BUSN 379 DeVry Entire Course

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

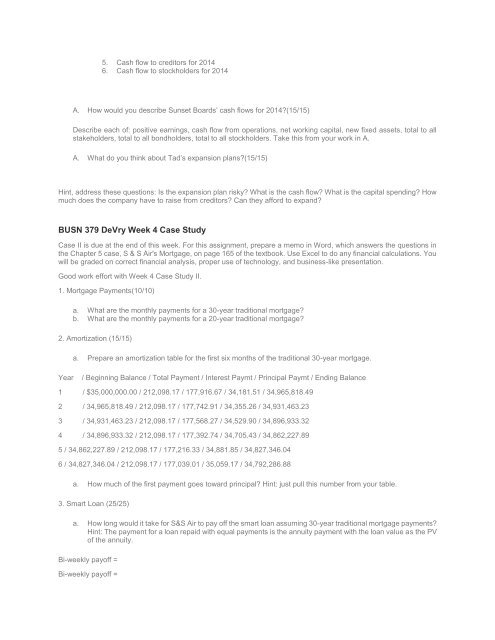

5. Cash flow to creditors for 2014<br />

6. Cash flow to stockholders for 2014<br />

A. How would you describe Sunset Boards’ cash flows for 2014?(15/15)<br />

Describe each of: positive earnings, cash flow from operations, net working capital, new fixed assets, total to all<br />

stakeholders, total to all bondholders, total to all stockholders. Take this from your work in A.<br />

A. What do you think about Tad’s expansion plans?(15/15)<br />

Hint, address these questions: Is the expansion plan risky? What is the cash flow? What is the capital spending? How<br />

much does the company have to raise from creditors? Can they afford to expand?<br />

<strong>BUSN</strong> <strong>379</strong> <strong>DeVry</strong> Week 4 Case Study<br />

Case II is due at the end of this week. For this assignment, prepare a memo in Word, which answers the questions in<br />

the Chapter 5 case, S & S Air's Mortgage, on page 165 of the textbook. Use Excel to do any financial calculations. You<br />

will be graded on correct financial analysis, proper use of technology, and business-like presentation.<br />

Good work effort with Week 4 Case Study II.<br />

1. Mortgage Payments(10/10)<br />

a. What are the monthly payments for a 30-year traditional mortgage?<br />

b. What are the monthly payments for a 20-year traditional mortgage?<br />

2. Amortization (15/15)<br />

a. Prepare an amortization table for the first six months of the traditional 30-year mortgage.<br />

Year<br />

/ Beginning Balance / Total Payment / Interest Paymt / Principal Paymt / Ending Balance<br />

1 / $35,000,000.00 / 212,098.17 / 177,916.67 / 34,181.51 / 34,965,818.49<br />

2 / 34,965,818.49 / 212,098.17 / 177,742.91 / 34,355.26 / 34,931,463.23<br />

3 / 34,931,463.23 / 212,098.17 / 177,568.27 / 34,529.90 / 34,896,933.32<br />

4 / 34,896,933.32 / 212,098.17 / 177,392.74 / 34,705.43 / 34,862,227.89<br />

5 / 34,862,227.89 / 212,098.17 / 177,216.33 / 34,881.85 / 34,827,346.04<br />

6 / 34,827,346.04 / 212,098.17 / 177,039.01 / 35,059.17 / 34,792,286.88<br />

a. How much of the first payment goes toward principal? Hint: just pull this number from your table.<br />

3. Smart Loan (25/25)<br />

a. How long would it take for S&S Air to pay off the smart loan assuming 30-year traditional mortgage payments?<br />

Hint: The payment for a loan repaid with equal payments is the annuity payment with the loan value as the PV<br />

of the annuity.<br />

Bi-weekly payoff =<br />

Bi-weekly payoff =