 14.0 13.5Total2010£M28

9 Debtors Total<strong>2011</strong>£MLegacies receivable 25.7 21.1Trade debtors 0.3 0.2Income tax and VAT recoverable 1.6 1.9Other debtors 1.5 1.6Prepayments and accrued income 0.4 0.9Total 29.5 25.7A proportion of legacies receivable may be received after more than 1 year, but this figure cannot be determined with any accuracydue to the inherent uncertainty in the timing of legacy income receipt.Total2010£M10 Creditors Total<strong>2011</strong>£MAmounts falling due within 1 yearTrade creditors 9.0 6.6PAYE taxes and social security 1.1 1.0Pension creditor 0.7 0.8Dependants’ pensions 0.3 0.3Other creditors including VAT - 0.1Finance leases 0.1 0.1Accruals and deferred income 3.5 3.2Total 14.7 12.1Total2010£MAmounts falling due after more than 1 yearFinance leases - 0.1VAT liability on non-business use of buildings - 0.6Total - 0.7Pension liabilitiesDependants’ pensions 4.9 5.3Defined benefit pension liability 33.4 38.1Total 38.3 43.4An amount, disclosed above as Dependants’ pensions, of £5.2M (2010: £5.6M), of which £4.9M (2010: £5.3M) falls due aftermore than 1 year, has been provided to meet future payments to dependants of former crew members who have lost their liveson lifeboat service. These amounts have been calculated by an actuarial valuation at 31 December <strong>2011</strong>. Further details areshown in note 14.29

<strong>RNLI</strong> notes to the accounts (continued)FOR THE YEAR ENDED 31 DECEMBER <strong>2011</strong>11 Loans to subsidiary companies Total<strong>2011</strong>£MThe loans to subsidiary companies comprise:Debenture to <strong>RNLI</strong> (Trading) Limited 0.4 0.5Debenture to <strong>RNLI</strong> (Sales) Limited 0.2 0.2Total2010£MTotal 0.6 0.7Working capital advance to <strong>RNLI</strong> (Trading) Limited 16.0 15.2The debenture to <strong>RNLI</strong> (Trading) Limited is redeemable and secured by a floating charge on the property of <strong>RNLI</strong> (Trading) Limitedand earns interest at HSBC plc Base Rate. The capital is repayable in annual instalments of £100,000.The debenture to <strong>RNLI</strong> (Sales) Limited is convertible and secured by a floating charge over the assets of the company and earnsinterest at HSBC plc Base Rate. The capital is repayable in annual instalments of £33,750.12 Capital commitmentsAt 31 December <strong>2011</strong>, capital commitments amounted to £8.4M (2010: £24.0M). Planned capital expenditure, largely on newlifeboats and shoreworks over the next 3 years, amounted to £111.9M (2010: £113.4M), of which £36.0M (2010: £35.4M) isrepresented by restricted funds and £75.9M (2010: £78.0M) is held in planned capital expenditure reserves.13 Operating lease commitments Land and buildings OtherAt 31 December <strong>2011</strong> the institutionhad the following annual commitmentsunder operating leases:Operating leases that expire:Within 1 year 0.1 0.1 - 0.1In 2 to 5 years 0.3 0.3 0.1 0.1After more than 5 years 0.3 0.4 - -Total 0.7 0.8 0.1 0.2Total<strong>2011</strong>£MTotal2010£MTotal<strong>2011</strong>£MTotal2010£M14 PENSION SCHEMESThe <strong>RNLI</strong> operates a defined benefit pension scheme for the majority of its employees, which was closed to new entrants from1 January 2007. These accounts reflect the requirements of Financial Reporting Standard FRS17 – ‘Retirement Benefits’ (‘FRS17’).The disclosures required by FRS17 cover both the pension scheme and the payments to certain dependants detailed in note 10.The figures in this note have been calculated by a qualified independent actuary based on a full actuarial valuation of the pensionscheme as at 31 December 2010, rolled forward to 31 December <strong>2011</strong> using summarised cash flow and membership details and afull actuarial valuation of the dependants’ pensions as at 31 December <strong>2011</strong> on the basis required by FRS17.On this basis, the FRS17 accounting deficit for the defined benefit pension scheme as at 31 December <strong>2011</strong> was £33.4M (2010:£38.1M) and £5.2M (2010: £5.6M) for the dependants’ pensions. The FRS17 basis is a prescribed basis that requires the discountrate to be the rate of return on AA-rated (or equivalent) corporate bonds. Each year, the Scheme Actuary assesses the financialposition of the scheme for the formal actuarial valuation, allowing for the returns expected to be generated by the assets plannedto be held by the scheme in the future. These assets would not typically consist of 100% in corporate bonds.30

14 PENSION SCHEMES (continued)The defined benefit pension scheme’s latest formal actuarial valuation under the Pensions Act 2004 was carried out by the SchemeActuary as at 31 December 2010. The position will be reviewed as part of the formal assessment carried out by the SchemeActuary as at the 31 December <strong>2011</strong> valuation date.Since 1 January <strong>2011</strong> the <strong>RNLI</strong> has been paying 35.4% (2010: 35.4%) and 21.1% (2010: 21.1%) in respect of operationallifeboat crew and other members respectively. In addition the <strong>RNLI</strong> paid additional deficit reduction contributions of £4.0M in <strong>2011</strong>(2010: £4.0M).The main financial assumptions used as at 31 December <strong>2011</strong> and the corresponding assumptions at 31 December 2010 and31 December 2009 for both purposes were:31/12/<strong>2011</strong>% pa31/12/2010% pa31/12/2009% paDiscount rate 4.7 5.4 5.7Rate of increase in salaries 3.5 4.4 4.5Rate of increase in pensions in payment* 2.8 3.6 3.7Rate of revaluation on deferred pensions 3.0 3.6 3.7Rate of retail price inflation (RPI) 3.0 3.6 3.7Rate of consumer price inflation (CPI) 2.0 N/A N/AAssumes life expectancy on retirement age 65 of: Years Years YearsRetiring today – males 20.6 19.5 19.1Retiring today – females 24.8 24.1 23.4Retiring in 15 years – males 22.0 21.1 20.2Retiring in 15 years – females 26.3 25.5 24.2* in excess of the Guaranteed Minimum Pension (GMP) elementThe assets in the pension scheme and the expected rates of return at 31 December <strong>2011</strong> and the corresponding amounts andassumptions at 31 December 2010 and 31 December 2009 were:Expected rateof return31/12/<strong>2011</strong> 31/12/2010 31/12/2009Market value Expected rate Market value Expected rateof assets of return of assets of returnMarket valueof assets% pa £M % pa £M % pa £MEquities 7.2 68.2 7.8 78.2 7.8 101.9Fixed interest 3.4 83.4 4.8 68.6 5.0 58.7Property 5.3 15.2 6.4 14.3 6.4 4.8Absolute return funds 5.9 28.0 6.6 19.4 - -Currency management 5.3 - 4.4 9.6 - -Cash and net current assets 2.7 19.1 4.4 13.6 4.4 11.9Total 5.0 213.9 6.2 203.7 6.6 177.3The overall future expected rate of return on assets for 2012 is calculated based on the weighted expected return on the actual assetsheld as at 31 December <strong>2011</strong>.31

<strong>RNLI</strong> notes to the accounts (continued)FOR THE YEAR ENDED 31 DECEMBER <strong>2011</strong>14 Pension schemeS (continued)a) The following amounts were measured in accordance with the requirements of FRS17:Pensionscheme£M<strong>2011</strong> 2010Dependants’pensions£MTotal£MPensionscheme£MDependants’pensions£MTotal£MTotal market value of assets 213.9 - 213.9 203.7 - 203.7Present value of liabilities (247.3) (5.2) (252.5) (241.8) (5.6) (247.4)Net pension liability (33.4) (5.2) (38.6) (38.1) (5.6) (43.7)b) Changes in the present value of the defined benefit obligation are as follows:Pensionscheme£M<strong>2011</strong> 2010Dependants’pensions£MTotal£MPensionscheme£MDependants’pensions£MOpening defined benefit obligation 241.8 5.6 247.4 217.6 5.6 223.2Service cost 7.5 - 7.5 7.0 - 7.0Interest cost 12.8 0.3 13.1 12.2 0.3 12.5Employee contributions 1.9 - 1.9 2.0 - 2.0Actuarial (gains)/losses (8.9) (0.4) (9.3) 10.1 - 10.1Benefits paid (7.8) (0.3) (8.1) (7.1) (0.3) (7.4)Defined benefit obligation247.3 5.2 252.5 241.8 5.6 247.4at the year endTotal£Mc) Changes in the fair value of the scheme assets are as follows:Pensionscheme£M<strong>2011</strong> 2010Dependants’pensions£MTotal£MPensionscheme£MDependants’pensions£MTotal£MOpening fair value of scheme assets 203.7 - 203.7 177.3 - 177.3Expected return 12.8 - 12.8 11.8 - 11.8Actuarial (losses)/gains (6.5) - (6.5) 9.6 - 9.6Employer contributions 9.8 - 9.8 10.1 - 10.1Employee contributions 1.9 - 1.9 2.0 - 2.0Benefits paid (7.8) - (7.8) (7.1) - (7.1)Fair value of scheme assets at the year end 213.9 - 213.9 203.7 - 203.7The actual return on scheme assets was £6.3M (2010: £21.4M).32

d) The amounts included within the Statement of Financial Activities are as follows:Pensionscheme£M<strong>2011</strong> 2010Dependants’pensions£MTotal£MPensionscheme£MDependants’pensions£MCurrent service cost 7.5 - 7.5 7.0 - 7.0Past service cost - - - - - -Expected return on scheme assets (12.8) - (12.8) (11.8) - (11.8)Interest on pension 12.8 0.3 13.1 12.2 0.3 12.5Total amount charged within net incoming7.5 0.3 7.8 7.4 0.3 7.7resourcesActuarial (gains)/losses (2.4) (0.4) (2.8) 0.5 - 0.5Total amount charged to the Statement ofFinancial Activities5.1 (0.1) 5.0 7.9 0.3 8.2Total£MContributions in <strong>2011</strong> were £11.7M (2010: £12.1M) and a further £12.0M is expected to be contributed to the defined benefit schemein the 2012 financial year. The cumulative actuarial loss recognised via the SoFA at the end of December <strong>2011</strong> is £64.8M (2010: £67.6M)e) A history of gains and losses experienced in the pension scheme and in relation to the dependants’ pensions is:Amount£M<strong>2011</strong> 2010 2009 2008 2007% ofassetsAmount£M% ofassetsAmount£M% ofassetsAmount£M% ofassetsAmount£M% ofassetsTotal market value of assets 213.9 203.7 177.3 148.6 175.0Present value of liabilities (252.5) (247.4) (223.2) (156.0) (185.1)Net pension liability (38.6) (43.7) (45.9) (7.4) (10.1)(Gains)/losses experienced on assets 6.5 3.0 (9.6) (4.7) (13.1) (7.4) 44.4 29.9 7.6 4.3(Gains)/losses experiencedon liabilities(Gains)/losses on liabilities on changeof assumptions2.7 1.1 0.3 0.1 8.2 3.7 (1.6) 1.0 (3.6) (1.9)(12.0) (4.8) 9.8 4.0 48.1 21.6 (41.4) (26.5) (5.5) (3.0)No (gains)/losses experienced on assets relate to dependants’ pensions (2010: nil); £(0.4)M (2010: nil) of gains experienced on liabilitiesrelate to dependents’ pensions.f) The defined contribution pension schemeThe defined benefit pension scheme was closed to new entrants from 1 January 2007, and a defined contribution pension schemewas established for new staff joining after that date. In <strong>2011</strong>, the <strong>RNLI</strong> paid contributions of £1.3M (2010: £1.0M) in respect ofmembers of the defined contribution pension scheme.15 Value added taxIncluded in the accounts is a cost of £2.0M (2010: £1.8M) in respect of irrecoverable VAT incurred in <strong>2011</strong> on both revenue andcapital expenditure.16 Connected charityThe <strong>RNLI</strong>’s Trustees are also Trustees of the Royal National Lifeboat Institution Lifeboatmen’s Benevolent Fund. The principal activityof the Fund, which as at 31 December <strong>2011</strong> had net assets of £0.9M (2010: £1.0M), is to make grants to relieve distress among pastand present members of crews of lifeboats, their families, relatives or dependants. Copies of the Fund’s accounts can be obtainedfrom the registered office of the <strong>RNLI</strong>.33

<strong>RNLI</strong> officers and contactsAS AT 4 APRIL 2012PatronHM The QueenPresidentHRH The Duke of Kent KGTrustee BoardAdmiral the Lord Boyce KG GCB OBE DL(Chairman)Mark Byford (appointed Feb 2012)Robert Colvill (retired May <strong>2011</strong>)John CoyleSir Andrew Cubie CBE FRSECharles Hunter-PeaseJan Kopernicki CMG (appointed Feb 2012)Vice Admiral Sir Tim Laurence KCVO CB MVOADC(P) (appointed Jul <strong>2011</strong>)Ronald Neil CBESir Alan Reid KCVORear Admiral John Tolhurst CB FRAeSSir Roger Vickers KCVOMalcolm Vincent MSc CEng FIMarESTVicky Wright BSc MSc CCIPDChairmanAdmiral the Lord Boyce KG GCB OBE DLVice-ChairmanJan Kopernicki CMG (appointed Feb 2012)Deputy ChairmenSir Andrew Cubie CBE FRSERonald Neil CBETreasurerSir Alan Reid KCVOChairmen EmeritiDavid Acland CBE DLPeter Nicholson CBEAdmiral Sir Jock Slater GCB LVO DLSir Michael VernonVice-PresidentsDavid Acland CBE DLDr Wilson Adam LRCP LRCS LDS HDDRobin Aisher OBERichard F Barclay FCIBSir John Batten KCVO MD FRCPRobert Braithwaite CBERoger BridgemanIain R Bryce TD DL FCACaptain Roy Bullen MBEMost Rev The Rt Hon Dr George L Carey PCR Angus Clark CBEGeorge ClarkVictor Cocker CBE BA(Econ) FIWEM CIMgtSurgeon Rear Admiral Ian Colley OBERobert ColvillVice Admiral Sir John Coward KCB DSOSir Andrew Cubie CBE FRSEDr Ian Dand BSc PhD FEng FRINA FRSADr Ronald Delany LLBRear Admiral Roger Dimmock CBTony Dorey OBE BSc CEng FRINAThe Hon Mrs Henry Douglas-HomeMaldwin Drummond OBE DL HonDSc FSAWilson Ervin CBERoly Franks OBEEric M Freeman FICSDr Norman GodmanSurgeon Rear Admiral Frank Golden OBE PhDAir Chief Marshal Sir Michael GraydonGCB CBE FRAeSLord GreenwayHelen GriffithsDr Bill Guild OBE BSc PhDJohn C Harrison MBE FCACommodore Sir Robert Hastie KCVO CBE KStJRD* JP RNRRobert HollondSir John James KCVO CBEMartin Jay CBE DLTerence C JohnsonHis Honour Judge Graham JonesCaptain George King CBE FRINSir Robin Knox-Johnston CBE RD*Clayton Love JnrCaptain Tony McCrum RNSir Peter MillerVice Admiral Sir Christopher Morgan KBERear Admiral Sir Morgan Morgan-Giles DSOOBE GM DLColin Mudie RDI CEng FRINA FRIN FCSDRear Admiral John Myres CBRonald Neil CBEPeter Nicholson CBEThe Rt Hon Sir John RochRear Admiral Sir Patrick Rowe KCVO CBEAlison Saunders MBEAdmiral Sir Jock Slater GCB LVO DLSir Nigel Southward KCVOVice Admiral RR SquiresRear Admiral Michael Stacey CBThe Lord Stanley of AlderleyDame Valerie Strachan DCBLieutenant CommanderJeremy Tetley DL RNAir Vice Marshal John Tetley CB CVOVice Admiral Sir Jonathan Tod KCB CBESir Michael VernonSir Peter ViggersLord Wakeham PC DLMajor General Michael Walsh CB CBE DSO DLSir Peter WaltersCaptain Sir Miles Wingate KCVO FNIJim WoodhousePeter Workman OBECouncilHRH The Duke of Kent KG (President)Admiral the Lord Boyce KG GCB OBE DL(Chairman)Richard AclandDavid AisherRosanna Allen-MirehouseJonathan Ball MBE RIBA FRSARobin Broadhurst CBE FRICSThe Hon Christopher A Brooke DLBelinda Bucknall QCMichael BuerkMark ByfordAlistair Carmichael MPRear Admiral John Clarke CB LVO MBEJohn CoylePeter CrowleySir Andrew Cubie CBE FRSEProf Charles Deakin MA MD FRCP FRCA FERCFFICMJohn DrakeWilliam Everard CBE BSc(Eng)Air Commodore Simon Falla CBE DSO RAFPhilip Gilbert CVO OBEAndrew GivenAdam GoslingDavid Grose MIH FCMIAnthony Hannay LLBRobert HodgePeter Hodges MNIAngela Horsman BA(Hons) Dip HCIMThe Rt Hon the Earl HoweCharles Hunter-PeaseLord IliffeMichael Jeffries RIBA FICEHis Honour Judge Graham Hume JonesPeter KillenCaptain Liam Kirwan MN FRIN Mar SurvRear Admiral John Lang DLVice Admiral Sir Tim Laurence KCVOCB MVO ADC(P)Neil LernerRichard LeworthyNorma MarwickJohn McAuleyRobin Middleton CBERear Admiral Ian Moncrieff CBE BARonald Neil CBEBeverley NielsenAlbert Owen MPDoug Pattison FREng FRINA CEng RCNCStuart Popham QC(Hon)34