ACCT 429 DeVry Week 4 Midterm Exam

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>ACCT</strong> <strong>429</strong> <strong>DeVry</strong> <strong>Week</strong> 4 <strong>Midterm</strong> <strong>Exam</strong><br />

Downloading is very simple, you can download this Course here:<br />

http://mindsblow.us/question_des/<strong>ACCT</strong><strong>429</strong><strong>DeVry</strong><strong>Week</strong>4<strong>Midterm</strong><strong>Exam</strong>/4194<br />

Or<br />

Contact us at:<br />

help@mindblows.us<br />

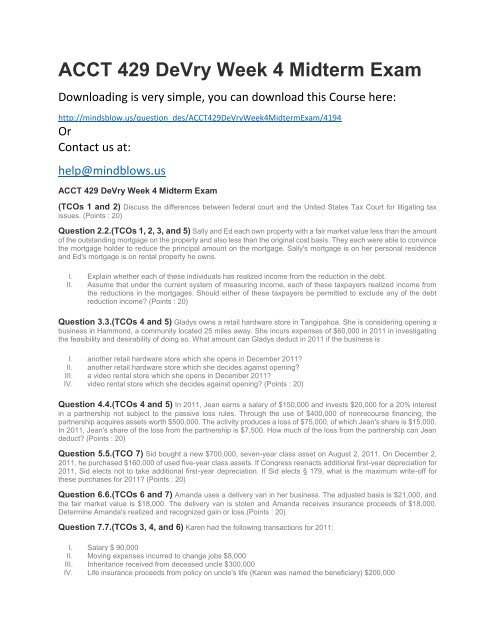

<strong>ACCT</strong> <strong>429</strong> <strong>DeVry</strong> <strong>Week</strong> 4 <strong>Midterm</strong> <strong>Exam</strong><br />

(TCOs 1 and 2) Discuss the differences between federal court and the United States Tax Court for litigating tax<br />

issues. (Points : 20)<br />

Question 2.2.(TCOs 1, 2, 3, and 5) Sally and Ed each own property with a fair market value less than the amount<br />

of the outstanding mortgage on the property and also less than the original cost basis. They each were able to convince<br />

the mortgage holder to reduce the principal amount on the mortgage. Sally's mortgage is on her personal residence<br />

and Ed's mortgage is on rental property he owns.<br />

I. Explain whether each of these individuals has realized income from the reduction in the debt.<br />

II. Assume that under the current system of measuring income, each of these taxpayers realized income from<br />

the reductions in the mortgages. Should either of these taxpayers be permitted to exclude any of the debt<br />

reduction income? (Points : 20)<br />

Question 3.3.(TCOs 4 and 5) Gladys owns a retail hardware store in Tangipahoa. She is considering opening a<br />

business in Hammond, a community located 25 miles away. She incurs expenses of $60,000 in 2011 in investigating<br />

the feasibility and desirability of doing so. What amount can Gladys deduct in 2011 if the business is<br />

I. another retail hardware store which she opens in December 2011?<br />

II. another retail hardware store which she decides against opening?<br />

III. a video rental store which she opens in December 2011?<br />

IV. video rental store which she decides against opening? (Points : 20)<br />

Question 4.4.(TCOs 4 and 5) In 2011, Jean earns a salary of $150,000 and invests $20,000 for a 20% interest<br />

in a partnership not subject to the passive loss rules. Through the use of $400,000 of nonrecourse financing, the<br />

partnership acquires assets worth $500,000. The activity produces a loss of $75,000, of which Jean's share is $15,000.<br />

In 2011, Jean's share of the loss from the partnership is $7,500. How much of the loss from the partnership can Jean<br />

deduct? (Points : 20)<br />

Question 5.5.(TCO 7) Sid bought a new $700,000, seven-year class asset on August 2, 2011. On December 2,<br />

2011, he purchased $160,000 of used five-year class assets. If Congress reenacts additional first-year depreciation for<br />

2011, Sid elects not to take additional first-year depreciation. If Sid elects § 179, what is the maximum write-off for<br />

these purchases for 2011? (Points : 20)<br />

Question 6.6.(TCOs 6 and 7) Amanda uses a delivery van in her business. The adjusted basis is $21,000, and<br />

the fair market value is $18,000. The delivery van is stolen and Amanda receives insurance proceeds of $18,000.<br />

Determine Amanda's realized and recognized gain or loss.(Points : 20)<br />

Question 7.7.(TCOs 3, 4, and 6) Karen had the following transactions for 2011:<br />

I. Salary $ 90,000<br />

II. Moving expenses incurred to change jobs $8,000<br />

III. Inheritance received from deceased uncle $300,000<br />

IV. Life insurance proceeds from policy on uncle's life (Karen was named the beneficiary) $200,000

V. Cash prize from church raffle $1,000<br />

VI. Payment of church pledge $3,000<br />

What is Karen's AGI for 2011? (Points : 20)<br />

Question 8.8.(TCOs 3, 4, and 6) Rachel lives and works in Chicago. She is the regional sales manager for a<br />

national fast food chain. Due to unusual developments, she is compelled to work six straight weeks in the St. Louis<br />

area. Instead of spending the weekend there, she flies home every Friday night and returns early Monday morning.<br />

The cost of coming home for the weekend approximates $500. Had she stayed in St. Louis, deductible meals and<br />

lodging would have been $600. How much, if any, may Rachel deduct as to each weekend?(Points : 20)