azerbaijan: emerging market islamic banking and finance

azerbaijan: emerging market islamic banking and finance

azerbaijan: emerging market islamic banking and finance

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

ACADEMIC ARTICLE<br />

NEWHORIZON October–December 2008<br />

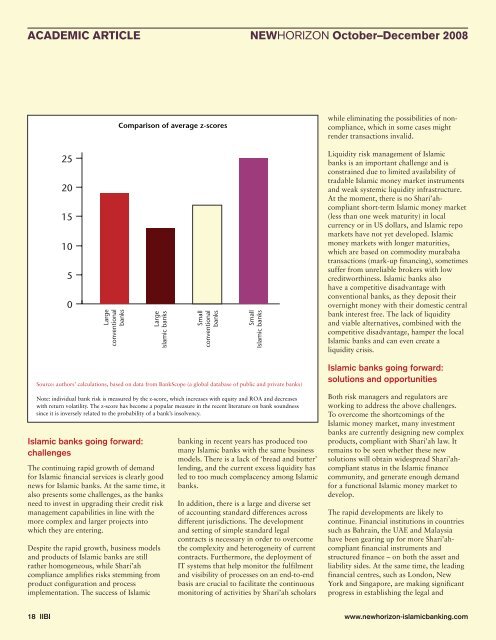

Comparison of average z-scores<br />

while eliminating the possibilities of noncompliance,<br />

which in some cases might<br />

render transactions invalid.<br />

Liquidity risk management of Islamic<br />

banks is an important challenge <strong>and</strong> is<br />

constrained due to limited availability of<br />

tradable Islamic money <strong>market</strong> instruments<br />

<strong>and</strong> weak systemic liquidity infrastructure.<br />

At the moment, there is no Shari’ahcompliant<br />

short-term Islamic money <strong>market</strong><br />

(less than one week maturity) in local<br />

currency or in US dollars, <strong>and</strong> Islamic repo<br />

<strong>market</strong>s have not yet developed. Islamic<br />

money <strong>market</strong>s with longer maturities,<br />

which are based on commodity murabaha<br />

transactions (mark-up financing), sometimes<br />

suffer from unreliable brokers with low<br />

creditworthiness. Islamic banks also<br />

have a competitive disadvantage with<br />

conventional banks, as they deposit their<br />

overnight money with their domestic central<br />

bank interest free. The lack of liquidity<br />

<strong>and</strong> viable alternatives, combined with the<br />

competitive disadvantage, hamper the local<br />

Islamic banks <strong>and</strong> can even create a<br />

liquidity crisis.<br />

Source: authors’ calculations, based on data from BankScope (a global database of public <strong>and</strong> private banks)<br />

Note: individual bank risk is measured by the z-score, which increases with equity <strong>and</strong> ROA <strong>and</strong> decreases<br />

with return volatility. The z-score has become a popular measure in the recent literature on bank soundness<br />

since it is inversely related to the probability of a bank’s insolvency.<br />

Islamic banks going forward:<br />

challenges<br />

The continuing rapid growth of dem<strong>and</strong><br />

for Islamic financial services is clearly good<br />

news for Islamic banks. At the same time, it<br />

also presents some challenges, as the banks<br />

need to invest in upgrading their credit risk<br />

management capabilities in line with the<br />

more complex <strong>and</strong> larger projects into<br />

which they are entering.<br />

Despite the rapid growth, business models<br />

<strong>and</strong> products of Islamic banks are still<br />

rather homogeneous, while Shari’ah<br />

compliance amplifies risks stemming from<br />

product configuration <strong>and</strong> process<br />

implementation. The success of Islamic<br />

<strong>banking</strong> in recent years has produced too<br />

many Islamic banks with the same business<br />

models. There is a lack of ‘bread <strong>and</strong> butter’<br />

lending, <strong>and</strong> the current excess liquidity has<br />

led to too much complacency among Islamic<br />

banks.<br />

In addition, there is a large <strong>and</strong> diverse set<br />

of accounting st<strong>and</strong>ard differences across<br />

different jurisdictions. The development<br />

<strong>and</strong> setting of simple st<strong>and</strong>ard legal<br />

contracts is necessary in order to overcome<br />

the complexity <strong>and</strong> heterogeneity of current<br />

contracts. Furthermore, the deployment of<br />

IT systems that help monitor the fulfilment<br />

<strong>and</strong> visibility of processes on an end-to-end<br />

basis are crucial to facilitate the continuous<br />

monitoring of activities by Shari’ah scholars<br />

Islamic banks going forward:<br />

solutions <strong>and</strong> opportunities<br />

Both risk managers <strong>and</strong> regulators are<br />

working to address the above challenges.<br />

To overcome the shortcomings of the<br />

Islamic money <strong>market</strong>, many investment<br />

banks are currently designing new complex<br />

products, compliant with Shari’ah law. It<br />

remains to be seen whether these new<br />

solutions will obtain widespread Shari’ahcompliant<br />

status in the Islamic <strong>finance</strong><br />

community, <strong>and</strong> generate enough dem<strong>and</strong><br />

for a functional Islamic money <strong>market</strong> to<br />

develop.<br />

The rapid developments are likely to<br />

continue. Financial institutions in countries<br />

such as Bahrain, the UAE <strong>and</strong> Malaysia<br />

have been gearing up for more Shari’ahcompliant<br />

financial instruments <strong>and</strong><br />

structured <strong>finance</strong> – on both the asset <strong>and</strong><br />

liability sides. At the same time, the leading<br />

financial centres, such as London, New<br />

York <strong>and</strong> Singapore, are making significant<br />

progress in establishing the legal <strong>and</strong><br />

18 IIBI www.newhorizon-<strong>islamic</strong><strong>banking</strong>.com