BIS 311 DeVry Week 3 iLab

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>BIS</strong> <strong>311</strong> <strong>DeVry</strong> <strong>Week</strong> 3 I Lab<br />

Downloading is very simple, you can download this Course here:<br />

http://mindsblow.us/question_des/<strong>BIS</strong><strong>311</strong><strong>DeVry</strong><strong>Week</strong>3<strong>iLab</strong>/4373<br />

Or<br />

Contact us at:<br />

help@mindblows.us<br />

<strong>BIS</strong> <strong>311</strong> <strong>DeVry</strong> <strong>Week</strong> 3 <strong>iLab</strong><br />

<strong>BIS</strong><strong>311</strong><br />

<strong>BIS</strong> <strong>311</strong> <strong>DeVry</strong> <strong>Week</strong> 3 <strong>iLab</strong><br />

iLAB OVERVIEW<br />

Scenario/Summary<br />

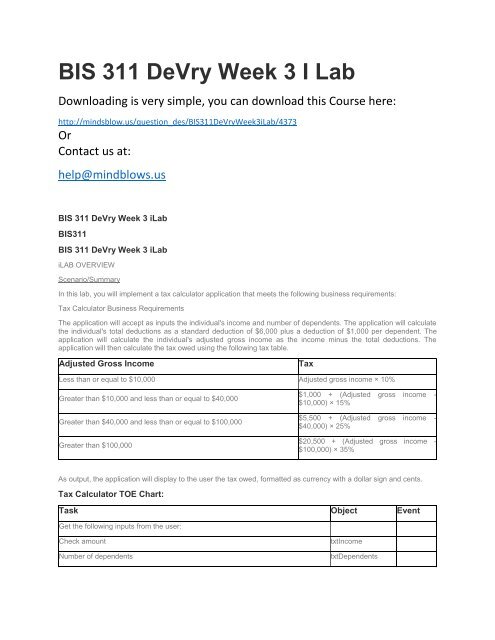

In this lab, you will implement a tax calculator application that meets the following business requirements:<br />

Tax Calculator Business Requirements<br />

The application will accept as inputs the individual's income and number of dependents. The application will calculate<br />

the individual's total deductions as a standard deduction of $6,000 plus a deduction of $1,000 per dependent. The<br />

application will calculate the individual's adjusted gross income as the income minus the total deductions. The<br />

application will then calculate the tax owed using the following tax table.<br />

Adjusted Gross Income<br />

Tax<br />

Less than or equal to $10,000 Adjusted gross income × 10%<br />

Greater than $10,000 and less than or equal to $40,000<br />

Greater than $40,000 and less than or equal to $100,000<br />

Greater than $100,000<br />

$1,000 + (Adjusted gross income -<br />

$10,000) × 15%<br />

$5,500 + (Adjusted gross income -<br />

$40,000) × 25%<br />

$20,500 + (Adjusted gross income -<br />

$100,000) × 35%<br />

As output, the application will display to the user the tax owed, formatted as currency with a dollar sign and cents.<br />

Tax Calculator TOE Chart:<br />

Task Object Event<br />

Get the following inputs from the user:<br />

Check amount<br />

Number of dependents<br />

txtIncome<br />

txtDependents

Perform the following processing: btnCalcTax Click<br />

Calculate total deductions = 6000 + Number of dependents × 1000<br />

Calculate adjusted gross income = Income - Total deductions<br />

Calculate tax owed using tax table in requirements<br />

Display the following output to the user:<br />

Tax owed formatted as currency with $ and cents<br />

lblTaxOwed<br />

Pseudocode for Tax Calculator Application<br />

Start<br />

Declare numeric constants for<br />

Standard deduction =6000<br />

Dependent deduction =1000<br />

Income bracket 1=10000<br />

Rate1=0.10<br />

Income bracket 2=40000<br />

Base2=1000<br />

Rate2=0.15<br />

Income bracket 3=100000<br />

Base3=5500<br />

Rate3=0.25<br />

Base4=20500<br />

Rate4=0.35<br />

Declare numeric variables for<br />

Income<br />

Number of dependents<br />

Total deductions<br />

Adjusted gross income<br />

Tax owed<br />

Get inputs:<br />

Income<br />

Number of dependents<br />

Calculate Total deductions =Standard deduction +(Number of dependents *Dependent deduction)<br />

Calculate Adjusted gross income =Income-Total deductions<br />

If Adjusted gross income is less than or equal to Income bracket 1 Then<br />

CalculateTax owed =Adjusted gross income * Rate 1<br />

Else If Adjusted gross income is less than or equal to Income bracket 2

Calculate Tax owed =Base 2 + (Adjusted gross income - Income bracket 1) * Rate 2<br />

Else If Adjusted gross income is less than or equal to Income bracket 3<br />

Calculate Tax owed =Base3 + (Adjusted gross income - Income bracket 2) * Rate 3<br />

Else<br />

Calculate Tax owed = Base 4 + (Adjusted gross income -Income bracket 3) * Rate 4<br />

End If<br />

Display Tax owed formatted as currency with $ and cents<br />

Stop<br />

NOTE: The above is a simplified version of tax calculations for purposes of this lab. Although the basic principles of a<br />

graduated income tax are illustrated here, real taxes are more complicated, and the rates and brackets are different.<br />

Please do not use this simple application to calculate your real taxes.<br />

Deliverables<br />

Submit a Word document named Lab3YourFirstLastName.docx (where YourFirstLastName = your first and last name;<br />

e.g., Lab3JohnSmith.docx) containing the following:<br />

Screenshots of form showing the application running, with the following correct input and output values displayed in<br />

the form.<br />

Income = 9,000, Number of dependents = 1, Tax owed = $200.00<br />

Income = 25,000, Number of dependents = 2, Tax owed = $2,050.00<br />

Income = 70,000, Number of dependents = 3, Tax owed = $10,750.00<br />

Income = 150,000, Number of dependents = 4, Tax owed = $34,500.00<br />

Copy of button-click event code<br />

Category Points % Description<br />

Create and rename form 5 10%<br />

Add controls to form 5 10%<br />

Set properties (name and text)<br />

5 10%<br />

for controls<br />

Code button-click event 15 30%<br />

Windows form was created and renamed TaxCalculator.vb. Form<br />

text property was set to Lab 3 Your Name (where Your Name =<br />

your full name).<br />

The following controls were added to the form: Identifying labels<br />

and text boxes for entry of income and number of dependents;<br />

Calculate Tax button; and label for display of tax owed. Controls<br />

are arranged on form in a logical and visually pleasing layout.<br />

Name and text properties of all controls were set appropriately,<br />

with no typos or spelling errors.<br />

Button-click event code was entered that corresponds to the given<br />

pseudocode, with no syntax errors.<br />

Test-run<br />

successfully<br />

application<br />

20 40%<br />

Application is shown running successfully with no errors, with valid<br />

inputs and correct output for each of the four specified test cases.<br />

Total 50 100%<br />

Required Software<br />

Log in to the Citrix <strong>iLab</strong> site as you did in the previous labs. The Microsoft Visual Studio 2012 icon should be displayed<br />

already on your Citrix main menu page. Click the Microsoft Visual Studio 2012 icon to launch Visual Studio.<br />

(a) Pull down the File menu and select New Project . . . .

(b) In the New Project dialog, ensure that in the left column, under Templates, Visual Basic is selected; and that in the<br />

center column Windows Form Application is selected. In the Name field at the bottom of the dialog, enter TaxCalculator.<br />

Click OK. (<br />

(a) Drag the following controls from the ToolBox onto the form, arrange them in a logical fashion, and set their properties<br />

as indicated in the table below.<br />

Control Name Property Text Property<br />

Label Label1 Income:<br />

TextBox<br />

txtIncome<br />

Label Label2 Number of dependents:<br />

TextBox<br />

txtDependents<br />

Button btnCalcTax Calculate Tax Owed<br />

Label lblTaxOwed Your tax owed will display here<br />

(b) Ensure that all controls are positioned and sized so that the form has a neat, professional appearance and none of<br />

the text is cut off. Your completed form should look similar to the following.<br />

(c) Your form should appear. Test your application using the following test cases. For each test case, enter the indicated<br />

values for Income and Number of dependents; click the Calculate Tax button; and check that the amount displayed for<br />

the tax owed is correct. Capture a screenshot showing the results of each correct test case and paste into a Word<br />

document. Remember, use CTRL+ALT+PrintScreen to capture a screenshot.<br />

Test case # Income Number of dependents Tax owed<br />

1 9,000 1 $200.00<br />

2 25,000 2 $2,050.00<br />

3 70,000 3 $10,750.00<br />

4 150,000 4 $34,500.00<br />

For example, the screenshot for test case #1 should look as follows:<br />

(c) If you receive an error message or your application did not work correctly, debug the application and try again. Post<br />

in the Q & A Forum or contact your professor for assistance if needed.<br />

(d) When your application works correctly for all the test cases, select and copy the code for the button-click event and<br />

paste it into your Word document below the four test case screenshots. Save the Word document containing the four<br />

test case screenshots and your button-click event code asLab3YourFirstLastName.docx (where YourFirstLastName =<br />

your first an