BusinessDay 09 Apr 2018

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Monday <strong>09</strong> <strong>Apr</strong>il <strong>2018</strong><br />

C002D5556<br />

BUSINESS DAY 35<br />

Stocks Currencies Commodities Rates + Bonds Economics Funds Week Ahead Watchlist P.E<br />

Yield curve flattens on Fiscal and<br />

monetary policy synchronisation<br />

FSDH sees Nigeria inflation slowing for<br />

fourteen successive months to 13.49%<br />

Page 36 Page 36<br />

ECONOMY<br />

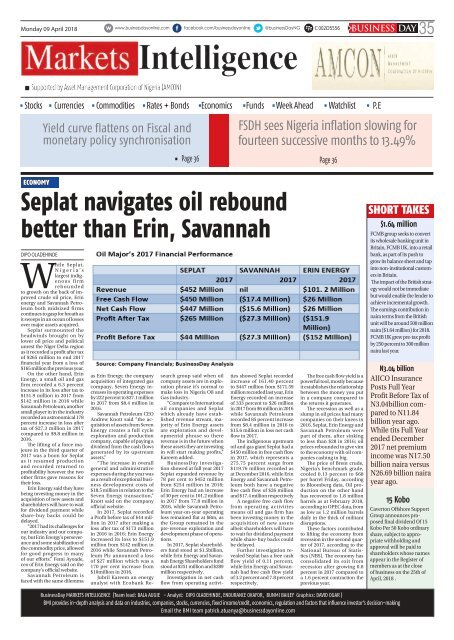

Seplat navigates oil rebound<br />

better than Erin, Savannah<br />

DIPO OLADEHINDE<br />

While Seplat,<br />

N i g e r i a ’ s<br />

largest indigenous<br />

firm<br />

rebounded<br />

to growth on the back of improved<br />

crude oil price, Erin<br />

energy and Savannah Petroleum<br />

both midsized firms<br />

continues to gasp for breath as<br />

it sweeps in an ocean of losses<br />

over major assets acquired.<br />

Seplat surmounted the<br />

headwinds brought on by<br />

lower oil price and political<br />

unrest the Niger Delta region<br />

as it recorded a profit after tax<br />

of $265 million to end 2017<br />

financial year from a loss of<br />

$165 million the previous year.<br />

On the other hand, Erin<br />

Energy, a small oil and gas<br />

firm recorded a 6.3 percent<br />

increase in its loss after tax to<br />

$151.9 million in 2017 from<br />

$142 million in 2016 while<br />

Savannah Petroleum, another<br />

small player in in the industry<br />

recorded an astronomical 178<br />

percent increase in loss after<br />

tax of $27.3 million in 2017<br />

compared to $9.8 million in<br />

2016.<br />

The lifting of a force majeure<br />

in the third quarter of<br />

2017 was a boon for Seplat<br />

as it resumed production<br />

and recorded returned to<br />

profitability however the two<br />

other firms gave reasons for<br />

their loss.<br />

Erin Energy said they have<br />

being investing money in the<br />

acquisition of new assets and<br />

shareholders will have to wait<br />

for dividend payment while<br />

share-buy backs could be<br />

delayed.<br />

“2017 had its challenges for<br />

our industry and our company,<br />

but Erin Energy’s perseverance<br />

and some stabilization of<br />

the commodity price, allowed<br />

for good progress in many<br />

of our efforts.” Femi Ayoade,<br />

ceo of Erin Energy said on the<br />

company’s official website.<br />

Savannah Petroleum is<br />

faced with the same dilemma<br />

as Erin Energy; the company<br />

acquisition of integrated gas<br />

company, Seven Energy increases<br />

its operating expenses<br />

by 222 percent to $27.1 million<br />

in 2017 from $8.4 million in<br />

2016.<br />

Savannah Petroleum CEO<br />

Andrew Knott said “the acquisition<br />

of assets from Seven<br />

Energy creates a full cycle<br />

exploration and production<br />

company, capable of paying a<br />

dividend from the cash flows<br />

generated by its upstream<br />

assets.”<br />

“The increase in overall<br />

general and administrative<br />

expenses during the year was<br />

as a result of exceptional business<br />

development costs of<br />

$18.5 million in relation to the<br />

Seven Energy transaction,”<br />

Knott said on the company<br />

official website.<br />

In 2017, Seplat recorded<br />

a Profit before tax of $44 million<br />

in 2017 after making a<br />

loss after tax of $173 million<br />

in 2016 in 2016; Erin Energy<br />

increased its loss to $151.9<br />

million from $142 million in<br />

2016 while Savannah Petroleum<br />

Plc announced a loss<br />

of $27 million which was a<br />

170 per cent increase from<br />

$10million in 2016.<br />

Jubril Kareem an energy<br />

analyst with Ecobank Re-<br />

search group said when oil<br />

company assets are in exploration<br />

phrase it’s normal to<br />

make loss in Nigeria Oil and<br />

Gas industry.<br />

“Compare to International<br />

oil companies and Seplat<br />

which already have established<br />

revenue stream, majority<br />

of Erin Energy assets<br />

are exploration and developmental<br />

phrase so there<br />

revenue is in the future when<br />

these assets they are investing<br />

in will start making profits,”<br />

Kareem added.<br />

<strong>BusinessDay</strong> investigation<br />

showed at full year 2017<br />

Seplat expanded revenue by<br />

78 per cent to $452 million<br />

from $254 million in 2016;<br />

Erin Energy had an increase<br />

of 30 per cent to 101.2 million<br />

in 2017 from 77.8 million in<br />

2016, while Savannah Petroleum<br />

year-on-year operating<br />

loss remained flat at $8m, as<br />

the Group remained in the<br />

pre-revenue exploration and<br />

development phase of operations.<br />

In 2017, Seplat shareholders<br />

fund stood at $1.5billion,<br />

while Erin Energy and Savannah<br />

Energy Shareholders fund<br />

stood at $251 million and $289<br />

million respectively.<br />

Investigation in net cash<br />

flow from operating activities<br />

showed Seplat recorded<br />

increase of 161.40 percent<br />

to $447 million from $171.59<br />

million recorded last year, Erin<br />

Energy recorded an increase<br />

of 333 percent to $26 million<br />

in 2017 from $6 million in 2016<br />

while Savannah Petroleum<br />

recorded 85 percent increase<br />

from $8.4 million in 2016 to<br />

$15.6 million in loss net cash<br />

flow in 2017.<br />

The indigenous upstream<br />

oil and gas giant Seplat had a<br />

$450 million in free cash flow<br />

in 2017, which represents a<br />

275.75 percent surge from<br />

$119.76 million recorded as<br />

at December 2016, while Erin<br />

Energy and Savannah Petroleum<br />

both have a negative<br />

free cash flow of $26 million<br />

and $17.4 million respectively<br />

A negative free cash flow<br />

from operating activities<br />

means oil and gas firm has<br />

been investing money in the<br />

acquisition of new assets<br />

albeit shareholders will have<br />

to wait for dividend payment<br />

while share-buy backs could<br />

be delayed.<br />

Further investigation revealed<br />

Seplat has a free cash<br />

flow yield of 0.11 percent,<br />

while Erin Energy and Savannah<br />

had free cash flow yield<br />

of 3.2 percent and 7.8 percent<br />

respectively.<br />

The free cash flow yield is a<br />

powerful tool, mostly because<br />

it establishes the relationship<br />

between the money you put<br />

in a company compared to<br />

the returns it generates.<br />

The recession as well as a<br />

slump in oil prices had many<br />

companies on their knees in<br />

2016. Seplat, Erin Energy and<br />

Savannah Petroleum were<br />

part of them, after sinking<br />

to less than $28 in 2016; oil<br />

prices rebounded to give vim<br />

to the economy with oil companies<br />

cashing in big.<br />

The price of Brent crude,<br />

Nigeria’s benchmark grade,<br />

cooled 0.13 percent to $68<br />

per barrel Friday, according<br />

to Bloomberg data, Oil production<br />

on the other hand<br />

has recovered to 1.8 million<br />

barrels as at February <strong>2018</strong>,<br />

according to OPEC data, from<br />

as low as 1.2 million barrels<br />

daily in the thick of militant<br />

disruptions.<br />

These factors contributed<br />

to lifting the economy from<br />

recession in the second quarter<br />

of 2017, according to the<br />

National Bureau of Statistics<br />

(NBS). The economy has<br />

consolidated its exit from<br />

recession after growing 0.8<br />

percent in 2017 compared to<br />

a 1.6 percent contraction the<br />

previous year.<br />

SHORT TAKES<br />

$1.64 million<br />

FCMB group seeks to convert<br />

its wholesale banking unit in<br />

Britain, FCMB UK, into a retail<br />

bank, as part of its push to<br />

grow its balance sheet and tap<br />

into non-institutional customers<br />

in Britain.<br />

The impact of the British strategy<br />

would not be immediate<br />

but would enable the lender to<br />

achieve incremental growth.<br />

The earnings contribution in<br />

naira terms from the British<br />

unit will be around 500 million<br />

naira ($1.64 million) for <strong>2018</strong>.<br />

FCMB UK grew pre-tax profit<br />

by 250 percent to 300 million<br />

naira last year.<br />

N3.04 billion<br />

AIICO Insurance<br />

Posts Full Year<br />

Profit Before Tax of<br />

N3.04billion compared<br />

to N11.84<br />

billion year ago .<br />

While tits Full Year<br />

ended December<br />

2017 net premium<br />

income was N17.50<br />

billion naira versus<br />

N26.69 billion naira<br />

year ago.<br />

15 Kobo<br />

Caverton Offshore Support<br />

Group announces proposed<br />

final dividend Of 15<br />

Kobo Per 50 Kobo ordinary<br />

share, subject to appropriate<br />

withholding and<br />

approval will be paid to<br />

shareholders whose names<br />

appear in the Register of<br />

members as at the close<br />

of business on the 25th of<br />

<strong>Apr</strong>il, <strong>2018</strong> .<br />

<strong>BusinessDay</strong> MARKETS INTELLIGENCE (Team lead: BALA AUGIE - Analyst: DIPO OLADEHINDE, ENDURANCE OKAFOR, BUNMI BAILEY Graphics: DAVID OGAR )<br />

BMI provides in-depth analysis and data on industries, companies, stocks, currencies, fixed income/credit, economics, regulation and factors that influence investor’s decision-making<br />

Email the BMI team patrick.atuanya@businessdayonline.com