114 Notes to the consolidated financial statements continued 2 Significant accounting policies continued Consolidated Income statement for the year to December 31, 2015 € million Previously <strong>report</strong>ed Reclassification After reclassification Passenger revenue 20,350 (20) 20,330 Cargo revenue 1,024 70 1,094 Other revenue 1,484 (50) 1,434 Total revenue 22,858 – 22,858 H<strong>and</strong>ling, catering <strong>and</strong> other operating costs 2,371 200 2,571 Property, IT <strong>and</strong> other costs 1,033 (200) 833 Other expenditure on operations 17,136 – 17,136 Total expenditure on operations 20,540 – 20,540 Operating profit 2,318 – 2,318 3 Business combination On August 18, 2015, the Group acquired 100 per cent of the issued ordinary share capital of Aer Lingus Group for €2.55 per share. The fair values of the assets <strong>and</strong> liabilities arising from the acquisition were presented in the financial statements for the year to December 31, 2015 on a provisional basis. During the twelve months to December 31, <strong>2016</strong> the valuation exercise was finalised, resulting in an increase of €58 million to the fair value of property, plant <strong>and</strong> equipment arising from the acquisition, a related €7 million deferred tax liability, <strong>and</strong> a corresponding decrease to goodwill. The comparative information is restated to reflect this adjustment. The goodwill is recognised as follows: € million Cash consideration 1,351 Fair value of identifiable net assets 1,079 Goodwill 272 4 Segment information a Business segments British Airways, Iberia, Vueling <strong>and</strong> Aer Lingus are managed as individual operating companies. Each airline operates its network operations as a single business unit. The chief operating decision maker is responsible for allocating resources <strong>and</strong> assessing performance of the operating segments, <strong>and</strong> has been identified as the IAG Management Committee. The IAG Management Committee makes resource allocation decisions based on network profitability, primarily by reference to the passenger markets in which the companies operate. The objective in making resource allocation decisions is to optimise consolidated financial results. Therefore, based on the way the Group treats its businesses, <strong>and</strong> the manner in which resource allocation decisions are made, the Group has four <strong>report</strong>able operating segments for financial <strong>report</strong>ing purposes, <strong>report</strong>ed as British Airways, Iberia, Vueling <strong>and</strong> Aer Lingus. Other Group companies include the head office companies. In <strong>2016</strong>, the Avios business has been treated as a separate operating unit <strong>and</strong> is included in Other Group companies in the Business segment information. In 2015, Avios was allocated to the British Airways <strong>and</strong> Iberia operating segments according to the ownership percentage. The 2015 comparatives have been restated <strong>and</strong> Avios has been included in Other Group companies. For the year to December 31, <strong>2016</strong> <strong>2016</strong> € million British Airways Iberia Vueling Aer Lingus Other Group companies Total Revenue External revenue 13,889 4,233 2,065 1,766 614 22,567 Inter-segment revenue 469 353 – – 452 1,274 Segment revenue 14,358 4,586 2,065 1,766 1,066 23,841 Depreciation, amortisation <strong>and</strong> impairment (950) (215) (19) (75) (28) (1,287) Operating profit before exceptional items 1,786 271 60 233 185 2,535 Exceptional items (note 5) (93) – – – 42 (51) Operating profit after exceptional items 1,693 271 60 233 227 2,484 Net non-operating costs (122) Profit before tax 2,362 INTERNATIONAL AIRLINES GROUP <strong>Annual</strong> Report <strong>and</strong> Accounts <strong>2016</strong>

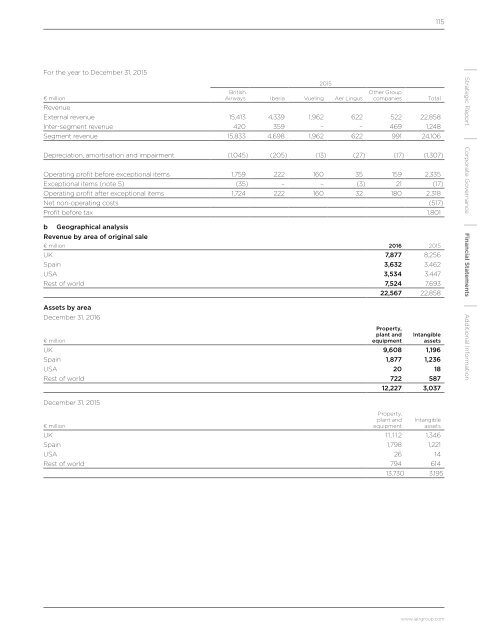

115 For the year to December 31, 2015 € million 2015 British Airways Iberia Vueling Aer Lingus Other Group companies Revenue External revenue 15,413 4,339 1,962 622 522 22,858 Inter-segment revenue 420 359 – – 469 1,248 Segment revenue 15,833 4,698 1,962 622 991 24,106 Depreciation, amortisation <strong>and</strong> impairment (1,045) (205) (13) (27) (17) (1,307) Operating profit before exceptional items 1,759 222 160 35 159 2,335 Exceptional items (note 5) (35) – – (3) 21 (17) Operating profit after exceptional items 1,724 222 160 32 180 2,318 Net non-operating costs (517) Profit before tax 1,801 b Geographical analysis Revenue by area of original sale € million <strong>2016</strong> 2015 UK 7,877 8,256 Spain 3,632 3,462 USA 3,534 3,447 Rest of world 7,524 7,693 22,567 22,858 Assets by area December 31, <strong>2016</strong> Property, € million plant <strong>and</strong> equipment Intangible assets UK 9,608 1,196 Spain 1,877 1,236 USA 20 18 Rest of world 722 587 12,227 3,037 Total Strategic Report Corporate Governance Financial Statements Additional Information December 31, 2015 Property, € million plant <strong>and</strong> equipment Intangible assets UK 11,112 1,346 Spain 1,798 1,221 USA 26 14 Rest of world 794 614 13,730 3,195 www.iairgroup.com

- Page 1 and 2:

INTERNATIONAL AIRLINES GROUP The be

- Page 3 and 4:

Strategic report “2016 was a chal

- Page 5 and 6:

3 Chairman’s letter A firm focus

- Page 7 and 8:

5 Q A And, importantly, we have to

- Page 9 and 10:

7 IAG combines the leading airlines

- Page 11 and 12:

9 Operating highlights British Airw

- Page 13 and 14:

11 Business model and strategy Maxi

- Page 15 and 16:

13 4 5 6 Grow share of Europeto-Afr

- Page 17 and 18:

15 The performance indicators prese

- Page 19 and 20:

17 IT This year significant work ha

- Page 21 and 22:

19 and additional summer aircraft a

- Page 23 and 24:

21 This is why we have recently lau

- Page 25 and 26:

23 Aer Lingus Making the most of ou

- Page 27 and 28:

25 IAG Cargo Resilient performance

- Page 29 and 30:

27 Risk management and principal ri

- Page 31 and 32:

29 Risk Potential impact Management

- Page 33 and 34:

31 Risk Potential impact Management

- Page 35 and 36:

33 Financial overview A significant

- Page 37 and 38:

35 However, continued weakness in t

- Page 39 and 40:

37 Exchange impact before exception

- Page 41 and 42:

39 By supplier cost category: Handl

- Page 43 and 44:

41 Capacity 21% 11% 8% 60% Operatin

- Page 45 and 46:

43 Cash flow € million 2016 2015

- Page 47 and 48:

45 Sustainability Committed to our

- Page 49 and 50:

47 UN Sustainable Development Goals

- Page 51 and 52:

49 Aspect and link to SDGs Noise Wa

- Page 53 and 54:

51 Air quality - electric tug trial

- Page 55 and 56:

“2016 has really tested the Group

- Page 57 and 58:

55 I think we can be very proud tha

- Page 59 and 60:

57 James Lawrence Non-Executive Dir

- Page 61 and 62:

59 The Group operating companies Av

- Page 63 and 64:

61 The Board Secretary is Álvaro L

- Page 65 and 66: 63 Induction programme New director

- Page 67 and 68: 65 Other statutory information Dire

- Page 69 and 70: 67 The significant shareholders of

- Page 71 and 72: 69 Report of the Audit and Complian

- Page 73 and 74: 71 ICFR, which is a Spanish Corpora

- Page 75 and 76: 73 The Committee’s responsibiliti

- Page 77 and 78: 75 Report of the Safety Committee D

- Page 79 and 80: 77 Despite a growth in share price

- Page 81 and 82: 79 The table below summarises the m

- Page 83 and 84: 81 Malus and Clawback Provisions Th

- Page 85 and 86: 83 Service contracts and exit payme

- Page 87 and 88: 85 Annual Remuneration Report Commi

- Page 89 and 90: 87 Additional explanations in respe

- Page 91 and 92: 89 IAG PSP Award 2014 The IAG PSP a

- Page 93 and 94: 91 Statement of Voting The table be

- Page 95 and 96: 93 IAG’s total shareholder return

- Page 97 and 98: 95 The second performance condition

- Page 99 and 100: 97 Incentive Award Deferral Plan Th

- Page 101 and 102: Strategic Financial Statements Repo

- Page 103 and 104: 101 Consolidated statement of other

- Page 105 and 106: 103 Consolidated cash flow statemen

- Page 107 and 108: 105 Consolidated statement of chang

- Page 109 and 110: 107 the Income statement. All other

- Page 111 and 112: 109 b Other interest-bearing deposi

- Page 113 and 114: 111 Employee leaving indemnities an

- Page 115: 113 IAG has initiated a project to

- Page 119 and 120: 117 7 Auditors’ remuneration The

- Page 121 and 122: 119 For the year to December 31, 20

- Page 123 and 124: 121 c Reconciliation of the total t

- Page 125 and 126: 123 13 Property, plant and equipmen

- Page 127 and 128: 125 16 Intangible assets and impair

- Page 129 and 130: 127 Basis for calculating recoverab

- Page 131 and 132: 129 19 Trade and other receivables

- Page 133 and 134: 131 2 Floating rate euro mortgage l

- Page 135 and 136: 133 depending on whether the employ

- Page 137 and 138: 135 At December 31, 2016 the Group

- Page 139 and 140: 137 27 Financial instruments a Fina

- Page 141 and 142: 139 The carrying amounts and fair v

- Page 143 and 144: 141 December 31, 2015 Financial ins

- Page 145 and 146: 143 31 Other reserves and non-contr

- Page 147 and 148: 145 Defined benefit schemes i. APS

- Page 149 and 150: 147 d Fair value of scheme assets A

- Page 151 and 152: 149 e Present value of scheme liabi

- Page 153 and 154: 151 33 Contingent liabilities and g

- Page 155 and 156: Spanish corporate governance report

- Page 157 and 158: 155 Indicate the most significant m

- Page 159 and 160: 157 Explain any significant changes

- Page 161 and 162: 159 B. SHAREHOLDERS’ MEETING B.1

- Page 163 and 164: 161 C.1.3 Complete the following ta

- Page 165 and 166: 163 Individual or corporate name of

- Page 167 and 168:

165 When reviewing board appointmen

- Page 169 and 170:

167 C.1.10 Indicate what powers, if

- Page 171 and 172:

169 Selection of directors In ident

- Page 173 and 174:

171 C.1.20 ter List any business re

- Page 175 and 176:

173 C.1.31 Indicate whether the con

- Page 177 and 178:

175 C.1.36 No Outgoing auditor Indi

- Page 179 and 180:

177 C.1.42 Indicate and, where appr

- Page 181 and 182:

179 C.2 Board committees C.2.1 Give

- Page 183 and 184:

181 f. To establish the appropriate

- Page 185 and 186:

183 F. Other responsibilities: a. T

- Page 187 and 188:

185 c) Steps taken during the year:

- Page 189 and 190:

187 C.2.2 b) Functions The main fun

- Page 191 and 192:

189 D.4 List any relevant transacti

- Page 193 and 194:

191 E.2 Identify the bodies respons

- Page 195 and 196:

193 Main risk Government interventi

- Page 197 and 198:

195 Audit and Compliance Committee

- Page 199 and 200:

197 The financial risk assessment i

- Page 201 and 202:

199 F.3.2 Internal control policies

- Page 203 and 204:

201 F.4.2 Mechanisms in standard fo

- Page 205 and 206:

203 6. Listed companies drawing up

- Page 207 and 208:

205 21. The board of directors shou

- Page 209 and 210:

207 37. When an executive committee

- Page 211 and 212:

209 52. The terms of reference of s

- Page 213 and 214:

211 IAG Remuneration Policy complie

- Page 215 and 216:

213 Director Enrique Dupuy de Lôme

- Page 217 and 218:

215 Strategic Report Corporate Gove

- Page 219 and 220:

217 Name and address Principal acti

- Page 221 and 222:

219 Associates Name and address Han

- Page 223 and 224:

221 Strategic Report Corporate Gove

- Page 225 and 226:

223 Operating margin Overall load f

- Page 227 and 228:

225 In 2015, the definition of inve

- Page 229 and 230:

227 Sustainability indicators Indic

- Page 231 and 232:

Shareholder information Registered