UOP FIN 571 Week 6 WileyPLUS Assignment UOP

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

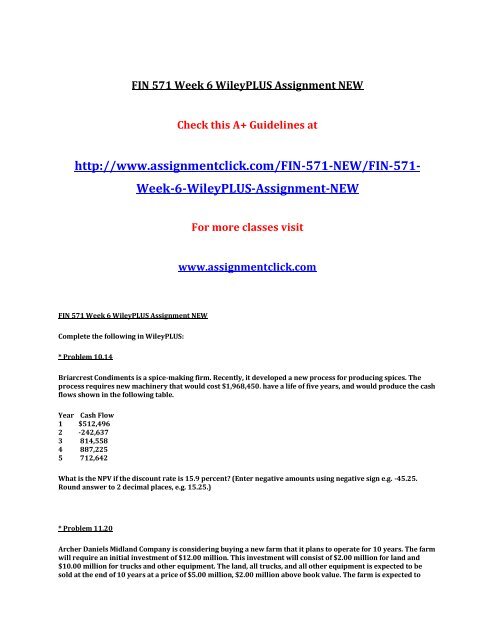

<strong>FIN</strong> <strong>571</strong> <strong>Week</strong> 6 <strong>WileyPLUS</strong> <strong>Assignment</strong> NEW<br />

Check this A+ Guidelines at<br />

http://www.assignmentclick.com/<strong>FIN</strong>-<strong>571</strong>-NEW/<strong>FIN</strong>-<strong>571</strong>-<br />

<strong>Week</strong>-6-<strong>WileyPLUS</strong>-<strong>Assignment</strong>-NEW<br />

For more classes visit<br />

www.assignmentclick.com<br />

<strong>FIN</strong> <strong>571</strong> <strong>Week</strong> 6 <strong>WileyPLUS</strong> <strong>Assignment</strong> NEW<br />

Complete the following in <strong>WileyPLUS</strong>:<br />

* Problem 10.14<br />

Briarcrest Condiments is a spice-making firm. Recently, it developed a new process for producing spices. The<br />

process requires new machinery that would cost $1,968,450. have a life of five years, and would produce the cash<br />

flows shown in the following table.<br />

Year Cash Flow<br />

1 $512,496<br />

2 -242,637<br />

3 814,558<br />

4 887,225<br />

5 712,642<br />

What is the NPV if the discount rate is 15.9 percent? (Enter negative amounts using negative sign e.g. -45.25.<br />

Round answer to 2 decimal places, e.g. 15.25.)<br />

* Problem 11.20<br />

Archer Daniels Midland Company is considering buying a new farm that it plans to operate for 10 years. The farm<br />

will require an initial investment of $12.00 million. This investment will consist of $2.00 million for land and<br />

$10.00 million for trucks and other equipment. The land, all trucks, and all other equipment is expected to be<br />

sold at the end of 10 years at a price of $5.00 million, $2.00 million above book value. The farm is expected to

produce revenue of $2.00 million each year, and annual cash flow from operations equals $1.80 million. The<br />

marginal tax rate is 35 percent, and the appropriate discount rate is 10 percent. Calculate the NPV of this<br />

investment. (Round intermediate calculations and final answer to 2 decimal places, e.g. 15.25.)<br />

* Problem 11.24<br />

Bell Mountain Vineyards is considering updating its current manual accounting system with a high-end<br />

electronic system. While the new accounting system would save the company money, the cost of the system<br />

continues to decline. The Bell Mountain’s opportunity cost of capital is 10 percent, and the costs and values of<br />

investments made at different times in the future are as follows:<br />

Year Cost Value of Future Savings<br />

(at time of purchase)<br />

0 $5,000 $7,000<br />

1 4,500 7,000<br />

2 4,000 7,000<br />

3 3,600 7,000<br />

4 3,300 7,000<br />

5 3,100 7,000<br />

Calculate the NPV of each choice. (Round answers to the nearest whole dollar, e.g. 5,275.)<br />

The NPV of each choice is:<br />

Suggest when should Bell Mountain buy the new accounting system?<br />

* Problem 12.24<br />

Chip’s Home Brew Whiskey management forecasts that if the firm sells each bottle of Snake-Bite for $20, then the<br />

demand for the product will be 15,000 bottles per year, whereas sales will be 90 percent as high if the price is<br />

raised 10 percent. Chip’s variable cost per bottle is $10, and the total fixed cash cost for the year is $100,000.<br />

Depreciation and amortization charges are $20,000, and the firm has a 30 percent marginal tax rate.<br />

Management anticipates an increased working capital need of $3,000 for the year. What will be the effect of the<br />

price increase on the firm’s FCF for the year? (Round answers to nearest whole dollar, e.g. 5,275.)<br />

* Problem 13.11<br />

Capital Co. has a capital structure, based on current market values, that consists of 50 percent debt, 10 percent<br />

preferred stock, and 40 percent common stock. If the returns required by investors are 8 percent, 10 percent,<br />

and 15 percent for the debt, preferred stock, and common stock, respectively, what is Capital’s after-tax WACC?<br />

Assume that the firm’s marginal tax rate is 40 percent. (Round intermediate calculations to 4 decimal places, e.g.<br />

1.2514 and final answer to 2 decimal places, e.g. 15.25%.)