ACC 349 Week 5 Final Exam (PHOENIX)

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

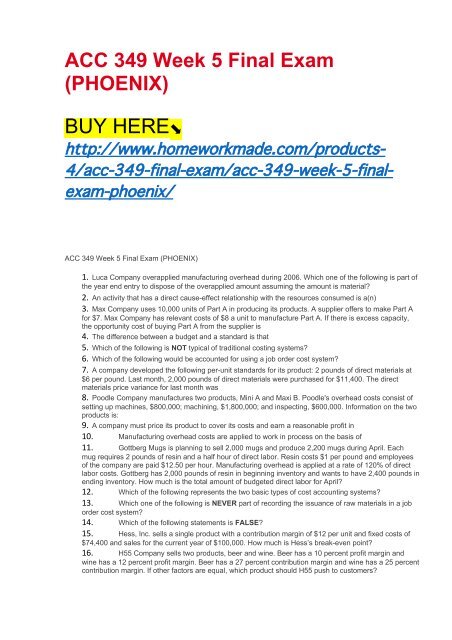

<strong>ACC</strong> <strong>349</strong> <strong>Week</strong> 5 <strong>Final</strong> <strong>Exam</strong><br />

(<strong>PHOENIX</strong>)<br />

BUY HERE⬊<br />

http://www.homeworkmade.com/products-<br />

4/acc-<strong>349</strong>-final-exam/acc-<strong>349</strong>-week-5-finalexam-phoenix/<br />

<strong>ACC</strong> <strong>349</strong> <strong>Week</strong> 5 <strong>Final</strong> <strong>Exam</strong> (<strong>PHOENIX</strong>)<br />

1. Luca Company overapplied manufacturing overhead during 2006. Which one of the following is part of<br />

the year end entry to dispose of the overapplied amount assuming the amount is material?<br />

2. An activity that has a direct cause-effect relationship with the resources consumed is a(n)<br />

3. Max Company uses 10,000 units of Part A in producing its products. A supplier offers to make Part A<br />

for $7. Max Company has relevant costs of $8 a unit to manufacture Part A. If there is excess capacity,<br />

the opportunity cost of buying Part A from the supplier is<br />

4. The difference between a budget and a standard is that<br />

5. Which of the following is NOT typical of traditional costing systems?<br />

6. Which of the following would be accounted for using a job order cost system?<br />

7. A company developed the following per-unit standards for its product: 2 pounds of direct materials at<br />

$6 per pound. Last month, 2,000 pounds of direct materials were purchased for $11,400. The direct<br />

materials price variance for last month was<br />

8. Poodle Company manufactures two products, Mini A and Maxi B. Poodle's overhead costs consist of<br />

setting up machines, $800,000; machining, $1,800,000; and inspecting, $600,000. Information on the two<br />

products is:<br />

9. A company must price its product to cover its costs and earn a reasonable profit in<br />

10. Manufacturing overhead costs are applied to work in process on the basis of<br />

11. Gottberg Mugs is planning to sell 2,000 mugs and produce 2,200 mugs during April. Each<br />

mug requires 2 pounds of resin and a half hour of direct labor. Resin costs $1 per pound and employees<br />

of the company are paid $12.50 per hour. Manufacturing overhead is applied at a rate of 120% of direct<br />

labor costs. Gottberg has 2,000 pounds of resin in beginning inventory and wants to have 2,400 pounds in<br />

ending inventory. How much is the total amount of budgeted direct labor for April?<br />

12. Which of the following represents the two basic types of cost accounting systems?<br />

13. Which one of the following is NEVER part of recording the issuance of raw materials in a job<br />

order cost system?<br />

14. Which of the following statements is FALSE?<br />

15. Hess, Inc. sells a single product with a contribution margin of $12 per unit and fixed costs of<br />

$74,400 and sales for the current year of $100,000. How much is Hess’s break-even point?<br />

16. H55 Company sells two products, beer and wine. Beer has a 10 percent profit margin and<br />

wine has a 12 percent profit margin. Beer has a 27 percent contribution margin and wine has a 25 percent<br />

contribution margin. If other factors are equal, which product should H55 push to customers?

17. One of Astro Company's activity cost pools is machine setups, with estimated overhead of<br />

$150,000. Astro produces sparklers (400 setups) and lighters (600 setups). How much of the machine<br />

setup cost pool should be assigned to sparklers?<br />

18. The cost to produce Part A was $10 per unit in 2005. During 2006, it has increased to $11 per<br />

unit. In 2006, Supplier Company has offered to supply Part A for $9 per unit. For the make-or-buy<br />

decision,<br />

19. What is the best way to handle manufacturing overhead costs in order to get the most timely<br />

job cost information?<br />

20. Managerial accounting<br />

21. The per-unit standards for direct labor are 2 direct labor hours at $12 per hour. If in producing<br />

2,400 units, the actual direct labor cost was $51,200 for 4,000 direct labor hours worked, the total direct<br />

labor variance is<br />

22. Disney’s variable costs are 30% of sales. The company is contemplating an advertising<br />

campaign that will cost $22,000. If sales are expected to increase $40,000, by how much will the<br />

company's net income increase?<br />

23. All of the following statements are correct EXCEPT that<br />

24. In most cases, prices are set by the<br />

25. Seran Company has contacted Truckel Inc. with an offer to sell it 5,000 of the wickets for $18<br />

each. If Truckel makes the wickets, variable costs are $11 per unit. Fixed costs are $12 per unit; however,<br />

$5 per unit is avoidable. Should Truckel make or buy the wickets?<br />

26. What broad functions does the management of an organization perform?<br />

27. A standard cost is<br />

28. Which of the following factors would suggest a switch to activity-based costing?<br />

29. Which cost is NOT charged to the product under absorption costing?<br />

30. The per-unit standards for direct materials are 2 gallons at $4 per gallon. Last month, 11,200<br />

gallons of direct materials that actually cost $42,400 were used to produce 6,000 units of product. The<br />

direct materials quantity variance for last month was<br />

31. At January 1, 2004, Barry, Inc. has beginning inventory of 4,000 widgets. Barry estimates it<br />

will sell 35,000 units during the first quarter of 2004 with a 10% increase in sales each quarter. Barry’s<br />

policy is to maintain an ending inventory equal to 25% of the next quarter’s sales. Each widget costs $1<br />

and is sold for $1.50. How much is budgeted sales revenue for the third quarter of 2004?<br />

32. Which cost is charged to the product under variable costing?<br />

33. At the end of the year, manufacturing overhead has been overapplied. What occurred to<br />

create this situation?<br />

34. If the standard hours allowed are less than the standard hours at normal capacity,<br />

35. Waco’s Widgets plans to sell 22,000 widgets during May, 19,000 units in June, and 20,000<br />

during July. Waco keeps 10% of the next month’s sales as ending inventory. How many units should<br />

Waco produce during June?<br />

36. Poodle Company manufactures two products, Mini A and Maxi B. Poodle's overhead costs<br />

consist of setting up machines, $800,000; machining, $1,800,000; and inspecting, $600,000. Information<br />

on the two products is:<br />

37. Prices are set by the competitive market when<br />

38. Which cost is NOT charged to the product under variable costing?<br />

39. Which one of the following is indirect labor considered?<br />

40. Which of the following statements is FALSE?<br />

41. What sometimes makes implementation of activity-based costing difficult in service industries<br />

is<br />

42. In traditional costing systems, overhead is generally applied based on