White Paper Channel Data Management: Enabling Data-Driven Decision Making

This white paper presents a method for establishing channel data management as a core competency across all channel-facing departments. It includes a maturity model for driving excellence in strategy, people, process, technology, and data workstreams. Companies that embrace a new approach to channel management based on data-driven decision making will develop stronger relationships with stronger channel partners than their rivals. Companies using this model are gaining channel capacity in a time of extraordinary transformation. For more information visit our website: http://www.zyme.com/resources/white-papers/channel-data-management-enabling-data-driven-decision-making

This white paper presents a method for establishing channel data management as a core competency across all channel-facing departments. It includes a maturity model for driving excellence in strategy, people, process, technology, and data workstreams. Companies that embrace a new approach to channel management based on data-driven decision making will develop stronger relationships with stronger channel partners than their rivals. Companies using this model are gaining channel capacity in a time of extraordinary transformation. For more information visit our website: http://www.zyme.com/resources/white-papers/channel-data-management-enabling-data-driven-decision-making

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

WHITE PAPER<br />

<strong>Channel</strong> <strong>Data</strong> <strong>Management</strong>: <strong>Enabling</strong> <strong>Data</strong>-<strong>Driven</strong><br />

<strong>Decision</strong> <strong>Making</strong><br />

Sponsored by: Zyme Solutions<br />

Gerry Murray<br />

January 2016<br />

IDC OPINION<br />

Manufacturers are increasingly reliant on channel partners to accelerate revenue growth and open<br />

new markets. However, channels are typically underutilized and manufacturers' processes that support<br />

them are poorly managed. This is because many manufacturers lack the channel data needed to<br />

create actionable insights. Leading manufacturers have realized the only way to accurately understand<br />

the channel is through data. Manufacturers are adopting channel data management (CDM) as a<br />

means to transform how they manage key channel business processes. CDM is a set of technology<br />

capabilities and best practices that simplify and standardize the collection of a wide range of channel<br />

data at scale and use it to drive channel performance and optimize channel-related processes.<br />

Traditionally, manufacturers have relied on products with a strong brand value to open markets and<br />

drive the channel business model. They have rolled out programs to engage and incent channel<br />

performance. But it is getting much harder to differentiate based on just products and programs.<br />

Ultimately, the business relationships between partners and manufacturers will determine long-term<br />

channel growth and performance. The nature of those relationships will hinge, in part, on how<br />

effectively manufacturers leverage partner data to drive key internal processes such as:<br />

<br />

<br />

<br />

<br />

<br />

<br />

Sales execution and coverage models<br />

Post-sales service<br />

Incentive and loyalty programs<br />

Finance, risk, and compliance<br />

Supply chain, inventory, and distribution<br />

<strong>Channel</strong> marketing<br />

Many vendors do some, or even all, of these things very well for some of their partners — usually the top<br />

5–20%. But very few vendors are able to scale best practices across the entire channel population. As a<br />

result, latent revenue and market share are buried in underperforming channels and latent inefficiencies<br />

and costs are buried in suboptimal channel management processes. IDC's <strong>Channel</strong> <strong>Data</strong> <strong>Management</strong><br />

maturity model provides a road map for companies to develop a mature channel data management<br />

function, which is essential to competing at the scale and speed today's channel requires. A mature CDM<br />

function can dramatically extend the reach and capability of your channel management practices,<br />

enabling you to get the best out of the best partners and leave the rest to your competitors.<br />

January 2016, IDC #US40629815

IN THIS WHITE PAPER<br />

This white paper presents a method for establishing channel data management as a core competency<br />

across all channel-facing departments. It includes a maturity model for driving excellence in strategy,<br />

people, process, technology, and data workstreams. Companies that embrace a new approach to<br />

channel management based on data-driven decision making will develop stronger relationships with<br />

stronger channel partners than their rivals. Companies using this model are gaining channel capacity<br />

in a time of extraordinary transformation.<br />

SITUATION OVERVIEW<br />

<strong>Channel</strong> partners are vitally important sources of revenue, strategic support, and customer experience.<br />

In spite of the channel's tremendous role in overall business performance, it is often under-resourced<br />

and inadequately managed. This is especially true for companies that established their channels to sell<br />

physical products, whether widgets or boxed software. In these models, channels typically were<br />

considered a mere fulfillment arm. The attitude of many manufacturers was, "We gave you great<br />

products and a strong brand, now go sell stuff." In an era when product release cycles were measured<br />

in years and solutions were relatively simple, that attitude worked pretty well.<br />

Today, the channel is vastly more competitive and complex. Large manufacturers can have channel<br />

populations in the tens or hundreds of thousands, making it difficult to optimize performance for all of<br />

them. Top-tier partners have extraordinary market power, making it extremely important to recruit,<br />

retain, and optimize the best channel partners. New technologies such as mobile, social, Internet of<br />

Things (IoT), 3D printing, and big data are changing customer behavior, blending product categories,<br />

blurring market definitions, and opening up new revenue streams. As a result, partners are under<br />

pressure to master the skills needed to deliver new solutions, market to new customers, and run new<br />

business models. Manufacturers that guide partners through these challenges will gain share, loyalty,<br />

and revenue at the expense of those that do not. But doing so requires manufacturers to master an<br />

increasingly complex world of channel data. Key drivers of complexity in channel data include:<br />

<br />

<br />

<br />

The number and variety of entities reporting data — distributors, TAPs, alliances, resellers,<br />

VARs, and service providers<br />

The volume and variety of data types needed — activation, consumption, and opportunities<br />

The depth of data (e.g., serial number, deal registration, and end-user data)<br />

The magic ingredient is data. Imagine having the financial, operational, and behavioral data on<br />

partners to optimize new product launches, margin splits, inventory turns, coverage models, and<br />

channel programs. Imagine being able to show partners — no matter how new or small or niche their<br />

focus — how other partners like them have achieved high return on investment (ROI) on their business<br />

with you. This is all possible, but it requires a new approach to channel data management, one that<br />

goes beyond ad hoc, fragmented, and periodic reporting to a model where data exchange is<br />

embedded into the relationship and data management is supported by dedicated infrastructure and<br />

best practices. Key questions that we address in this document include:<br />

<br />

<br />

<br />

<br />

How can manufacturers progress through IDC's <strong>Channel</strong> <strong>Data</strong> <strong>Management</strong> maturity model?<br />

How can manufacturers leverage partner data for competitive advantage?<br />

How can manufacturers get partners to participate?<br />

What are the benefits for partners?<br />

©2016 IDC #US40629815 2

Progressing Through IDC's <strong>Channel</strong> <strong>Data</strong> <strong>Management</strong> Maturity Model<br />

At even the largest, most leading-edge companies, channel data management is in its nascent stages.<br />

Companies typically lack the organizational expertise, process controls, technology infrastructure, and<br />

data management practices necessary to fully leverage channel data throughout the business. As a<br />

result, this leads to poor decision making in areas such as:<br />

<br />

<br />

<br />

<br />

<br />

<br />

Sales execution: Unable to match MDF to bookings and hard to enforce price and discount<br />

policies and partner reviews based on gut checks<br />

Post-sales support: Don't know the end customer, unable to upsell, and unable to validate<br />

warranty claims<br />

Incentives and loyalty: Incorrect partner payments<br />

Finance: Unable to produce accurate sales forecasts and business plans and slow to<br />

adjudicate partner payment disputes<br />

Supply chain: Unable to analyze how much product partners have on hand<br />

<strong>Channel</strong> marketing: Programs are generic, effectiveness is hard to measure, and ROI is<br />

unknowable<br />

Practitioners we spoke with are aspiring to or are in newly created (two years or less) global CDM roles,<br />

but few of them have the dedicated resources and authority to be truly successful. Leadership and<br />

executive sponsorship are essential but are not enough. The transformation requires an organizational<br />

commitment. People must be assigned to own the processes. Then the processes can be defined,<br />

optimized, and automated. Technology must be brought in to support the new processes and generate<br />

the data necessary to deliver insights into partner performance. <strong>Data</strong> is the final, but most important<br />

workstream. It will provide the scalability needed to better manage, support, and enable every partner,<br />

not just those that justify dedicated human resource commitments. But the data cannot be effectively<br />

captured and leveraged until significant changes are made in the technology platform, organization, and<br />

processes. Table 1 provides a detailed description of the key stages in this journey.<br />

©2016 IDC #US40629815 3

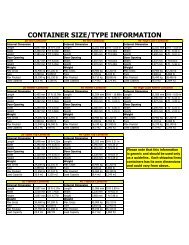

TABLE 1<br />

IDC's <strong>Channel</strong> <strong>Data</strong> <strong>Management</strong> Maturity Model: Detailed Description by Stage<br />

Stage 1:<br />

Ad Hoc<br />

Stage 2:<br />

Opportunistic<br />

Stage 3:<br />

Repeatable<br />

Stage 4:<br />

Managed<br />

Stage 5:<br />

Optimized for Scale<br />

Strategic<br />

vision<br />

Start-up<br />

mode<br />

Extend<br />

product<br />

marketing to<br />

the channel<br />

<strong>Channel</strong><br />

marketing/<br />

management<br />

asserts<br />

leadership<br />

Corporate<br />

owner to create<br />

enterprise<br />

efficiencies and<br />

strategic<br />

alignment<br />

Identify and continuously<br />

deliver the most effective<br />

support to all channels;<br />

consume channel data in all<br />

downstream business<br />

process to deliver value<br />

People<br />

No dedicated<br />

resources<br />

<strong>Driven</strong> by<br />

product<br />

groups<br />

Departmental or<br />

business unit (BU)<br />

or regional CDM<br />

teams<br />

Corporate team<br />

under sales VP<br />

Global channel data leader<br />

with sponsorship and<br />

resources<br />

Process<br />

No clearly<br />

defined<br />

processes<br />

Ad hoc data<br />

capture and<br />

limited use<br />

cases<br />

Single<br />

department to<br />

consolidate<br />

channel data and<br />

expand datadriven<br />

use cases<br />

Centralized<br />

channel data<br />

that<br />

departments<br />

can leverage to<br />

drive specific<br />

use cases<br />

Enterprise/global processes<br />

for data collection, analysis,<br />

and use cases with SLAs<br />

across functions<br />

Technology<br />

Uncertain<br />

what systems<br />

are being<br />

used to<br />

capture<br />

channel data<br />

Existing backend<br />

systems<br />

to house<br />

fragmented<br />

channel data<br />

Departmental<br />

systems of record<br />

dominate (CRM in<br />

sales, ERP in<br />

finance)<br />

<strong>Channel</strong> data<br />

management<br />

platform<br />

implemented in<br />

BU<br />

<strong>Channel</strong> data management<br />

platform implemented<br />

enterprisewide<br />

<strong>Data</strong><br />

No one<br />

knows what<br />

data is<br />

captured or<br />

where it is<br />

Limited,<br />

poorly<br />

managed<br />

channel data<br />

Emergent<br />

standards for<br />

channel data<br />

validation,<br />

enrichment, and<br />

governance<br />

Enterprise/master<br />

channel data<br />

management<br />

best practices for<br />

validation,<br />

enrichment, and<br />

governance<br />

Analytics exposed to partners<br />

to propagate best practices<br />

and drive performance at<br />

scale; data is accurate and<br />

decision grade; connecting it<br />

back to master data is<br />

important so that it can be<br />

used in all downstream<br />

systems<br />

Capability<br />

Opinionbased<br />

channel<br />

decisions<br />

Collect POS<br />

and inventory<br />

data monthly<br />

in predefined<br />

templates<br />

Weekly updates<br />

with support for<br />

multiple data<br />

collection formats<br />

and modes of<br />

transmission<br />

Support for<br />

global data<br />

collection<br />

standard and<br />

advanced<br />

collection<br />

methods<br />

Partner data captured via<br />

automated partner<br />

submission portal with no<br />

manual steps; attention to<br />

frequency of data collection<br />

and depth of incoming data<br />

Source: IDC, 2015<br />

©2016 IDC #US40629815 4

In any maturity model, it is important to benchmark yourself against industry norms and best practices.<br />

In CDM, you would benchmark things such as your coverage and latency of tier 1 and tier 2 data, the<br />

kinds of data you collect, the accuracy of the data you collect, the compliance of your partners with the<br />

process, and your ability to leverage the data in downstream processes to drive business value.<br />

Benefits for Manufacturers<br />

<strong>Channel</strong> Marketing<br />

<br />

<br />

<br />

Customer segmentation is the capability to classify your prospective and current customers and<br />

create groups of similar customers based on their behavioral and demographic attributes. It is<br />

used to make key business decisions for effective marketing, promotions, and product planning.<br />

Partner segmentation is the capability to segment partners and assign tiers by sales<br />

performance, order history, or other value measures and to profile partners based on sales<br />

performance. Partner segmentation data can be used to set or revise sales targets, analyze or<br />

define partner engagement models, map coverage to market segmentation, and improve the<br />

ROI for the channel incentive program.<br />

Campaign management is the capability to design, execute, and manage campaigns to deliver<br />

the right offer via the right channel at the right time and maximize profits. It consumes channel<br />

data to "close the loop" and match sales data to cost data to determine the ROI for the campaign.<br />

Sales Execution<br />

<br />

<br />

Deal registration is the capability to identify deal registrations and match them to actual sales<br />

through partner-reported point-of-sale (POS) data. It is used to validate and pay incentives for<br />

the deal registration based on the actual POS-reported sale. It calculates close rate and cycle<br />

time of a deal, the "net, net price," and supports the automated closure of the deal registration<br />

and automated auditing of incentive payments.<br />

<strong>Channel</strong> sales performance management is the capability to aggregate channel performance<br />

across a geography, a segment (i.e., retail), and/or globally. It is used to drive sales<br />

performance in the channel by providing granular data on sales and inventory management.<br />

Post-Sales Service<br />

<br />

<br />

<br />

<br />

Installed base via POS is the capability to populate installed base records using clean and<br />

enriched POS data. It can be used to create serial number installed base records from POS<br />

data; match activations, license, and other customer data; track the asset; and identify<br />

additional service to customers.<br />

End-customer visibility is the capability to collect POS data with end user and serial number<br />

information to identify the end user of the device or asset within the installed base. It is used to<br />

identify the channel "route to customer" to generate leads and target marketing campaigns into<br />

the installed base.<br />

Warranty and returns management is the capability to validate whether the product sold<br />

follows the terms and conditions of warranty or not (e.g., product manufactured should be sold<br />

only in the United States; if sold outside the United States, warranty is not applicable). If<br />

warranty conditions are fulfilled, so is the ability to derive the validity period of warranty.<br />

Upsell and re-engagement is the capability to build a detailed profile of the installed base<br />

(e.g., product, device identifiers, service, and warranty expiration dates) to identify sales<br />

opportunities for additional product/services and the route to customer. It can be used for<br />

supporting upsell and cross-sell alerts and the advance notifications of upcoming renewal<br />

expiration dates to reengage with customers and eliminate any lapse in service and/or<br />

unnecessary fees.<br />

©2016 IDC #US40629815 5

Incentive and loyalty is the capability to pay partner incentives from POS data or inventory<br />

data submitted by the partner without the administrative burden of a claiming process. It is<br />

used to accelerate partner payments and reduce the cost of partner incentive programs. It<br />

supports the ship and debit process, special pricing, net-net valuations, and other incentive<br />

plans based off of sales and inventory data.<br />

Finance, Risk, and Compliance<br />

<br />

<br />

<br />

Supply Chain<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

Revenue recognition is the ability to use the sell-out POS data and to reconcile sell-in/sell-out<br />

data in order to accurately recognize revenue from channel sales net of all MDF and channel<br />

incentives spend. It is used by finance to recognize the financial statement revenue or internal<br />

business unit revenue.<br />

Financial planning is the capability to monitor financial planning and budgeting items from POS<br />

and inventory data reported by channel partners. It is used to extend the financial planning to<br />

include channel sales and incentives to better predict the financial performance of the enterprise.<br />

<strong>Channel</strong> audit is the ability to aggregate sales by partner, inventory, and risk alerts in a<br />

package that can be provided to internal or external auditors to complete channel compliance<br />

audits in an effective and efficient manner. It is used to focus audits on high-risk partners and<br />

high-risk transactions and to reduce the time to audit these partners and/or transactions.<br />

SISO inventory reconciliation is the capability to analyze reported sell-through information<br />

with inventory data to enhance profitability. It is used to detect variances within defined<br />

tolerance limits for validation that the channel partner sales and inventory data are in sync<br />

with. It supports the identification of grey market activities and high-risk partners as well as<br />

improves overall data quality.<br />

Demand forecasting is the capability to consume granular POS data to quantify future demand<br />

at a very granular level. It is used to align inventory balances with predicting future quantities<br />

demanded by sold-to customer or end customer. Accurate forecasting will reduce inventory<br />

balances, reduce stock-outs, and identify excess inventory for supply chain actions.<br />

Inventory tracking is the capability to analyze the current inventory level with recent sales<br />

history to determine the number of days of inventory (inventory aging) at the current sales<br />

level. It is used to identify excess inventory, reduce inventory aging, and avoid inventory writeoffs.<br />

For retail channel partners, store-level POS and inventory data should provide channel<br />

visibility to the larger retail chains.<br />

Stock-out avoidance is the capability to minimize the occurrences of stock-outs at the point of<br />

sale by understanding product availability within the channel to identify locations with low<br />

volumes earlier. It can be used to increase revenue by providing stock at locations where sales<br />

would otherwise be lost and reduce the logistics costs associated with accelerated shipments.<br />

Sell-in/sell-through analysis is the capability to link the sell-in and sell-through POS data to<br />

provide channel visibility from sell-in to end-customer sale or activation. It is used to drive<br />

visibility to channel inventory and overall channel sales.<br />

POS returns and optimization is the capability to evaluate the rate of product returns to<br />

manufacturer, identify specific high-rate partners, and understand the reasons for the return. It<br />

can be used to reduce the associated costs of returns via early detection of potential product<br />

issues and abnormal partner return rates.<br />

Logistics and inventory optimization is the capability that provides the POS and inventory data<br />

to supply chain modeling to reduce the overall number of inventory moves to achieve the<br />

optimal cost of logistics and inventory.<br />

©2016 IDC #US40629815 6

Getting Partners to Participate<br />

Large distributors and partners are likely prepared to deliver a well-defined set of sales and marketing<br />

data. Smaller partners with limited resources, however, will need a tangible and immediate benefit and<br />

a very low overhead process to participate fully and consistently. The general rule for channel data<br />

should be that everything that goes out to partners should be designed to bring data back. The four<br />

broad categories of ways in which manufacturers can capture partner data are:<br />

<br />

<br />

<br />

<br />

Contractual obligation. <strong>Data</strong> should be part of the partner contract. This approach is usually<br />

already in place with the largest partners and distributors. Contractual reporting should cover<br />

all the data attributes required by the manufacturer such as point of sale, inventory, part/serial<br />

numbers, customer identity, and MDF spend. Key to effective data provisioning by partners is<br />

the accuracy, completeness, and timeliness of the data. The best practice in this regard is for<br />

weekly updates. Performance against these requirements should also be factored into how the<br />

partner receives rewards or penalties relating to incentives, certifications, go-to-market funds,<br />

and so forth.<br />

Operationalized data capture. One of the most difficult types of partner data to capture is<br />

marketing and sales activities. To facilitate this, companies should redesign the partner portal<br />

as a SaaS platform that provides a wide range of functionality. The ideal platform will<br />

consolidate all of the interactions with partners by offering personalized access to content and<br />

transactional systems, as well as the ability to execute customer interactions such as<br />

marketing campaigns. By virtue of this consolidation, it captures an increasingly large portion<br />

of partner activities and provides a continuous flow of valuable data to inform channel<br />

marketing and management.<br />

Partner scorecards. Many companies use partner scorecards, but they are typically designed<br />

around lagging indicators that are based on incomplete, outdated, and inaccurate data. A<br />

CDM process will enable much richer and more useful scorecards to be developed. A critical<br />

component of the partner score must be related to the data provisioning process itself.<br />

Partners should be scored on the accuracy, completeness, and timeliness of the data, which<br />

can be linked to a number of valuable perks: MDF allocation, prompt payout processing, and<br />

access to greater data services.<br />

<strong>Data</strong> as a service. A more advanced method is to externalize the database of partner<br />

performance data and make it available to partners in a way that captures even more data<br />

from more partners. By offering access to the data to partners, manufacturers can deliver<br />

specific insights to them on how they can better run their businesses. Partners can query the<br />

database for detailed benchmarks on the financial, operational, and behavioral characteristics<br />

of very similar peer groups. Of course, the level of detail they get in return depends on the<br />

level of detail they provide. As a result, the database is in a virtuous cycle of enrichment. They<br />

should be able to get insight into a wide variety of strategic and tactical questions such as:<br />

<br />

<br />

<br />

<br />

<br />

How many people do I need in marketing, sales, technical, and support roles?<br />

What level of skills and training should people have?<br />

What marketing activities are most effective?<br />

What sales methodologies and plays are most effective and at what stage?<br />

What manufacturer resources and networks should staff be utilizing most frequently?<br />

©2016 IDC #US40629815 7

OPPORTUNITIES<br />

Benefits for <strong>Channel</strong> Partners<br />

While the benefits to internal departments that interact with channel partners are significant, the real<br />

payoff for channel data management is in driving the partner performance curve. By gathering more<br />

detailed data on a broader range of partners, manufacturers can get more revenue from their existing<br />

partner base. The key is for manufacturers to leverage their unique position at the center of the partner<br />

universe. No other company, including your distributors and partners, can possibly have the same<br />

level of insight into how different types of partners perform and why. Armed with that data,<br />

manufacturers can start to identify who the highest-performing partners are and the best practices for<br />

partners like them. These insights can be used to show underperforming partners, specifically how<br />

they can boost their ROI on their relationship with the manufacturer — how should they invest the next<br />

dollar in the relationship: Marketing campaigns? Sales training? Technical certifications? Hiring staff?<br />

Recommendations can apply to every role in the partner organization and might include any or all of<br />

the following:<br />

<br />

<br />

<br />

<br />

<br />

Marketing: Improving competencies, longer-term campaign planning, and new accounts or<br />

buyer types; leveraging social and mobile channels; and understanding buyer's journey,<br />

product mix, pricing, marketing technology or services, customer data management practices,<br />

and so forth<br />

Sales: Updated or more pervasive sales training, new sales plays, and improved qualification<br />

milestones<br />

Technical sales: Advanced certifications and more pervasive technical training<br />

Support: Upsell skills<br />

Executive management: Balancing staff resources<br />

This highly personalized guidance can bring underperforming partners closer to their high-performing<br />

peers. It can be a source of tremendous value and promote loyalty that product and programs alone<br />

cannot. Key benefits for partners include:<br />

<br />

<br />

<br />

<br />

<br />

Improved cash flow and product availability<br />

Proactive help to reduce inventory levels<br />

Benchmarking performance against peers<br />

<strong>Data</strong>-driven account reviews<br />

More effective collaboration to grow business<br />

Of course all this data sharing must be conducted within a good channel conflict structure so that<br />

partners are not helping their direct competitors. But the experience of one partner in one region can<br />

be highly beneficial for partners in other regions with similar business and market profiles. The ability<br />

to propagate best practices with data enables manufacturers to optimize channel recruitment.<br />

©2016 IDC #US40629815 8

FUTURE OUTLOOK<br />

Companies must adopt a new data-driven model for channel engagement:<br />

<br />

<br />

<br />

<br />

<br />

Enterprise/global leadership role and team<br />

CDM platform for data collection, aggregation, analysis, and management<br />

CDM governance to maintain completeness, accuracy, and timeliness of channel data<br />

<strong>Data</strong>-driven channel management processes and investment models across functions<br />

Virtuous cycle of information exchange with channel partners<br />

Leading companies are starting to appoint global heads of channel data management, assess the<br />

(topically sorry) state of their partner databases and data management practices, and deploy solutions<br />

to provide a channel data management platform. These companies are exerting organizational,<br />

process, and technological influence across a wide range of departmental areas — product marketing,<br />

corporate and field marketing, sales, sales operations, and regional channel management. They are<br />

aggressively pursuing the vision of stage 5 maturity (refer back to Table 1). In large organizations,<br />

progress will be measured in years, giving first movers significant market advantage. IDC recommends<br />

that to compete, companies must take the following actions (at a minimum) over the next few years:<br />

<br />

<br />

<br />

Now<br />

<br />

<br />

<br />

<br />

<br />

<br />

Establish a channel data management organization.<br />

Decide where the channel data management leadership should be positioned — in sales or<br />

under the CEO.<br />

Assess channel strategy and objectives against the current channel data management<br />

organization and processes.<br />

Develop urgency and a new story line to move company culture to a channel data<br />

management mentality.<br />

Assess the current state of your partner portal technology and the governance structure<br />

for capturing and managing partner data.<br />

Expand partner advisory boards to include representatives from all segments of the<br />

partner community.<br />

Next budget cycle<br />

<br />

<br />

<br />

<br />

Develop a plan to consolidate the organization's channel data management infrastructure.<br />

Establish key organizational interlocks between all partner-facing departments with<br />

associated service-level agreements (SLAs), where appropriate.<br />

Develop standard taxonomy and governance models for partner data, and roll out globally<br />

across systems.<br />

Plan to establish an analytics function (staff, tools, and governance) to support internal<br />

and external analytics requirements.<br />

Over the next one to two years<br />

<br />

<br />

<br />

<br />

Adopt a data-driven approach to everything related to channel management, marketing,<br />

and enablement.<br />

Reveal insights that both reinforce and challenge current thinking on what drives channel<br />

revenue.<br />

Encourage partners to use your data to help them better run their businesses.<br />

Promote your ability to provide business insights as a key differentiator, and socialize success.<br />

©2016 IDC #US40629815 9

CHALLENGES<br />

Companies are not able to perform mission-critical business operations because of lack of channel<br />

visibility. For example, they are not able to:<br />

<br />

<br />

<br />

<br />

<br />

<br />

Accurately detect and prevent overpayment of incentives/discounts<br />

Understand drivers of supply and demand across the globe, within specific regions or<br />

countries, branch locations, or end-customer demographics<br />

Pinpoint the amount of inventory in the distribution system<br />

Get timely, detailed insight to identify and propagate best practices needed to drive partner<br />

performance<br />

Perform partner profiling and segmentation and measure partner satisfaction<br />

Make confident, data-driven decisions on revenue recognition and reserves<br />

CDM can be a large undertaking for companies that have neglected their channel management<br />

processes over the years. A culture of ad hoc decision making can be hard to change. But technology<br />

is one of the most effective catalysts for change. New systems demand new thinking about how work<br />

routines, holistic processes, and business outcomes can be forged into a core competency. New CDM<br />

solutions such as those from Zyme that provide scalable channel data management capabilities can<br />

be rallying points for channel-facing functions to come together.<br />

Another key challenge is getting partner participation. The CDM program needs to be supported with<br />

marketing and training for distributors, VARs, resellers, and integrators. Every new partner should get<br />

a standard training package explaining the data requirements and usage policies. Every partner<br />

account manager (PAM) or equivalent should also receive training and support resources to help them<br />

assist partners in achieving the highest data provisioning scores they can.<br />

CONCLUSION<br />

By using CDM solutions such as Zyme's, companies can get unprecedented insight into large-scale<br />

channel populations and leverage their position at the center of their channel universe. In addition to its<br />

CDM platform, Zyme provides a global channel directory of over a million partners, support for a wide<br />

range of partner data formats, and a methodology for ensuring partner reporting compliance. With a<br />

deeper understanding of customers, manufacturers can improve regional sales performance and<br />

product planning. Finance and IT benefit from more efficient data collection and financial reporting<br />

enabled by CDM. Other key benefits include:<br />

<br />

<br />

<br />

<br />

<br />

Drive channel revenue<br />

Lower inventory costs<br />

Market more effectively<br />

Rationalize partner investment<br />

Increase compliance<br />

Technology is only one piece of the project, but it is the organizing principle around which change<br />

happens in the organization, the processes, and the data related to channel partners.<br />

©2016 IDC #US40629815 10

About IDC<br />

International <strong>Data</strong> Corporation (IDC) is the premier global provider of market intelligence, advisory<br />

services, and events for the information technology, telecommunications and consumer technology<br />

markets. IDC helps IT professionals, business executives, and the investment community make factbased<br />

decisions on technology purchases and business strategy. More than 1,100 IDC analysts<br />

provide global, regional, and local expertise on technology and industry opportunities and trends in<br />

over 110 countries worldwide. For 50 years, IDC has provided strategic insights to help our clients<br />

achieve their key business objectives. IDC is a subsidiary of IDG, the world's leading technology<br />

media, research, and events company.<br />

Global Headquarters<br />

5 Speen Street<br />

Framingham, MA 01701<br />

USA<br />

508.872.8200<br />

Twitter: @IDC<br />

idc-insights-community.com<br />

www.idc.com<br />

Copyright Notice<br />

External Publication of IDC Information and <strong>Data</strong> — Any IDC information that is to be used in advertising, press<br />

releases, or promotional materials requires prior written approval from the appropriate IDC Vice President or<br />

Country Manager. A draft of the proposed document should accompany any such request. IDC reserves the right<br />

to deny approval of external usage for any reason.<br />

Copyright 2016 IDC. Reproduction without written permission is completely forbidden.