Ombudsmann-Tätigkeitsbericht 2014 Englisch

To settle disputes between banks and their customers as quickly and smoothly as possible, Germany's private commercial banks introduced an out-of-court conciliation procedure as early as 1992: the Ombudsman Scheme. The Ombudsman Scheme is the centrepiece of the private commercial banks overall consumer policy scheme, which rests on four pillars: consumer education, consumer information, contract transparency and out-of-court dispute-resolution facilities.

To settle disputes between banks and their customers as quickly and smoothly as possible, Germany's private commercial banks introduced an out-of-court conciliation procedure as early as 1992: the Ombudsman Scheme. The Ombudsman Scheme is the centrepiece of the private commercial banks overall consumer policy scheme, which rests on four pillars: consumer education, consumer information, contract transparency and out-of-court dispute-resolution facilities.

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

ankenverband<br />

when investment advice was given, and at least roughly<br />

outline the course of events.<br />

Of particular interest is naturally the question of whom<br />

the scales tip towards in the outcome of ombudsman<br />

proceedings. The experience over the years is that<br />

around 50% of complaints are usually settled in favour<br />

of customers. These are complaints that are resolved<br />

by ombudsman adjudication or settled amicably in<br />

advance. At the time this report went to print, around<br />

76% of the admissible complaints dealt with under<br />

the Ombudsman Scheme in <strong>2014</strong> had been settled in<br />

favour of customers and only just under 1% in favour<br />

of banks. The number of complaints settled in favour of<br />

customers is likely to be much higher in <strong>2014</strong> than over<br />

the past five years. This is due particularly to the fact<br />

that complaints concerning consumer loan processing<br />

fees were designed to suspend time-barring under<br />

the statute of limitations by instigating ombudsman<br />

proceedings and to obtain reimbursement of such fees<br />

from banks in line with the Federal Court of Justice<br />

rulings. In 219 cases, the ombudsmen proposed that<br />

the parties accept a compromise. At the time of going<br />

to print, the acceptance rate was just under 49%.<br />

These provisional figures will change, however, as<br />

more than 25,000 complaints are still being processed<br />

at present - the “wave of complaints” in December <strong>2014</strong><br />

is to blame.<br />

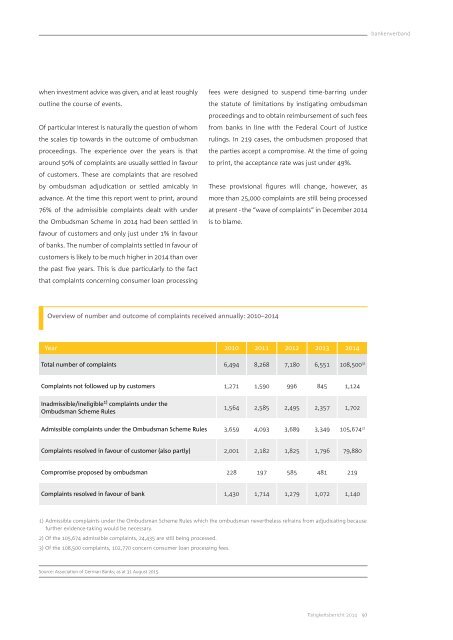

Overview of number and outcome of complaints received annually: 2010–<strong>2014</strong><br />

Year 2010 2011 2012 2013 <strong>2014</strong><br />

Total number of complaints 6,494 8,268 7,180 6,551 108,500 3)<br />

Complaints not followed up by customers 1,271 1,590 996 845 1,124<br />

Inadmissible/ineligible 1) complaints under the<br />

Ombudsman Scheme Rules<br />

1,564 2,585 2,495 2,357 1,702<br />

Admissible complaints under the Ombudsman Scheme Rules 3,659 4,093 3,689 3,349 105,674 2)<br />

Complaints resolved in favour of customer (also partly) 2,001 2,182 1,825 1,796 79,880<br />

Compromise proposed by ombudsman 228 197 585 481 219<br />

Complaints resolved in favour of bank 1,430 1,714 1,279 1,072 1,140<br />

1) Admissible complaints under the Ombudsman Scheme Rules which the ombudsman nevertheless refrains from adjudicating because<br />

further evidence-taking would be necessary.<br />

2) Of the 105,674 admissible complaints, 24,435 are still being processed.<br />

3) Of the 108,500 complaints, 102,770 concern consumer loan processing fees.<br />

Source: Association of German Banks; as at 31 August 2015.<br />

<strong>Tätigkeitsbericht</strong> <strong>2014</strong> 97