Jeweller - September 2020

Best of the bench: Show-stopping pieces from local jewellers Star power: Assessing the value of celebrities and ambassadors in brand marketing Amazon effect: How small businesses can learn from online mega-retailers

Best of the bench: Show-stopping pieces from local jewellers

Star power: Assessing the value of celebrities and ambassadors in brand marketing

Amazon effect: How small businesses can learn from online mega-retailers

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Best of Business | RETAIL FEATURE<br />

technology, shutting Walmart out for<br />

months.<br />

Like something out of a sci-fi movie, this is<br />

a battle fought between retail Goliaths in<br />

cyberspace and the importance cannot be<br />

overstated for traditional retailers.<br />

Amazon’s mastery of the complex, behindthe-scenes<br />

technologies that power<br />

modern e-commerce is vitally important<br />

to its success.<br />

exterity with bots allows Amazon to not<br />

only see what rivals are doing but also<br />

keep those rivals in the dark when Amazon<br />

undercuts them on price or quietly goes on<br />

to charge more.<br />

Pricing bots are just one example of the<br />

integrated ecosystem of technology and<br />

systems that Amazon and Walmart have in<br />

their omnichannel arsenal.<br />

Smaller retailers simply do not have<br />

the resources to recreate this strategic<br />

infrastructure.<br />

Applying AI effectively<br />

If a retailer does not know the acronym<br />

IFTTT then they are falling behind in digital<br />

retailing. IFTTT stands for “If this then that”<br />

and it is AI applied at the simplest level to<br />

automate choices and actions.<br />

IFTTTs can create algorithms that enable<br />

consumers to make a purchase based<br />

on a predefined set of criteria, like price<br />

point, quantity left in stock, or even the<br />

weather conditions.<br />

Amazon deploys a host of IFTTTs online<br />

and engages customers through its<br />

dashboard buttons.<br />

Of course, Amazon is not the only retailer<br />

deploying IFTTTs in retail and supply-chain<br />

automation. Supermarkets such as the<br />

UK’s Tesco began adopting the technology<br />

as far back as 2013.<br />

Tom Furphy, CEO Consumer Equity<br />

Partners, explained the technology to retail<br />

news site Morning News Beat at the time:,<br />

saying, “Their applets can automatically<br />

order products if they meet a certain price,<br />

they can add burgers to a shopping basket<br />

based on the weather or they can set a<br />

reminder to add certain items to a basket<br />

at a certain time.<br />

“They are also using IFTTT to<br />

allow customers to use Google<br />

Home to add items to their<br />

basket,” he added.<br />

Traditional retailers might scoff<br />

and say that their consumers<br />

don’t need or want IFTTTs, but<br />

consumers expect all retailers<br />

to match the convenience and<br />

services levels provided by<br />

Amazon or a Tesco in today’s<br />

omnichannel world.<br />

IFTTTs create convenience and<br />

place even more pressure on<br />

competitive pricing driven by real-time<br />

criteria, which is controlled by empowered<br />

customers.<br />

E-tailer fulfilment<br />

Amazon’s genius is using its own Amazon<br />

Marketplace to recruit retailers and brands<br />

to sell products through its ecosystem.<br />

As part of Amazon’s ‘turn key’ solution,<br />

the Marketplace products are “Fulfilled by<br />

Amazon” (FBA).<br />

Amazon’s own fulfilment costs for its<br />

membership program Prime run into the<br />

billions. By incorporating its Marketplace<br />

sellers into FBA, Amazon gains logistical<br />

volume, efficiencies and resources to<br />

continue to build state-of-the-art systems.<br />

Amazon is taking FBA to new levels by<br />

picking up products at manufacturing<br />

locations and delivering them directly to the<br />

consumer’s home.<br />

This process cuts out the role of<br />

distributors and most of the traditional<br />

supply chain.<br />

World domination or bust<br />

There are many more components<br />

of Amazon’s ecosystem but the ones<br />

mentioned here already create a huge<br />

strategic advantage that leaves even US<br />

retail behemoth Walmart struggling<br />

to compete.<br />

There are only a handful of retailers<br />

with deep-enough pockets to be able to invest<br />

billions in this kind of infrastructure, again<br />

giving Amazon a huge competitive advantage.<br />

At the same time, there is little profit to<br />

be made in e-commerce today without<br />

efficiencies and massive scale.<br />

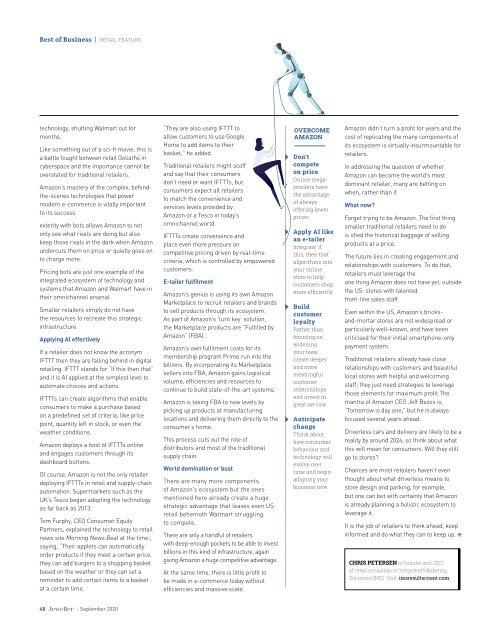

OVERCOME<br />

AMAZON<br />

Don’t<br />

compete<br />

on price<br />

Online megaretailers<br />

have<br />

the advantage<br />

of always<br />

offering lower<br />

prices<br />

Apply AI like<br />

an e-tailer<br />

Integrate ‘if<br />

this, then that’<br />

algorithms into<br />

your online<br />

store to help<br />

customers shop<br />

more efficiently<br />

Build<br />

customer<br />

loyalty<br />

Rather than<br />

focusing on<br />

widening<br />

your base,<br />

create deeper<br />

and more<br />

meaningful<br />

customer<br />

relationships<br />

and invest in<br />

great service<br />

Anticipate<br />

change<br />

Think about<br />

how consumer<br />

behaviour and<br />

technology will<br />

evolve over<br />

time and begin<br />

adapting your<br />

business now<br />

Amazon didn’t turn a profit for years and the<br />

cost of replicating the many components of<br />

its ecosystem is virtually insurmountable for<br />

retailers.<br />

In addressing the question of whether<br />

Amazon can become the world’s most<br />

dominant retailer, many are betting on<br />

when, rather than if.<br />

What now?<br />

Forget trying to be Amazon. The first thing<br />

smaller traditional retailers need to do<br />

is shed the historical baggage of selling<br />

products at a price.<br />

The future lies in creating engagement and<br />

relationships with customers. To do that,<br />

retailers must leverage the<br />

one thing Amazon does not have yet, outside<br />

the US: stores with talented<br />

front-line sales staff.<br />

Even within the US, Amazon’s bricksand-mortar<br />

stores are not widespread or<br />

particularly well-known, and have been<br />

criticised for their initial smartphone-only<br />

payment system.<br />

Traditional retailers already have close<br />

relationships with customers and beautiful<br />

local stores with helpful and welcoming<br />

staff; they just need strategies to leverage<br />

those elements for maximum profit.The<br />

mantra of Amazon CEO Jeff Bezos is,<br />

“Tomorrow is day one,” but he is always<br />

focused several years ahead.<br />

Driverless cars and delivery are likely to be a<br />

reality by around 2024, so think about what<br />

this will mean for consumers. Will they still<br />

go to stores?<br />

Chances are most retailers haven’t even<br />

thought about what driverless means to<br />

store design and parking, for example,<br />

but one can bet with certainty that Amazon<br />

is already planning a holistic ecosystem to<br />

leverage it.<br />

It is the job of retailers to think ahead, keep<br />

informed and do what they can to keep up.<br />

CHRIS PETERSEN is founder and CEO<br />

of retail consultancy Integrated Marketing<br />

Solutions (IMS). Visit: imsresultscount.com<br />

48 | <strong>September</strong> <strong>2020</strong>