The un(der)banked is FinTech’s largest opportunity

DeNovo-Quarterly-Q2-2016.pdf?utm_content=buffer9dd60&utm_medium=social&utm_source=twitter

DeNovo-Quarterly-Q2-2016.pdf?utm_content=buffer9dd60&utm_medium=social&utm_source=twitter

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

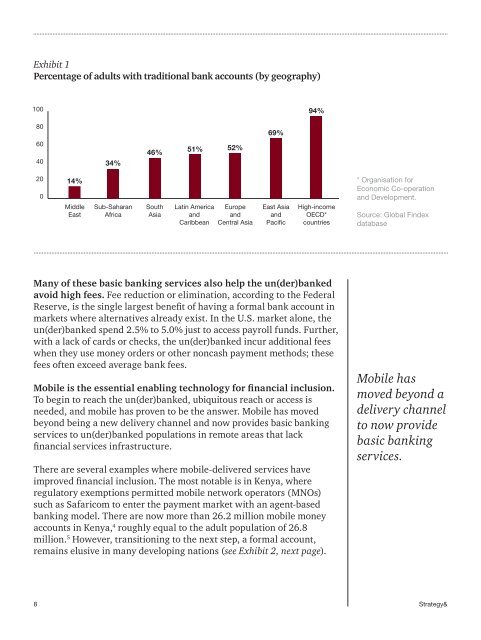

Exhibit 1<br />

Percentage of adults with traditional bank acco<strong>un</strong>ts (by geography)<br />

100 94%<br />

80<br />

69%<br />

60<br />

40<br />

34%<br />

46%<br />

51%<br />

52%<br />

20<br />

0<br />

14%<br />

Middle<br />

East<br />

Sub-Saharan<br />

Africa<br />

South<br />

Asia<br />

Latin America<br />

and<br />

Caribbean<br />

Europe<br />

and<br />

Central Asia<br />

East Asia<br />

and<br />

Pacific<br />

High-income<br />

OECD*<br />

co<strong>un</strong>tries<br />

* Organ<strong>is</strong>ation for<br />

Economic Co-operation<br />

and Development.<br />

Source: Global Findex<br />

database<br />

Many of these basic banking services also help the <strong>un</strong>(<strong>der</strong>)<strong>banked</strong><br />

avoid high fees. Fee reduction or elimination, according to the Fe<strong>der</strong>al<br />

Reserve, <strong>is</strong> the single <strong>largest</strong> benefit of having a formal bank acco<strong>un</strong>t in<br />

markets where alternatives already ex<strong>is</strong>t. In the U.S. market alone, the<br />

<strong>un</strong>(<strong>der</strong>)<strong>banked</strong> spend 2.5% to 5.0% just to access payroll f<strong>un</strong>ds. Further,<br />

with a lack of cards or checks, the <strong>un</strong>(<strong>der</strong>)<strong>banked</strong> incur additional fees<br />

when they use money or<strong>der</strong>s or other noncash payment methods; these<br />

fees often exceed average bank fees.<br />

Mobile <strong>is</strong> the essential enabling technology for financial inclusion.<br />

To begin to reach the <strong>un</strong>(<strong>der</strong>)<strong>banked</strong>, ubiquitous reach or access <strong>is</strong><br />

needed, and mobile has proven to be the answer. Mobile has moved<br />

beyond being a new delivery channel and now provides basic banking<br />

services to <strong>un</strong>(<strong>der</strong>)<strong>banked</strong> populations in remote areas that lack<br />

financial services infrastructure.<br />

<strong>The</strong>re are several examples where mobile-delivered services have<br />

improved financial inclusion. <strong>The</strong> most notable <strong>is</strong> in Kenya, where<br />

regulatory exemptions permitted mobile network operators (MNOs)<br />

such as Safaricom to enter the payment market with an agent-based<br />

banking model. <strong>The</strong>re are now more than 26.2 million mobile money<br />

acco<strong>un</strong>ts in Kenya, 4 roughly equal to the adult population of 26.8<br />

million. 5 However, transitioning to the next step, a formal acco<strong>un</strong>t,<br />

remains elusive in many developing nations (see Exhibit 2, next page).<br />

Mobile has<br />

moved beyond a<br />

delivery channel<br />

to now provide<br />

basic banking<br />

services.<br />

8 Strategy&