BUSN 379 DeVry Entire Course

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

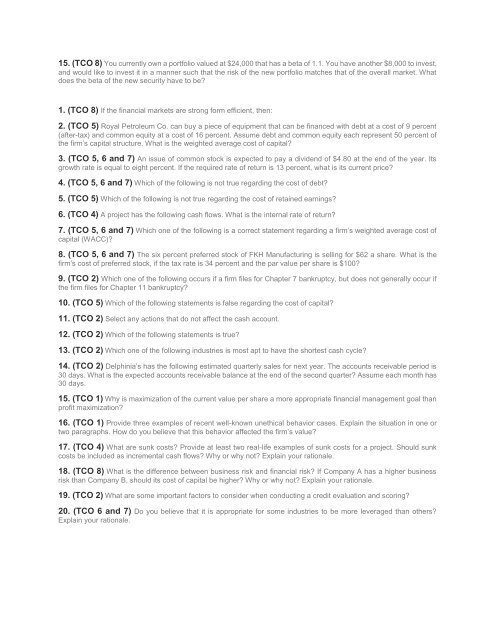

15. (TCO 8) You currently own a portfolio valued at $24,000 that has a beta of 1.1. You have another $8,000 to invest,<br />

and would like to invest it in a manner such that the risk of the new portfolio matches that of the overall market. What<br />

does the beta of the new security have to be?<br />

1. (TCO 8) If the financial markets are strong form efficient, then:<br />

2. (TCO 5) Royal Petroleum Co. can buy a piece of equipment that can be financed with debt at a cost of 9 percent<br />

(after-tax) and common equity at a cost of 16 percent. Assume debt and common equity each represent 50 percent of<br />

the firm’s capital structure. What is the weighted average cost of capital?<br />

3. (TCO 5, 6 and 7) An issue of common stock is expected to pay a dividend of $4.80 at the end of the year. Its<br />

growth rate is equal to eight percent. If the required rate of return is 13 percent, what is its current price?<br />

4. (TCO 5, 6 and 7) Which of the following is not true regarding the cost of debt?<br />

5. (TCO 5) Which of the following is not true regarding the cost of retained earnings?<br />

6. (TCO 4) A project has the following cash flows. What is the internal rate of return?<br />

7. (TCO 5, 6 and 7) Which one of the following is a correct statement regarding a firm’s weighted average cost of<br />

capital (WACC)?<br />

8. (TCO 5, 6 and 7) The six percent preferred stock of FKH Manufacturing is selling for $62 a share. What is the<br />

firm’s cost of preferred stock, if the tax rate is 34 percent and the par value per share is $100?<br />

9. (TCO 2) Which one of the following occurs if a firm files for Chapter 7 bankruptcy, but does not generally occur if<br />

the firm files for Chapter 11 bankruptcy?<br />

10. (TCO 5) Which of the following statements is false regarding the cost of capital?<br />

11. (TCO 2) Select any actions that do not affect the cash account.<br />

12. (TCO 2) Which of the following statements is true?<br />

13. (TCO 2) Which one of the following industries is most apt to have the shortest cash cycle?<br />

14. (TCO 2) Delphinia’s has the following estimated quarterly sales for next year. The accounts receivable period is<br />

30 days. What is the expected accounts receivable balance at the end of the second quarter? Assume each month has<br />

30 days.<br />

15. (TCO 1) Why is maximization of the current value per share a more appropriate financial management goal than<br />

profit maximization?<br />

16. (TCO 1) Provide three examples of recent well-known unethical behavior cases. Explain the situation in one or<br />

two paragraphs. How do you believe that this behavior affected the firm’s value?<br />

17. (TCO 4) What are sunk costs? Provide at least two real-life examples of sunk costs for a project. Should sunk<br />

costs be included as incremental cash flows? Why or why not? Explain your rationale.<br />

18. (TCO 8) What is the difference between business risk and financial risk? If Company A has a higher business<br />

risk than Company B, should its cost of capital be higher? Why or why not? Explain your rationale.<br />

19. (TCO 2) What are some important factors to consider when conducting a credit evaluation and scoring?<br />

20. (TCO 6 and 7) Do you believe that it is appropriate for some industries to be more leveraged than others?<br />

Explain your rationale.