MA2017-Final

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

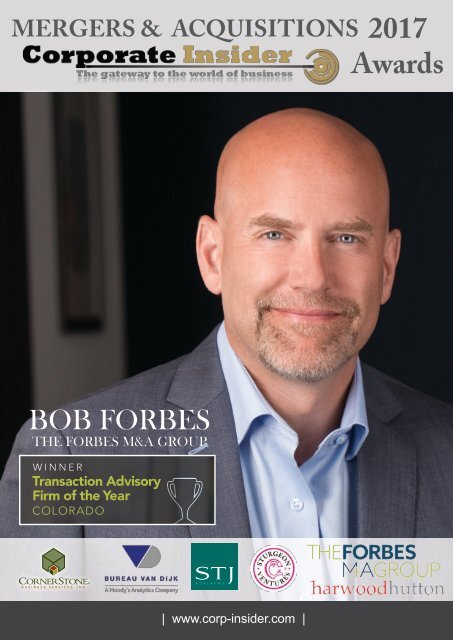

MERGERS & ACQUISITIONS 2017<br />

Awards<br />

ForbesMA.com | 303.770.6017 | Info@ForbesMA.com<br />

BOB FORBES<br />

THE FORBES M&A GROUP<br />

WINNER<br />

Transaction Advisory<br />

Firm of the Year<br />

COLORADO<br />

THE FORBES M+A GROUP is an award-winning mergers and acquisitions advisory firm that<br />

serves buyers and sellers in middle-market transactions. As former entrepreneurs, CEOs and<br />

corporate finance professionals, and with over 150 years of combined experience, we have<br />

deep relationships, experience and expertise with more industries, transaction types, sizes,<br />

structures, motivations and challenges than almost anyone else in the business.<br />

| www.corp-insider.com |<br />

The Forbes M+A Group enjoys working with businesses that stand<br />

out from the pack across diverse industries. Private company

“We all do better when we work together.<br />

Our differences do matter, but our common<br />

humanity matters more."<br />

- Bill Clinton”<br />

www.corp-insider.com

Cornerstone Business Services, Inc.<br />

Bureau van Dijk<br />

STJ Advisors<br />

Sturgeon Ventures LLP<br />

Harwood Hutton Limited<br />

The Forbes M&A Group<br />

Ryuka IP Law Firm<br />

Jank Weiler Operenyi Rechtsanwälte<br />

Skadden Arps Slate Meagher & Flom LLP<br />

M&A Business Advisors<br />

Marxer & Partner Rechtsanwälte<br />

Moh and Associates, Inc.<br />

DN Legal<br />

M&A Advisory<br />

Sutton Place Strategies<br />

Birketts LLP<br />

RSM Poland<br />

Avondale<br />

Alder & Sound<br />

KPMG<br />

Consulting<br />

Finance<br />

Intellectual Property<br />

Legal<br />

www.corp-insider.com

Jason has 20 years of professional experience in business operations and development.<br />

Having spent his entire career as an entrepreneur and business transformation consultant, he is well positioned to guide<br />

other business owners through their M&A options while coordinating all efforts to help ensure a successful outcome for<br />

each and every one of his clients.<br />

Earlier in his career, Jason founded a<br />

consulting business that provided his clients<br />

brand development, systems development<br />

and optimization expertise. He served more<br />

than a dozen business groups with 100+<br />

business units throughout the Midwest and<br />

Northeast regions of the U.S., increasing<br />

gross profit by at least 10% at<br />

each unit. On one engagement, he<br />

transformed a major brand experiencing<br />

five years of $84K/month in losses to one<br />

with $30K/month in profitability –in just four<br />

months.<br />

His most recent achievements involve<br />

developing an alternative fuel technology and<br />

successfully navigating the global regulatory<br />

environment. Jason leveraged his innovation<br />

into a joint venture, serving as COO for<br />

ThermoDynamics Group, a<br />

Netherlands-based multinational.<br />

Jason ushered his technology through R&D<br />

and commercialization to successfully license<br />

the intellectual property.<br />

As part of that initiative, Jason spent 4+ years<br />

in the Netherlands, achieving the only EU<br />

Ministry of Shipping recommendation to date<br />

for retrofit HHO technology and the first ever<br />

Global Third Party accreditation for emissions<br />

reduction and increased power generation.<br />

Jason recently authored “Be Frustrated, Be<br />

Terrified, Be Heartbroken (A conversation on<br />

achieving a life worth living)” and continually<br />

strives for ways to mentor and give back to his<br />

community. As a director of the Howard<br />

Suamico Education Foundation (HSEF),<br />

and chairman of the scholarship committee,<br />

Jason is proud to be an active participant and<br />

facilitator of positive change within his<br />

community and educational system.<br />

Jason Tuzinkewich<br />

CBI, CM&AP<br />

Mergers &<br />

Acquisitions Advisor<br />

A Green Bay-area native, Jason studied<br />

chemical engineering and mathematics at<br />

the University of Minnesota and holds<br />

multiple patents for HHO fuel generator<br />

systems. He held Magna Cum Laude honors<br />

while earning a Bachelor of Science in<br />

Operations Management from Ashford<br />

University and the Forbes School of Business.

M&A Advisor of the Year<br />

JASON TUZINKEWICH<br />

CBI, CM&AP<br />

Cornerstone is a national full service mergers and acquisitions firm that specializes in the lower middle<br />

market sale and acquisition of privately held / family-owned businesses with revenues $2 Million to $100<br />

Million+ and/or EBITDA $500,000 to $10 Million+.<br />

Cornerstone Services:<br />

♦ Sell Side<br />

♦ Buy Side<br />

♦ Estimate of Value<br />

♦ Business and Market Analysis<br />

Benefits of Engaging Cornerstone Business Services, Inc.<br />

♦ Closing ratio 2-3 times the national average<br />

♦ Limited clientele per advisor leading to more advisor engagement throughout process<br />

♦ Confidentiality, integrity, expertise, and time-tested, proven process<br />

♦ Honest and realistic upfront conversations<br />

♦ National/International buyer reach<br />

♦ Marketing program customized for each client<br />

♦ One of the Midwest’s largest M&A firms to exclusively focus on the lower-middle market<br />

♦ Substantial expertise in a wide variety of industries<br />

Regional Offices<br />

♦ Wisconsin<br />

♦ Iowa<br />

Industry Affiliations<br />

♦ Alliance of Mergers & Acquisitions Advisors<br />

♦ M&A Source<br />

♦ International Business Brokers Association<br />

♦ Midwest Business Brokers & Intermediaries<br />

(AM&AA)<br />

(IBBA)<br />

(MBBI)<br />

Professional Certifications, Designations & Awards<br />

♦ Certified Mergers and Acquisitions Professional<br />

♦ Merger and Acquisitions Master Intermediary Designation<br />

♦ Certified Business Intermediary<br />

(CM&AP)<br />

(M&AMI)<br />

(CBI)

Lisa Wright<br />

www.bvdinfo.com<br />

info@bvdinfo.com<br />

For over 25 years Bureau van<br />

Dijk has been providing global<br />

M&A firms and professionals<br />

with high-quality databases<br />

enabling them to draw on<br />

an unrivalled set of private<br />

company and global deal data<br />

in order to assist them with their<br />

daily work.<br />

Fame, Amadeus, Orbis and<br />

Zephyr are all names that<br />

are synonymous with M&A<br />

research, whether it be<br />

determining lists of potential<br />

target companies, reviewing<br />

historical deal information in<br />

order to appraise comparable<br />

deals and deal multiples, or<br />

assisting with the identification<br />

of comparable companies.<br />

Providing the appropriate tools<br />

for M&A professionals to be<br />

able to do their jobs is more<br />

than just supplying them with<br />

a database of historical and<br />

ongoing deals or a standalone<br />

database of company<br />

information. This is where<br />

Bureau van Dijk’s offerings of<br />

fully integrated products, such<br />

as Orbis – which combines<br />

private company data, detailed<br />

ownership and deal information<br />

in one single platform – is<br />

incredibly powerful.<br />

The requirement for timely<br />

information on relevant deals,<br />

the ability to identify the entire<br />

“universe” of companies with a<br />

specific business activity and<br />

the depth at which these<br />

companies can be analysed<br />

are critical components of the<br />

services that M&A advisors<br />

provide to their clients. More<br />

often than not the decisions<br />

being made off the back of<br />

this data involve significant<br />

investment from the companies<br />

who are making the acquisitions<br />

recommended to them by their<br />

M&A advisors.<br />

Bureau van Dijk’s global M&A,<br />

IPO, private equity and venture<br />

capital database, Zephyr, was<br />

first launched to the market<br />

in May 2002 and its global<br />

coverage currently stands at<br />

over 1.6 million deals from 1st<br />

January 2000, with a further<br />

100,000+ new deals added<br />

annually.<br />

The Zephyr database is<br />

created by the Bureau van<br />

Dijk subsidiary, Zephus Ltd,<br />

with teams located in Salford<br />

Quays, Manchester, in the UK<br />

and in Singapore. The company<br />

employs over 130 people in<br />

total, with 85 of these working<br />

specifically on the compilation of<br />

the global M&A data. Collecting<br />

global deal information when the<br />

largest number of deals by far<br />

that happen each year involve<br />

two privately held companies is<br />

a challenging task. Very often<br />

these companies are based in<br />

jurisdictions where the legal<br />

requirement to even disclose<br />

the deal is minimal, let alone to<br />

disclose detailed information<br />

relating to the price paid for the<br />

target and the deal structure.<br />

So in order to provide the most<br />

complete picture of the deals<br />

that are happening, multiple<br />

data sources have to be utilised<br />

and cross-referenced, and one<br />

key aspect of collecting such<br />

data is not to be reliant on the<br />

information only being available<br />

in English. To ensure that even<br />

the smallest deals happening<br />

anywhere in the world are<br />

located and included in the<br />

database, Zephus staff work in<br />

over 45 different languages and<br />

carry out all of the translation of<br />

these sources in house as part<br />

of the research process. Data<br />

sources utilised include global<br />

stock exchanges, regulatory<br />

bodies, news and company<br />

websites, SEC filings, annual<br />

reports and accounts from the<br />

Orbis database, and in addition<br />

data submissions from advisory<br />

firms all over the world are<br />

received.<br />

Zephus research staff are<br />

provided with in-depth initial<br />

training on the M&A subject<br />

matter to enable them to be able<br />

to understand the deals they<br />

are researching and tracking.<br />

Time-honed quality controls<br />

are applied to the work that<br />

the M&A researchers do. In<br />

addition, continual reviews of<br />

the sources of the data are<br />

carried out to ensure that the<br />

widest range and highest quality<br />

of M&A deal news are utilised.<br />

New sources will be added<br />

when appropriate and sources<br />

will be removed if deemed to<br />

be no longer reliable or creating<br />

noise.

GLOBAL M&A RESEARCH<br />

FIRM OF THE YEAR<br />

A core philosophy of the<br />

business is one of continual<br />

improvement, whether that be in<br />

the knowledge of the staff, the<br />

range and quality of the data<br />

sources utilised or via the use of<br />

technology where appropriate.<br />

Orbis, Bureau van Dijk’s<br />

global company information<br />

product, includes information on<br />

companies from all countries of<br />

the world and currently<br />

holds data on around 250 million<br />

private entities. It combines<br />

information from regulatory and<br />

many other sources to provide as<br />

comprehensive a picture<br />

of each company as possible.<br />

Over 160 different information<br />

providers are utilised to populate<br />

the company reports, and the<br />

information held ranges from<br />

financial statements to company<br />

news, to risk profiles, through to<br />

any intellectual property that the<br />

company might have registered.<br />

Wherever possible detailed<br />

corporate ownership structures<br />

are included, providing<br />

information on: direct and<br />

indirect ownership; ultimate<br />

owners – both domestic and<br />

global; and corporate groups<br />

– all companies with the same<br />

ultimate owner as the subject<br />

company and the beneficial<br />

owners of the subject company.<br />

Bureau van Dijk’s ownership<br />

information, like its M&A data,<br />

is proprietary, is collected by a<br />

dedicated team, sourced from<br />

multiple sources, and is<br />

cross-referenced to provide as<br />

complete a picture as possible.<br />

Both Orbis and Zephyr provide<br />

a number of powerful analysis<br />

tools enabling users to be<br />

able to determine trends, such<br />

as identifying annual deal<br />

numbers by geography or<br />

sector. Aggregated balance<br />

sheets of companies from the<br />

same industry can be produced,<br />

enabling the evolution of an<br />

industry in financial terms to be<br />

mapped. Such analysis tools,<br />

along with alerting functions,<br />

are utilised in M&A research so<br />

that advisors can provide added<br />

value by assisting their clients<br />

to plan their longer-term M&A<br />

strategy.<br />

M&A is a constantly evolving<br />

industry as more companies<br />

look to include acquisitions<br />

or mergers as part of their<br />

corporate strategy. An<br />

example of the evolution<br />

of the industry is the<br />

increasing significance<br />

that a company’s<br />

intangible assets has<br />

upon its valuation.<br />

With this in mind, Bureau van<br />

Dijk also continually reviews<br />

its M&A offering by adding<br />

more relevant and topical data<br />

– for example the imminent<br />

inclusion of more detailed patent<br />

information into Orbis and the<br />

identification of when a patent<br />

has been included in the sale<br />

of a company in Zephyr. The<br />

launch of Bureau van Dijk’s<br />

latest product interface, built<br />

having received substantial<br />

client feedback, is also reflective<br />

of the company’s willingness to<br />

continue to innovate and serve<br />

its client base.<br />

By combining high-quality data<br />

with user-friendly platforms,<br />

Bureau van Dijk helps its clients<br />

understand the companies in<br />

their ecosystem – and also<br />

brings the business of certainty.

Capital Markets Advisory<br />

Firm Of The Year<br />

STJ Advisors is the leading independent global specialist<br />

equity advisory platform. Our only business is providing<br />

expert and independent advice for issuers, management<br />

and shareholders on all equity capital markets activities.<br />

We have the deepest bench of senior Equity Capital<br />

Markets (ECM) experts from the leading investment<br />

banks and all major markets with broad experience in all<br />

types of equity products (Pre-IPO, Private Placements,<br />

Public Equity, Convertible Bonds, Special Purpose<br />

Acquisition Companies (SPACs) and issuance situations<br />

(Capital Increases, Follow-ons, Initial Public Offerings<br />

(IPOs) and Rights Issues).<br />

Since inception, we have advised many of the major<br />

private equity funds including Apax, Bain, Blackstone,<br />

Cinven, CVC, EQT, General Atlantic, KKR, Oaktree,<br />

Permira and Warburg Pincus as well as corporates<br />

including Brenntag, Countryside, Scout24, Virgin Active,<br />

NN Group, bpost and Ziggo to name a few. Our platform<br />

is further augmented by our long-standing alliance with<br />

Solebury Capital, the market leading equity advisory firm<br />

in the Americas.<br />

Our only clients are shareholders, issuers and their<br />

management. We do not do anything the investment<br />

banks do (Research, Trading, M&A, Sales,<br />

Underwriting). We are therefore completely free from<br />

conflicts of interest when advising our clients. STJ is<br />

the only advisor with a 100% completion record on<br />

IPOs over the past 3 years (vs. an average 65% for<br />

the market). In addition we have consistently delivered<br />

optimised pricing, as measured by 1st day volatility.<br />

We have been pioneers in our field, successfully<br />

introducing unique techniques and processes including<br />

the first competitive IPOs and the first rights issue<br />

auction process. Perhaps, most importantly our unique<br />

and proprietary Investor Database technology allows us<br />

to substantially deepen the pool of available capital to<br />

our clients. This combined with our best in-class<br />

experience enables us to deliver transparency and<br />

control to issuers and shareholders ensuring the goal<br />

of certainty of execution, an optimised price which is<br />

consistent with a healthy and stable after market.<br />

The first half of 2017 has been very busy, we have<br />

successfully raised €2.1bn of completed advisory<br />

mandates in EMEA, ¥116bn in Japan and our USA<br />

alliance partner Solebury Capital has advised on<br />

$15.8bn of completed mandates.<br />

SELECTED 1H 2017 EMEA & ASIA /<br />

JAPAN HIGHLIGHTS:<br />

$611m raised for Sushiro Global Holdings Ltd - the<br />

largest Japanese IPO in the 1H of 2017 and the largest<br />

dining / lodging company to list in this region since 2001.<br />

£178m raised for Global Ports PLC - initially a failed IPO<br />

attempt in 2015 (in which STJ wasn’t involved), the IPO<br />

of GPH is the first international only listing of a company<br />

founded in Turkey. STJ’s management of the investor<br />

education process (as well as a flexible syndicate structure)<br />

helped validate the final outcome of a re-domiciliation to<br />

the UK with the right set of banks (having investigated 4<br />

different listing venues). Our clear advice to include retail<br />

through a dedicated intermediaries offer proved very<br />

valuable representing c. 11% of allocations.<br />

£321m sale of Countryside PLC - on behalf of<br />

Oaktree, our third mandate on Countryside having<br />

previously advised on the IPO and first follow-on. This<br />

transaction was highly unusual in that it was a rare ‘above<br />

market’ placement, priced at a 2% premium to close vs. a<br />

market average discount of 4.6% for ABBs in 1H 2017.<br />

£249m sale of Wizz Air PLC - on behalf of Indigo allowing<br />

Indigo to fully exit its position. This was the 1st UK block<br />

since the General Election. The sale came at a tight 4.3%<br />

discount to market price (which was at an-all time high).<br />

€73m raised for Waberer’s - on the Budapest Stock<br />

Exchange, the first IPO over €50m in Hungary for 19 years<br />

despite extremely difficult market conditions with concurrent<br />

IPOs being pulled or trading down significantly. Our advice<br />

helped the Company complete a successful listing which<br />

otherwise would not have been possible.

John St John<br />

Founder,<br />

Chairman & CEO<br />

Marcus Le Grice<br />

Deputy CEO<br />

STJ ADVISORS<br />

Please feel free to contact us if you wish to discuss any of the above.<br />

STJ ADVISORS Eagle House,<br />

108 – 110 Jermyn Street London SW1Y 6JE<br />

Tel: +44 (0) 207 8712 993 www.stjadvisors.com

Regulatory Hosting Firm<br />

of the Year - UK<br />

Sturgeon Ventures is the pioneer of regulatory<br />

incubation and mentoring start up financial services<br />

companies. We want to share a corporate piece of<br />

UK legislation for all start-ups.<br />

The U.K. Criminal Finances Act (“CFA”) received<br />

Royal Assent on 27 April 2017. The CFA contains two<br />

new criminal offences aimed at corporates – the<br />

failure to prevent the facilitation of U.K. tax evasion,<br />

and the failure to prevent the facilitation of foreign<br />

tax evasion – it is expected that these provisions will<br />

become effective later this year.<br />

These rules now mean that the conduct of persons<br />

associated with a company i.e. its employees,<br />

customers, suppliers, contractors, agents and<br />

advisors could bring a strict liability for the company.<br />

This increases the importance of having a thorough<br />

knowledge of your business partners and having a<br />

well-developed system of risk management policies<br />

and procedures. The CFA covers all forms of<br />

incorporated entities and those entities that are found<br />

guilty will face unlimited financial penalties. An<br />

entity would need to have reasonable prevention<br />

procedures in place to act as a defence against<br />

prosecution in the event a tax evasion facilitation<br />

charge is brought against them<br />

The CFA received royal assent on 27 April 2017. It<br />

introduces two new corporate criminal offences to<br />

tackle the failure to prevent the facilitation of tax<br />

evasion. The expectation is that these offences will<br />

become effective via treasury regulations later this<br />

year.<br />

There are no specific thresholds or de-minimis<br />

requirements and these provisions apply to every<br />

company and partnership in the U.K. and overseas<br />

(foreign entities in scope only if they have a U.K.<br />

nexus).<br />

These rules make it much easier for businesses to be<br />

prosecuted if they are engaged in the facilitation of tax<br />

evasion, as it will no longer be necessary to prove that<br />

the board (or top level management) was aware of the<br />

tax evasion.<br />

The only defence for a business against<br />

prosecution is that it had reasonable prevention<br />

procedures in place when the facilitation of the<br />

tax offence is committed or it was unreasonable<br />

(due to size and complexity) to expect the<br />

business to have any prevention procedures<br />

in place.<br />

The new offences<br />

The CFA introduces a new strict liability corporate<br />

offence of failing to prevent the facilitation of tax<br />

evasion. This could occur either in the UK or<br />

overseas and therefore has extraterritorial application.<br />

For a UK evasion event to be committed there must<br />

be (a) a criminal offence at the taxpayer’s level (b) a<br />

criminal facilitation of this offence by an associated<br />

person (an associated person can be an employee or<br />

agent or any other person who performs services for<br />

or on behalf of the company) and (c) there has been a<br />

failure by the relevant body (company or partnership)<br />

to prevent its associated person from committing the<br />

criminal facilitation.<br />

Facilitation is widely defined to include aiding,<br />

abetting, counselling or procuring tax evasion, as well<br />

as being knowingly concerned in, or taking steps with<br />

a view to, the fraudulent evasion of a tax by another<br />

person.The foreign offence, on the other hand,<br />

requires a “U.K. nexus” and “dual criminality” to be<br />

present. U.K. nexus exists where the relevant body is<br />

either incorporated or formed in the U.K. or operates<br />

in the U.K. through a branch or where an associated<br />

person is in the U.K. at the time the criminal act<br />

facilitating the evasion of foreign tax takes place.<br />

The dual criminality condition will be met where both<br />

the actions of the taxpayer itself and of the associated<br />

person would be an offence under U.K. law and where<br />

the overseas jurisdiction also has equivalent offences<br />

at both the taxpayer and facilitator level.<br />

Reasonable prevention procedures<br />

Businesses are reviewing their existing policies and<br />

procedures, both in the U.K. and overseas, to ensure<br />

that they have reasonable prevention procedures to<br />

defend themselves from any potential prosecution.<br />

Per HMRC guidance, what constitutes reasonable<br />

prevention procedures is mainly informed by six<br />

guiding principles.

STURGEON<br />

VENTURES<br />

SEONAID<br />

MACKENZIE<br />

1. Risk Assessment<br />

This is the most important guiding principle. The<br />

business will need to assess (now) the nature and<br />

extent of its exposure to the risk of criminal facilitation<br />

of tax evasion in relation to its stakeholders.<br />

2. Proportionality of Risk-based<br />

Prevention Procedures<br />

Actions, if any, required from the risk assessment<br />

exercise will need to be balanced depending on the<br />

size and complexity of the business. HMRC is clear in<br />

its guidance that burdensome procedures with a view<br />

to eliminating all risks are not required.<br />

3.Top Level Commitment<br />

Messaging from the top should be timely and clear<br />

which should be woven into the risk management<br />

fabric of the business. Top management should lead<br />

from the front in making sure that everyone that works<br />

in and with the business is made aware of the risks<br />

and the consequences of non-compliance.<br />

4.Due Diligence<br />

Business leads should ensure that there are<br />

procedures in place to conduct appropriate diligence<br />

on persons who perform services for and on behalf<br />

of the organisation to mitigate potential risks.<br />

5.Communication (including training)<br />

Businesses should communicate the policies in<br />

relation to the facilitation of tax evasion and ensure that<br />

these are understood throughout the organisation. This<br />

should be done through regular training of the staff and<br />

the key stakeholders of the business.<br />

6.Monitoring and Review<br />

Regular monitoring and review by top management<br />

and business leads should be built into the risk<br />

management framework. The results of the review<br />

should be documented and variations to and from the<br />

policies and procedures should be addressed.<br />

The very first step will be for businesses to understand<br />

the law and how this impacts their business. If action is<br />

required, it needs to be immediate (given the rules are<br />

likely to be in force later in the year) and policies and<br />

procedures de-risking the business from a potential<br />

prosecution will need to be developed and<br />

implemented at the earliest opportunity.<br />

Senior members of the business would need to take<br />

ownership of the project and assess the risks and<br />

identify the existing gaps in policies and procedures<br />

currently in place. Policies around regular engagement<br />

with staff and stakeholders will need to be put in place.<br />

Prevention...........<br />

It is critical that all actions taken and the results are<br />

properly documented such that if ever the business is<br />

to be challenged on grounds of facilitating tax evasion<br />

under these rules they are in a position to demonstrate<br />

the work done in this area to mitigate their risks by<br />

having the documents to hand.<br />

However, if the business is unsuccessful in<br />

demonstrating to the satisfaction of HMRC (or<br />

ultimately the courts) that they have taken all steps<br />

to limit the facilitation of a tax evasion offence and an<br />

investigation were to start that will be a different ball<br />

game all-together.<br />

Please note this is only guidance not advice and you<br />

should seek advice on your own process and<br />

procedures from your Accountant and Legal Counsel<br />

Sturgeon Ventures LLP<br />

Linstead House<br />

2nd Floor<br />

9 Disraeli Road<br />

London SW15 2DR<br />

www.sturgeonventures.com<br />

hello@sturgeonventures.com<br />

Implementation<br />

Implementation may not necessarily be a<br />

time-consuming exercise for smaller organisations.

Harwood Hutton is our<br />

Business and Tax Advisory<br />

Firm of the Year 2017<br />

The award recognises the exceptional talent within the firm and its reputation, built over several decades, for<br />

delivering intelligent and practical advice that is often innovative and always bespoke.Harwood Hutton is a<br />

multi-disciplinary firm of chartered accountants and tax advisers with offices in central London and<br />

Beaconsfield, not far from Heathrow. We serve clients from all over the world and across a variety of sectors.<br />

One of the attractions of working with Harwood Hutton is the fully supportive, personal service: Our clients<br />

benefit from far more ‘partner time’ than they might get at one of the big ‘City’ firms. They also enjoy rates that<br />

are vastly more competitive. Harwood Hutton has specialists in the M&A discipline acting for purchasers<br />

looking to acquire businesses, vendors looking to sell, start-ups seeking capital and established businesses<br />

wanting to restructure their operations.<br />

In transaction support assignments, the firm provides financial<br />

due diligence reports to clients as diverse as owner-managed<br />

businesses and quoted international clients. Corporate finance<br />

advisory assignments include acting as lead adviser on<br />

transactions and running sale auction processes.<br />

Harwood Hutton guides businesses assuredly through the<br />

various steps in transactions, which can include: due diligence;<br />

business valuation assessments; review of the structure of the<br />

transaction; agreeing an offer and putting a Non-Disclosure<br />

Agreement and Heads of Terms in place; exclusivity/ lock-out<br />

agreements; negotiating the transaction documents and<br />

completion of the acquisition.<br />

Over the years, we have helped scores of clients with their<br />

business plans and then advised on the merits of different<br />

forms of business finance, whether debt or equity. The<br />

principals of the firm have built strong relationships with banks,<br />

angels and mid- market private equity houses.<br />

Adam Stronach has extensive experience advising businesses at different<br />

stages of their development He combines great technical knowledge with a<br />

highly personalised service<br />

Adam Stronach<br />

Phone: 01494 739500<br />

Web: www.harwoodhutton.co.uk<br />

Email: adamstronach@harwoodhutton.co.uk

Business & Tax Advisory<br />

Firm of the Year - UK<br />

ADAM STRONACH<br />

Harwood Hutton Limited<br />

The firm also advises on share options and on restructurings using statutory tax reliefs. Our specialist tax<br />

advisory work helps clients gain a clear understanding of the tax implications of the commercial plans they<br />

are looking to implement, and our team can advise on appropriate tax advantaged schemes, such as the<br />

Enterprise Investment Scheme (EIS).<br />

One of the first questions we are asked by both buyers and sellers is “what’s the business worth?” We are<br />

highly skilled at assisting clients assess the value of unquoted shares and equity in a business. Harwood<br />

Hutton’s corporate finance work is led by Adam Stronach, supported by a team with experience across a broad<br />

range of corporate finance assignments, including those undertaken in both the private and public sector.<br />

Before joining Harwood Hutton in 2004, Adam spent 14 years with Deloitte where he qualified as a chartered<br />

accountant. He personally leads a variety of corporate finance assignments, and his work has included acting<br />

as lead adviser on multi-million pound sale and purchase deals. Adam is also a business valuation specialist<br />

and has given oral evidence on valuation at the English High Court. He has drafted financial due diligence<br />

reports for clients, and helped others with business plans and financial forecasts.<br />

Adam Stronach, pictured with Emma Tredgett from the Harwood Hutton Corporate Finance team, manages both the forensic<br />

accounting and corporate finance divisions of HH<br />

www.harwoodhutton.co.uk

ForbesMA.com | 303.770.6017 | Info@ForbesMA.com<br />

WINNER<br />

Transaction Advisory<br />

Firm of the Year<br />

COLORADO<br />

THE FORBES M+A GROUP is an award-winning mergers and acquisitions advisory firm that<br />

serves buyers and sellers in middle-market transactions. As former entrepreneurs, CEOs and<br />

corporate finance professionals, and with over 150 years of combined experience, we have<br />

deep relationships, experience and expertise with more industries, transaction types, sizes,<br />

structures, motivations and challenges than almost anyone else in the business.<br />

The Forbes M+A Group enjoys working with businesses that stand<br />

out from the pack across diverse industries. Private company<br />

owners from a wide range of businesses turn to Forbes M+A to:<br />

•<br />

Receive hands-on, senior-level leadership and support on every transaction.<br />

•<br />

Benefit from their cross-functional industry knowledge, extensive network of contacts,<br />

and diverse operational and transactional experience.<br />

•<br />

Have a team that has its finger on the pulse of changing market valuations and consolidation<br />

activities.<br />

•<br />

Profit from their professionalism, accountability, and unbiased, objective advice.<br />

•<br />

Have at their disposal a team that understands the market, sees the big picture, and makes<br />

the right decisions for their clients.<br />

OUR SERVICES INCLUDE:<br />

• Business Sales<br />

• Business Acquisitions<br />

• Mergers<br />

• Valuations<br />

• Exit Optimization <br />

ForbesMA.com<br />

BOB FORBES<br />

PRESIDENT<br />

JOHN CLAYBOUGH<br />

MANAGING DIRECTOR<br />

GARY GRANGE<br />

MANAGING DIRECTOR<br />

JIM JOHNSTON<br />

MANAGING DIRECTOR<br />

Our clients see us as their most trusted advisors, dogged<br />

advocates and steadfast partners. They rely on us to exhaust<br />

every strategy, maintain the highest professional and ethical<br />

standards, close transactions against all odds and give them<br />

exactly what they expect—the very best deal possible.<br />

Bob Forbes<br />

BILL NACK<br />

MANAGING DIRECTOR<br />

DAN PELLEGRINO<br />

MANAGING DIRECTOR<br />

TOM SCHMIDT<br />

MANAGING DIRECTOR<br />

JON WILEY<br />

MANAGING DIRECTOR<br />

page xx

Intellectual Property Law<br />

Firm of the Year - Japan<br />

info@ryuka.com<br />

Tel. +81-3-5322-6375<br />

www.ryuka.com<br />

AKI RYUKA<br />

RYUKA IP Law Firm is led by IP<br />

professionals with diverse backgrounds in many<br />

technical fields and expertise in a variety of<br />

jurisdictions. Our clients can always expect a<br />

prompt response, and we have always<br />

demonstrated professionalism to meet our<br />

clients’ needs and expectations.<br />

Our Policy:<br />

Providing clients with proactive suggestions for<br />

obtaining more valid patents.<br />

Our History:<br />

RYUKA has experienced rapid growth since its<br />

founding in 1998. We now serve clients around<br />

the world for patent, trademark, and design<br />

prosecutions, license negotiations, opinions,<br />

and IP litigations.<br />

At RYUKA, we focus on proactive<br />

communication, attention to detail, and rapid<br />

turn-around. It is these values, as well as our<br />

emphasis on client objectives, that have ensured<br />

our continued success and growth. Despite<br />

the global recession, we represented a record<br />

number of patent applications in 2009. During<br />

the course of the year, over two hundred and<br />

sixty patent applications were transferred to us<br />

from various major Japanese<br />

law firms.<br />

Our mission is to be leaders in contributing to<br />

society by protecting the new businesses of our<br />

clients.<br />

Technical Expertiese:<br />

Our key practice areas include patents,<br />

trademarks, copyrights, licensing, designs, utility<br />

models, and litigation, with areas of technical<br />

specialty in electronics, telecommunications,<br />

software, optics, mechanical engineering,<br />

semiconductors, electronic materials, and<br />

chemicals.<br />

International IP Services:<br />

In cooperation with our international associates,<br />

we assist our clients in filing applications all<br />

over the world. Our international associates are<br />

amongst the most respected firms in the world.<br />

Patent Prosecution:<br />

In addition to having the legal skills required to<br />

practice patent law, our patent attorneys have<br />

significant experience as professional engineers<br />

and scientists in their respective fields.<br />

Here is a sample of services offered by our<br />

patent prosecution team:<br />

* Conducting prior art searches<br />

* Preparing patent applications<br />

* Providing legal consultation on the<br />

strengths and weaknesses of a patent<br />

* Prosecuting interference contests<br />

to resolve invention priority<br />

* Drafting and negotiating license agreements<br />

Patent Visualization:<br />

Patent visualisation is an inventing strategy<br />

aimed at systematically developing ideas from a<br />

very early stage to optimise the chances of filing<br />

patent applications at the critical time before<br />

market growth.<br />

Patent Translation Services:<br />

RYUKA offers English-to-Japanese translations<br />

of the highest quality at a reasonable cost.<br />

Litigation:<br />

RYUKA is qualified for IP litigation in Japan. We<br />

routinely represent foreign clients at the Tokyo<br />

district court, the Osaka district court and the IP<br />

High Court in patent infringement cases.<br />

Our TEAM:<br />

RYUKA currently has 114 employees<br />

Attorneys 34<br />

Patents<br />

Electronics, Software 14<br />

Mechanics, Optics 5<br />

Chemical, Biotechnology 5<br />

Trademarks 4<br />

Designs 3<br />

includes overlaps<br />

Number of Applications Newly Represented<br />

The total number of domestic and foreign applications per<br />

year for patents, utility models, designs, and trademarks by<br />

both national and foreign applicants,<br />

*International applications into or out of Japan are based<br />

on the nationalization date, pending applications transferred<br />

to our firm are based on the date of transferring, and all<br />

others are based on their actual filing date.<br />

Recent Recognition:<br />

Patent & Trademark Law Firm of the Year in Japan, Corporate<br />

INTL<br />

Rising Starin Japan IP, ILASA<br />

Top 5 Japan Patent Firm, Asia IP Awards<br />

Top 10 Japan Patent Firm,<br />

Asia IP Patent Survey<br />

Top 20 Japan Patent Firm,<br />

Managing IP<br />

Top 20 Japan Trademark Firm, Managing IP<br />

We appreciate the trusts our clients showed. We will strive<br />

to learn and improve our services for the benefit of our<br />

clients.

Banking & Finance Law<br />

Firm of the Year - Austria<br />

JANK WEILER<br />

MAXIMILIAN WEILER<br />

OPERENYI RECHTSANWÄLTE<br />

The Austrian law firm Jank Weiler Operenyi Rechtsanwälte GmbH<br />

(JWO) was established in the year 2011 by Andreas Jank and Maximilian<br />

Weiler. Before setting up JWO, both Andreas and Maximilian had longterm<br />

careers in Austrian, as well as international, corporate law firms (as<br />

associates and junior partners). Both therefore offer a high level of expertise<br />

in the practice group areas JWO offers, namely corporate/M&A,<br />

banking/finance, litigation, real estate and private clients.<br />

With the arrival of the new partner Alexander Operenyi in March 2014,<br />

the local and international corporate and M&A practice of JWO was<br />

further strengthened. Alexander joined the firm after nine years at<br />

Freshfields (Vienna/London), where he worked on some of the largest<br />

Austrian/international M&A transactions as well as on high-end corporate<br />

litigation matters as lead senior associate.<br />

In 2017 JWO joined the global network Deloitte Legal with more than<br />

1,700 lawyers in 76 countries.<br />

Main areas of practice<br />

Corporate/M&A: JWO advises corporations in all areas of corporate and<br />

business law matters. The team has long-term experience and broad<br />

expertise in advising both national and cross-border M&A, private equity,<br />

venture capital and joint venture<br />

transactions within different industrial sectors. JWO<br />

covers the structuring of transaction processes, the preparation and<br />

execution of due diligence exercises, as well as the<br />

drafting and negotiation of the respective transaction<br />

documentation.<br />

Banking and finance: JWO advises financial<br />

institutions and insurers both within the applicable regulatory framework<br />

as well as in connection with general banking and insurance<br />

contract law matters. One of the core competences is the provision of<br />

legal as well as strategical advice with respect to national and<br />

cross-border (project) financing and financial restructuring.<br />

Real estate:<br />

JWO provides advice and transactional service with respect to the<br />

acquisition, financing and development of real estate. The client portfolio<br />

includes private and institutional lessors. In this respect JWO provides<br />

support in all areas of the tenancy law and in the structuring of claim<br />

management.<br />

Litigation:<br />

JWO represents corporations and private clients in front of court and<br />

within arbitration proceedings and with respect to alternative conflict<br />

settlement. In addition, JWO handles the structuring and execution of<br />

claim management and claim enforcement.<br />

IP/IT, Data Protection:<br />

JWO advises on all fields of intellectual and industrial property rights,<br />

information technologies, unfair competition law and data protection law.<br />

Developing and optimizing adequate IP strategies, filing, managing and<br />

licensing of intellectual property rights, executing IP related due-diligence<br />

exercises as well as preparation and examination of IT-policies and<br />

IT-contracts, examination of data protection strategies, data protection<br />

policies and processor agreements belong the core competences.<br />

Private clients:<br />

JWO advises and supports national and international family<br />

offices, foundations and high-net-worth individuals in all areas of wealth<br />

and private asset management, in particular with respect to the<br />

structuring and execution of strategic investments. The<br />

flexible and personal approach coupled with close cooperation with the<br />

tax experts of Deloitte and the global network of law firms of Deloitte<br />

Legal allows JWO to offer clients the benefit of a one-stop-shop service.

Cross-border Transactions<br />

Legal Advisor of the Year -<br />

France<br />

ARMAND W. GRUMBERG<br />

SKADDEN<br />

FRANCE<br />

Skadden’s Paris office offers a wealth of experience in<br />

corporate matters, mergers and acquisitions, dispute<br />

resolution, regulatory, tax and employment law. French and U.S.<br />

qualified attorneys advise French, European and multinational<br />

companies, financial institutions and investment funds on a range of<br />

legal matters, notably on highly complex cross-border transactions.<br />

The Paris office serves as one of Skadden’s major hubs for<br />

pan-European work, and our attorneys are experienced in working<br />

with the various cultural differences that frequently arise in<br />

transactions involving multiple jurisdictions.<br />

Skadden has built a strong reputation in the French market, tailored<br />

to address our client’s needs.<br />

Our dedicated teams:<br />

- have high-caliber project management skills and a ‘can-do’ attitude;<br />

- truly understand a project’s requirements on both a legal<br />

and business level;<br />

- are exceedingly responsive to evolving conditions & deadlines; and<br />

- draw on the depth of resources of Skadden’s international network.<br />

We are at the cutting-edge of innovation on behalf of our clients and<br />

have, in particular, been involved in:<br />

- the very first merger of a French-listed company with and into an<br />

English company under EU cross-border merger rules, in<br />

connection with the combination of Stallergenes and the U.S.<br />

company Greer Laboratories, and the creation of Stallergenes<br />

Greer, a global biopharmaceutical company registered<br />

in England and listed on Euronext Paris;<br />

- the creation of France’s very first trust structure (or fiducie),<br />

in order to guarantee against specific long-term risks<br />

(environmental, health and safety risks, etc.) in the context of the<br />

sale of a subsidiary by a French group (as an alternative to the<br />

traditional escrow mechanism); and<br />

- the incorporation of the first ever French European company<br />

(Societas Europaea) listed on Euronext Paris, as well as the<br />

incorporation of the first ever Societas Europaea in Europe through a<br />

merger involving three separate jurisdictions (France, Germany<br />

and Italy).<br />

Skadden’s Paris attorneys, many of whom are multilingual and<br />

multicultural, are consistently recommended in Chambers Europe,<br />

The Legal 500: EMEA and other legal directories.<br />

ARMAND W. GRUMBERG<br />

Head of Skadden’s European Mergers & Acquisitions Practice<br />

Tel: +33.1.55.27.11.95<br />

Email: armand.grumberg@skadden.com<br />

Armand is the head of Skadden’s European Mergers and<br />

Acquisitions practice and the leader of the firm’s Paris office. He has<br />

extensive experience in strategic and complex cross-border<br />

transactions, including public and private acquisitions, contested and<br />

hostile bids, joint ventures, corporate reorganizations, and capital<br />

markets transactions. He also has extensive experience in<br />

shareholder activist-related matters.<br />

Transactions in which he has recently acted include SCOR SE<br />

in the equity investment by COVEA, Daimler in a series of<br />

disposals in France and Nokia in its combination with Alcatel-Lucent<br />

through a 15.6 billion public exchange offer and public buyout offer<br />

followed by a squeeze-out.

Dealmaker of the Year<br />

Nevada<br />

KATRINA<br />

LOFTIN-WINKEL<br />

Katrina Loftin-Winkel is the co-founder and Managing Partner of M&A<br />

Business Advisors. Katrina has been active in the industry since 1992.<br />

Over the years, she has handled numerous transactions including<br />

privately held businesses of all kinds including manufacturing,<br />

distribution, automotive dealerships and auto related businesses,<br />

franchises, restaurants, service, and hospitality companies. Katrina is<br />

licensed in booth California and Nevada and regular handles<br />

transactions in both states.<br />

M&A Business Advisors (MABA) is a full-service Business Brokerage<br />

and M&A Advisory Firm. MABA specializes in the confidential sale of<br />

privately owned businesses in a wide range of industries including:<br />

Manufacturing, Distribution, Service,<br />

Retail, Health Care, E-Commerce, Construction, Food &<br />

Beverage, Automotive and other industries. In 2017, M&A Business<br />

Advisors was formed by Katrina and her partners, all of whom are top<br />

producers and industry leaders. The Partners joined forces to<br />

collaborate and share their knowledge and experience to best<br />

represent business Buyers and Sellers. The background of our<br />

principle advisors include business owners, top producers, Certified<br />

Business Intermediates (CBI), Certified Business Brokers (CBB),<br />

Business Brokerage Press Industry Experts, Industry Association<br />

Board Members, Presidents and Committee Chairs, Industry<br />

instructors and experts in a wide range of industries. Our principle<br />

advisors have been instrumental in improving the standards<br />

and ethic within our industry.<br />

Katrina has extensive business ownership and sale experience and<br />

has previously owned and operated multiple businesses herself<br />

including an automobile dealership, auto pawn business, a motel,<br />

a marketing company and also owns the Nevada M&A Business<br />

Advisors office.<br />

served on many other community organizations. With her father, she<br />

cofounded and chaired of the River City Classic Car Show, which<br />

raised funds for local charities. Katrina has also served on the<br />

Business License Task Force Committee for the City of Reno and the<br />

Business Broker License committee for the State of Nevada.<br />

Over her 25 years in Business brokerage, Katrina has earned<br />

numerous distinctions including Top Listing Agent and<br />

Top Producer many times over and every year since 2010.<br />

Client comments:<br />

“Katrina is a very professional tenacious lady. Does<br />

everything she says and much more. A very positive<br />

experience.” - Stan Kinder President, Sierra Chemical<br />

Company<br />

“As a CPA, I spent over 30 years in mergers and<br />

acquisitions for public and private companies and<br />

certainly recognize technical expertise and a<br />

professional job “well done”. Katrina exceeded my<br />

expectations in all areas.” Burt Koenig, President<br />

Mountain Papa, Inc.<br />

“You and your staff have probably added 10 years to<br />

our lives. I will continue to send you leads on anyone<br />

I hear that’s interested in buying or selling.”<br />

-Jerry Cail, President, Bear Industries Printing<br />

& Publishing

Excellence in Business Law<br />

Liechtenstein<br />

Dr. Michael<br />

Oberhuber, LL.M<br />

Marxer & Partner<br />

Attorneys-at-Law<br />

Heiligkreuz 6<br />

LI-9490 Vaduz<br />

Phone: +423 235 8181<br />

Fax: +423 235 8282<br />

E-mail: info@marxerpartner.com<br />

Web: www.marxerpartner.com<br />

The Principality of Liechtenstein is a small European<br />

country in the heart of Europe whose economy has been<br />

continuously growing over the years. Its membership in<br />

the European Economic Area (EEA), on the one hand,<br />

and its close links to Switzerland, on the other hand,<br />

have prepared the ground for extensive and prosperous<br />

activities of foreign investors in the industrial, business,<br />

and finance sector. Today Liechtenstein can provide<br />

special qualities as an economic base, mainly because<br />

of the great political stability and the associated legal<br />

continuity, the excellent infrastructure and efficient<br />

administration, and the modern and liberal company and<br />

tax legislation. As a matter of fact, Liechtenstein<br />

has succeeded in acquiring an excellent reputation for its<br />

powerful local trade, its high-tech export industry<br />

consisting of leading-edge technology companies like<br />

Hilti and Ivoclar, and its robust and well-functioning<br />

financial center, the standards of which, as the International<br />

Monetary Fund confirms, meet the latest and highest level<br />

of compliance and proper business conduct and the<br />

sophisticated financial and legal services of which are<br />

highly appreciated by an increasing number<br />

of international clients.<br />

Marxer & Partner Attorneys-at-Law was very much<br />

involved in shaping the destiny of Liechtenstein as a<br />

financial center and has been growing with it side by<br />

side. Established in 1925, it is the oldest and largest law<br />

firm in Liechtenstein, having 15 partners, three<br />

of-counsels, 11 associates and a supporting staff of about<br />

60 paralegals and administrative staff. Of all firms<br />

providing legal services to a demanding international<br />

clientele Marxer & Partner has certainly become the most<br />

renowned in Liechtenstein. Since many years the law firm<br />

has focused its activities on the fields of corporate law,<br />

capital markets, M&A, tax, as well as trust and estate<br />

including foundations. The firm provides in-depth<br />

knowledge and excellent advice in these particular<br />

fields to its international client base. Marxer & Partner's<br />

experienced corporate litigation division which has<br />

successfully represented clients in litigation and<br />

international arbitration proceedings completes the<br />

scope of services provided to clients. Partners of the law<br />

firm are recommended as experienced arbitrators for<br />

complex arbitration proceedings. No wonder that Marxer<br />

& Partner is continuously rated as a top tier firm. The firm<br />

represents Liechtenstein at Lex Mundi, a worldwide<br />

association of independent law firms.

Project & Construction<br />

Management Firm Of The Year Asia<br />

RICHARD MOH<br />

Moh and Associates, Inc.<br />

MAA Group Consulting Engineers<br />

School, Stadium and Gymnasium, Hospital, Laboratory,<br />

Theater, Library, Factory, Residence, Shopping Center,<br />

Founded in 1975, MAA is a leading engineering and<br />

consulting service provider in the East and Southeast<br />

Asian region with a broad range of focus areas<br />

including infrastructure, land resources,<br />

environment, buildings, and information technology.<br />

MAA employs over 1200 professionals(including over<br />

40% with Master’s or Doctoral degrees, and over 41%<br />

with local professional licenses), with offices in the<br />

Greater China Region (Beijing, Shanghai, Chengdu,<br />

Hong Kong and Taiwan) and Southeast Asian Region<br />

(Bangkok, Singapore and Yangon), creating a strong<br />

professional network in East and Southeast Asia<br />

To meet the global needs of both public and private<br />

clients, MAA has developed sustainable engineering<br />

solutions - ranging from conceptual planning, general<br />

consultancy, engineering design, to project<br />

management.<br />

MAA has accumulated over 40 year’s execution<br />

experience for various types of construction works<br />

including providing Project & Construction Management<br />

(PCM) Services from planning, design, procurement to<br />

construction and project handover phases throughout<br />

the construction project lifecycle. Our scope of services<br />

range from Feasibility Study, Site Investigation,<br />

Masterplan Review, Design Review, Procurement and<br />

Tendering, Construction Supervision and Contract<br />

Management,Commission & Operation Testing and<br />

Existing Works Evaluation, etc. MAA is able to provide<br />

its clients with integrated solutions by offering a wide<br />

variety of services. MAA has provided PCM services for<br />

various types of commercial and public works, including<br />

Office, Hotel, Mass Rapid Transit System, and Land<br />

Development projects. To enhance our<br />

PCM services, MAA has adopted the use of BIM<br />

to improve project delivery and facilitate project<br />

decision making. From design review to construction<br />

scheduling control, MAA is able to enhance<br />

communication between parties and project owners<br />

through the use of BIM 3-D integrated databases and<br />

visual models.<br />

Mr. Richard Moh is the Executive Senior Vice President<br />

and Special Assistant to the Chairman of MAA Group.<br />

From marketing, management, and corporate<br />

development to financial and business strategies,<br />

Richard has created and led many successful<br />

programs within and outside of the MAA Group<br />

Consulting Engineers.<br />

With experience in leading MAA branches throughout<br />

Asia, he has advanced MAA Group’s global business<br />

presence and capabilities. Since 1998, Richard has<br />

begun his experience in Hong Kong, eventually<br />

establishing cross-regional coordination strategies and<br />

promoted BIM as a project management tool in MAA<br />

Taiwan.<br />

With a MS in civil engineering from Cornell University,<br />

a MBA from Wharton School at the University of<br />

Pennsylvania, and as a Project Management<br />

Professional, he actively strengthens MAA Group’s<br />

international presence and seeks to establish it as an<br />

integral civil engineering consulting group in East and<br />

Southeast Asia.<br />

Richard is also passionate about the civil engineering<br />

community and fostering the next generation of<br />

engineers, serving as the chairman of the Young<br />

Engineer Committee of the Chinese Institute of<br />

Engineers. Richard was also elected as a Director of<br />

the Construction Management Association of the<br />

Republic of China in July 2017.<br />

Phone: +886 2 26961555<br />

Email: maagroup@maaconsultants.com<br />

Web: www.maaconsultants.com

M&A Legal Advisor<br />

of the Year - Vietnam<br />

DN Legal was established in July of 2014 by Ms.<br />

Dao Nguyen. Having managed and helped build law<br />

practices in Vietnam for two international firms as<br />

managing partner and with over 25 years of experience in<br />

Vietnam and in Tokyo and the US, Dao decided to set up on<br />

her own so that she can provide personal attention to only<br />

a number of key clients. Thus, DN Legal’s approach is a<br />

tailored and personal legal service. All work taken on by the<br />

firm will be personally handled by Dao. We work with clients<br />

who require commercial and innovative solutions and<br />

structures to build their businesses in Vietnam.<br />

Dao is the managing partner of DN Legal. She advises<br />

investors on all aspects of doing business in Vietnam. Her<br />

practice includes corporate and M&A, banking and finance,<br />

real estate, energy and infrastructure. She has acted for<br />

developers and the government of Vietnam on several<br />

landmark projects including the first licensed BOT project in<br />

Vietnam. Dao is an US qualified lawyer and she can speak<br />

Vietnamese fluently.<br />

The Asia Pacific Legal 500 2012 notes she<br />

"demonstrates a detailed view of on-going and likely future<br />

legal developments, a strong willingness to understand the<br />

client's needs, combined with a pragmatic approach". Dao<br />

is recognized as a leading lawyer by Chambers Asia in<br />

Corporate/M&A (2008-2014), Banking & Finance (2008-2012)<br />

and Projects & Energy (2010-2014). She is also a leading<br />

lawyer in Real Estate; Financial & Corporate; M&A by the<br />

Asia Pacific Legal 500 (2014); IFLR1000 (2016 & 2017) and<br />

APAC legal awards winners (2016).<br />

With a strong and experienced team, DN Legal advises in all<br />

aspects of corporate, M&A, investment, contract,<br />

commercial, banking, financial, real estate, tax, energy and<br />

infrastructure, capital markets, securities, tax and dispute<br />

resolution in Vietnam.<br />

Contact Details<br />

Company: DN Legal Limited<br />

Phone: +84 28 3827 2418<br />

Address: Level 3, 93 Nguyen Du, Ben Nghe Ward, District 1,<br />

HCMC, Vietnam<br />

Email: info@daonguyenlegal.com<br />

Web address: www.daonguyenlegal.com<br />

The firm was highly recommended for the Corporate Law<br />

Position in Vietnam by Global Law Experts;<br />

recognized as Leading Advisor in Vietnam (2015) and<br />

Corporate Advisor of the year - Vietnam (2016) by<br />

Acquisition International. recognized for Financial and<br />

Corporate (2016) by IFLR1000. The firm also was Boutique<br />

Law Firm and Franchise Law Firm of the Year – Vietnam<br />

(2016) by Corporate Live Wire; awarded a gold medal in the<br />

2017 PSA Competition and was Boutique Law Firm of the<br />

Year (2017) by Lawyer Issue awards.

Dealmaker Of The Year<br />

DAVID BLOIS<br />

M&A ADVISORY<br />

M&A Advisory is a marketing communications specialist with a twenty-year heritage and has a close<br />

understanding of all aspects of ‘people business’ transactions. We invited David Blois to talk us<br />

through the firm and the range of services it offers.<br />

Thanks to our vast experience in the industry, M&A Advisory works for a whole range of clients from<br />

larger firms with £3m plus operating profits down to smaller agencies and provides a top quality<br />

professional service to all. In the last year the firm completed six transactions. Two were sell side<br />

mandates for UK based companies and two were UK buy-side projects. The remaining two were<br />

international sell side mandates for companies in Sweden and Turkey. David discusses the firm’s<br />

service offering in more detail and outlines how the firm aims to offer clients the very highest<br />

standards of service.<br />

“Here at M&A Advisory, we provide a high quality end to end M&A service for our clients including initial<br />

strategic consulting, preparation of information, candidate research, facilitation, negotiation, project<br />

management of the legal and due diligence process and overseeing of any earn out. One of our larger<br />

deals recently was representing Pond Innovation, a digital innovation consultancy, in its sale to PwC.<br />

As a specialist, we have a sound knowledge covering all sizes of agencies across the industry. When<br />

this is combined with solid business experience, not just M&A experience, our successful deal<br />

completion rates soar well above industry norms”.<br />

Thanks to a number of exciting developments in the M&A market, including the increasing number<br />

and breadth of acquirers, David and his team have an opportunity laden future and are determined to<br />

build upon their current success, as he concludes.<br />

“As a firm, we are very positive about the future. We have grown year on year since inception and<br />

clients are coming to us based on our reputation for finding successful solutions. Thanks to changes<br />

in the market it sometimes can be an interesting challenge for us to locate, contact and create<br />

relationships with the broadening range of acquirers, but it also represents an opportunity in terms<br />

of increasing the overall buyer pool for our clients which we are excited to take advantage of’.<br />

Contact Details<br />

Company: M&A Advisory<br />

Contact: David Blois<br />

Contact Email: davidb@mandaadvisory.com<br />

Address: Unit 23, Level 5, St Hilda’s Wharf,<br />

160 Wapping High Street,<br />

London, E1W 3PG<br />

Phone: 0207 680 9849<br />

Website: www.mandaadvisory.com

Deal Sourcing Intelligence<br />

Platform of the Year - USA<br />

Nadim Malik – CEO<br />

SUTTON PLACE<br />

STRATEGIES, LLC<br />

Sutton Place Strategies (SPS) is an award-winning provider of<br />

actionable data and analytics for PE and M&A professionals to<br />

transform their deal sourcing and business development efforts.<br />

The team comprises a group of talented and experienced<br />

professionals, with a passion for turning raw data into<br />

meaningful relationships. Having worked with 200+ sponsors,<br />

lenders, and advisors, SPS knows what it takes to succeed in<br />

M&A deal origination.<br />

After launching the SPS Portal at the end of 2015, SPS has<br />

successfully scaled its offering to various clients’ needs and<br />

requirements. The Portal empowers users, across the M&A<br />

ecosystem, to optimize business travel, uncover new deal<br />

sources, and transform their deal pipelines into an active<br />

resource – just to name a few capabilities. The SPS Mobile<br />

App, which combines the power of the SPS Portal with the<br />

dynamic features of the app, ignites business development on<br />

the go, with numerous proprietary features that are vital for our<br />

increasingly mobile-first world.<br />

SPS also prides itself as an industry-leader in deal origination<br />

knowledge. Each year, the company releases half-a-dozen<br />

articles and features that take a deep dive into various market<br />

trends and insights. On a weekly basis, The Source, SPS’ blog,<br />

doses out deal to LPs, as well as unique ways to build<br />

relationships with new deal sources. The blog is a<br />

compendious source for engaged M&A professionals.<br />

Other thoughtful initiatives undertaken by SPS include its<br />

annual, industry-standard Deal Origination Benchmark Report<br />

(DOBR) released each Fall. The DOBR aggregates market<br />

coverage metrics for all sponsors and specific peer groups.<br />

Clients utilize this report to understand the market at large, as<br />

well as how their firms compare individually. In addition, SPS<br />

compiles its Mezzanine Market Perspective on a quarterly<br />

basis. This unique Perspective focuses on market trends and<br />

transactions in the mezzanine space; shining the spotlight on<br />

an often-underappreciated group. Lastly, every six months,<br />

SPS refreshes its Harvest Report to help M&A professionals<br />

identify which PE portfolio companies may be ready for exit.<br />

This exhaustive report is a great resource for proactively<br />

targeting relevant companies acquired in prior years that are<br />

potentially ready to sell in the near term. Each of these<br />

customizable reports help to expand SPS’ presence in the<br />

market, and further cement its reputation as a data-driven,<br />

forward-looking team.<br />

SPS is also committed to giving back to the magnificent city<br />

that we live and work in – New York. Several times a year, SPS<br />

takes time to volunteer with local charities and other<br />

philanthropic organization. Activities have included working<br />

with the NYC Foodbank, helping to clean up Randall’s Island,<br />

and working at the Ronald McDonald House on the Upper<br />

East Side. Each of these events have afforded an<br />

opportunity to bond and grow as a team, as well as<br />

remind us how invaluable the surrounding community<br />

has been to our existence and continued growth.<br />

Contact Details:<br />

Sutton Place Strategies, LLC<br />

757 Third Avenue, 20th Floor<br />

New York, NY 10017<br />

O: 212.376.6126

Excellence in Restructuring<br />

& Insolvency Law - UK<br />

BIRKETTS LLP<br />

GREG ALLAN<br />

Birketts is a full service, top 100 UK law firm, based in the<br />

East of England. With a rich heritage spanning over 150<br />

years, we’ve built an enviable track record advising<br />

businesses, institutions and individuals in the UK and<br />

internationally. While we operate from four offices<br />

(Cambridge, Chelmsford, Ipswich and Norwich) providing a<br />

wide range of services, the firm shares a common culture<br />

and approach to service delivery.<br />

Over 550 people are engaged in the business and our<br />

lawyers and support staff all have a shared commitment to<br />

deliver the best possible outcome for our clients. We are<br />

large enough to provide specialist expertise in most areas of<br />

the law at a standard that is frequently compared with major<br />

City firms, but not at the expense of maintaining a personal<br />

and tailored service.<br />

We understand the legal, regulatory and commercial<br />

pressures faced by all businesses. Highly responsive and<br />

willing to go the extra mile, we successfully deliver complex<br />

transactions to the most demanding of timetables, focusing<br />

on key issues, demonstrating pragmatism where justified<br />

and, always, protecting the interest of our client.<br />

Many of our lawyers started their careers in major domestic<br />

or international law firms, or have worked in industry. We<br />

expect them to bring not just their legal skills to all our<br />

clients’ transactions and commercial needs, but also their<br />

business experience and knowledge of market practice.<br />

As well as UK deals, our team is experienced in dealing with<br />

international transactions, including acquisitions of overseas<br />

companies and disposals of UK companies to international<br />

buyers.The team also continues to advise our clients on a<br />

range of other transactions including an international sale<br />

and subsequent investment in a manufacturing company in<br />

the UK, the domestic purchase of multiple residential and<br />

leisure facilities across the UK and investment in the<br />

technology sector.<br />

While international transactions are certainly prevalent<br />

in the work Birketts handles, at the core of our corporate<br />

deal activity are domestic transactions, both regionally and<br />

nationally. We advise our clients across a number of<br />

specialist sectors, including family owned businesses,<br />

leisure and tourism, logistics and road transport, strategic<br />

land development and technology.<br />

Greg Allan, a Partner in Birketts’ Corporate Team,<br />

specialises in corporate finance, acquisition and secured<br />

finance, as well as corporate business recovery work. Greg’s<br />

Restructuring and Insolvency Team advises on all issues<br />

arising from corporate and personal distress, covering the<br />

following service areas:<br />

• Acquisitions / Disposal of distressed accounts,<br />

• Bankruptcy and Individual Voluntary Arrangements,<br />

• Restructuring and Insolvency advice to both<br />

directors and creditors.<br />

Our specialisms include:<br />

Formal insolvencies<br />

• Administrations<br />

• Receiverships<br />

• Liquidations<br />

• Pre-packs<br />

• Bankruptcies (winding-up petitions)<br />

• Advising insolvency practitioners<br />

• Advising lenders<br />

• Advising creditors<br />

• All forms of insolvency litigation and dispute resolution<br />

• Solvent liquidations (members’ voluntary liquidation)<br />

Restructuring<br />

• Refinancing<br />

• Debt and equity restructuring<br />

• Debt for equity swaps<br />

• Voluntary arrangements<br />

• Asset disposals / acquisitions<br />

• Work-outs and turnarounds<br />

• Tax considerations<br />

Please contact Greg Allan on greg-allan@birketts.co.uk<br />

or visit www.birketts.uk/about-us for more information.

Excellence in Tax Consultancy<br />

Services - Poland<br />

Bartosz MIŁASZEWSKI<br />

RSM POLAND<br />

RSM POLAND<br />

We support our clients at each and every stage of conducting business activity<br />

RSM Poland is a member of RSM, the world’s 6th largest network of independent advisory and<br />

auditing companies, with over 800 offices in 120 countries, employing over 41,000 professionals<br />

worldwide. We are wherever your business needs us.<br />

Our company is shaped by our clients whose requirements always take priority. Due to close<br />

cooperation, we are able to understand our clients’ businesses, strategies and objectives. It is the deep understanding<br />

of your requirements that enables us to anticipate new opportunities and<br />

challenges, and ensure comprehensive services – exceeding your expectations. We care for our<br />

clients’ interests both in domestic and international markets, based on the knowledge and<br />

experience of our experts worldwide. To our clients, we deliver services of the highest quality, a<br />

relationship based on trust, as well as solutions which will bring added value to the company.<br />

The RSM Poland team consists of more than 210 professionals – tax advisors, lawyers, statutory auditors, accountants<br />

and consultants who are always ready to support our clients at each stage of their operations. At our<br />

Poznań, Warsaw and Szczecin offices, we provide highest quality services in auditing, accountancy outsourcing,<br />

payroll and reporting, tax and legal advisory as well as transaction advisory and M&A. We also offer comprehensive<br />

assistance in the process of company incorporation and the services of our cross-functional German<br />

Desk. Due to effective and close cooperation within the RSM network, we support our clients in starting up<br />

and operating a business in Poland and,<br />

naturally, wherever they choose to develop it further.<br />

We serve small and medium, rapidly developing companies as well as leading international<br />