BEUTEL GOODMAN MANAGED FUNDS

Annual Financial Report - Beutel, Goodman & Company Ltd.

Annual Financial Report - Beutel, Goodman & Company Ltd.

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

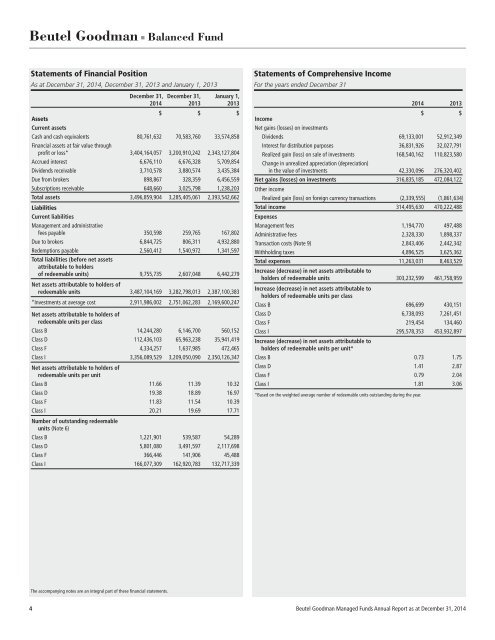

Beutel Goodman ■ Balanced Fund<br />

Statements of Financial Position<br />

As at December 31, 2014, December 31, 2013 and January 1, 2013<br />

December 31, December 31, January 1,<br />

2014 2013 2013<br />

$ $ $<br />

Assets<br />

Current assets<br />

Cash and cash equivalents 80,761,632 70,583,760 33,574,858<br />

Financial assets at fair value through<br />

profit or loss* 3,404,164,057 3,200,910,242 2,343,127,804<br />

Accrued interest 6,676,110 6,676,328 5,709,854<br />

Dividends receivable 3,710,578 3,880,574 3,435,384<br />

Due from brokers 898,867 328,359 6,456,559<br />

Subscriptions receivable 648,660 3,025,798 1,238,203<br />

Total assets 3,496,859,904 3,285,405,061 2,393,542,662<br />

Liabilities<br />

Current liabilities<br />

Management and administrative<br />

fees payable 350,598 259,765 167,802<br />

Due to brokers 6,844,725 806,311 4,932,880<br />

Redemptions payable 2,560,412 1,540,972 1,341,597<br />

Total liabilities (before net assets<br />

attributable to holders<br />

of redeemable units) 9,755,735 2,607,048 6,442,279<br />

Net assets attributable to holders of<br />

redeemable units 3,487,104,169 3,282,798,013 2,387,100,383<br />

*Investments at average cost 2,911,986,002 2,751,062,283 2,169,600,247<br />

Net assets attributable to holders of<br />

redeemable units per class<br />

Class B 14,244,280 6,146,700 560,152<br />

Class D 112,436,103 65,963,238 35,941,419<br />

Class F 4,334,257 1,637,985 472,465<br />

Class I 3,356,089,529 3,209,050,090 2,350,126,347<br />

Net assets attributable to holders of<br />

redeemable units per unit<br />

Class B 11.66 11.39 10.32<br />

Class D 19.38 18.89 16.97<br />

Class F 11.83 11.54 10.39<br />

Class I 20.21 19.69 17.71<br />

Number of outstanding redeemable<br />

units (Note 6)<br />

Class B 1,221,901 539,587 54,289<br />

Class D 5,801,080 3,491,597 2,117,698<br />

Class F 366,446 141,906 45,488<br />

Class I 166,077,309 162,920,783 132,717,339<br />

Statements of Comprehensive Income<br />

For the years ended December 31<br />

Income<br />

Net gains (losses) on investments<br />

2014 2013<br />

$ $<br />

Dividends 69,133,001 52,912,349<br />

Interest for distribution purposes 36,831,926 32,027,791<br />

Realized gain (loss) on sale of investments 168,540,162 110,823,580<br />

Change in unrealized appreciation (depreciation)<br />

in the value of investments 42,330,096 276,320,402<br />

Net gains (losses) on investments 316,835,185 472,084,122<br />

Other income<br />

Realized gain (loss) on foreign currency transactions (2,339,555) (1,861,634)<br />

Total income 314,495,630 470,222,488<br />

Expenses<br />

Management fees 1,194,770 497,488<br />

Administrative fees 2,328,330 1,898,337<br />

Transaction costs (Note 9) 2,843,406 2,442,342<br />

Withholding taxes 4,896,525 3,625,362<br />

Total expenses 11,263,031 8,463,529<br />

Increase (decrease) in net assets attributable to<br />

holders of redeemable units 303,232,599 461,758,959<br />

Increase (decrease) in net assets attributable to<br />

holders of redeemable units per class<br />

Class B 696,699 430,151<br />

Class D 6,738,093 7,261,451<br />

Class F 219,454 134,460<br />

Class I 295,578,353 453,932,897<br />

Increase (decrease) in net assets attributable to<br />

holders of redeemable units per unit*<br />

Class B 0.73 1.75<br />

Class D 1.41 2.87<br />

Class F 0.79 2.04<br />

Class I 1.81 3.06<br />

*Based on the weighted average number of redeemable units outstanding during the year.<br />

The accompanying notes are an integral part of these financial statements.<br />

4 Beutel Goodman Managed Funds Annual Report as at December 31, 2014