August 2018 Taking Care of Business

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

TAKING CARE OF BUSINESS <strong>August</strong>-September <strong>2018</strong><br />

VOL. 3 EDITION 6<br />

<strong>Taking</strong><br />

<strong>Care</strong> <strong>of</strong> <strong>Business</strong>…<br />

A<br />

s the Executive Director <strong>of</strong> Rasheed Communications and Editor <strong>of</strong><br />

<strong>Taking</strong> <strong>Care</strong> <strong>of</strong> <strong>Business</strong>, a new innovative bi-monthly business news<br />

magazine, our hope is to bring to you local and national news coverage<br />

from the African American community. Our focus is on premier black<br />

owned businesses, powerful women in business, minority small<br />

business owners, and startup companies. We distribute this bi-monthly<br />

publication commercially and residentially with a target circulation <strong>of</strong><br />

5,000 copies six times per calendar year.<br />

We highlight corporations and companies that reinvest in our communities and further advance<br />

African Americans and women up their corporate ladder. We also intend to expose those companies<br />

which do not. We would like to provide your business with the opportunity to expand your marketing<br />

and advertising promotions for the Spring and Summer. Our goal is to build bridges so that the<br />

businesses in our community will support each other more.<br />

We will continue to foster an environment that encourages customers to shop locally for goods and<br />

services as we work to strengthen our community.<br />

We look forward to expanding the reach <strong>of</strong> your business.<br />

Sincerely,<br />

Saleem Rasheed, Jr.<br />

Executive Director<br />

REASONS TO ADVERTISE WITH US<br />

Visibility<br />

Affordable Packages and Rates<br />

Posting for maximized exposure<br />

More Customers<br />

Digital subscriptions are available via email request<br />

3

By TANISHA A. SYKES<br />

The median income <strong>of</strong> black households in 2014 was<br />

$35,398, compared with the national median <strong>of</strong> $53,657,<br />

according to the U.S. Census Bureau’s annual report on<br />

Income and Poverty in the United States. Even for those<br />

African Americans who are doing well, the truth is that<br />

we still experience less intergenerational inheritance,<br />

higher rates <strong>of</strong> caretaking for extended family, and<br />

differing patterns <strong>of</strong> home ownership. One way to take<br />

steps toward closing the wealth gap is to return to the<br />

kind <strong>of</strong> financial lessons my grandmother espoused. Here<br />

are five ways you could make her proud, and help<br />

yourself in the bargain.<br />

• Pay with cash.<br />

• Buy only what I need.<br />

• Eat at home.<br />

• Pay all my bills on time.<br />

• Don’t spend without a budget.<br />

Give every dollar a home. “We need to put a GPS<br />

on our dollars and see exactly where they are going,”<br />

says Gail Perry-Mason, financial coach and author <strong>of</strong><br />

Girl! Make Your Money Grow: A Sister’s Guide to<br />

Protecting Your Future and Enriching Your Life. “Every<br />

cent should have a home, whether it’s for savings and<br />

checking, the bills, the credit union, or retirement funds.”<br />

To track spending, take advantage <strong>of</strong> online tools like<br />

Money Minder. You can quickly see if your spending<br />

reflects your values, visions, or goals or if you need to<br />

make some adjustments.<br />

Dine in. Sure, it’s Friday and you’ve worked hard, why<br />

not hit the town? For starters, because spending $100 a<br />

week on eating out means you’ll blow through $5,200 a<br />

year. If you saved that same amount and earned 5%, after<br />

10 years you would have $68,000, thanks to compound<br />

interest. That doesn’t mean you have to be a complete<br />

homebody. If cabin fever is setting in, go out on<br />

Wednesdays, when you’re likely to order less food and<br />

drink than on the weekend. Or hold a pot luck, with<br />

everyone’s favorite apps and cocktails.<br />

Offer a hand up, not a hand out. We do a lot <strong>of</strong><br />

emotional spending as African Americans, especially when it<br />

comes to helping out family and friends. “People can tug at<br />

our heart, while at the same time tugging at our purse<br />

strings,” Perry-Mason says. But if the money you’re doling<br />

out, whether it’s $20 or $200, isn’t part <strong>of</strong> your spending<br />

plan, then you’re busting your budget. Perry-Mason suggests<br />

<strong>of</strong>fering a portion, then helping guide the borrower toward<br />

other ways to bring in more income<br />

Tweak your money mind-set. African American<br />

buying power is expected to reach $1.3 trillion by 2017,<br />

according to a report published by Nielsen in collaboration<br />

with the National Newspaper Publishers Association. While<br />

the upward trend is good news, it’s not enough just to be able<br />

to afford what you want today. “Africans Americans must<br />

consume less and own more,” Perry-Mason says. Toward that<br />

end, she recommends creating at least five different income<br />

streams. That way, if one financial resource dries up, you’ll<br />

always have another to fall back on. For example, if you have<br />

some extra time, pick up a side hustle on pennyhoarder.com.<br />

Got extra stuff? Unload it for cash on eBay. And it you have<br />

some money left over at the end <strong>of</strong> the month, make it<br />

work harder for you by investing spare change in one <strong>of</strong> the<br />

portfolios at Acorn.com, or read up on how you can build<br />

long-term wealth by investing in real estate.<br />

Take a “mind your own business” day. Think <strong>of</strong><br />

yourself as the CEO <strong>of</strong> your own company, and if your<br />

budget is stubbornly in the red, make a few lay<strong>of</strong>fs. This<br />

week maybe it’s streamlining the cable, next week it could be<br />

saying goodbye to custom haircuts and mani-pedis. “You<br />

have to realize: My house is not going to be run like a<br />

nonpr<strong>of</strong>it,” Perry-Mason says. Review every bill. Look for<br />

miscellaneous fees, overspending, high interest rates, and<br />

recurring automatic payments for goods and services you<br />

don’t use.<br />

Tanisha A. Sykes is a personal finance and career<br />

development expert. Follow her on Twitter @tanishastips.<br />

5

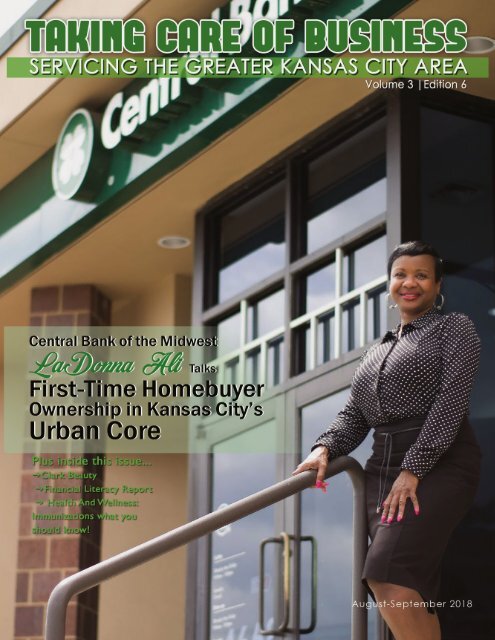

For LaDonna Ali, it all started in Kansas City’s Vineyard<br />

neighborhood. She was born and raised there and watched her<br />

mother, Kay, take an active role in the community. “My mother was<br />

very passionate about the community. She was in the neighborhood<br />

association and was always looking for ways to make our block<br />

better,” she recalled fondly. It was this influence, watching her<br />

mother care about and advocate for their community, that planted<br />

within Ali a love for community, for people, for building<br />

relationships.<br />

She noticed at a young age that homeownership was <strong>of</strong>ten difficult<br />

for people in low- to moderate-income neighborhoods. “I had family<br />

members who were realtors. One <strong>of</strong> the things I would do is go to<br />

open houses with them. I would always see people, especially in the<br />

urban core, who would ask how to get assistance buying a home with<br />

no down payment. That stuck with me.” Inspired by what she’d<br />

observed, Ali took a job in an on-campus bank shortly after starting<br />

college. She quickly fell in love with the industry and changed her<br />

major from telecommunications to banking. She knew she had found<br />

a career where she could help the community that had raised her. That<br />

was nearly 30 years ago and she hasn’t looked back since.<br />

“I’ve done it from every aspect—from the mortgage processing piece<br />

to the mortgage lending origination piece,” Ali explained. As she<br />

moved through the banking system and learned the intricacies <strong>of</strong> the<br />

industry, she realized how important it is to work in a banking<br />

environment that specifically supports low- to<br />

moderate-income families.<br />

Because applicants from less affluent areas may not<br />

qualify for traditional home loans, some home<br />

Loan Officers avoid the population all together.<br />

Undeterred, Ali recognized a need for opportunity<br />

and only worked harder to build relationships with<br />

organizations and colleagues that could be <strong>of</strong><br />

service. With the help <strong>of</strong> local realtors and not-forpr<strong>of</strong>it<br />

organizations like Habitat for Humanity <strong>of</strong><br />

Kansas City, Neighborhood Housing Services <strong>of</strong><br />

Kansas City, CHES, Inc., Housing Information<br />

Center, and Community Housing <strong>of</strong> Wyandotte,<br />

Ali created a network <strong>of</strong> resources to help low- to<br />

moderate-income community members get into<br />

their first home.<br />

Over the years, Ali gained the necessary knowledge<br />

and experience to match her passion. She<br />

worked as a mortgage loan processor, a mortgage<br />

loan <strong>of</strong>ficer and, currently, a community affairs<br />

<strong>of</strong>ficer at Central Bank <strong>of</strong> the Midwest. In this<br />

position, she is able to use her banking expertise<br />

while also engaging her passion for community<br />

involvement. “Fifty percent <strong>of</strong> my job is being out<br />

in the community making low- to moderate-income<br />

families aware <strong>of</strong> home ownership. The other fifty<br />

percent, I originate mortgage loans and help them<br />

get financing. I help a lot <strong>of</strong> people with down<br />

payment assistance programs,” she said cheerfully.<br />

Down payment assistance is, perhaps, the biggest<br />

aspect <strong>of</strong> her job because so many potential<br />

homeowners talk themselves out <strong>of</strong> the process<br />

because <strong>of</strong> misinformation. “Over the 10 years I’ve<br />

been doing this, it still surprises me that a lot <strong>of</strong><br />

people are not aware <strong>of</strong> down payment assistance,”

COVER STORY<br />

AUGUST—SEPTEMBER <strong>2018</strong><br />

she admitted. Many incorrectly assume home ownership is a privilege<br />

afforded only to the wealthy, but Ali is excited about the programs Central<br />

Bank <strong>of</strong> the Midwest has in place. In partnership with the down payment<br />

funding sources as an approved lender for Missouri Housing Development<br />

Commission (MHDC) and the Community Housing Improvement<br />

Program (CHIP) in Kansas and most recently NeighborhoodLIFT<br />

(Let’s Invest for Tomorrow), they are able to <strong>of</strong>fer home loans to a much<br />

wider group <strong>of</strong> community members. “I had the humbling opportunity to<br />

work with the LIFT program in 2014 while at Neighborhood Housing<br />

Services <strong>of</strong> Kansas City. We were able to help about 308 families purchase<br />

homes with the LIFT down payment assistance,” Ali said.<br />

“I love that we have the mortgage loan, Portfolio Conventional Home<br />

Turf Program…. It is unlike any other,” she said <strong>of</strong> the program. “We pay the closing costs, we pay for the inspection, we pay for the appraisal,<br />

and there is no mortgage insurance…. This program only requires 3% down, and that can come from the down payment assistance<br />

program. We can also originate conventional, FHA, VA and USDA mortgage loans,” she explained further..<br />

Ali has put hundreds <strong>of</strong> community members in touch with resources that enabled them to become homeowners, but no matter how many<br />

people she helps, the feeling <strong>of</strong> satisfaction never gets old. “Every closing I go to is a great moment.<br />

That’s my why…. I<br />

see the daughter<br />

talking about how<br />

she is going to<br />

decorate her room.<br />

I see the mother<br />

crying, especially<br />

single moms. It<br />

blows me away,”<br />

she said. The sense<br />

<strong>of</strong> pride and accomplishment<br />

home ownership encourages is something everyone deserves to<br />

experience, and Ali is thankful for the opportunity to be involved<br />

in that process.<br />

But home ownership is not just about accomplishment and pride.<br />

It is <strong>of</strong>ten a more practical and economical choice. To many, the<br />

thought <strong>of</strong> buying a home is intimidating. It seems complicated<br />

and expensive, but the reality is that “they’re paying a mortgage<br />

anyway,” Ali said. “Rent can be $500–$1500. Buying a house is<br />

a come-up because it’s lower than what you’re paying for rent—<br />

and it’s yours!” she added. Plus, the revitalization that has been<br />

taking place in the city has made it possible for community members<br />

to buy homes right in their own neighborhoods. For example,<br />

local realtor Helen Bryant, owner/broker <strong>of</strong> Bryant Real Estate<br />

I, LLC, is the listing broker for duplexes on 39 th and Euclid<br />

in the Ivanhoe neighborhood. “People thought it would never<br />

happen, but she had a waiting list before it was even built!” Ali<br />

said excitedly.<br />

However, not everyone is prepared to buy. Though perfect<br />

credit is not a requirement, very low scores leave applicants<br />

ineligible for program approval. Though this is not easy news<br />

to deliver, Ali prizes integrity and is always honest yet<br />

optimistic. ”I’ve had 4–5 people this week where the score<br />

was under 500. No one can do a loan with a 400 credit score.<br />

I’m really honest with people. I tell them, ‘Life happens.<br />

There are not-for-pr<strong>of</strong>it agencies that can help build your<br />

credit back up,’” she explained. She cautions against for-pr<strong>of</strong>it<br />

“credit building” companies, which <strong>of</strong>ten turn out to be<br />

scams. “Sometimes I get people who say they spent thousands<br />

<strong>of</strong> dollars to clean up their credit and the company didn’t do<br />

anything,” she said. This is a major setback for people who<br />

are already struggling financially.<br />

For those who do not qualify, it is best to work on credit<br />

improvement and familiarize themselves with the home loan<br />

process. “The first thing I tell people is that there are three<br />

factors no matter where you go, no matter what bank you talk<br />

to. They are credit score, debt-to-income ratio, and where is<br />

the down payment and closing cost coming from,” Ali explained.<br />

Banks need to know they are making a wise<br />

investment, so it is the applicant’s job to explain their<br />

financial history and current income.<br />

As the cityscape changes and new homes and businesses are<br />

being built, Ali is excited about the new life and energy being<br />

piped into the urban core. Quite literally, she wants residents<br />

to take ownership <strong>of</strong> their communities and never allow<br />

themselves to believe that they can’t be homeowners, too.<br />

7

Home Turf Loans<br />

When it comes to achieving your<br />

goal <strong>of</strong> homeownership, we believe<br />

in you.

Bryant Real Estate I, LLC<br />

Real Estate Agents for buying<br />

and selling real estate<br />

Today there’s reason to celebrate as<br />

the new Ivanhoe Gateway at 39th duplexes<br />

are being built on the site at<br />

U.S. 71 Hwy and 39 th Street.<br />

These duplexes are Urban Living at its<br />

very best! Ivanhoe Gateway at 39 th<br />

duplexes defy the image many people<br />

have <strong>of</strong> housing opportunities on the<br />

east side – quality For Sale housing.<br />

The duplexes are three-bedroom, 2-1/2 bath units which come with garages and<br />

stainless steel appliances.<br />

Call for a status on these duplexes.

A diagnosis <strong>of</strong> an auto immune<br />

disorder can be life shattering or life<br />

changing. For Regina Clark, it was the<br />

latter. When she began wearing wigs due<br />

to lupus-related hair loss, she noticed how<br />

rudely she was treated in many local<br />

beauty supply stores. Rather than<br />

begrudgingly deal with the treatment, she<br />

used it as motivation to open her own store.<br />

As a real estate agent looking for a career<br />

change, the idea <strong>of</strong> opening a beauty<br />

supply store was exactly what she needed<br />

to revive her passion. “I would always go<br />

to the Koreans to purchase my wigs,”<br />

Clark recalled. “It was the way that they<br />

would make me feel. Walk you around the<br />

store like you’re going to steal something.<br />

Then they want you to purchase wigs without<br />

trying them on. A lace wig can be $600<br />

and they want you to purchase it without<br />

trying on,” she said. Something had to be<br />

done, and so she did it. That’s how Clark’s<br />

Beauty Supply was born seven years ago.<br />

Because Clark had no experience in the<br />

hair care industry, she was patient and<br />

strategic as she planned the opening <strong>of</strong> her<br />

business. “I started researching how it<br />

works, how it operates, what you have to<br />

do,” she explained. When it came time to<br />

open, she opted for a s<strong>of</strong>t launch inside <strong>of</strong> a<br />

building she already owned. “I spent about<br />

a year in the building. I started with little<br />

things like wigs. I wanted to see how that<br />

would go. Then I started getting wholesale<br />

clothes. After a while I said, ‘Ok, I can do<br />

this,’” she explained.<br />

Clarks first <strong>of</strong>ficial store was located in<br />

Kansas City, Kansas. She spent a year<br />

there but found that the area foot traffic<br />

was too low. “I was on Quindero Blvd. It<br />

used to be very vibrant, but most <strong>of</strong> the<br />

businesses there are gone, so it was a<br />

struggle,” Clark said. From there, she<br />

moved to her current Raytown location at<br />

5226 Blue Ridge Blvd. In addition to a<br />

large assortment <strong>of</strong> hair products, barber<br />

and beautician supplies, braiding hair and<br />

much more, she <strong>of</strong>fers clergy<br />

uniforms and church clothes. This is something<br />

no other beauty supply store in<br />

Spotlight on <strong>Business</strong><br />

Kansas City <strong>of</strong>fers. She has been in this location for the past five years and<br />

has established herself as a friend to many <strong>of</strong> her customers. The warm and<br />

inviting atmosphere <strong>of</strong> her store is a welcomed change from the blatant and<br />

latent racism many African American women face in beauty supply stores<br />

nationwide.<br />

African American women have long had a complicated relationship with their<br />

hair. It has been both a point <strong>of</strong> pride and pain, self-confidence and struggle.<br />

Clark knows this relationship intimately and wants to ensure every woman<br />

who walks through her door feels valued and understood. “Some women<br />

come in just to talk, just to look around…. A lot <strong>of</strong> times, a young lady will<br />

come in and won’t feel comfortable taking <strong>of</strong>f her wig. Sometimes I’ll just<br />

take <strong>of</strong>f my hair and say, ‘Now, you good?’ You have to feel comfortable,”<br />

said Clark, who estimates approximately 10% <strong>of</strong> her customers suffer from<br />

alopecia.<br />

The comfort Clark <strong>of</strong>fers her customers extends far beyond hair care. She<br />

sometimes takes on a motherly role to those in need. “There is a young lady<br />

that comes in here all the time and buys little items,” Clark said. “She came in<br />

and was feeling pretty good. I could tell she’d been drinking. I said, ‘You’re<br />

only 17 years old. You know better than that.’ She said, ‘You know what, you<br />

never knew this but my mother’s dead. Every time I come in here, you’re

always so personable with me. I came in here just for you to do what<br />

you just did. I’m going home because I know I’m wrong for doing<br />

that.’”<br />

Clark’s relationship with her customers is something that sets her<br />

apart. She may not have the complete selection <strong>of</strong> Korean hair stores<br />

or the prices <strong>of</strong> big-box stores like Walmart, but she has unbeatable<br />

customer service and intimate knowledge <strong>of</strong> her products. When a<br />

customer complained about her prices being higher than other stores,<br />

she explained that “Walmart is a billion-dollar company…. I can’t<br />

compete. But when it comes to customer service, one-on-one, telling<br />

you how a product works, and telling you other customers’ results, I<br />

can tell you that and be honest about it,” Clark said.<br />

She is proud to serve her customers with integrity and relies on her<br />

family and faith in God to keep her going. “My husband has been a<br />

big help. He has a radio broadcast. Every Friday he gives us a shoutout<br />

and lets everyone know we’re here. It’s his business as well. It’s a<br />

family thing. My children do the social media. My church family<br />

helps me. When people see that you’re serious about what you do and<br />

you’re never going to give up, they help you out,” Clark said. By the<br />

grace <strong>of</strong> God and the love and encouragement <strong>of</strong> her supporters,<br />

Clark keeps pushing. Even though she knows she is fighting an uphill<br />

battle as a Black woman in the hair care<br />

industry, she has no intentions <strong>of</strong> giving up. “I had a<br />

Korean friend that told me, ‘Regina, this is really<br />

something you shouldn’t do…. You’re African American,<br />

you’re a minority when it comes to this. They’re not<br />

going to let you in. They’re going to make it hard on<br />

you,’” she<br />

recalled.<br />

As one <strong>of</strong> the few<br />

black-owned hair<br />

stores in the city,<br />

Clark has faced<br />

many challenges,<br />

including trouble<br />

finding product vendors. However, her dedication to her<br />

passion and her people keeps her energized and ready for<br />

whatever’s next. She hopes to one day open a second location<br />

and pass the business <strong>of</strong>f to her children, but for<br />

now she is focused on growing the business and making<br />

more women aware <strong>of</strong> what she has to <strong>of</strong>fer. “At the end<br />

<strong>of</strong> the day,” she said, “there is a need for our people. This<br />

is what they want. For me to throw in the towel is like<br />

saying they’re not important—and they are.”<br />

11

11

African-Americans,<br />

Vaccines and a<br />

History <strong>of</strong> Suspicion<br />

A good parent is not sure what to believe. On one side, doctors<br />

tell us vaccinations are safe and necessary for our children.<br />

They’ve been in existence for hundreds <strong>of</strong> years, most people get<br />

them and they are credited with eradicating diseases and saving<br />

lives.<br />

On the other side are numerous horror stories involving<br />

vaccinated children like that <strong>of</strong> Harvard-educated attorney<br />

George Fatheree, who was pressured by a pediatrician to resume<br />

vaccination despite seizures his infant, Clayton, experienced after<br />

a previous round <strong>of</strong> vaccines. That night, Clayton’s seizures<br />

returned and he stopped speaking for three years. He grew into a<br />

severely disabled teen, suffering dozens <strong>of</strong> seizures a day.<br />

Because <strong>of</strong> similar vaccine-related injuries and deaths, the<br />

National Vaccine Injury Compensation Program — a fund under<br />

the U.S. Department <strong>of</strong> Health and Human Services set up to<br />

shield vaccine manufacturers from liability — has paid out over<br />

$3.6 billion in compensation to affected families.<br />

Given such occurrences, coupled with a dark history <strong>of</strong><br />

government-backed medical atrocities enacted upon the Black<br />

community, African-American parents are <strong>of</strong>ten unsure what to<br />

think about vaccination. But, whatever one believes, when it<br />

comes to injecting potentially harmful materials into our children<br />

— among vaccine ingredients listed by the Centers for Disease<br />

Control and Prevention (CDC) are known neurotoxins aluminum<br />

and formaldehyde, along with human fetal tissue — parents need<br />

to be as informed as possible.<br />

Some focus on what they believe to be a bigger picture.<br />

“Vaccinations are great advances,” says Harriet A. Washington, a<br />

medical ethicist, researcher and writer who has held numerous<br />

university fellowships. Washington points to the eradication <strong>of</strong><br />

serious diseases current generations now take for granted.<br />

“Medical innovations are very important,” she contends,<br />

especially “considering the very poor health <strong>of</strong><br />

African-Americans” who “die younger, more quickly and in<br />

greater proportions than most from cancer and other infectious<br />

diseases.”<br />

Health Report<br />

Few would dispute the underlying concept <strong>of</strong> an immune<br />

response being generated by exposure to a virus or disease.<br />

Accordingly, most who contracted measles or chicken pox<br />

as children currently enjoy a natural lifelong immunity to<br />

these illnesses and others. However, critics contend this<br />

natural immunity is far different from the unnatural process<br />

<strong>of</strong> vaccination in place today.<br />

“You cannot put adjuvants — which you know are<br />

neurotoxins such as mercury, aluminum or a carcinogen like<br />

formaldehyde — into these vaccines and then inject them<br />

into these little bodies and think it’s not going to have any<br />

effects,” says Dr. Nancy Turner Banks, a Harvard Medical<br />

School graduate and former director <strong>of</strong> outpatient<br />

gynecology at North General Hospital in Harlem, N.Y. The<br />

real question, says Banks, is “not if vaccines are safe, but if<br />

the ingredients they put in vaccines are safe.”<br />

Last July, upon educating herself on vaccines and potential<br />

links to autism and learning disabilities, Dr. Rachael Ross<br />

— family physician, Ph.D and co-host <strong>of</strong> Emmy Awardwinning<br />

TV show, “The Doctors” — issued a heartfelt<br />

apology to “any children and parents that I have<br />

unknowingly harmed.” As a Black physician with a Black<br />

patient base, wrote Ross, “I am very concerned and very<br />

sorry.” With what “I now know, I cannot support mandatory<br />

vaccines for children.” Parents, insisted Ross, “have to have<br />

the right to choose.”<br />

Undoubtedly, there are many sides to the debate given most<br />

medical pr<strong>of</strong>essionals are neither for nor against all<br />

vaccines. But, in America today, a healthy debate is not<br />

taking place. Medical pr<strong>of</strong>essionals who merely question the<br />

existing schedule risk reputation, career and are branded<br />

“quacks” in Internet posts and press. Because the mainstream<br />

media in this country, says Fisher, is “very much<br />

influenced by the pharmaceutical companies who advertise”<br />

in their space, “they characterize it as either you are against<br />

all vaccines or you are for all vaccines.” Not true, since<br />

most “want to use some <strong>of</strong> the vaccines or a different<br />

schedule,” yet are “being forced into using all the vaccines<br />

or are being called ‘anti-vaccine’ because they simply want<br />

to make informed choices.”<br />

Still, what looms larger than any debate over immunity is<br />

the ongoing issue <strong>of</strong> trust — or lack there<strong>of</strong> — between<br />

Black Americans, the American medical establishment and<br />

the pr<strong>of</strong>it-thirsty pharmaceutical companies that dominate.<br />

15

Hours:<br />

8:00 A.M.– 5:30 P.M. Monday thru Friday<br />

FISHER<br />

AUTO ELECTRIC<br />

COMPLETE AUTO REPAIR<br />

WE ACCEPT ALL FORMS OF PAYMENT<br />

VISA MASTERCARD AMERICAN<br />

EXPRESS DISCOVER<br />

All Electrical Repairs Diagnostic Checks<br />

Cold AC Service Complete Suspension<br />

4901 East 31st Chelsea, Kansas City, Missouri 64128<br />

Phone: (816) 861-5527 Fax: (816) 861-3010

Buwen W. Johnson<br />

Owner<br />

Simeom E. Johnson<br />

General Manager<br />

Store Hours<br />

Wed-Sat 10 a.m. –7pm<br />

11331 E. 23rd Street<br />

Independence, MO 64052<br />

Office: 816.252.2144<br />

Cell: 816.786.7156<br />

rbuwen@yahoo.com<br />

FOR LEASE<br />

LOCATION #1<br />

Conveniently Located Office/Medical Space<br />

300 to 1500 Sq/ft.<br />

1734 E. 63rd Street<br />

Kansas City, Missouri 64110<br />

On-Site Management<br />

On-Site Maintenance<br />

On-Site Security Guard<br />

Covered Parking<br />

9.50 Sq. Ft. Lease Rate (Full Service)<br />

Tenant Improvement Allowance<br />

For information contact: John Barbieri<br />

Phone: (816) 363-1516<br />

Fax: (816) 363-8902