BIS 311 DeVry Week 5 iLab

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>BIS</strong> <strong>311</strong> <strong>DeVry</strong> <strong>Week</strong> 5 I Lab<br />

Downloading is very simple, you can download this Course here:<br />

http://mindsblow.us/question_des/<strong>BIS</strong><strong>311</strong><strong>DeVry</strong><strong>Week</strong>5<strong>iLab</strong>/4375<br />

Or<br />

Contact us at:<br />

help@mindblows.us<br />

<strong>BIS</strong> <strong>311</strong> <strong>DeVry</strong> <strong>Week</strong> 5 <strong>iLab</strong><br />

<strong>BIS</strong><strong>311</strong><br />

<strong>BIS</strong> <strong>311</strong> <strong>DeVry</strong> <strong>Week</strong> 5 <strong>iLab</strong><br />

iLAB OVERVIEW<br />

Scenario/Summary<br />

In this lab, you'll implement an application that performs a simple sales tax calculation. The new feature of this<br />

application, compared to what you have done in previous <strong>iLab</strong>s, is that the values entered by the user will be checked<br />

for validity. If the amounts entered are invalid, the application will display appropriate error messages to the user. If the<br />

input data are valid, the application will calculate the sales tax due and the total, including tax.<br />

Sales Tax Application Business Requirements<br />

The user enters an order amount and a sales tax percent. The order amount must be numeric and greater than 0. The<br />

sales tax percent must be numeric, greater than or equal to 0, and less than or equal to 0.14. If the input data are<br />

invalid, appropriate error messages will be displayed to the user. If the input data are valid, the application will calculate<br />

the sales tax by multiplying the order amount by the sales tax percent, and will calculate the order total, including tax,<br />

by adding the order amount and the sales tax. The sales tax and the order total, including tax, will be displayed to the<br />

user.<br />

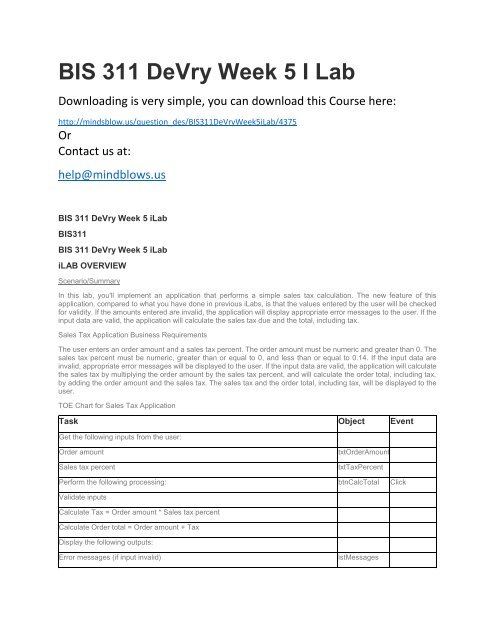

TOE Chart for Sales Tax Application<br />

Task Object Event<br />

Get the following inputs from the user:<br />

Order amount<br />

Sales tax percent<br />

txtOrderAmount<br />

txtTaxPercent<br />

Perform the following processing: btnCalcTotal Click<br />

Validate inputs<br />

Calculate Tax = Order amount * Sales tax percent<br />

Calculate Order total = Order amount + Tax<br />

Display the following outputs:<br />

Error messages (if input invalid)<br />

lstMessages

Tax (if input valid)<br />

Order total (if input valid)<br />

lstMessages<br />

lstMessages<br />

Pseudocode for Sales Tax Application<br />

Start button-click event handler<br />

Declare numeric variables for<br />

Order amount<br />

Sales tax percent<br />

Tax<br />

Order total<br />

Declare string variables for<br />

Order amount message<br />

Sales tax percent message<br />

Declare Boolean variable for<br />

Inputs valid (initialize to True)<br />

Clear messages<br />

Call ValidateOrderAmount function with Order amount, returning Order amount message<br />

If Order amount message is not empty (i.e. there was an error)<br />

Display Order amount message<br />

Set Inputs valid to False<br />

End If<br />

Call ValidateSalesTaxPercent function with Sales tax percent, returning Sales tax percent message<br />

If Sales tax percent message is not empty (i.e. there was an error)<br />

Display Sales tax percent message<br />

Set Inputs valid to False<br />

End If<br />

If Inputs valid is True<br />

Get Order amount<br />

Get Sales tax percent<br />

Calculate Tax = Order amount * Sales tax percent<br />

Calculate Order total = Order amount + Tax<br />

Display Tax<br />

Display Order amount<br />

End If<br />

Stop button-click event handler<br />

Start ValidateOrderAmount function (Order amount)

If Order amount is not numeric<br />

Set Order amount message to "Please enter a numeric order amount."<br />

Else If Order amount is less than or equal to zero<br />

Set Order amount message to "Please enter an order amount greater than zero."<br />

Else<br />

Set Order amount message to the empty string (no error)<br />

End If<br />

Return Order amount message<br />

Stop ValidateOrderAmount<br />

Start ValidateSalesTaxPercent (Sales tax percent)<br />

If Sales tax percent is not numeric<br />

Set Sales tax percent message to "Please enter a numeric sales tax percent."<br />

Else If Sales tax percent is less than zero or greater than 0.14<br />

Set Sales tax percent message to "Please enter a sales tax percent between 0.00 and 0.14."<br />

Else<br />

Set Sales tax percent message to the empty string(no error)<br />

End If<br />

Return Sales tax percent message<br />

Stop ValidateSalesTaxPercent<br />

Deliverables<br />

<br />

<br />

<br />

<br />

<br />

Submit a Word document named Lab5YourFirstLastName.docx (where YourFirstLastName = your first and<br />

last name; e.g., Lab5JohnSmith.docx) containing the following:<br />

Screenshot of form showing the application running, with non-numeric entries for Order amount and Sales tax<br />

percent, and appropriate error messages displayed.<br />

Screenshot of form showing the application running, with out-of-range entries for Order amount and Sales tax<br />

percent, and appropriate error messages displayed.<br />

Screenshot of form showing the application running, with valid entries for Order amount and Sales tax percent,<br />

and correct Tax and Order total results displayed.<br />

Copy of code for button-click event, ValidateOrderAmount function, and ValidateSalesTaxPercent function.<br />

Category Points % Description<br />

Create and rename form 5 10%<br />

Add controls to form 5 10%<br />

Set properties for controls 5 10%<br />

Code button-click event 5 10%<br />

Windows form was created and renamed SalesTax.vb. Form text<br />

property was set toLab 5 Your Name (where Your Name = your<br />

full name).<br />

The following controls were added to the form: Identifying labels<br />

and text boxes for entry of order amount and sales tax percent;<br />

button to calculate total including tax; and list box for display of<br />

error messages and results.<br />

Name and text properties of all controls were set appropriately,<br />

with no typos or spelling errors.<br />

Button-click event code was entered that corresponds to the<br />

given pseudocode, with no syntax errors.

Code<br />

function<br />

ValidateOrderAmount<br />

5 10%<br />

Function code was entered that corresponds to the given<br />

pseudocode, with no syntax errors.<br />

Code ValidateSalesTaxPercent<br />

5 10%<br />

function<br />

Function code was entered that corresponds to the given<br />

pseudocode, with no syntax errors.<br />

Application is shown running successfully with screen shots for<br />

each of the three test cases:<br />

Test-run application successfully 20 40%<br />

(1) non-numeric entries for order amount and sales tax percent,<br />

with appropriate error messages;<br />

(2) out-of-range entries for order amount and sales tax percent,<br />

with appropriate error messages; and<br />

(3) valid entries for order amount and sales tax percent, with<br />

correct tax and order total results.<br />

Total 50 100%<br />

Required Software<br />

Visual Studio 2012<br />

Access the software at.devry.edu/">https://lab.devry.edu.<br />

Steps: all<br />

iLAB STEPS<br />

Step 1: Launch Visual Studio and Create Project<br />

.equella.ecollege.com/file/dd98a67d-9ec9-4df4-8603-220cf23d1074/30/<strong>BIS</strong><strong>311</strong>_W5_<strong>iLab</strong>.html#top">Back to Top<br />

(a) Log into the Citrix <strong>iLab</strong> site as you did in the previous labs. Click the Microsoft Visual Studio 2012 icon to launch<br />

Visual Studio.<br />

(b) Pull down the File menu and select New Project . . .<br />

(c) In the New Project dialog, ensure that under Templates in the left column, Visual Basic is selected, and that in the<br />

center column, Windows Form Application is selected. In the Name field at the bottom of the dialog, enter SalesTax.<br />

Click OK.<br />

Step 2: Rename Form and Add Controls<br />

.equella.ecollege.com/file/dd98a67d-9ec9-4df4-8603-220cf23d1074/30/<strong>BIS</strong><strong>311</strong>_W5_<strong>iLab</strong>.html#top">Back to Top<br />

(a) In the Solution Explorer pane on the right side of the screen, right-click on Form1.vb, select Rename, and change<br />

the name to SalesTax.vb. Press Enter after entering the new form name.<br />

(b) Change the Text property of the form to Lab 5 Your Name (where Your Name = your full name), as you have done<br />

in previous labs.<br />

(c) Drag the following controls from the ToolBox onto the form, arrange them in a logical fashion, and set their properties<br />

as indicated in the table below.<br />

Control Name Property Text Property<br />

Label Label1 Order amount:<br />

TextBox<br />

txtOrderAmount<br />

Label Label2 Sales tax percent:<br />

TextBox<br />

txtSalesTaxPercent

Button btnCalcTotal Calculate Total Including Tax<br />

ListBox<br />

lstMessages<br />

(d) Ensure that all controls are positioned and sized so that the form has a neat, professional appearance and none of<br />

the text is cut off. Your completed form should look similar to the following.<br />

(e) Pull down the File menu and select Save All to save your work. If a Save Project dialog appears, ensure that the<br />

project is saved to the My DocumentsVisual Studio 2012Projects folder under your DSI number. Click Save.<br />

Step 4: Test, Debug, and Submit<br />

.equella.ecollege.com/file/dd98a67d-9ec9-4df4-8603-220cf23d1074/30/<strong>BIS</strong><strong>311</strong>_W5_<strong>iLab</strong>.html#top">Back to Top<br />

(a) Run the application by doing one of the following: click the Start button; pull down the Debug menu, and select Start<br />

Debugging; or press the F5 key.<br />

(b) Your form should appear. Test your application by using the following test cases. For each test case, enter the<br />

indicated values for Order amount and Sales tax percent; click the Calculate Total Including Tax button; and check that<br />

the messages displayed in the list box are correct. Capture a screenshot showing the results of each correct test case<br />

and paste it into a Word document. Remember to use CTRL+ALT+PrintScreen to capture a screenshot.<br />

Test case<br />

Order amount Sales tax percent Messages<br />

#<br />

1 abc def<br />

2 -1 0.15<br />

3 100.00 0.10<br />

Please enter a numeric order amount.<br />

Please enter a numeric sales tax percent.<br />

Please enter an order amount greater than 0.<br />

Please enter a sales tax percent between 0 and 0.14.<br />

The sales tax is $10.00.<br />

The total including tax is $110.00.<br />

As an example, the screenshot for Test Case 1 should look as follows.<br />

(c) If your application does not work correctly, debug the application and try again. Post in the Q & A Forum or contact<br />

your professor for assistance, if needed.<br />

(d) When your application works correctly for all test cases, select and copy all the code for the button-click event<br />

handler, the ValidateOrderAmount function, and the ValidateSalesTaxPercent function, and paste it into your Word<br />

document below the three test case screenshots. Save the Word document as Lab5YourFirstLastName.docx (where<br />

YourFirstLastName = your first and last name; e.g., JohnSmith) and submit it to the appropriate dropbox.