Caribbean Times 29th Issue - Tuesday June 14th 2016

Caribbean Times 29th Issue - Tuesday June 14th 2016

Caribbean Times 29th Issue - Tuesday June 14th 2016

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

2 c a r i b b e a n t i m e s . a g<br />

<strong>Tuesday</strong> <strong>14th</strong> <strong>June</strong> <strong>2016</strong><br />

MP Massiah advocates for<br />

more assistance for businesses<br />

Joanna Paris<br />

Opposition Member and<br />

Parliamentary representative<br />

for the All Saints East<br />

and St. Luke Constituency,<br />

the Hon. Joanne Massiah<br />

gave sound advice to the<br />

government with regards<br />

to the implementation of<br />

the Unincorporated Income<br />

Editor’s Note<br />

<strong>Caribbean</strong> <strong>Times</strong> is printed<br />

and published at Woods<br />

Estate/Friars Hill Road.<br />

The Editor is Justin Peters.<br />

Contact: <strong>Caribbean</strong> <strong>Times</strong>,<br />

P.O. Box W2099,<br />

Woods Estate/Friars Hill<br />

Road,<br />

St. John’s,<br />

Antigua.<br />

Tel: (268) 562-8688,<br />

Fax: (268) 562-8685.<br />

Visit us online at our website:<br />

www. caribbeantimes.ag<br />

We ask you to send:<br />

Pertinent news items to<br />

news@caribbeantimes.ag.<br />

Advertisement inquiries to<br />

accounts@caribbeantimes.ag.<br />

Letters to the editor to<br />

editor@caribbeantimes.ag<br />

Tax, which was debated and<br />

passed in the Lower House<br />

on Monday.<br />

Massiah did not take the<br />

traditional route expected<br />

and opposed the bill, but<br />

rather gave a number of<br />

suggestions to enhance the<br />

legislation and increase the<br />

efficiency of unincorporated<br />

businesses on a whole.<br />

She suggested that as the<br />

government seeks to place<br />

more focus on developing<br />

a cadre of entrepreneurs, a<br />

system is also put in place<br />

to monitor the emergence of<br />

these businesses as well as<br />

to track their success.<br />

“Is there any plan to establish<br />

some mechanism for<br />

mentoring these perspective<br />

entrepreneurs and has anything<br />

been put in place to<br />

track their progress?<br />

“Because you will have<br />

people with very good ideas<br />

but without the monitoring<br />

and advice, they are bound<br />

to fail”, MP Massiah suggested.<br />

Meanwhile, with reference<br />

to the provisions in the<br />

bill, she voiced her agree-<br />

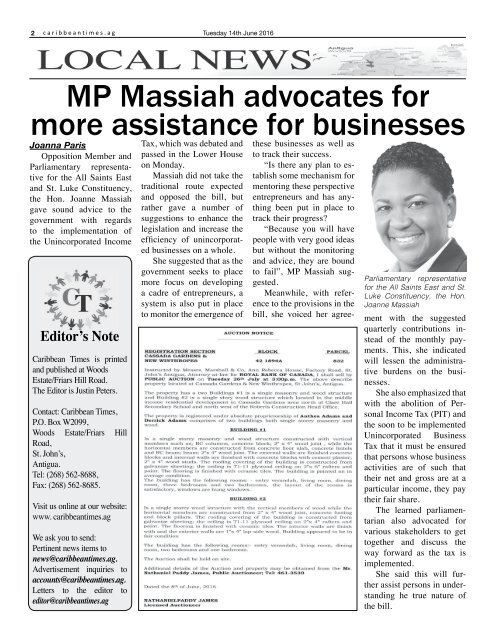

Parliamentary representative<br />

for the All Saints East and St.<br />

Luke Constituency, the Hon.<br />

Joanne Massiah<br />

ment with the suggested<br />

quarterly contributions instead<br />

of the monthly payments.<br />

This, she indicated<br />

will lessen the administrative<br />

burdens on the businesses.<br />

She also emphasized that<br />

with the abolition of Personal<br />

Income Tax (PIT) and<br />

the soon to be implemented<br />

Unincorporated Business<br />

Tax that it must be ensured<br />

that persons whose business<br />

activities are of such that<br />

their net and gross are at a<br />

particular income, they pay<br />

their fair share.<br />

The learned parliamentarian<br />

also advocated for<br />

various stakeholders to get<br />

together and discuss the<br />

way forward as the tax is<br />

implemented.<br />

She said this will further<br />

assist persons in understanding<br />

he true nature of<br />

the bill.