Annual Comprehensive Financial Report 2021

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

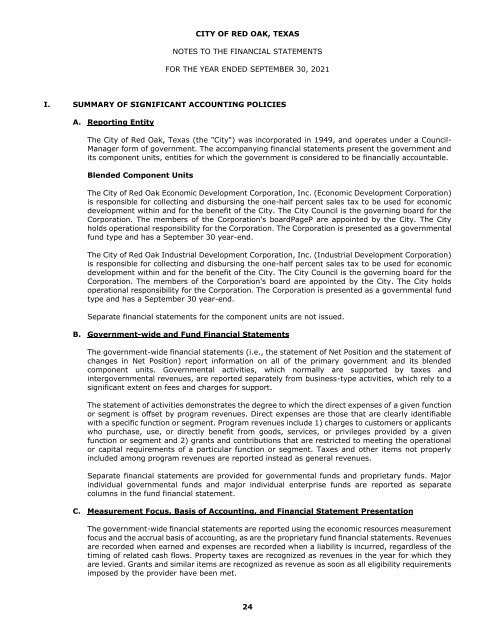

CITY OF RED OAK, TEXAS<br />

NOTES TO THE FINANCIAL STATEMENTS<br />

FOR THE YEAR ENDED SEPTEMBER 30, <strong>2021</strong><br />

I. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES<br />

A. <strong>Report</strong>ing Entity<br />

The City of Red Oak, Texas (the "City") was incorporated in 1949, and operates under a Council-<br />

Manager form of government. The accompanying financial statements present the government and<br />

its component units, entities for which the government is considered to be financially accountable.<br />

Blended Component Units<br />

The City of Red Oak Economic Development Corporation, Inc. (Economic Development Corporation)<br />

is responsible for collecting and disbursing the one-half percent sales tax to be used for economic<br />

development within and for the benefit of the City. The City Council is the governing board for the<br />

Corporation. The members of the Corporation's boardPageP are appointed by the City. The City<br />

holds operational responsibility for the Corporation. The Corporation is presented as a governmental<br />

fund type and has a September 30 year-end.<br />

The City of Red Oak Industrial Development Corporation, Inc. (Industrial Development Corporation)<br />

is responsible for collecting and disbursing the one-half percent sales tax to be used for economic<br />

development within and for the benefit of the City. The City Council is the governing board for the<br />

Corporation. The members of the Corporation's board are appointed by the City. The City holds<br />

operational responsibility for the Corporation. The Corporation is presented as a governmental fund<br />

type and has a September 30 year-end.<br />

Separate financial statements for the component units are not issued.<br />

B. Government-wide and Fund <strong>Financial</strong> Statements<br />

The government-wide financial statements (i.e., the statement of Net Position and the statement of<br />

changes in Net Position) report information on all of the primary government and its blended<br />

component units. Governmental activities, which normally are supported by taxes and<br />

intergovernmental revenues, are reported separately from business-type activities, which rely to a<br />

significant extent on fees and charges for support.<br />

The statement of activities demonstrates the degree to which the direct expenses of a given function<br />

or segment is offset by program revenues. Direct expenses are those that are clearly identifiable<br />

with a specific function or segment. Program revenues include 1) charges to customers or applicants<br />

who purchase, use, or directly benefit from goods, services, or privileges provided by a given<br />

function or segment and 2) grants and contributions that are restricted to meeting the operational<br />

or capital requirements of a particular function or segment. Taxes and other items not properly<br />

included among program revenues are reported instead as general revenues.<br />

Separate financial statements are provided for governmental funds and proprietary funds. Major<br />

individual governmental funds and major individual enterprise funds are reported as separate<br />

columns in the fund financial statement.<br />

C. Measurement Focus, Basis of Accounting, and <strong>Financial</strong> Statement Presentation<br />

The government-wide financial statements are reported using the economic resources measurement<br />

focus and the accrual basis of accounting, as are the proprietary fund financial statements. Revenues<br />

are recorded when earned and expenses are recorded when a liability is incurred, regardless of the<br />

timing of related cash flows. Property taxes are recognized as revenues in the year for which they<br />

are levied. Grants and similar items are recognized as revenue as soon as all eligibility requirements<br />

imposed by the provider have been met.<br />

24