2014 Financial Statement

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

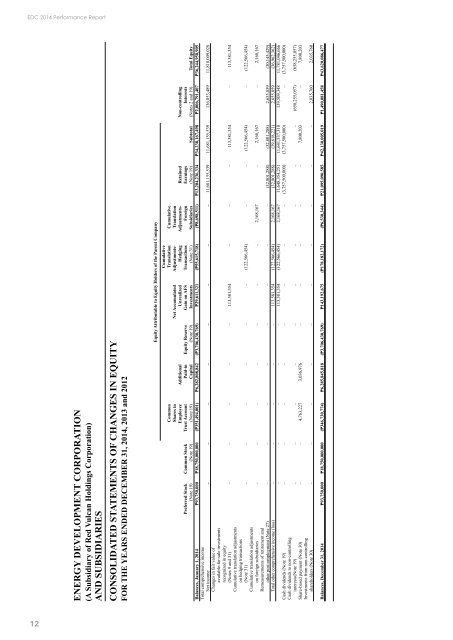

EDC <strong>2014</strong> Performance Report<br />

ENERGY DEVELOPMENT CORPORATION<br />

(A Subsidiary of Red Vulcan Holdings Corporation)<br />

AND SUBSIDIARIES<br />

CONSOLIDATED STATEMENTS OF CHANGES IN EQUITY<br />

FOR THE YEARS ENDED DECEMBER 31, <strong>2014</strong>, 2013 and 2012<br />

Equity Attributable to Equity Holders of the Parent Company<br />

Preferred Stock<br />

(Note 19)<br />

Common Stock<br />

(Note 19)<br />

Common<br />

Shares in<br />

Employee<br />

Trust Account<br />

(Note 19)<br />

Additional<br />

Paid-in<br />

Capital<br />

Equity Reserve<br />

(Note 19)<br />

Net Accumulated<br />

Unrealized<br />

Gain on AFS<br />

Investments<br />

Cumulative<br />

Translation<br />

Adjustments-<br />

Hedging<br />

Transactions<br />

(Note 31)<br />

Cumulative<br />

Translation<br />

Adjustments-<br />

Foreign<br />

Subsidiaries<br />

Retained<br />

Earnings<br />

(Note 19) Subtotal<br />

Non-controlling<br />

Interests<br />

(Notes 2 and 19) Total Equity<br />

Balances, January 1, <strong>2014</strong> ₱93,750,000 ₱18,750,000,000 (₱351,494,001) ₱6,282,808,842 (₱3,706,430,769) ₱29,611,321 (₱55,615,718) (₱8,698,511) ₱13,204,236,334 ₱34,238,167,498 ₱2,006,791,407 ₱36,244,958,905<br />

Total comprehensive income<br />

Net income – – – – – – – – 11,681,155,539 11,681,155,539 136,853,489 11,818,009,028<br />

Changes in fair value of<br />

available-for-sale investments<br />

recognized in equity<br />

(Notes 9 and 31) – – – – – 113,581,354 – – – 113,581,354 – 113,581,354<br />

Cumulative translation adjustments<br />

on hedging transactions<br />

(Note 31) – – – – – – (122,566,454) – – (122,566,454) – (122,566,454)<br />

Cumulative translation adjustments<br />

on foreign subsidiaries – – – – – – – 2,168,167 – 2,168,167 – 2,168,167<br />

Remeasurements of retirement and<br />

other post-employment (Note 27) – – – – – – – – (32,801,288) (32,801,288) 2,655,859 (30,145,429)<br />

Total other comprehensive income (loss) – – – – – 113,581,354 (122,566,454) 2,168,167 (32,801,288) (39,618,221) 2,655,859 (36,962,362)<br />

– – – – – 113,581,354 (122,566,454) 2,168,167 11,648,354,251 11,641,537,318 139,509,348 11,781,046,666<br />

Cash dividends (Note 19) – – – – – – – – (3,757,500,000) (3,757,500,000) – (3,757,500,000)<br />

Cash dividends to non-controlling<br />

interests(Note 19) – – – – – – – – – – (658,255,057) (658,255,057)<br />

Share-based payment (Note 30) – – 4,763,227 3,036,976 – – – – – 7,800,203 – 7,800,203<br />

Investments from non-controlling<br />

shareholders (Note 30) – – – – – – – – – – 2,035,760 2,035,760<br />

Balances, December 31, <strong>2014</strong> ₱93,750,000 ₱18,750,000,000 (₱346,730,774) ₱6,285,845,818 (₱3,706,430,769) ₱143,192,675 (₱178,182,172) (₱6,530,344) ₱21,095,090,585 ₱42,130,005,019 ₱1,490,081,458 ₱43,620,086,477<br />

12