Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

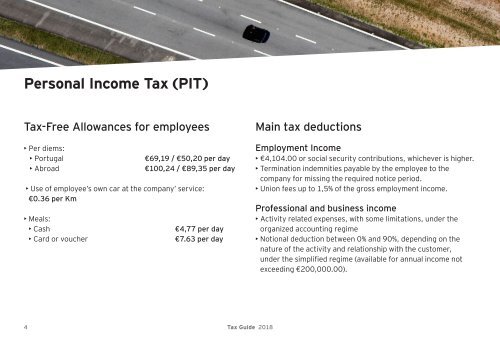

Personal Income <strong>Tax</strong> (PIT)<br />

<strong>Tax</strong>-Free Allowances for employees<br />

• Per diems:<br />

• Portugal<br />

• Abroad<br />

€69,19 / €50,20 per day<br />

€100,24 / €89,35 per day<br />

• Use of employee’s own car at the company’ service:<br />

€0.36 per Km<br />

• Meals:<br />

• Cash<br />

• Card or voucher<br />

€4,77 per day<br />

€7.63 per day<br />

Main tax deductions<br />

Employment Income<br />

• €4,104.00 or social security contributions, whichever is higher.<br />

• Termination indemnities payable by the employee to the<br />

company for missing the required notice period.<br />

• Union fees up to 1,5% of the gross employment income.<br />

Professional and business income<br />

• Activity related expenses, with some limitations, under the<br />

organized accounting regime<br />

• Notional deduction between 0% and 90%, depending on the<br />

nature of the activity and relationship with the customer,<br />

under the simplified regime (available for annual income not<br />

exceeding €200,000.00).<br />

4 <strong>Tax</strong> <strong>Guide</strong> <strong>2018</strong>