MARKET UPDATE – AFRICA (Abridged)

20160706%20July%20Africa%20Market%20Update%20ABRIDGED

20160706%20July%20Africa%20Market%20Update%20ABRIDGED

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

A financial Advisory<br />

Company<br />

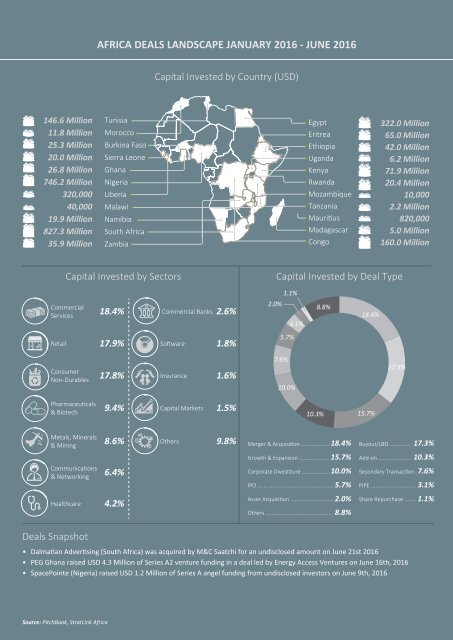

<strong>AFRICA</strong> DEALS LANDSCAPE JANUARY 2016 - JUNE 2016<br />

Capital Invested by Country (USD)<br />

146.6 Million<br />

11.8 Million<br />

25.3 Million<br />

20.0 Million<br />

26.8 Million<br />

746.2 Million<br />

320,000<br />

40,000<br />

19.9 Million<br />

827.3 Million<br />

35.9 Million<br />

Tunisia<br />

Morocco<br />

Burkina Faso<br />

Sierra Leone<br />

Ghana<br />

Nigeria<br />

Liberia<br />

Malawi<br />

Namibia<br />

South Africa<br />

Zambia<br />

Egypt<br />

Eritrea<br />

Ethiopia<br />

Uganda<br />

Kenya<br />

Rwanda<br />

Mozambique<br />

Tanzania<br />

Maurius<br />

Madagascar<br />

Congo<br />

322.0 Million<br />

65.0 Million<br />

42.0 Million<br />

6.2 Million<br />

71.9 Million<br />

20.4 Million<br />

10,000<br />

2.2 Million<br />

820,000<br />

5.0 Million<br />

160.0 Million<br />

Capital Invested by Sectors<br />

Capital Invested by Deal Type<br />

1.1%<br />

Commercial<br />

Services<br />

18.4%<br />

Commercial Banks<br />

2.6%<br />

2.0%<br />

3.1%<br />

8.8%<br />

18.4%<br />

Retail<br />

17.9%<br />

Soware<br />

1.8%<br />

5.7%<br />

Consumer<br />

Non-Durables<br />

17.8%<br />

Insurance<br />

1.6%<br />

7.6%<br />

10.0%<br />

17.3%<br />

Pharmaceucals<br />

& Biotech<br />

9.4%<br />

Capital Markets<br />

1.5%<br />

10.3%<br />

15.7%<br />

Metals, Minerals<br />

& Mining<br />

8.6%<br />

Others<br />

9.8%<br />

18.4% 17.3%<br />

Merger & Acquision ................... Buyout/LBO ..............<br />

Communicaons<br />

& Networking<br />

6.4%<br />

15.7% 10.3%<br />

Growth & Expansion .................... Add-on ......................<br />

Corporate Divesture .................. 10.0% Secondary Transacon.. 7.6%<br />

5.7% 3.1%<br />

IPO ................................................... PIPE ..............................<br />

Healthcare 4.2%<br />

2.0%<br />

Asset Acquision ............................. Share Repurchase ........<br />

Others ............................................. 8.8%<br />

1.1%<br />

Deals Snapshot<br />

• Dalmaan Adversing (South Africa) was acquired by M&C Saatchi for an undisclosed amount on June 21st 2016<br />

• PEG Ghana raised USD 4.3 Million of Series A2 venture funding in a deal led by Energy Access Ventures on June 16th, 2016<br />

• SpacePointe (Nigeria) raised USD 1.2 Million of Series A angel funding from undisclosed investors on June 9th, 2016<br />

Source: PitchBook, StratLink Africa<br />

JULY 2016 | <strong>MARKET</strong> <strong>UPDATE</strong> <strong>–</strong> <strong>AFRICA</strong><br />

3<br />

www.stratlinkglobal.com