The Regional Review-News from the AFHU Northeast Region

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

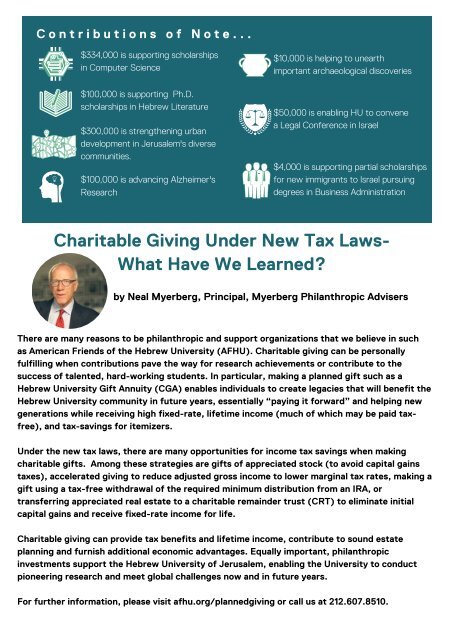

C o n t r i b u t i o n s o f N o t e . . .<br />

$334,000 is supporting scholarships<br />

in Computer Science<br />

$100,000 is supporting Ph.D.<br />

scholarships in Hebrew Literature<br />

$300,000 is streng<strong>the</strong>ning urban<br />

development in Jerusalem's diverse<br />

communities.<br />

$100,000 is advancing Alzheimer's<br />

Research<br />

$10,000 is helping to unearth<br />

important archaeological discoveries<br />

$50,000 is enabling HU to convene<br />

a Legal Conference in Israel<br />

$4,000 is supporting partial scholarships<br />

for new immigrants to Israel pursuing<br />

degrees in Business Administration<br />

Charitable Giving Under New Tax Laws-<br />

What Have We Learned?<br />

by Neal Myerberg, Principal, Myerberg Philanthropic Advisers<br />

<strong>The</strong>re are many reasons to be philanthropic and support organizations that we believe in such<br />

as American Friends of <strong>the</strong> Hebrew University (<strong>AFHU</strong>). Charitable giving can be personally<br />

fulfilling when contributions pave <strong>the</strong> way for research achievements or contribute to <strong>the</strong><br />

success of talented, hard-working students. In particular, making a planned gift such as a<br />

Hebrew University Gift Annuity (CGA) enables individuals to create legacies that will benefit <strong>the</strong><br />

Hebrew University community in future years, essentially “paying it forward” and helping new<br />

generations while receiving high fixed-rate, lifetime income (much of which may be paid taxfree),<br />

and tax-savings for itemizers.<br />

Under <strong>the</strong> new tax laws, <strong>the</strong>re are many opportunities for income tax savings when making<br />

charitable gifts. Among <strong>the</strong>se strategies are gifts of appreciated stock (to avoid capital gains<br />

taxes), accelerated giving to reduce adjusted gross income to lower marginal tax rates, making a<br />

gift using a tax-free withdrawal of <strong>the</strong> required minimum distribution <strong>from</strong> an IRA, or<br />

transferring appreciated real estate to a charitable remainder trust (CRT) to eliminate initial<br />

capital gains and receive fixed-rate income for life.<br />

Charitable giving can provide tax benefits and lifetime income, contribute to sound estate<br />

planning and furnish additional economic advantages. Equally important, philanthropic<br />

investments support <strong>the</strong> Hebrew University of Jerusalem, enabling <strong>the</strong> University to conduct<br />

pioneering research and meet global challenges now and in future years.<br />

For fur<strong>the</strong>r information, please visit afhu.org/plannedgiving or call us at 212.607.8510.