quarterly-insurtech-briefing-q4-2017

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

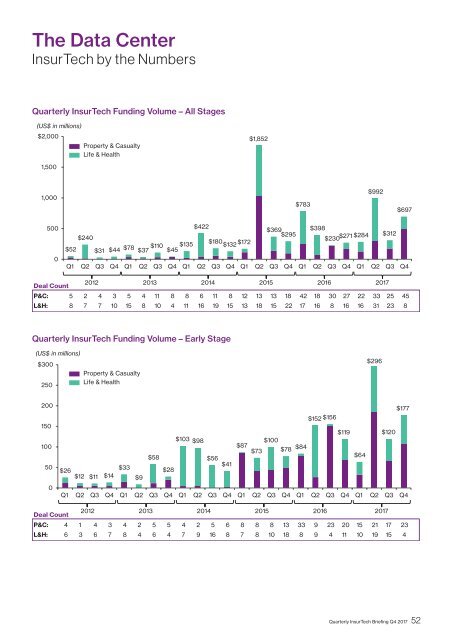

The Data Center<br />

InsurTech by the Numbers<br />

Quarterly InsurTech Funding Volume – All Stages<br />

(US$ in millions)<br />

$2,000<br />

Property & Casualty<br />

Life & Health<br />

$1,852<br />

1,500<br />

1,000<br />

$992<br />

$697<br />

500<br />

0<br />

$422<br />

$369<br />

$783$398<br />

$295<br />

$240<br />

$52 $31 $44 $78 $37 $110 $45 $135 $230<br />

$180 $271 $284 $312<br />

$132<br />

$172<br />

Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4<br />

Deal Count<br />

P&C: 5<br />

L&H: 8<br />

2012 2013 2014 2015 2016 <strong>2017</strong><br />

2 4 3 5 4<br />

7 7 10 15 8<br />

11 8 8 6<br />

10 4 11 16<br />

11 8 12 13<br />

19 15 13 18<br />

13 18 42 18<br />

15 22 17 16<br />

30 27 22 33<br />

8 16 16 31<br />

25<br />

23<br />

45<br />

8<br />

Quarterly InsurTech Funding Volume – Early Stage<br />

(US$ in millions)<br />

$300<br />

250<br />

Property & Casualty<br />

Life & Health<br />

$296<br />

200<br />

150<br />

100<br />

50<br />

0<br />

$177<br />

$152 $156<br />

$119<br />

$120<br />

$103 $98 $100<br />

$87<br />

$73 $78 $84<br />

$58<br />

$64<br />

$56<br />

$41<br />

$33<br />

$26 $28<br />

$12 $11 $14 $9<br />

Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4<br />

Deal Count<br />

P&C: 4<br />

L&H: 6<br />

2012 2013 2014 2015 2016 <strong>2017</strong><br />

1 4 3 4 2<br />

3 6 7 8 4<br />

5 5 4 2 5<br />

6 4 7 9 16<br />

6 8 8 8 13<br />

8 7 8 10 18<br />

33 9 23 20<br />

8 9 4 11<br />

15 21 17<br />

10 19 15<br />

23<br />

4<br />

Quarterly InsurTech Briefing Q4 <strong>2017</strong> 52