Philly Eats Eats Magazine_#5

A foodie magazine that enjoys both cooking but dining out.

A foodie magazine that enjoys both cooking but dining out.

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Money<br />

much more than $8.25 per hour, your<br />

employer must pay you an additional<br />

$2.13 per hour. For example, if you<br />

work a six-hour day and receive $90<br />

in tips (including cash that you take<br />

home), that would mean that you<br />

made $15 per hour in tips. Even so,<br />

your employer must pay you an additional<br />

$2.13 per hour for a paycheck,<br />

bringing your real gross hourly wage<br />

up to $17.13 per hour.<br />

The government takes seven deductions<br />

from every employee in<br />

America: State and Federal Income<br />

Taxes, as well as deductions for Family<br />

Leave, Social Security, Unemployment,<br />

Disability, and Medicare. As<br />

tipped employees can take home<br />

most of their cash tips, these deductions<br />

can exceed the $2.13 per hour<br />

additional that your employer pays<br />

you by check. In such cases, the entire<br />

$2.13 per hour would go to the<br />

government to satisfy these deductions.<br />

The check will be zero because<br />

the funds were transferred from<br />

your employer to<br />

the government.<br />

Tipped employees’<br />

income is<br />

subject to the<br />

same withholding<br />

as non-tipped<br />

employees.<br />

As a tipped<br />

employee,<br />

am i entitled<br />

to a premium payment<br />

for overtime?<br />

Yes. Whenever you work more<br />

than 40 hours in an established work<br />

week, all hours worked in excess of<br />

40 must be compensated at the<br />

overtime pay rate like any other nontipped<br />

employee. Overtime must be<br />

paid at 1.5 times the regular rate for<br />

all hours worked in excess of 40. The<br />

minimum overtime rate must not be<br />

less than $12.38.<br />

What we would like to point out is<br />

that absolutely please tip for quality<br />

service but do remember that all of<br />

our waiters and waitresses live off of<br />

your generosity.<br />

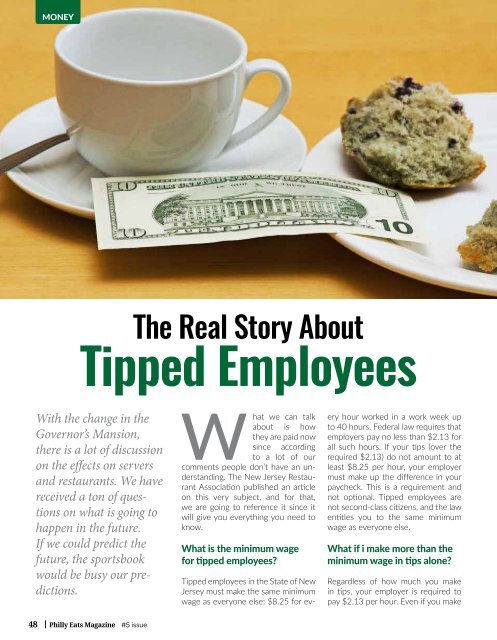

The Real Story About<br />

Tipped Employees<br />

Bad or No Credit? No Problem We Finance<br />

Jojosauto.com<br />

48<br />

With the change in the<br />

Governor’s Mansion,<br />

there is a lot of discussion<br />

on the effects on servers<br />

and restaurants. We have<br />

received a ton of questions<br />

on what is going to<br />

happen in the future.<br />

If we could predict the<br />

future, the sportsbook<br />

would be busy our predictions.<br />

<strong>Philly</strong> <strong>Eats</strong> <strong>Magazine</strong> <strong>#5</strong> issue<br />

What we can talk<br />

about is how<br />

they are paid now<br />

since according<br />

to a lot of our<br />

comments people don’t have an understanding.<br />

The New Jersey Restaurant<br />

Association published an article<br />

on this very subject, and for that,<br />

we are going to reference it since it<br />

will give you everything you need to<br />

know.<br />

What is the minimum wage<br />

for tipped employees?<br />

Tipped employees in the State of New<br />

Jersey must make the same minimum<br />

wage as everyone else: $8.25 for every<br />

hour worked in a work week up<br />

to 40 hours. Federal law requires that<br />

employers pay no less than $2.13 for<br />

all such hours. If your tips (over the<br />

required $2.13) do not amount to at<br />

least $8.25 per hour, your employer<br />

must make up the difference in your<br />

paycheck. This is a requirement and<br />

not optional. Tipped employees are<br />

not second-class citizens, and the law<br />

entitles you to the same minimum<br />

wage as everyone else.<br />

What if i make more than the<br />

minimum wage in tips alone?<br />

Regardless of how much you make<br />

in tips, your employer is required to<br />

pay $2.13 per hour. Even if you make<br />

The Dealer That Makes A Difference<br />

(856) 251 - 9200<br />

1382 Delsea Dr.<br />

Deptford Township, NJ 08096