Jeweller - April Issue 2018

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

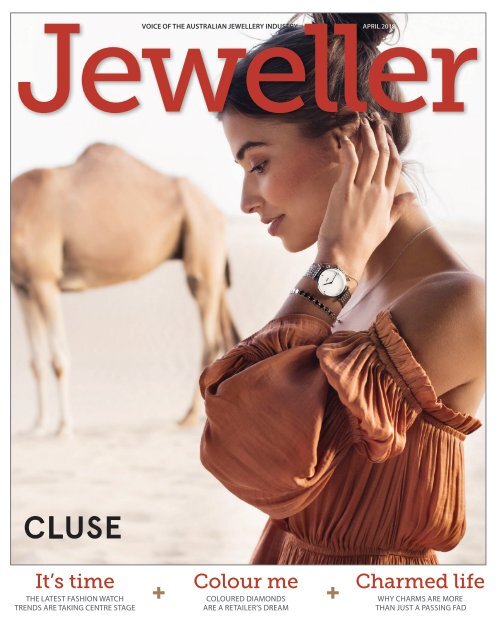

VOICE OF THE AUSTRALIAN JEWELLERY INDUSTRY<br />

APRIL <strong>2018</strong><br />

It’s time<br />

THE LATEST FASHION WATCH<br />

TRENDS ARE TAKING CENTRE STAGE<br />

Colour me<br />

+ +<br />

COLOURED DIAMONDS<br />

ARE A RETAILER’S DREAM<br />

Charmed life<br />

WHY CHARMS ARE MORE<br />

THAN JUST A PASSING FAD

Seeing is<br />

believing<br />

Personally select<br />

from thousands of<br />

stunning pieces,<br />

just right for your<br />

business.<br />

Meet skilled<br />

craftspeople and<br />

be inspired by their<br />

commitment to<br />

quality and design.<br />

See the latest<br />

fashions and dazzle<br />

your competitors as<br />

you stay ahead<br />

of trends.<br />

pms 2935 C<br />

pms 2935 C<br />

Organised by<br />

August 25 > 27, <strong>2018</strong><br />

ICC Sydney<br />

Exhibition Centre<br />

Darling Harbour

WORLD SHINER PTY LTD<br />

Inspired Performance. Year After Year...<br />

WORLD SHINER<br />

World Shiner proudly introduces Argyle Pink Diamonds<br />

NEW SOUTH WALES Suite 301, Level 3, 70 Castlereagh Street, Sydney 2000, P: 02 9232 3557, E: sydney@worldshiner.com<br />

VICTORIA Suite 502, Wales Corner, 227 Collins Street, Melbourne 3000, P: 03 9654 6369, E: melbourne@worldshiner.com<br />

QUEENSLAND Unit 17, Level 11, 138 Albert Street, Brisbane 4000, P: 07 3210 1237 E: brisbane@worldshiner.com<br />

NEW ZEALAND Suite 4K, 47 High Street, Auckland P: 09 358 3443 E: nz@worldshiner.com<br />

WWW.WORLDSHINER.COM<br />

• AUSTRALIA • BELGIUM • CANADA • GERMANY • INDIA • JAPAN • SPAIN • TAIWAN • UNITED KINGDOM • USA • NEW ZEALAND

One of<br />

ASIA’S<br />

TOP THREE<br />

Fine <strong>Jeweller</strong>y Events<br />

JUNE<br />

Hong Kong <strong>Jeweller</strong>y & Gem Fair<br />

21 – 24 June <strong>2018</strong><br />

Hong Kong Convention & Exhibition Centre<br />

UBM Asia Ltd<br />

Tel : (852) 2585 6127<br />

Fax : (852) 3749 7344<br />

Email : visitjgf-hk@ubm.com<br />

www.<strong>Jeweller</strong>yNet.com

THE LATEST FASHION WATCH<br />

TRENDS ARE TAKING CENTRE STAGE<br />

VOICE OF THE AUSTRALIAN JEWELLERY INDUSTRY<br />

COLOURED DIAMONDS<br />

ARE A RETAILER’S DREAM<br />

APRIL <strong>2018</strong><br />

WHY CHARMS ARE MORE<br />

THAN JUST A PASSING FAD<br />

CONTENTS<br />

APRIL <strong>2018</strong><br />

15/<br />

21/<br />

26/<br />

FEATURES REGULARS BUSINESS<br />

15/ WATCH OUT<br />

<strong>Jeweller</strong>’s latest insight into the<br />

enduring fashion watch category.<br />

21/ COLOURED AFFAIR<br />

It’s time to take advantage of<br />

coloured diamond sales.<br />

24/ WATCH FAIR<br />

Watch connoisseur Martin Foster<br />

explains why luxury watch fairs are<br />

reassuring the industry.<br />

26/ A REAL CHARMER<br />

Why charms present untapped<br />

opportunities for retailers.<br />

7/ Editorial<br />

8/ Upfront<br />

9/ News<br />

29/ Gems<br />

Colour investigation: ruby<br />

37/ My Store<br />

Be inspired by the most unique<br />

store layouts around.<br />

38/ 10 Years Ago<br />

39/ Calendar<br />

40/ My Bench<br />

42/ Soapbox<br />

Coloured gemstones are seriously<br />

underrated, Charles Lawson declares.<br />

31/ Business feature<br />

Francesca Nicasio discusses how<br />

to boost customers through instore<br />

experiences.<br />

33/ Selling<br />

Sales can be greatly improved<br />

with technology, Gretchen<br />

Gordon notes.<br />

34/ Management<br />

Bryan Pearson lays out how<br />

to use data to boost sales.<br />

35/ Marketing<br />

Use in-store data to spot the next<br />

big trends, David Brown states.<br />

36/ Logged On<br />

Melissa Megginson describes<br />

how to use Instagram to reach<br />

more customers.<br />

It’s time<br />

Colour me<br />

+ +<br />

Charmed life<br />

Front cover description:<br />

Cluse watches are distributed<br />

by Heart & Grace.<br />

<strong>April</strong> <strong>2018</strong> <strong>Jeweller</strong> 5

The Original customisable jewellery with interchangeable colours<br />

Mother’s Day<br />

Collection<br />

lesgeorgettes.com - Trademark, registered designs and patents pending - Copyright © <strong>2018</strong> Altesse<br />

An original creation by Altesse Paris<br />

Made in France<br />

contactaus@lesgeorgettes.com - #lesgeorgettes_byaltesse - +61 (0)2 8998 1900

EDITORIAL<br />

PAGE #1 OF GOOGLE; HOT DIGGITY DOG!<br />

You have probably received the emails<br />

yourself – you know the ones; they tell you<br />

that your business is not on the first page of<br />

a Google search or that your website “doesn’t<br />

have major keywords in your niche, which<br />

affects visibility”.<br />

If you believe these promotional emails from<br />

search-engine optimisation (SEO) businesses,<br />

you’ll soon think you have far greater<br />

problems, such as low ‘Domain Authority’ and<br />

‘Page Authority’ or, even worse, “Your website<br />

seems to be attracting traffic but this traffic is<br />

almost stagnant and limited.”<br />

Nothing worse than stagnant traffic, right!<br />

Well, actually there is because your<br />

website has now “been diagnosed with<br />

coding issues”.<br />

Of course, these SEO emails always tug at<br />

your heartstrings; they promise to put you on<br />

the first page of Google and, ideally, within<br />

the first 10 listings!<br />

“As a business owner, you might be<br />

interested to attract more visitors. So despite<br />

having a proficient website, you might be<br />

wondering why you are not able to overturn<br />

your competitors from the top search results.”<br />

the sales pitch goes.<br />

There’s no doubt that all retail businesses<br />

would love to sit at the top spot on the first<br />

page of Google but it’s not as simple as a<br />

pay-to-play solution. These spammers will<br />

claim that they will propel you to the top –<br />

for a handsome fee, of course – but can it be<br />

guaranteed and would it generate any real<br />

value to your business anyway?<br />

For example, and to stretch logic to expose<br />

silly and false claims, is there any sense or<br />

benefit in appearing on the first page of a<br />

Google search for ‘hot dog shops’ if you own<br />

a jewellery store? Of course not but let’s deal<br />

with some other issues.<br />

A recent email told me, “While doing a<br />

search, we found that Gunnamatta Media is<br />

not on the first page of Google.”<br />

Knowing that to be bullshit, I checked<br />

anyway as one should always be sceptical<br />

and check the facts. Of course what I found<br />

was the opposite of what I was told by<br />

Daniel, my international “digital marketing<br />

expert” who, by the way, operates from a<br />

personal Gmail account.<br />

Well, not only was Gunnamatta Media on<br />

the first page but it also occupied the first 30<br />

listings related to the company. So much for<br />

not being “on the first page of a Google”!<br />

I am sure that if you search your own store<br />

name it would, or at least should, appear<br />

on the first page, depending on how many<br />

jewellery stores have similar names. If it<br />

doesn’t, then adding your suburb to the<br />

search should fix the problem.<br />

You see, being on the first page is<br />

determined by keywords and how specific<br />

those terms are, such as whether they<br />

include your store name and suburb.<br />

WHAT’S THE<br />

USE OF BEING<br />

ON PAGE ONE<br />

FOR SEARCH<br />

TERMS THAT NO<br />

ONE IS USING?<br />

YOU MAY AS<br />

WELL BE ON<br />

PAGE ONE<br />

FOR ‘HOTDOG<br />

SHOPS’.<br />

Obviously, if you search ‘jewellery stores<br />

NSW’, it’s unlikely a small store would be on<br />

page one, which is dominated by the major<br />

jewellery chains. That’s because this is a broad<br />

search term and it is unlikely that any SEO<br />

service could guarantee you the first search<br />

page on such a broad criteria. Again, even if it<br />

were possible, what benefit would it be?<br />

On the other hand, if the keyword search is<br />

more specific, such as ‘diamond jewellery<br />

Melbourne’, then there’s way more value for<br />

stores to appear on page one, which is where<br />

the competition for position heats up, as<br />

does the work, effort and cost!<br />

So how do these SEO businesses claim to get<br />

you a page-one ranking? Well one way is that<br />

they rank your website for keywords that no<br />

one is searching. That’s one trick but what’s<br />

the use of being on page one for search<br />

terms that no one is using? You may as well<br />

be on page one for ‘hotdog shops’.<br />

Google searches and ranking are not only<br />

dynamic but are also unstable. You will get<br />

different results in different geographic<br />

locations because local results skew Google<br />

rankings, as do reviews.<br />

Retailers should be very cautious about<br />

SEO ‘consultants’ who make claims about<br />

getting your business onto the first page of<br />

Google searches and, even if true, is there<br />

truly any value?<br />

Coleby Nicholson<br />

Managing Editor<br />

<strong>April</strong> <strong>2018</strong> <strong>Jeweller</strong> 7

UPFRONT<br />

“I miss a lot of<br />

independent<br />

retailers in<br />

regional towns<br />

who closed. Many<br />

became not just<br />

customers, but<br />

friends.”<br />

What do you miss about the industry 10 years ago?<br />

RITA WILLIAMS,<br />

SUNSTATE JEWELLERS<br />

BULLETIN BOARD<br />

n YES, YES YES!<br />

Suppliers must be inventive to keep up<br />

with consumer’s evolving demands.<br />

Case in point: one company created<br />

a smartphone case to conceal an<br />

engagement ring and record the user’s<br />

proposal. With the trend for couples to<br />

share their proposals on social media<br />

becoming more popular, retailers would<br />

do well to think how they too can meet<br />

such demands.<br />

n PINNING IT DOWN<br />

Pinterest has revealed its top three most<br />

pinned engagement ring styles for the<br />

year so far. According to the company,<br />

moissanite gem styles are up 294 per<br />

cent, marquise diamond art deco styles<br />

have increased 173 per cent and oval<br />

engagement stones are up 125 per cent.<br />

n HEALTHY PROFITS<br />

According to a JewelerProfit.com article,<br />

keeping inventory over a year old,<br />

wrong price points, under-charging for<br />

repairs, low web traffic and poor sales<br />

staff are key reasons why retailers find<br />

themselves in financial distress. Solution:<br />

jewellers should focus on “excellent<br />

sales, good salaries and excellent cash<br />

flow,” the article states.<br />

“I miss how<br />

personal it used<br />

to be, spending<br />

time getting to<br />

know customers.<br />

Everything is so<br />

fast paced now,<br />

people don’t build<br />

a connection<br />

anymore.”<br />

JESS RICHARDS,<br />

SECRETS SHHH –<br />

CHADSTONE<br />

DIGITAL<br />

BRAINWAVE<br />

“Ten years ago, we<br />

had a very robust<br />

business. Our retail<br />

was booming and<br />

everybody was<br />

happy. When we<br />

had the election,<br />

everything<br />

changed and it<br />

became tough.”<br />

TIM HAAB, HAAB<br />

DESIGNER JEWELLERS<br />

HIT PLAY<br />

Thinking about getting into video marketing? An<br />

article by business2community offers some hefty<br />

best practice tips for retailers wanting to incorporate<br />

videos into their marketing efforts. First, it<br />

recommends to plan what is going to be said before<br />

pressing record – that means no ‘winging it’ and rambling. Instead, it advises to practice<br />

but don’t read from a script – the more conversational the tone, the better. Other top<br />

tips include creating videos that double as teaching moments, calling on consumers to<br />

take action, and ensuring all keywords – including the video title, description and tags –<br />

are catchy and natural. Time to get recording!<br />

TOP PRODUCT<br />

Dansk Smykkekunst’s ‘Tamara<br />

Orbit’ earrings feature a silverplated<br />

ball on 7cm rose goldplated<br />

copper. They are also<br />

available in haematite with a gold<br />

coloured ball, rhodium with a rose<br />

gold coloured ball, and silver with a<br />

haematite ball. They were the most<br />

popular product last month ranked<br />

by views at jewellermagazine.com.<br />

VOICE OF THE AUSTRALIAN<br />

JEWELLERY INDUSTRY<br />

jewellermagazine.com<br />

Managing Editor<br />

Coleby Nicholson<br />

Assistant Editor<br />

Alex Eugene<br />

alex.eugene@jewellermagazine.com<br />

Journalist<br />

Talia Paz<br />

talia.paz@gunnamattamedia.com<br />

Advertising Manager<br />

Gary Collins<br />

gary.collins@jewellermagazine.com<br />

Digital Manager<br />

Angela Han<br />

angela.han@gunnamattamedia.com<br />

Production Manager<br />

& Graphic Design<br />

Jo De Bono<br />

art@gunnamattamedia.com<br />

Accounts<br />

Paul Blewitt<br />

accounts@gunnamattamedia.com<br />

Subscriptions<br />

info@jewellermagazine.com<br />

<strong>Jeweller</strong> is published by:<br />

Gunnamatta Media Pty Ltd<br />

Locked Bag 26, South Melbourne,<br />

VIC 3205 AUSTRALIA<br />

ABN 64 930 790 434<br />

Phone: +61 3 9696 7200<br />

Fax: +61 3 9696 8313<br />

info@gunnamattamedia.com<br />

Copyright: All material appearing<br />

in <strong>Jeweller</strong> is subject to copyright.<br />

Reproduction in whole or in part is<br />

strictly forbidden without prior written<br />

consent of the publisher.<br />

Gunnamatta Media Pty Ltd strives to<br />

report accurately and fairly and it is<br />

our policy to correct significant errors<br />

of fact and misleading statements in<br />

the next available issue. All statements<br />

made, although based on information<br />

believed to be reliable and accurate at<br />

the time, cannot be guaranteed and<br />

no fault or liability can be accepted<br />

for error or omission. Any comment<br />

relating to subjective opinions should<br />

be addressed to the editor.<br />

Advertising: The publisher reserves<br />

the right to omit or alter any<br />

advertisement to comply with<br />

Australian law and the advertiser<br />

agrees to indemnify the publisher for<br />

all damages or liabilities arising from<br />

the published material.<br />

8 <strong>Jeweller</strong> <strong>April</strong> <strong>2018</strong>

NEWS<br />

NEWS<br />

Michael Hill closes Emma & Roe stores<br />

Michael Hill International (MHI) has<br />

announced it will close 24 of its 30 Emma &<br />

Roe stores in order to refocus the “direction”<br />

of the brand.<br />

According to the company, the 24<br />

Australian and New Zealand stores would<br />

be closed by 30 June <strong>2018</strong>. The remaining<br />

six will be repositioned to take on the<br />

demi-fine jewellery market in smaller,<br />

concentrated stores.<br />

“In January, MHI announced it had<br />

undertaken a comprehensive review of<br />

Emma & Roe to help shape the future<br />

strategic direction of the brand,” a company<br />

statement said. “The findings of this review<br />

identified a major opportunity in the demifine<br />

jewellery segment [up-market fashion<br />

jewellery] and an emergence in customer<br />

preferences towards fine fashion.<br />

“These remaining stores will be focused in a<br />

single market area, [as MHI] considers the six<br />

store footprint will provide the opportunity<br />

to iterate the new model at speed.”<br />

The statement added MHI estimated it<br />

would cost between $5.8 and $7.9 million to<br />

exit the stores.<br />

As previously reported by <strong>Jeweller</strong>, MHI will<br />

also close all of its “loss-making” stores in<br />

the US. MHI CEO Phil Taylor noted the nine<br />

US stores had “struggled” with a reported<br />

$12 million loss over the last 12 months.<br />

He said a highly competitive market,<br />

costly advertising and “significant” industry<br />

pressure aided the decision.<br />

The recent company statement added<br />

negotiations for exiting the US stores were<br />

“ongoing” and it would provide further<br />

information at a later date.<br />

MHI’s Emma & Roe range was launched<br />

in <strong>April</strong> 2014. It specialises in a range of<br />

charms, bracelets, necklaces, earrings and<br />

stackable rings. Named after Michael Hill’s<br />

daughter Emma and his wife’s maiden<br />

name Roe, the range was launched to<br />

complement MHI’s offering.<br />

‘Unicorn’ watch up for auction<br />

One of the rarest watches ever made is<br />

estimated to sell for more than CHF$3<br />

million (AU$4 m) at an upcoming<br />

international auction. According to auction<br />

house Phillips, the Rolex Cosmogaph<br />

Daytona 6265 is the only known white gold<br />

manual-winding Daytona ever produced.<br />

EMMA & ROE JEWELLERY STORES SET TO CLOSE<br />

Butterfly Silver in<br />

administration<br />

Well-known fashion jewellery chain<br />

Butterfly Silver has been placed into<br />

administration. Headquartered in<br />

Brisbane, the retail business specialises<br />

in sterling silver rings, earrings,<br />

necklaces, bangles and charms. It<br />

is understood that in mid-March<br />

it appointed P.A Lucas & Co as its<br />

administrator. Auctioneer house<br />

Hymans is handling the expressions of<br />

interest from potential buyers.<br />

Advertisements offering the business<br />

for sale have appeared in national<br />

newspapers.<br />

“This prominent and popular jewellery<br />

retailer runs from 19 outlets across the<br />

east coast of Australia, operating out of<br />

a head office and distribution centre in<br />

Brisbane,” a Hymans statement noted. “It<br />

had an annual turnover of approximately<br />

$6.5 million, with approximately<br />

$800,000 stock on hand at cost price.”<br />

It added that offers for all or individual<br />

stores would be considered, with retail<br />

outlets located throughout Queensland,<br />

New South Wales and Victoria.<br />

<strong>Jeweller</strong> contacted P.A Lucas & Co<br />

and Hymans asking why the business<br />

had been placed into administration<br />

and how many expressions of interest<br />

had been submitted. However, a<br />

response had not been received at<br />

the time of publication.<br />

Butterfly Silver managing director<br />

Michael Granshaw was also contacted<br />

for comment.<br />

Butterfly Silver was established in 2002.<br />

At the time of publication the company’s<br />

website had made no mention of being<br />

“under administration”.<br />

“Nicknamed ‘The Unicorn’ because of its<br />

elusive nature, Rolex made this extravagant<br />

Daytona in 1970 and delivered it to a<br />

German retailer,” a Phillips statement read.<br />

“Before the discovery of this piece, we<br />

believed that only stainless steel and yellow<br />

gold versions of the 6265 existed.”<br />

More than 30 of the “most sought-after”<br />

Daytonas will be on offer at Phillips’ Daytona<br />

Ultimatum auction in Geneva, Switzerland<br />

on 12 May. The headlining 6265 watch is<br />

RAREST ROLEX WATCH EVER MADE WILL AUCTION<br />

fitted with a sigma dial and white gold<br />

hour indicator, and has a crown made from<br />

stainless steel. It also features a white gold<br />

bracelet with bark finish, which was added<br />

by its current owner, Italian watch collector<br />

John Goldberger. Proceeds from the sale will<br />

go to charity Children Action.<br />

+ MORE BREAKING NEWS<br />

JEWELLERMAGAZINE.COM<br />

A BUTTERFLY SILVER PROMOTIONAL SHOT<br />

<strong>April</strong> <strong>2018</strong> <strong>Jeweller</strong> 9

NEWS<br />

IN BRIEF<br />

*<br />

GENIUS RATING<br />

A new industry report has revealed<br />

the digital strategies of high-profile<br />

jewellery and watch brands. The Digital<br />

IQ Index: Watches & <strong>Jeweller</strong>y <strong>2018</strong> report<br />

released by L2 Research, analysed the<br />

digital performance of several prominent<br />

companies including Swarovski, Pandora,<br />

Tiffany & Co and Alex and Ani. All were<br />

ranked by five digital e-commerce<br />

categories, from ‘genius’ through to<br />

‘feeble’. Tiffany & Co and Cartier were the<br />

only brands given ‘genius’ status.<br />

*<br />

INDIA EXPORTS STRONG<br />

Indian polished diamond exports went<br />

up in February, according to a Gem &<br />

<strong>Jeweller</strong>y Export Promotion Council India<br />

(GJEPC) report. The 0.5 per cent increase<br />

represented US$2.5 billion (AU$3.2 b)<br />

annually, but a 6 per cent drop in volume<br />

to 3.1 million carats. The average price<br />

of polished diamonds rose 6 per cent to<br />

US$791 (AU$1,028) per carat.<br />

*<br />

FITBIT GETS IN SHAPE<br />

A significantly cheaper Fitbit smartwatch<br />

model that “looks more like an Apple<br />

watch” has been released, a recent article<br />

by Fortune.com revealed. According<br />

to the report, the company’s first<br />

smartwatch was released in 2017, but<br />

was met with “tepid” sales figures. The<br />

revamped Fitbit design reportedly aims to<br />

appeal to more women.<br />

Alexandre Sidrov<br />

Master diamond workshop announced<br />

Sydney-based <strong>Jeweller</strong>y Institute of Australia<br />

(JIA) will host a workshop with Dutch<br />

“master setter” Alexandre Sidrov this month.<br />

Sidrov will deliver a class in micro-pave<br />

setting, and highlight methods used by<br />

the Alexandre School for Optical Diamond<br />

Setting, Belgium.<br />

“Sidrov is the pioneer in optical diamond<br />

setting. He created setting techniques that<br />

are faster, safer and more appealing, with the<br />

ability to make your own custom tools for<br />

each job,” Gabriel Owen, the founder of JIA<br />

told <strong>Jeweller</strong>.<br />

Synthetic prices on a downer<br />

According to a recent report by the Mining<br />

Journal, synthetic diamonds have decreased<br />

in price.<br />

Independent New York diamond analyst<br />

Paul Zimnisky noted that the decreasing<br />

cost of technology had contributed to<br />

the fall. “The price pressure is directly a<br />

result of supply growth leading to more<br />

price competition, especially as generic<br />

production coming out of Asia increases,”<br />

Zimnisky told <strong>Jeweller</strong>.<br />

However, this would help boost diamond<br />

quality, he said. “The result of more<br />

production facilities, and increased<br />

Million dollar fail<br />

“We are lucky here in Australia to have such<br />

a master come and visit. Usually people have<br />

to wait six months to a year for a seat at his<br />

school in Belgium,” Owen added.<br />

As previously reported by <strong>Jeweller</strong>, Owen, a<br />

jeweller and graduate of the Gemological<br />

Institute of America (GIA), founded the JIA in<br />

2017. He started the school because there<br />

were “no advanced classes for micro-pave<br />

setting and hand engraving.”<br />

Students are invited to attend either one<br />

or two week courses, beginning Monday<br />

16 <strong>April</strong>.<br />

production capacity of existing facilities, will<br />

impact both supply output and quality of<br />

output going forward, with both metrics<br />

inevitably improving.”<br />

Zimnisky added he believed “consumer<br />

sentiment towards laboratory-created<br />

diamonds is improving, as awareness and<br />

education about the product increases”.<br />

According to the report, true gem-quality,<br />

synthetic diamonds suitable for jewellery<br />

represent less than 10 per cent of global<br />

output. However, laboratories supply around<br />

99 per cent of industrial-grade diamonds for<br />

other applications.<br />

*<br />

SYNTHETIC RUBY LAYER<br />

The Gemological Institute of America<br />

(GIA) has identified two red stones as<br />

colourless natural sapphires with a<br />

synthetic ruby ‘overgrowth’. According to<br />

the GIA, the outer layers were “a cover of<br />

lab-grown stone that tinted the entire<br />

gems red.” To “the naked eye”, they had the<br />

appearance of chemically treated natural<br />

rubies, it noted. “This is not the first report<br />

of synthetic ruby overgrowth, but it marks<br />

the first time the laboratories have had<br />

them submitted for identification. The<br />

resurfacing of these vintage overgrowth<br />

synthetics shows that once a material is in<br />

the trade, it is here to stay,” the GIA added.<br />

+ MORE BREAKING NEWS<br />

JEWELLERMAGAZINE.COM<br />

The National Museum of Prague has<br />

discovered that some of its diamonds,<br />

sapphires and rubies are “fakes”. According<br />

to reports, a routine audit exposed the<br />

stones. One diamond was reportedly plain<br />

glass with a diamond cut, while others were<br />

synthetic instead of natural.<br />

Ivo Macek, head of the museum’s precious<br />

stones department said, “What we have is<br />

still a sapphire, but it is not a natural stone as<br />

was documented when the museum gained<br />

it in the 1970s. It was artificially created so it<br />

does not have the value we thought it did. It<br />

was acquired for CZK$200,000 (AU$12,354)<br />

and today it would have been worth tens<br />

of millions.”<br />

The museum’s deputy director Michal Stehlík<br />

said the museum was now investigating<br />

how the fakes came to be part of its<br />

collection, adding that the museum would<br />

“thoroughly” audit all its artefacts over the<br />

next three years.<br />

10 <strong>Jeweller</strong> <strong>April</strong> <strong>2018</strong>

Pink Diamonds from Argyle<br />

Suite 1108, 227 Collins Street, Melbourne, 3000<br />

Tel: 61 3 9650 3066 Mobile: 61 (0) 411 331 777<br />

pinkdiamondsfromargyle@gmail.com

NEW PRODUCTS<br />

HERE, JEWELLER HAS COMPILED A SNAPSHOT OF THE LATEST PRODUCTS TO HIT THE MARKET.<br />

SEIKO<br />

The Seiko Astron GPS Solar<br />

Dual-Time watch is powered by<br />

light, connects to a GPS network<br />

and automatically adjusts at<br />

the touch of a button. It also<br />

features a 12-hour sub-dial with<br />

a separate AM/PM indicator<br />

to keep track of a different<br />

timezone. Visit: seiko.com.au<br />

NAJO<br />

The ‘Amarres Wide Bangle’ is 64 mm and features four<br />

rows of vine-like coils wrapped around a beaten sterling<br />

silver bangle, which can also be stacked. Visit: najo.com.au<br />

OSJAG<br />

These earrings are part of the<br />

new <strong>2018</strong> Gold Collection. They<br />

come with black diamonds,<br />

and are crafted in 14¬-carat or<br />

18-carat gold. Visit: osjag.com<br />

STONES<br />

& SILVER<br />

These pieces are some of the latest<br />

available from Australian designers<br />

Stones & Silver. All products are<br />

set in .925 sterling silver.<br />

Visit: stonesandsilver.com.au<br />

DYRBERG/<br />

KERN<br />

These ‘Shiny Gold Arc’ earrings<br />

from Dyrberg/Kern are available<br />

in a range of different finishes.<br />

Supplied by JLM International.<br />

Visit: dyrbergkern.com<br />

PASTICHE<br />

The new Rising Sun collection from<br />

Pastiche is “inspired by light and shade,<br />

and the beauty of the moments in<br />

between”. These earrings and necklace<br />

are crafted from rose gold-plated,<br />

stainless steel. Visit: pastiche.com.au<br />

WORTH &<br />

DOUGLAS<br />

New designs have been added to<br />

the Ziro range of rings, which include<br />

roman numerals and skulls engraved<br />

in black zirconium, which has a<br />

ceramic-like texture.<br />

Visit: wdrings.com<br />

12 <strong>Jeweller</strong> <strong>April</strong> <strong>2018</strong>

NEW PRODUCTS<br />

COUTURE KINGDOM<br />

Mickey Mouse is nine decades old this year!<br />

Celebrate with the 90th birthday Mickey Mouse<br />

Limited Edition Collectable pieces from Couture<br />

Kingdom, to be released in October <strong>2018</strong>.<br />

Visit: couturekingdom.com<br />

NIKKI LISSONI<br />

The secret behind Nikki Lissoni’s designs<br />

is said to be that “each piece of precision<br />

cast and hand-finished jewellery<br />

provides the opportunity for women<br />

to create their own signature style.” The<br />

new range is available from Duraflex.<br />

Visit: nikkilissoni.com.au<br />

+ MORE NEW PRODUCTS<br />

JEWELLERMAGAZINE.COM<br />

SAMS GROUP<br />

This Blush Arabella Pendant and<br />

earring set features a floral<br />

design of natural Australian<br />

Argyle pink diamonds, with<br />

fine white diamonds.<br />

Crafted in 18-carat rose<br />

and white gold.<br />

Visit: samsgroup.com.au<br />

FABULEUX<br />

VOUS<br />

The latest addition to the Heart Series is the<br />

‘Captured’ design. Made in sterling silver, these<br />

delicate earrings are “inspired by love and the many<br />

shapes and forms it comes in”. They are available as<br />

drop earrings or studs. Visit: fabuleuxvous.com<br />

THOMAS<br />

SABO<br />

Available from Duraflex, the<br />

Generation Charm Club has<br />

been completely reinvented<br />

this year. Over 250 new<br />

pieces will be available.<br />

Visit: thomassabo.com<br />

CLUSE<br />

This slim rose gold-plated necklace chain,<br />

with an elegant, simple marbled hexagon<br />

pendant is from the new Cluse collection.<br />

Available through Heart & Grace. Visit: cluse.com<br />

BAUSELE<br />

Available from Bolt International,<br />

the new Noosa After Dark watch is<br />

said to “capture the breathtaking<br />

beauty of two of<br />

Australia’s most celebrated<br />

beaches with sophistication<br />

and style”. Pure white grains<br />

of sand from Whitehaven<br />

beach are nestled in the<br />

crown. Visit: bausele.com<br />

<strong>April</strong> <strong>2018</strong> <strong>Jeweller</strong> 13

Instyle Watches PTY LTD<br />

02 8399 7300<br />

adminw@instylewatches.com.au<br />

www.pierrecardinwatches.com.au

FASHION WATCHES<br />

About time: <strong>2018</strong>’s<br />

FASHION<br />

watch styles<br />

WHILE JEWELLERY TRENDS<br />

COME AND GO, FASHION WATCHES<br />

REMAIN STYLISH NO MATTER THE<br />

SEASON. TALIA PAZ PROVIDES<br />

THE LATEST INSIGHT INTO THIS<br />

ENDURING CATEGORY.<br />

very year, suppliers and retailers are introduced to luxury<br />

watch manufacturers’ latest offerings, including their<br />

updated versions, special editions, and a bevy of new,<br />

unique styles.<br />

After key releases are unveiled at the important watch fairs<br />

– think Switzerland’s enigmatic Baselworld – the fashion watch trends<br />

inevitably trickle down the supply chain, making their way to the local<br />

market. Here is where the cascade of vibrant colours, striking bands,<br />

simplistic details and ornate embellishments come into play, with<br />

consumer demand for this category showing no signs of abating.<br />

With that in mind, here’s a taste of the latest trends shaping the<br />

ultimate statement accessory category.<br />

PEAK DEMAND<br />

Minimalist yet versatile styles continue to saturate the watch market,<br />

Simon Garber, director of Cluse distributor Heart & Grace attests.<br />

PIERRE CARDIN<br />

<strong>April</strong> <strong>2018</strong> <strong>Jeweller</strong> 15

FASHION WATCHES<br />

Sceats agrees with these sentiments, adding that it’s up to retailers to make sure<br />

their stock is fresh and consistently in tune with consumer demand.<br />

“The market is tiring of so many watches with leather straps or mesh bands and<br />

consumers are looking for watches with linked, integrated metal bands,” Sceats<br />

says. “As well as wholesalers, we are watch designers and we need to work hard to<br />

find and design styles that the consumer is looking to purchase.”<br />

HEART & GRACE<br />

INSTYLE WATCHES<br />

“Classic styles continue to stay on trend and always will,” Garber says. “They can be<br />

adapted with new fashionable colours and fabrications each season to match any<br />

wardrobe. Classic watches really can be dressed up or down to suit any look.”<br />

Cluse expanded into jewellery mid-2017 when the brand debuted three bracelet<br />

ranges. Capitalising on the trend of pairing watches with bracelets has paid off – it’s<br />

one of the key trends making the rounds locally and internationally. Are there other<br />

trends that retailers should consider this year?<br />

“Square watch faces, rose gold, interchangeable watch straps and new bi-colour<br />

mesh straps,” Garber declares.<br />

Jeanette Sceats, managing director of Pierre Cardin supplier Instyle Watches, has a<br />

few other ideas. She says simple, understated styles remain strong and what was<br />

fashionable a few years ago also seems to be coming back for round two – albeit in<br />

a slightly revamped way.<br />

“Medium-size women’s watches are coming back but not as large as they have<br />

been in previous years,” Sceats notes. “We have also been asked to release more<br />

women’s watches with crystals so it looks like ‘bling’ may be coming back too.”<br />

This appears to be the case for the men as well. “After the last few years of the<br />

very simple and minimal style men’s watches, we have been asked for more<br />

large, multi-function and chronograph men’s watches,” she continues. “There is<br />

still a part of the market that wants understated, simple styles, but this look is<br />

diminishing in popularity.”<br />

David Faraday, managing director of Oozoo Timepieces and Dukudu distributer<br />

Hipp, offers his own take on what consumers will want this year.<br />

“While the 40 mm, oversized watches continue to be the most popular, retailers<br />

need to be aware of the resurgence of desire for smaller-case watches – think<br />

32 or 36 mm,” Faraday says. “Also, mesh straps are definitely in greater demand.<br />

Understated, simple styles are classic, and classic will always be popular.”<br />

Part of the game plan is to take more chances with stock, Garber adds: “Take a risk<br />

with new styles and colours to see if they resonate with your customer. Fashion<br />

trends now move at a fast pace, so it’s important to stay one step ahead and<br />

educate customers on the latest offering.”<br />

YOUNG AT HEART<br />

A 2017 report by UK research firm Deloitte offered interesting insight into how<br />

retailers can sell watches to younger generations. One of its main conclusions?<br />

Gen Y and Gen Z shoppers care more about the style of a watch than any<br />

of its functions.<br />

“For all practical purposes we can assume that every Millennial consumer already<br />

owns a functioning and highly-accurate timepiece in the form of a smartphone<br />

or tablet,” the report begins. “Mobile devices can offer all of the functionality of an<br />

analogue watch and more. They can also duplicate most, if not all, of the functions<br />

of a smartwatch. Yet Millennials continue to buy analogue watches for reasons of<br />

fashion and prestige.”<br />

An article by US business publication Fast Company also provides insight into the<br />

younger generation’s penchant for fashion watches.<br />

“Many of us [Millennials] are feeling that we’re not consuming technology anymore;<br />

technology is consuming us,” it begins. “Millennials have distinct memories of<br />

wearing watches while they were growing up… [therefore] Millennials have a<br />

nostalgic association with analogue watches. They’re looking for timepieces that<br />

look more sophisticated than the plastic Swatch or Casio Baby G watches they<br />

wore when they were children, but don’t want to shell out thousands for a highend<br />

luxury watch.”<br />

As Steven Kaiser, president of watch and jewellery consultant company Kaiser Time<br />

also explained in an article with US publication National Jeweler, a watch should<br />

always be treated as the emotional purchase it is. As such, this means some specific<br />

selling strategies need to come into play for younger generations.<br />

“Aside from being technically educated on the intricacies of quartz and mechanical<br />

watches, sales staff need to romance the purchase by sharing the history of<br />

the brand and by telling personal stories that resonate with potential buyers,”<br />

STAYING AHEAD OF THE GAME<br />

Fashion watches continue to experience healthy consumer interest; however,<br />

suppliers and retailers agree that maintaining a share of the market is one of the<br />

biggest issues they face. Those challenged with the task of maintaining robust sales<br />

believe a well-considered strategy is integral to success.<br />

“We all know many brands have entered the fashion watch market because of the<br />

high consumer demand,” Faraday says. “Retailers should always consider the quality<br />

of the watches and a supplier’s commitment to fast warranty servicing and aftersales<br />

service when choosing which brands to stock.”<br />

HIPP<br />

16 <strong>Jeweller</strong> <strong>April</strong> <strong>2018</strong>

INSTYLE WATCHES<br />

Kaiser said back in 2016. “The ability of the<br />

salesperson to key in on the emotional part<br />

of the purchase is in many cases just as<br />

important as the technical aspects of the<br />

timepiece itself.”<br />

Staff must also be equipped to counter<br />

an all-too-common sales rejection: that<br />

consumers don’t require watches when they<br />

have mobile phones. The best way to do<br />

this is to entice shoppers to physically try on<br />

watches of interest.<br />

“Phones do tell the time but nothing<br />

will ever replace the feeling of having a<br />

beautiful timepiece on your wrist,” Gretchen<br />

Mathews, senior vice president of human<br />

resources at watch retailer Tourneau, said in<br />

the same article.<br />

Faraday also offers some advice for<br />

capitalising on the desires of younger<br />

generations. “Choose models that are in line<br />

with the current fashion trends,” he says. “Keep<br />

your range looking fresh and always have<br />

something new and exciting to catch your<br />

customers’ eyes.”<br />

FOR THE ‘GRAM<br />

Employing some simple social-media<br />

techniques can do wonders for watch<br />

sales, and a good place to start is by<br />

taking inspiration from some of the big<br />

watch names.<br />

Last year, Omega marketed its latest watch on<br />

Instagram and then created its own hashtag<br />

– #SpeedyTuesday – so that consumers could<br />

upload images of their purchases or search<br />

directly for the watch. The simple strategy<br />

paid off as the watch reportedly sold out<br />

within four hours!<br />

Local retailers could use similar marketing<br />

ideas to improve the visibility of their latest<br />

HIPP<br />

offerings. After all, as Faraday explains, social<br />

media continues to be “very influential” for<br />

shoppers.<br />

“Consumers are more aware of the concept<br />

of a fashion watch and are matching their<br />

watches to their outfits and changing them in<br />

line with the season,” he says.<br />

Garber agrees with these sentiments.<br />

“Social and digital media has had a huge<br />

influence on consumers buying fashion<br />

watches,” she adds. “Influencers, celebrities<br />

and consumers love to share their watches<br />

on social media; consumers follow these<br />

fashion influencers to stay up to date with<br />

the colours and styles trending globally and<br />

buy into these new styles.”<br />

Keeping track of what consumers are<br />

following on social media isn’t the only<br />

strategy retailers should be employing to<br />

boost watch sales. Instead, Sceats advises<br />

those seeking additional inspiration to take<br />

notice of what’s on the fashion runways.<br />

“Look to the more fashion-forward parts of<br />

the market to determine what styles are the<br />

focus of international icons. These styles will<br />

usually trickle down the market but leave<br />

their influence in many ways, such as sizes,<br />

colours, simplicity or bling,” Sceats explains.<br />

“Look for new styles that are wearable but<br />

have features that will attract the eye of<br />

passing consumers. By adding some colour<br />

and imagery to the store windows, you will<br />

attract customers more than by just showing<br />

the same conservative styles you have been<br />

selling for several years,” she adds.<br />

Trends may come and go but consumers<br />

continue to maintain a healthy appetite for<br />

fashion watches. With a few savvy techniques,<br />

retailers can ultimately gain the upper hand in<br />

this robust sector. i<br />

Exclusive Distribution by hiPP.com.au<br />

in AU & NZ<br />

info@hiPP.com.au | 1300 132 522<br />

(NZ 0800 65 4477)

COLOURED DIAMOND REPORT<br />

BOLTON GEMS WORLD SHINER ELLENDALE DIAMONDS<br />

True<br />

COLOURS<br />

WITH CONSUMERS INCREASINGLY SAVVY ABOUT<br />

WHITE DIAMONDS, COLOURED DIAMONDS<br />

CONTINUE TO OFFER RETAILERS A BETTER MARGIN.<br />

ALEX EUGENE REPORTS ON THE BEST WAY TO TAKE<br />

ADVANTAGE OF THESE HIGHLY-PRIZED STONES.<br />

here’s a scene in the film Titanic where Kate Winslet’s character<br />

Rose sits for a seductive nude portrait, wearing a 56-carat blue<br />

diamond, strung upon a chain of white diamonds.<br />

The fictional gemstone, known as ‘the heart of the ocean’, is a replica of<br />

the famous Hope Diamond, a 45.52-carat stone reportedly stolen from<br />

an ancient statue in India, and subsequently blamed for the misfortune that<br />

afflicted its various owners. According to myth, the Hope Diamond is cursed,<br />

but this hasn’t stopped it from enchanting the collective consciousness of<br />

gemstone lovers since the 17th century.<br />

History is abundant with intriguing tales of coloured diamonds, which have<br />

only become more popular over time.<br />

A HISTORY OF LOVE<br />

Whether invention or fact, many of the greatest love stories have involved<br />

coloured diamonds.<br />

“There has traditionally been a romance associated with coloured diamonds<br />

and this has always attracted a premium in their pricing,” says Gersande Price,<br />

sales manager at Ellendale Diamonds. “There is no fixed price for exceptionally<br />

fine coloured diamonds.”<br />

Brett Bolton, Director of Bolton Gems confirms this is the case: “Consumers<br />

believe price is secondary to finding the right stone for them. Colour is more<br />

of an incentive.”<br />

Add to that the dwindling supply of some colours, notably Australian pink, and<br />

say hello to one of the most lucrative products available to jewellers.<br />

“Despite producing 95 per cent of the world’s pink diamonds, the Argyle<br />

mine’s total pinks production is under 1 per cent, and with the upcoming<br />

closure in two to three years’ time, Argyle pink diamonds are a unique West<br />

Australian sensation around the world,” says Price.<br />

Miri Chen, CEO of the Fancy Color Research Foundation (FCRF) says that<br />

fancy-colour diamonds are so rare and beautiful they have become a serious<br />

investment opportunity.<br />

“Out of all diamonds in the world, only a fraction of a percent actually<br />

show special colours and are entitled to being called fancy-colour diamonds,”<br />

she says.<br />

Maulin Shah, director of World Shiner says, “Demand is increasing for the pink<br />

diamonds; they are very unique. People are buying Argyle diamonds<br />

for investment.”

COLOURED DIAMOND REPORT<br />

Price agrees with that sentiment. “Everyone<br />

in the market is after an Argyle diamond,<br />

for love of their land, the beautiful arrays of<br />

colours or for pure investment purpose.”<br />

Steve Der Bedrossian, CEO of Sams Group,<br />

is matter of fact about his pink diamond<br />

stock. “A low end pink melee in a light<br />

pink colour is still going to cost around<br />

AU$1,900 a carat. But for white diamonds,<br />

the best, cleanest, small melee white<br />

diamond is never going to pass AU$750 a<br />

carat,” he explains.<br />

THE NEW PRESTIGE, A SEA OF WHITE<br />

Once considered exclusive and for the<br />

elite, white diamonds have become more<br />

accessible to lower ends of the market,<br />

which has made them more popular.<br />

A wealth of online information has<br />

demystified diamonds further.<br />

More information means customers are<br />

more knowledgeable, and generally know<br />

what they want – although the quality<br />

of that knowledge may be lacking. Gary<br />

Holloway, one of the world’s leading<br />

diamond experts and owner of Holloway<br />

Diamonds says that more accurately,<br />

“consumer confidence” is high. Customers<br />

“come in confident of what they want,” he<br />

explains with a smile.<br />

On top of that, “the white diamond market<br />

is saturated,” says Der Bedrossian. “Retailers<br />

can only bill them at 5 to 10 per cent<br />

markup. They make the money on the<br />

ring mount, not the diamond. It’s really<br />

cut throat.” Conversely, he says that pink<br />

diamonds “are more unique and every<br />

stone is individual. There’s less competition<br />

and overall I think the retailers can make<br />

more margin.”<br />

He adds that because of the flooded<br />

white market, retailers can still make more<br />

margins on the sale of brown and black<br />

diamonds, despite the fact that they are<br />

cheaper to buy than white diamonds.<br />

Brown and black diamonds from Australia<br />

also have the upper hand due to their<br />

local origin, he says. “If it’s a diamond from<br />

Argyle, that’s what sells.”<br />

According to Chen, there are many<br />

misconceptions that harm the industry.<br />

“Most people wrongly believe that<br />

diamonds will come out of the ground<br />

ELLENDALE DIAMONDS<br />

forever. This is far from the reality,” she<br />

explains.<br />

THE PRICE ADVANTAGE<br />

Consumers are a long way from knowing<br />

everything about coloured diamonds.<br />

Holloway points out that there’s far more<br />

variation in the way coloured diamonds are<br />

viewed for quality.<br />

Bolton agrees: “Customers are trying to use<br />

what they know about white diamonds<br />

and apply it to colour. There is no finite<br />

grading structure for coloured diamonds.<br />

Consumers need to know that clarity<br />

and symmetry is less important, and that<br />

perfection in colour matching may not be<br />

possible. Coloured diamonds are cut for<br />

colour return.”<br />

Holloway states bluntly: “The grading<br />

system for coloured diamonds is not very<br />

good. It’s quite common to have two<br />

identical diamonds, but of a different grade.<br />

So I might buy a brown diamond that looks<br />

exactly the same as another diamond that<br />

has a higher grade, but really, you can’t tell<br />

them apart.”<br />

Nonetheless, Der Bedrossian says<br />

customers who come asking for coloured<br />

diamonds will be well aware they have to<br />

pay more for them. “When they’ve come for<br />

a 1-carat pink diamond, it could be up to<br />

AU$1million per stone…believe me they’re<br />

going to do their homework,” he says. And<br />

with the Argyle mine estimated to close as<br />

soon as 2020, he says those prices are on<br />

the increase.<br />

Shah agrees that there is a huge difference<br />

in the price when comparing white<br />

and natural pink diamonds, so it’s not<br />

Timeless outside.<br />

Revolutionary inside.<br />

• Timeless design<br />

• Fitness tracking<br />

• Water resistant*<br />

* Certified IP68 water-resistant up<br />

to 1.5 meters for up to 30 minutes.<br />

E sales@samsgroup.com.au<br />

W samsgroup.com.au<br />

P 02 9290 2199

COLOURED DIAMOND REPORT<br />

over-priced. Such a story reinforces the<br />

importance for jewellers to educate their<br />

customers.<br />

A COLOURED POINT OF DIFFERENCE<br />

Retailers who choose to stock coloured<br />

diamonds are already ahead of the game<br />

because they will attract customers looking<br />

to fulfil a special request.<br />

www.ClassiqueWatches.com<br />

E pink@samsgroup.com.au<br />

W samsgroup.com.au<br />

P 02 9290 2199<br />

BOLTON GEMS<br />

comparable at all. “It depends on the<br />

colour, it depends on the shade and there<br />

is a different price structure,” he explains.<br />

Chen confirms it is much harder for the<br />

average consumer to understand what<br />

makes them valuable. “The value of a<br />

fancy-coloured diamond is impacted by<br />

many parameters that are very different<br />

from those used to estimate the value of a<br />

colourless diamond,” she says.<br />

These complexities have helped coloured<br />

diamonds to retain their mystique, for<br />

the most part shielding them from ‘price<br />

hagglers’.<br />

So not only are coloured diamonds rarer,<br />

more unique and more likely to be graded<br />

as high quality, but consumers also know<br />

less about them. This makes them one of<br />

the better products for increasing retail<br />

gross margin.<br />

Another benefit for bricks-and-mortar<br />

retailers is that coloured diamonds are<br />

much harder to properly assess on a<br />

computer screen.<br />

“Coloured diamonds are something that<br />

customers really have to see to appreciate,”<br />

Chen says. “How accurate is a website<br />

description? Has the colour in the photo<br />

been re-touched or colour enhanced? With<br />

coloured diamonds, clients have to come<br />

into the store to see for themselves exactly<br />

what is on offer.”<br />

Holloway stresses the importance of<br />

the jeweller’s knowledge with a striking<br />

anecdote. At a trade fair last year, he viewed<br />

two yellow diamonds that were thousands<br />

of dollars apart in price, but the lighting<br />

had effectively reversed their appearance,<br />

making each look excessively under or<br />

Chen says “offering fancy-colour diamonds<br />

helps retailers position themselves at a<br />

whole different level. Because of their<br />

rarity and the fact that each fancy-colour<br />

diamond is different, they allow a much<br />

more interesting dialogue with the client<br />

who will want to understand what he or<br />

she is buying.”<br />

Shah agrees: “In white diamonds there is<br />

a lot of competition and similar stones<br />

available, but every coloured stone is<br />

different and unique so it will be easier<br />

for retailers to make a sale and a mark-up.<br />

It’s not easy to find something exactly the<br />

same at another jeweller.”<br />

Price says low supply will always fuel<br />

demand. “There is a marked increase in<br />

the desirability of coloured diamonds<br />

with a very restricted supply so prices<br />

can be much higher for these diamonds,”<br />

she explains. “Argyle pink diamonds are a<br />

particular example; as the mine is closing<br />

very soon and is the world’s major source,<br />

supplier prices are revised regularly.”<br />

The attractiveness of Australian pink<br />

diamonds isn’t just about rarity. Der<br />

Bedrossian says demand for ethically<br />

sourced stones is increasing.<br />

“It’s what people want in Australia. It’s<br />

called a chain of custody…from ‘the<br />

ground to the finger’ they say. Argyle<br />

diamonds are always worth more. You can<br />

find the same stone on the market with a<br />

GIA certificate – it will be argyle material,<br />

you can tell – but if it doesn’t have the<br />

inscription or any paperwork saying it came<br />

from Argyle, it will be at least 25 per cent<br />

cheaper than exactly the same stone with<br />

Argyle paperwork,” he explains.<br />

Bolton Gems are delivering on that demand<br />

from consumers: “If a retailer is an exclusive<br />

stockist of Australian Chocolate Diamonds,<br />

they get a stone with a story that starts<br />

from the day the diamond is mined. They

also get diamonds at a price that allows flexibility in creativity to<br />

make a statement piece with larger diamonds.”<br />

It’s also good news for customers of Ellendale. “We supply coloured<br />

diamonds with origin, namely from the Argyle and Ellendale Mine<br />

– Argyle pinks, yellows, champagne, cognacs, Ellendale yellow<br />

and whites. Our diamond inventory covers melee size, matching<br />

sets, single stones to investment stones and are all supplied with<br />

certificate of origin in addition to a lab certificate where available,”<br />

Price says.<br />

This demand also means customers who can’t afford a large stone<br />

would still rather walk away with a small one than nothing at all.<br />

Therefore, even smaller stones are fetching higher prices over time.<br />

“Fancy-colour demand and supply go in opposite directions,” Chen<br />

says. “Supply is dwindling and demand is rising sharply. As such,<br />

we see that in the last three years, clients who look for rare colours<br />

and cannot afford them anymore are willing to settle for very low<br />

clarities or very small sizes.”<br />

THE FUTURE IS BRIGHT<br />

There’s no denying that coloured diamonds are in a class of their<br />

own, and more unique than white diamonds in many ways.<br />

Holloway also points to a lucky break the industry may gain thanks<br />

to technology: “A lot of yellow diamonds that used to be on the<br />

market were in the ‘D to Z’ scale… but those diamonds, by virtue of<br />

the cutting technology, could be turned into fancy and fancy light.”<br />

For now though, most of the focus remains on the shrinking yield<br />

of Australian coloured diamonds, particularly pinks.<br />

“In the past year, World Shiner has increased its inventory of Argyle<br />

pink diamonds, because demand will definitely increase. People<br />

are buying lots of coloured diamonds for reasons of culture and<br />

fashion,” Shah says.<br />

Der Bedrossian couldn’t agree more, saying that prices have<br />

climbed so much in recent years that he wonders just how high<br />

they can go. “Every year these diamonds are getting rarer. I don’t<br />

know what’s going to happen to prices once it closes because it’s<br />

already going up all the time.”<br />

Price sums it up elegantly: “The famous ‘diamonds are a girl’s<br />

best friend’ slogan is still very accurate; the demand for coloured<br />

diamonds is forever increasing. In recent years, the fancy-coloured<br />

diamond market has been reaching record sales.”<br />

Chen, however, turns to numbers to make her point: “The price of<br />

smaller fancy-colour diamonds between 1.5 and 9 carats rose over<br />

400 per cent in the past five years, and it looks like this upward<br />

trend will continue. Also, rare colours in low clarity – SI2 and<br />

lower – used to be hard sellers, but in the last three years, they<br />

have been in high demand as they are more affordable. These two<br />

phenomena will keep gaining momentum for years to come.”<br />

In a challenging retail climate, coloured diamonds offer retailers an<br />

exceptional opportunity to make healthy sales. Salespeople who<br />

are armed with expert information will be able to woo customers<br />

with these unique beauties. i

WATCH FAIR REVIEW<br />

GENEVA WATCH FAIR<br />

reassures the industry<br />

IN A WORLD WHERE THE SWISS WATCH AND CLOCK INDUSTRY IS SUFFERING<br />

UNPREDICTABLE BUYING PATTERNS, THE GENEVA SALON PROVIDED LUXURY WATCH<br />

BRANDS WITH MUCH-NEEDED INTERNATIONAL ATTENTION. MARTIN FOSTER REPORTS.<br />

Each year when the Salon International de la Haute Horlogerie Genève (SIHH)<br />

opens for its annual trade fair, it marks the first showing of the newest high-end<br />

luxury watches.<br />

It’s a fabulous showcase with no equivalent anywhere in the world. The Geneva<br />

Salon, as it is known, is as famous for its prestigious exhibitors as it is for the quality<br />

of its infrastructure. SIHH represents the finest examples on offer from the major<br />

luxury brands of the Swiss watchmaking industry.<br />

This year’s event (15–19 January) expanded the successful presentation elements<br />

of last year, again increasing the number of exhibitors despite an extremely tough<br />

commercial environment.<br />

With BaselWorld enduring a major restructure, Geneva Salon is currently the only<br />

expanding European trade show. More than 20,000 visitors attended this year – a<br />

record number – along with 1,500 media personnel – an increase over last year of<br />

20 per cent and 12 per cent, respectively.<br />

The exhibition area had to be expanded to 55,000 square metres to<br />

accommodate this, a 20 per cent increase in floor space. This year also saw the<br />

largest number of watch houses yet; there were 35 exhibitors, compared with 30<br />

in 2017 and just 16 in 2014.<br />

WHAT IS THE SIHH?<br />

SIHH launched in 1991 as a private exhibition of the luxury house brands of the<br />

Richemont Group. In 2005, the Richemont Group, Audemars Piguet and Girard-<br />

Perregaux formed the Fondation de la Haute Horlogerie (FHH) which is now the<br />

body that oversees the event. Subsequently, the scope of the Geneva Salon has<br />

been expanded to include closely associated watch brands.<br />

In 2016, SIHH added a new category titled Carré des Horlogers (the Watchmaker’s<br />

Square), which consisted of a group of highly skilled artisan-creators representing<br />

avant-guard watchmakers and independent workshops.<br />

Carré des Horlogers brands of note included Christophe Claret, Chronométrie<br />

Ferdinand Berthoud, DeWitt, and Grönefeld among others. Exhibitors in the main<br />

hall included a grand offering of brands, including A.Lange & Söhne, Baume &<br />

Mercier, Cartier, Hermès, IWC and Montblanc to name just a few.<br />

Last year, for the first time the Geneva Salon was opened to the public on the<br />

final day. Fabienne Lupo, President and Managing Director of SIHH said, “The<br />

new approach has proven its worth. The Salon has successfully undertaken<br />

a significant transformation process that implies evolving in order to offer<br />

exhibiting maisons [houses] not only the best platform conducive to doing good<br />

business, but also the finest showcase in terms of communication and visibility –<br />

all firmly plugged into today’s world.”<br />

WHAT IS PALEXPO?<br />

Geneva Salon is held in the PALEXPO, a large exhibition centre located adjacent to<br />

the Geneva airport.<br />

The event organiser gains access to PALEXPO a month before its opening date to<br />

construct an imaginative and attractive fantasy world. Absolutely no expense is<br />

spared: the bare concrete walls are converted into an expansive luxury complex<br />

of about 30 brand suites and showrooms with fine, lofty architectural style, soft<br />

carpets, diffused lighting, and hushed, luxury ambience in keeping with its high<br />

horology exhibitors.<br />

This luxurious set must withstand the footfall of 20,000 visitors in the week of the<br />

trade show, only to be torn down a week later and consigned to the horological<br />

history books. PALEXPO then returns to its regular exhibiting role for the<br />

International Motor Show and Arts Geneva.<br />

The past 12 months was a reassuring year for the luxury watch market, improving<br />

somewhat on the sliding trends of recent years. Reportedly, Richemont’s buyback<br />

implementations were successful and delivered some good year-end results<br />

for the company.<br />

According to Richemont’s November interim report, sales increased by 10 per<br />

cent for the previous six months, and operating profits for the period were up 80<br />

per cent representing final figures of more than €974 million (AU$1.5 b).<br />

Swiss Federal Customs Administration (FCA) confirmed this trend, reporting that<br />

Swiss watch exports for November 2016 stood at just under CHF$2 b (AU$2.7 b),<br />

equivalent to 6.3 per cent growth.<br />

These are very comforting numbers for industry stakeholders, and the group’s<br />

performance was reflected in the optimism around the brands at the fair. Fine and<br />

inventive watchmakers find new ways of combining old ideas in beautiful ways,<br />

and this is philosophically reflected across the exhibiting brands. The 2019 Geneva<br />

Salon will take place from 14–19 January. i<br />

24 <strong>Jeweller</strong> <strong>April</strong> <strong>2018</strong>

CHARM BRACELETS<br />

GET<br />

Lucky<br />

with charms this season<br />

DURAFLEX NIKKI LISSONI<br />

THEY MAY BE SMALL BUT THEY’RE NOT TO BE<br />

IGNORED. ALEX EUGENE DISCOVERS WHY CHARMS<br />

ARE SO MUCH MORE THAN A PASSING FAD.<br />

K Rowling, the author of the Harry Potter children’s book series,<br />

first received a charm bracelet when she was just five years old.<br />

Remembering the event in 2013 for Harper’s Bazaar, she wrote, “I had<br />

never been given anything more beautiful.”<br />

Later in life, when the seventh Harry Potter book was released, Rowling’s editor<br />

gave her what would become “my most treasured piece of jewellery: a bracelet<br />

covered in gold and silver charms from the books. There was a tiny Golden<br />

Snitch, a silver Ford Anglia, a Pensieve and a stag Patronus. There was even a<br />

Philosopher’s Stone in the form of an uncut garnet.”<br />

Like her books, Rowling’s personal story will hit a note for millions of people<br />

everywhere: charms have been made and worn for deeply personal reasons<br />

since the earliest times. And for retailers today, there’s no better item that taps<br />

into the highly emotional market of jewellery, but also presents an opportunity<br />

for repeat business on a regular basis.<br />

IN THE HISTORY BOOKS<br />

“The charm concept has been part of human history going back to prehistoric<br />

times,” Isaac <strong>Jeweller</strong>y director Annet Atakliyan explains. “The need to keep things<br />

close to the body – individual treasure, things of beauty, cherished memories and<br />

marking prominent moments in life – was always met through charm jewellery.”<br />

Indeed, ancient charms have been discovered that were made from shells, wood<br />

and bone long before fine jewellery existed. Christians used tiny fish charms<br />

hidden inside their cloaks to identify themselves to each other during the Roman<br />

Empire’s reign, between 64 AD and 313 AD.<br />

Today it remains popular to wear charms as a symbol of personal meaning. Small<br />

and delicate, they have a unique ability to capture significant moments in life.<br />

This, combined with the sheer diversity of designs on the market, makes charms<br />

a highly “collectable concept” that perfectly suits the personalised jewellery<br />

consumer, says Phil Edwards, managing director of Duraflex.<br />

“For consumers, the appeal of this category is the unique product concepts,<br />

which allow wearers to celebrate their own personality and diversity – there are<br />

innumerable jewellery combinations possible,” he explains.<br />

Ken Abbott, managing director of Timesupply, echoes the sentiment with regard<br />

to the Nomination bracelets, which feature unique interchangeable links. “Being<br />

able to create stories link by link with endless combinations for women, men, girls<br />

and boys allows the wearer to express their personality using an icon<br />

based language.”<br />

Edwards adds there is further appeal for retailers: “Charm bracelets and bangles<br />

make the perfect gift, which can then be added to with additional charms to<br />

celebrate birthdays, Valentine’s Day, Mother’s Day, Christmas and more. This<br />

generates customer loyalty and ignites consumers passion for a brand.”<br />

THE QUIET ACHIEVER<br />

In a price line-up, charms might seem negligible alongside engagement rings<br />

and other big sellers; however, it’s this very affordability that means customers are<br />

more likely to buy more than one and come back frequently.<br />

Pandora has built an empire on these tiny heroes. The company’s managing<br />

director, Mikael Kruse Jensen, admits that Pandora harnessed “a magic formula in<br />

increasing customer basket size and engaging in a long-term relationship with<br />

the customer”.<br />

“Charms as a concept is built on gifting and repeat purchases. With Pandora,<br />

consumers want to fill their bracelets and create different looks according to their<br />

26 <strong>Jeweller</strong> <strong>April</strong> <strong>2018</strong>

CONTACT: (02) 9417 0177

DURAFLEX - THOMAS SABO ISAAC JEWELLERY STONES & SILVER<br />

PANDORA<br />

style and sensibility, as well as mark the moments and milestones in their lives.<br />

The broad spread of pricing also appeals to many consumers, therefore price is<br />

not a barrier,” he explains.<br />

For the quiet achiever to become that winning formula, visibility is crucial,<br />

Edwards explains.<br />

“The concept of collectability is key, and effectively marketing this is critical,” he<br />

says. “This is why with Thomas Sabo, the launch of Generation Charm Club is<br />

accompanied by a comprehensive marketing concept to support local retailpartner<br />

marketing strategies. This includes a new generation Charm Club logo,<br />

unique POS presentation, advertising campaign, value-adding promotions, staff<br />

training portal, social media support and more.”<br />

Atakliyan says charms lend themselves perfectly to today’s online sales climate.<br />

“Charms are playful and full of meaning, and as marketing ingredients, they are<br />

easily conveyed in today’s world of social media,” she says. “Charm material can<br />

be presented with any occasion, memory or message you wish to pass on to<br />

your clientele.”<br />

For Abbott, personally helping the customer make the first step is key. “Be<br />

interested in you customer, listen and ask questions, to be able to help them build<br />

a story in iconic links that resonates emotionally,” he suggests.<br />

GETTING BANG FOR BUCK<br />

Charms don’t have to be limited to the bracelet domain either, Edwards says. In<br />

addition to the Thomas Sabo Generation Charm Club, Duraflex also carries the<br />

popular Nikki Lissoni range, which includes collectible charm bangles.<br />

“They are essentially similar, but also provide options for interchanging,<br />

personalisation and wearing more charms, further driving the passion for<br />

collecting and sales,” Edwards says.<br />

Even better, Atakliyan says retailers can benefit without blowing out the budget.<br />

“Small collections of charms will benefit stores as customers will be attracted to<br />

them. Once the offer is there as a choice, retailers can order on an as-needed basis<br />

without committing a huge part of their yearly budget. They will stay relevant<br />

with the current market demand, instead of missing out,” she explains.<br />

“We have found the Australian consumer loves Australian quality products. The<br />

messages ‘We are Australian’ and ‘Hand-made in Australia’ helps with successful<br />

sales,” she adds.<br />

A CHARMING FUTURE<br />

The popularity of charms has exploded worldwide and the local market is<br />

no different.<br />

“Sell-through from existing Composable stockists has been strong, with<br />

consistent reorders,” says Abbott. “And since the new distribution arrangement<br />

that started in January, with a refocus on Composable Links, we have 25 new<br />

retail partners.”<br />

Edwards says: “Both Thomas Sabo and Nikki Lissoni continue to be strong<br />

jewellery brands in both the Australian and New Zealand markets. The Thomas<br />

Sabo Charm Club is the strongest-selling range in Australia, closely followed by<br />

the sterling silver jewellery range.<br />

“For Nikki Lissoni, the charm products are an excellent addition to the core<br />

concept of interchangeable coins, which are the best sellers here locally.”<br />

Atakliyan also says the Isaac charm collections “have performed very well since<br />

our initial launch of the Surreal brand in 2008.” She puts it down to being an<br />

Australian product, with a quality that inspires consumers to choose Isaac over<br />

other brands.<br />

With the trend still going strong, suppliers are hard at work keeping it new<br />

and fresh.<br />

“We are launching ‘Illuminate’, our new range of charms and jewellery with<br />

luminous gems and diamonds, which are collectable items,” Atakliyan adds. “The<br />

sky is the limit for mixing jewellery with charms; there is always room for<br />

marvellous creations.”<br />

Thomas Sabo also has an extensive new range of offerings. “With around 260<br />

restyled, high-quality charm designs, including extra-large charms, single<br />

earrings and a wealth of different carriers such as necklaces, bracelets and hinged<br />

hoops, the new collection is a completely new and modern offering,” Edwards<br />

says. “Generation Charm Club now addresses all Thomas Sabo target groups,<br />

above and beyond the loyal fans of the collection. This is by means of the new<br />

alignment of the collection, new pricing and combination options, and the<br />

addition of the unisex ‘Vintage Rebel’ designs.”<br />

As Atakliyan puts it, “Charm jewellery has been<br />

in our lives and will be part of it for many<br />

centuries to come.”<br />

If history is anything to<br />

go by, she may be right,<br />

and retailers can be<br />

the ones to help<br />

turn it into<br />

a reality. i<br />

28 <strong>Jeweller</strong> <strong>April</strong> <strong>2018</strong><br />

NOMINATION

GEMS<br />

COLOUR INVESTIGATION: RUBY<br />

African supplies have traditionally produced<br />

darker stones, however the new mines<br />

produce colours that bridge the gap between<br />

those from the classic sources of Myanmar<br />

(low iron, strong fluorescence) and Thailand/<br />

Cambodia (high iron, low fluorescence)<br />

suiting a range of different markets.<br />

A ruby’s value is determined not only by<br />

colour, but its clarity, cut and carat size.<br />

Consumers must be aware of the multitude<br />

of treatments and synthetics.<br />

Heat treatment is common practice as it<br />

parallels what can happen in nature. The<br />

heating process removes silk inclusions,<br />

enhancing clarity and richness of colour.<br />

Although it does affect the price, if heat<br />

treatment does not add anything artificial<br />

to the stone, it is an accepted treatment<br />

amongst gemmologists.<br />

INTERPRETATION OF COLOUR IS SUBJECTIVE<br />

Desire for ruby today is great as ever. With<br />