Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

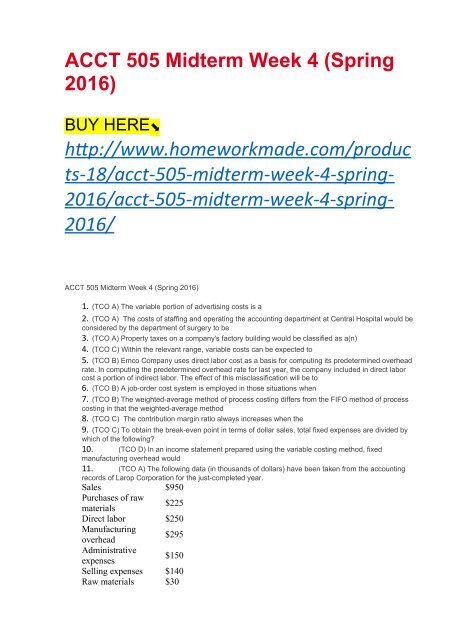

<strong>ACCT</strong> <strong>505</strong> <strong>Midterm</strong> <strong>Week</strong> 4 (<strong>Spring</strong><br />

<strong>2016</strong>)<br />

BUY HERE⬊<br />

htp://www.homeworkmade.com/produc<br />

ts-18/acct-<strong>505</strong>-midterm-week-4-spring-<br />

<strong>2016</strong>/acct-<strong>505</strong>-midterm-week-4-spring-<br />

<strong>2016</strong>/<br />

<strong>ACCT</strong> <strong>505</strong> <strong>Midterm</strong> <strong>Week</strong> 4 (<strong>Spring</strong> <strong>2016</strong>)<br />

1. (TCO A) The variable portion of advertising costs is a<br />

2. (TCO A) The costs of staffing and operating the accounting department at Central Hospital would be<br />

considered by the department of surgery to be<br />

3. (TCO A) Property taxes on a company's factory building would be classified as a(n)<br />

4. (TCO C) Within the relevant range, variable costs can be expected to<br />

5. (TCO B) Emco Company uses direct labor cost as a basis for computing its predetermined overhead<br />

rate. In computing the predetermined overhead rate for last year, the company included in direct labor<br />

cost a portion of indirect labor. The effect of this misclassification will be to<br />

6. (TCO B) A job-order cost system is employed in those situations when<br />

7. (TCO B) The weighted-average method of process costing differs from the FIFO method of process<br />

costing in that the weighted-average method<br />

8. (TCO C) The contribution margin ratio always increases when the<br />

9. (TCO C) To obtain the break-even point in terms of dollar sales, total fixed expenses are divided by<br />

which of the following?<br />

10. (TCO D) In an income statement prepared using the variable costing method, fixed<br />

manufacturing overhead would<br />

11. (TCO A) The following data (in thousands of dollars) have been taken from the accounting<br />

records of Larop Corporation for the just-completed year.<br />

Sales $950<br />

Purchases of raw<br />

$225<br />

materials<br />

Direct labor $250<br />

Manufacturing<br />

$295<br />

overhead<br />

Administrative<br />

$150<br />

expenses<br />

Selling expenses $140<br />

Raw materials $30

inventory, beginning<br />

Raw materials<br />

inventory, ending<br />

$45<br />

Work-in-process<br />

inventory, beginning $20<br />

Work-in-process<br />

inventory, ending<br />

$55<br />

Finished goods<br />

inventory, beginning $100<br />

Finished goods<br />

inventory, ending<br />

$135<br />

12.<br />

Prepare a Schedule of Cost of Goods Manufactured statement in the text box below.<br />

13. (TCO B) The Florida Company manufactures a product that goes through three processing<br />

departments. Information relating to activity in the first department during June is given below.<br />

Percentage Completed<br />

Units Materials Conversion<br />

Work in process, June 1 160,000 65% 45%<br />

Work in process, Jun 30 130,000 75% 65%<br />

14.<br />

The department started 650,000 units into production during the month and transferred 680,000<br />

completed units to the next department.<br />

Required: Compute the equivalent units of production for the first department for June, assuming that the<br />

company uses the weighted-average method of accounting for units and costs.<br />

15. (TCO C) A cement manufacturer has supplied the following data.<br />

Tons of cement produced and sold 220,000<br />

Sales revenue $924,000<br />

Variable manufacturing expense $297,000<br />

Fixed manufacturing expense $280,000<br />

Variable selling and admin expense $165,000<br />

Fixed selling and admin expense $82,000<br />

Net operating income $100,000<br />

16.<br />

Required:<br />

Calculate the company's unit contribution margin.<br />

Calculate the company's contribution margin ratio.<br />

If the company increases its unit sales volume by 5% without increasing its fixed expenses, what would<br />

the company's net operating income be?<br />

17. (TCO D) Johnson Company, which has only one product, has provided the following data<br />

concerning its most recent month of operations.<br />

Selling price $175<br />

Units in beginning<br />

inventory<br />

0<br />

Units produced 9,500<br />

Units sold 8,000<br />

Units in ending Inventory 1,500<br />

Variable costs per unit:<br />

Direct materials $50<br />

Direct labor $36<br />

Variable manufacturing $2

overhead<br />

Variable selling and<br />

admin<br />

$10<br />

Fixed costs:<br />

Fixed manufacturing<br />

$300,000<br />

overhead<br />

Fixed selling and admin $100,000<br />

18.<br />

Required:<br />

What is the unit product cost for the month under variable costing?<br />

What is the unit product cost for the month under absorption costing?<br />

Prepare an income statement for the month using the variable costing method.<br />

Prepare an income statement for the month using the absorption costing method.