BusinessDay 01 Apr 2018

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Sunday <strong>01</strong> <strong>Apr</strong>il 2<strong>01</strong>8<br />

C002D5556<br />

37<br />

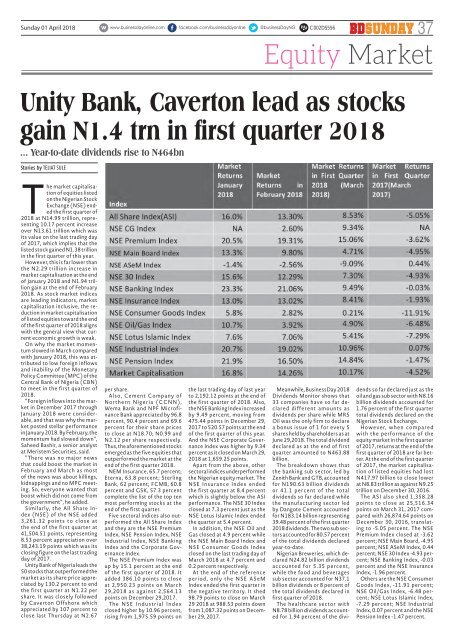

Equity Market<br />

Unity Bank, Caverton lead as stocks<br />

gain N1.4 trn in first quarter 2<strong>01</strong>8<br />

... Year-to-date dividends rise to N464bn<br />

Stories by TELIAT SULE<br />

The market capitalisation<br />

of equities listed<br />

on the Nigerian Stock<br />

Exchange (NSE) ended<br />

the first quarter of<br />

2<strong>01</strong>8 at N14.99 trillion, representing<br />

10.17 percent increase<br />

over N13.61 trillion which was<br />

its value on the last trading day<br />

of 2<strong>01</strong>7, which implies that the<br />

listed stock gained N1.38 trillion<br />

in the first quarter of this year.<br />

However, this is far lower than<br />

the N2.29 trillion increase in<br />

market capitalisation at the end<br />

of January 2<strong>01</strong>8 and N1.94 trillion<br />

gain at the end of February<br />

2<strong>01</strong>8. As stock market indices<br />

are leading indicators, market<br />

capitalisation inclusive, the reduction<br />

in market capitalisation<br />

of listed equities toward the end<br />

of the first quarter of 2<strong>01</strong>8 aligns<br />

with the general view that current<br />

economic growth is weak.<br />

On why the market momentum<br />

slowed in March compared<br />

with January 2<strong>01</strong>8, this was attributed<br />

to low foreign inflows<br />

and inability of the Monetary<br />

Policy Committee (MPC) of the<br />

Central Bank of Nigeria (CBN)<br />

to meet in the first quarter of<br />

2<strong>01</strong>8.<br />

“Foreign inflows into the market<br />

in December 2<strong>01</strong>7 through<br />

January 2<strong>01</strong>8 were considerable,<br />

and that was why the market<br />

posted stellar performance<br />

in January 2<strong>01</strong>8. By February, the<br />

momentum had slowed down”,<br />

Saheed Bashir, a senior analyst<br />

at Meristem Securities, said.<br />

“There was no major news<br />

that could boost the market in<br />

February and March as most<br />

of the news was about killings,<br />

kidnappings and no MPC meeting.<br />

So, everyone wanted that<br />

boost which did not come from<br />

the government”, he added.<br />

Similarly, the All Share Index<br />

(NSE) of the NSE added<br />

3,261.32 points to close at<br />

the end of the first quarter at<br />

41,504.51 points, representing<br />

8.53 percent appreciation over<br />

38,243.19 points which was its<br />

closing figure on the last trading<br />

day of 2<strong>01</strong>7.<br />

Unity Bank of Nigeria leads the<br />

50 stocks that outperformed the<br />

market as its share price appreciated<br />

by 130.2 percent to end<br />

the first quarter at N1.22 per<br />

share. It was closely followed<br />

by Caverton Offshore which<br />

appreciated by 107 percent to<br />

close last Thursday at N2.67<br />

per share.<br />

Also, Cement Company of<br />

Northern Nigeria (CCNN),<br />

Wema Bank and NPF Microfinance<br />

Bank appreciated by 96.8<br />

percent, 90.4 percent and 69.6<br />

percent for their share prices<br />

to close at N18.70; N0.99 and<br />

N2.12 per share respectively.<br />

Thus, the aforementioned stocks<br />

emerged as the five equities that<br />

outperformed the market at the<br />

end of the first quarter 2<strong>01</strong>8.<br />

NEM Insurance, 65.7 percent;<br />

Eterna, 63.8 percent; Sterling<br />

Bank, 62 percent; FCMB, 60.8<br />

percent and GSK, 57.3 percent<br />

complete the list of the top ten<br />

most performing stocks at the<br />

end of the first quarter.<br />

Five sectoral indices also outperformed<br />

the All Share Index<br />

and they are the NSE Premium<br />

Index, NSE Pension Index, NSE<br />

Industrial Index, NSE Banking<br />

Index and the Corporate Governance<br />

Index.<br />

The NSE Premium Index was<br />

up by 15.1 percent at the end<br />

of the first quarter of 2<strong>01</strong>8. It<br />

added 386.10 points to close<br />

at 2,950.23 points on March<br />

29,2<strong>01</strong>8 as against 2,564.13<br />

points on December 29,2<strong>01</strong>7.<br />

The NSE Industrial Index<br />

closed higher by 10.96 percent,<br />

rising from 1,975.59 points on<br />

the last trading day of last year<br />

to 2,192.12 points at the end of<br />

the first quarter of 2<strong>01</strong>8. Also,<br />

the NSE Banking Index increased<br />

by 9.49 percent, moving from<br />

475.44 points in December 29,<br />

2<strong>01</strong>7 to 520.57 points at the end<br />

of the first quarter of this year.<br />

And the NSE Corporate Governance<br />

Index was higher by 9.34<br />

percent as it closed on March 29,<br />

2<strong>01</strong>8 at 1,659.25 points.<br />

Apart from the above, other<br />

sectoral indices underperformed<br />

the Nigerian equity market. The<br />

NSE Insurance Index ended<br />

the first quarter at 8.4 percent<br />

which is slightly below the ASI<br />

performance. The NSE 30 Index<br />

closed at 7.3 percent just as the<br />

NSE Lotus Islamic Index ended<br />

the quarter at 5.4 percent.<br />

In addition, the NSE Oil and<br />

Gas closed at 4.9 percent while<br />

the NSE Main Board Index and<br />

NSE Consumer Goods Index<br />

closed on the last trading day of<br />

March 2<strong>01</strong>8 at 4.7 percent and<br />

0.2 percent respectively.<br />

At the end of the reference<br />

period, only the NSE ASeM<br />

Index ended the first quarter in<br />

the negative territory. It shed<br />

98.79 points to close on March<br />

29 2<strong>01</strong>8 at 988.53 points down<br />

from 1,087.32 points on December<br />

29, 2<strong>01</strong>7.<br />

Meanwhile, <strong>BusinessDay</strong> 2<strong>01</strong>8<br />

Dividends Monitor shows that<br />

33 companies have so far declared<br />

different amounts as<br />

dividends per share while MRS<br />

Oil was the only firm to declare<br />

a bonus issue of 1 for every 5<br />

shares held by shareholders as at<br />

June 29,2<strong>01</strong>8. The total dividend<br />

declared as at the end of first<br />

quarter amounted to N463.88<br />

billion.<br />

The breakdown shows that<br />

the banking sub sector, led by<br />

Zenith Bank and GTB, accounted<br />

for N190.63 billion dividends<br />

or 41.1 percent of the total<br />

dividends so far declared while<br />

the manufacturing sector led<br />

by Dangote Cement accounted<br />

for N183.14 billion representing<br />

39.48 percent of the first quarter<br />

2<strong>01</strong>8 dividends. The two sub sectors<br />

accounted for 80.57 percent<br />

of the total dividends declared<br />

year-to-date.<br />

Nigerian Breweries, which declared<br />

N24.82 billion dividends<br />

accounted for 5.35 percent,<br />

while the food and beverages<br />

sub sector accounted for N37.1<br />

billion dividends or 8 percent of<br />

the total dividends declared in<br />

first quarter of 2<strong>01</strong>8.<br />

The healthcare sector with<br />

N8.78 billion dividends accounted<br />

for 1.94 percent of the dividends<br />

so far declared just as the<br />

oil and gas sub sector with N8.16<br />

billion dividends accounted for<br />

1.76 percent of the first quarter<br />

total dividends declared on the<br />

Nigerian Stock Exchange.<br />

However, when compared<br />

with the performance of the<br />

equity market in the first quarter<br />

of 2<strong>01</strong>7, returns at the end of the<br />

first quarter of 2<strong>01</strong>8 are far better.<br />

At the end of the first quarter<br />

of 2<strong>01</strong>7, the market capitalisation<br />

of listed equities had lost<br />

N417.97 billion to close lower<br />

at N8.83 trillion as against N9.25<br />

trillion on December 30, 2<strong>01</strong>6.<br />

The ASI also shed 1,358.28<br />

points to close at 25,516.34<br />

points on March 31, 2<strong>01</strong>7 compared<br />

with 26,874.64 points on<br />

December 30, 2<strong>01</strong>6, translating<br />

to -5.05 percent. The NSE<br />

Premium Index closed at -3.62<br />

percent; NSE Main Board, -4.95<br />

percent; NSE ASeM Index, 0.44<br />

percent; NSE 30 Index -4.93 percent;<br />

NSE Banking Index, -0.03<br />

percent and the NSE Insurance<br />

Index, -1.96 percent.<br />

Others are the NSE Consumer<br />

Goods Index, -11.91 percent;<br />

NSE Oil/Gas Index, -6.48 percent;<br />

NSE Lotus Islamic Index,<br />

-7.29 percent; NSE Industrial<br />

Index, 0.07 percent and the NSE<br />

Pension Index -1.47 percent.