632598256894

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

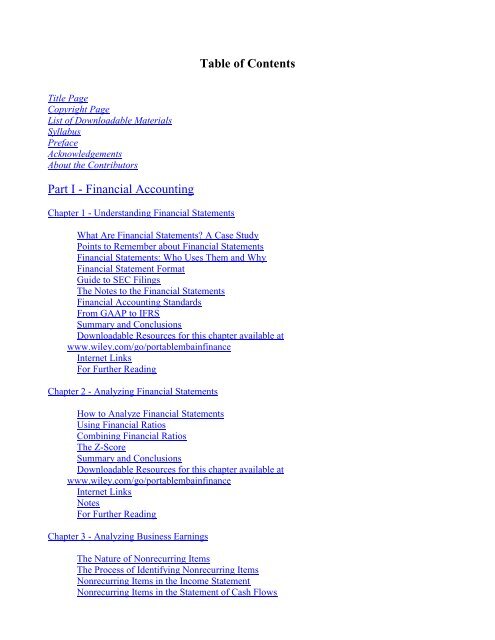

Table of Contents<br />

Title Page<br />

Copyright Page<br />

List of Downloadable Materials<br />

Syllabus<br />

Preface<br />

Acknowledgements<br />

About the Contributors<br />

Part I - Financial Accounting<br />

Chapter 1 - Understanding Financial Statements<br />

What Are Financial Statements? A Case Study<br />

Points to Remember about Financial Statements<br />

Financial Statements: Who Uses Them and Why<br />

Financial Statement Format<br />

Guide to SEC Filings<br />

The Notes to the Financial Statements<br />

Financial Accounting Standards<br />

From GAAP to IFRS<br />

Summary and Conclusions<br />

Downloadable Resources for this chapter available at<br />

www.wiley.com/go/portablembainfinance<br />

Internet Links<br />

For Further Reading<br />

Chapter 2 - Analyzing Financial Statements<br />

How to Analyze Financial Statements<br />

Using Financial Ratios<br />

Combining Financial Ratios<br />

The Z-Score<br />

Summary and Conclusions<br />

Downloadable Resources for this chapter available at<br />

www.wiley.com/go/portablembainfinance<br />

Internet Links<br />

Notes<br />

For Further Reading<br />

Chapter 3 - Analyzing Business Earnings<br />

The Nature of Nonrecurring Items<br />

The Process of Identifying Nonrecurring Items<br />

Nonrecurring Items in the Income Statement<br />

Nonrecurring Items in the Statement of Cash Flows

Interpreting Information in the Operating Activities Section<br />

Nonrecurring Items in the Inventory Disclosures of LIFO Firms<br />

Nonrecurring Items in the Income Tax Note<br />

Nonrecurring Items in the Other Income and Expense Note<br />

Nonrecurring Items in Management‟s Discussion and Analysis (MD&A)<br />

Nonrecurring Items in Other Selected Notes<br />

Earnings Analysis and Other Comprehensive Income<br />

Summarizing Nonrecurring Items and Determining Sustainable Earnings<br />

Role of the Sustainable Earnings Base<br />

Application of the Sustainable Earnings Base Worksheet: Pfizer, Inc.<br />

The Pfizer Worksheet Analysis: Downloadable Tool 3.38<br />

Summary<br />

Downloadable Resources for this chapter available at<br />

www.wiley.com/go/portablembainfinance<br />

Internet Links<br />

Annual Reports Referenced in the Chapter<br />

Notes<br />

For Further Reading<br />

Part II - Financial Management<br />

Chapter 4 - Discounted Cash Flow<br />

Time Value of Money<br />

Future Value<br />

Present Value<br />

Annuities<br />

Amortized Loans<br />

Summary<br />

Downloadable Resources for this chapter available at<br />

www.wiley.com/go/portablembainfinance<br />

For Further Reading<br />

Chapter 5 - Capital Structure<br />

Risk and Return<br />

Portfolio Risk<br />

Capital Asset Pricing Model<br />

Cost of Capital<br />

Cost of Debt and Equity Capital<br />

Weight of Debt and Equity Capital<br />

Capital Structure Theory<br />

Capital Structure in Practice<br />

Bond Valuation<br />

Equity Valuation<br />

Conclusion<br />

Downloadable Resources for this chapter available at<br />

www.wiley.com/go/portablembainfinance<br />

Online Content<br />

Note

Chapter 6 - Planning Capital Expenditure<br />

The Objective: Maximize Wealth<br />

Computing NPV: Projecting Cash Flows<br />

Initial Cash Outflow<br />

Cash Flows in Later Years<br />

Treatment of Net Working Capital<br />

Depreciation<br />

Windfall Profit and Windfall Tax<br />

Taxable Income and Income Tax<br />

Interest Expense<br />

Putting the Pieces Together to Forecast Cash Flow<br />

Guiding Principles for Forecasting Cash Flows<br />

Computing NPV: The Time Value of Money<br />

Discounting Cash Flows<br />

Summing the Discounted Cash Flows to Arrive at NPV<br />

Outsourcing and the Build/Buy Decision<br />

The Discount Rate<br />

Weighted Average Cost of Capital<br />

The Effects of Leverage<br />

Divisional versus Firm Cost of Capital<br />

Other Decision Rules<br />

Internal Rate of Return<br />

Innovations in Capital Budgeting<br />

Summary and Conclusions<br />

Note<br />

For Further Reading<br />

Chapter 7 - Global Finance<br />

Currency Exchange Rates: A Case of Individual Investing<br />

Currency Exchange Rates: A Case in China with Country Risk<br />

Local Partner: Robinson Investment Case<br />

Unknown Rental Cars Borrowing Case: January 1, 1985<br />

Theory: Interest Rate Parity<br />

Theory: Purchasing Power Parity<br />

Futures and Options<br />

Summary<br />

For Further Reading<br />

Part III - Business Entities<br />

Chapter 8 - Choosing a Business Form<br />

The Consulting Firm<br />

The Software Entrepreneur<br />

The Hotel Venture<br />

The Purpose of This Chapter<br />

Business Forms<br />

Comparison Factors

Formation of Sole Proprietorships<br />

Formation of Partnerships<br />

Formation of Corporations<br />

Formation of Limited Partnerships<br />

Formation of Limited Liability Companies<br />

Out-of-State Operation of Sole Proprietorships and Partnerships<br />

Out-of-State Operation of Corporations, Limited Partnerships, and Limited ...<br />

Recognition of Sole Proprietorships as Legal Entities<br />

Recognition of Partnerships as Legal Entities<br />

Recognition of Corporations and Limited Liability Companies as Legal Entities<br />

Recognition of Limited Partnerships as Legal Entities<br />

Continuity of Life<br />

Transferability of Interest<br />

Control<br />

Liability<br />

Taxation<br />

Choice of Entity<br />

Conclusion<br />

Problems<br />

For Further Reading<br />

Chapter 9 - Taxes and Business Decisions<br />

The Business<br />

Unreasonable Compensation<br />

Making the Subchapter S Election<br />

Acquisition<br />

Executive Compensation<br />

Sharing the Equity<br />

Vacation Home<br />

Like-Kind Exchanges<br />

Dividends<br />

Estate Planning<br />

Spin-Offs and Split-Ups<br />

Sale of the Corporation<br />

Conclusion<br />

Problems<br />

For Further Reading<br />

Chapter 10 - The Integrity of Financial Reporting<br />

Introduction<br />

Restatements of Previously Published Financial Statements<br />

Asleep at the Switch<br />

The Remedies<br />

It‟s Not Just the Private Sector<br />

Summary and Conclusions<br />

Downloadable Resources for this chapter available at<br />

www.wiley.com/go/portablembainfinance<br />

Notes

For Further Reading<br />

Part IV - Management Accounting<br />

Chapter 11 - Forecasts and Budgeting<br />

The Concept of Budgeting<br />

Functions of Budgeting<br />

Reasons for Budgeting<br />

Effective Budgeting<br />

Developing a Budget<br />

Forecasting<br />

Fixed Budgets versus Flexible Budgets<br />

The Profit Plan<br />

The Budget Review Process<br />

Recent Trends<br />

Internet Link<br />

Note<br />

For Further Reading<br />

Chapter 12 - Cost Structure Analysis, Profit Planning, and Value Creation<br />

Estimating Cost Structure from Publicly Available Information<br />

Pitfalls<br />

Profit Planning from an Internal Perspective<br />

Pricing in CVP Analysis<br />

Predatory Pricing<br />

Dumping<br />

Notes<br />

Chapter 13 - Activity-Based Costing<br />

Basics of Activity-Based Systems<br />

Reflections<br />

What an ABC Systems Is and Is Not<br />

Lessons from Japan<br />

Summary<br />

Notes<br />

Part V - Planning and Strategy<br />

Chapter 14 - Business Planning<br />

How This Chapter Fits in a Typical MBA Curriculum<br />

Who Uses This Material in the Real World<br />

The Story of Your Business<br />

Types of Plans<br />

From Glimmer to Action: The Process<br />

The Story Model

The Business Plan<br />

Conclusion<br />

Other Resources<br />

Internet Links<br />

Notes<br />

For Further Reading<br />

Chapter 15 - Financial Management of Risks<br />

What Went Wrong: Case Studies of Derivatives Debacles<br />

Size of the Derivatives Market and Widespread Use<br />

The Instruments<br />

How to Choose the Appropriate Hedge<br />

Summary and Final Recommendations<br />

Notes<br />

For Further Reading<br />

Chapter 16 - Business Valuation<br />

Three Approaches to Value<br />

Different Types of Buyers<br />

An Overview of the Business Valuation Process<br />

The Fundamental Position of the Firm<br />

Financial Statement Analysis<br />

Ratio Analysis<br />

Comparison to Industry Averages<br />

Valuation Methods<br />

Debt-Free Analysis<br />

Cost of Capital<br />

Adjustments to Earnings for Valuation Purposes<br />

Income Approach: Discounted Cash Flow Method<br />

Discount Rate for the Valuation Model<br />

Market Approach: Publicly Traded Guideline Companies Method<br />

Reconciliation of Valuation Methods<br />

Adjustment for Illiquidity<br />

Valuation Conclusion for Acme<br />

Valuing Minority Interests<br />

Business Valuation Standards<br />

Value Engineering<br />

Summary<br />

Notes<br />

For Further Reading<br />

Chapter 17 - Profitable Growth by Acquisition<br />

Definitions and Background<br />

Recent Trends and the Performance Record of Mergers and Acquisitions<br />

Anatomy of a Successful Acquirer: The Case of Cisco Systems Inc.<br />

Creating Value in Mergers and Acquisitions<br />

Some Practical Considerations

Successful Postmerger Implementation<br />

Summary and Conclusions<br />

Notes<br />

References<br />

Chapter 18 - Outsourcing<br />

Motivation to Outsource<br />

Domestic versus Offshore Outsourcing<br />

Issues with Using Offshore Providers<br />

Risks and Challenges of Outsourcing<br />

Determining Success<br />

Outsourcing a Process or a Project<br />

Summary<br />

Internet Links<br />

Notes<br />

For Further Reading<br />

Part VI - Advanced Topics<br />

Chapter 19 - Information Technology and You<br />

Introduction<br />

Hardware<br />

Software<br />

Networking<br />

Data<br />

The Future—Today, Tomorrow, and Next Week<br />

Downloadable Resources for this chapter available at<br />

www.wiley.com/go/portablembainfinance<br />

Note<br />

For Further Reading<br />

Chapter 20 - Information Technology and the Firm<br />

Historical Perspective<br />

Information Systems<br />

Organizational Productivity<br />

Managing IT Resources<br />

Information Technology Strategy<br />

Conclusion<br />

Downloadable Resources for this chapter available at<br />

www.wiley.com/go/portablembainfinance<br />

Internet Links<br />

Note<br />

For Further Reading<br />

Chapter 21 - Careers in Finance<br />

Overview: What Is the Marketplace for MBAs?

Glossary<br />

Index<br />

Career Opportunities in Finance<br />

Your Career Plan/Your End Game<br />

Aiming for Your Goals<br />

Implementing Your Strategy<br />

Networking<br />

Assessing Opportunities<br />

Closing Thoughts: Coping with the Challenges<br />

Notes

This book is printed on acid-free paper.<br />

Copyright © 2009 by John Wiley & Sons, Inc. All rights reserved.<br />

Published by John Wiley & Sons, Inc., Hoboken, New Jersey.<br />

Published simultaneously in Canada.<br />

No part of this publication may be reproduced, stored in a retrieval system, or transmitted in any form or by any means, electronic,<br />

mechanical, photocopying, recording, scanning, or otherwise, except as permitted under Section 107 or 108 of the 1976 United States<br />

Copyright Act, without either the prior written permission of the Publisher, or authorization through payment of the appropriate per-copy<br />

fee to the Copyright Clearance Center, Inc., 222 Rosewood Drive, Danvers, MA 01923, (978) 750-8400, fax (978) 646-8600, or on the<br />

web at www.copyright.com. Requests to the Publisher for permission should be addressed to the Permissions Department, John Wiley &<br />

Sons, Inc., 111 River Street, Hoboken, NJ 07030, (201) 748-6011, fax (201) 748-6008, or online at<br />

http://www.wiley.com/go/permissions.<br />

Limit of Liability/Disclaimer of Warranty: While the publisher and author have used their best efforts in preparing this book, they make<br />

no representations or warranties with respect to the accuracy or completeness of the contents of this book and specifically disclaim any<br />

implied warranties of merchantability or fitness for a particular purpose. No warranty may be created or extended by sales<br />

representatives or written sales materials. The advice and strategies contained herein may not be suitable for your situation. You should<br />

consult with a professional where appropriate. Neither the publisher nor author shall be liable for any loss of profit or any other<br />

commercial damages, including but not limited to special, incidental, consequential, or other damages.<br />

For general information on our other products and services or for technical support, please contact our Customer Care Department<br />

within the United States at (800) 762-2974, outside the United States at (317) 572-3993 or fax (317) 572-4002.<br />

Microsoft Office suite including Word, Excel, PowerPoint, and Access are registered trademarks of the Microsoft Corporation.<br />

Wiley also publishes its books in a variety of electronic formats. Some content that appears in print may not be available in electronic<br />

books. For more information about Wiley products, visit our web site at www.wiley.com.<br />

eISBN : 978-0-470-52631-6

List of Downloadable Materials<br />

For access to the following list of downloadable materials for The Portable MBA in Finance and<br />

Accounting, Fourth edition, please visit www.wiley.com/go/portablembainfinance<br />

Understanding Financial Statements Balance Sheet: Liabilities + Equity<br />

Analyzing Financial Statements: Direct Competitor Comparison Worksheet<br />

Analyzing Financial Statements: Financial Statement Ratio Analysis<br />

Adjustment Worksheet for Sustainable Earnings Base<br />

Adjustment Worksheet for Sustainable Earnings Base, Pfizer, Inc.<br />

Discounted Cash Flow: Using Excel to Solve Financial Formulas<br />

Discounted Cash Flow Web<br />

Capital Structure Problems and Solutions<br />

The Integrity of Financial Accounting: Sarbanes-Oxley and Fraudulent Financial Reporting<br />

Information about the Sarbanes-Oxley Act and Corporate Governance and Financial Reporting<br />

Ethics and the Golden Rule<br />

Information Technology and You<br />

Information Technology and the Firm

Syllabus<br />

How Chapter Topics in This Book Track the Core MBA Curriculum<br />

If one were to review the core curriculum for first-year students offered by most of the major MBA<br />

programs, one would find, in one form or another, the following courses:<br />

• Financial Accounting<br />

• Management Accounting<br />

• Financial Management<br />

• Business Law and Business Entities<br />

• Planning and Strategy<br />

• Information Systems<br />

• Operations Management<br />

• Decision Support or Management Sciences<br />

• Marketing<br />

• Managerial Economics<br />

• Organizational Behavior<br />

• Entrepreneurial Thinking<br />

Of course this varies from school to school; however, the vast majority follow this pattern, including<br />

Harvard University, the University of Michigan, Babson College, Stanford University, Columbia<br />

University, and many others.<br />

While this book makes no attempt to cover the entire core curriculum, it does cover most, if not all,<br />

of the accounting and finance topics, as well as several others. The following table compares the<br />

chapter topics with the typical courses that would be in an MBA program.

Preface<br />

Since the third edition of this book was published in late 2001, much has happened to reshape the<br />

business world as we now know it. Our financial system almost collapsed. Stalwarts like Lehman<br />

Brothers and Merrill Lynch ceased to exist because they had assumed huge risk in financial<br />

instruments that were vastly overvalued. The mortgage market collapsed and along with it went a host<br />

of financial companies and banks that had invested in subprime mortgage-backed securities. Bernie<br />

Madoff went from obscurity to become a household name after allegedly bilking investors out of<br />

approximately $50 billion in the largest-ever Ponzi scheme. The stock market lost 35% of its value.<br />

Personal 401(k) retirement accounts were devastated, and people had to rethink their retirement plans.<br />

Companies planning to use their stock to finance the purchase of acquisitions found that the value of<br />

their stock had plunged. Credit became tight and financing difficult.<br />

As a result of the Enron scandal, corporate governance has become a hot topic, with potential<br />

liability for CEOs and CFOs and with much increased and highly expensive and cumbersome added<br />

requirements for internal control imposed by the 2002 Sarbanes-Oxley Act.<br />

All of these issues have created a new financial world that requires special skills for a manager to<br />

succeed. Do you have those skill sets?<br />

Do you know how to accomplish these important business tasks?<br />

• Understand financial statements.<br />

• Measure liquidity of a business.<br />

• Analyze business profitability.<br />

• Differentiate between regular income and extraordinary items.<br />

• Predict future bankruptcy for an enterprise.<br />

• Prepare a budget.<br />

• Do a break-even analysis.<br />

• Figure out return on investment.<br />

• Compute the cost of capital.<br />

• Put together a business plan.<br />

• Legitimately minimize income taxes payable by you or your business.<br />

• Decide what your obligations are as an officer or director of the company.<br />

• Determine the implications of outsourcing a product, a function, or a project either<br />

domestically or internationally.<br />

• Manage foreign currency exposure.<br />

• Evaluate a merger or acquisition target.<br />

• Serve as a director of a corporation.<br />

• Build a successful e-business.<br />

• Understand and use financial derivatives.<br />

• Use information technology for competitive advantage.<br />

• Value a business.<br />

These are some of the key topics explained in this book. It is a book designed to help you learn the<br />

basics in finance and accounting, without incurring the considerable time and expense of a formal<br />

MBA program. The book consists of valuable, practical how-to information, applicable to an entire<br />

range of businesses, from the smallest start-up to the largest corporations in the world. Each chapter of<br />

the book has been written by an outstanding expert in the subject matter of that particular chapter.

Some of these experts are full-time practitioners in the real world, and others are business school<br />

professors with substantial real-world experience who also serve as part-time management<br />

consultants. Most of these professors are on the faculty of Babson College, which is famous for its<br />

major contributions to the field of entrepreneurship, and which year after year is at the top of the<br />

annual list of leading independent business schools compiled by U.S. News & World Report and the<br />

University of Maryland‟s University College, a leading Internet university with 100,000 students,<br />

including 3,000 MBA students.<br />

The first edition of this book was published in 1992, the second edition in 1997, and the third in<br />

2001. All of the editions, hardback and paperback, have been highly successful, and have sold many,<br />

many copies. In addition, the book has been translated into Chinese (Cantonese and Mandarin),<br />

Indonesian, Portuguese, Russian, and Spanish. We are delighted that so many readers in various<br />

countries have found this book useful. Now, the entire book has been updated for the fourth edition.<br />

New chapters have been added on the following subjects:<br />

• Discounted Cash Flow.<br />

• Analyzing Financial Statements.<br />

• Capital Structure.<br />

• The Integrity of Financial Reporting.<br />

• Outsourcing.<br />

• Careers in Finance.<br />

Also, there are six new authors, substantial revisions of several chapters, and complete updates of<br />

the remaining chapters.<br />

Some of the chapters include additional online materials that will reinforce the materials contained<br />

in the chapters. Please go to www.wiley.com/go/portablembainfinance.com to access the online<br />

materials that are designated for this book.<br />

This book can be read, and reread, with a great deal of profit. Also, it can be kept handy on a nearby<br />

shelf so you can pull it down and look up answers to questions as they occur. Further, this book will<br />

help you to work with finance and accounting professionals on their own turf and in their own jargon.<br />

You will know what questions to ask, and you will better understand the answers you receive, without<br />

being confused or intimidated.<br />

Who can benefit from this book? Many different people, such as:<br />

• Managers wishing to improve their business skills.<br />

• Engineers, attorneys, chemists, scientists, and other technical specialists preparing to take<br />

on increased management responsibilities.<br />

• People already operating their own businesses, or thinking of doing so.<br />

• Businesspeople in nonfinancial positions who want to be better versed in financial matters.<br />

• BBA or MBA alumni who want a refresher in finance and accounting.<br />

• People in many walks of life who need to understand more about financial matters.<br />

Whether you are in one, some, or even none of these categories, you will find much of value in this<br />

book, and the book is reader-friendly. Frankly, most finance and accounting books are technically<br />

complex, boringly detailed, or just plain dull. This book emphasizes clarity to nonfinancial readers,<br />

using many helpful examples and a bright, interesting style of writing. Learn, and enjoy!<br />

THEODORE GROSSMAN JOHN LESLIE LIVINGSTONE

Acknowledgments<br />

A book like this can result only from the contributions of many talented people. We would like to<br />

thank the chapter authors who make up this book for their clear and informative explanations of the<br />

powerful concepts and tools of finance and accounting. These people dedicate their lives to educating<br />

others in the complexities of their disciplines. In this ever-changing world of technology, strategy,<br />

economic cycles, geopolitical events, and the Internet, while most of the underlying concepts remain<br />

fixed, the applications are ever changing, requiring the authors to constantly rededicate themselves to<br />

their professions. We thank our editor, Michael Grossman, for his reviewing of the materials from the<br />

perspective of an MBA student.<br />

We dedicate this book to our wives, Ruthie Grossman and Trudy Livingstone, and to our children<br />

and grandchildren. They provide the daily inspiration to diligently perform our work and to have<br />

undertaken this project.<br />

T. G.<br />

J. L. L.

About the Contributors<br />

Richard T. Bliss has been involved in corporate financial analysis since 1987 and is currently on the<br />

finance faculty at Babson College. He teaches at the undergraduate, MBA, and executive levels,<br />

specializing in the areas of corporate financial strategy and entrepreneurial finance. Prior to coming to<br />

Babson, Dr. Bliss was on the faculty at Indiana University, and he has also taught extensively in<br />

Central and Eastern Europe, including at the Warsaw School of Economics, Warsaw University, and<br />

the University of Ljubljana in Slovenia.<br />

With publications in the areas of corporate finance, emerging markets, entrepreneurship, and<br />

banking, Dr. Bliss has an active research agenda. His work on the impact of bank mergers on CEO<br />

compensation has been cited in Fortune magazine and numerous other business publications and was<br />

published in the Journal of Financial Economics.<br />

Dr. Bliss holds a PhD in finance from Indiana University. He also received his MBA in finance/real<br />

estate from Indiana University and graduated with honors from Rutgers University, earning a BS<br />

degree in engineering and a BA degree in economics.<br />

Ralph J. Constantino is associate director of the MBA Center for Career Development, F.W. Olin<br />

Graduate School of Business, Babson College. He has had over 30 years of senior-level professional<br />

experience in the financial services industry. Prior to joining Babson, he served as the managing<br />

director for strategic marketing and product development for State Street Global Advisors, where he<br />

drove international initiatives in Hong Kong and Australia and played a leading role in the formation<br />

of CitiStreet LLC, a joint venture between State Street and CitiCorp. He was also the senior vice<br />

president and chief investment officer for the Schoolhouse Capital business unit that built solutions for<br />

the 529 college savings marketplace. Before his tenure at State Street Corporation, he held senior-level<br />

positions with the Abu Dhabi Investment Authority, Chase Consulting Group, Mercer Meidenger<br />

Hanson, Equitable Capital Management Company, Smilen and Safian, and Citibank. Aside from his<br />

corporate experience, Mr. Constantino has also served as a member of the adjunct faculty at New<br />

York University, Loyola University, the American Institute of Banking, and Bentley University. He is<br />

also a featured speaker at professional conferences in the United States, Europe, and Asia. He has also<br />

appeared on the Nightly Business Report and major print media. He holds a BS degree in economics<br />

and business administration from Wagner College as well as a master‟s degree in economics from<br />

Rutgers University.<br />

Michael A. Crain, CPA/ABV, CFA, ASA, CFE, MBA, is a practitioner specializing mostly in<br />

business valuation and forensic accounting in Fort Lauderdale, Florida. He holds several certifications<br />

related to valuation: Chartered Financial Analyst awarded by the CFA Institute, Accredited Senior<br />

Appraiser in business valuation from the American Society of Appraisers, and Accredited in Business<br />

Valuation awarded by the American Institute of Certified Public Accountants (AICPA). Mr. Crain is a<br />

past chairman of the AICPA business valuation committee, and he has been a member of the<br />

committee that develops the examination given to CPAs who seek the AICPA‟s certification in<br />

business valuation. He teaches a business valuation course at Florida Atlantic University. Mr. Crain<br />

has received several awards, including the AICPA Journal of Accountancy Lawler Award for best<br />

article of the year, and has been inducted into the AICPA business valuation hall of fame. His articles<br />

have been published in practitioner journals, and he has spoken to national audiences. He is currently<br />

working on doctorate research at the Manchester Business School, University of Manchester, England.

Dawna Travis Dewire is a member of the full-time faculty at Babson College in Massachusetts. She<br />

teaches courses in information systems design, database development, and process reengineering. Ms.<br />

Dewire is the author of five books and has been the editor of The James Martin Report, the Year 2000<br />

Practitioner, and the quarterly Journal of Information Systems Management. Prior to joining Babson<br />

College, she was on the full-time faculty at Bentley College. Ms. Dewire‟s professional experience<br />

includes positions with Information Resources, Inc., TRW United-Carr Division, Blue Cross/Blue<br />

Shield, and the State of New York. Ms. Dewire holds a BS in mathematics and an MS in computer<br />

science from the University at Albany-State University of New York and an MBA from Northeastern<br />

University.<br />

James A. Elfter currently resides in East Seaham, a suburb of Newcastle, New South Wales,<br />

Australia. Jim has an MBA from the University of Maryland University College and an undergraduate<br />

degree from Governors State University in Illinois. Since 2006, he has been working for the<br />

University of Maryland‟s Graduate School of Management and Technology as a graduate faculty<br />

assistant. Jim retired from General Motors after more than 30 years of service in various managerial<br />

capacities and international assignments. He has lived and worked in Greece, Egypt, Yugoslavia,<br />

Brazil, Canada, and Australia, where he is enjoying semiretirement.<br />

Steven P. Feinstein is an associate professor of finance at Babson College. He has earned a PhD in<br />

economics from Yale University and a BA degree in economics from Pomona College, and he also<br />

holds the Chartered Financial Analyst (CFA) designation. His research and teaching specialties are in<br />

the fields of investments and capital markets. In addition to his teaching and research, Professor<br />

Feinstein provides consulting services and expert testimony on a variety of financial topics, most<br />

frequently securities litigation. Past and present clients include the United States Securities and<br />

Exchange Commission, the National Association of Securities Dealers, the Internal Revenue Service,<br />

the attorney general of the State of Illinois, State Street Bank, and numerous law firms.<br />

Theodore Grossman is a member of the faculty of Babson College, where he teaches information<br />

technology and accounting. He lectures on various information technology topics such as Web<br />

technologies, e-commerce, strategic information systems, managing information technology, and<br />

systems analysis and design. He also performs extensive consulting for food and nonfood retailers and<br />

suppliers of technology products to the retail industry. He is called on frequently to act as an expert<br />

witness in complex litigation in matters relating to technology and cyber law. Prior to joining Babson<br />

College, he was the founder and CEO of a computer software company for the retail industry. He<br />

holds a BS degree in engineering from the University of New Hampshire and an MS in management<br />

from Northeastern University. Mr. Grossman was a contributor to the second edition of this book and<br />

is an editor of both the third and fourth editions.<br />

Robert F. Halsey has a BA, MBA, and PhD from the University of Wisconsin-Madison. During his<br />

business career, Dr. Halsey managed the commercial lending division of a large Midwestern bank and<br />

served as the chief financial officer of a privately held retailing and manufacturing company. Prior to<br />

joining the faculty of Babson College, he taught at the University of Wisconsin-Madison, where he<br />

received the Douglas Clarke Memorial teaching award. His teaching and research interests are in the<br />

area of financial reporting and include firm valuation, financial statement analysis, and disclosure<br />

issues. Dr. Halsey is the author of Advanced Financial Accounting (forthcoming in 2009 by<br />

Cambridge Business Publishers) and a co-author of Financial Accounting for MBAs, third edition<br />

(Cambridge Business Publishers), MBA Financial & Managerial Accounting (Cambridge Business<br />

Publishers), and Financial Statement Analysis, ninth edition (McGraw-Hill). He has published in

Advances in Quantitative Analysis of Finance and Accounting, the Journal of the American Taxation<br />

Association, and Issues in Accounting Education.<br />

William C. Lawler is the leadership professor, strategy and accounting, F.W. Olin Graduate School<br />

of Business, Babson College. He is also the director of the Consortium for Executive Development at<br />

Babson Executive Education. His teaching and research focus on two areas: financial footprints of<br />

business unit strategy and the impact of new technologies on cost systems design. Dr. Lawler has<br />

written several papers and given numerous professional presentations. His primary focus is on aiding<br />

operational managers in understanding the financial consequences of their decisions. He has run<br />

seminars on this topic for such diverse groups as telecom managers in China, production managers in<br />

the Czech Republic, and R&D managers in the United States. Dr. Lawler consults with a number of<br />

companies, ranging from small biotechs to Fortune 100 technology companies, concerning the design<br />

and use of cost information systems for management decision support rather than external financial<br />

reporting. His most recent publications in this area are a chapter, “Understanding the Financial<br />

Footprint of Strategy,” in Strategy, Innovation, and Change (Oxford University Press, 2008), and<br />

chapters on activity-based costing and profit planning in the fourth edition of The Portable MBA in<br />

Finance and Accounting.<br />

Les Livingstone is the MBA Program Director in Economics, Finance and Accounting at the<br />

University of Maryland University College, a leading Internet university with 100,000 students,<br />

including 3,000 MBA students. (http://www.umuc.edu/index.shtml). He earned MBA and PhD<br />

degrees at Stanford University and is a CPA (licensed in New York and Texas). Since 1991 he has<br />

directed his own consulting firm, specializing in damage estimation for large-scale commercial<br />

litigation and in business valuation. He has served as a consulting or testifying expert in many cases,<br />

and has testified in federal and state courts in Arizona, California, Florida, Georgia, Illinois,<br />

Massachusetts, New York, Rhode Island, and Texas. He has also testified before federal government<br />

agencies, including the Federal Trade Commission (FTC) Federal Energy Regulatory Commission<br />

(FERC), as well as the Public Utilities Commission of Texas. Web site http://leslivingstone.com.<br />

Richard P. Mandel is associate dean of the Undergraduate School and associate professor of law at<br />

Babson College, where he teaches a variety of courses in business law and taxation on the<br />

undergraduate, graduate, and executive education levels and has served as chair of the finance division<br />

and acting dean of the Undergraduate School. He is also of counsel to the law firm of Bowditch and<br />

Dewey, of Worcester, Framingham, and Boston, Massachusetts, where he specializes in the<br />

representation of growing businesses and their executives. Mr. Mandel has written a number of<br />

articles regarding legal issues encountered by small businesses. He holds an AB in government and<br />

meteorology from Cornell University and a JD from Harvard Law School.<br />

Tracee Petrillo is director, MBA Center for Career Development, and assistant dean, F. W. Olin<br />

Graduate School of Business, Babson College. She has over 15 years of corporate and higher<br />

education experience. Prior to receiving her MBA at Babson in 2000, she had been in operations<br />

management, business development, and corporate sales in the hospitality industry working for<br />

organizations such as Disney, Doubletree, and Sheraton. After her Babson MBA, she worked at Keane<br />

Consulting Group as an operations consultant. She returned to Babson as program manager of the twoyear<br />

MBA program in 2003. Subsequently she became the director of the office of program<br />

management before becoming assistant dean of the graduate school. During this time, she led the<br />

transition of the experiential learning function to the graduate school leading the corporate business<br />

development program for the experiential learning programs, and implemented new processes for both<br />

programs. In addition to her Babson MBA, she holds a BA degree from Union College. She is

proficient in Spanish and German, and has traveled extensively, including time living abroad in both<br />

Germany and Spain. In Madrid, she studied at Sampere Language School.<br />

Michael J. Riley is a professor at the University of Maryland University College, teaching MBAs. He<br />

is a board member of Church Mutual Insurance Company and chairs the audit committee of the<br />

Architect of the Capitol, an agency of the U.S. Congress. Previously, Dr. Riley earned his doctorate of<br />

business administration from Harvard University (1977), his MBA from the University of Southern<br />

California (1972), and his BS from the United States Naval Academy (1965). Dr. Riley has served as<br />

CFO of the United States Postal Service, CFO of Lee Enterprises, CFO of United Airlines, and<br />

treasurer of Michigan Bell Telephone Company. During his tenure, the Postal Service posted the<br />

largest increase in profits of any organization in the world (1995) and remained consistently profitable<br />

during the remainder of his service. He has consulted with companies, government agencies, and a<br />

major union. He has taught at Harvard University, Boston University, the University of Connecticut,<br />

the University of Michigan, and George Mason University. His articles have appeared in major<br />

magazines and newspapers, including the Wall Street Journal. Dr. Riley began his career as a Navy<br />

pilot, earning the Air Medal for service in Vietnam.<br />

Virginia Earll Soybel teaches financial accounting and financial statement analysis in both the<br />

graduate and undergraduate programs at Babson College. She earned her MBA and PhD at Columbia<br />

University and taught at the Amos Tuck School of Business at Dartmouth College before coming to<br />

Babson in 1995. Professor Soybel‟s research focuses on the effects of alternate reporting methods on<br />

corporate financial statements and ratios, the time series behavior of financial ratios, and the political<br />

process of accounting standard-setting. Her publications include articles in Strategic Management<br />

Journal and in the Journal of Accounting and Public Policy.<br />

Craig A. Stephenson has been a member of the faculty at Babson College since 1997. He has<br />

experience in the CFO organizations of Phillips Petroleum, Texas Instruments, and Dell. He teaches in<br />

the undergraduate, graduate, and executive education programs, and he specializes in corporate<br />

finance and financial strategy. He has also been on the faculty at the University of Colorado, the<br />

University of Wisconsin, and MIT‟s Sloan School of Management. Professor Stephenson received his<br />

PhD from the University of Arizona, his MBA from the University of Texas, and his BS from the<br />

University of Colorado. He is also the recipient of an honorary degree from the Babson College<br />

graduating class of 2004, awarded to the undergraduate professor of the year. He is a member of the<br />

Institute of Management Accountants, and is a certified management accountant.<br />

Andrew Zacharakis is the John H. Muller Jr. chair in entrepreneurship and the director of the Babson<br />

College Entrepreneurship Research Conference, the leading academic conference on entrepreneurship<br />

worldwide. He previously served as chair of the entrepreneurship department at Babson College from<br />

2003 to 2005 and as acting director of the Arthur M. Blank Center for Entrepreneurship at Babson<br />

College from 2003 to 2004. In addition, Dr. Zacharakis was the president of the Academy of<br />

Management, entrepreneurship division, an organization with 1,800 members, from 2004 to 2005. He<br />

also served as an associate editor at the Journal of Small Business Management (2003-2006). His<br />

primary research areas include the venture capital process and entrepreneurial growth strategies. Dr.<br />

Zacharakis is the co-author of five books, The Portable MBA in Entrepreneurship, third edition;<br />

Business Plans That Work; How to Raise Capital; Entrepreneurship, The Engine of Growth; and a<br />

forthcoming textbook titled Entrepreneurship. The editors of Journal of Small Business Management<br />

selected “Differing Perceptions of New Venture Failure” as the 1999 best article. His dissertation The<br />

Venture Capital Investment Decision received the 1995 Certificate of Distinction from the Academy<br />

of Management and Mr. Edgar F. Heizer, recognizing outstanding research in the field of new

enterprise development. Dr. Zacharakis has been interviewed in newspapers nationwide, including the<br />

Boston Globe, the Wall Street Journal, and USA Today. He has also appeared on the Bloomberg Small<br />

Business Report and been interviewed on National Public Radio. He has taught seminars to leading<br />

corporations, such as Boeing, Met Life, Lucent, and Intel. He has also taught executives in countries<br />

worldwide, including Spain, Chile, Costa Rica, Mexico, Australia, China, Turkey, and Germany. Dr.<br />

Zacharakis received a BS (finance/marketing) from the University of Colorado, an MBA<br />

(finance/international business) from Indiana University, and a PhD (strategy and<br />

entrepreneurship/cognitive psychology) from the University of Colorado. Professor Zacharakis<br />

actively consults with entrepreneurs and small business startups. His professional experience includes<br />

positions with The Cambridge Companies (investment banking/venture capital), IBM, and Leisure<br />

Technologies.

Part I<br />

Financial Accounting<br />

1<br />

Understanding Financial Statements<br />

Les Livingstone<br />

What Are Financial Statements? A Case Study<br />

Gail was applying for a bank loan to start her new business: Nutrimin, a retail store selling nutritional<br />

supplements, vitamins, and herbal remedies. She described her concept to Hal, a loan officer at the<br />

bank.<br />

Hal: How much money will you need to get started?<br />

Gail: I estimate $80,000 for the beginning inventory, plus $36,000 for store signs, shelves, fixtures,<br />

counters, and cash registers, plus $24,000 working capital to cover operating expenses for about two<br />

months. That‟s a total of $140,000 for the start-up.<br />

Hal: How are you planning to finance the investment of $140,000 for the start-up?<br />

Gail: I can put in $100,000 from my savings, and I‟d like to borrow the remaining $40,000 from the<br />

bank.<br />

Hal: Suppose the bank lends you $40,000 on a one-year note, at 15% interest, secured by a lien on the<br />

inventory. Let‟s put together projected financial statements from the figures you gave me. Your<br />

beginning balance sheet would look like what you see on the computer screen:<br />

Nutrimin

The left side shows Nutrimin‟s investment in assets. It classifies the assets into “current” (which<br />

means turning into cash in a year or less) and “noncurrent” (not turning into cash within a year). The<br />

right side shows how the assets are to be financed: partly by the bank loan and partly by your equity as<br />

the owner.<br />

Gail: Now I see why it‟s called a “balance sheet.” The money invested in assets must equal the<br />

financing available—it‟s like two sides of the same coin. Also, I see why the assets and liabilities are<br />

classified as “current” and “noncurrent”—the bank wants to see if the assets turning into cash in a year<br />

or less will provide enough cash to repay the one-year bank loan. Well, in a year there should be cash<br />

of $104,000. That‟s enough cash to pay off more than twice the $40,000 amount of the loan. I guess<br />

that guarantees approval of my loan!<br />

Hal: We‟re not quite there yet. We need some more information. First, tell me: How much do you<br />

expect your operating expenses will be?<br />

Gail: For year 1, I estimate as follows:<br />

Hal: We also have to consider depreciation on the store equipment. It probably has a useful life of 10<br />

years. So each year it depreciates 10% of its cost of $36,000. That is $3,600 a year for depreciation. So<br />

operating expenses must be increased by $3,600 a year from $96,400 to $100,000. Now, moving on,<br />

how much do you think your sales will be this year?<br />

Gail: I‟m confident that sales will be $720,000 or even a little better. The wholesale cost of the items<br />

sold will be $480,000, giving a markup of $240,000—which is 33 % on the projected sales of<br />

$720,000.<br />

Hal: Excellent! Let‟s organize this information into a projected income statement. We start with the<br />

sales, and then deduct the cost of the items sold to arrive at the gross profit. From the gross profit we<br />

deduct your operating expenses, giving us the income before taxes. Finally we deduct the income tax<br />

expense in order to get the famous “bottom line,” which is the net income. Here is the projected<br />

income statement shown on my computer screen:<br />

Nutrimin

Gail, this looks very good for your first year in a new business. Many business start-ups find it<br />

difficult to earn income in their first year. They do well just to limit their losses and stay in business.<br />

Of course, I‟ll need to carefully review all your sales and expense projections with you, in order to<br />

make sure that they are realistic. But first, do you have any questions about the projected income<br />

statement?<br />

Gail: I understand the general idea. But what does “gross profit” mean?<br />

Hal: It‟s the usual accounting term for sales less the amount that your suppliers charged you for the<br />

goods that you sold to your customers. In other words, it represents your markup from the wholesale<br />

cost you paid for goods to the price for which you sold those goods to your customers. It is called<br />

“gross profit” because your operating expenses have to be deducted from it. In accounting, the word<br />

gross means “before deductions.” For example, “gross sales” means sales before deducting goods<br />

returned by customers. Sales after deducting goods returned by customers are referred to as “net<br />

sales.” In accounting, the word net means “after deductions.” So, “gross profit” means income before<br />

deducting operating expenses. By the same token, “net income” means income after deducting<br />

operating expenses and income taxes. Now, moving along, we are ready to figure out your projected<br />

balance sheet at the end of your first year in business. But first, I need to ask you: How much cash do<br />

you plan to draw out of the business as your compensation?<br />

Gail: My present job pays $76,000 a year. I‟d like to keep the same standard of compensation in my<br />

new business this coming year.<br />

Hal: Let‟s see how that works out after we‟ve completed the projected balance sheet at the end of year<br />

1. Here it is on my computer screen:<br />

Nutrimin

Gail, let‟s go over this balance sheet together. It has changed, compared to the balance sheet as of<br />

January 1. On the “Liabilities and Equity” side of the balance sheet, the net income of $84,000 has<br />

increased capital to $184,000 (because earning income adds to the owner‟s capital), and deducting<br />

drawings of $76,000 has reduced capital to $108,000 (because drawings take capital out of the<br />

business). On the “Assets” side, notice that the equipment now has a year of depreciation deducted,<br />

which writes it down from the original $36,000 to a net (there‟s that word “net” again) $32,400 after<br />

depreciation. The equipment had an expected useful life of 10 years, now reduced to a remaining life<br />

of nine years. Last, but not least, notice that the cash has increased by only $11,600 from $24,000 at<br />

the beginning of the year to $35,600 at year-end. This leads to a problem: The bank loan of $40,000 is<br />

due for repayment on December 31. But there is only $35,600 of cash available on December 31. How<br />

can the loan be paid off when there is not enough cash to do so?<br />

Gail: I see the problem. But I think it‟s bigger than just paying off the loan. The business will also<br />

need to keep about $25,000 cash on hand to cover two months‟ operating expenses and income taxes.<br />

So, with $40,000 to repay the loan, plus $25,000 for operating expenses, the cash requirements add up<br />

to $65,000. But there is only $35,600 cash on hand. This leaves a cash shortage of almost $30,000<br />

($65,000 less $35,600). Do you think that will force me to cut down my drawings by $30,000, from<br />

$76,000 to $46,000? Here I am, opening my own business, and it looks as if I have to go back to what<br />

I was earning five years ago!<br />

Hal: That‟s one way to do it. But here‟s another way that you might like better. After your suppliers<br />

get to know you, and do business with you for a few months, you can ask them to open credit accounts<br />

for Nutrimin. If you get the customary 30-day credit terms, then your suppliers will be financing one<br />

month‟s inventory. That amounts to one-twelfth of your $480,000 annual cost of goods sold, or<br />

$40,000. This $40,000 will more than cover the cash shortage of $30,000.<br />

Gail: That‟s a perfect solution! Now, can we see how the balance sheet would look in this case?<br />

Hal: Sure. When you pay off the bank loan, it vanishes from the balance sheet. It is replaced by<br />

accounts payable of $40,000. Then the balance sheet looks like this:<br />

Nutrimin

Now the cash position looks a lot better. But it hasn‟t been entirely solved: there is still a gap between<br />

the accounts payable of $40,000 and the cash of $35,600. So, you will need to cut your drawings by<br />

about $5,000 in year 1. But that‟s still much better than the cut of $30,000 that had seemed necessary<br />

before. In year 2, the bank loan will be gone, so the interest expense of $6,000 will be saved. Then you<br />

can use $5,000 of this savings to restore your drawings back up to $76,000 again.<br />

Gail: That‟s good news. I‟m beginning to see how useful projected financial statements are for<br />

business planning. Can we look at the revised projected balance sheet now?<br />

Hal: Of course. Here it is:<br />

Nutrimin<br />

As we see, cash is increased by $5,000 to $40,600—which is sufficient to pay the accounts payable of<br />

$40,000. Drawings are decreased by $5,000 to $71,000, which provided the $5,000 increase in cash.<br />

Gail: Thanks. That makes sense. I really appreciate everything you‟ve taught me about financial<br />

statements.<br />

Hal: I‟m happy to help. But there is one more financial statement to discuss. A full set of financial<br />

statements consists of more than the balance sheet and the income statement. It also includes a cash<br />

flow statement. Here is the projected cash flow statement:<br />

Nutrimin

Gail, do you have any questions about this cash flow statement?<br />

Gail: Actually, it makes sense to me. I realize that there are only two sources that a business can tap in<br />

order to generate cash: internal (by earning income) and external (by obtaining cash from outside<br />

sources, such as bank loans). In our case the internal sources of cash are represented by the “Cash<br />

from Operations” section of the cash flow statement, and the external sources are represented by the<br />

“Cash from Financing” section of the cash flow statement. It happens that the “Cash from Financing”<br />

is negative, because no additional outside financing is received for the year 20XX, but cash payments<br />

are incurred for drawings and for repayment of the bank loan. I also understand that there are no “Uses<br />

of Cash” because no extra equipment was acquired. In addition, I can see that the total sources of cash<br />

less the total uses of cash must equal the net cash increase, which in turn is the cash at the end of the<br />

year less the cash at the beginning of the year. But I am puzzled by the “Cash from Operations”<br />

section of the cash flow statement. I can understand that earning income produces cash. However, why<br />

do we add back depreciation to the net income in order to calculate cash from operations?<br />

Hal: This can be confusing, so let me try to explain as clearly as I can. Certainly net income increases<br />

cash, but first an adjustment has to be made in order to convert net income to a cash basis.<br />

Depreciation was deducted as an expense in figuring net income. So adding back depreciation to net<br />

income just reverses the charge for depreciation expense. We back it out because depreciation is not a<br />

cash outflow. Remember that depreciation represents just one year‟s use of the equipment. The cash<br />

outflow for purchasing the equipment was incurred back when the equipment was first acquired, and<br />

amounted to $36,000. The equipment cost of $36,000 is spread out over the 10-year life of the<br />

equipment at the rate of $3,600 per year, which we call depreciation expense. So, it would be double<br />

counting to recognize the $36,000 cash outflow for the equipment when it was originally acquired,<br />

and then to recognize it again a second time when it shows up as depreciation expense. We do not<br />

write a check to pay for depreciation each year, because it is not a cash outflow.<br />

Gail: Thanks. Now I understand that depreciation is not a cash outflow. But I don‟t see why we also<br />

added back the increase in current liabilities to the net income in order to calculate cash from<br />

operations. Can you explain that to me?

Hal: Of course. The increase in current liabilities is caused by an increase in accounts payable.<br />

Accounts payable is amounts owed to our suppliers for our purchases of goods for resale in our<br />

business. Purchasing goods for resale from our suppliers on credit is not a cash outflow. The cash<br />

outflow occurs only when the goods are actually paid for by writing out checks to our suppliers. That<br />

is why we added back the increase in current liabilities to the net income in order to calculate cash<br />

from operations. In the future, the increase in current liabilities will, in fact, be paid in cash. But that<br />

will take place in the future, and is not a cash outflow in this year. Going back to the cash flow<br />

statement, notice that it ties in neatly with our balance sheet amount for cash. It shows how the cash at<br />

the beginning of the year plus the net cash increase equals the cash at the end of the year.<br />

Gail: Now I get it. Am I right that you are going to review my projections and then I‟ll hear from you<br />

about my loan application?<br />

Hal: Yes, I‟ll be back to you in a few days. By the way, would you like a printout of the projected<br />

financial statements to take with you?<br />

Gail: Yes, please. I really appreciate your putting them together and explaining them to me. I picked<br />

up some financial skills that will be very useful to me as an aspiring entrepreneur.<br />

Points to Remember about Financial Statements<br />

When Gail arrived home, she carefully reviewed the projected financial statements, and then made<br />

notes about what she had learned.<br />

1. The basic form of the balance sheet is Assets = Liabilities + Owner Equity.<br />

2. Assets are the expenditures made for items such as inventory and equipment that are<br />

needed to operate the business. The liabilities and owner equity reflect the funds that financed the<br />

expenditures for the assets.<br />

3. Balance sheets show the financial position of a business at a given moment of time.<br />

4. Balance sheets change as transactions are recorded.<br />

5. Every transaction is an exchange, and both sides of each transaction are recorded. For<br />

example, when a bank loan is made, there is an increase in cash, which is matched by an increase<br />

in a liability entitled “Bank loan.” When a bank loan is repaid, there is a decrease in cash, which<br />

is matched by a decrease in a liability entitled “Bank loan.” After every transaction, the balance<br />

sheet stays in balance.<br />

6. Income increases owner equity, and drawings decrease owner equity.<br />

7. The income statement shows how the income for the period was earned.<br />

8. The basic form of the income statement is:<br />

a. Sales - Cost of Goods Sold = Gross Income.<br />

b. Gross Income - Expenses = Net Income.<br />

9. The income statement is simply a detailed explanation of the increase in owner equity<br />

represented by net income. It shows how the owner equity increased from the beginning of the<br />

year to the end of the year on account of the net income.<br />

10. Net income contributes to cash from operations, after it has been adjusted to a cash<br />

basis.

11. Not all expenses are cash outflows: for instance, depreciation.<br />

12. Changes in current assets (except cash) and current liabilities are not cash outflows or<br />

inflows, respectively, in the period under consideration. They represent future, rather than<br />

present, cash flows.<br />

13. Cash can be generated internally by operations, or externally from outside sources such<br />

as lenders (or equity investors).<br />

14. The cash flow statement is simply a detailed explanation of how cash at the start<br />

developed into cash at the end by virtue of cash inflows, generated internally and externally, less<br />

cash outflows.<br />

15. As previously noted:<br />

a. The income statement is an elaboration of the change in owner equity in the<br />

balance sheet caused by earning income.<br />

b. The cash flow statement is an elaboration of the balance sheet change in beginning<br />

and ending cash.<br />

Therefore, all three financial statements are interrelated, or, to use the technical term,<br />

“articulated.” They are mutually consistent, and that is why they are referred to as a “set” of<br />

financial statements. The three-piece set consists of a balance sheet, income statement, and<br />

cash flow statement.<br />

16. A set of financial statements can convey much valuable information about the enterprise<br />

to anyone who knows how to analyze financial statements. This information goes to the core of<br />

the organization‟s business strategy and the effectiveness of its management.<br />

While Gail was making her notes, Hal was carefully analyzing the Nutrimin projected financial<br />

statements in order to make his recommendation to the bank‟s loan committee about the Nutrimin loan<br />

application. He paid special attention to the cash flow statement, keeping handy the bank‟s guidelines<br />

on cash flow analysis, which included issues such as the following:<br />

• Is cash from operations positive? Is it growing over time? Is it keeping pace with growth in<br />

sales? If not, why not?<br />

• Are cash withdrawals by owners only a small portion of cash from operations? If cash<br />

withdrawals by owners are a large share of cash from operations, then the business is conceivably<br />

being milked of cash, and may not be able to finance its future growth.<br />

• Of the total sources of cash, how much is being internally generated by operations versus<br />

obtained from outside sources? Normally, it is wiser to rely more on internally generated cash for<br />

growth than on external financing.<br />

• Of the outside financing, how much is derived from equity investors and how much is<br />

borrowed money? Normally, it is preferable to rely more on equity than on debt financing.<br />

• What kinds of assets is the company acquiring with the cash being expended? Is it likely<br />

that that these asset expenditures will be profitable? How long will it take for these assets to<br />

repay their cost, and then to earn a reasonable return?<br />

Hal reflected carefully on these issues, and then finalized his recommendation, which was to<br />

approve the loan. It turned out that the bank‟s loan committee accepted Hal‟s recommendation, and<br />

even went further. They authorized Hal to tell Gail that—if she met all of her responsibilities in regard<br />

to the loan throughout the year—the bank would renew the loan at the end of the year and even<br />

increase the amount. Hal called Gail with the good news. Their conversation included the following<br />

dialogue:

Hal: In order to renew the loan, the bank will ask you for new projected financial statements for the<br />

subsequent year. Also, the loan agreement will want you to submit financial statements for the year<br />

just past—that is, not projected, but actual financial statements. The bank will require that these actual<br />

financial statements have been reviewed by an independent CPA.<br />

Gail: Let me be sure I understand: Projected financial statements are forward-looking, whereas actual<br />

financial statements are backward-looking. Is that correct?<br />

Hal: Yes, that‟s right.<br />

Gail: Next, what is an independent CPA?<br />

Hal: As you probably know, a CPA is a certified public accountant, a professional trained in finance<br />

and accounting, and licensed by the state. Independent means a CPA who is not an employee of yours,<br />

or a relative. It means someone in public practice in a CPA firm. In other words, it is someone outside,<br />

objective and unbiased. Gail: And what does reviewed mean?<br />

Hal: Good question. CPAs offer three levels of service relating to financial statements:<br />

1. An audit is a thorough in-depth examination of the financial statements and tests of the<br />

supporting records. The result is an audit report, which states whether the financial statements are<br />

free of material misstatements (whether caused by error or by fraud). A “clean” audit report<br />

provides assurance that the financial statements are free of material misstatements. A “modified”<br />

report gives no such assurance, and is cause for concern. Financial professionals always read the<br />

auditor‟s report first, before even looking at any financial statement, in order to see if the report is<br />

clean. If it is not clean, there is no assurance that the financial statements are free of material<br />

misstatements. The auditor is a watchdog, and this watchdog barks by issuing a modified audit<br />

report. By law, all companies that have publicly traded securities must have their financial<br />

statements audited, as a protection to investors, creditors, and other financial statement users.<br />

Private companies are not required by law to have audits. But sometimes audits are required for<br />

private companies by agreement with particular investors or creditors. An audit provides the<br />

highest level of assurance that a CPA can provide. Audits are also the most expensive level of<br />

service. There are less expensive and less thorough levels of service, such as the following.<br />

2. A review is a less extensive, and less expensive, level of financial statement inspection by<br />

a CPA. Since it is less extensive and less expensive, it provides a lower level of assurance that the<br />

financial statements are free of material misstatements.<br />

3. Finally, there is the lowest level of service, which is called a compilation, where the<br />

outside CPA puts together the financial statements from the client company‟s books and records<br />

but does not examine them in much depth. A compilation provides the least assurance and is the<br />

least expensive level of service.<br />

So the bank is asking you for the middle level of assurance when it requires a review by an<br />

independent CPA. Banks usually require a review from borrowers that are smaller private<br />

businesses.<br />

Gail: Thanks. That makes it very clear.<br />

We now leave Gail and Hal to their successful loan transaction, and move on.

Financial Statements: Who Uses Them and Why<br />

Here is a brief list of who uses financial statements and why. This list gives only 14 examples, and is<br />

by no means complete.<br />

1. Existing equity investors and lenders, to monitor their investments and to evaluate the<br />

performance of management.<br />

2. Prospective equity investors and lenders, to decide whether to invest.<br />

3. Investment analysts, money managers, and stockbrokers to make buy/sell/hold<br />

recommendations to their clients.<br />

4. Rating agencies (such as Moody‟s Investors Service, Standard & Poor‟s, and Fitch<br />

Ratings), to assign credit ratings, or Dun & Bradstreet, to obtain business information reports.<br />

5. Major customers and suppliers, to evaluate the financial strength and staying power of the<br />

company as a dependable resource for their business.<br />

6. Labor unions, to gauge how much of a pay increase a company is able to afford in<br />

upcoming labor negotiations.<br />

7. The board of directors, to review the performance of management.<br />

8. Management, to assess its own performance.<br />

9. Corporate raiders, to seek hidden value in companies with underpriced stock.<br />

10. Competitors, to benchmark their own financial results.<br />

11. Potential competitors, to assess how profitable it may be to enter an industry.<br />

12. Government agencies responsible for taxing, regulating, or investigating the company.<br />

13. Politicians, lobbyists, issue groups, consumer advocates, environmentalists, think tanks,<br />

foundations, media reporters, and others who are supporting or opposing any particular issue.<br />

14. Actual or potential joint venture partners, franchisors or franchisees, and other business<br />

interests that have a reason to be informed about the company and its financial situation.<br />

This brief list shows how many people use and rely on financial statements for a large variety of<br />

business purposes. It shows how important financial statements are in business.<br />

It also shows how essential it is to master the understanding, analysis, and use of financial<br />

statements in order to be successful in the business world.<br />

Financial Statement Format<br />

Financial statements have a standard format. This format is similar whether an enterprise is as small as<br />

Nutrimin or as large as a major corporation. For example, a recent set of financial statements for a<br />

large public corporation can be summarized (in millions of dollars) as follows:<br />

Income Statement

Note what this income statement tells us:<br />

• Revenue increased each year, by $4,485 in XXX2 and by $3,209 in XXX3. These<br />

increases are good news, but note that the amount of increase has dropped in year XXX3.<br />

• Total expenses have also increased each year, but by a smaller amount than revenue.<br />

• As a result, net income increased each year, by $3,295 in XXX2 and by $1,636 in XXX3.<br />

Again, this is good news, but note that the amount of increase has dropped in year XXX3.<br />

Cash Flow Statement<br />

Note what this cash flow statement tells us:<br />

• Cash from operations increased each year, by $4,704 in XXX2 and by $824 in XXX3.<br />

These increases are good news, but note that the amount of increase has dropped in year XXX3.<br />

• Cash from financing is negative each year. The corporation has not increased its outside<br />

financing, but rather has reduced it—mainly by repurchasing its own stock.<br />

• Net cash invested increased each year, by $3,919 in XXX2 and by $736 in XXX3. Again,<br />

this is good news, because investment is needed to grow the company. But note that the amount<br />

of increase has dropped in year XXX3.<br />

• Cash from operations has been sufficient to provide for the company‟s investment needs,<br />

and even to reduce outside financing. That shows a company with sufficient growth and

profitability to keep investing for further growth. It generates sufficient cash from operations to<br />

cover all investment needs while also reducing outside financing.<br />

Balance Sheet<br />

Note what this balance sheet tells us:<br />

• This company grew its total assets by $13,525, from $38,625 to $52,150.<br />

• But total liabilities increased only by $595, from $10,187 to $10,782.<br />

• Therefore net assets grew by $13,525 less $595, which is $12,930.<br />

• This $12,930 is the same amount by which total equity increased from $28,438 to $41,368,<br />

because, as we know: Total Assets = Total Liabilities + Owner Equity.<br />

You may have observed that there are only two years of balance sheets but three years of income<br />

statements and cash flow statements. This is because these public company financial statements were<br />

obtained from filings with the U.S. Securities and Exchange Commission (SEC), and the SEC<br />

requirements for corporate annual report filings are two years of balance sheets, plus three years of<br />

income statements and cash flow statements.<br />

These corporate financial statements contain numbers very much larger than those for Nutrimin.<br />

But there is no difference in the general format of these two sets of financial statements.

Guide to SEC Filings<br />

The SEC requires all public companies in the United States to disclose certain financial information in<br />

filings with the SEC, which can be viewed online. The main filings include:<br />

• Form 8-K. Disclosure of significant financial events—for example, resignation or<br />

termination of auditor, a new borrowing of material amount, a material merger or acquisition, or<br />

a material divestment.<br />

• Form 10-Q. Quarterly financial statements.<br />

• Form 10-K. Annual report for the fiscal year. Typical Table of Contents:<br />

Item 1. Brief Description of Company Business<br />

Item 1A. Risk Factors<br />

Item 1B. Unresolved Staff Comments<br />

Item 2. Properties<br />

Item 3. Legal Proceedings<br />

Item 4. Submission of Matters to a Vote of Security Holders<br />

Item 5. Market for Registrant‟s Common Equity, Related Stockholder Matters and<br />

Issuer, Purchases of Equity Securities<br />

Item 6. Selected Financial Data<br />

Item 7. Management‟s Discussion and Analysis of Financial Condition and Results<br />

of Operations (often abbreviated as MD&A)<br />

Item 7A. Quantitative and Qualitative Disclosures about Market Risk<br />

Item 8. Financial Statements and Supplementary Data<br />

Item 9. Changes in and Disagreements with Accountants on Accounting and<br />

Financial Disclosure<br />

Item 9A. Controls and Procedures<br />

Item 9B. Other Information<br />

Item 10. Directors and Executive Officers of the Registrant<br />

Item 11. Executive Compensation<br />

Item 12. Security Ownership of Certain Beneficial Owners and Management and<br />

Related Stockholder Matters<br />

Item 13. Certain Relationships and Related Transactions<br />

Item 14. Principal Accountant Fees and Services<br />

Item 15. Exhibits and Financial Statement Schedules<br />

The Notes to the Financial Statements<br />

In addition to the three financial statements, there are the notes to the financial statements, which are<br />

regarded as an integral part of the three statements. (See Exhibit 1.1.)

Financial Accounting Standards<br />

It is no accident that financial statements have a standard format. There are financial accounting<br />

standards that require uniformity in financial statement presentation, in order that financial statements<br />

can be compared:<br />

• From period to period for the same organization.<br />

• From organization to organization for the same period.<br />

This comparability is essential because accounting is the language of business, so it is important<br />

that all businesses use the same language. How is this uniformity established?<br />

Since 1973, the Financial Accounting Standards Board (FASB) has been the designated<br />

organization in the private sector for establishing standards in financial accounting and reporting.<br />

Those standards govern the preparation of financial reports, and are known as generally accepted<br />

accounting principles (GAAP). They are officially recognized as authoritative by the Securities and<br />

Exchange Commission (SEC) (Financial Reporting Release No. 1, Section 101, and reaffirmed in its<br />

April 2003 Policy Statement) and the American Institute of Certified Public Accountants (AICPA)<br />

(Rule 203, Rules of Professional Conduct, as amended May 1973 and May 1979). The main purpose<br />

of GAAP is to make financial statements uniform and comparable in form and content from<br />

organization to organization and from period to period. Such standards are essential to the efficient<br />

functioning of the economy, because investors, creditors, auditors, and others rely on credible,<br />

transparent, and comparable financial information.<br />

Exhibit 1.1 Notes to financial statements.<br />

The Securities and Exchange Commission has statutory authority to establish financial accounting<br />

and reporting standards for publicly held companies under the Securities Exchange Act of 1934.<br />

Throughout its history, however, the SEC‟s policy has been to rely on the private sector for this

function to the extent that the private sector demonstrates ability to fulfill the responsibility in the<br />

public interest.<br />

From GAAP to IFRS<br />

While GAAP has served the United States for many years, other countries have developed their own<br />

accounting standards. With increasing globalization it becomes more important to be able to read,<br />

understand, and compare financial statements for firms in many different countries. In order to do so it<br />

is necessary for the various financial accounting standards of different countries to be replaced with a<br />

single set of worldwide financial accounting standards. That development is currently proceeding<br />

under the name of International Financial Reporting Standards (IFRS).<br />