2005 Annual Report Julius Baer Holding Ltd. - GAM Holding AG

2005 Annual Report Julius Baer Holding Ltd. - GAM Holding AG

2005 Annual Report Julius Baer Holding Ltd. - GAM Holding AG

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Notes<br />

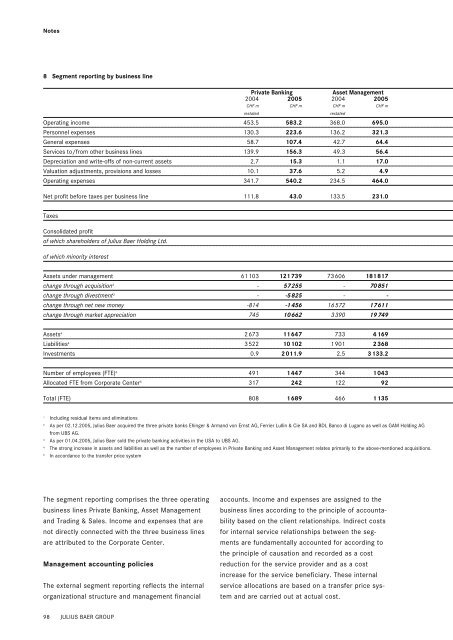

8 Segment reporting by business line<br />

The segment reporting comprises the three operating<br />

business lines Private Banking, Asset Management<br />

and Trading & Sales. Income and expenses that are<br />

not directly connected with the three business lines<br />

are attributed to the Corporate Center.<br />

Management accounting policies<br />

The external segment reporting reflects the internal<br />

organizational structure and management financial<br />

98 JULIUS BAER GROUP<br />

Private Banking Asset Management<br />

2004 <strong>2005</strong> 2004 <strong>2005</strong><br />

CHF m CHF m CHF m CHF m<br />

restated restated<br />

Operating income 453.5 583.2 368.0 695.0<br />

Personnel expenses 130.3 223.6 136.2 321.3<br />

General expenses 58.7 107.4 42.7 64.4<br />

Services to/from other business lines 139.9 156.3 49.3 56.4<br />

Depreciation and write-offs of non-current assets 2.7 15.3 1.1 17.0<br />

Valuation adjustments, provisions and losses 10.1 37.6 5.2 4.9<br />

Operating expenses 341.7 540.2 234.5 464.0<br />

Net profit before taxes per business line 111.8 43.0 133.5 231.0<br />

Taxes<br />

Consolidated profit<br />

of which shareholders of <strong>Julius</strong> <strong>Baer</strong> <strong>Holding</strong> <strong>Ltd</strong>.<br />

of which minority interest<br />

Assets under management 61103 121739 73606 181817<br />

change through acquisition 2 - 57255 - 70851<br />

change through divestment 3 - -5825 - -<br />

change through net new money -814 -1456 16572 17611<br />

change through market appreciation 745 10662 3390 19749<br />

Assets 4 2673 11647 733 4169<br />

Liabilities 4 3522 10102 1901 2368<br />

Investments 0.9 2011.9 2.5 3133.2<br />

Number of employees (FTE) 4 491 1447 344 1043<br />

Allocated FTE from Corporate Center 5 317 242 122 92<br />

Total (FTE) 808 1689 466 1135<br />

1 Including residual items and eliminations<br />

2 As per 02.12.<strong>2005</strong>, <strong>Julius</strong> <strong>Baer</strong> acquired the three private banks Ehinger & Armand von Ernst <strong>AG</strong>, Ferrier Lullin & Cie SA and BDL Banco di Lugano as well as <strong>GAM</strong> <strong>Holding</strong> <strong>AG</strong><br />

from UBS <strong>AG</strong>.<br />

3 As per 01.04.<strong>2005</strong>, <strong>Julius</strong> <strong>Baer</strong> sold the private banking activities in the USA to UBS <strong>AG</strong>.<br />

4 The strong increase in assets and liabilities as well as the number of employees in Private Banking and Asset Management relates primarily to the above-mentioned acquisitions.<br />

5 In accordance to the transfer price system<br />

accounts. Income and expenses are assigned to the<br />

business lines according to the principle of accountability<br />

based on the client relationships. Indirect costs<br />

for internal service relationships between the segments<br />

are fundamentally accounted for according to<br />

the principle of causation and recorded as a cost<br />

reduction for the service provider and as a cost<br />

increase for the service beneficiary. These internal<br />

service allocations are based on a transfer price system<br />

and are carried out at actual cost.