Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

24 ADVICE<br />

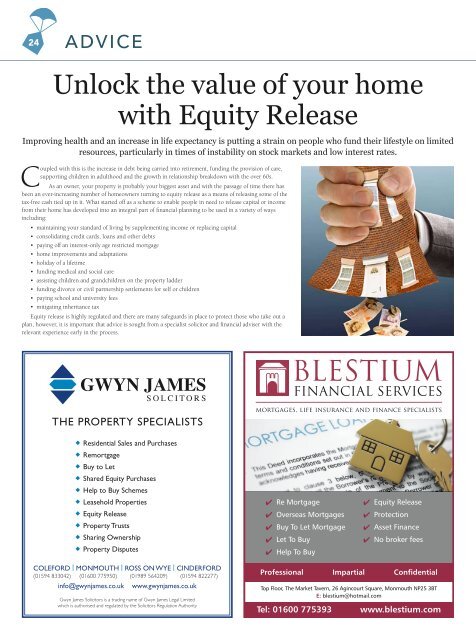

Unlock the value of your home<br />

with Equity Release<br />

Improving health and an increase in life expectancy is putting a strain on people who fund their lifestyle on limited<br />

resources, particularly in times of instability on stock markets and low interest rates.<br />

Coupled with this is the increase in debt being carried into retirement, funding the provision of care,<br />

supporting children in adulthood and the growth in relationship breakdown with the over 60s.<br />

As an owner, your property is probably your biggest asset and with the passage of time there has<br />

been an ever-increasing number of homeowners turning to equity release as a means of releasing some of the<br />

tax-free cash tied up in it. What started off as a scheme to enable people in need to release capital or income<br />

from their home has developed into an integral part of financial planning to be used in a variety of ways<br />

including:<br />

• maintaining your standard of living by supplementing income or replacing capital<br />

• consolidating credit cards, loans and other debts<br />

• paying off an interest-only age restricted mortgage<br />

• home improvements and adaptations<br />

• holiday of a lifetime<br />

• funding medical and social care<br />

• assisting children and grandchildren on the property ladder<br />

• funding divorce or civil partnership settlements for self or children<br />

• paying school and university fees<br />

• mitigating inheritance tax<br />

Equity release is highly regulated and there are many safeguards in place to protect those who take out a<br />

plan, however, it is important that advice is sought from a specialist solicitor and financial adviser with the<br />

relevant experience early in the process.<br />

GWYN JAMES<br />

S O L C I T O R S<br />

THE PROPERTY SPECIALISTS<br />

mortgages, life insurance and finance specialists<br />

u Residential Sales and Purchases<br />

u Remortgage<br />

u Buy to Let<br />

u Shared Equity Purchases<br />

u Help to Buy Schemes<br />

u Leasehold Properties<br />

u Equity Release<br />

u <strong>Property</strong> Trusts<br />

u Sharing Ownership<br />

u <strong>Property</strong> Disputes<br />

4 Re Mortgage<br />

4 Overseas Mortgages<br />

4 Buy To Let Mortgage<br />

4 Let To Buy<br />

4 Help To Buy<br />

4 Equity Release<br />

4 Protection<br />

4 Asset Finance<br />

4 No broker fees<br />

COLEFORD | MONMOUTH | ROSS ON WYE | CINDERFORD<br />

(01594 833042) (01600 775950) (01989 564209) (01594 822277)<br />

info@gwynjames.co.uk<br />

www.gwynjames.co.uk<br />

Gwyn James Solicitors is a trading name of Gwyn James Legal Limited<br />

which is authorised and regulated by the Solicitors Regulation Authority<br />

Professional Impartial Confidential<br />

Top Floor, The Market Tavern, 26 Agincourt Square, Monmouth NP25 3BT<br />

E: blestium@hotmail.com<br />

Tel: 01600 775393<br />

www.blestium.com