ENERGY Caribbean newsletter (April 2014 • Issue no. 72)

The final edition of the ENERGY Caribbean newsletter

The final edition of the ENERGY Caribbean newsletter

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

CARIBBEAN NATURAL GAS MARKET <strong>•</strong> CARIBBEAN NATURAL GAS MARKET <strong>•</strong> CARIBBEAN NATUR<br />

The IDB’s natural gas study<br />

Inter-American Development Bank experts Jed Bailey<br />

and Nils Janson have produced the most comprehensive<br />

analysis so far of the <strong>Caribbean</strong> natural gas trade – “A<br />

Pre-Feasibility Study of the Potential Market for Natural<br />

Gas as a Fuel for Power Generation in the <strong>Caribbean</strong>”.<br />

This formed the reference document for a meeting of<br />

<strong>Caribbean</strong> energy ministers held under the Bank’s auspices<br />

in Washington in early December 2013. The study focuses<br />

on 13 possible recipients of natural gas, including the<br />

Dominican Republic but excluding the French <strong>Caribbean</strong><br />

territories of Martinique and Guadeloupe, which are<br />

expected to buy natural gas for the power turbines they<br />

are installing, probably from the small LNG plant the<br />

UK’s Gasfin Development intends to build at La Brea<br />

in Trinidad. The strengths and weaknesses of the three<br />

methods of gas delivery are outlined in the study.<br />

CNG can’t compete<br />

with LNG<br />

Shipping costs make all the difference<br />

The IDB study has bad news for the UK’s Centrica<br />

Energy, which has been trying to put together a deal to<br />

export its gas from blocks 22 and NCMA 4 in Trinidad and<br />

Tobago to Puerto Rico in compressed natural gas (CNG)<br />

form, and for other promoters thinking along similar lines<br />

for other <strong>Caribbean</strong> markets. It rules out marine CNG as a<br />

commercial proposition for the region.<br />

“Seaborne CNG does <strong>no</strong>t appear to provide a large<br />

e<strong>no</strong>ugh cost reduction [compared with fuel oil] to justify the<br />

added risk of using an unproven tech<strong>no</strong>logy,” it says firmly.<br />

Since the whole point of <strong>Caribbean</strong> utilities switching to<br />

natural gas is to dramatically lower their fuel costs, this<br />

conclusion seems to make sense.<br />

For example, the final delivered price of CNG from<br />

Trinidad and Tobago to Barbados, as calculated by the<br />

study’s authors, is expected to be US$8.71 per mmbtu,<br />

while that for LNG is US$8.65. The disparity is even<br />

greater in the case of gas supplied to Antigua (US$11.48<br />

per mmbtu for CNG, US$9.06 for LNG).<br />

The difference in price, for the same fuel costing the<br />

same at the point of export but delivered by different<br />

methods, seems to lie in the cost of shipping. The IDB study<br />

concludes that “shipping CNG is likely to be much more<br />

expensive. CNG ships are essentially floating platforms<br />

for high pressure pipelines which require thick, high-grade<br />

steel that is heavy and expensive ... each CNG ship will<br />

likely cost more than a typical LNG ship, particularly the<br />

first generation of ships, and will be able to carry much<br />

less natural gas.”<br />

Because of the transportation cost, “shipping distance<br />

has a large impact on the final delivered cost.” CNG<br />

shipping costs will “likely come down as the tech<strong>no</strong>logy<br />

matures, but much additional investment and development<br />

is required before seaborne CNG will be as readily available<br />

as LNG.”<br />

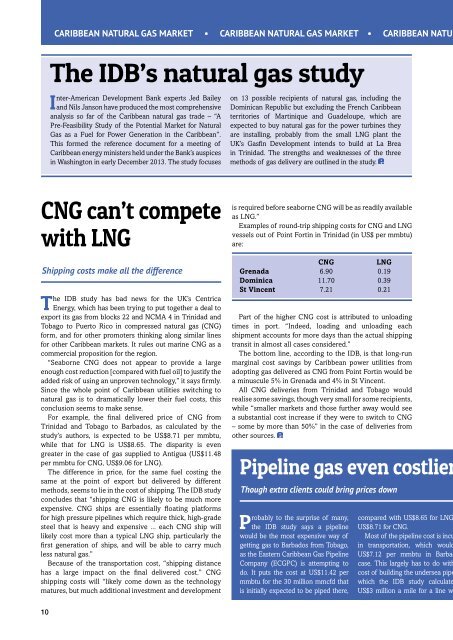

Examples of round-trip shipping costs for CNG and LNG<br />

vessels out of Point Fortin in Trinidad (in US$ per mmbtu)<br />

are:<br />

CNG<br />

LNG<br />

Grenada 6.90 0.19<br />

Dominica 11.70 0.39<br />

St Vincent 7.21 0.21<br />

Part of the higher CNG cost is attributed to unloading<br />

times in port. “Indeed, loading and unloading each<br />

shipment accounts for more days than the actual shipping<br />

transit in almost all cases considered.”<br />

The bottom line, according to the IDB, is that long-run<br />

marginal cost savings by <strong>Caribbean</strong> power utilities from<br />

adopting gas delivered as CNG from Point Fortin would be<br />

a minuscule 5% in Grenada and 4% in St Vincent.<br />

All CNG deliveries from Trinidad and Tobago would<br />

realise some savings, though very small for some recipients,<br />

while “smaller markets and those further away would see<br />

a substantial cost increase if they were to switch to CNG<br />

– some by more than 50%” in the case of deliveries from<br />

other sources.<br />

Pipeline gas even costlier<br />

Though extra clients could bring prices down<br />

Probably to the surprise of many,<br />

the IDB study says a pipeline<br />

would be the most expensive way of<br />

getting gas to Barbados from Tobago,<br />

as the Eastern <strong>Caribbean</strong> Gas Pipeline<br />

Company (ECGPC) is attempting to<br />

do. It puts the cost at US$11.42 per<br />

mmbtu for the 30 million mmcfd that<br />

is initially expected to be piped there,<br />

compared with US$8.65 for LNG<br />

US$8.71 for CNG.<br />

Most of the pipeline cost is incu<br />

in transportation, which would<br />

US$7.12 per mmbtu in Barbad<br />

case. This largely has to do with<br />

cost of building the undersea pipe<br />

which the IDB study calculate<br />

US$3 million a mile for a line w<br />

10