ACCT 336 DeVry Week 6 Quiz

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>ACCT</strong> <strong>336</strong> <strong>DeVry</strong> <strong>Week</strong> 6 <strong>Quiz</strong><br />

Downloading is very simple, you can download this Course here:<br />

http://wiseamerican.us/product/acct-<strong>336</strong>-devry-week-6-quiz/<br />

Or<br />

Contact us at:<br />

SUPPORT@WISEAMERICAN.US<br />

<strong>ACCT</strong> <strong>336</strong> <strong>DeVry</strong> <strong>Week</strong> 6 <strong>Quiz</strong><br />

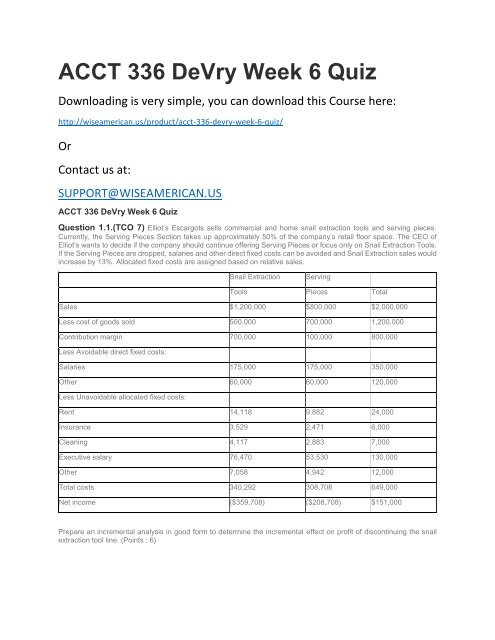

Question 1.1.(TCO 7) Elliot’s Escargots sells commercial and home snail extraction tools and serving pieces.<br />

Currently, the Serving Pieces Section takes up approximately 50% of the company’s retail floor space. The CEO of<br />

Elliot’s wants to decide if the company should continue offering Serving Pieces or focus only on Snail Extraction Tools.<br />

If the Serving Pieces are dropped, salaries and other direct fixed costs can be avoided and Snail Extraction sales would<br />

increase by 13%. Allocated fixed costs are assigned based on relative sales.<br />

Snail Extraction<br />

Serving<br />

Tools Pieces Total<br />

Sales $1,200,000 $800,000 $2,000,000<br />

Less cost of goods sold 500,000 700,000 1,200,000<br />

Contribution margin 700,000 100,000 800,000<br />

Less Avoidable direct fixed costs:<br />

Salaries 175,000 175,000 350,000<br />

Other 60,000 60,000 120,000<br />

Less Unavoidable allocated fixed costs:<br />

Rent 14,118 9,882 24,000<br />

Insurance 3,529 2,471 6,000<br />

Cleaning 4,117 2,883 7,000<br />

Executive salary 76,470 53,530 130,000<br />

Other 7,058 4,942 12,000<br />

Total costs 340,292 308,708 649,000<br />

Net income ($359,708) ($208,708) $151,000<br />

Prepare an incremental analysis in good form to determine the incremental effect on profit of discontinuing the snail<br />

extraction tool line. (Points : 6)

Question 2.2.(TCO 4) Paschal’s Parasailing Enterprises has estimated that fixed costs per month are $115,600<br />

and variable cost per dollar of sales is $0.35 (6 points).<br />

What is the break-even point per month in sales?<br />

What level of sales is needed for a monthly profit of $70,000?<br />

For the month of August, Paschal’s anticipates sales of $600,000. What is the expected level of profit?(Points : 6)<br />

Question 3.3.(TCO 6) Princess Cruise Lines has the following service departments; concierge, valet, and<br />

maintenance. Expenses for these departments are allocated to Mediterranean and transatlantic cruises. Expenses for<br />

the departments are totaled (both variable and components are combined) and as follows.<br />

Concierge $1,500,000<br />

Valet $2,750,000<br />

Maintenance $2,250,000<br />

The sea miles logged are 5,000,000 for the Mediterranean and 20,000,000 for the transatlantic voyages.<br />

Based upon the sea miles logged, allocate the service department costs (6 points).<br />

Question 4.4.(TCO 9) Thurman Munster, the owner of Adams Family RVs, is considering the addition of a service<br />

center his lot. The building and equipment are estimated to cost $1,200,000, and both the building and equipment will<br />

be depreciated over 10 years using the straight-line method. The building and equipment have zero estimated residual<br />

value at the end of 10 years. Munster’s required rate of return for this project is 12%. Net income related to each year<br />

of the investment is as follows.<br />

Revenue $450,000<br />

Less:<br />

Material Cost $60,000<br />

Labor 100,000<br />

Depreciation 120,000<br />

Other 10,000 290,000<br />

Income before taxes 160,000<br />

Taxes at 40% 64,000<br />

Net Income $96,000<br />

(A) Determine the net present value of the investment in the service center. Should Munster invest in the service center?<br />

(B) Calculate the internal rate of return of the investment to the nearest 0.5%.<br />

(C) Calculate the payback period of the investment.<br />

(D) Calculate the accounting rate of return. (Points : 8)<br />

Question 5.5.(TCO 5) The following information relates to Vice Versa Ventures for calendar year 20XX, the<br />

company’s first year of operations.<br />

Units produced 20,000

Units sold 15,000<br />

Selling price per unit $30<br />

Direct material per unit $5<br />

Direct labor per unit $5<br />

Variable manufacturing overhead per unit $2<br />

Variable selling cost per unit $3<br />

Annual fixed manufacturing overhead $160,000<br />

Annual fixed selling and administrative expense $80,000<br />

(a) Prepare an income statement using full costing.<br />

(b) Prepare an income statement using variable costing. (Points : 8)<br />

Question 6.6.(TCO 8) Leekee Shipyards has a new barnacle-removing product for ocean-going vessels. The<br />

company invests $1,200,000 in operating assets and plans to produce and sell 400,000 units per year. Leekee wants<br />

to make a return on investment of 20% each year. Leekee needs to know what price to charge for this product.<br />

Use the absorption costing approach to determine the markup necessary to make the desired return on investment<br />

based on the following information.<br />

Per Unit<br />

Total<br />

Direct Materials $2.00<br />

Direct Labor $1.50<br />

Variable Manufacturing Overhead $1.00<br />

Fixed Manufacturing Overhead $100,000<br />

Variable Selling and Administrative Expense $0.10<br />

Fixed Selling and Administrative Expense $100,000<br />

(Points : 6)