July 2018

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

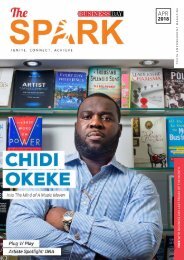

The Spark | Ignite/Connect/Achieve<br />

www.thesparkng.com<br />

blockchain solutions within a private, permissioned and secure network<br />

without exposing themselves to the risks of using public blockchain<br />

solutions. This means they are not inundated with problems around<br />

speed (transaction-per-second) plaguing some public blockchains. Newer<br />

altcoins are also seeking ways to run functionally using minimal electricity<br />

resources.<br />

The U.S SEC is playing a key role in the classification of different tokens as<br />

securitized and non-securitized tokens. This move is also putting<br />

organizations issuing tokens, in check. Different institutions are discovering<br />

use cases for the blockchain in their businesses and are adapting their<br />

business models to accommodate blockchain solutions. Some of them are<br />

leveraging the use of cryptocurrencies as utility tokens to reward loyalty,<br />

have users pay for services such as electricity or in the case of Basic<br />

Attention Token (BAT) get incentivized for watching ads online.<br />

As more people get paid with tokens for doing micro tasks, incentivized<br />

for loyalty, feel more secure storing their money in cold wallets or online<br />

wallets and watching the value of those tokens rise, the underlying<br />

technology would get adopted by different governments seeking to<br />

tokenize different areas of their economies. For cryptocurrencies to become<br />

adopted by the legislators, the clamour for anonymity must reduce with<br />

administrations knowing that it will not be an avenue to evade taxes and<br />

launder money. The wider world would adopt the tech easily as blockchain<br />

start-ups create better user experiences with their products ensuring that<br />

onboarding, adoption and continued use of their cryptocurrency is more<br />

convenient than obtaining and transacting with cash or debit/credit cards.<br />

Strings of long alphanumeric characters in crypto have to shorten into<br />

8-10 numbers or letters that can be easily remembered.<br />

In the next couple of years, we should begin to see the proliferation of two<br />

distinct classes of assets that would be in most demand among<br />

cryptocurrencies. These would be Stable coins and Securitized tokens.<br />

People may begin to adopt stable coins with functional wallets and high<br />

transaction speeds for day-to-day transactions, while securitized tokens<br />

will replace shares in emerging start-ups and existing organizations looking<br />

to onboard tech enthusiasts as shareholders. Larger institutionalized<br />

stock exchanges would begin to add crypto portfolios to their day-to-day<br />

trading. To gain mass appeal, cross-chain atomic swaps will need to occur<br />

seamlessly, reduce time and money lost by using centralized exchanges,<br />

and different protocols will need to work in consonance, keeping<br />

interoperability as a priority while complimenting themselves using their<br />

tech strengths.<br />

“<br />

Cryptocurrencies have been likened to<br />

the Dutch tulip bulb bubbles of the<br />

17th century as well as being named<br />

the future of money.<br />

“<br />

10<br />

@thesparkng