“When

x8QZh

x8QZh

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Oklahoma<br />

Volume 6, Issue 11 • November 30, 2016<br />

Economic Report TM<br />

News and analysis of Oklahoma’s economy<br />

A publication of the Office of the State Treasurer • Treasurer Ken Miller, Ph.D.<br />

As goes the oil patch . . .<br />

Oklahoma and the energy industry are<br />

inextricably linked. When oil and gas<br />

prices rise, so do employment levels<br />

and state revenue. When prices drop,<br />

as they did most recently starting in<br />

2014, the whole state feels the pain with<br />

rising joblessness and plummeting tax<br />

collections.<br />

What some may not realize is the extent<br />

to which the industry, the state economy,<br />

and state government are bound<br />

together.<br />

A September 2016 report, commissioned<br />

by the State Chamber of Oklahoma’s<br />

Research Foundation and conducted<br />

by RegionTrack, Inc. of Oklahoma<br />

City, found the industry accounts for 17<br />

percent of state gross<br />

domestic product,<br />

13 percent of state<br />

household earnings,<br />

and 6.5 percent of<br />

total employment,<br />

while paying 22<br />

percent of total state<br />

taxes.<br />

Direct state<br />

revenue effect<br />

The industry directly pays gross<br />

production, corporate income, sales<br />

<strong>“When</strong> oil and gas<br />

prices rise, so do<br />

employment levels<br />

and state revenue.<br />

When prices drop,<br />

the whole state<br />

feels the pain.”<br />

and motor vehicle taxes to the state.<br />

However, specific measurement of the<br />

industry’s direct<br />

contributions to state<br />

coffers can most<br />

easily be seen in gross<br />

production collections<br />

since payments come<br />

exclusively from oil<br />

and gas companies.<br />

State law prohibits<br />

publicly releasing<br />

what individual<br />

companies pay, so<br />

segregating energy company payments<br />

SEE ENERGY PAGE 3<br />

Inside<br />

• Guest commentary by<br />

Corporation Commissioner<br />

Dana Murphy<br />

• Incentive Evaluation<br />

Commission issues<br />

recommendations<br />

• Year-to-date General<br />

Revenue trails estimate<br />

• Oil and gas tax collections rise<br />

in October Gross Receipts<br />

• State unemployment drops<br />

Editor<br />

Tim Allen, Deputy Treasurer for<br />

Communications and Program<br />

Administration<br />

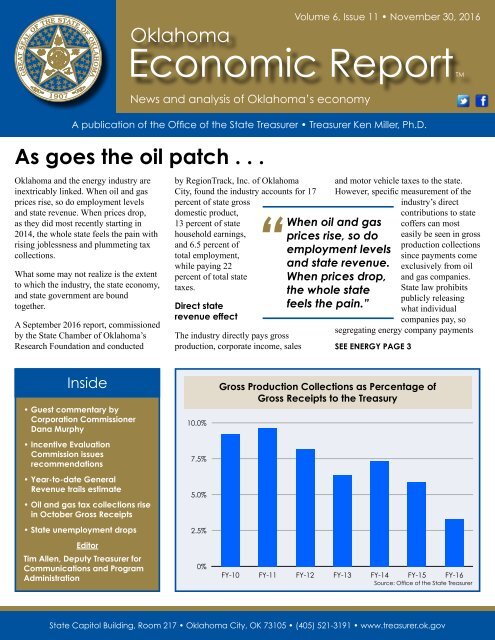

10.0%<br />

7.5%<br />

5.0%<br />

2.5%<br />

0%<br />

Gross Production Collections as Percentage of<br />

Gross Receipts to the Treasury<br />

FY-10 FY-11 FY-12 FY-13 FY-14 FY-15 FY-16<br />

Source: Office of the State Treasurer<br />

State Capitol Building, Room 217 • Oklahoma City, OK 73105 • (405) 521-3191 • www.treasurer.ok.gov

Oklahoma Economic Report TM November 30, 2016<br />

Guest Commentary<br />

By Dana Murphy, Corporation Commissioner<br />

The more things change . . .<br />

On December 3, 1934, Oklahoma<br />

Governor-elect E.W. Marland<br />

met with the governors of Texas and<br />

Kansas. On the agenda: A bold new<br />

plan being pushed by Oklahoma to<br />

bring states together in a cooperative<br />

arrangement to foster the sound<br />

development of oil and natural gas<br />

resources. From these talks came<br />

the Interstate Oil and Gas Compact<br />

Commission.<br />

Back then, the issue was what was<br />

called “waste.” In part, this was the<br />

result of a gold-rush mentality and<br />

uncontrolled development, which was<br />

itself brought about by advances in<br />

drilling technology. “Waste” included<br />

large amounts of oil spilled on the<br />

ground, rather than making it to<br />

market.<br />

Nowadays we would categorize such<br />

a problem as both environmental<br />

and financial. Oklahoma was among<br />

the first of the large producing<br />

states to adopt “anti-waste” law,<br />

laying the groundwork for modern<br />

environmental regulation that seeks<br />

to ensure that Oklahoma’s oil and<br />

gas resources are developed in a safe,<br />

economically beneficial manner.<br />

The idea of bringing states together to<br />

work on the problem to their mutual<br />

benefit was very much “outside the<br />

box” thinking, and represented a<br />

fresh, creative approach to a new<br />

problem.<br />

Fast-forward more than 80 years<br />

and one finds that “the more things<br />

change, the more they stay the same.”<br />

The sweep of technological change in<br />

the oil and gas industry, particularly<br />

over the past decade, cannot be<br />

overstated.<br />

“America has gone<br />

from an oil and gas<br />

‘has-been’ to being a<br />

real threat to OPEC’s<br />

and Russia’s market<br />

dominance – so<br />

much so that a price<br />

war was launched<br />

that in part targeted<br />

U.S. producers.”<br />

Horizontal drilling using the<br />

technologies undreamed of only a<br />

relatively short time ago has unlocked<br />

oil and natural gas resources to an<br />

extent that America has gone from<br />

an oil and gas “has-been” to being a<br />

real threat to OPEC’S and Russia’s<br />

market dominance – so much so that<br />

a price war was launched that in part<br />

targeted U.S. producers.<br />

But with all that change has<br />

come new problems. Just as our<br />

counterparts of 1934, we face a<br />

changed world and the need for<br />

fresh new approaches to solving the<br />

challenges presented by that change.<br />

Horizontal drilling has not only<br />

unlocked huge amounts of oil<br />

and natural gas; it also unlocked<br />

vast amounts of water from the<br />

formations that must be disposed of<br />

without raising the risk for induced<br />

earthquakes while still protecting our<br />

precious fresh water.<br />

The rules and laws that served to<br />

protect the rights of mineral owners<br />

and producers were written when<br />

prominent development was through<br />

vertical wells. Applying a vertical<br />

regulatory scheme to one now<br />

dominated by horizontal wells is the<br />

proverbial square peg in a round hole.<br />

The difficulties and complexities<br />

created by this “horizontal world”<br />

SEE MURPHY PAGE 3<br />

www.treasurer.ok.gov • Page 2

Oklahoma Economic Report TM November 30, 2016<br />

Murphy<br />

FROM PAGE 2<br />

seem overwhelming at times.<br />

However, in order to tackle a<br />

problem, one has to admit to its<br />

existence.<br />

Those who gathered in 1934 faced no<br />

less daunting a set of circumstances.<br />

They and others joined together to<br />

meet the challenges. Oklahoma’s<br />

oil and gas history has been a long<br />

series of chapters of challenges and<br />

changes.<br />

I see that same effort every day in<br />

countless ways, and it is largely<br />

a cooperative one. Industry,<br />

government, and researchers are<br />

working to meet today’s challenges<br />

with an eye toward the future’s<br />

challenges.<br />

The journey may be different, but<br />

the goal is the same: Meeting the<br />

energy needs of the nation in an<br />

economically and environmentally<br />

safe manner.<br />

I am honored to have the opportunity<br />

to be part of today’s and tomorrow’s<br />

solutions for Oklahoma and the<br />

nation.<br />

Energy<br />

FROM PAGE 1<br />

into the other revenue streams is not<br />

possible.<br />

As shown in the graph on page 1, in<br />

the past seven fiscal years – FY-10<br />

through FY-16 – gross production taxes<br />

accounted for between 9.6 percent and<br />

3.3 percent of total Gross Receipts to<br />

the Treasury. Collections ranged from<br />

just more than $978 million in FY-11,<br />

when the average price of benchmark<br />

West Texas Intermediate Crude Oil sold<br />

for $85.22 per barrel, to a low of $367<br />

million in FY-16, when benchmark<br />

crude sold for $43.71 per barrel.<br />

$110.00<br />

Crude Oil – Price vs. Gross Production Collections<br />

$60<br />

During those years, monthly natural gas<br />

prices have ranged from $6 per million<br />

Btu in February 2014 to $1.73 in March<br />

2016.<br />

Price per barrel<br />

$82.50<br />

$55.00<br />

$27.50<br />

$0<br />

West Texas Intermediate Crude Oil Prices<br />

Crude Oil Gross Production Tax Collections<br />

Jan-11<br />

Feb-11<br />

Mar-11<br />

Apr-11<br />

May-11<br />

Jun-11<br />

Jul-11<br />

Aug-11<br />

Sep-11<br />

Oct-11<br />

Nov-11<br />

Dec-11<br />

Jan-12<br />

Feb-12<br />

Mar-12<br />

Apr-12<br />

May-12<br />

Jun-12<br />

Jul-12<br />

Aug-12<br />

Sep-12<br />

Oct-12<br />

Nov-12<br />

Dec-12<br />

Jan-13<br />

Feb-13<br />

Mar-13<br />

Apr-13<br />

May-13<br />

Jun-13<br />

Jul-13<br />

Aug-13<br />

Sep-13<br />

Oct-13<br />

Nov-13<br />

Dec-13<br />

Jan-14<br />

Feb-14<br />

Mar-14<br />

Apr-14<br />

May-14<br />

Jun-14<br />

Jul-14<br />

Aug-14<br />

Sep-14<br />

Oct-14<br />

Nov-14<br />

Dec-14<br />

Jan-15<br />

Feb-15<br />

Mar-15<br />

Apr-15<br />

May-15<br />

Jun-15<br />

Jul-15<br />

Aug-15<br />

Sep-15<br />

Oct-15<br />

Nov-15<br />

Dec-15<br />

Jan-16<br />

Feb-16<br />

Mar-16<br />

Apr-16<br />

May-16<br />

Jun-16<br />

Jul-16<br />

Sources: U.S. Energy Information Administration and Oklahoma Tax Commission<br />

$45<br />

$30<br />

$15<br />

$0<br />

Gross Production collections in $ millions<br />

Drilling activity has also varied greatly<br />

for both oil and natural gas. Monthly rig<br />

counts for oil have ranged from 199 in<br />

October 2014 to 14 in June 2010. For<br />

natural gas, rig counts from ranged from<br />

140 in September and October of 2011<br />

to 1 in May 2015.<br />

The graph on this page shows the direct<br />

link between benchmark crude prices<br />

and oil gross production collections. A<br />

comparison of natural gas prices to gas<br />

gross production collections shows the<br />

same linkage.<br />

SEE ENERGY PAGE 4<br />

Opinions and positions cited in the Oklahoma Economic Report TM<br />

are not necessarily those of Oklahoma State Treasurer Ken Miller or<br />

his staff, with the exception of the Treasurer’s Commentary, which of course, is the viewpoint of the treasurer.<br />

www.treasurer.ok.gov • Page 3

Oklahoma Economic Report TM November 30, 2016<br />

Energy<br />

FROM PAGE 3<br />

A cursory analysis of gross production<br />

collections has yet to show the effect of<br />

changes approved in tax rates in 2015.<br />

All new production is now taxed at a<br />

rate of 2 percent for the first 36 months<br />

and then at a 7 percent rate. Previously,<br />

certain types of well, such as those<br />

horizontally drilled, were initially taxed<br />

at a 1 percent rate.<br />

Demonstrating the linkage<br />

The claim that oil and gas activity<br />

and prices have a profound effect on<br />

the state economy is perhaps best<br />

demonstrated by the graph at the bottom<br />

of this page.<br />

It compares Gross Receipts to the<br />

Treasury to employment levels in the<br />

Mining and Logging supersector, which<br />

in Oklahoma equates to oil and gas jobs.<br />

As the number of those employed in<br />

the oil fields rises and falls, so, too, do<br />

Oil & Gas Employment<br />

gross state tax receipts within a two to<br />

four month lag. For example, during<br />

the Great Recession employment levels<br />

turned downward in November 2008<br />

and state gross receipts followed suit<br />

in January 2009, two months later. The<br />

recovery in gross receipts began four<br />

months after employment levels began<br />

to rebound.<br />

The latest downturn in revenue<br />

began three months after oil and gas<br />

employment levels began to fall.<br />

Total economic effect<br />

The indirect impact of an industry<br />

as large as oil and gas reaches deep<br />

into nearly every sector of the state’s<br />

economy.<br />

The State Chamber report states that<br />

in addition to $37.1 billion in average<br />

annual output of goods and services, the<br />

energy industry supports an estimated<br />

$28.6 billion in spillover. The industry,<br />

according to the report, is responsible<br />

Gross Receipts to the Treasury/Oil & Gas Employment<br />

January 2008 – October 2016<br />

65.0<br />

57.5<br />

50.0<br />

42.5<br />

Shaded area denotes U.S. recession<br />

$12.25<br />

$11.50<br />

$10.75<br />

$10.00<br />

12-Month Gross Receipts (in $ billions)<br />

Oil & Gas Employment (in thousands)<br />

35.0<br />

$9.25<br />

08 09 10 11 12 13 14 15 16 17<br />

12-Month Gross Receipts<br />

Sources: Bureau of Labor Statistics & State Treasurer<br />

for $65.7 million in total state output.<br />

When spillover is included, the report<br />

says 27 percent, or $32.6 billion, of total<br />

state household income is supported by<br />

the energy sector.<br />

In the labor market, almost 1 in 5<br />

wage and salary workers and the selfemployed<br />

are employed either directly<br />

or indirectly by the energy industry in<br />

Oklahoma, according to the report.<br />

Even though employment levels have<br />

decreased during the recent state<br />

recession, the economic study shows<br />

that on a five-year average the industry<br />

has employed 133,800 self-employed<br />

proprietors and wage and salary<br />

workers. That has generated total annual<br />

income of $15.35 billion, according to<br />

the study.<br />

The report estimates average annual<br />

purchases of $11.3 billion from statebased<br />

suppliers by the industry. Plus,<br />

an estimated $1.7 billion in oil and gas<br />

royalties were paid to Oklahomans in<br />

2015.<br />

As measured by the energy sector’s<br />

share of state household income, the<br />

Chamber report says Oklahoma remains<br />

as sensitive to the energy sector as in<br />

1982.<br />

Learn more<br />

Read the State Chamber’s Research<br />

Foundation report: Economic<br />

Impact of the Oil & Gas Industry on<br />

Oklahoma.<br />

Read the State Treasurer’s Gross<br />

Receipts to the Treasury reports.<br />

www.treasurer.ok.gov • Page 4

Oklahoma Economic Report TM November 30, 2016<br />

Incentive Evaluation Commission issues recommendations<br />

The Incentive Evaluation Commission<br />

(IEC), established by the Legislature<br />

in 2015 to make recommendations on<br />

changes to Oklahoma’s tax incentives,<br />

has issued its first annual report.<br />

The first incentive on the chopping<br />

block is the zero-emission tax credit<br />

for the wind power industry. Current<br />

law allows companies that come online<br />

before the beginning of 2021 to claim<br />

the credit, which IEC consultants say<br />

could cost the state $100 million each<br />

year through 2030.<br />

The IEC agreed with the consultant’s<br />

recommendation that the Legislature<br />

reconfigure the credit to either establish<br />

a program cap or accelerate closing<br />

the window for eligibility. The project<br />

team also recommended that facilities<br />

claiming a credit be required to provide<br />

monthly data relating to use of the<br />

credit.<br />

Year-to-date General Revenue trails estimate by 1.8 percent<br />

After one-third of FY-17, allocations<br />

to the General Revenue Fund (GRF)<br />

trail the estimate by $30.5 million, or<br />

1.8 percent, according to the Office of<br />

Management and Enterprise Services<br />

(OMES).<br />

At the end of October, two of the GRF’s<br />

four major revenue streams exceed the<br />

estimate.<br />

Net income tax and gross production tax<br />

top the estimate by a combined $19.8<br />

million. Sales tax and motor vehicle tax<br />

allocations are less than the estimate by<br />

a combined total of $46.6 million.<br />

In the first four months of the current<br />

fiscal year, GRF collections have been<br />

less than the estimate three times.<br />

In the 52 months since July 2012, the<br />

beginning of FY-13, GRF allocations<br />

have been less than the estimate 35<br />

times, or in just more than two-thirds of<br />

the months.<br />

In each of the past four fiscal years,<br />

total GRF collections have been below<br />

the official estimate. Except for FY-16<br />

when revenue failure was declared and<br />

across-the-board cuts were ordered for<br />

appropriated state agencies, total fiscal<br />

year allocations have been within the 5<br />

percent cushion established in the state<br />

constitution.<br />

Monthly General Revenue Fund Allocations vs. Estimate<br />

(percentage difference)<br />

40%<br />

FY-13<br />

-0.5%<br />

FY-14<br />

-4.8%<br />

FY-15<br />

-2.2%<br />

FY-16<br />

-9.4%<br />

FY-17 YTD<br />

-1.8%<br />

20%<br />

0%<br />

-20%<br />

Jul-12<br />

Oct-12<br />

Jan-13<br />

Apr-13<br />

Jul-13<br />

Oct-13<br />

Jan-14<br />

Apr-14<br />

Jul-14<br />

Oct-14<br />

Jan-15<br />

Apr-15<br />

Jul-15<br />

Oct-15<br />

Jan-16<br />

Apr-16<br />

Jul-16<br />

Oct-16<br />

Source: Office of Management and Enterprise Services<br />

www.treasurer.ok.gov • Page 5

Oklahoma Economic Report TM November 30, 2016<br />

October Gross<br />

Receipts &<br />

General Revenue<br />

compared<br />

October Gross Receipts to the<br />

Treasury totalled $886.2 million,<br />

while the General Revenue<br />

Fund (GRF), as reported by the<br />

Office of Management and<br />

Enterprise Services, received<br />

$390.9 million, or 44.1%, of the<br />

total.<br />

The GRF received between<br />

29.7% and 52.8% of monthly<br />

gross receipts during the past<br />

12 months.<br />

From October gross receipts,<br />

the GRF received:<br />

• Individual income tax: 55.4%<br />

• Corporate income tax: None<br />

• Sales tax: 43.4%<br />

Oil and gas tax collections rise in<br />

October Gross Receipts to the Treasury<br />

(Original release date: November 8,<br />

2016.)<br />

For the first time in almost two<br />

years, October tax<br />

collections from<br />

the production of<br />

oil and natural gas<br />

topped collections<br />

from the same month<br />

of the prior year,<br />

State Treasurer Ken<br />

Miller announced<br />

today as he released<br />

the monthly Gross<br />

Receipts to the<br />

Treasury report.<br />

While still significantly lower than<br />

collections prior to the ongoing oil<br />

price slump, October gross production<br />

collections of $35.1 million were above<br />

“It’s not yet time<br />

to sing ‘Happy<br />

Days Are Here<br />

Again,’ but this<br />

month’s gross<br />

production number<br />

is welcome news.”<br />

October 2015 collections by $2.9<br />

million, or 8.9 percent. The last time<br />

monthly gross production collections<br />

topped those of the prior year was in<br />

December 2014, when<br />

receipts totaled $72.1<br />

million.<br />

“It’s not yet time to<br />

sing ‘Happy Days<br />

Are Here Again,’ but<br />

this month’s gross<br />

production number is<br />

welcome news,” Miller<br />

said. “Since April,<br />

we’ve seen monthly<br />

gross production<br />

collections generally rise along with<br />

crude oil prices. Passing the prior year<br />

threshold this month is encouraging.”<br />

SEE REVENUE PAGE 7<br />

• Gross production-Gas: 67.2%<br />

• Gross production-Oil: 8.7%<br />

• Motor vehicle tax: 27.1%<br />

• Other sources: 37.6%<br />

$50<br />

$25<br />

Monthly Gross Receipts vs. Prior Year<br />

October GRF allocations are<br />

below the estimate by $47.3<br />

million, or 10.8%. Year-to-date<br />

GRF revenue trail the estimate<br />

by $30.5 million or 1.8%.<br />

October insurance premium<br />

taxes totaled $105,673, a<br />

decrease of $279,671, or 72.6%,<br />

from the prior year.<br />

Tribal gaming fees generated<br />

$11.2 million during the month,<br />

up by $503,942, or 4.7%, from<br />

last October.<br />

$0<br />

-$25<br />

-$50<br />

-$75<br />

-$100<br />

-$125<br />

Nov-15<br />

Income Tax<br />

Sales Tax<br />

Dec-15<br />

Jan-16<br />

Gross Production<br />

Motor Vehicle<br />

Feb-16<br />

Dollar change (in millions) from prior year<br />

Other<br />

Mar-16<br />

Apr-16<br />

May-16<br />

Jun-16<br />

Jul-16<br />

Aug-16<br />

Sep-16<br />

Oct-16<br />

Source: Office of the State Treasurer<br />

www.treasurer.ok.gov • Page 6

Oklahoma Economic Report TM November 30, 2016<br />

Revenue<br />

FROM PAGE 6<br />

October gross production collections<br />

are based on production activity from<br />

August when benchmark West Texas<br />

Intermediate crude oil sold for $44.72<br />

per barrel.<br />

An apparent trough was reached last<br />

April when gross production collections,<br />

(in millions)<br />

$100<br />

$80<br />

$60<br />

$40<br />

$20<br />

based on February prices of $30.32<br />

per barrel, dropped to a 17-year low of<br />

$20.8 million.<br />

Gross Production Tax Collections<br />

November 2013 – October 2016<br />

Current 12 months<br />

Oil and gas tax collections<br />

notwithstanding, all other major revenue<br />

streams – income, sales, and motor<br />

vehicle taxes – were lower in October<br />

and total monthly Gross Receipts to<br />

the Treasury continued a 20-month<br />

contraction. October collections, at<br />

$886.2 million, were down by 3.5<br />

percent from October of last year. The<br />

last time October collections were lower<br />

was in 2011. Collections during the<br />

past 12 months, at $10.9 billion, are the<br />

lowest since March 2012.<br />

About Gross Receipts to the<br />

Treasury<br />

Since March 2011, the Treasurer’s<br />

Office has issued the monthly Gross<br />

Receipts to the Treasury report, which<br />

provides a timely and broad view of the<br />

state’s macro economy.<br />

FOR RELEASE: November 18, 2016<br />

It is provided in conjunction with the<br />

General Revenue Fund (GRF) report<br />

from the Office of Management and<br />

OKLAHOMA EMPLOYMENT REPORT<br />

Enterprise Services,<br />

– October<br />

which provides<br />

2016<br />

information to state agencies for<br />

Oklahoma unemployment rate down<br />

budgetary<br />

slightly<br />

purposes.<br />

in<br />

The<br />

October<br />

GRF receives<br />

One year prior Two years prior<br />

about half of the state’s gross receipts<br />

Oklahoma’s seasonally adjusted unemployment rate edged down with 0.1 the percentage remainder point paid in to rebates 5.2 percent and in<br />

October, while the U.S. unemployment rate was little changed at refunds, 4.9 percent remitted in October. cities The and state’s counties, seasonal<br />

adjusted unemployment rate Source: was Oklahoma up by 1.0 Tax percentage Commission point compared and placed to into October earmarks 2015. to other funds.<br />

$0<br />

Nov Dec Jan Feb Mar Apr May Jun Jul Aug Sep Oct<br />

Unemp.<br />

State unemployment notches October 2016 down slightly in October<br />

rate*<br />

Oklahoma’s seasonally-adjusted<br />

unemployment rate fell by one-tenth<br />

of one percentage points in October,<br />

ending eight months of increases, figures<br />

released by the Oklahoma Employment<br />

Security Commission show.<br />

In addition, September’s state jobless<br />

rate was revised to 5.3 percent from<br />

a preliminary 5.2 percent. October<br />

marks the fourth consecutive month the<br />

Oklahoma unemployment rate has been<br />

higher than the national rate, which was<br />

set at 4.9 percent.<br />

Labor force* Employment* Unemployment*<br />

Oklahoma 5.2% 1,815,604 1,720,628 94,976<br />

United States 4.9% 159,712,000 151,925,000 7,787,000<br />

* Data adjusted for seasonal factors<br />

OKLAHOMA<br />

Oklahoma Unemployment Report<br />

October 2016<br />

Unemp.<br />

rate*<br />

Labor force* Employment* Unemployment*<br />

Oct '16 5.2% 1,815,604 1,720,628 94,976<br />

Sept '16 5.3% 1,815,694 1,720,369 95,325<br />

Aug '16 5.1% 1,821,459 1,729,204 92,255<br />

July '16 5.0% 1,834,543 1,743,047 91,496<br />

June '16 4.8% 1,850,770 1,761,046 89,724<br />

May '16 4.7% 1,864,194 1,776,399 87,795<br />

Oct '15 4.2% 1,845,974 1,768,887 77,087<br />

* Data adjusted for seasonal factors<br />

Source: OESC<br />

In October, statewide www.treasurer.ok.gov seasonally adjusted employment • Page 7 grew by 259 persons (0.0 percent), and

Oklahoma Economic Report TM<br />

November 30, 2016<br />

Economic Indicators<br />

11.0<br />

Unemployment Rate<br />

January 1980 – October 2016<br />

65.0<br />

Gross Receipts vs. Oil & Gas Employment<br />

January 2008 – October 2016<br />

$12.25<br />

9.0<br />

7.0<br />

5.0<br />

3.0<br />

U.S.<br />

Oklahoma<br />

1.0<br />

80 82 84 86 88 90 92 94 96 98 00 02 04 06 08 10 12 14 16<br />

Shaded areas denote U.S. recessions<br />

OK-5.2%<br />

U.S.-4.9%<br />

Source: Bureau of Labor Statistics<br />

Oil & Gas Employment<br />

57.5<br />

50.0<br />

42.5<br />

12-Month Gross Receipts (in $ billions)<br />

Oil & Gas Employment (in thousands)<br />

35.0<br />

$9.25<br />

08 09 10 11 12 13 14 15 16 17<br />

Shaded area denotes U.S. recession<br />

$11.50<br />

$10.75<br />

$10.00<br />

Sources: Bureau of Labor Statistics & State Treasurer<br />

12-Month Gross Receipts<br />

5.0<br />

2.5<br />

Leading Economic Index<br />

January 2001 – October 2016<br />

0<br />

U.S.<br />

8-2.5<br />

10 12 14 16<br />

-5.0<br />

Oklahoma<br />

01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17<br />

This graph predicts six-month economic movement by tracking leading indicators,<br />

including initial unemployment claims, interest rate spreads, manufacturing and earnings.<br />

Numbers above 0 indicate anticipated growth.<br />

Shaded areas denote U.S. recessions<br />

Source: Federal Reserve<br />

$70<br />

$50<br />

$30<br />

Avg. = $43.17<br />

Shaded area denotes U.S. recession<br />

Oklahoma Stock Index<br />

Top capitalized companies<br />

January 2009 – November 2016<br />

$43.70<br />

$10<br />

09 10 11 12 13 14 15 16 17<br />

Source: Office of the State Treasurer<br />

Oklahoma Natural Gas Prices & Active Rigs<br />

January 2011 – November 2016<br />

Oklahoma Oil Prices & Active Rigs<br />

January 2011 – November 2016<br />

200<br />

$8<br />

200<br />

Price<br />

$120<br />

Active Rigs<br />

150<br />

100<br />

50<br />

Price<br />

Active Rigs<br />

$6<br />

$4<br />

$2<br />

Price per MMBtu<br />

Active Rigs<br />

150<br />

100<br />

50<br />

Active<br />

Rigs<br />

$90<br />

$60<br />

$30<br />

Price per BBL<br />

0<br />

$0<br />

11 12 13 14 15 16 17<br />

Sources: Baker Hughes & U.S. Energy Information Administration<br />

0<br />

$0<br />

11 12 13 14 15 16 17<br />

Sources: Baker Hughes & U.S. Energy Information Administration<br />

www.treasurer.ok.gov • Page 8