BUSN 380 DEVRY WEEK 4 QUIZ LATEST

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

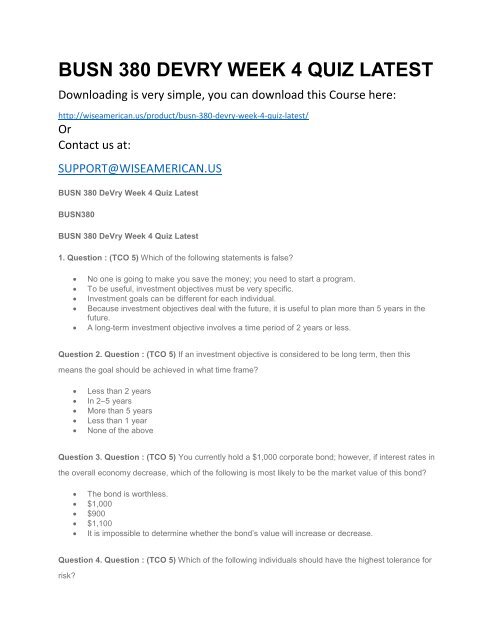

<strong>BUSN</strong> <strong>380</strong> <strong>DEVRY</strong> <strong>WEEK</strong> 4 <strong>QUIZ</strong> <strong>LATEST</strong><br />

Downloading is very simple, you can download this Course here:<br />

http://wiseamerican.us/product/busn-<strong>380</strong>-devry-week-4-quiz-latest/<br />

Or<br />

Contact us at:<br />

SUPPORT@WISEAMERICAN.US<br />

<strong>BUSN</strong> <strong>380</strong> DeVry Week 4 Quiz Latest<br />

<strong>BUSN</strong><strong>380</strong><br />

<strong>BUSN</strong> <strong>380</strong> DeVry Week 4 Quiz Latest<br />

1. Question : (TCO 5) Which of the following statements is false?<br />

<br />

<br />

<br />

<br />

<br />

No one is going to make you save the money; you need to start a program.<br />

To be useful, investment objectives must be very specific.<br />

Investment goals can be different for each individual.<br />

Because investment objectives deal with the future, it is useful to plan more than 5 years in the<br />

future.<br />

A long-term investment objective involves a time period of 2 years or less.<br />

Question 2. Question : (TCO 5) If an investment objective is considered to be long term, then this<br />

means the goal should be achieved in what time frame?<br />

<br />

<br />

<br />

<br />

<br />

Less than 2 years<br />

In 2–5 years<br />

More than 5 years<br />

Less than 1 year<br />

None of the above<br />

Question 3. Question : (TCO 5) You currently hold a $1,000 corporate bond; however, if interest rates in<br />

the overall economy decrease, which of the following is most likely to be the market value of this bond?<br />

The bond is worthless.<br />

$1,000<br />

$900<br />

$1,100<br />

It is impossible to determine whether the bond’s value will increase or decrease.<br />

Question 4. Question : (TCO 5) Which of the following individuals should have the highest tolerance for<br />

risk?

Joan Cummings, who is a single mother with two small children<br />

Darren Carter, who works for American Airlines and is worried that he is going to be laid off soon<br />

Barry Parks, who is an investment banker and earns over $200,000 per year<br />

Michael Clark, who is 74 years old and been retired for 6 years<br />

Fred Funderbunk, who delivers pizzas and makes about $15,000 per year<br />

Question 5. Question : (TCO 5) Mary Ann recently received a $20,000 gift from her uncle and is<br />

considering investing in stocks, because she knows that historically they have earned an approximately<br />

10–12% rate of return over the last few years. Referring to aspects of investing, Mary Ann is most<br />

concerned about which of the following?<br />

<br />

<br />

<br />

<br />

<br />

Risk<br />

Return<br />

Diversification<br />

Liquidity<br />

Income<br />

Question 6. Question : (TCO 5) A $1,000 corporate bond pays 7.5% a year. What is the annual interest<br />

you will receive?<br />

$1,075<br />

$7.50<br />

$0.75<br />

$75.00<br />

$0<br />

Question 7. Question : (TCO 5) _____ risk occurs when an investment does not keep up with increasing<br />

price levels in our economy.<br />

<br />

<br />

<br />

<br />

<br />

Market<br />

Interest<br />

Inflation<br />

Business failure<br />

Current<br />

Question 8. Question : (TCO 5) John Farmer recently received a legal form from the company where he<br />

owns stocks that list the issues to be decided at the annual stockholders’ meeting. The item asks that he<br />

signs something that allows someone else to vote for him. What has he received?<br />

<br />

<br />

<br />

<br />

<br />

Equity<br />

Proxy<br />

Voting rights<br />

Dividends<br />

None of the above

Question 9. Question : (TCO 5) Matt Dannon just bought the stock of a company that provides him with<br />

the responsibility to approve major company actions. Which one of the following best characterizes this<br />

responsibility?<br />

<br />

<br />

<br />

<br />

<br />

Voting rights<br />

Proxy<br />

Equity<br />

Dividends<br />

None of the above<br />

Question 10. Question : (TCO 5) If Orlando Blodgett is buying the stock of the Getaway Caribbean<br />

Cruise Company. If he buys the stock today, knowing it is the first day it is selling without the dividend for<br />

this quarter, on what date is Orlando buying the stock?<br />

<br />

<br />

<br />

<br />

<br />

Record date<br />

Sale date<br />

Payment date<br />

Ex dividend date<br />

None of the above<br />

Question 11. Question : (TCO 5) Lindsey Holt owns stock in the Galloway Gems Company. She knows<br />

she will receive a $1.50 dividend each quarter. Given this, you know for sure that she purchased which<br />

type of stock?<br />

<br />

<br />

<br />

<br />

<br />

Preferred<br />

Common<br />

Blue chip<br />

Growth<br />

Penny<br />

Question 12. Question : (TCO 5) Dividends must be approved by a firm’s board of directors, and<br />

<br />

<br />

<br />

<br />

<br />

dividend payments are paid out of profits.<br />

dividends are guaranteed.<br />

dividends are paid before a firm’s taxes are paid.<br />

dividends are usually paid twice a year.<br />

dividends can be paid forever.<br />

Question 13. Question : (TCO 5) One option for long-term corporate financing is equity financing, and<br />

this is a popular choice because<br />

<br />

<br />

<br />

a lender is always available to provide this type of financing.<br />

it does not cost anything to sell in the primary market.<br />

repayment doesn’t have to be made for 10 years or more.

only interest must be paid for the first 5 years.<br />

it does not have to be repaid.<br />

Question 14. Question : (TCO 5) Dividends will remain with the stock until<br />

<br />

<br />

<br />

<br />

<br />

5 days after the date of record.<br />

two business days after the date of record.<br />

5 days before the date of record.<br />

two business days before the date of record.<br />

5 days before the actual payment date.<br />

Question 15. Question : (TCO 5) Nancy Groom owns one $1,000 corporate bond issued by Chevron.<br />

The bond has a yield of 10% and pays 8% interest semiannually. How much interest will Ms. Groom<br />

receive in 1 year?<br />

$50<br />

$100<br />

$80<br />

$40<br />

$1,000<br />

Question 16. Question : (TCO 5) Which of the statements below is false?<br />

<br />

<br />

<br />

<br />

<br />

Stock is a form of equity capital.<br />

Stock does not have a maturity date.<br />

Bonds are a form of debt capital.<br />

Bonds do not have to be repaid at maturity.<br />

Interest payments are made to bondholders.<br />

Question 17. Question : (TCO 5) All of the statements are false except for which?<br />

<br />

<br />

<br />

<br />

<br />

Convertible corporate bonds are more secure than government bonds.<br />

Convertible bonds often pay 3–4% more interest than nonconvertible bonds.<br />

Because of the conversion feature, it is not necessary to evaluate convertible corporate bonds.<br />

Even if convertible bondholders convert their investment to common stock, the bondholders still<br />

receive interest payments.<br />

In reality, there is no guarantee that bondholders will convert to common stock even if the market<br />

value of the common stock does increase in value.<br />

Question 18. Question : (TCO 5) You have been thinking about investing in corporate bonds, but are<br />

seeking the most secure bond investment possible. Most likely, you would want to select _____ bonds.<br />

<br />

<br />

<br />

<br />

<br />

debenture<br />

subordinated<br />

indenture<br />

convertible<br />

mortgage

Question 19. Question : (TCO 5) A(n) _____ fund is a fund to which annual or semiannual deposits are<br />

made for the purpose of redeeming a bond issue.<br />

<br />

<br />

<br />

<br />

<br />

serial<br />

indenture<br />

debenture<br />

sinking<br />

money<br />

Question 20. Question : (TCO 5) _____ bonds are a part of a single issue, but they mature on different<br />

dates.<br />

<br />

<br />

<br />

<br />

<br />

Serial<br />

Mortgage<br />

Sinking fund<br />

Subordinate<br />

Debenture