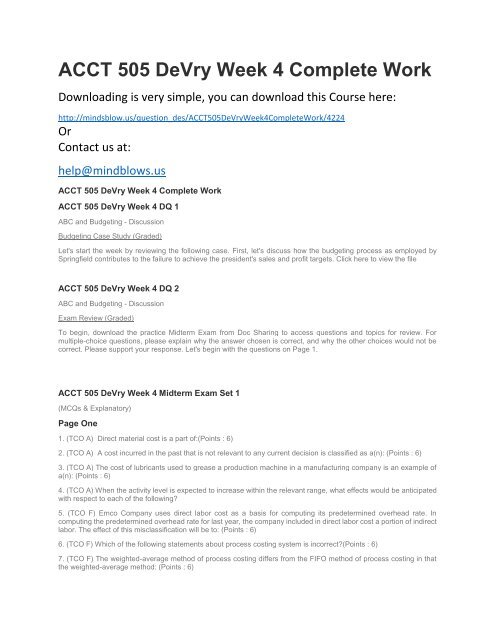

ACCT 505 DeVry Week 4 Complete Work

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>ACCT</strong> <strong>505</strong> <strong>DeVry</strong> <strong>Week</strong> 4 <strong>Complete</strong> <strong>Work</strong><br />

Downloading is very simple, you can download this Course here:<br />

http://mindsblow.us/question_des/<strong>ACCT</strong><strong>505</strong><strong>DeVry</strong><strong>Week</strong>4<strong>Complete</strong><strong>Work</strong>/4224<br />

Or<br />

Contact us at:<br />

help@mindblows.us<br />

<strong>ACCT</strong> <strong>505</strong> <strong>DeVry</strong> <strong>Week</strong> 4 <strong>Complete</strong> <strong>Work</strong><br />

<strong>ACCT</strong> <strong>505</strong> <strong>DeVry</strong> <strong>Week</strong> 4 DQ 1<br />

ABC and Budgeting - Discussion<br />

Budgeting Case Study (Graded)<br />

Let's start the week by reviewing the following case. First, let's discuss how the budgeting process as employed by<br />

Springfield contributes to the failure to achieve the president's sales and profit targets. Click here to view the file<br />

<strong>ACCT</strong> <strong>505</strong> <strong>DeVry</strong> <strong>Week</strong> 4 DQ 2<br />

ABC and Budgeting - Discussion<br />

Exam Review (Graded)<br />

To begin, download the practice Midterm Exam from Doc Sharing to access questions and topics for review. For<br />

multiple-choice questions, please explain why the answer chosen is correct, and why the other choices would not be<br />

correct. Please support your response. Let's begin with the questions on Page 1.<br />

<strong>ACCT</strong> <strong>505</strong> <strong>DeVry</strong> <strong>Week</strong> 4 Midterm Exam Set 1<br />

(MCQs & Explanatory)<br />

Page One<br />

1. (TCO A) Direct material cost is a part of:(Points : 6)<br />

2. (TCO A) A cost incurred in the past that is not relevant to any current decision is classified as a(n): (Points : 6)<br />

3. (TCO A) The cost of lubricants used to grease a production machine in a manufacturing company is an example of<br />

a(n): (Points : 6)<br />

4. (TCO A) When the activity level is expected to increase within the relevant range, what effects would be anticipated<br />

with respect to each of the following?<br />

5. (TCO F) Emco Company uses direct labor cost as a basis for computing its predetermined overhead rate. In<br />

computing the predetermined overhead rate for last year, the company included in direct labor cost a portion of indirect<br />

labor. The effect of this misclassification will be to: (Points : 6)<br />

6. (TCO F) Which of the following statements about process costing system is incorrect?(Points : 6)<br />

7. (TCO F) The weighted-average method of process costing differs from the FIFO method of process costing in that<br />

the weighted-average method: (Points : 6)

8. (TCO B) The contribution margin ratio always increases when the:(Points : 6)<br />

9. (TCO B) The unit sales needed to attain the target profit is found by: (Points : 6)<br />

10. (TCO E) In an income statement prepared using the variable costing method, variable selling and administrative<br />

expenses would: (Points : 6)<br />

Page Two<br />

1. (TCO A). The following data (in thousands of dollars) have been taken from the accounting records of Larklin<br />

Corporation for the just completed year…….. Required: Prepare a Schedule of Cost of Goods Manufactured statement<br />

in the text box below.(Points : 15)<br />

2. (TCO F) The Indiana Company manufactures a product that goes through three processing departments. Information<br />

relating to activity in the first department during June is given below:……..The department started 290,000 units into<br />

production during the month and transferred 300,000 completed units to the next department………. (Points : 20)<br />

3. (TCO B) A tile manufacturer has supplied the following data:………Calculate the company's unit contribution ratioc.<br />

If the company increases its unit sales volume by 5% without increasing its fixed expenses, what would the company's<br />

net operating income be? (Points : 25)<br />

4. (TCO E) Lehne Company, which has only one product, has provided the following data concerning its most recent<br />

month of operations:………The company produces the same number of units every month, although the sales in units<br />

vary from month to month. The company's variable costs per unit and total fixed costs have been constant from month<br />

to month……..(Points : 30)<br />

<strong>ACCT</strong> <strong>505</strong> <strong>DeVry</strong> <strong>Week</strong> 4 Midterm Exam Set 2<br />

(MCQs & Explanatory)<br />

1. (TCO A) The variable portion of advertising costs is a.............<br />

2. (TCO A) The costs of staffing and operating the accounting department at Central Hospital would be considered by<br />

the Department of Surgery to be.........<br />

3. (TCO A) The cost of lubricants used to grease a production machine in a manufacturing company is an example of<br />

a(n):...............<br />

4. (TCO A) When the activity level is expected to increase within the relevant range, what effects would be anticipated<br />

with respect to each of the following?<br />

5. (TCO F) Which of the following statements is true? I. Overhead application may be made slowly as a job is worked<br />

on. II. Overhead application may be made in a single application at the time of completion of the job. III. Overhead<br />

application should be made to any job not completed at year end in order to properly value the work in process<br />

inventory.<br />

6. (TCO F) Which of the following statements about the process-costing system is incorrect?<br />

7. (TCO F) The weighted-average method of process costing differs from the FIFO method of process costing in that<br />

the weighted-average method...........<br />

8. (TCO B) The contribution margin equals........<br />

9. (TCO B) Which of the following would not affect the break-even point?<br />

10. (TCO E) In an income statement prepared using the variable costing method, variable selling and administrative<br />

expenses would..........<br />

<strong>ACCT</strong> <strong>505</strong> <strong>DeVry</strong> <strong>Week</strong> 4 Midterm Exam Set 3<br />

(MCQs & Essay)<br />

Page One

1. (TCO A) Wages paid to an assembly line worker in a factory are a:<br />

2. (TCO A) A cost incurred in the past that is not relevant to any current decision is classified as a(n):<br />

3. (TCO A) Property taxes on a company's factory building would be classified as a(n):<br />

4. (TCO A) When the activity level is expected to increase within the relevant range, what effects would be anticipated<br />

with respect to each of the following?<br />

Fixed Cost Per Unit Variable Cost Per Unit<br />

5. (TCO F) Which of the following statements is true? I. Overhead application may be made slowly as a job is worked<br />

on. II. Overhead application may be made in a single application at the time of completion of the job. III. Overhead<br />

application should be made to any job not completed at year-end in order to properly value the work in process<br />

inventory.<br />

6. (TCO F) Which of the following statements about process costing system is incorrect?<br />

7. (TCO F) Equivalent units for a process costing system using the FIFO method would be equal to:<br />

8. (TCO B) The contribution margin ratio always increases when the:<br />

9. (TCO B) Which of the following would not affect the break-even point?<br />

10. (TCO E) In an income statement prepared using the variable costing method, variable selling and administrative<br />

expenses would:<br />

Page Two<br />

1. (TCO A) The following data (in thousands of dollars) have been taken from the accounting records of Larden<br />

Corporation for the just completed year.<br />

2. (TCO F) The Illinois Company manufactures a product that goes through three processing departments. Information<br />

relating to activity in the first department during June is given below:<br />

3. (TCO B) Drake Company's income statement for the most recent year appears below:<br />

4. (TCO E) The Dean Company produces and sells a single product. The following data refer to the year just completed:<br />

<strong>ACCT</strong> <strong>505</strong> <strong>DeVry</strong> <strong>Week</strong> 4 Midterm Exam Set 4<br />

(MCQs & Essay)<br />

1. (TCO A) Wages paid to a timekeeper in a factory are a ______.<br />

2. (TCO A) The costs of staffing and operating the accounting department at Central Hospital would be considered by<br />

the Department of Surgery to be ______.<br />

3. (TCO A) Inventoriable costs are also known as ______.<br />

4. (TCO A) Within the relevant range, variable costs can be expected to ______.<br />

5. (TCO F) When manufacturing overhead is applied to production, it is added to ______.<br />

6. (TCO F) Under a job-order costing system, the dollar amount transferred from <strong>Work</strong> in Process to Finished Goods<br />

is the sum of the costs charged to all jobs ______.<br />

7. (TCO F) Equivalent units for a process costing system using the FIFO method would be equal to___.<br />

8. (TCO B) The contribution margin ratio always decreases when the ______.<br />

9. (TCO B) The break-even point in unit sales is found by dividing total fixed expenses by______.<br />

10. (TCO E) Under variable costing, ______.