PRICING GUIDE 2016

44mukZ

44mukZ

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

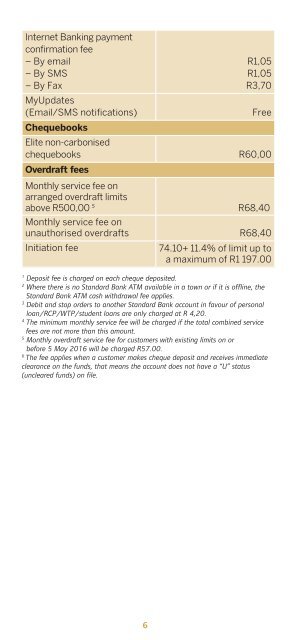

Internet Banking payment<br />

confirmation fee<br />

– By email<br />

– By SMS<br />

– By Fax<br />

MyUpdates<br />

(Email/SMS notifications)<br />

Chequebooks<br />

R1,05<br />

R1,05<br />

R3,70<br />

Free<br />

Elite non-carbonised<br />

chequebooks R60,00<br />

Overdraft fees<br />

Monthly service fee on<br />

arranged overdraft limits<br />

above R500,00 5 R68,40<br />

Monthly service fee on<br />

unauthorised overdrafts R68,40<br />

Initiation fee<br />

74.10+ 11.4% of limit up to<br />

a maximum of R1 197.00<br />

1<br />

Deposit fee is charged on each cheque deposited.<br />

2<br />

Where there is no Standard Bank ATM available in a town or if it is offline, the<br />

Standard Bank ATM cash withdrawal fee applies.<br />

3<br />

Debit and stop orders to another Standard Bank account in favour of personal<br />

loan/RCP/WTP/student loans are only charged at R 4,20.<br />

4<br />

The minimum monthly service fee will be charged if the total combined service<br />

fees are not more than this amount.<br />

5<br />

Monthly overdraft service fee for customers with existing limits on or<br />

before 5 May <strong>2016</strong> will be charged R57.00.<br />

6<br />

The fee applies when a customer makes cheque deposit and receives immediate<br />

clearance on the funds, that means the account does not have a “U” status<br />

(uncleared funds) on file.<br />

6