Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

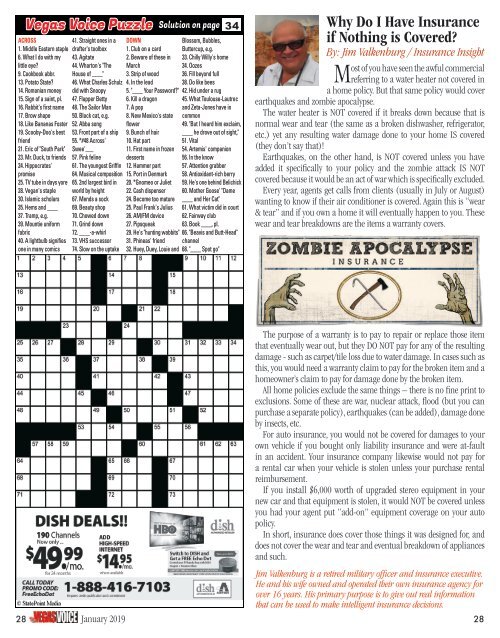

34<br />

Why Do I Have Insurance<br />

if Nothing is Covered?<br />

By: Jim Valkenburg / Insurance Insight<br />

Most of you have seen the awful commercial<br />

referring to a water heater not covered in<br />

a home policy. But that same policy would cover<br />

earthquakes and zombie apocalypse.<br />

The water heater is NOT covered if it breaks down because that is<br />

normal wear and tear (the same as a broken dishwasher, refrigerator,<br />

etc.) yet any resulting water damage done to your home IS covered<br />

(they don’t say that)!<br />

Earthquakes, on the other hand, is NOT covered unless you have<br />

added it specifically to your policy and the zombie attack IS NOT<br />

covered because it would be an act of war which is specifically excluded.<br />

Every year, agents get calls from clients (usually in July or August)<br />

wanting to know if their air conditioner is covered. Again this is “wear<br />

& tear” and if you own a home it will eventually happen to you. These<br />

wear and tear breakdowns are the items a warranty covers.<br />

The purpose of a warranty is to pay to repair or replace those item<br />

that eventually wear out, but they DO NOT pay for any of the resulting<br />

damage - such as carpet/tile loss due to water damage. In cases such as<br />

this, you would need a warranty claim to pay for the broken item and a<br />

homeowner’s claim to pay for damage done by the broken item.<br />

All home policies exclude the same things – there is no fine print to<br />

exclusions. Some of these are war, nuclear attack, flood (but you can<br />

purchase a separate policy), earthquakes (can be added), damage done<br />

by insects, etc.<br />

For auto insurance, you would not be covered for damages to your<br />

own vehicle if you bought only liability insurance and were at-fault<br />

in an accident. Your insurance company likewise would not pay for<br />

a rental car when your vehicle is stolen unless your purchase rental<br />

reimbursement.<br />

If you install $6,000 worth of upgraded stereo equipment in your<br />

new car and that equipment is stolen, it would NOT be covered unless<br />

you had your agent put “add-on” equipment coverage on your auto<br />

policy.<br />

In short, insurance does cover those things it was designed for, and<br />

does not cover the wear and tear and eventual breakdown of appliances<br />

and such.<br />

Jim Valkenburg is a retired military officer and insurance executive.<br />

He and his wife owned and operated their own insurance agency for<br />

over 16 years. His primary purpose is to give out real information<br />

that can be used to make intelligent insurance decisions.<br />

28 January 2019<br />

28