Contact_Vol19No1_March2019_WEB full and final

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

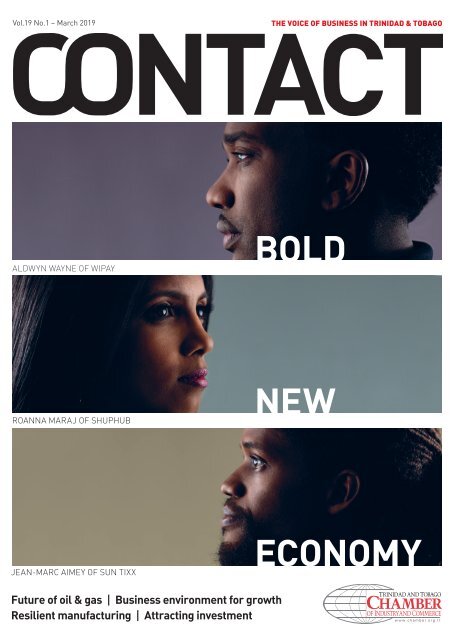

Vol.19 No.1 – March 2019<br />

The Voice of Business in Trinidad & ToBago<br />

Aldwyn wAyne of wiPAy<br />

BOLD<br />

RoAnnA MARAJ of SHUPHUB<br />

NEW<br />

JeAn-MARC AiMey of SUn TiXX<br />

ECONOMY<br />

Future of oil & gas | Business environment for growth<br />

Resilient manufacturing | Attracting investment

Developers - Builders<br />

Welcome<br />

Smart is the new st<strong>and</strong>ard<br />

Our solutions are designed to make homes more comfortable, more<br />

energy efficient <strong>and</strong> more secure — complementing your home designs with<br />

personalized features <strong>and</strong> experiences that transform a dream home into a dream<br />

way of living. Set yourself apart <strong>and</strong> appeal to a more informed homebuyer, by<br />

incorporating smart-home experiences into your projects.<br />

• Smart-homes are among the top amenities that consumers<br />

expect in modern homes today. Manetsys Trinidad LTD. is the<br />

partner of choice with truly personalized <strong>and</strong> flexible smart<br />

experiences to meet every budget.<br />

• Smart-experiences may offer an ROI of up to 30%,<br />

according to market research.<br />

*Showroom by invitation only, please call to schedule an appointment.<br />

Manetsys Trinidad, LTD.<br />

Lot 29B-31 Lower Sixth Avenue<br />

Barataria | Trinidad & Tobago<br />

(868) 223-7871 | www.manetsys.com

Vol.19 No.1 – March 2019<br />

Contents<br />

Editor’s note 7<br />

Natalie Dookie introduces this issue of CONTACT<br />

The future of fossil fuels 8<br />

Energy strategist Anthony Paul explores the future of oil<br />

<strong>and</strong> gas, taking us from challenges to opportunities<br />

The economic outlook 44<br />

Prospects for Trinidad <strong>and</strong> Tobago, the Caribbean,<br />

<strong>and</strong> the global economy in the year ahead<br />

Energy update 46<br />

The state of the energy sector in figures<br />

Special CONTACT Survey:<br />

Blueprint for a bold new economy<br />

Welcome to new members 48<br />

The Chamber extends a warm greeting to members<br />

who have recently joined<br />

An inconvenient truth 14<br />

In an economy lacking growth, Hayden Blades suggests<br />

how we can create an enabling business environment for<br />

long-term sustainable development <strong>and</strong> prosperity<br />

Selling our services 18<br />

The Trinidad <strong>and</strong> Tobago Coalition of Services Industries<br />

has a road map for going global. Learn about their new<br />

national exporters’ services registry <strong>and</strong> internationalisation<br />

initiatives<br />

Where are all the tourists? 23<br />

The T&T tourism success story is still waiting to happen.<br />

John Bell looks at the S<strong>and</strong>als saga <strong>and</strong> lessons to be learnt.<br />

How can we save the sector?<br />

Manufacturing the future 26<br />

According to the Trinidad & Tobago Manufacturers’<br />

Association, there is still much to be done in order<br />

to create a more resilient sector geared for success<br />

Empowering our artists 28<br />

Keith Nurse <strong>and</strong> Alicia Shepherd make the case for greater<br />

investment in the creative/cultural sector<br />

Towards a renaissance of agriculture 32<br />

How prepared is our agriculture sector for climate change?<br />

Steve Maximay guides us on how to re-align the sector<br />

The challenge of renewable energy 36<br />

Dr Zaffar Khan <strong>and</strong> Atiyyah A. Khan discuss the challenge<br />

of maximising renewable energy <strong>and</strong> increasing energy<br />

efficiency in T&T<br />

Attracting the investor 40<br />

InvesTT tells Joel Henry about its success stories <strong>and</strong> how<br />

it is engaging with the diaspora<br />

On the cover:<br />

Aldwyn Wayne, Chief Executive<br />

Officer, WiPay (Trinidad <strong>and</strong> Tobago)<br />

Limited; Roanna Maraj, Managing<br />

Director, Keystone Designs Limited/<br />

ShupHub; <strong>and</strong> Jean-Marc Aimey,<br />

Chief Executive Officer, Sun Tixx<br />

Caribbean Limited<br />

(Photos by: Dos Imagery)<br />

4 MARCH 2019 CHAMBER.ORG.TT

The voice of business in Trinidad & Tobago<br />

Published by<br />

The Trinidad <strong>and</strong> Tobago Chamber<br />

of Industry <strong>and</strong> Commerce<br />

Columbus Circle, Westmoorings, Port of Spain, Trinidad <strong>and</strong> Tobago<br />

PO Box 499, Port of Spain • Tel: (868) 637-6966 • Fax: (868) 622-4475<br />

Email: chamber@chamber.org.tt • Website: www.chamber.org.tt<br />

Tobago Division:<br />

ANSA McAL Building, Milford Road, Scarborough, Tobago<br />

Tel: (868) 639-2669 • Fax: (868) 639-2669<br />

Email: tobagochamber@chamber.org.tt<br />

Produced for the Chamber by<br />

MEP Publishers (Media & Editorial Projects Ltd)<br />

6 Prospect Avenue, Maraval, Port of Spain, Trinidad <strong>and</strong> Tobago<br />

Tel: 622-3821 • Fax: 628-0639<br />

Email: info@meppublishers.com • Website: www.meppublishers.com<br />

Editor<br />

Online editor<br />

General manager<br />

Page layout & design<br />

Advertising<br />

Production<br />

Editorial assistant<br />

Natalie Dookie<br />

Caroline Taylor<br />

Halcyon Salazar<br />

Kriston Chen<br />

Evelyn Chung, Tracy Farrag,<br />

Mark-Jason Ramesar<br />

Jacqueline Smith<br />

Shelly-Ann Inniss<br />

DISCLAIMER<br />

Opinions expressed in <strong>Contact</strong> are those of the authors, <strong>and</strong><br />

not necessarily of the Trinidad <strong>and</strong> Tobago Chamber of Industry<br />

<strong>and</strong> Commerce or its partners or associates.<br />

COURTESY CHRISTINA MORELLO / PEXELS.COM<br />

CONTACT is published quarterly by the Trinidad <strong>and</strong> Tobago Chamber of<br />

Industry <strong>and</strong> Commerce (TTCIC). It is available online at www.chamber.org.tt/<br />

media/the-contact-business-magazine. ©2019 TTCIC. All rights reserved. No part<br />

of this magazine may be reproduced in any form without the written permission<br />

of the publisher.<br />

CHAMBER.ORG.TT

COURTESY INVESTT<br />

6 MARCH 2019 CHAMBER.ORG.TT

Editor’s Note<br />

Editor’s note<br />

In this issue of CONTACT, we have<br />

assembled a team of experts to build<br />

a Blueprint for a Bold New Economy<br />

Trinidad <strong>and</strong> Tobago’s energy sector is expected to have contributed 36.1%<br />

to GDP in 2018, in stark contrast to the highs of 50% <strong>and</strong> more in past<br />

decades. Economic growth in 2018 is projected to reach 1.9%. In the face of<br />

these sobering statistics, coupled with volatile global oil prices <strong>and</strong> depleting<br />

resources, there is a lot of uncertainty regarding our future.<br />

Economic diversification of the energy <strong>and</strong> non-energy sectors must<br />

therefore become a priority, especially as the process can take decades before<br />

it brings real change to the bottom line.<br />

Does Trinidad <strong>and</strong> Tobago have enough time to transform its economy<br />

before oil <strong>and</strong> gas run out, <strong>and</strong> what path should it take? In this issue of<br />

CONTACT, we have assembled a team of experts to build a Blueprint for a<br />

Bold New Economy.<br />

We begin by examining how to maximise our remaining resources <strong>and</strong><br />

enhance the energy services sector for export. Next, we develop a business<br />

environment geared for economic growth.<br />

We look at how to further champion the services sector, already a strong<br />

contributor to GDP, <strong>and</strong> include a detailed review of the challenges <strong>and</strong> solutions<br />

for tourism.<br />

Manufacturing has many cross-sector linkages, <strong>and</strong> making it more resilient<br />

is critical to our future. And what about new sectors – does the creative<br />

industry present an opportunity?<br />

How will we achieve food security <strong>and</strong> counter the effects of climate<br />

change? We tackle these issues alongside improving energy efficiency <strong>and</strong><br />

exploring renewable energy. Investment will be needed in all of these sectors –<br />

InvesTT tells us how to attract this.<br />

We look forward to your feedback on this packed issue: let us know if<br />

you agree with what our experts say.<br />

Natalie Dookie, Editor<br />

On the cover<br />

Technology is already transforming every sector of our economy, <strong>and</strong> it will play a key<br />

role in diversification efforts, creating new industries <strong>and</strong> opportunities for solutionoriented<br />

entrepreneurs. On the cover, we feature three <strong>final</strong>ists in the Trinidad <strong>and</strong><br />

Tobago Chamber of Industry <strong>and</strong> Commerce’s Business Technology Award 2018.<br />

WiPay has removed a significant barrier for online payments, offering great benefits for<br />

small- <strong>and</strong> medium-sized enterprises. Its free platform can be integrated into any merchant’s<br />

website to facilitate credit card payments. In 2016, WiPay also introduced its Top-Up Service,<br />

a form of digital cash, which offers financial inclusion for the unbanked or under-banked. It<br />

is now the number one online payment platform in the Caribbean.<br />

ShupHub.com is an e-commerce platform that brings together vendors <strong>and</strong> customers. Prior<br />

to its launch, there were hardly any portals available locally for vendors to distribute their<br />

goods <strong>and</strong> services online. Entrepreneurs will no longer need brick <strong>and</strong> mortar stores as<br />

this online platform allows them to market products throughout the Caribbean – this year,<br />

Shuphub’s service will be available in every Caricom territory.<br />

Sun Tixx provides a technology-driven service which manages the generation, distribution<br />

<strong>and</strong> sale of tickets for events. It uses secure ticketing <strong>and</strong> access control technology, making<br />

it easier for patrons to collect tickets <strong>and</strong> for event hosts to collect payments. Sun Tixx<br />

has exp<strong>and</strong>ed into St Lucia, St Vincent, Grenada <strong>and</strong> Barbados, becoming the largest ticket<br />

distribution network provider in the Caribbean.<br />

CHAMBER.ORG.TT<br />

MARCH 2019 7

Energy<br />

COURTESY PIXABAY.COM<br />

8 MARCH 2019 CHAMBER.ORG.TT

Energy<br />

The future<br />

of fossil fuels<br />

Trinidad <strong>and</strong> Tobago’s energy industry is more than a century old,<br />

<strong>and</strong> the country depends heavily on it for revenue. It will still have<br />

its place in the future economy, especially if its current constraints<br />

are addressed<br />

by Anthony Paul<br />

Principal Energy & Strategy Consultant,<br />

Association of Caribbean Energy Specialists Limited<br />

None of these factors suggests<br />

that the global life of oil <strong>and</strong> gas<br />

will be over in the next 50 years<br />

At government’s stated<br />

sustainable production levels<br />

of 4.2 billion cubic feet per<br />

day, new reserves may be able<br />

to support existing plants for<br />

decades to come<br />

To paraphrase Mark Twain: “The rumours of the death of oil are greatly<br />

exaggerated.”<br />

Outlooks for the global energy mix over the next 20 to 30 years, from<br />

major international oil <strong>and</strong> gas companies like BP, Equinor (formerly Statoil),<br />

ExxonMobil, Shell <strong>and</strong> Total, as well as consultancies, research institutions <strong>and</strong><br />

the International Energy Agency, all point to a future where energy dem<strong>and</strong><br />

grows, <strong>and</strong> the greatest increase in market share is taken by renewables.<br />

Interestingly, in that same timeframe, while the share of oil <strong>and</strong> gas<br />

declines, actual dem<strong>and</strong> for both is predicted to grow under current global<br />

policy scenarios, with gas replacing oil as an energy source to reduce harmful<br />

effects on the environment.<br />

As technology advances rapidly on many fronts, it makes renewables more<br />

efficient <strong>and</strong> competitive, <strong>and</strong> the discovery <strong>and</strong> production of more oil <strong>and</strong> gas<br />

easier; it also reduces the impact of fossil fuels on the environment.<br />

These factors point to a dynamic range of scenarios, none of which suggests<br />

that the global life of oil <strong>and</strong> gas will be over in the next 50 years. There is still<br />

enough time to invest <strong>and</strong> benefit.<br />

Maximising our remaining resources<br />

But what about Trinidad <strong>and</strong> Tobago? How long does our industry have again?<br />

The Ministry of Energy <strong>and</strong> Energy Industries uses its annual Scott-Ryder<br />

audit to better underst<strong>and</strong> the energy industry’s growth. This approach is an<br />

unnecessary public expenditure, as exploration companies are required to do<br />

the same, <strong>and</strong> the ministry has the authority to dictate how this is done so that<br />

it meets their requirements.<br />

Further, the approach taken grossly understates the potential of our already<br />

discovered fields <strong>and</strong> geological basins, dissuading investment in exploration<br />

<strong>and</strong> indigenous research <strong>and</strong> development. The reserves audit has limited scope,<br />

relative to the potential of the basins.<br />

CHAMBER.ORG.TT<br />

MARCH 2019 9

Blueprint for a Bold New Economy<br />

Oil <strong>and</strong> gas exploration <strong>and</strong> production opportunities<br />

10<br />

1. North Coast Marine Area: gas fields, deep water<br />

2. Northern Gulf of Paria / Northern Basin:<br />

small oil & gas fields, sub-anhydrite imaging<br />

3. Southern Gulf of Paria:<br />

enhanced imaging, deep drilling/older horizons, heavy oil, enhanced<br />

recovery, deeper <strong>and</strong> older (incl. cretaceous) prospects, stratigraphic plays<br />

4. Offshore South Coast:<br />

small gas & oil, enhanced imaging, cretaceous shelf edge<br />

5. Southern Basin:<br />

deeper <strong>and</strong> older (cretaceous) prospects, stripper fields, oil s<strong>and</strong>s,<br />

enhanced recovery, 3D seismic for new projects, field extensions,<br />

stratigraphic plays<br />

6. Central Range Thrust Belt<br />

7. East Coast Shelf:<br />

deep drilling, small & medium sized gas fields,<br />

JV/farm-ins, enhanced recovery, shallow gas<br />

imaging challenges, possible participation in<br />

Venezuelan border fields, infrastructure-led E&P<br />

8. East Coast Slope:<br />

deep water, underexplored, adjacent to existing production<br />

& infrastructure (EC Slope)<br />

9. Ultra Deep Water, East Coast:<br />

oil - structural & stratigraphic traps (reservoir<br />

modelling & petroleum system research needed),<br />

natural gas/small field challenge, gas hydrates<br />

10. Tobago Trough:<br />

deep water, underexplored, continuation<br />

of C. Range/Angostura trend<br />

2<br />

3<br />

1<br />

4<br />

6<br />

5<br />

7<br />

8<br />

9<br />

Source: Association of Caribbean Energy Specialists Limited<br />

Fig. 1: Across multiple geological basins, Trinidad <strong>and</strong> Tobago still has a wide range of oil <strong>and</strong> gas exploration development <strong>and</strong> production opportunities.<br />

That said, in October 2018 the ministry announced that,<br />

according to the most recent audit, for the first time since<br />

2004 reserves had grown, with 154% replacement of<br />

reserves produced in 2017.<br />

This was welcome news, but Trinidad <strong>and</strong> Tobago<br />

still needs to take urgent steps to maximise its remaining<br />

energy resources, alongside investing capital to fund<br />

economic diversification.<br />

Aside from new exploration in deepwater acreage,<br />

Figure 1 shows other areas where oil <strong>and</strong> gas can be found<br />

including onshore, the Gulf of Paria, <strong>and</strong> shallow water off<br />

the north, east, <strong>and</strong> south coasts.<br />

The use of new technologies, field depletion policies<br />

consistent with national interests <strong>and</strong> industry best<br />

practice, suitable investors <strong>and</strong>/or commercial models,<br />

can enable production from small fields, lower pressured<br />

reservoirs, tight reservoirs, deeper older formations <strong>and</strong><br />

trapping types, <strong>and</strong> heavy oil.<br />

In addition, by applying the phenomenon known as<br />

“creaming curve”, whereby oil <strong>and</strong> gas basins typically<br />

contain as much reserves in multiple small fields as<br />

they do in the few large ones, basin development would<br />

translate into over 50tcf in smaller pools, given currently<br />

producing fields.<br />

In a mature gas market like ours, small fields can be<br />

commercialised as their development is not burdened by<br />

the need to invest in pipelines <strong>and</strong> other infrastructure,<br />

or to guarantee the long-term supply needed to satisfy<br />

financing requirements for new plants.<br />

Given that our gas processing plants have mostly been<br />

paid off <strong>and</strong> are still relatively very efficient, they can<br />

compete with new plants in global markets, even with<br />

higher prices.<br />

Because our resources are mostly onshore <strong>and</strong> in<br />

shallow waters, they can provide opportunities for local<br />

investors, contractors <strong>and</strong> suppliers to participate, <strong>and</strong> for<br />

the government to give incentives for investment that can<br />

be translated into benefits to the economy via increased<br />

local revenue flows, taxes <strong>and</strong> employment.<br />

Indigenous supplies aside, development <strong>and</strong> exploration<br />

opportunities on the Venezuelan side of our borders<br />

can provide potential inputs for refining at Pointe-à-Pierre<br />

<strong>and</strong> Point Lisas, at costs lower than most other options<br />

– though geopolitics <strong>and</strong> uncertainty over the refinery<br />

present immediate challenges.<br />

Implementing these initiatives can bring tens of<br />

trillions of cubic feet to market. At the government’s stated<br />

sustainable production levels of 4.2 billion cubic feet per<br />

day of gas, new reserves may be able to support existing<br />

plants for decades to come.<br />

Positive developments taking place in Guyana <strong>and</strong><br />

Suriname also present opportunities for the local sector to<br />

provide assistance in developing indigenous capabilities<br />

in services, skills enhancement, infrastructure <strong>and</strong> natural<br />

gas industries.<br />

Enhancing energy services for export<br />

How do we maximise our remaining resources, while ensuring<br />

the growth <strong>and</strong> development of domestic firms?<br />

As local reserves become depleted, the energy services<br />

sector will take on even greater importance. Enhancing<br />

competitiveness <strong>and</strong> investing in capacity development of<br />

10 MARCH 2019 CHAMBER.ORG.TT

Energy<br />

fabrication<br />

engineering &<br />

construction<br />

UPSTREAM ACTIVITIES<br />

subsurface<br />

services<br />

logistics-boats rigs/wells maintenance<br />

$ upstream spend<br />

job creation<br />

potential<br />

cyclical nature<br />

CHARACTERISTICS<br />

gas/oil price<br />

sensitivity<br />

value-added skill<br />

content<br />

innovation<br />

potential<br />

technology<br />

potential<br />

knowledge<br />

transferability<br />

non-energy<br />

transferability<br />

jv attractiveness<br />

High sustainability sectors High impact sectors High Moderate Low<br />

Fig. 2: Multiple areas have been identified for local content to support diversification. (Source: Association of Caribbean Energy Specialists Limited)<br />

local firms will be fundamental to improving their export<br />

capability.<br />

Although we have a robust local content policy <strong>and</strong><br />

supporting regulations, foreign individuals <strong>and</strong> companies<br />

are often brought in to do work for which locals are <strong>full</strong>y<br />

capable <strong>and</strong> qualified. Other work that can <strong>and</strong> should be<br />

done here is sent overseas, thus facilitating revenue leakage,<br />

transfer pricing, <strong>and</strong> tax avoidance.<br />

The Trinidad <strong>and</strong> Tobago Local Content Policy of 2004<br />

identified areas in the oil <strong>and</strong> gas sector that had significant<br />

projected dem<strong>and</strong> <strong>and</strong> could support the competitiveness<br />

of local companies, encouraging them to export their<br />

services, while contributing to diversification efforts.<br />

Work that can <strong>and</strong> should be done<br />

here is sent overseas, facilitating<br />

revenue leakage, transfer pricing,<br />

<strong>and</strong> tax avoidance<br />

Areas such as big data management, seismic processing,<br />

design engineering <strong>and</strong> fabrication were identified as<br />

opportunities, <strong>and</strong> were pursued to the extent that several<br />

international firms set up operations locally, some serving<br />

foreign-based clients while partnering with locals.<br />

Unfortunately, this initiative found itself on a collision<br />

course with the decision to engage Chinese contractors at<br />

the expense of local industry. The oil <strong>and</strong> gas local content<br />

policy was quarantined as a consequence, <strong>and</strong> the affected<br />

companies folded up.<br />

Policy decisions favouring mega-projects <strong>and</strong> foreign<br />

investment, preventing access to natural gas <strong>and</strong> gas-derived<br />

products, resulted in the door being shut on locals<br />

wanting to invest downstream in small plants to convert<br />

methanol <strong>and</strong> syngas by manufacturing, <strong>and</strong> small-scale<br />

LNG for export to regional markets.<br />

Figure 2 demonstrates how investment in high<br />

sustainability <strong>and</strong> high impact energy services can<br />

contribute to job creation <strong>and</strong> knowledge transfer.<br />

Improving administration <strong>and</strong> tax collection<br />

Aside from the direct impact on the economy <strong>and</strong> business,<br />

the energy sector traditionally provided the biggest share<br />

of government revenue <strong>and</strong> foreign exchange, until recent<br />

times. As highlighted at the Ministry of Energy <strong>and</strong> Energy<br />

Industries March 2018 “Spotlight on Energy”, failures in<br />

government taxation policy <strong>and</strong> tax collection resulted in<br />

over TT$120 billion of uncollected taxes.<br />

This tax avoidance was facilitated by weak regulatory<br />

capacity <strong>and</strong> governance systems. Recent assurances by<br />

the government that they are going after this, supported by<br />

bold, if long overdue, measures to institute a transparent<br />

<strong>and</strong> consistent royalty regime, will result in much more<br />

foreign exchange being available to the domestic economy.<br />

While these developments are encouraging, they do<br />

not do nearly enough to address the core issue that has<br />

plagued the industry <strong>and</strong> led to its slide. A woe<strong>full</strong>y underresourced<br />

<strong>and</strong> opaque Ministry of Energy <strong>and</strong> Energy<br />

Industries, lacking in self-confidence, denuded of authority<br />

<strong>and</strong> perpetually avoiding the legal strictures in place to<br />

CHAMBER.ORG.TT<br />

MARCH 2019 11

Blueprint for a Bold New Economy<br />

Fig. 3: Recommended measures to increase activities, production <strong>and</strong> revenue in the T&T oil <strong>and</strong> gas sector.<br />

➤ Good governance<br />

• Clear, consistently applied policies<br />

• Enhanced institutional capacity<br />

i. Technical<br />

ii. Commercial (incl. negotiating)<br />

iii. Technology<br />

iv. Funding<br />

• Transparency & accountability, as prescribed by the<br />

Petroleum Act & Regulations<br />

• Enlightened tax regime – close loopholes<br />

• Industry st<strong>and</strong>ard procurement processes<br />

- Simple, predictable, transparent<br />

- Easy analysis <strong>and</strong> decision-making<br />

- Quick response<br />

➤ Clear exploration & depletion strategies<br />

• Resource management<br />

• Contract/licence management<br />

• Improved data availability<br />

➤ Indigenous R&D<br />

(T&T Ministry of Energy & Energy Industries has an R&D<br />

Fund in excess of TT$100 Million, that has not been used!)<br />

➤ Clear <strong>and</strong> consistently applied national priorities<br />

• Well defined expectations<br />

➤ Local Content & value addition<br />

• Access to product for value addition<br />

➤ Clear <strong>and</strong> transparent investor selection<br />

& partnering strategies<br />

➤ Rule of law<br />

Source: Association of Caribbean Energy Specialists Limited<br />

ensure it conducts its role in a transparent manner, must<br />

be fixed.<br />

With 100% excess power generating capacity fired by<br />

natural gas, the road to renewables is a policy minefield.<br />

Unless we are willing to think differently, make bold<br />

decisions <strong>and</strong> act decisively, we shall lose that battle. Ideas<br />

like selling electricity to industries in eastern Venezuela, or<br />

limiting CNG to just fleet vehicles <strong>and</strong> focusing instead on<br />

electric <strong>and</strong> hybrid vehicles for most other forms of private<br />

transport, should be explored.<br />

The way forward<br />

Implementation of the key measures in Figure 3 will<br />

ensure that Trinidad <strong>and</strong> Tobago’s oil <strong>and</strong> gas sector gets<br />

back onto a healthy growth path, <strong>and</strong> will provide the<br />

stimulus to diversifying the rest of the economy which we<br />

so desperately need.<br />

The Petrotrin situation brought the<br />

sector into the sharp glare of public<br />

scrutiny as nothing else has done for<br />

a long time<br />

Ongoing negotiations for contract extensions locally<br />

will allow government to leverage beneficiary clauses in<br />

existing agreements, such as the return of all assets to the<br />

state at the end of a contract’s life.<br />

We can also learn from Azerbaijan, where BP,<br />

ExxonMobil <strong>and</strong> partners recently paid US$3.2 billion<br />

into the Sovereign Wealth Fund in order to be allowed to<br />

continue exploiting producing fields.<br />

Service companies are required to be licensed <strong>and</strong><br />

registered, <strong>and</strong> to pay taxes in Trinidad <strong>and</strong> Tobago. That<br />

is not happening reliably, so billions of dollars in profits<br />

have been untaxed. We need a stronger rule of law which<br />

enforces these regulations more effectively.<br />

In Azerbaijan, BP, ExxonMobil <strong>and</strong><br />

partners recently paid US$3.2 billion<br />

into the Sovereign Wealth Fund, in<br />

order to be allowed to continue<br />

exploiting producing fields<br />

The Petrotrin situation brought the energy sector into the<br />

sharp glare of public scrutiny as nothing else has done for<br />

a long time. Decision-making without public consultation,<br />

when dealing with state assets, involves risk, if any lessons<br />

are to be learnt here.<br />

For further reading<br />

Oil to Gas <strong>and</strong> Beyond – A Review of the Trinidad <strong>and</strong> Tobago Model <strong>and</strong><br />

Analysis of Future Challenges. Editors Trevor M. Boopsingh <strong>and</strong> Gregory Mc-<br />

Guire. University Press of America, 2014. See Chapter 7 (“Future Hydrocarbon<br />

Resources”) <strong>and</strong> Chapter 13 (“Taking Trinidad & Tobago Forward & Abroad –<br />

The Technical Challenges”).<br />

12 MARCH 2019 CHAMBER.ORG.TT

KEVIN SAMMY

Blueprint for a Bold New Economy<br />

An inconvenient truth<br />

Trinidad <strong>and</strong> Tobago’s commodity-based economy is heavily<br />

reliant on global market prices, <strong>and</strong> continually caught in a<br />

cycle of boom <strong>and</strong> bust. What structural adjustment is needed<br />

to avoid future volatility?<br />

by Hayden Blades<br />

President, Business Insight Limited<br />

In Trinidad <strong>and</strong> Tobago, clarity regarding national objectives which define<br />

the way forward in a rapidly evolving global economic environment has all<br />

but escaped political <strong>and</strong> public discourse.<br />

Sensible macro-economic management in small open economies such as<br />

ours must achieve the following outcomes for long-term survival:<br />

• sustainable growth<br />

• general price stability<br />

• socially acceptable income distribution patterns<br />

• investor <strong>and</strong> consumer confidence.<br />

Trinidad <strong>and</strong> Tobago is a small,<br />

open, resource-rich economy with<br />

a narrow productive base<br />

The economy is subject to the extremes<br />

of a boom-bust-recovery-boom cycle<br />

In the absence of adequate economic<br />

growth, it is inevitable that unemployment<br />

will rise in Trinidad <strong>and</strong> Tobago<br />

Trinidad <strong>and</strong> Tobago is a small, open <strong>and</strong> resource-rich economy. Its narrow<br />

productive base is dominated by global market prices <strong>and</strong> the domestic output<br />

of its key export commodities – oil, gas <strong>and</strong> petrochemicals. This economic<br />

structure lacks diversification, <strong>and</strong> has fostered income, employment <strong>and</strong><br />

inflation patterns that are closely correlated with the global market prices of<br />

carbon-based commodities.<br />

The economy has suffered from generally declining output levels in its<br />

dominant energy sector, further exacerbating the volatility of key economic<br />

aggregates such as real GDP growth, international reserves, public debt <strong>and</strong><br />

sustainable employment levels. It is an economy subject to the extremes of a<br />

boom-bust-recovery-boom business cycle.<br />

Current economic assessment<br />

The inconvenient truth is that Trinidad <strong>and</strong> Tobago has not been proactive in<br />

structurally adjusting its energy-dependent economy to minimise volatility after<br />

more than 56 years of independence.<br />

Furthermore, the fiscal space does not easily accommodate necessary <strong>and</strong><br />

sufficient public sector investment. Technological, knowledge-based industries,<br />

<strong>and</strong> arts, culture <strong>and</strong> entertainment industries, which all represent drivers of<br />

youth employment, are still in their infancy.<br />

An economy lacking growth<br />

In the absence of adequate economic growth, it is inevitable that unemployment<br />

will rise in Trinidad <strong>and</strong> Tobago, <strong>and</strong> this will be exacerbated if such conditions<br />

are prolonged. A further complication is the absence of a strong growth impetus<br />

from the energy sector; based on current output <strong>and</strong> price trends it is not<br />

expected to provide the growth stimulus it did in the recent past.<br />

With Trinidad <strong>and</strong> Tobago’s growth rate expected to creep to 2.13% by 2021<br />

(see graphic), restoration of economic growth ought to be the most important<br />

14 MARCH 2019 CHAMBER.ORG.TT

Business Environment<br />

pillar of any future fiscal package, with the role of the non-energy sector taking<br />

on even greater importance in stabilising <strong>and</strong> growing the economy. Currently,<br />

government is intensely focused on recovery of output in the energy sector,<br />

with some success, though the volatility of global market prices will create a<br />

significant headwind in this regard.<br />

Trinidad <strong>and</strong> Tobago: Growth rate of real gross domestic product (GDP)<br />

from 2012-2022 (compared to the previous year)<br />

2.7%<br />

1.71%<br />

1% 0.88%<br />

1.56%<br />

2.13%<br />

1.24%<br />

2012 2022<br />

-1.75%<br />

-1.19%<br />

-2.6%<br />

-6.08%<br />

Source: ©Statista 2019 – The Statistics Portal<br />

The intensity of government’s focus on the recovery of the energy sector<br />

must be replicated across the non-energy sector. The creation of an enabling<br />

environment that facilitates new <strong>and</strong> sustainable growth within the non-energy<br />

sector is therefore critical if we are to avoid:<br />

• persistent fiscal deficits <strong>and</strong> rising public debt<br />

• persistent balance of payment deficits <strong>and</strong> a weakened TT dollar<br />

• increasing rates of unemployment<br />

• low investor <strong>and</strong> consumer confidence<br />

• an economy perpetually confined to zero to low growth outcomes<br />

• lost generations of young citizens.<br />

Trinidad <strong>and</strong> Tobago’s economy comprises four critical sectors: energy,<br />

services, manufacturing <strong>and</strong> agriculture. Of these, services <strong>and</strong> energy have<br />

been the major contributors to Gross Domestic Product (GDP).<br />

In 2008, Trinidad <strong>and</strong> Tobago had an estimated GDP (at constant 2000<br />

prices) of TT$93,024.5 million, with the services <strong>and</strong> energy sector accounting<br />

for 51% <strong>and</strong> 40.3% of GDP respectively. The manufacturing <strong>and</strong> agriculture<br />

sectors contributed 8.4% <strong>and</strong> 0.5% to GDP. Since then, the economy has<br />

contracted <strong>and</strong> there have been adverse changes to its GDP composition.<br />

The creation of an enabling<br />

environment that facilitates<br />

new <strong>and</strong> sustainable growth<br />

within the non-energy sector is<br />

therefore critical<br />

The way forward<br />

Our services sector is robust <strong>and</strong> diverse, with each sub-sector contributing<br />

significantly to GDP. Although labour-intensive <strong>and</strong> a small contributor, the<br />

agriculture sector possesses significant opportunities for new growth <strong>and</strong><br />

employment creation. Stimulating rapid agricultural growth will provide the<br />

opportunity to reduce our food import bill <strong>and</strong> create greater domestic price<br />

stability.<br />

Other sectors which hold prospects for new growth in new markets are<br />

manufacturing <strong>and</strong> tourism. However, the key to attaining sustainability, price<br />

stability, acceptable income distribution <strong>and</strong> market confidence will be the<br />

services sector, which can then support employment creation <strong>and</strong> growth in<br />

agriculture <strong>and</strong> manufacturing.<br />

CHAMBER.ORG.TT<br />

MARCH 2019 15

COURTESY FRANK MCKENNA / UNSPLASH.COM<br />

While agriculture, manufacturing <strong>and</strong> services can provide new<br />

platforms for economic growth <strong>and</strong> employment creation, this will<br />

require implementation of the appropriate policy framework<br />

FX-eating imports or FX-earning exports?<br />

Based on these characteristics, several national strategic<br />

issues come into focus:<br />

• What aspects of the services sector are exportable? How<br />

can these sub-sectors become more competitive, <strong>and</strong> do<br />

we have access to key markets, traditional <strong>and</strong> nontraditional?<br />

• How can the services sector be positioned to enhance<br />

growth in agriculture <strong>and</strong> manufacturing?<br />

• If sustainable job creation is predominantly located in<br />

the services sector, then what type of services <strong>and</strong> service<br />

providers should we develop?<br />

• Can we wean the exportable components of the services<br />

sector off state funding <strong>and</strong> thus create a cadre of competitive<br />

service providers who will strategically seek out<br />

export markets as part of well-crafted growth strategies?<br />

• Are we getting value for money from the services sector,<br />

both public <strong>and</strong> private, <strong>and</strong> is there a need to revisit<br />

the way in which we organise the production of services<br />

<strong>and</strong> manage service quality <strong>and</strong> consistency?<br />

Implementation deficit<br />

To avoid or minimise the implementation deficit, government<br />

must explicitly address these new sources of economic<br />

growth, even as we continue to diversify the energy sector<br />

<strong>and</strong> create higher value-added exports.<br />

This can be achieved through the establishment<br />

of tripartite sector working committees, supported by<br />

permanent secretaries. The output of these committees<br />

should be a list of short- <strong>and</strong> medium-term development<br />

strategies, to be adopted as government policy for execution<br />

by ministries.<br />

These working committees can include institutions such as:<br />

• the Caribbean Industrial Research Institute (CARIRI)<br />

• exportTT<br />

• business stakeholders such as Chambers of Commerce<br />

• Eximbank<br />

• the Bankers’ Association of Trinidad & Tobago<br />

• labour stakeholders<br />

• the tertiary sector<br />

• an industrial park operator<br />

• the Ministry of Trade <strong>and</strong> Industry.<br />

The creation of an enabling environment for growth<br />

<strong>and</strong> development of the non-energy sector ought to be<br />

prioritised as we seek to enhance competitiveness in<br />

traditional <strong>and</strong> non-traditional export markets. This<br />

enabling environment should address:<br />

• development of appropriate labour force skills<br />

• provision of funding for business growth <strong>and</strong><br />

development (predominantly exportable sectors)<br />

• enhancing critical infrastructure<br />

• provision of key business support services.<br />

While agriculture, manufacturing <strong>and</strong> services<br />

can provide new platforms for economic growth <strong>and</strong><br />

employment creation, this will require implementation<br />

of the appropriate policy framework <strong>and</strong> a commitment<br />

to enhancing compet-iveness, both on a national level<br />

<strong>and</strong> at the level of the individual firm.<br />

16 MARCH 2019 CHAMBER.ORG.TT

Services<br />

COURTESY CHRISTINA MORELLO / PEXELS.COM<br />

18 MARCH 2019 CHAMBER.ORG.TT

Services<br />

Selling<br />

our services<br />

The services sector is turning in a strong performance, but is yet<br />

to become a viable exporter. A national exporters’ services registry<br />

<strong>and</strong> export training are just two of the initiatives TTCSI will launch<br />

in 2019 to help grow the services economy<br />

by Vashti G. Guyadeen<br />

General Manager,<br />

Trinidad <strong>and</strong> Tobago Coalition of Services Industries<br />

This year’s World Economic Forum held in Switzerl<strong>and</strong> in January focused<br />

on the “Industrial Revolution 4.0”. This refers to the significant role that<br />

automation <strong>and</strong> data analytics play in transforming manufacturing<br />

processes.<br />

IR 4.0 has not only impacted manufacturing. According to Professor<br />

Klaus Schwab, Executive Chairman of the World Economic Forum, “the Fourth<br />

Industrial Revolution, <strong>final</strong>ly, will change not only what we do but also who<br />

we are.<br />

“It will affect our identity <strong>and</strong> all the issues associated with it: our sense<br />

of privacy, our notions of ownership, our consumption patterns, the time we<br />

devote to work <strong>and</strong> leisure, <strong>and</strong> how we develop our careers, cultivate our skills,<br />

meet people, <strong>and</strong> nurture relationships.”<br />

Without a doubt, IR 4.0 will also impact the services sector. The question<br />

is, how prepared are Trinidad <strong>and</strong> Tobago services providers <strong>and</strong> industries for<br />

these changes?<br />

But despite the services sector showing<br />

a strong performance locally, it is yet to<br />

become a viable foreign exchange earner:<br />

its export performance has been poor compared<br />

with manufacturing <strong>and</strong> energy<br />

Strong local performance<br />

In Trinidad <strong>and</strong> Tobago, services’ contribution to GDP in 2017 was estimated<br />

at 50.8%, while agriculture <strong>and</strong> industry stood at 0.4% <strong>and</strong> 48.8% respectively<br />

(TTCSI, 2016). The services sector, unlike the hydrocarbon sector, has<br />

experienced significant growth despite external shocks attributed to the recent<br />

fall in global oil prices.<br />

But despite a strong performance locally, the sector is yet to become a<br />

viable foreign exchange earner: its export performance has been poor compared<br />

with manufacturing <strong>and</strong> energy. While the sector has been earmarked to fasttrack<br />

national diversification, it falls short in its ability to increase its trade <strong>and</strong><br />

earning power – a situation reflected in Trinidad <strong>and</strong> Tobago’s negative trade<br />

balance (exports minus imports) in international trade in services.<br />

For the period 2011 to 2016, there was a reported negative trade balance<br />

in regard to international trade in services, with services accounting for only<br />

28% of exports in 2011 (TTCSI, 2016). Clearly there are great opportunities to<br />

accelerate growth in the services sector.<br />

CHAMBER.ORG.TT<br />

MARCH 2019 19

Blueprint for a Bold New Economy<br />

We have a comparative advantage in<br />

several sub-sectors including education<br />

services; cultural <strong>and</strong> creative services;<br />

professional services; <strong>and</strong> health services<br />

Net importer of services<br />

The European Union, in an assessment of the Economic Partnership Agreement<br />

(EPA) with Cariforum, noted that international trade in services has assumed<br />

a significant dimension in the sustainable development <strong>and</strong> economic growth<br />

strategies of Cariforum states, <strong>and</strong> commitments in external trade arrangements<br />

are critical in advancing the region’s prospects.<br />

The data in Table 1 show that Trinidad <strong>and</strong> Tobago is a net importer of<br />

services. However, in relative terms we are also a key exporter of services<br />

compared with other Cariforum states.<br />

Trinidad <strong>and</strong> Tobago’s primary services exports are travel, transport <strong>and</strong><br />

commercial services. We also have a comparative advantage in several subsectors<br />

including education services; cultural <strong>and</strong> creative services; professional<br />

services; <strong>and</strong> health services. It is imperative that support systems <strong>and</strong> the<br />

enabling environment are developed to foster growth in these sectors<br />

Table 1: Cariforum states – value of services exports <strong>and</strong> imports, 2016-2017<br />

Country Value of services exports (million US$) Value of services imports (million US$)<br />

Barbados (2016) 1,483 743<br />

Dominican Republic (2017) 8,476 3,354<br />

Guyana (2017) 134 453<br />

Jamaica (2017) 3,432 2,242<br />

Suriname (2017) 145 516<br />

Trinidad <strong>and</strong> Tobago (2017) 1,076 2,500<br />

The key ingredient in “going global” is<br />

ensuring that service providers <strong>and</strong><br />

industries meet global st<strong>and</strong>ards <strong>and</strong><br />

certification<br />

Source: World Trade Organisation<br />

Championing the services sector<br />

The Trinidad <strong>and</strong> Tobago Coalition of Services Industries (TTCSI) will embark<br />

on a number of initiatives in 2019 to propel growth in the services economy.<br />

Foremost on the agenda is data analytics. One of the key projects we have<br />

undertaken, with the support of the Ministry of Trade <strong>and</strong> Industry, is the<br />

development of a national exporters’ services registry. This will be invaluable in<br />

measuring the sector <strong>and</strong> giving government <strong>and</strong> the TTCSI better information,<br />

in order to provide knowledge-driven products which stimulate growth.<br />

Secondly, the TTCSI will execute a robust training schedule this year,<br />

including rollout of the Services Go Global (SGG) training programme. SGG<br />

was developed by Caribbean Export over eight years ago specifically to optimise<br />

the Cariforum region’s export of services. It aimed to develop the capacity of<br />

service providers <strong>and</strong> industries to capitalise on opportunities under the EPA,<br />

with a focus on export readiness.<br />

Participants will be guided through a four-stage road map showing how<br />

to propel their businesses onto the international stage. The TTCSI is the only<br />

certified agency locally to offer this training. SGG will be conducted in four<br />

sector clusters – creative <strong>and</strong> cultural industries including animation; tourism;<br />

health <strong>and</strong> wellness; <strong>and</strong> energy services.<br />

The key ingredient in “going global” is ensuring that service providers<br />

<strong>and</strong> industries meet global st<strong>and</strong>ards <strong>and</strong> certification. This issue is also being<br />

tackled by the TTCSI, <strong>and</strong> plans are in train to collaborate with the relevant<br />

agencies to ensure that our member associations <strong>and</strong> their members are<br />

equipped to trade regionally <strong>and</strong> globally.<br />

20 MARCH 2019 CHAMBER.ORG.TT

Tourism<br />

Where are<br />

all the tourists?<br />

Travel <strong>and</strong> tourism contribute less than 10% to Trinidad <strong>and</strong> Tobago’s GDP.<br />

There were high expectations with the possibility of S<strong>and</strong>als adding its<br />

br<strong>and</strong> to the sector. But why do we need a big name?<br />

by John Bell<br />

Past Director General <strong>and</strong> CEO, Caribbean Hotel Association<br />

<strong>and</strong> past President, International Hotel <strong>and</strong> Restaurant Association<br />

LIDIAN NEELEMAN / SHUTTERSTOCK.COM<br />

The best way to assess whether tourism has any real chance of success in<br />

Trinidad <strong>and</strong> Tobago is to determine the condition of the industry today<br />

in both isl<strong>and</strong>s. With that as a basis we can then project into the future.<br />

There can be little doubt that tourism is presently not much more than a<br />

basket case in Tobago, or that we have two quite separate isl<strong>and</strong> destinations<br />

to address.<br />

Current state of tourism<br />

Are we presently in any position to consider tourism as a viable financial<br />

opportunity? Let’s begin with Tobago.<br />

• Arrivals in Tobago in 2005 were slightly over 90,000. Today they are well<br />

under 20,000<br />

• As a consequence of this precipitous collapse in traffic there has been<br />

a decline in maintenance of the hotel stock, which has deteriorated<br />

significantly<br />

• In 2018 the efficiency <strong>and</strong> effectiveness of the seabridge has been<br />

disastrous<br />

• Airlift into Tobago out of the USA is virtually non-existent<br />

• The condition of the ANR Robinson International Airport at Crown Point<br />

is reminiscent of the mid-20th century in the Windward Isl<strong>and</strong>s.<br />

CHAMBER.ORG.TT<br />

MARCH 2019 23

CHRIS ANDERSON

Tourism<br />

Now let’s review Trinidad:<br />

• With meetings <strong>and</strong> conventions growing in Port of<br />

Spain, there is a real prospect that conference tourism<br />

can be further developed<br />

• Adventure tourism is evolving slowly, but sadly with<br />

limited support thus far from Tourism Trinidad Limited<br />

• Sports tourism is also evolving slowly as a result of<br />

the government’s stadium construction programme<br />

• Golf in Trinidad remains dormant<br />

• Apart from carnival, cultural tourism remains<br />

undeveloped<br />

• Despite their obvious value, <strong>and</strong> access to several<br />

suitable bodies of water, watersports activity is sadly<br />

depressed.<br />

Restructuring the sector<br />

In short, it seems there has been little or no planned<br />

development in tourism on either isl<strong>and</strong>, leaving the<br />

nature of the industry speculative at best. But this should<br />

not deter us from thinking big about where tourism can<br />

<strong>and</strong> should go.<br />

Last year there was a welcome reorganisation of the<br />

government’s administration of the tourism sector. After<br />

several years of mismanagement, the Tourism Development<br />

Company Limited (TDC) was closed down <strong>and</strong> replaced<br />

by Tobago Tourism Agency Limited <strong>and</strong> Tourism Trinidad<br />

Limited.<br />

In Tobago at least, there was recognition that the private<br />

sector was a major player in the game, with several<br />

key appointments being made to the agency’s board.<br />

In short it seems there has been little<br />

or no planned development in tourism<br />

on either isl<strong>and</strong>, leaving the nature of<br />

the industry speculative at best<br />

The S<strong>and</strong>als saga<br />

So what are the prospects for the future?<br />

A great deal seemed to depend on S<strong>and</strong>als, which<br />

presented an exciting prospect for launching Tobago into<br />

the “real” Caribbean tourism world.<br />

There is no doubt that tourism, particularly in the<br />

northern Caribbean, has evolved separately into something<br />

quite different from what we know in Trinidad <strong>and</strong> Tobago.<br />

Tobago has long been a success story waiting to<br />

happen. The isl<strong>and</strong> is scenically beautiful. It has magnificent<br />

beaches <strong>and</strong> a splendid reef. Previous attempts<br />

at tourism development have resulted in two golf courses.<br />

The real problem is the airport at Crown Point, which is<br />

hopelessly inadequate.<br />

Which brings us back to the contentious issue of<br />

S<strong>and</strong>als.<br />

A great deal seemed to depend on<br />

S<strong>and</strong>als, which presented an exciting<br />

prospect for launching Tobago into<br />

the “real” Caribbean tourism world<br />

Benefits of a big br<strong>and</strong><br />

The benefit of a 900-room state-of-the-art resort opening<br />

in Tobago appeared to be enormous. S<strong>and</strong>als offered a<br />

valuable grown-up couples experience, while its twin<br />

sister, Beaches, promised a <strong>full</strong>-blown family programme.<br />

It seemed that Tobago might at last acquire a property<br />

of the kind that Jamaica, Dominican Republic <strong>and</strong> The<br />

Bahamas have long hosted.<br />

And that was only the beginning. The overriding<br />

value that S<strong>and</strong>als would have been able to provide was<br />

airlift access out of the United States.<br />

S<strong>and</strong>als had the potential to attract American Airlines<br />

to Tobago out of its Miami hub. JetBlue would have been<br />

able to provide access from New York <strong>and</strong> the tri-state<br />

area. United Airlines might also have been attracted to<br />

serve Tobago out of Washington DC, Newark, or Houston.<br />

But the United States, with all its up-market worth<br />

<strong>and</strong> two or even three new gateways, remains completely<br />

closed to Tobago.<br />

The projects <strong>and</strong> developments cited<br />

above are still very much needed to<br />

establish our tourism offering on the<br />

global stage. With the right marketing<br />

strategy, infrastructure <strong>and</strong> political<br />

will, accomplishing all of them is still<br />

entirely possible<br />

The government was prepared to provide S<strong>and</strong>als with<br />

a location at Golden Grove, <strong>and</strong> the valuable asset that<br />

goes with that. So there was a very real expectation that<br />

the S<strong>and</strong>als development would set off a chain reaction,<br />

stimulating development in the rest of Tobago. The ANR<br />

Robinson International Airport at Crown Point would have<br />

become a real international port of entry.<br />

However, S<strong>and</strong>als pulled out of the Tobago deal.<br />

But all is not lost. The projects <strong>and</strong> developments cited<br />

above are still very much needed to establish Trinidad <strong>and</strong><br />

Tobago’s tourism offering on the global stage. With the<br />

right marketing strategy, infrastructure, <strong>and</strong> political will,<br />

accomplishing all of them is still entirely possible.<br />

CHAMBER.ORG.TT<br />

MARCH 2019 25

Blueprint for a Bold New Economy<br />

Manufacturing the future<br />

An improved trading environment is needed to<br />

create a sustainable resilient manufacturing sector.<br />

Tackling bureaucratic challenges, illicit trade <strong>and</strong><br />

an uncertain industrial relations climate are high<br />

on the TTMA’s agenda<br />

by The Trinidad <strong>and</strong> Tobago<br />

Manufacturers’ Association<br />

It is no secret that business conditions in the Trinidad<br />

<strong>and</strong> Tobago economy are less than ideal. The Central<br />

Bank reported in its last monetary policy announcement<br />

(December 2018) that “primary economic indicators are<br />

all down as growth has slackened <strong>and</strong> inflation remains<br />

sluggish because of weak domestic dem<strong>and</strong>”.<br />

The manufacturing sector provides<br />

the necessary foundation for an<br />

economically, socially <strong>and</strong> environmentally<br />

sustainable society<br />

In an environment with slow economic growth, the<br />

Trinidad <strong>and</strong> Tobago Manufacturers’ Association<br />

(TTMA) believes there is an urgent need to explore new<br />

opportunities in the manufacturing sector, which has the<br />

potential to contribute to positive economic growth <strong>and</strong><br />

development.<br />

The manufacturing sector goes far beyond the<br />

employees, companies <strong>and</strong> investors directly involved<br />

in industry. It affects everyone. Defined by the TTMA as<br />

including all the non-energy sub-sectors, it provides the<br />

necessary foundation for an economically, socially <strong>and</strong><br />

environmentally sustainable society. Manufacturing also<br />

drives technological innovation – the key to research<br />

<strong>and</strong> development – <strong>and</strong> the creation of new products <strong>and</strong><br />

manufacturing processes.<br />

While the sector is critical to the local economy, it<br />

faces many challenges, one of which is operating in a<br />

dual economy that relies heavily on oil <strong>and</strong> gas revenues.<br />

The inability of the manufacturing sector’s contribution to<br />

Trinidad <strong>and</strong> Tobago’s GDP, to move beyond 9% for the<br />

past ten years indicates stagnation. This is the result of<br />

several factors, including poor policy infrastructure <strong>and</strong><br />

too many bureaucratic procedures that cause delays or<br />

bottlenecks.<br />

Bureaucratic agencies <strong>and</strong> procedures<br />

Manufacturers are critical of the regulatory bodies<br />

that support the trading environment, because of their<br />

recurring inability to function efficiently <strong>and</strong> effectively.<br />

A number of agencies play key roles in fostering an<br />

enabling environment, but they are plagued by a lack<br />

of human <strong>and</strong> financial resources, <strong>and</strong> lack of access to<br />

technological advances, which can result in delays in<br />

trading both locally <strong>and</strong> internationally.<br />

Another concern of local producers is the growth<br />

of illicit trade, which has a negative impact on local<br />

manufacturing. Every year, more goods <strong>and</strong> br<strong>and</strong>s are<br />

affected, from consumer products – including electronics,<br />

apparel <strong>and</strong> alcoholic beverages – to vehicle lubricants<br />

<strong>and</strong> auto parts. This undermines legitimate manufacturers,<br />

as illicit goods are cheaper on the local market. Most of the<br />

illicit traders do not pay the correct duties, <strong>and</strong> if goods<br />

are smuggled in, they do not pay any duties at all. In some<br />

instances goods do not meet national st<strong>and</strong>ards, <strong>and</strong> in<br />

others they do not even have free sale certificates in their<br />

countries of origin.<br />

Agencies are plagued by the lack of<br />

human <strong>and</strong> financial resources, <strong>and</strong> lack<br />

of access to technological advances,<br />

which can result in delays in<br />

trading both locally <strong>and</strong> internationally<br />

Improving industrial relations<br />

According to local producers, labour force issues are also<br />

affecting the manufacturing sector. For example, when<br />

job openings are not filled <strong>and</strong> the work force lacks the<br />

skill sets that the market needs, manufacturers cannot<br />

maintain or increase production levels to satisfy customer<br />

dem<strong>and</strong>. The fragile industrial climate of Trinidad <strong>and</strong><br />

Tobago along with the uncertain relations between<br />

employers <strong>and</strong> employees, has had a negative impact on<br />

the manufacturing sector <strong>and</strong> the overall economy.<br />

Additionally, local companies face considerable<br />

barriers to trade when exporting. The lack of market<br />

intelligence, lengthy registration procedures, <strong>and</strong> onerous<br />

labelling requirements, are some of the major concerns for<br />

firms which aim to become net foreign exchange earners<br />

<strong>and</strong> <strong>full</strong>y contribute to the local economy.<br />

26 MARCH 2019 CHAMBER.ORG.TT

1968 / SHUTTERSTOCK.COM<br />

Resilient manufacturing<br />

In spite of these challenges, there are real opportunities<br />

in the manufacturing sector. The food <strong>and</strong> beverage<br />

sub-sector, for example, is dynamic <strong>and</strong> innovative. In<br />

2018, a 5.6% increase in food, beverage <strong>and</strong> tobacco production<br />

demonstrated its continued growth. There are also<br />

opportunities in chemicals, printing <strong>and</strong> packaging, <strong>and</strong><br />

construction.<br />

In order for these opportunities to advance, however,<br />

a resilient, sustainable manufacturing environment needs<br />

to be developed. Certain strategic initiatives are required:<br />

• a globally competitive regulatory framework<br />

• improved performance by government processes<br />

• a supportive international trade position.<br />

A resilient, sustainable manufacturing<br />

environment needs to be developed<br />

The bottom line<br />

Every economic sector faces challenges, <strong>and</strong> the<br />

manufacturing sector is no exception. The TTMA<br />

believes that the way in which the challenges of the<br />

manufacturing sector are addressed holds the key to<br />

progress. The above recommendations can go a long<br />

way in building a future sustainable economy <strong>and</strong> contributing<br />

to economic growth.<br />

Other key prerequisites for success include:<br />

• the development of a science, technology<br />

<strong>and</strong> innovation policy which promotes local<br />

manufacturing<br />

• promotion of innovative/technological<br />

entrepreneurship<br />

• adoption of an education <strong>and</strong> workforce policy<br />

that develops superior talent<br />

• furtherance of economic diversification strategies<br />

• more collaboration between manufacturers <strong>and</strong><br />

universities.<br />

CHAMBER.ORG.TT MARCH 2019 27

COURTESY THE LUSH KINGDOM

Creativity<br />

Empowering<br />

our artists<br />

The creative sector was identified by Trinidad<br />

<strong>and</strong> Tobago as a priority sector for growth in<br />

2011. What has it achieved since then, <strong>and</strong> how<br />

far does it still have to go to become a viable<br />

contributor to GDP?<br />

by Keith Nurse<br />

Senior Fellow <strong>and</strong> WTO Chair<br />

Sir Arthur Lewis Institute of Social <strong>and</strong> Economic Studies,<br />

The University of the West Indies<br />

Alicia Shepherd<br />

Sir Arthur Lewis Institute of Social <strong>and</strong> Economic Studies,<br />

The University of the West Indies<br />

The Caribbean region is by no means short of globally recognisable artists;<br />

<strong>and</strong> for decades now Trinidad <strong>and</strong> Tobago has stood out as one of the<br />

region’s major artistic sources, with the likes of Michel-Jean Cazabon, Sir<br />

Vidia S Naipaul, Sparrow, Geoffrey Holder, Boscoe Holder, Billy Ocean, Peter<br />

Minshall, Heather Headley, Nicki Minaj, Meiling, Bunji Garlin, <strong>and</strong> Machel<br />

Montano.<br />

These artists have generated global reach beyond what the country’s<br />

size would suggest. And in recent times, new digital, mobile <strong>and</strong> internet<br />

technologies have offered creatives alternative business models <strong>and</strong> markets,<br />

creating the space for new areas of employment such as animation <strong>and</strong> gaming.<br />

In recognition of the industries’ vast<br />

potential, Caribbean governments have<br />

recently begun to carve out strategic<br />

pathways to develop the industries with<br />

the aim of diversifying their economies<br />

Growth of the sector<br />

By way of contributions to GDP, exports, employment <strong>and</strong> intellectual property<br />

earnings, the cultural/creative industries, even amidst global economic setbacks,<br />

continue to outperform most other sectors in Caribbean economies. In t<strong>and</strong>em<br />

with other key stakeholders, <strong>and</strong> in recognition of the industries’ vast potential,<br />

Caribbean governments have recently begun to carve out strategic pathways to<br />

develop the industries with the aim of diversifying their economies.<br />

The government of Trinidad <strong>and</strong> Tobago, for example, in 2010 highlighted<br />

the creative industries as growth poles in its quest for “consensus building,<br />

advanced social <strong>and</strong> economic prosperity <strong>and</strong> sustainability, <strong>and</strong> successful<br />

diversification” (GORTT 2011).<br />

Capturing carnival’s contribution<br />

The country’s carnival activities, for instance, generate on average about 12%<br />

of arrivals <strong>and</strong> visitor expenditures on an annual basis, a spectacular return<br />

on investment considering its official events span a three-week period. Its<br />

impact on other sectors such as media, retail, food <strong>and</strong> beverage, <strong>and</strong> ground<br />

Striking design from the Lush<br />

Kingdom fashion label<br />

CHAMBER.ORG.TT<br />

MARCH 2019 29

Blueprint for a Bold New Economy<br />

transport are also quite significant. In 2017, the estimated<br />

total visitor expenditure was measured at US$50 million.<br />

The country’s carnival activities, for<br />

instance, generate on average about 12%<br />

of arrivals <strong>and</strong> visitor expenditures on an<br />

annual basis<br />

It can be argued that through their synergistic relationships<br />

with other sectors in the local economy, the creative<br />

industries rank among the top revenue earners in Trinidad<br />

<strong>and</strong> Tobago. In 2006, the music industry was reported as<br />

having earned US$28.2 million <strong>and</strong> employed some 5,500<br />

people. In film, between 2007 <strong>and</strong> 2016, foreign filming<br />

on the isl<strong>and</strong> contributed some TT$37 million.<br />

Trade flows<br />

According to the Minister of Planning <strong>and</strong> Development,<br />

Camille Robinson-Regis, the internet technology sector,<br />

which has significant influence in the creative industries,<br />

has the potential to surpass its present contribution to GDP<br />

of TT$5.5 billion (CreativeTT, Trinidad Guardian 2018).<br />

Invariably, the spend in these <strong>and</strong> other creative industries<br />

doesn’t capture the synergistic impact of intellectual<br />

property br<strong>and</strong>ing <strong>and</strong> destination br<strong>and</strong>ing.<br />

On closer examination of trade flows, however,<br />

Trinidad <strong>and</strong> Tobago is found to have a substantial <strong>and</strong><br />

widening trade deficit in cultural goods. We import more<br />

than we export. Trade in services (e.g. live performances,<br />

tours, concerts, designers’ fees etc.) <strong>and</strong> earnings from<br />

cultural, heritage <strong>and</strong> festival tourism are the significant<br />

sources of export earnings; but unfortunately these are<br />

the areas where there is limited reporting <strong>and</strong> data capture,<br />

<strong>and</strong> so the sector is not adequately represented in national<br />

accounts. Other challenges to business development<br />

include the lack of access to fintech services <strong>and</strong> capital<br />

from the local financial sector.<br />

On closer examination of trade flows,<br />

however, Trinidad <strong>and</strong> Tobago is found to<br />

have a substantial <strong>and</strong> widening trade<br />

deficit in cultural goods<br />

Going forward, there is need for governmental<br />

agencies to monitor <strong>and</strong> evaluate<br />

existing policies <strong>and</strong> support mechanisms,<br />

<strong>and</strong> to allocate greater capital investment<br />

There has also been growth in the festivals sector (e.g.<br />

the Bocas Literary Festival, the Trinidad <strong>and</strong> Tobago Film<br />

Festival, Animae Caribe) <strong>and</strong> in the export expansion of<br />

some sectors, particularly mas (carnival), fashion, music,<br />

animation <strong>and</strong> film.<br />

Export facilitation by way of entities such as<br />

CreativeTT, exporTT, TTBizLink, the drafting of a<br />

national cultural policy, <strong>and</strong> the Cariforum-EU Economic<br />

Partnership Agreement (EPA) also create valuable space<br />

for industry expansion.<br />

Outlook<br />

Going forward, there is need for governmental agencies<br />

to monitor <strong>and</strong> evaluate existing policies <strong>and</strong> support<br />

mechanisms, allocate greater capital investment, <strong>and</strong><br />

provide adequate <strong>and</strong> appropriate training programmes<br />

for both business start-up <strong>and</strong> business expansion.<br />

Another critical area is financial sector reform to<br />

reflect the needs of this industry. Such approaches would<br />

require the collaboration of key stakeholders, the mapping<br />

of sectoral performance, digital innovation, <strong>and</strong> the<br />

adoption of a managerial culture that prioritises improved<br />

quality <strong>and</strong> global competitiveness.<br />

References<br />

“Businesses get $3.2 million for innovation”. Trinidad Guardian, May 4, 2018.<br />

Accessed August 30, 2018. http://www/guardian.co.tt/business/2018-04-15/<br />

businesses-get-32m-innovation<br />

CreativeTT, accessed January 1, 2018. http://www.musictt.co.tt/ <strong>and</strong> http://<br />

www.filmtt.co.tt/<br />

Government of the Republic of Trinidad <strong>and</strong> Tobago, Ministry of Planning<br />

<strong>and</strong> the Economy, Mid-Term Policy Framework 2011-2014, Innovation for<br />

Lasting Prosperity. Accessed November 21, 2018. http://www.finance.gov.tt/<br />

wp-content/uploads2013/11/medium-Term-Policy-Framework-2011-14.pdf<br />

Recommendations <strong>and</strong> next steps<br />

Nonetheless, strategies followed in previous years have<br />

yielded positive outcomes.<br />

The Copyright Music Organisation of Trinidad <strong>and</strong><br />

Tobago (COTT), for example, has been critical in areas of<br />

revenue generation by securing royalty income for authors<br />

<strong>and</strong> composers, <strong>and</strong> in the deepening of the institutional<br />

structure of the sector. As the global cultural economy is<br />

further aligned with digital trade, the role of COTT <strong>and</strong><br />

digital aggregators will become even more important.<br />

30 MARCH 2019 CHAMBER.ORG.TT

Creativity<br />

CHAMBER.ORG.TT<br />

MARCH 2019 31

MARCI PARAVIA/SHUTTERSTOCK.COM<br />

32 MARCH 2019 CHAMBER.ORG.TT

Agriculture <strong>and</strong> Food Security<br />

Towards a renaissance<br />

of agriculture<br />

If there is one good thing to come from climate change, it will be a<br />

radical rethink of agriculture <strong>and</strong> agro-processing <strong>and</strong> a shift towards<br />

a “climate-smart” industry<br />

by Steve Maximay<br />

Managing Director, Science-Based Initiatives<br />

You could be forgiven for for thinking you have heard this talk about<br />

diversification before. Successive, but by no means successful,<br />

governments have touted diversification efforts, which included<br />

agriculture as part of a magical restructuring of the Trinidad <strong>and</strong> Tobago<br />

economy.<br />

Early efforts were concentrated on producing more food to offset the<br />

ever-increasing import bill <strong>and</strong> to bolster exports. Prior to the volatile food<br />

price crisis of 2008-2009, the Trinidad <strong>and</strong> Tobago government’s idea of food<br />

security revolved around “months of cover”, where the amount of foreign<br />

exchange held in the Central Bank was divided by the monthly food import<br />

bill to determine how many months of imports were achievable.<br />

Once worldwide food prices <strong>and</strong> food availability returned to less<br />

cataclysmic levels by 2010, the prioritising of substantial local production<br />

became less important.<br />

A review of agricultural trade statistics, local production data, pronouncements<br />

by officials, <strong>and</strong> the heralded benefits of diversification, is<br />

insufficient to explain the lack of success to date. It will take more than an<br />

urgent need, worthwhile individual efforts, fledgling agro-industrial enterprises,<br />

<strong>and</strong> a declining oil <strong>and</strong> gas sector to propel agriculture to equitable stature<br />

within the local economy.<br />

At the core of diversification is change, which is dependent on the<br />

production of a “positive vision of the future”, which in turn evolves when<br />

dissatisfaction with the status quo exceeds the natural human resistance to<br />

change. It is safe to conclude that, notwithst<strong>and</strong>ing the work of the Vision<br />

2020 agriculture sub-committee <strong>and</strong> other attempts at articulating a vision of<br />

a modern agricultural sector, the outlook is still less than positive.<br />

Notwithst<strong>and</strong>ing the work of the Vision<br />

2020 agriculture sub-committee <strong>and</strong><br />

other attempts at articulating a vision of<br />

a modern agricultural sector, the outlook<br />

is less than positive<br />

Climate-smart agriculture<br />

Previous attempts at diversification were ostensibly driven by economic<br />