Clarksville- Main File

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

COMPREHENSIVE<br />

LABOR ANALYSIS<br />

<strong>Clarksville</strong>-Montgomery County<br />

Economic Development Council<br />

NOVEMBER 2017

CONTENTS<br />

4 ACKNOWLEDGMENTS<br />

5 INTRODUCTION<br />

7 DEMOGRAPHIC PROFILE<br />

8 Population Trends<br />

10 Generation Dynamics<br />

11 Diversity<br />

13 Income<br />

15 Poverty<br />

16 Educational Attainment<br />

17 Stakeholder Themes<br />

18 LABOR FORCE<br />

22 Underemployment<br />

23 Commuting Patterns<br />

28 Stakeholder Themes<br />

30 THE ECONOMY AND JOB PERFORMANCE<br />

30 Industry<br />

34 Regional Business Dynamics<br />

36 Workers<br />

39 Real-Time Data<br />

41 Compensation<br />

43 Stakeholder Themes<br />

44 MILITARY<br />

45 Military Skills in the Civilian Labor Force<br />

52 Stakeholder Themes<br />

54 EDUCATION & TRAINING DEMAND<br />

57 Meeting the Needs of Industry<br />

60 Stakeholder Themes<br />

2<br />

COMPREHENSIVE LABOR ANALYSIS: CLARKSVILLE-MONTGOMERY COUNTY

61 INDUSTRY CLUSTER AND SUPPLY CHAIN ANALYSIS<br />

61 The Region<br />

63 Industry Clusters<br />

65 Supply Chain Analysis<br />

68 Stakeholder Themes<br />

69 PEER REGION ANALYSIS<br />

70 Duo Peer Regions<br />

72 Individual Peer Regions<br />

74 Corporate Investment<br />

75 RECOMMENDATIONS<br />

75 Increase communication and collaboration<br />

76 Attract or grow more creative and technology-based jobs and investment<br />

77 Develop targeted and highly visible strategies to retain exiting military<br />

personnel<br />

78 Create an implementation plan<br />

80 CONCLUSION<br />

82 APPENDIX I: CORPORATE SUPPORT<br />

83 APPENDIX II: INVESTMENT IN CLARKSVILLE-MONTGOMERY<br />

COUNTY<br />

84 APPENDIX III: CLARKSVILLE-MONTGOMERY COUNTY EDC<br />

BUSINESS SURVEY<br />

92 APPENDIX IV: MOC TO SOC CROSSWALK<br />

112 APPENDIX V: DATA SOURCES AND CALCULATIONS<br />

CONTENTS<br />

3

ACKNOWLEDGMENTS<br />

Emsi would like to thank the <strong>Clarksville</strong>-Montgomery County Economic<br />

Development Council, Aspire <strong>Clarksville</strong> Foundation, and the Industrial<br />

Development Board for the opportunity to prepare this report.<br />

The authors would like to thank the many people – representing the organizations listed below,<br />

who provided meeting facilities and hosted focus groups, assisted with scheduling, and offered<br />

valuable data, inputs, and feedback. These organizations’ representatives took the time to meet<br />

with Emsi researchers and provide insight into the <strong>Clarksville</strong>-Montgomery County economy and<br />

region. In addition to these organizations, many <strong>Clarksville</strong> companies participated in surveys,<br />

focus groups, and interviews. A list of these companies can be found in Appendix I.<br />

• Austin Peay State University<br />

• City of <strong>Clarksville</strong><br />

• <strong>Clarksville</strong> Area Chamber of Commerce<br />

• <strong>Clarksville</strong>-Montgomery County School<br />

System<br />

• Fort Campbell Employment Readiness<br />

Program Army Community Service<br />

• Fort Campbell Soldier For Life-Transition<br />

Assistance Program<br />

• Hopkinsville Community College<br />

• Hopkinsville County Government<br />

• Kentucky Regional Workforce<br />

• Montgomery County Government<br />

• Nashville State Community College<br />

• Pennyrile Area Development District<br />

• Robertson County Chamber of<br />

Commerce<br />

• Southwest Kentucky Economic<br />

Development Council<br />

• Tennessee College of Applied<br />

Technology<br />

• Workforce Essentials, Inc.<br />

This study is the result of a group effort. The authors would like to thank our colleagues at Emsi for their assistance<br />

with this study—in particular, Daniel Botkin, Brandon Crouch, and Bethany Hoyt.<br />

Jennifer Hackman, Account Executive<br />

Debbie Maranger Menk, Director of Consulting<br />

Alivia Metts, Senior Economist<br />

James Howard, Research Analyst<br />

4<br />

COMPREHENSIVE LABOR ANALYSIS: CLARKSVILLE-MONTGOMERY COUNTY

INTRODUCTION<br />

Over the past five years, major manufacturing companies have invested<br />

$2 billion in <strong>Clarksville</strong>, creating 3,500 jobs. For a city the size of <strong>Clarksville</strong>,<br />

this is an astounding level of investment that has changed the trajectory<br />

of <strong>Clarksville</strong>’s growth and development. The purpose of this study is to<br />

provide information for the <strong>Clarksville</strong>-Montgomery County Economic<br />

Development Council to use in guiding the direction of this growth and<br />

development.<br />

During the course of this study,<br />

many <strong>Clarksville</strong> leaders from<br />

Fort Campbell, education, and<br />

industry participated in surveys,<br />

focus groups, and interviews. The<br />

results are included at the end of<br />

each section to better understand<br />

the strengths, weaknesses, and<br />

opportunities open to the region.<br />

Through the Chamber of Commerce,<br />

the Industrial Development Board,<br />

the <strong>Clarksville</strong>-Montgomery County<br />

Economic Development Council, and<br />

Workforce Essentials, <strong>Clarksville</strong> has<br />

dynamic and interactive participants<br />

representing all facets of the economy. This group of leaders and level of participation are among<br />

<strong>Clarksville</strong>’s greatest assets.<br />

<strong>Clarksville</strong> has many options for continued development. It has a strong manufacturing base,<br />

substantial downtown and riverfront areas, and a highly regarded educational system, from grade<br />

school through to universities and technical training.<br />

An informal survey of <strong>Clarksville</strong> leaders was telling in the consistency of responses when asked<br />

about the desired direction for <strong>Clarksville</strong>’s future:<br />

“I see <strong>Clarksville</strong>-Montgomery County becoming a town that owns its<br />

manufacturing roots and beginnings of advanced manufacturing but<br />

to also focus on an effort around attracting professional opportunities<br />

Introduction 5

to town. Research has shown that people tend to move to cities with<br />

plentiful amenities. Research also tells us that college graduates<br />

prefer built urban amenities, while the elderly favor natural amenities<br />

and people engaging in technology patents like both. I believe that<br />

we have the infrastructure to do both. With a growing industrial<br />

presence and manufacturing reputation that will only grow, I see us<br />

at a tipping point, in reference to who we are. Should our riverside<br />

development ever take off, alongside the manufacturing growth,<br />

‘Sky’s the limit!’”<br />

Now is an opportune time for <strong>Clarksville</strong> to build on its manufacturing and educational foundations<br />

to increase the number of office jobs, research and development work, entrepreneurial activity,<br />

and options for graduates to remain in the area. Uniformly, these leaders believe that a target<br />

population for Montgomery County should range from 250,000 to 350,000 so that <strong>Clarksville</strong><br />

can retain its hometown feel while supporting a vibrant, diverse economy.<br />

‘We should create enough infrastructure and business so that people<br />

who don’t want to go to Nashville for shopping/entertainment don’t<br />

have to, but we do not need to replicate Nashville. We can highlight<br />

the uniqueness of <strong>Clarksville</strong> with its beautiful greenways, river,<br />

downtown areas. We can make <strong>Clarksville</strong> a destination for people<br />

in Nashville and other parts of Middle Tennessee who want to spend<br />

a weekend or an afternoon exploring. We do not need to recruit lowwage<br />

manufacturing jobs. As <strong>Clarksville</strong> grows, more people will be<br />

required to support that growth (restaurants, service industries, for<br />

instance). They’ll have opportunities to work in the bigger economy.’<br />

(paraphrased for clarity)<br />

<strong>Clarksville</strong> is rich in natural resources, corporate investment and activity, defense spending (Fort<br />

Campbell), and educational opportunities. It is strategically located—along the Cumberland River<br />

and both close enough to Nashville for residents to enjoy the rich entertainment offered there,<br />

yet distant enough to retain its identity. With so many choices for future direction, the goal of this<br />

study is to provide <strong>Clarksville</strong> leaders with information to enable highly focused action in building<br />

<strong>Clarksville</strong>’s identity, supporting infrastructure, and future development.<br />

6<br />

COMPREHENSIVE LABOR ANALYSIS: CLARKSVILLE-MONTGOMERY COUNTY

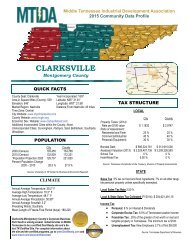

DEMOGRAPHIC PROFILE<br />

The City of <strong>Clarksville</strong> is situated within Montgomery County in middle<br />

Tennessee. Located only 50 miles north of Nashville and easily accessible<br />

from several major interstates, <strong>Clarksville</strong> is strategically located within a<br />

day’s drive of 76% of major U.S. cities. This scenic region is a prime area<br />

for business and commerce with an array of metropolitan amenities and<br />

year-round attractions with its rich history and culture.<br />

KEY HIGHLIGHTS<br />

• Strong population growth in <strong>Clarksville</strong> and Montgomery County<br />

• The share of millennials is above the national average for an area of its size<br />

• <strong>Clarksville</strong> and Montgomery County resemble the country with respect to racial<br />

diversity.<br />

• Average earnings are 23–32% below the national average, depending on regional<br />

geography<br />

• High levels of poverty in <strong>Clarksville</strong> and 10-county region but below the national<br />

average in Montgomery County<br />

• Share of residents holding a bachelor’s degree or higher is below the national<br />

average<br />

Demographic Profile 7

POPULATION TRENDS<br />

<strong>Clarksville</strong> is home to over 150,000 people and comprises nearly 77% of the Montgomery County’s<br />

total population. The city and the county have experienced solid population growth over the past<br />

decade—growing at annual average rates of 2.9% and 2.5%, respectively. The 10-county region<br />

boasts over 500,000 residents; however, it experienced sluggish population growth during the<br />

same period, just over 1% annually. Table 1 and Figure 1 summarize total population trends over<br />

the past decade.<br />

FIGURE 1: Annual Population Growth, 2006-2016<br />

<strong>Clarksville</strong> Montgomery County 10-county region<br />

8.0%<br />

7.0%<br />

6.0%<br />

Year-over-Year % Change<br />

5.0%<br />

4.0%<br />

3.0%<br />

2.0%<br />

1.0%<br />

0.0%<br />

–1.0%<br />

2006<br />

2007<br />

2008<br />

2009<br />

2010<br />

2011<br />

2012<br />

2013<br />

2014<br />

2015<br />

2016<br />

2017<br />

2018<br />

2019<br />

2020<br />

2021<br />

Sources: Emsi Dataset 2017.3 and U.S. Census American Community Survey, 1-Year Estimates<br />

TABLE 1: Total Population Trends, 2006-2016<br />

GEOGRAPHY<br />

POPULATION<br />

COMPOUND ANNUAL<br />

POPULATION GROWTH<br />

2006 2011 2016 2006-2011 2011-2016<br />

<strong>Clarksville</strong> 113,317 136,237 150,280 3.8% 2.0%<br />

Montgomery County 153,052 176,664 195,739 2.9% 2.1%<br />

10-county region 444,189 480,890 503,769 1.6% 0.9%<br />

Sources: Emsi Dataset 2017.3 and U.S. Census American Community Survey, 1-Year Estimates<br />

8<br />

COMPREHENSIVE LABOR ANALYSIS: CLARKSVILLE-MONTGOMERY COUNTY

The map below illustrates total migration flows in and out of Montgomery County in 2015.<br />

Negative numbers (in blue) indicate a net outbound of Montgomery County residents while<br />

positive numbers (in orange) indicate where current Montgomery County residents came from<br />

in 2015. The largest number of individuals have stayed in Tennessee, moving just southeast of<br />

Nashville and to the Memphis area. The second largest share of residents have moved to Texas,<br />

to Galveston and the Austin area.<br />

Most of the people moving into Montgomery County during 2015 were from right over the border<br />

in Christian County, Kentucky. Tulsa, Oklahoma was a far second, followed by people coming from<br />

El Paso, Texas. Similarities that appear to exist between Montgomery County and these cities are<br />

a manufacturing-rich sector around Tulsa (aerospace and tech) and a military base near El Paso.<br />

These trends look slightly different over the past five years but were consistently similar in 2014<br />

and 2015.<br />

Demographic Profile 9

GENERATION DYNAMICS<br />

One issue facing employers is retirement risk, which is the loss of employees, as well as possibly<br />

the loss of valuable experience and company knowledge. In general, companies that have a long,<br />

stable history are now facing retirement of up to a quarter of their employees in the next few<br />

years. One measure of the risk of retirement turnover is understanding the relative percentages<br />

of millennials and baby boomers in the labor force—the two largest generations living in the<br />

United States today.<br />

The number of millennials (ages 19-35 in 2016) flocking to the region, particularly into <strong>Clarksville</strong>,<br />

is astounding. For a city of its size, the number of millennials residing in <strong>Clarksville</strong> is significantly<br />

above the national average—29% of the total population. The median age in <strong>Clarksville</strong> is 29 and<br />

30 in Montgomery County, compared to 38 in Tennessee and the nation. The share of millennials<br />

in the 10-county region is also significant, at 23%. However, sans Montgomery County, that share<br />

drops to 20% of the total population.<br />

The share of baby boomers (ages 52-70) are much lower—15% in <strong>Clarksville</strong> and Montgomery<br />

County and 19% in the 10-county region. Both generations have been on the rise in this region<br />

over the past decade while prime-age wage earners (those 25-54 years) have been on the decline.<br />

The figures and table below show how each region compares to the national average of an area<br />

of its size and summarizes the breakdown of the generational trends around the region.<br />

FIGURE 2: Millennials: A Comparison to the National Average for an Area of its Size<br />

USA<br />

USA<br />

USA<br />

LO<br />

43,500<br />

<strong>Clarksville</strong><br />

HI<br />

LO<br />

55,100<br />

Montgomery<br />

County<br />

HI<br />

LO<br />

118,000<br />

10-county<br />

HI<br />

FIGURE 3: Generation Breakdown as a Share of Total Population, 2016<br />

Millennials Baby Boomers Prime-age wage earners<br />

87+86+82+83 44+43+42+43 29+28+23+21<br />

<strong>Clarksville</strong><br />

Montgomery County<br />

10-county<br />

U.S.<br />

0%<br />

Source: Emsi Dataset 2017.3<br />

10%<br />

29%<br />

28%<br />

23%<br />

21%<br />

20%<br />

30%<br />

15%<br />

15%<br />

19%<br />

22%<br />

40%<br />

50%<br />

60%<br />

70%<br />

43%<br />

43%<br />

40%<br />

40%<br />

80%<br />

90%<br />

100%<br />

10<br />

COMPREHENSIVE LABOR ANALYSIS: CLARKSVILLE-MONTGOMERY COUNTY

TABLE 2: Generation Breakdown, 10-county Region (2006-2016)<br />

10-COUNTY<br />

REGION<br />

POPULATION<br />

COMPOUND ANNUAL<br />

POPULATION GROWTH<br />

/ PERCENTAGE POINT<br />

DIFFERENCE<br />

2006 2011 2016 2006-2011 2011-2016<br />

Millennials 97,257 107,926 117,840 2.1% 1.8%<br />

Baby Boomers 69,806 86,326 96,251 4.3% 2.2%<br />

Prime-age wage earners 188,448 198,620 202,771 1.1% 0.4%<br />

Millennials 22% 22% 23% 0.5% 0.9%<br />

Baby Boomers 16% 18% 19% 2.2% 1.2%<br />

Prime-age wage earners 42% 41% 40% -1.1% -1.1%<br />

Source: Emsi Dataset 2017.3<br />

DIVERSITY<br />

Diversity in the workforce can be a driving factor in helping businesses appeal to larger markets<br />

and customer preferences. The variety of backgrounds and experiences that can be found in<br />

diverse employee groups often brings more creativity into the workplace. Many local economies<br />

have economic development efforts that seek to attract a diverse population base to increase<br />

local entrepreneurship and grow local creative endeavors, such as in the arts.<br />

FIGURE 4: Racial Diversity: A Comparison to the National Average for an Area of its Size<br />

USA<br />

USA<br />

USA<br />

LO<br />

66,982<br />

<strong>Clarksville</strong><br />

HI<br />

LO<br />

69,009<br />

Montgomery<br />

County<br />

HI<br />

LO<br />

119,630<br />

10-county<br />

HI<br />

Racial diversity is about average in <strong>Clarksville</strong> and Montgomery County, for areas of their size,<br />

but it is below average for the 10-county region. As shown in Table 3, on the next page, only<br />

approximately 24% of citizens in the 10-county region identify themselves as ethnic or racial<br />

minorities, compared to 37% in <strong>Clarksville</strong> and 36% in Montgomery County.<br />

Demographic Profile 11

TABLE 3: Total Population Diversity Trends, 10-county Region (2006-2016)<br />

10-COUNTY<br />

POPULATION<br />

PERCENTAGE POINT<br />

DIFFERENCE<br />

2006 2011 2016 2006-2011 2011-2016<br />

White 79% 78% 76% -1.4% -2.0%<br />

Black 13% 12% 13% -0.3% 0.3%<br />

American Indian or<br />

Alaskan Native<br />

0.4% 0.4% 0.4% 0.0% 0.0%<br />

Asian 1% 1% 1% 0.1% 0.2%<br />

Native Hawaiian or<br />

Pacific Islander<br />

0.2% 0.2% 0.2% 0.0% 0.0%<br />

Two or More Races 2% 2% 3% 0.4% 0.4%<br />

Hispanic, all races 5% 6% 7% 1.1% 1.1%<br />

Source: Emsi Dataset 2017.3<br />

Organizations and communities stand to gain several benefits from having a diverse workforce.<br />

Many firms experience growth in market share and are able to penetrate new markets or experience<br />

greater innovation with increasing diversity. Likewise, many communities have achieved greater<br />

success in attracting creative, skilled talent as their communities grow more diverse.<br />

FIGURE 5: Race/Ethnicity by Region, 2016<br />

White<br />

Black<br />

American Indian or Alaskan Native<br />

Asian<br />

Native Hawaiian or Pacific Islander Two or More Races Hispanic, all races<br />

0%<br />

10%<br />

20%<br />

30%<br />

40%<br />

50%<br />

60%<br />

70%<br />

80%<br />

90%<br />

100%<br />

<strong>Clarksville</strong><br />

Montgomery County<br />

10-county<br />

Source: Emsi Dataset 2017.3<br />

12<br />

COMPREHENSIVE LABOR ANALYSIS: CLARKSVILLE-MONTGOMERY COUNTY

INCOME<br />

Income is generally used as a measure of the economic well-being of individuals and communities.<br />

Montgomery County is on par with the nation for median household income, $53,185 compared<br />

to the nation at $53,889. Only two counties are above (Robertson and Cheatham counties) and<br />

the remainder counties in the region fall significantly below. The most recent recession took a toll<br />

on income levels across the country and effects were felt in this 10-county region.<br />

When adjusted for inflation, a decline in median household income is a result of a fairly flat trend<br />

in wages and salaries from 2010 to 2015 (see Table 4 and Figure 6). Significant drops in wage levels<br />

occurred in 2012, 2013 and 2014. Incomes improved slightly in 2015 but not enough to makeup<br />

for the overall decline.<br />

TABLE 4: Median Household Income by County (adjusted to 2015 dollars), 2010-2015<br />

GEOGRAPHY<br />

MEDIAN HOUSEHOLD INCOME<br />

(ADJUSTED IN $2015)<br />

COMPOUND ANNUAL<br />

GROWTH RATE<br />

2010 2015 2010-2015<br />

Robertson County, Tennessee $55,239 $53,151 -0.8%<br />

Cheatham County, Tennessee $57,158 $51,857 -1.9%<br />

Montgomery County, Tennessee $53,185 $50,344 -1.1%<br />

<strong>Clarksville</strong> city, Tennessee $50,806 $46,947 -1.6%<br />

Dickson County, Tennessee $48,428 $44,680 -1.6%<br />

Trigg County, Kentucky $45,462 $44,083 -0.6%<br />

Stewart County, Tennessee $43,711 $42,023 -0.8%<br />

Todd County, Kentucky $40,205 $40,497 0.1%<br />

Christian County, Kentucky $40,284 $39,521 -0.4%<br />

Houston County, Tennessee $36,672 $39,401 1.4%<br />

Logan County, Kentucky $37,660 $38,570 0.5%<br />

* sorted by highest median household income in 2015<br />

Source: U.S. Census Bureau, 2011-2015 and 2006-2010 American Community Survey 5-Year Estimates<br />

Demographic Profile 13

FIGURE 6: Average Earnings Trends (adjusted in 2015 dollars), 2010-2015<br />

<strong>Clarksville</strong> Montgomery County 10-county region<br />

$50,000<br />

$40,000<br />

$30,000<br />

$20,000<br />

$10,000<br />

$0<br />

2010 2011 2012 2013 2014 2015<br />

Source: Emsi Dataset 2017.3<br />

AVERAGE WEEKLY WAGE<br />

> $805–$871<br />

> $723–$805<br />

> $618–$721<br />

> $566–$618<br />

Christian<br />

Todd<br />

Logan<br />

Trigg<br />

Stewart<br />

Montgomery<br />

Robertson<br />

Cheatham<br />

Houston<br />

Tennessee: $912<br />

Dickison<br />

U.S.: $1,031<br />

14<br />

COMPREHENSIVE LABOR ANALYSIS: CLARKSVILLE-MONTGOMERY COUNTY

POVERTY<br />

Poverty rates are one measure used to gauge the health of regional economies because it is<br />

expected that as the economy grows, so will employment and income growth. Using federal<br />

poverty guidelines, Figure 7 illustrates that poverty rates in the past five years have generally<br />

edged downward throughout the region. Poverty in the 10-county region stands at 16.5% while<br />

the City of <strong>Clarksville</strong>’s overall poverty rate is 17.4%. Montgomery County has one of the lowest<br />

rates in the region at 13.4%. Christian County has the highest at 20.3% and Cheatham County has<br />

the lowest at 10.6%.<br />

Poverty is especially hurtful to children as they can be greatly impacted by hazardous or unhealthy<br />

living conditions, poor nutrition, and other risk factors associated with poverty. These risk factors<br />

may impact physical or emotional development, which may further reduce the acquisition of skills<br />

required for a career and a steady income.<br />

Roughly one in four persons under the age of 18 in the 10-county region is living in poverty. The<br />

region’s childhood poverty rate was approximately 24% in 2015. Montgomery County’s childhood<br />

poverty rate was 18% the same year—far less than the surrounding region. Houston County’s<br />

childhood poverty rate was the highest, at nearly 30% (see Figure 8).<br />

FIGURE 7: Poverty Rates by Geographic Area<br />

(2010-2015)<br />

FIGURE 8: Childhood Poverty Rates by<br />

Geographic Area (2010-2015)<br />

2010 2015 2010<br />

2015<br />

City of <strong>Clarksville</strong><br />

City of <strong>Clarksville</strong><br />

17.4 24.8<br />

10-county<br />

10-county<br />

16.5 23.9<br />

Montgomery County<br />

Christian County<br />

Logan County<br />

Todd County<br />

Trigg County<br />

Cheatham County<br />

Dickson County<br />

Houston County<br />

Robertson County<br />

Stewart County<br />

Montgomery County<br />

13.4 18.4<br />

Christian County<br />

20.3 28.9<br />

Logan County<br />

15.5 24.3<br />

Todd County<br />

19.3 28.1<br />

15.1 Trigg County<br />

26.5<br />

Cheatham County<br />

10.6 16.3<br />

16.4 Dickson County<br />

23.3<br />

Houston County<br />

19.5 29.9<br />

Robertson County<br />

12.3 18.4<br />

15.5 Stewart County<br />

25.2<br />

Source: U.S. Census Bureau, Small Area Income and Poverty Estimates<br />

Demographic Profile 15

EDUCATIONAL ATTAINMENT<br />

Long-term changes in educational attainment causes structural changes in the economy. Regional<br />

increases in educational attainment over the past decade can be considered a structural change<br />

with a permanent impact on the labor market.<br />

Montgomery County contains the largest share of residents who hold a bachelor’s degree or higher<br />

in the 10-county region. The region as a whole sits significantly below the national average, at<br />

30%, for percentage of residents who possess a bachelor’s degree or higher, but is similar to the<br />

national average for associate’s degrees earned. More than 17% of Montgomery County residents<br />

possess a bachelor’s degree (1.1% below the national average), and 8.8% hold an associate’s degree<br />

(1.0% above the national average). Figure 9 illustrates these trends.<br />

FIGURE 9: Educational Attainment (2016)<br />

Less than 9th grade<br />

9th grade to 12th grade High school diploma Some college<br />

Associate’s degree Bachelor’s degree Graduate degree and higher<br />

3+5+29+30+9+16+8+K4+6+30+27+9+17+7+K<br />

5+9+35+24+8+12+7+K<br />

9.4%<br />

16.3%<br />

7.9%<br />

<strong>Clarksville</strong><br />

29.5%<br />

2.8%<br />

5.0%<br />

7.9%<br />

12.3%<br />

23.9%<br />

29.0%<br />

6.7%<br />

4.8%<br />

10-county<br />

8.8%<br />

9.1%<br />

17.1%<br />

3.9%<br />

5.9%<br />

Montgomery<br />

County<br />

35.4%<br />

7.1%<br />

27.3%<br />

29.8%<br />

16<br />

COMPREHENSIVE LABOR ANALYSIS: CLARKSVILLE-MONTGOMERY COUNTY

STAKEHOLDER THEMES<br />

In August and September, Emsi conducted surveys, focus groups and individual interviews with<br />

small to large businesses, educators, military and workforce professionals. These touch points<br />

provided perspectives from people engaged in hiring, preparing and planning for the workforce<br />

relative to various aspects. During these interactions, the following was noted:<br />

• Stakeholders across many dimensions experience <strong>Clarksville</strong>, Montgomery as a young area.<br />

Read another way, more of the workforce here is comprised of younger workers than elsewhere.<br />

The number of retirement age workers is lower here than in other places. It will behoove the<br />

community to seek to better understand its youngest working age cohorts independently from<br />

the rest of the labor force; their skills and abilities, education trends, desired amenities, career<br />

needs and life plans. This should include the major segments of military veterans, Austin-Peay<br />

students and graduates, and those born and raised in the region.<br />

• There is strong agreement that the <strong>Clarksville</strong> school system is an asset. The 1300 student<br />

bump for the 2017-2018 school year exceeded expectations by 700 students. This indicates,<br />

along with a low housing inventory (1,100 in <strong>Clarksville</strong> compared to a 2,300-2,500 norm) that<br />

families are increasingly choosing <strong>Clarksville</strong>. <strong>Clarksville</strong> needs to ensure that the jobs in its<br />

foreseeable future enable families to remain in the region.<br />

• This is a military-friendly area. <strong>Clarksville</strong> is exceedingly proud of its military and seeks to keep<br />

more of those exiting the military. The diversity, youth, discipline and service of those who are<br />

coming out of Fort Campbell are highly valued. There is a recognition that gaps exist between<br />

the ways exiting military are prepared to engage with businesses versus how businesses are<br />

prepared to engage those separating from the military.<br />

In many respects, <strong>Clarksville</strong>-Montgomery leads the 10-county region for positive demographic<br />

trends. It has the most positive migration and generation dynamics, has the most diverse population,<br />

the highest levels of educational attainment and the lowest percentage of poverty. Areas of<br />

concern include income stagnation and ensuring that younger cohorts continue to attain levels<br />

of skill and education consistent with industries’ current and future needs, as well as to support<br />

and build the industry mix that meets the community’s vision for the future.<br />

As will be explored in the following sections, some of <strong>Clarksville</strong>’s distinct segments bear review<br />

for their potential impact on the short and long-term needs of the community.<br />

Demographic Profile 17

LABOR FORCE<br />

Measuring labor utilization is important in that labor is a productive input<br />

to vibrant economies which cannot be stored. As well, productive labor<br />

determines income and for many people, labor is the only income source.<br />

In this section, the region’s workforce will be explored for its composition<br />

and performance using both well known metrics such as participation rates<br />

as well as a newer measure of underemployment.<br />

KEY HIGHLIGHTS<br />

• Labor force participation rates are higher than the national average.<br />

• High levels of underemployment.<br />

• About half of Montgomery County residents leave the county for work—a large<br />

untapped segment of Montgomery County’s workforce include transportation<br />

and material moving jobs along with those working in manufacturing elsewhere.<br />

• Montgomery County is a great location for teachers, while healthcare and business<br />

professionals seek work elsewhere.<br />

The labor force is composed of those people age 16 and over in the civilian non-institutionalized<br />

population, including those classified as unemployed. Understanding labor force composition,<br />

particularly in terms of skills availability, provides some indications of an economy’s dynamism.<br />

For example, some economists project lower rates of economic growth in the coming years driven<br />

largely by the slowing growth of the labor force. Nationwide, slowing labor force growth may be<br />

due to several factors, including but not limited to the following:<br />

• Demographic shifts—increases or decreases in retirees or youth<br />

• Discouraged workers who have dropped out due to a lack of job prospects<br />

• People who stay in school longer or return to school<br />

• Disengaged young adults<br />

18<br />

COMPREHENSIVE LABOR ANALYSIS: CLARKSVILLE-MONTGOMERY COUNTY

Below are the labor force figures pertaining to Montgomery County.<br />

39+2+K 41+36+K 77+23+H<br />

FIGURE 10: 2016 Labor Force Breakdown: Montgomery County<br />

197,290<br />

Population<br />

POPULATION<br />

Total Working Age Population 151,720<br />

Labor Force 80,453<br />

Employed 76,276<br />

Unemployed 4,177<br />

Not in Labor Force (15+) 71,267<br />

Under 15 45,571<br />

The larger 10-county region boasts nearly 216,000 residents in the labor force. More than one-third<br />

of this labor force lives in Montgomery County and over one-quarter resides in <strong>Clarksville</strong> alone.<br />

<strong>Clarksville</strong> is the population center of Montgomery County, as 77% of its population resides there.<br />

It also supplies 74% of its labor force. It makes sense, therefore, that <strong>Clarksville</strong> and Montgomery<br />

County trends closely follow each other—both grew over 2.5% over the past five years, or at an<br />

annual rate of 0.5% (see Table 5).<br />

TABLE 5: Labor Force Trends, 2011-2016<br />

LABOR FORCE<br />

COMPOUND<br />

ANNUAL<br />

GROWTH RATE<br />

STRAIGHT<br />

GROWTH RATE<br />

2011 2016 (2011-2016)<br />

<strong>Clarksville</strong> 57,584 59,075 0.5% 2.6%<br />

Montgomery County 77,267 79,415 0.5% 2.8%<br />

10-county 216,422 215,998 0.0% -0.2%<br />

Source: Emsi Dataset 2017.3 using U.S. Bureau of Labor Statistics, LAUS program<br />

Six of the ten counties experienced declines. Labor force growth in the greater 10-county region<br />

was flat. Montgomery County showed the strongest labor force growth of the 10 counties, adding<br />

over 2,100 people to its available labor force over the past five years.<br />

A slowing growth in the labor force is a trend confronting employers across the country.<br />

Labor Force 19

To better understand this regional phenomenon, we analyzed the labor force participation rate.<br />

This broader measure is another indicator of labor market supply and demand and is defined as<br />

the share of population (age 16+) that is either working or actively seeking work.<br />

Across the country, the labor force participation rate (LFPR) has been steadily declining for the<br />

past 15 years. The trend continues with a net decline of over one percentage point between 2011<br />

(64.8%) and 2016 (63.5%) nationwide. While this may not seem significant, one way to put this in<br />

perspective is that if the LFPR were at historic levels, another 10 million people would be in the<br />

workforce. Economists have attributed the low LFPR to two main factors. First, an unusually slow<br />

recovery which has caused some workers to become discouraged, or disengaged, and permanently<br />

drop out of the labor force—particularly the younger working-age. And secondly, the demographic<br />

shift of an aging workforce and retiring Baby Boomers. Combined, these factors have resulted in<br />

a structural shift in labor force dynamics.<br />

If the workers who make up the decline in labor force participation refuse to enter the workforce<br />

even as job prospects strengthen, there will be no sizable influx of workers as a robust recovery<br />

takes hold—which we are now seeing. Consequently, the unemployment rate will fall much more<br />

quickly than in a typical recovery. Conversely, a cyclical change would occur if these discouraged<br />

and disengaged workers can be drawn back into the labor market by a robust recovery; they will<br />

boost the labor force participation rate (since they would be actively looking for work).<br />

Tennessee has an even lower labor force participation rate than the nation. <strong>Clarksville</strong>’s and<br />

Montgomery County’s rate are exceptionally higher, nearly three percentage points, but trending<br />

downward like the nation. The rate amongst the 16 to 19 age cohort has dropped nearly 8<br />

percentage points (most likely due to the recession) over the five year period, followed by the 25<br />

to 44 age cohort (3 percentage points). Conversely, population has continued to grow at a fast<br />

rate in these age cohorts.<br />

20<br />

COMPREHENSIVE LABOR ANALYSIS: CLARKSVILLE-MONTGOMERY COUNTY

FIGURE 11: Labor Force Participation Rates, 2011-2016<br />

2011<br />

2016<br />

96+95+88+91 93+92+86+89<br />

68.5%<br />

66.4%<br />

67.9% 66.0%<br />

62.7% 61.1%<br />

64.8% 63.5%<br />

<strong>Clarksville</strong><br />

Montgomery<br />

County<br />

Tennessee<br />

U.S.<br />

Source: Emsi Dataset 2017.3 using U.S. Bureau of Labor Statistics, LAUS program<br />

FIGURE 12: Labor Force Participation Rate by Age Group, Montgomery County (2011-2016)<br />

2011<br />

2016<br />

52+92+99+92+74+21+6 43+93+95+90+72+27+8<br />

35.6%<br />

77.3%<br />

79.2%<br />

75.3%<br />

60.1%<br />

22.3%<br />

16 to 19 20 to 24 25 to 44 45 to 54 55 to 64 65 to 74 75 and<br />

over<br />

6.3%<br />

Source: Emsi Dataset 2017.3 using U.S. Bureau of Labor Statistics, LAUS program<br />

Labor Force 21

UNDEREMPLOYMENT<br />

Underemployment describes portions of a population working in careers which do not fully utilize<br />

the education they have received. The underemployed workforce represents a talent pool of<br />

qualified workers available for jobs with more education than required by the jobs they currently<br />

hold. Emsi evaluates gaps between the educational attainment of a regional population and typical<br />

entry level job requirements. Emsi uses detailed regional analysis of deltas between this supply<br />

and demand of education in a market to reveal underemployment. The figure below represents<br />

employment of the population age 25 and older.<br />

Understanding underemployment in <strong>Clarksville</strong> requires further investigation. While the most<br />

obvious explanation, that jobs requiring higher skills are not available, may be true; there are other<br />

reasons that could factor into the gap. One being that exiting military do not have the typical<br />

educational requirements to apply for higher wage jobs but may have the experience to do these<br />

jobs well. Given the prevalence of military, highly educated spouses may be choosing lower level<br />

jobs for flexibility (however, this plays a small role, given recent survey results – only 33% of military<br />

spouses surveyed, work). Another argument could be made that the large number of businesses,<br />

particularly in manufacturing, have jobs available but not the population to support them. Another<br />

potential factor could be that wages are low, despite the education or the experience level required.<br />

The figure below depicts the percentage point difference between share of jobs and people to<br />

fill them by typical entry level education. Negative numbers indicate an oversupply of people<br />

while a positive number represents more jobs than people to fill them. Keeping in mind this is<br />

typical entry level of education, there are not enough middle skill jobs for the amount of people<br />

with these skill levels. There are plenty of people with skills or who want skills to get better jobs<br />

but the jobs are not available.<br />

UNDEREMPLOYMENT IN THE CLARKSVILLE MSA<br />

(difference* between share of jobs and population by typical entry level of educational attainment)<br />

–20% –15% –10% –5% 0% 5%<br />

10%<br />

15%<br />

Graduate Degree and Higher<br />

Bachelor’s Degree<br />

Associate’s Degree<br />

Some college, no degree<br />

High school diploma or equivalent<br />

No formal educational credential<br />

* negative numbers indicate a surplus<br />

Source: Emsi Dataset 2017.3<br />

MORE PEOPLE<br />

THAN JOBS<br />

MORE JOBS THAN<br />

PEOPLE<br />

22<br />

COMPREHENSIVE LABOR ANALYSIS: CLARKSVILLE-MONTGOMERY COUNTY

COMMUTING PATTERNS<br />

Commuting patterns show how far workers travel from their places of residence to their places<br />

of work. This data demonstrates whether there is an adequate supply of workers or jobs within<br />

a given area. For a more concise and directed assessment, commuting patterns were analyzed<br />

for Montgomery County using data from the Census LEHD’s On the Map program. Then, Emsi<br />

proprietary data was analyzed to better understand the skillsets of Montgomery County residents.<br />

FIGURE 13: Concentration of Jobs vs. Net Commuters, 10-County Region<br />

Source: Emsi Dataset 2017.3<br />

Labor Force 23

FIGURE 14: Commuting Patterns, Montgomery County (2015, all jobs)<br />

27+50+87+22+25+25+29+27 23+38+64+19+14+22+28+25 22+28+26+17+12+21+26+24 17+23+22+16+8+19+19+15<br />

W<br />

WHERE MONTGOMERY<br />

COUNTY RESIDENTS WORK<br />

Job Counts by Distance/Direction in 2015<br />

All Workers<br />

NW<br />

4,000<br />

N<br />

34+71+96+54+73+76+65+47 31+58+70+47+57+71+63+45 29+47+48+40+52+62+61+43 26+39+36+31+38+51+52+39<br />

Circles are<br />

at >10 miles,<br />

10-24 miles,<br />

25-50 miles,<br />

TABLE 6: Where Residents from Montgomery County Work within the 10-county Region, 2015<br />

(all jobs)<br />

WORK IN COUNTY<br />

OF RESIDENCE<br />

WORK OUTSIDE COUNTY<br />

OF RESIDENCE<br />

AVG TRAVEL TIME<br />

TO WORK<br />

Cheatham 15% 85% 31.6<br />

Dickson 34% 66% 31.3<br />

Houston 30% 70% 33.4<br />

Robertson 28% 72% 28.9<br />

Stewart 26% 74% 34.4<br />

Montgomery 53% 47% 24.2<br />

Trigg 34% 66% 26.5<br />

Christian 62% 38% 17<br />

Todd 28% 72% 24<br />

Logan 41% 59% 23<br />

Source: U.S. Census Bureau, Center for Economic Studies, On the Map program (2015, all jobs)<br />

Roughly 53% of Montgomery County residents work within the county—a high share compared<br />

to the greater region, while 47% leave the county every day for work. The data show a portion of<br />

Montgomery County residents working as far as Memphis, Chattanooga, and Knoxville, Tennessee.<br />

This can be triggered by the student population, residents working at larger firms (headquarters,<br />

etc), or higher education institutions in those areas.<br />

According to the Census, there are more Montgomery County residents earning at least $21 per<br />

hour than there are jobs paying that wage within the County. Meanwhile, there are more jobs in<br />

Montgomery County that pay less than $7.80 per hour than there are residents who earn that wage.<br />

It stands to reason that the gap is made up of people who work in Montgomery County but live<br />

outside of it. These wage data point to two potential trends worth investigating: whether more<br />

talented workers must leave the area daily, while those with fewer skills who make up a sizable<br />

chunk of the local workforce are unable to live in the area.<br />

FIGURE 15: Net Commuters of Resident Workers, Montgomery County (2016)<br />

JOBS<br />

58,500<br />

RESIDENT WORKERS<br />

(AVAILABLE WORKFORCE)<br />

64,000<br />

NET COMMUTERS<br />

(OF RESIDENT WORKERS)<br />

-5,500<br />

Source: Emsi dataset 2017.3<br />

Labor Force 25

0+2+0+0+0+0+1+3+0+0+3+2+10+7+1+3+2+2+1<br />

Cheatham and Robertson counties both have the largest share of residents working outside their<br />

counties. However, Montgomery County is an employment hub within this 10-county region (see<br />

Table 6).<br />

Emsi proprietary data allows us to look at the data in a different way. Emsi uses place of residence<br />

data derived from the Census LODES data (specifically from Origin and Destination data, Regional<br />

Area Characteristics, and Workforce Area Characteristics data) which Emsi applied to occupation<br />

and job numbers. This data is referred to here as “Resident Workers.” Note that Emsi jobs and<br />

commuting data do not match the Census’ On the Map data (Figure 14). Emsi uses county-level<br />

data while the Census uses drive-time radii.<br />

This data allow us to see the overall number of people commuting into or out of an area. This<br />

is referred to as Net Commuters. The data tells the story further by viewing what occupations<br />

residents hold.<br />

The term “resident workers” defines workers by where they live in comparison to where they work.<br />

“Net commuters” refers to the minimum number of workers who commute in or out of the region<br />

to satisfy the region’s jobs. A positive number (shown in BLUE in the figure on the previous page)<br />

describes net commuters entering a region, while a negative number (shown in RED) describes<br />

net commuters leaving a region. A broader view of the region is illustrated in Figure 13.<br />

Retail and food service type jobs typically comprise the largest share of an area’s workforce.<br />

However, Montgomery County is unique in its concentration of production and management<br />

occupations. This is no surprise considering that manufacturing is the largest private industry<br />

FIGURE 16: Available Workforce, Montgomery County (2016)<br />

Jobs Resident Net Commuters<br />

–2,000<br />

0<br />

2,000<br />

4,000<br />

6,000<br />

8,000<br />

10,000<br />

12,000<br />

Source: Emsi Dataset 2017.3<br />

Retail Sales<br />

Food and Beverage Serving<br />

Cooks and Food Preparation<br />

Information and Record Clerks<br />

Other Management Occupations<br />

Secretaries and Administrative Assistants<br />

Other Office and Administrative support<br />

Business Operations Specialists<br />

Financial Clerks<br />

Supervisors of Sales<br />

Motor Vehicle Operators<br />

Material, Scheduling, Dispatching, and Distributing<br />

Material Moving<br />

Assemblers and Fabricators<br />

Other Installation, <strong>Main</strong>tenance, and Repair<br />

Production Occupations<br />

Metal and Plastic<br />

Construction Trades<br />

Building Cleaning and Pest Control<br />

Health Diagnosing and Treating Practitioners<br />

Health Technologists and Technicians<br />

Teachers<br />

Other Teachers and Instructors<br />

Other Personal Care and Service<br />

Military Occupations<br />

100+0+41 94+73+40 50+36+2061+37+0+0+0+0+22 58+36+30+25+23+23+21 30+18+15+12+10+11+11 0+0+0+0+0+0+0+0+0 31+34+23+27+28+23+20+34+31 14+16+7+10+14+10+9+16+15<br />

31+30 14+150+34 33+29 16+1727+0 27+23 13+6<br />

26<br />

COMPREHENSIVE LABOR ANALYSIS: CLARKSVILLE-MONTGOMERY COUNTY

sector. Figure 16 above shows residents who commute out of Montgomery County for work by<br />

occupation. At least 2,800 residents leave the county for transportation, material moving, and<br />

production occupations, whose median wage is $15 per hour. This is a large untapped segment<br />

of the labor pool in Montgomery County.<br />

Approximately 360 residents seek work elsewhere for business and financial jobs and an additional<br />

360 for healthcare jobs, of which half are registered nurses. On the flip side, there are more teaching<br />

jobs in Montgomery County than there are teachers living in the county by roughly 570.<br />

Labor Force 27

STAKEHOLDER THEMES<br />

When asked generally about their labor force, labor force strengths in this area and future needs,<br />

survey and focus group responses varied.<br />

• 74% of businesses surveyed mentioned they experience difficulty in being able to hire enough<br />

workers. While overall retention rates are strong, with turnover rates as low as 5-8% after<br />

6 months of employment, some manufacturers mentioned difficulty hiring and retaining<br />

production workers with the necessary soft skills. Others discussed the lack of an adequately<br />

skilled workforce. Suggestions for the lack in workforce ranged from people preferring to receive<br />

government assistance, opioid addiction, and segments of the population who simply do not<br />

want to participate in the labor force. As is shown in this report, labor force participation among<br />

young workers is average for those age groups. Two further items to consider as potential<br />

inhibitors to labor force participation are the use of temporary agencies and even without<br />

them, the offer of part-time or contract work as opposed to full-time employment. Survey<br />

respondents indicated that contract or part-time employees made up 18% of the workforce.<br />

This, as well as use of temporary agencies, signals a lack of investment in employees, which<br />

can make attracting highly competent and skilled workers difficult in an already tough labor<br />

market. On the military base, transition program managers suggested that veterans will often<br />

avoid applying for work through staffing agencies, while interview and focus group results<br />

showed that among many manufacturers, using staffing agencies is the first route these<br />

employers take to find production workers.<br />

• A few employers acknowledged that the manufacture of their products is carried out under<br />

difficult physical working conditions (particularly unconditioned environments), and that they<br />

have unpopular policies such as mandatory overtime and weekend work. These conditions<br />

require a unique workforce and specific programs to attract workers. For these, transitions from<br />

retail, service sectors, and military are more difficult as the work environment and demands<br />

do not match expectations.<br />

• For other manufacturers, manufacturing environments and the nature of the work has changed<br />

dramatically, with more mechanized processes and more comfortable working environments.<br />

Unfortunately, the feeling was that the community remains largely unaware about the present<br />

state of these improvements in manufacturing. Employers want the community to encourage<br />

more young workers to consider that their industries provide good working environments<br />

and career paths.<br />

• Small entrepreneurial businesses indicated that they experience positive hiring processes. These<br />

business owners relied on informal social connections to connect with military spouses, Austin<br />

Peay students, and other segments. They also noted that employees, especially the youngest,<br />

needed additional hard and soft skill training once hired. This need was met through informal<br />

mentoring with each new employee. Importantly, mentees of these entrepreneurs can remain<br />

in <strong>Clarksville</strong> and become a part of a more connected and skilled talent base.<br />

• Employers mentioned difficulty connecting rural workers to jobs in <strong>Clarksville</strong>, as well as finding<br />

management skill for companies located in rural parts of the area. This kind of disconnect is<br />

felt in many communities. Strategies to address it range from public transportation, private/<br />

28<br />

COMPREHENSIVE LABOR ANALYSIS: CLARKSVILLE-MONTGOMERY COUNTY

public transportation, broadband availability, and housing options.<br />

• Bus transportation from <strong>Clarksville</strong> to Nashville was highlighted. The system handles 8,000 riders per<br />

month.<br />

• Amongst millennials ages 25-34, a significant group in <strong>Clarksville</strong>, 27% percent hold bachelor’s degrees.<br />

This is six percentage points lower than the national average. Meanwhile, the area’s occupational mix<br />

indicates a demand for people with bachelor degrees while an oversaturation of those with associate<br />

degrees exists. There is, therefore, an opportunity to transition those with some college or an associate’s<br />

degree to occupations requiring a bachelor’s degree.<br />

Labor Force 29

THE ECONOMY AND<br />

JOB PERFORMANCE<br />

INDUSTRY<br />

KEY HIGHLIGHTS<br />

• $5 billion economy<br />

• 13% Job Growth<br />

Top employing industries:<br />

• Government<br />

• Retail trade<br />

• Accommodation and food services<br />

• Health care<br />

• Manufacturing<br />

Important industries that may require attention:<br />

• Textile product mills<br />

• Nonmetallic mineral product manufacturing<br />

• Nursing and residential care facilities<br />

• Machinery manufacturing<br />

Montgomery County has grown into a $4.92 billion economy following exceptional job growth<br />

over the past five years. The largest contributors (with the exception of government) include retail,<br />

followed by manufacturing and health care. <strong>Clarksville</strong> accounted for nearly all job growth and<br />

contributes 86% to the county’s overall gross regional product (GRP).<br />

GROSS REGIONAL PRODUCT (GRP)<br />

$19.3 billion<br />

10-county<br />

$11.53<br />

billion<br />

<strong>Clarksville</strong> MSA<br />

$4.92 billion<br />

Montgomery County<br />

$4.23 billion<br />

<strong>Clarksville</strong><br />

30<br />

COMPREHENSIVE LABOR ANALYSIS: CLARKSVILLE-MONTGOMERY COUNTY

TABLE 7: Job Performance<br />

2011 2016<br />

NUMERIC<br />

CHANGE<br />

COMPOUND<br />

ANNUAL GROWTH<br />

RATE<br />

<strong>Clarksville</strong> 50,863 57,608 6,745 2.5%<br />

Montgomery County 51,647 58,483 6,836 2.5%<br />

10-county 186,351 197,222 10,871 1.1%<br />

Source: Emsi Dataset 2017.3<br />

Manufacturing is the largest private industry sector in the 10-county region, although it is not<br />

Montgomery County’s largest sector. Government, retail trade, accommodation and food services,<br />

and health care are all larger employers than manufacturing in Montgomery County. To understand<br />

Montgomery County’s most critical industries, we measure jobs by their concentration, or location<br />

quotient. Location quotients, or LQ, measures a region’s industry concentration compared to the<br />

nation. We also analyze the region’s gross regional product (GRP), and job growth. The staffing<br />

patterns of these critical industries can be used to identify driver occupations.<br />

FIGURE 17: Share of Total Jobs by Region, 2016<br />

<strong>Clarksville</strong> Montgomery County 10-county<br />

0%<br />

5%<br />

10%<br />

15%<br />

20%<br />

25%<br />

30%<br />

35%<br />

Government<br />

Retail Trade<br />

Accommodation and Food Services<br />

Health Care and Social Assistance<br />

Manufacturing<br />

Admin., Support, Waste Mgt., Remediation Services<br />

Construction<br />

Other Services (except Public Administration)<br />

Professional, Scientific, and Technical Services<br />

Finance and Insurance<br />

Wholesale Trade<br />

Real Estate and Rental and Leasing<br />

Information<br />

Transportation and Warehousing<br />

Educational Services<br />

Arts, Entertainment, and Recreation<br />

Management of Companies and Enterprises<br />

Mining, Quarrying, and Oil and Gas Extraction<br />

Crop and Animal Production<br />

Utilities<br />

* sorted by Montgomery County<br />

Source: Emsi Dataset 2017.3<br />

The Economy and Job Performance 31

FIGURE 18: Industry Concentration, Montgomery County (2016), 5-digit NAICS<br />

Industry Jobs<br />

National Average<br />

0<br />

1,000<br />

2,000<br />

3,000<br />

4,000<br />

5,000<br />

6,000<br />

7,000<br />

Restaurants and Other Eating Places<br />

Education and Hospitals (Local Government)<br />

Local Government, Excluding Education and Hospitals<br />

Other General Merchandise Stores<br />

Education and Hospitals (State Government)<br />

Source: Emsi Dataset 2017.3<br />

To better gauge how industries are performing in Montgomery County and help determine where<br />

to concentrate economic development efforts, an analysis was performed on all industries with<br />

over 400 jobs. The indicators were job growth and job concentration (or LQ). All industries that<br />

showed a decline in job growth from 2011 to 2016 and had an LQ below 1.0 (percent below the<br />

national average) signified little promise to the local economy and were disregarded.<br />

Emerging industries are those industries which have job growth but which also have an LQ below<br />

1.0. In other words, industries whose concentrations are currently lower than the national average<br />

but jobs are increasing. Specialty trade contractors, for example, may be an industry to watch.<br />

The more concentrated an industry, the more likely it is the industry is exporting products and<br />

services, thereby bringing wealth to the region.<br />

Industries important to the area have experienced healthy job growth and an LQ above 1.2. These<br />

industries are considered Montgomery County’s areas of specialty and can provide opportunities<br />

for industry and supply chain expansion.<br />

Critically, there are industries that are important to the region’s economy but may be struggling<br />

and need some attention. These industries reveal a loss in jobs over time but higher LQs. Textile<br />

product mills and nonmetallic mineral product manufacturing are highly unique to the region but<br />

have lost approximately 100 jobs over the five year period. See Figure 19, on the next page, for a<br />

summary of findings.<br />

32<br />

COMPREHENSIVE LABOR ANALYSIS: CLARKSVILLE-MONTGOMERY COUNTY

FIGURE 19: Montgomery County Industry Health Check<br />

POTENTIAL<br />

EMERGING<br />

IMPORTANT THAT<br />

MAY REQUIRE ATTENTION<br />

IMPORTANT GROWTH<br />

INDUSTRIES<br />

Speciality Trade Contractors Textile Product Mills Food Services and Drinking Places<br />

Professional, Scientific,<br />

and Technical Services<br />

Nonmetallic Mineral<br />

Product Manufacturing<br />

Administrative and Support Services<br />

Food and Beverage Stores Nursing and Residential Care Facilities Ambulatory Health Care Services<br />

Merchant wholesalers,<br />

Nondurable Goods<br />

Machinery Manufacturing<br />

Publishing Industries (except Internet)<br />

Accommodation<br />

General Merchandise Stores<br />

Merchant Wholesalers,<br />

Durable Goods<br />

Transportation Equipment<br />

Manufacturing<br />

Truck Transportation<br />

Real Estate<br />

Sporting Goods, Hobby, Musical<br />

Instrument, and Book Stores<br />

Credit Intermediation and<br />

Related Activities<br />

Repair and <strong>Main</strong>tenance<br />

Miscellaneous Store Retailers<br />

Motor Vehicle and Parts Dealers<br />

Social Assistance<br />

Clothing and Clothing<br />

Accessories Stores<br />

The Economy and Job Performance 33

REGIONAL BUSINESS DYNAMICS<br />

KEY HIGHLIGHTS<br />

• 3,000 payrolled businesses<br />

• 17% firm growth<br />

• Many medium to large sized businesses<br />

• Self-employment rate: 7.5%<br />

Analyzing an area’s business mix provides a useful snapshot of the firm dynamics of a regional<br />

economy. The number, sizes, and types of firms say much about the character, dependencies,<br />

and growth opportunities within a region.<br />

The context of Montgomery County’s firm composition reveals several striking dimensions to<br />

the area’s economy. In 2016, there were nearly 3,000 firms with paid employees in Montgomery<br />

County. According to the U.S. Census’ County Business Patterns program, over 85% of those firms<br />

had 19 or fewer employees, which is relatively low for an area of this size. This means there are<br />

more medium to large sized businesses in the region than average—10% of businesses employ<br />

20-49 people, and 5% employ over 50 people.<br />

The employment created by local entrepreneurs and second and third tier suppliers puts a<br />

positive pressure on the region’s development. In addition to the payrolled firms described<br />

above, Montgomery County has 4,400 self-employed individuals, a 7.5% self-employment rate.<br />

Montgomery County stands out above the national self-employment rate of 6.5% with most of<br />

these people working as construction and landscaping workers, hairdressers, and childcare workers.<br />

34<br />

COMPREHENSIVE LABOR ANALYSIS: CLARKSVILLE-MONTGOMERY COUNTY

TABLE 8: Number of Payrolled Businesses by Industry<br />

INDUSTRY<br />

2016 PAYROLLED<br />

BUSINESS LOCATIONS<br />

All Industries 2,947<br />

Retail Trade 530<br />

Accommodation and Food Services 342<br />

Health Care and Social Assistance 315<br />

Construction 278<br />

Other Services (except Public Administration) 269<br />

Professional, Scientific, and Technical Services 249<br />

Finance and Insurance 194<br />

Administrative and Support and Waste Management and Remediation Services 149<br />

Real Estate and Rental and Leasing 143<br />

Wholesale Trade 119<br />

Manufacturing 84<br />

Transportation and Warehousing 63<br />

Government 62<br />

Educational Services 46<br />

Arts, Entertainment, and Recreation 35<br />

Information 34<br />

Management of Companies and Enterprises 15<br />

Crop and Animal Production 8<br />

Mining, Quarrying, and Oil and Gas Extraction 4<br />

Utilities 4<br />

Source: Emsi<br />

FIRM GROWTH<br />

2011–2016<br />

17%<br />

Montgomery County<br />

TOP SELF-EMPLOYED IN<br />

MONTGOMERY COUNTY<br />

SELF-EMPLOYMENT RATES<br />

1. Construction trades<br />

2. Landscaping workers<br />

15+15+13<br />

Montgomery County<br />

10-county Region<br />

U.S.<br />

7.5%<br />

7.5%<br />

6.5%<br />

3. Hairdressers<br />

4. Childcare workers<br />

The Economy and Job Performance 35

WORKERS<br />

KEY HIGHLIGHTS<br />

Hot Jobs:<br />

• Registered nurses<br />

• Teachers (all levels)<br />

• General and operations managers<br />

Most abundant occupations:<br />

• Office and administrative support<br />

• Sales<br />

• Food services<br />

• Education<br />

• Production<br />

Industry data is necessary to gain a sense of regional economic trends, but to better understand<br />

the quality of the jobs contained within a region, some knowledge of occupations is needed. This<br />

is because earning and educational levels of workers are associated more directly to occupations<br />

than with the industry in which they work. For example, the manufacturing industry, while employing<br />

a number of assemblers and machine operators—also employs people in management occupations<br />

and in professional occupations such as engineering. All of these occupations have different pay<br />

scales and require varying levels of education and training.<br />

FIGURE 20: Top Occupation Groups, Montgomery County (2016)<br />

2016 Jobs 2021 Jobs<br />

0<br />

2,000<br />

4,000<br />

6,000<br />

8,000<br />

10,000<br />

12,000<br />

Office and Administrative Support<br />

Sales and Related<br />

Food Preparation and Serving<br />

Education, Training, and Library<br />

Production<br />

Management<br />

Healthcare Practitioners and<br />

Transportation and Material<br />

Installation, <strong>Main</strong>tenance, and<br />

Construction and Extraction<br />

Personal Care and Service<br />

Building Grounds <strong>Main</strong>tenance<br />

Healthcare Support<br />

Business and Financial Operations<br />

Protective Services<br />

Source: Emsi Dataset 2017.3<br />

36<br />

COMPREHENSIVE LABOR ANALYSIS: CLARKSVILLE-MONTGOMERY COUNTY

TABLE 9: Occupation Groups with Most Growth Potential and Median Wage of $15/hr and<br />

Higher, Montgomery County (2016-2021)<br />

SOC<br />

DESCRIPTION<br />

2016<br />

JOBS<br />

2021<br />

JOBS<br />

CHANGE<br />

%<br />

CHANGE<br />

2016<br />

LOCATION<br />

QUOTIENT<br />

MEDIAN<br />

HOURLY<br />

EARNINGS<br />

ANNUAL<br />

OPENINGS<br />

SOC<br />

Description<br />

2016<br />

Jobs<br />

2021<br />

Jobs<br />

Change<br />

%<br />

Change<br />

2016<br />

Location<br />

Quotient<br />

Median<br />

Hourly<br />

Earnings<br />

Annual<br />

Openings<br />

29-0000<br />

25-0000<br />

Healthcare<br />

Practitioners and<br />

Technical<br />

Education, Training,<br />

and Library<br />

2,962 3,372 410 14% 0.95 $25.50 152<br />

4,450 4,827 377 8% 1.35 $24.84 189<br />

11-0000 Management 3,536 3,822 286 8% 1.13 $27.52 150<br />

13-0000<br />

49-0000<br />

Business and Financial<br />

Operations<br />

Installation,<br />

<strong>Main</strong>tenance, and<br />

Repair<br />

1,472 1,708 236 16% 0.51 $25.78 80<br />

2,420 2,616 196 8% 1.10 $19.07 100<br />

33-0000 Protective Service 944 1,085 141 15% 0.73 $19.02 56<br />

15-0000<br />

21-0000<br />

27-0000<br />

Computer and<br />

Mathematical<br />

Occupations<br />

Community and<br />

Social Service<br />

Occupations<br />

Arts, Design,<br />

Entertainment,<br />

Sports, and Media<br />

Occupations<br />

576 685 109 19% 0.36 $30.26 31<br />

855 963 108 13% 0.91 $19.17 42<br />

775 851 76 10% 0.75 $16.62 37<br />

55-0000 Military occupations 638 694 56 9% 0.88 $16.79 27<br />

47-0000<br />

17-0000<br />

19-0000<br />

Construction and<br />

Extraction<br />

Architecture<br />

and Engineering<br />

Occupations<br />

Life, Physical, and<br />

Social Science<br />

Occupations<br />

2,234 2,283 49 2% 0.87 $15.07 61<br />

560 596 36 6% 0.59 $30.29 24<br />

209 244 35 17% 0.45 $27.65 14<br />

23-0000 Legal Occupations 162 176 14 9% 0.34 $36.24 6<br />

51-0000 Production 3,994 3,664 (330) (8%) 1.17 $16.06 106<br />

Source: Emsi Dataset 2017.3<br />

The Economy and Job Performance 37

Office and administrative support is the largest occupation group in Montgomery County. Call<br />

centers employ the largest share of these workers, followed by local government. The majority of<br />

sales positions are in warehouse clubs—either Wal-Mart, Sam’s Club or Costco (Figure 20). Only<br />

eight of the 23 occupation groups have a median wage under $15 per hour, which approaches the<br />

regional median. None of these rank amongst the highest paid, however (Table 9).<br />

Occupations that appear to be highest on the regional pay scale, and which also employ a sizeable<br />

number of workers, are registered nurses and elementary school teachers at approximately $28<br />

per hour. Several high skills, high wage occupations are expected to experience growth in the<br />

next five years, such as elementary and secondary school teachers, registered nurses, general and<br />

operations managers, and postsecondary teachers.<br />

Figure 21 provides a look at job growth and the average annual job openings for workers with<br />

some college or above by occupation group. Job openings refer to new jobs due to growth<br />

plus replacement jobs due to worker turnover. Between 2016 and 2021, the occupations with<br />

the projected highest number of job growth and average annual job openings for workers with<br />

some college or above occurs in education occupations (teachers), healthcare practitioners, and<br />

management.<br />

FIGURE 21: Job Growth and Average Annual Openings by Occupation Group with Some<br />

College and Above Experience, Montgomery County (2016-2021)<br />

Job Growth<br />

Annual Openings<br />

0 50 100 150 200 250 300 350<br />

400<br />

Education, Training, and Library<br />

Healthcare Practitioners and Technical<br />

Management<br />

Business and Financial Operations<br />

Healthcare Support<br />

Computer and Mathematical<br />

Community and Social Service<br />

Personal Care and Service<br />

Arts, Design, Entertainment, Sports, and Media<br />

Transportation and Material Moving<br />

Installation, <strong>Main</strong>tenance, and Repair<br />

Architecture and Engineering<br />

Protective Service<br />

Office and Administrative Support<br />

Life, Physical, and Social Science<br />

Sales and Related<br />

Legal<br />

Source: Emsi Dataset 2017.3<br />

38<br />

COMPREHENSIVE LABOR ANALYSIS: CLARKSVILLE-MONTGOMERY COUNTY

REAL-TIME DATA<br />

KEY HIGHLIGHTS<br />

Supply: 37,000 profiles of Montgomery County residents<br />

• customer service reps<br />

• retail<br />

• sales and general managers<br />

• administrative assistants<br />

Demand: 45,000 annual job postings<br />

• truck drivers<br />

• registered nurses<br />

• real estate agents and salespersons<br />

• supervisors of retail and food workers<br />

Emsi’s proprietary database, Workforce Insight, includes the professional profiles of nearly 37,000<br />

people in Montgomery County who are currently employed, recently employed, or seeking<br />

employment. These Montgomery County residents work in a range of jobs from customer service<br />

representatives, retail and sales, to managers, maintenance mechanics, and registered nurses (see<br />

Figure 22, on the next page).<br />

Workforce Insight observations rely heavily on resumes and profiles found within online social<br />

and professional networking sites as well as job hunting sites. These sites tend to reflect a<br />

higher number of people who work in professional or office environments over those who work<br />

in the skilled trades, as well as people who may use such sites professionally, including sales,<br />

account or project managers, and sales or customer services representatives.<br />

According to Emsi’s Job Posting Analytics, there were over 45,000 unique job postings over the<br />

past year. One in four unique job postings were in Montgomery County with most of them in<br />

<strong>Clarksville</strong>, followed closely by Hopkinsville in Christian County. The top posted occupations<br />

were truck drivers, by far. This is a national trend as some of the top trucking companies post<br />

nationwide on a continual basis. The next two posted occupations were registered nurses and,<br />

surprisingly, physicians. Figure 22 provides a trendline of the real-time labor market supply and<br />

demand trends in Montgomery County. The data enable important findings, such as, the most<br />

listed employers, top listed occupations, and compensation data.<br />

The Economy and Job Performance 39

FIGURE 22: Supply and Demand, Montgomery County<br />

WORKFORCE INSIGHT: REAL TIME ONLINE PROFILE DATA<br />

0<br />

200 400 600 800 1,000 1,200<br />

Customer Service Representative<br />

Retail Sales Associate<br />

Sales Manager<br />

Administrative Assistant<br />

Farm Owner<br />

General Manager<br />

<strong>Main</strong>tenance Mechanic<br />

President<br />

Cashier<br />

Registered Nurse<br />

Sales Representative<br />

Office Manager<br />

TOP JOB POSTINGS<br />

37,000 Unique Profiles in<br />

Montgomery County, TN<br />

0<br />

200 400 600 800 1,000 1,200<br />

United States Department of the Army<br />

Austin Peay State University<br />

Montgomery County School System<br />

Convergys Corporation<br />

United States Army<br />

Wal-Mart Stores, Inc.<br />

Murray State University<br />

Gateway Medical Group LLC<br />

Dyncorp<br />

City of <strong>Clarksville</strong><br />

The Trane Company<br />

State of Tennessee<br />

TOP COMPANIES<br />

POSTING JOBS<br />

45,000 Unique Annual Postings<br />

in Montgomery County, TN<br />

JOB POSTING ANALYTICS: REAL TIME DEMAND DATA<br />

0<br />

200 400 600 800 1,000 1,200<br />

Heavy and Tractor-Trailer Truck Drivers<br />

Registered Nurses<br />

Real Estate Sales Agents<br />

First-Line Spvr.s of Retail Sales Workers<br />

Retail Salespersons<br />

First-Line Spvs. of Food Prep. & Serving Workers<br />

Stock Clerks and Order Fillers<br />

Taxi Drivers and Chauffeurs<br />

Customer Service Representatives<br />

Cashiers<br />

Combined Food Preparation Workers<br />

Postsecondary Teachers<br />

TOP JOB POSTINGS<br />

37,000 Unique Profiles in<br />

Montgomery County, TN<br />

0<br />

200 400 600 800 1,000 1,200<br />

Lyft, Inc.<br />

Community Health Systems<br />

Austin Peay State University<br />

Comphealth Associates, Inc<br />

Cmcss<br />

Crye-Leike, Inc<br />

United States Air Force<br />

Lowe’s<br />

Celadon<br />

CRST Int.<br />

Averitt Exp.<br />

Panera<br />

TOP COMPANIES<br />

POSTING JOBS<br />

45,000 Unique Annual Postings<br />

in Montgomery County, TN<br />

40<br />

COMPREHENSIVE LABOR ANALYSIS: CLARKSVILLE-MONTGOMERY COUNTY

COMPENSATION<br />

KEY HIGHLIGHTS<br />

• Average earnings are 23-32% below the national average, depending on regional<br />

geography<br />

• 39,000 workers are available at the average wage of $20.50 per hour<br />

• Typical compensation for production workers in Montgomery County is $16.87<br />

per hour (includes supervisors, management, and workers with experience)<br />

TABLE 10: Wage Comparisons across Geographies<br />

All Industries<br />

Production Occupations<br />

61+62+69+76+78+90 53+53+51+53+49+53<br />

$29.86<br />

$25.22<br />

$26.10<br />

$22.96<br />

$20.45 $20.50<br />

$17.80 $17.82<br />

$16.91<br />

$17.65<br />

$17.81<br />

$16.40<br />

City of<br />

<strong>Clarksville</strong><br />

Montgomery<br />

County<br />

10-county Kentucky Tennessee United<br />

States<br />

The average wage for Montgomery County is $20.50 per hour, 31% below the national average.<br />

At this wage, there are over 39,000 workers available, or 72% of the entire workforce. Like most<br />

occupations, as wages increase, fewer workers are added to each wage increment. Younger, less<br />

experienced workers start at lower wages but see raises more often while more seasoned workers<br />

hit wage ceilings.<br />

FIGURE 23: Workforce Availability by Wage Increment<br />

Workers Added at Each Wage Increment<br />