BUSN 380 DEVRY COMPLETE QUIZ PACKAGE

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

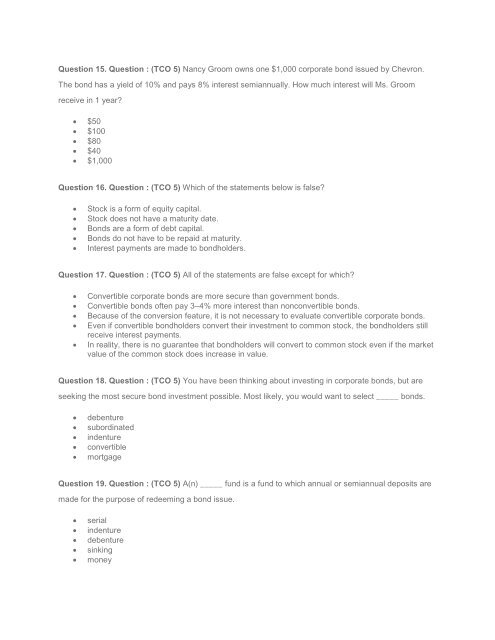

Question 15. Question : (TCO 5) Nancy Groom owns one $1,000 corporate bond issued by Chevron.<br />

The bond has a yield of 10% and pays 8% interest semiannually. How much interest will Ms. Groom<br />

receive in 1 year?<br />

$50<br />

$100<br />

$80<br />

$40<br />

$1,000<br />

Question 16. Question : (TCO 5) Which of the statements below is false?<br />

<br />

<br />

<br />

<br />

<br />

Stock is a form of equity capital.<br />

Stock does not have a maturity date.<br />

Bonds are a form of debt capital.<br />

Bonds do not have to be repaid at maturity.<br />

Interest payments are made to bondholders.<br />

Question 17. Question : (TCO 5) All of the statements are false except for which?<br />

<br />

<br />

<br />

<br />

<br />

Convertible corporate bonds are more secure than government bonds.<br />

Convertible bonds often pay 3–4% more interest than nonconvertible bonds.<br />

Because of the conversion feature, it is not necessary to evaluate convertible corporate bonds.<br />

Even if convertible bondholders convert their investment to common stock, the bondholders still<br />

receive interest payments.<br />

In reality, there is no guarantee that bondholders will convert to common stock even if the market<br />

value of the common stock does increase in value.<br />

Question 18. Question : (TCO 5) You have been thinking about investing in corporate bonds, but are<br />

seeking the most secure bond investment possible. Most likely, you would want to select _____ bonds.<br />

<br />

<br />

<br />

<br />

<br />

debenture<br />

subordinated<br />

indenture<br />

convertible<br />

mortgage<br />

Question 19. Question : (TCO 5) A(n) _____ fund is a fund to which annual or semiannual deposits are<br />

made for the purpose of redeeming a bond issue.<br />

<br />

<br />

<br />

<br />

<br />

serial<br />

indenture<br />

debenture<br />

sinking<br />

money