Annual Report of Euram Bank Vienna 2018

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

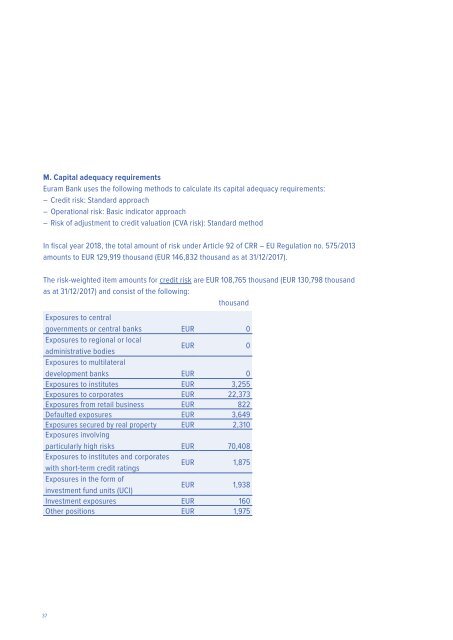

M. Capital adequacy requirements<br />

<strong>Euram</strong> <strong>Bank</strong> uses the following methods to calculate its capital adequacy requirements:<br />

– Credit risk: Standard approach<br />

– Operational risk: Basic indicator approach<br />

– Risk <strong>of</strong> adjustment to credit valuation (CVA risk): Standard method<br />

In fiscal year <strong>2018</strong>, the total amount <strong>of</strong> risk under Article 92 <strong>of</strong> CRR – EU Regulation no. 575/2013<br />

amounts to EUR 129,919 thousand (EUR 146,832 thousand as at 31/12/2017).<br />

The risk-weighted item amounts for credit risk are EUR 108,765 thousand (EUR 130,798 thousand<br />

as at 31/12/2017) and consist <strong>of</strong> the following:<br />

thousand<br />

Exposures to central<br />

governments or central banks EUR 0<br />

Exposures to regional or local<br />

administrative bodies<br />

EUR 0<br />

Exposures to multilateral<br />

development banks EUR 0<br />

Exposures to institutes EUR 3,255<br />

Exposures to corporates EUR 22,373<br />

Exposures from retail business EUR 822<br />

Defaulted exposures EUR 3,649<br />

Exposures secured by real property EUR 2,310<br />

Exposures involving<br />

particularly high risks EUR 70,408<br />

Exposures to institutes and corporates<br />

with short-term credit ratings<br />

EUR 1,875<br />

Exposures in the form <strong>of</strong><br />

investment fund units (UCI)<br />

EUR 1,938<br />

Investment exposures EUR 160<br />

Other positions EUR 1,975<br />

37