ACCT 591 DeVry Week 6 Quiz Latest

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

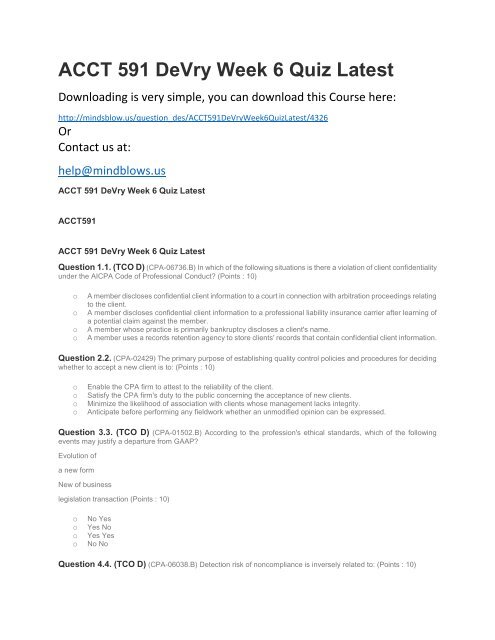

<strong>ACCT</strong> <strong>591</strong> <strong>DeVry</strong> <strong>Week</strong> 6 <strong>Quiz</strong> <strong>Latest</strong><br />

Downloading is very simple, you can download this Course here:<br />

http://mindsblow.us/question_des/<strong>ACCT</strong><strong>591</strong><strong>DeVry</strong><strong>Week</strong>6<strong>Quiz</strong><strong>Latest</strong>/4326<br />

Or<br />

Contact us at:<br />

help@mindblows.us<br />

<strong>ACCT</strong> <strong>591</strong> <strong>DeVry</strong> <strong>Week</strong> 6 <strong>Quiz</strong> <strong>Latest</strong><br />

<strong>ACCT</strong><strong>591</strong><br />

<strong>ACCT</strong> <strong>591</strong> <strong>DeVry</strong> <strong>Week</strong> 6 <strong>Quiz</strong> <strong>Latest</strong><br />

Question 1.1. (TCO D) (CPA-06736.B) In which of the following situations is there a violation of client confidentiality<br />

under the AICPA Code of Professional Conduct? (Points : 10)<br />

o<br />

o<br />

o<br />

o<br />

A member discloses confidential client information to a court in connection with arbitration proceedings relating<br />

to the client.<br />

A member discloses confidential client information to a professional liability insurance carrier after learning of<br />

a potential claim against the member.<br />

A member whose practice is primarily bankruptcy discloses a client's name.<br />

A member uses a records retention agency to store clients' records that contain confidential client information.<br />

Question 2.2. (CPA-02429) The primary purpose of establishing quality control policies and procedures for deciding<br />

whether to accept a new client is to: (Points : 10)<br />

o<br />

o<br />

o<br />

o<br />

Enable the CPA firm to attest to the reliability of the client.<br />

Satisfy the CPA firm's duty to the public concerning the acceptance of new clients.<br />

Minimize the likelihood of association with clients whose management lacks integrity.<br />

Anticipate before performing any fieldwork whether an unmodified opinion can be expressed.<br />

Question 3.3. (TCO D) (CPA-01502.B) According to the profession's ethical standards, which of the following<br />

events may justify a departure from GAAP?<br />

Evolution of<br />

a new form<br />

New of business<br />

legislation transaction (Points : 10)<br />

o<br />

o<br />

o<br />

o<br />

No Yes<br />

Yes No<br />

Yes Yes<br />

No No<br />

Question 4.4. (TCO D) (CPA-06038.B) Detection risk of noncompliance is inversely related to: (Points : 10)

o<br />

o<br />

o<br />

o<br />

Audit risk of noncompliance.<br />

Risk of material noncompliance.<br />

Inherent risk of noncompliance.<br />

Control risk of noncompliance.<br />

Question 5.5. (TCO D) (CPA-02925.B) When an auditor tests a computerized accounting system, which of the<br />

following is true of the test data approach? (Points : 10)<br />

o<br />

o<br />

o<br />

o<br />

Several transactions of each type must be tested.<br />

Test data are processed by the client's computer programs under the auditor's control.<br />

Test data must consist of all possible valid and invalid conditions.<br />

The program tested is different from the program used throughout the year by the client.<br />

Question 6.6. (CPA-05904) Quality control policies and procedures that are established to decide whether to accept<br />

a new client should provide the CPA firm with reasonable assurance that: (Points : 10)<br />

o<br />

o<br />

o<br />

o<br />

The CPA firm's duty to the public concerning the acceptance of new clients is satisfied.<br />

The likelihood of associating with clients whose management lacks integrity is minimized.<br />

Client-prepared schedules that are necessary for the engagement are completed on a timely basis.<br />

Sufficient corroborating evidence to support the financial statement assertions is available.<br />

Question 7.7. (TCO D) (CPA-06110.B) Under the ethical standards of the profession in the United States, which<br />

of the following circumstances would impair independence in the audit of an issuer but would not impair independence<br />

in the audit of a nonissuer? (Points : 10)<br />

o<br />

o<br />

o<br />

o<br />

The firm performing the financial statement audit also designed and implemented the client's financial<br />

information system.<br />

The audit firm provided a loan to the client during the prior year.<br />

The lead partner has worked on the audit engagement of a client for ten years.<br />

The audit firm has an immaterial direct financial interest in the client.<br />

Question 8.8. (TCO D) (CPA-03065.B) The two requirements crucial to achieving audit efficiency and effectiveness<br />

with a computer are selecting: (Points : 10)<br />

o<br />

o<br />

o<br />

o<br />

The appropriate audit tasks for computer applications and the appropriate software to perform the selected<br />

audit tasks.<br />

The appropriate software to perform the selected audit tasks and client data that can be accessed by the<br />

auditor's computer.<br />

Client data that can be accessed by the auditor's computer and audit procedures that are generally applicable<br />

to several clients in a specific industry.<br />

Audit procedures that are generally applicable to several clients in a specific industry and the appropriate audit<br />

tasks for computer applications.<br />

Question 9.9. (TCO D) (CPA-03482.B) An audit performed in accordance with 2 CFR 200 single audit will expand<br />

the auditor's responsibilities beyond generally accepted auditing standards. The auditor's expanded responsibilities<br />

include: (Points : 10)<br />

o<br />

o<br />

o<br />

o<br />

Performance of additional procedures to test and report on compliance with laws, rules, regulations and<br />

provisions of contracts or grant agreements that have any effect on federal award programs.<br />

Performance of additional procedures to test for noncompliance with laws, rules and regulations targeted for<br />

review by the Office of the Inspector General.<br />

Performance of additional procedures to test and report on compliance with laws, rules, regulations and<br />

provisions of contracts or grant agreements that have a direct and material effect on major federal award<br />

programs.<br />

Performance of additional procedures to test and report on achievement of program objectives.

Question 10.10. (TCO D) (CPA-05961.B) Under the ethical standards of the profession, which of the following<br />

investments by a CPA in a corporate client is an indirect financial interest? (Points : 10)<br />

o<br />

o<br />

o<br />

o<br />

An investment held in a retirement plan.<br />

An investment held in a blind trust.<br />

An investment held through a regulated mutual fund.<br />

An investment held through participation in an investment club.