Tech Hardware Supply Chain - Gazhoo

Tech Hardware Supply Chain - Gazhoo

Tech Hardware Supply Chain - Gazhoo

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

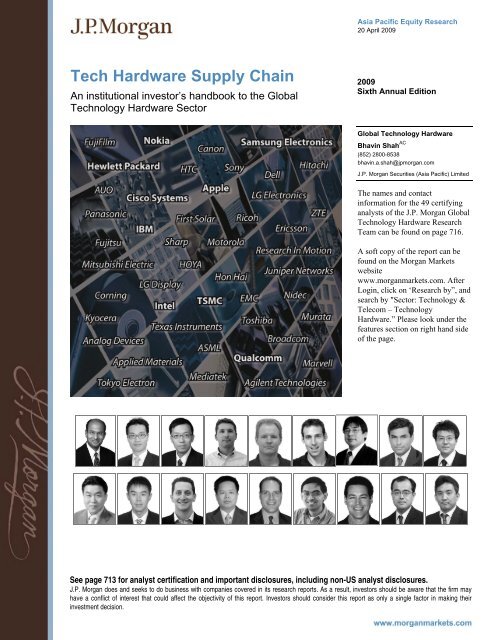

<strong>Tech</strong> <strong>Hardware</strong> <strong>Supply</strong> <strong>Chain</strong><br />

An institutional investor’s handbook to the Global<br />

<strong>Tech</strong>nology <strong>Hardware</strong> Sector<br />

Asia Pacific Equity Research<br />

20 April 2009<br />

2009<br />

Sixth Annual Edition<br />

Global <strong>Tech</strong>nology <strong>Hardware</strong><br />

Bhavin Shah AC<br />

(852) 2800-8538<br />

bhavin.a.shah@jpmorgan.com<br />

J.P. Morgan Securities (Asia Pacific) Limited<br />

The names and contact<br />

information for the 49 certifying<br />

analysts of the J.P. Morgan Global<br />

<strong>Tech</strong>nology <strong>Hardware</strong> Research<br />

Team can be found on page 716.<br />

A soft copy of the report can be<br />

found on the Morgan Markets<br />

website<br />

www.morganmarkets.com. After<br />

Login, click on ‘Research by”, and<br />

search by "Sector: <strong>Tech</strong>nology &<br />

Telecom – <strong>Tech</strong>nology<br />

<strong>Hardware</strong>.” Please look under the<br />

features section on right hand side<br />

of the page.<br />

See page 713 for analyst certification and important disclosures, including non-US analyst disclosures.<br />

J.P. Morgan does and seeks to do business with companies covered in its research reports. As a result, investors should be aware that the firm may<br />

have a conflict of interest that could affect the objectivity of this report. Investors should consider this report as only a single factor in making their<br />

investment decision.

Bhavin Shah<br />

(852) 2800-8538<br />

bhavin.a.shah@jpmorgan.com<br />

2<br />

Asia Pacific Equity Research<br />

20 April 2009<br />

Introduction<br />

We are pleased to publish the sixth edition of <strong>Tech</strong> <strong>Hardware</strong> <strong>Supply</strong> <strong>Chain</strong>, a<br />

hardware technology industry handbook. Similar to previous editions, the report is<br />

split into two parts: Part I includes industry and product analysis and Part II provides<br />

the supply-chain-related information for major technology companies.<br />

With this edition, we have divided Part I into five segments: three C’s -- i.e.,<br />

Computing, Communications, and Consumer Electronics; a section on Energy<br />

Efficient <strong>Tech</strong>nologies; and, finally, a section on Semiconductors. Special emphasis<br />

is being placed on “convergence” with separate sub-sections for 3G/4G technologies<br />

(wireless radio technologies), VOIP, IPTV and video conferencing. With the<br />

increasing focus on technologies addressing the issue of climate change, we are<br />

introducing a new section, Energy Efficient <strong>Tech</strong>nologies. This section includes<br />

Epaper, Solar technology, Electric vehicles, Batteries and LED. One thing missing<br />

from the past edition was a section on foundries, and we have addressed that gap<br />

with this edition. Those familiar with past editions may find it handy to refer to the<br />

“What’s new?” page at the beginning of every sub-section. On this page, one can<br />

find details of key revisions to each of the sections versus the previous edition.<br />

Part II (available only in the online version) contains supply-chain-related<br />

information covering more than 300 major technology companies. Each company<br />

sheet includes information such as products and services mix, geographic<br />

breakdown, suppliers and customers. We have also expanded the financial<br />

information for each company. We include revenue, gross profit, operating profit, net<br />

profit, ROE, EPS, cash and equivalents, gross debt, shareholders equity, BPS, R&D<br />

and capital expenditure.<br />

We hope this report remains a valuable source of information for you. We<br />

acknowledge the contribution of Aniruddha Loya, Gourav Vijayvergiya and Udit<br />

Garg of J.P. Morgan Services India Private Ltd., Mumbai, to this report.<br />

Bhavin Shah<br />

Global Leader- <strong>Tech</strong>nology Sector Equity Research<br />

(852) 2800-8538<br />

bhavin.a.shah@jpmorgan.com

Bhavin Shah<br />

(852) 2800-8538<br />

bhavin.a.shah@jpmorgan.com<br />

Diversified Companies<br />

(Design, Manufacturing & End<br />

Product Capabilities)<br />

Advantech Oki Electric<br />

Fuji Electric Omron<br />

Fujitsu Samsung Elect<br />

Hitachi Siemens<br />

IBM Sun Micro<br />

Mitsubishi Toshiba<br />

National Instrument Xerox<br />

Semi equipment<br />

Advanced Energy Jusung<br />

Advantest KLA Tencor<br />

Agilent <strong>Tech</strong> LAM Research<br />

AIXTRON Mattson <strong>Tech</strong><br />

Applied Materials MKS Instrument<br />

ASM International Novellus<br />

ASM Pacific Shimazdu<br />

ASML Teradyne<br />

ATMI Inc Tokyo Electron<br />

Brooks Automation Tokyo Seimitsu<br />

Cabot Micro Ulta Clean<br />

Cymer Ultratech<br />

Dainippon Ulvac<br />

Disco Ushio<br />

Entergis Varian Semi<br />

Yokogawa<br />

Semi materials<br />

Form Factor Photronic<br />

MEMC Electonics SOITEC<br />

Solar<br />

Ascent Solar Q-Cells<br />

Energy Conv Dev REC<br />

Evergreen Solar SolarWorld<br />

First Solar SunPower<br />

Motech Suntech<br />

PC OEM<br />

Acer Apple<br />

Dell Lenovo<br />

HewlettPackard ASUSTek<br />

Source: J.P. Morgan.<br />

Asia Pacific Equity Research<br />

20 April 2009<br />

The Big Picture<br />

IC IDM<br />

AMD Analog Devices<br />

Fairchild Infineon<br />

IDT Intersil Corp<br />

Intel Linear <strong>Tech</strong><br />

LSI Logic MaximIntegrated<br />

Melexis Microchip <strong>Tech</strong><br />

ON Semi Nanya <strong>Tech</strong><br />

NEC National Semi<br />

Rohm Sandisk Corp<br />

Sanken Semtech Corp<br />

STMicro TI<br />

Winbond<br />

Memory<br />

Elpida Hynix<br />

Inotera Micron<br />

Powerchip ProMos<br />

Foundries<br />

TSMC CHRT<br />

UMC Vanguard<br />

IC Assembly & Test<br />

Amkor STATSChipPAC<br />

ASE Unisem<br />

Powertech Verigy<br />

SPIL<br />

IC and components<br />

EMS/ODM<br />

Divesified EMS: Ability Benchmark<br />

Celestia Flextronics Hi-P<br />

Jurong Hon Hai Jabil<br />

Sanmina-SCI Mitac Plexus<br />

VentureCorp Smart Modular USI<br />

PC ODM : CompalElect<br />

CompalElect GigaByte <strong>Tech</strong> Inventec<br />

Microstar QuantaComp Wistron<br />

HandsetODM/EMS : BYD CompalComm<br />

Elcoteq Foxconn Int’l<br />

IC Fabless<br />

Altera Cypress Semi Novatek Sierra<br />

Applied Microcircuit Elan Micro Novatel SiS<br />

Arm Holding Greatek NVIDIA Sunplus<br />

Atheros Himax OmniVision TriQuint<br />

Broadcom Lattice Semi PMC-Sierra VIA <strong>Tech</strong><br />

Cavium Marvell <strong>Tech</strong> QUALCOMM Wolfson Micro<br />

Corning MediaTek RF Micro Devices Xilinx<br />

CSR Microsemi Richtek <strong>Tech</strong> Zoran<br />

Distribution<br />

Arrow Electronics<br />

Avnet Inc<br />

Ingram Micro<br />

<strong>Tech</strong> Data<br />

HCL Infosystems<br />

Synnex Corp<br />

Mellanox<br />

Opnext<br />

Voltaire<br />

Electronics<br />

Consumer: Casio Citizen<br />

Sharp LG Electronics Canon<br />

Sony Panasonic Philips<br />

Pioneer Sanyo Tandberg<br />

Automobile: Alpine Clarion<br />

Printer&Imaging: DaiNippon EastmanKodak<br />

FujiFilm KonicaMinolta Lexmark<br />

Nikon Olympus Ricoh<br />

Toppan Samsung<strong>Tech</strong>win SeikoEpson<br />

DisplayMonitor: Qisda Corp TPV <strong>Tech</strong><br />

Applied <strong>Tech</strong> AV<strong>Tech</strong> Cogent<br />

Garmin Photronics Trimble<br />

Nice Digital Theatre<br />

Components<br />

PC/Handset: AAC Avermedia Catcher<br />

Cheng Uei Ichia Ju Teng Logitech<br />

DFI LG Innotek BYD Synaptics<br />

Merry Electronics Silitech Shin Zu Shing<br />

Connectors: Amphenol Hirose Molex<br />

Optical: Largan Sunny Optical Hoya<br />

HDD: MinAikTek NHK Spring<br />

LED: Bright LED Epistar Everlight<br />

Seol Semi<br />

Diversified: Alps Mitsumi Foxconn<br />

Funai Huan Hsin Lite-On Nidec<br />

NOK TDK SEMCO Tyco<br />

Power<br />

Cosel Delta<br />

Dongyang InternationalRect<br />

PowerOne SPI<br />

PCB, Substrates<br />

AT&S Phoenix<br />

Compeq Shinko<br />

Daeduck Taiflex<br />

Ibiden Topoint<br />

Kinsus Tripod<br />

NanYa TTM<br />

NGK Spark Unimicron<br />

Display Panel<br />

AU Optronics Innolux<br />

Chi Mei LG Display<br />

CPT Samsung<br />

Digitech Sys SDI<br />

Hannstar Wintek<br />

AVX<br />

Passives<br />

TaiyoYuden<br />

Cyntec TXC<br />

EPCOS Vishay<br />

Murata Yageo<br />

Nichicon Nippon<br />

ChemiCon<br />

Storage<br />

Brocade EMC<br />

Emulex NetworkAppliance<br />

Qlogic Quantum<br />

HDD:<br />

Seagate WesternDigital<br />

Optical:<br />

Moser Baer Quanta Storage<br />

Telecom<br />

HandsetOEM: HTC Motorola Nokia<br />

Palm RIM<br />

Equipment: ADCT ADTRAN ADVA<br />

Alcatel Lucent ARRIS Aruba Centron<br />

CIENA Cicso CommScope D-Link<br />

Ericsson F5 Infinera JDSU<br />

Juniper Kyocera NEC Powerware<br />

ShoreTel Sonus Spirent Starent<br />

Tellabs TomTom ZTE<br />

3

Bhavin Shah<br />

(852) 2800-8538<br />

bhavin.a.shah@jpmorgan.com<br />

4<br />

Asia Pacific Equity Research<br />

20 April 2009<br />

Table of Contents<br />

Introduction ..............................................................................2<br />

Part 1: Industry and Product Analysis....................................6<br />

Computing ................................................................................7<br />

PC..........................................................................................................................82<br />

Broadband .............................................................................................................52<br />

Wireless networking..............................................................................................62<br />

Communications ....................................................................74<br />

Wireless Handsets .................................................................................................75<br />

Wireless handset radio technologies....................................................................122<br />

VOIP ...................................................................................................................132<br />

Video Conferencing ............................................................................................137<br />

Consumer Electronics .........................................................144<br />

Displays...............................................................................................................148<br />

IPTV....................................................................................................................172<br />

Game Consoles....................................................................................................187<br />

DVD ....................................................................................................................201<br />

Digital Still Camera.............................................................................................210<br />

Energy Efficient <strong>Tech</strong>nologies ............................................223<br />

Electronic Paper ..................................................................................................225<br />

Solar Cells ...........................................................................................................231<br />

Electric Vehicle and Battery................................................................................253<br />

Light Emitting Diode...........................................................................................269<br />

Semiconductors ...................................................................294<br />

Semi manufacturing Equipment ..........................................................................295<br />

Foundry ...............................................................................................................330<br />

IC packaging and Testing....................................................................................339<br />

Part 2: Company Information ..............................................346<br />

Semiconductors ...................................................................347<br />

IC IDM ................................................................................................................348<br />

Memory ...............................................................................................................372<br />

IC Fabless............................................................................................................379<br />

IC Foundry ..........................................................................................................412<br />

IC Assembly & Test............................................................................................417<br />

Semiconductor Equipment ..................................................................................425<br />

Semiconductors Materials ...................................................................................457<br />

Components .........................................................................462<br />

PC Handset Components.....................................................................................463<br />

Display Components ...........................................................................................478<br />

Passive Components............................................................................................485

Bhavin Shah<br />

(852) 2800-8538<br />

bhavin.a.shah@jpmorgan.com<br />

Asia Pacific Equity Research<br />

20 April 2009<br />

HDD Components ...............................................................................................496<br />

Optical Components............................................................................................499<br />

Diversified Components......................................................................................503<br />

PCB Substracts....................................................................................................515<br />

Connectors...........................................................................................................530<br />

Power <strong>Supply</strong> ......................................................................................................534<br />

Display...................................................................................538<br />

Display Panels .....................................................................................................539<br />

LED .....................................................................................................................549<br />

Display Monitors.................................................................................................554<br />

EMS/ODM ..............................................................................557<br />

Handset EMS/ODM ............................................................................................558<br />

PC ODM..............................................................................................................563<br />

Diversified EMS..................................................................................................570<br />

Storage ..................................................................................584<br />

HDD ....................................................................................................................591<br />

Optical Disc.........................................................................................................594<br />

OEM .......................................................................................597<br />

Handset OEM......................................................................................................598<br />

PC OEM ..............................................................................................................604<br />

Consumer Electronics..........................................................................................611<br />

Diversified IT ......................................................................................................623<br />

Solar <strong>Chain</strong> ...........................................................................638<br />

Printers and Imaging............................................................649<br />

Applied <strong>Tech</strong>nologies ..........................................................661<br />

Automobiles Electronics .....................................................669<br />

Telecom Equipment .............................................................672<br />

Distribution ...........................................................................699<br />

The ratings, models, and investment conclusions in this <strong>Supply</strong> <strong>Chain</strong> book are<br />

accurate as of March 12, 2009 . J.P. Morgan clients should contact their sales<br />

representative or visit www.morganmarkets.com for updated information on the<br />

companies in this publication.<br />

5

Bhavin Shah<br />

(852) 2800-8538<br />

bhavin.a.shah@jpmorgan.com<br />

6<br />

Asia Pacific Equity Research<br />

20 April 2009<br />

Industry and Product Analysis<br />

P A R T1

Bhavin Shah<br />

(852) 2800-8538<br />

bhavin.a.shah@jpmorgan.com<br />

Asia Pacific Equity Research<br />

20 April 2009<br />

The PC supply chain...................................................................... 8<br />

What’s new? .....................................................................................................................8<br />

Our global PC forecasts ....................................................................................................8<br />

Netbooks: Ultra-low-cost notebooks ..............................................................................12<br />

Outlook for PC brands....................................................................................................14<br />

Challenges for the netbook segment...............................................................................15<br />

How Apple could introduce a netbook-like device.........................................................15<br />

Ultra-slim laptop: MacBook Air .....................................................................................16<br />

All-in-one PCs ................................................................................................................17<br />

Notebook ODMs: Order reshuffling in unusual manner.................................................17<br />

Desktop virtualization: We expect upward pressure on servers .....................................18<br />

Server market............................................................................. 20<br />

Servers: A muted outlook ...............................................................................................20<br />

Analysis of market servers..............................................................................................20<br />

Key segment themes to follow in servers .......................................................................23<br />

Components and parts of a PC ................................................ 32<br />

PC and notebook bill of materials breakdown................................................................32<br />

Motherboard ...................................................................................................................33<br />

Central processing unit ...................................................................................................33<br />

Chipsets ..........................................................................................................................40<br />

Graphics cards ................................................................................................................41<br />

Memory ..........................................................................................................................42<br />

Printed circuit board .......................................................................................................42<br />

Display............................................................................................................................42<br />

Optical drives..................................................................................................................44<br />

Power supply/battery ......................................................................................................44<br />

Internal storage disks ............................................................... 45<br />

HDD components ...........................................................................................................46<br />

Storage technologies trends ............................................................................................47<br />

HDD: Industry overview ................................................................................................47<br />

NAND flash solid state disks will encroach on HDDs ...................................................49<br />

Secure digital (SD) cards ................................................................................................51<br />

Broadband access ....................................................................... 52<br />

What’s new? ...................................................................................................................52<br />

Broadband: Brief overview.............................................................................................52<br />

Broadband market outlook..............................................................................................55<br />

Digital subscriber line (xDSL)........................................................................................56<br />

Cable modem..................................................................................................................57<br />

Metro ethernet internet access (MEIA)...........................................................................57<br />

Passive Optical Networks (PON)....................................................................................58<br />

Fixed wireless broadband: WiMAX ...............................................................................58<br />

Wireless networking .................................................................... 62<br />

What’s new? ...................................................................................................................62<br />

What is wireless networking? .........................................................................................62<br />

Wireless personal area network (WPAN).......................................................................62<br />

Wireless local area network (WLAN) or Wi-Fi..............................................................67<br />

The WLAN equipment market .......................................................................................71<br />

Computing<br />

7

Bhavin Shah<br />

(852) 2800-8538<br />

bhavin.a.shah@jpmorgan.com<br />

Mark Moskowitz AC<br />

(1-415) 315-6704<br />

mark.a.moskowitz@jpmorgan.com<br />

J.P. Morgan Securities Inc<br />

Gokul Hariharan AC<br />

(886-2) 2725 9869<br />

gokul.hariharan@jpmorgan.com<br />

J.P. Morgan Securities (Taiwan) Limited<br />

Alvin Kwock AC<br />

(852) 2800 8533<br />

alvin.yl.kwock@jpmorgan.com<br />

J.P. Morgan Securities (Asia Pacific)<br />

Limited<br />

8<br />

Asia Pacific Equity Research<br />

20 April 2009<br />

The PC supply chain<br />

What’s new?<br />

PC OEMs have jumped onto the netbook bandwagon along with the early-leader<br />

ASUS due to strong penetration pickup in emerging markets. Migration to 10"<br />

appears to be happening rapidly and the competition in the netbook space is getting<br />

intense. Transition to 12" netbooks is a new trend in this space. Netbooks and all-inones<br />

are the most promising new product trends, in our view. They are cheaper than<br />

their alternatives and offer a significant upgrade in user experience. Although they<br />

should result in significant cannibalization over time, there is a risk that the netbook<br />

could cede to smartphones. Major order reshuffling has been taking place in terms of<br />

orders to notebook ODMs. We discuss the “key segment themes to follow” in servers<br />

and PC virtualization that could gain traction in the coming years.<br />

The processor space has seen major developments since the past year. Intel launched<br />

core i7 family processors, based on the new Nehalem microarchitecture. AMD is<br />

getting more competitive with Shanghai, which should narrow the performance gap.<br />

Several Ultramobile processors were introduced. Intel launched the Atom processor<br />

aimed at netbooks and MIDs, followed by VIA’s nano. In 2H08, Nvidia launched<br />

tegra targeted at MIDs. AMD introduced Neo athelon at the CES 2009. Qualcomm’s<br />

work on Snapdragon solution is aimed at reducing the power consumption and the<br />

cost to new lows.<br />

In the storage space, we believe demand and pricing conditions are not favorable,<br />

and the high level of manufacturing parity is adding to a volatile pricing<br />

environment. We prefer to see consolidation among HDD manufacturers. We expect<br />

little in the way of positive impact from any consolidation of the smaller market<br />

share players this year. HDD manufacturers, such as Hitachi and Toshiba, are<br />

working on new storage technologies such as patterned magnetic media and<br />

thermally assisted recording methods to circumvent the density limitations issues.<br />

NAND-based SDD is gaining market share but is still not competitive enough for<br />

HDD and will likely encroach upon HDDs over time. Netbooks are an emerging<br />

application for NAND demand, but incremental NAND demand from netbook<br />

should be limited due to low penetration rate in 2009.<br />

Our global PC forecasts<br />

For the PC market, we forecast that the total unit shipment will decline 13.5% in<br />

2009. We expect desktop and notebook PC units to decline 21.4% and 5.5%,<br />

respectively. Consensus estimate for 2009 appears to gravitate around a mid- to highsingle-digit<br />

decline in PC units. We believe the consensus view takes into account<br />

continued growth from netbooks, offset by a substantial fall-off in desktop and<br />

notebook PCs in developed regions. We do not think the consensus view, however,<br />

has fully contemplated that the PC replacement cycle in the enterprise could be<br />

meaningfully deferred to next year. Also, we expect the US to be the early cycle<br />

decliner, which points to declines in Asia-Pacific and other emerging markets this<br />

year, in stark contrast to the double-digit growth of recent years in those regions.

Bhavin Shah<br />

(852) 2800-8538<br />

bhavin.a.shah@jpmorgan.com<br />

Figure 1: PC and servers supply chain<br />

Enterprise (47%)<br />

IT Distributors<br />

Avnet, CDW Corp, Ingram Micro,<br />

<strong>Tech</strong> Data, Synnex, Redington,<br />

US:<br />

Celestica<br />

Jabil<br />

Sanmina-SCI<br />

Flextronics<br />

COMPONENTS<br />

CPU DRAM Motherboard Clock HDD LCD Graphics<br />

Intel-80%<br />

ICST Seagate-32% Samsung-24%<br />

AMD-19%<br />

VIA -1%<br />

CY<br />

Samsung<br />

Hynix<br />

Micron<br />

Powerchip<br />

Elpida<br />

ProMos<br />

Source: Company reports, Gartner, Mercury Research, J.P. Morgan.<br />

Asia Pacific Equity Research<br />

20 April 2009<br />

PC OEMs (60%)<br />

HP, Dell, Acer, Lenovo, ) Toshiba, Fujitsu-Siemens,<br />

NEC<br />

EMS and ODM<br />

Asia:<br />

Quanta<br />

Compal<br />

Inventec<br />

MITAC<br />

Wistron<br />

Hon Hai,<br />

ASUSTek<br />

Hon Hai<br />

Elitegroup<br />

Microstar<br />

Gigabyte<br />

Government and<br />

Education (13%)<br />

Retailers<br />

BBY, Dixons<br />

PC White Box (40%)<br />

Ati, Aris Computer, PC Direct<br />

Component distributors<br />

Arrow Electronics Avnet Inc, Future<br />

Electronics, Redington<br />

WD-27%<br />

HGST-17%<br />

Toshiba-9%<br />

Samsung-8%<br />

Fujitsu-7%<br />

Consumer (40%)<br />

LG Philips-22%<br />

AUO-17%<br />

CMO-15%<br />

Sharp-8%<br />

NVIDIA-30%<br />

AMD-19%<br />

Intel-47%<br />

SIS -2%<br />

9

Bhavin Shah<br />

(852) 2800-8538<br />

bhavin.a.shah@jpmorgan.com<br />

Table 1: J.P. Morgan worldwide PC unit shipment forecasts<br />

Units in ‘000s<br />

1Q08A 2Q08A 3Q08A 4Q08E 2008E 1Q09E 2Q09E 3Q09E 4Q09E 2009E 2010E<br />

PC shipments 71,844 71,780 80,568 77,869 302,061 63,524 59,297 68,317 70,270 261,407 275,027<br />

% of total 100.0% 100.0% 100.0% 100.0% 100.0% 100.0% 100.0% 100.0% 100.0% 100.0% 100.0%<br />

Y/Y % change 13.6% 15.9% 15.0% 0.9% 10.9% -11.6% -17.4% -15.2% -9.8% -13.5% 5.2%<br />

Q/Q % change -6.9% -0.1% 12.2% -3.3% -18.4% -6.7% 15.2% 2.9%<br />

Desktop PC 38,100 38,118 38,375 35,854 150,447 29,659 28,059 30,032 30,559 118,308 117,011<br />

% of segment 53.0% 53.1% 47.6% 46.0% 49.8% 46.7% 47.3% 44.0% 43.5% 45.3% 42.5%<br />

Y/Y % change 0.3% 3.1% -2.4% -15.2% -3.9% -22.2% -26.4% -21.7% -14.8% -21.4% -1.1%<br />

Q/Q % change -9.9% 0.0% 0.7% -6.6% -17.3% -5.4% 7.0% 1.8%<br />

Notebook PC 31,574 31,398 39,942 39,853 142,767 31,890 29,186 36,203 37,636 134,915 149,502<br />

% of segment 43.9% 43.7% 49.6% 51.2% 47.3% 50.2% 49.2% 53.0% 53.6% 51.6% 54.4%<br />

Y/Y % change 35.8% 36.5% 39.5% 22.2% 32.8% 1.0% -7.0% -9.4% -5.6% -5.5% 10.8%<br />

Q/Q % change -3.2% -0.6% 27.2% -0.2% -20.0% -8.5% 24.0% 4.0%<br />

Server 2,170 2,265 2,251 2,162 8,847 1,974 2,052 2,083 2,076 8,184 8,513<br />

% of segment 3.0% 3.2% 2.8% 2.8% 2.9% 3.1% 3.5% 3.0% 3.0% 3.1% 3.1%<br />

Y/Y % change 8.2% 15.0% 6.7% -6.0% 5.5% -9.0% -9.4% -7.5% -4.0% -7.5% 4.0%<br />

Q/Q % change -5.7% 4.4% -0.6% -3.9% -8.7% 3.9% 1.5% -0.3%<br />

Source: Gartner Personal Computer Quarterly Statistics Worldwide Database, 12/08; J.P. Morgan estimates for 2008-2010.<br />

Table 2: J.P. Morgan worldwide PC revenues forecasts<br />

US$ in millions<br />

1Q08A 2Q08A 3Q08A 4Q08E 2008E 1Q09E 2Q09E 3Q09E 4Q09E 2009E 2010E<br />

PC Revenues 64,789 62,114 68,122 66,427 261,452 52,433 47,370 52,455 54,146 206,405 202,704<br />

% of total 100.0% 100.0% 100.0% 100.0% 100.0% 100.0% 100.0% 100.0% 100.0% 100.0% 100.0%<br />

Y/Y % change 12.4% 10.6% 7.9% -5.5% 5.7% -19.1% -23.7% -23.0% -18.5% -21.1% -1.8%<br />

Q/Q % change -7.8% -4.1% 9.7% -2.5% -21.1% -9.7% 10.7% 3.2%<br />

Desktop PC 26,226 25,207 24,566 23,112 99,110 18,677 17,045 17,760 18,264 71,745 67,163<br />

% of segment 40.5% 40.6% 36.1% 34.8% 37.9% 35.6% 36.0% 33.9% 33.7% 34.8% 33.1%<br />

Y/Y % change 1.0% 0.1% -8.6% -21.4% -7.8% -28.8% -32.4% -27.7% -21.0% -27.6% -6.4%<br />

Q/Q % change -10.9% -3.9% -2.5% -5.9% -19.2% -8.7% 4.2% 2.8%<br />

Notebook PC 31,243 29,584 35,965 36,205 132,997 27,408 23,936 27,938 29,343 108,625 109,412<br />

% of segment 48.2% 47.6% 52.8% 54.5% 50.9% 52.3% 50.5% 53.3% 54.2% 52.6% 54.0%<br />

Y/Y % change 27.1% 23.4% 24.9% 9.9% 20.6% -12.3% -19.1% -22.3% -19.0% -18.3% 0.7%<br />

Q/Q % change -5.1% -5.3% 21.6% 0.7% -24.3% -12.7% 16.7% 5.0%<br />

Server 7,320 7,323 7,591 7,110 29,345 6,349 6,389 6,758 6,539 26,035 26,130<br />

% of segment 11.3% 11.8% 11.1% 10.7% 11.2% 12.1% 13.5% 12.9% 12.1% 12.6% 12.9%<br />

Y/Y % change 3.3% 4.4% 1.7% -10.3% -0.5% -13.3% -12.7% -11.0% -8.0% -11.3% 0.4%<br />

Q/Q % change -7.7% 0.0% 3.7% -6.3% -10.7% 0.6% 5.8% -3.2%<br />

Source: Gartner Personal Computer Quarterly Statistics Worldwide Database, 12/08; J.P. Morgan estimates for 2008-2010.<br />

Table 3: J.P. Morgan worldwide PC ASP forecasts<br />

Average selling prices (US$)<br />

1Q08A 2Q08A 3Q08A 4Q08E 2008E 1Q09E 2Q09E 3Q09E 4Q09E 2009E 2010E<br />

PC ASPs 902 865 846 853 866 825 799 768 771 790 737<br />

Y/Y % change -1.0% -4.6% -6.2% -6.3% -4.6% -8.5% -7.7% -9.2% -9.7% -8.8% -6.7%<br />

Q/Q % change -1.0% -4.0% -2.3% 0.9% -3.2% -3.2% -3.9% 0.4%<br />

Desktop PC 688 661 640 645 659 630 607 591 598 606 574<br />

Y/Y % change 0.7% -2.9% -6.4% -7.4% -4.0% -8.5% -8.1% -7.6% -7.3% -7.9% -5.3%<br />

Q/Q % change -1.1% -3.9% -3.2% 0.7% -2.3% -3.5% -2.7% 1.1%<br />

Notebook PC 990 942 900 908 932 859 820 772 780 805 732<br />

Y/Y % change -6.4% -9.6% -10.5% -10.0% -9.2% -13.1% -13.0% -14.3% -14.2% -13.6% -9.1%<br />

Q/Q % change -2.0% -4.8% -4.4% 0.9% -5.4% -4.6% -5.9% 1.0%<br />

Server 3,373 3,234 3,373 3,289 3,317 3,216 3,114 3,245 3,150 3,181 3,069<br />

Y/Y % change -4.6% -9.2% -4.7% -4.6% -5.7% -4.7% -3.7% -3.8% -4.2% -4.1% -3.5%<br />

Q/Q % change -2.1% -4.1% 4.3% -2.5% -2.2% -3.2% 4.2% -2.9%<br />

Source: Gartner Personal Computer Quarterly Statistics Worldwide Database, 12/08; J.P. Morgan estimates for 2008-2010.<br />

10<br />

Asia Pacific Equity Research<br />

20 April 2009

Bhavin Shah<br />

(852) 2800-8538<br />

bhavin.a.shah@jpmorgan.com<br />

Asia Pacific Equity Research<br />

20 April 2009<br />

Table 4: J.P. Morgan Asia tech team’s PC shipment forecasts by region and segment<br />

Units in ‘000s<br />

2007 2008E 2009E 2010E 2007<br />

Growth<br />

2008E 2009E 2010E<br />

Desktop PC APAC 50,177 50,004 38,247 34,424 10.2% -0.3% -23.5% -10.0%<br />

Japan 6,108 5,669 4,055 4,101 -4.1% -7.2% -28.5% 1.2%<br />

W.Europe 25,639 23,045 14,817 11,793 -3.3% -10.1% -35.7% -20.4%<br />

E. Europe, MEA 21,617 20,976 15,672 13,914 8.3% -3.0% -25.3% -11.2%<br />

North America 34,224 29,424 19,083 16,457 -6.3% -14.0% -35.1% -13.8%<br />

Latin America 18,827 19,510 17,884 17,558 22.1% 3.6% -8.3% -1.8%<br />

NB PC APAC 19,795 29,094 37,539 46,867 54.1% 47.0% 29.0% 24.8%<br />

Japan 7,364 8,761 8,968 9,082 1.4% 19.0% 2.4% 1.3%<br />

W.Europe 30,617 41,796 35,734 39,395 28.6% 36.5% -14.5% 10.2%<br />

E. Europe, MEA 11,777 19,394 22,108 27,008 53.5% 64.7% 14.0% 22.2%<br />

North America 33,081 38,264 31,682 34,431 23.4% 15.7% -17.2% 8.7%<br />

Latin America 4,837 7,637 8,708 12,038 73.8% 57.9% 14.0% 38.2%<br />

Server APAC 1,289 1,408 1,415 1,467 11.9% 9.2% 0.5% 3.7%<br />

Japan 568 541 455 451 -2.1% -4.7% -16.0% -0.8%<br />

W.Europe 1,935 1,951 1,412 1,326 9.1% 0.8% -27.6% -6.1%<br />

E. Europe, MEA 638 708 716 769 18.4% 11.0% 1.1% 7.4%<br />

North America 3,623 3,621 2,439 2,390 6.1% -0.1% -32.6% -2.0%<br />

Latin America 309 362 338 359 18.7% 17.1% -6.6% 6.3%<br />

Total PC APAC 71,262 80,506 77,200 82,757 19.7% 13.0% -4.1% 7.2%<br />

Japan 14,040 14,971 13,478 13,635 -1.2% 6.6% -10.0% 1.2%<br />

W.Europe 58,190 66,792 51,964 52,514 11.7% 14.8% -22.2% 1.1%<br />

E. Europe, MEA 34,032 41,078 38,496 41,691 20.8% 20.7% -6.3% 8.3%<br />

North America 70,928 71,309 53,203 53,277 6.2% 0.5% -25.4% 0.1%<br />

Latin America 23,973 27,508 26,929 29,955 29.8% 14.7% -2.1% 11.2%<br />

Worldwide Desktop PC 156,592 148,628 109,758 98,248 4.2% -5.1% -26.2% -10.5%<br />

NB PC 107,471 144,945 144,739 168,821 32.4% 34.9% -0.1% 16.6%<br />

Server 8,362 8,592 6,774 6,762 8.3% 2.7% -21.2% -0.2%<br />

Total 272,425 302,164 261,271 273,831 13.9% 10.9% -13.5% 4.8%<br />

Source: Gartner, J.P. Morgan estimates. Published on February 03, 2009.<br />

PC ASPs could be entering dire straits<br />

We expect significant ASP deterioration in 2009. Our ASP assumptions for desktop<br />

and notebook PCs underpin a total PC market revenue decline of 21.1%, versus 9.7%<br />

previously. A combination of weak demand, customer requests for heavy<br />

discounting, mix to lower-end SKUs, and competitive pressure could drive the ASP<br />

erosion. We expect notebook PCs to be the hardest hit as the continued migration<br />

from desktop PCs should force greater competitive face-offs in a compressing PC<br />

market. In addition, the netbook PC should continue to be a deflationary force as the<br />

sub-US$400 base price drives more adoption.<br />

Emergence of ultra-low-cost and ultra-portable notebooks<br />

The continuing shift towards mobility has given rise to light-weight ultra-portable<br />

notebooks. Tablet PCs were the first PCs in this category but could not become a<br />

major segment due to cost constraints. The initial adoption of ultra-portable Asus Eee<br />

PC and HP Mini-Note indicated that a certain percentage of users were willing to<br />

adopt these sub-notebooks due to higher mobility and lower weight offered. In<br />

addition, the lower price points of this segment are likely to attract a lot more users<br />

who may have been put off by high price tags for ultra-mobile tablet PCs to buy a<br />

sub-notebook. This results in a new segment of ultra-low-cost and ultra-portable PCs,<br />

which is often referred to as netbooks. Moreover, low-cost notebook has started to<br />

penetrate to the US$400 level, a territory previously only available to desktops.<br />

11

Bhavin Shah<br />

(852) 2800-8538<br />

bhavin.a.shah@jpmorgan.com<br />

12<br />

Asia Pacific Equity Research<br />

20 April 2009<br />

Netbooks: Ultra-low-cost notebooks<br />

There are two target segments for such a product. The first segment is a developed<br />

market buyer looking for a light-weight and cheap second PC. The second segment is<br />

focused on pushing these small form factor notebooks as the first PC in an emerging<br />

market household. We believe small form factor, low weight, and attractive design<br />

should drive netbook adoption as a second notebook in developed markets. Increase<br />

in feature set, support for Microsoft XP, and larger keyboards with 8.9" and 10"<br />

models help drive this trend. Also 12" netbooks have started coming to the market.<br />

Over the past year, multiple PC OEMs have jumped into the netbook bandwagon<br />

along with the early leader, ASUS due to a strong PC penetration pickup in emerging<br />

markets, and we believe the competition in this space is getting intense.<br />

Eee PCs: Easy, excellent and exciting<br />

Asus launched new generation of Eee PCs—the Eee PC 901 and 1000 series. First<br />

generations of Eee PCs were launched by ASUS (Taiwan) in October, 2007. (Please<br />

refer to the previous edition of the <strong>Supply</strong> <strong>Chain</strong> Guide for more information on firstgeneration<br />

Eee PCs and OLPCs)<br />

Table 5: Eee PC configuration<br />

Eee PC 901/ 904 HA/ 904 HD Eee PC 1000/ 1000HA/ 1002HD/ S101<br />

Display 8.9” LED Backlit 10"/10.2"<br />

Operating System Genuine Windows XP® Home GNU Linux<br />

Intel CPU Atom 270/ Atom 270/ Celeron M 353 Atom 270/ Atom 270/ Celeron M 353/ Atom 270<br />

HDD/SSD Storage SSD 12GB (XP),20GB (Linux)/ 160GB SSD 40GB/160GB HDD/ 160GB HDD/16GB(XP)<br />

HDD/ 160GB HDD<br />

& 32GB,64GB(Linux)<br />

Online Eee Storage 20GB/10GB/10GB 60GB/10GB/10GB/30GB<br />

Default Memory 1GB/1GB/1GB(XP) & 2GB(Linux) 1GB/1GB/1GB(XP) & 2GB(Linux)/1GB<br />

Wireless 802.11b,g,n / 802.11b,g /802.11b,g 802.11b,g,n / 802.11b,g,n / 802.11b,g<br />

/802.11b,g,n<br />

Bluetooth YES/No/No YES/ YES/ YES/ YES<br />

Webcam<br />

Source: www.asus.com.<br />

1.3M Pixel/1.3M Pixel/0.3M Pixel 1.3M Pixel/1.3M Pixel/ 1.3M Pixel/0.3M Pixel<br />

Remodeling for Asus’ Eee PC<br />

Currently, 10" models account for 70-80% of Asus’s Eee PC revenue and the<br />

company plans to launch two new 10" models in 2Q09 that will be the mainstream of<br />

its 10" models for 2H09. The ASP could stay stable in 1H09, but the blended ASP<br />

might be higher due to transition to the 10" model.<br />

HP Mini-Note<br />

The new HP 2140 Mini-Note (announced at CES 2009) uses 10" LED backlit display<br />

and 1.6GHz Atom processor. It has up to 2GB RAM, 80GB/160GB HDD, Wi-Fi and<br />

Bluetooth. In 2008, HP launched its first netbooks with 8.9" models (2133),<br />

primarily targeting the education market. The 2133 model had a high resolution<br />

display, full-sized keyboard and much better industrial design, but the CPU<br />

performance was an issue as it used VIA processors. Mini 1000 was an improvement<br />

in features but lacked in design. In this way, we believe 2140 is a blend of the best of<br />

both. HPQ substituted the Via CPU with Intel Atom in its new 2140 model.<br />

Currently, HP’s newest Mini uses Intel’s Atom and offers higher storage capacity<br />

HDD.

Bhavin Shah<br />

(852) 2800-8538<br />

bhavin.a.shah@jpmorgan.com<br />

Table 8: Inspiron Mini netbooks<br />

Asia Pacific Equity Research<br />

20 April 2009<br />

Table 6: HP Mini netbooks<br />

2140 2133 1000<br />

Operating system Windows/ Linux Linux Windows Vista Windows XP Home Linux<br />

Processor 1.6 GHz Atom 1.0GHz VIA 1.6GHz VIA 1.6 GHz Atom 1.6 GHz Atom<br />

Storage 80GB/160GB HDD 4GB Flash 120GB HDD 60GB HDD 60GB HDD<br />

DRAM<br />

Source: www.hp.com.<br />

Up to 2 GB 512 MB 2 GB Up to 1GB Up to 2GB<br />

Acer Aspire One<br />

Acer Aspire One was the highest selling netbook in 2008. Now, Acer appears to<br />

continue its aggressive push in netbooks with the launch of its 10" Aspire One model<br />

in 2009.<br />

Table 7: Inspiron Mini Netbooks<br />

8.9” 10.1”<br />

Processor 1.6GHz Intel Atom N270 1.6GHz Intel Atom N270<br />

Chipset Intel 945GSE Intel 945GSE<br />

DRAM Up to 1.5GB DDR2 SDRAM at 533 MHz Up to 2GB DDR2 SDRAM at 533MHz<br />

Operating system Windows XP Home Windows XP Home SP3<br />

Storage 120 GB Hard Drive (5400RPM) 160 GB Hard Drive (5400RPM)<br />

Display LED display WSVGA(1024X600) 10.1” LED display WSVGA(1024X600)<br />

Optical Drives None None<br />

Wireless 802.11b/g 802.11b/g<br />

Video Card Intel Graphics Media Accelerator (GMA) 950 Intel Graphics Media Accelerator (GMA) 950<br />

Battery Life 3 cell Lithium-Ion Battery 3/6 cell Lithium-Ion Battery<br />

Weight Starting at 2.2 pounds Starting at 2.9 pounds<br />

Price Starting at $270 Starting at $349<br />

Source: http://reviews.cnet.com/laptops/acer-aspire-one-aod150/4507-3121_7-33517218.html?tag=mncol;psum .<br />

Dell Inspiron Mini<br />

Dell recently entered the netbook bandwagon with Inspiron Mini 8.9" and 12.1",<br />

aiming at competing with Eee PC 901 and Macbook Air, respectively. Silverthrone is<br />

used in MIDs but Dell has used it in netbooks since it has smaller footprint and is<br />

more power efficient than Dimondville. Dell announced the launch of Mini 10 at the<br />

CES 2009. The Dell Mini 10 will have multi-touch capabilities, built-in broadband<br />

technology and built-in GPS.<br />

8.9” 12.1” 10.1”<br />

Processor 1.6GHz Intel Atom N270(Diamondville) 1.33GHz Intel Atom Z520/Z530(Silverthorne) 1.33GHz Intel Atom Z520(Silverthorne)<br />

Chipset Intel 965PM Intel US15W Intel US15W<br />

DRAM Up to 1GB DDR2 at 533 MHz 1GB DDR2 (Not expandable) 1GB2 DDR2 SDRAM at 533MHz<br />

Operating system Ubuntu/Windows XP Home Ubuntu/Windows XP Home Windows XP Home SP3<br />

Storage Up to 16GB SSD(Windows)/ 32 GB(Ubuntu) Up to 80 GB Hard Drive (4200 RPM) 120/160 GB Hard Drive (5400RPM)<br />

Display 8.9” LED display(1024X600) 12.1” widescreen (1280x800) 10.1" widescreen (1024x576)<br />

Optical Drives None None None<br />

Wireless 802.11g mini -card 802.11g mini -card 802.11g or a/g/n mini cards<br />

Bluetooth Internal (2.0) mini-card Internal (2.0) mini-card Internal (2.1) mini-card<br />

Camera Optional 0.3MP or 1.3 MP 1.3 MP 1.3 MP<br />

Video Card Intel Graphics Media Accelerator (GMA) 950 Intel®Graphics Media Accelerator 500 Intel®Graphics Media Accelerator 500<br />

Battery Life 32WHr Battery (4 cell) 24/48WHr Lithium-Ion Battery (3/6-cell) 24WHr Lithium-Ion Battery (3-cell)<br />

Weight Starting at 2.3 pounds(1.035 Kg) Starting at 2.72 pounds(1.035 Kg) Starting at 2.86 pounds(1.3 Kg)<br />

Price<br />

Source: www.dell.com.<br />

Starting at $249 Starting at $399 Starting at $399<br />

13

Bhavin Shah<br />

(852) 2800-8538<br />

bhavin.a.shah@jpmorgan.com<br />

Table 9: 12” ultra portable notebooks<br />

14<br />

Transition to larger-size ultra-portable notebooks is the new trend<br />

The current trend in the netbook space is the transition to 12" netbooks. Dell had<br />

launched Inspiron Mini 12 last year. Asus S121 (12" model) is a luxury product with<br />

the price starting at US$899. HP pavilion dv2 will soon likely debut AMD’s new<br />

ultra-thin notebook platform.<br />

Dell Inspiron Mini 12 Asus Eee PC S121 HP Pavilion dv2<br />

Processor Intel Atom Z520/Z530(Silverthorne) Intel Atom Z520 CPU(1.33GHz) 1.6-GHzAMD Athlon Neo (Yukon)<br />

DRAM 1GB DDR2 (Not expandable) DDR2 533MHz up to 2GB Upto 4GB DDR2 RAM<br />

Operating system Ubuntu/Windows XP Home Linux/Windows XP Home/Vista Home basic Windows Vista Home basic/Premium<br />

Storage Up to 80 GB Hard Drive (4200 RPM) - 1.8” SATA HDD up to 250GB / 5400RPM Upto 500GB HDD(5400 RPM)<br />

- Optional 512GB SSD (MLC)<br />

Display 12.1” widescreen (1280x800) 12” LED display, WXGA(1280X800) resolution 12” LED display, WXGA(1280X800) resolution<br />

Optical Drives None External drives supported External Blu-Ray disk support<br />

Wireless 802.11g 802.11n 802.11g/n<br />

Video Card Intel GMA 500 Intel GMA 950 ATI mobility Radeon HD 3410<br />

Battery Life 24/48WHr Lithium-Ion Battery (3/6-cell) 4 cell polymer battery 4/6 cell battery<br />

Weight Starting at 2.72 pounds(1.035 Kg) 3 pounds (1.45 Kg) Starting at 3.8 pounds<br />

Price Starting at $399 Starting at $899 Starting at $699<br />

Source: Dell, http://usa.asus.com/news_show.aspx?id=14001, http://www.ubergizmo.com/zoom.php?dir=2009/1/hp-dv2/&page=20.<br />

Figure 2: Netbook unit forecast<br />

30<br />

25<br />

20<br />

15<br />

10<br />

5<br />

-<br />

0%<br />

8%<br />

14%<br />

17%<br />

2007 2008E 2009E 2010E<br />

Netbook units (M) % of total notebook units<br />

Source: Gartner, J.P. Morgan estimates.<br />

20%<br />

16%<br />

12%<br />

8%<br />

4%<br />

0%<br />

Asia Pacific Equity Research<br />

20 April 2009<br />

Outlook for PC brands<br />

Given that the netbook is likely to be the fastest growing segment and cannibalize<br />

some of the mainstream notebook market, we believe individual brands’ strategies in<br />

this segment is quite an important determinant of market share. We have a mixed<br />

prognosis for the PC brands.<br />

Incremental for units but likely becoming a deflationary force<br />

The netbook category should continue to grow strongly in 2009 as 10" models with<br />

acceptable specs become the flagship models for most PC OEMs. However, we<br />

believe the cannibalization impact of netbooks (on mainstream consumer notebooks)<br />

should intensify as netbooks migrate to the 10" and above form factors. We expect<br />

the netbook market to grow from 11.5 million units in 2008 to 20+ million units in<br />

2009. The netbook PC, with a base price below US$400, continues to gain traction.<br />

The target customer is the consumer. With the low sticker price, we expect some<br />

users to be first-time notebook purchasers, whereas others could seek the smaller<br />

form factor for targeted mobility. In any event, we expect the netbook to drag down<br />

pricing of standard notebook PCs over time, and this is not likely to be good for<br />

anyone but the end-customer.<br />

Cannibalization widespread: Our mixed prognosis for brands<br />

We believe, over time, the line between netbooks and notebooks will blur and the<br />

low-end value notebook category will get eventually merged. We think the first sign<br />

of blurring lines between netbooks and notebooks is the 12-inch form factor, where<br />

the main difference is the price.<br />

We expect Acer to remain the leader in this segment, followed by ASUS and HPQ.<br />

Lenovo could enter this segment, but lack of established consumer channels may<br />

hamper its effort. Given its publicly stated focus on profitability and retreat from less<br />

profitable markets, Dell is not likely to be a big player in the netbook segment, in our<br />

view. In addition, Dell also lacks the channels to efficiently sell huge volumes. HP’s<br />

netbook strategy still looks quite uncertain, in our view. Our current understanding is<br />

that HP is likely to treat netbook as a very incremental market and will not likely be

Bhavin Shah<br />

(852) 2800-8538<br />

bhavin.a.shah@jpmorgan.com<br />

Asia Pacific Equity Research<br />

20 April 2009<br />

very aggressive in taking market share. If this indeed plays out, then ASUS and Acer<br />

should benefit significantly in the netbook space. Japanese PC brands are likely to be<br />

the worst hit from this phenomenon. In 4Q08, we saw proliferation of netbooks<br />

starting to adversely affect the profitability of these brands. We expect incremental<br />

unit upside to benefit notebook ODMs and component vendors.<br />

Challenges for the netbook segment<br />

Low-priced models: Open price point schemes<br />

OEMs, such as HPQ and Acer, have dedicated product development teams (open<br />

price point teams), which design customized products for emerging markets. These<br />

teams often utilize low-priced components (in some cases, shifting to the Taiwan<br />

food chain), with limited warranty and no bundling of software or OS to reduce price<br />

points. Open price point schemes at several PC OEMs are more suited to address the<br />

emerging market need, in our view. Our checks suggest that HP is extending the<br />

offer of OPP (open price point) models from the emerging market to a global launch.<br />

Netbooks could be a temporary fad or a longer-term deflationary force<br />

We believe there will be interest for netbooks as the second-generation products start<br />

shipping, but we are not sure that this emerging segment has staying power. If<br />

anything, netbooks could pressure ASPs for more traditional notebooks, but even this<br />

risk could be minor, as we think netbooks could eventually lose to smartphones. Our<br />

current PC forecast incorporates a higher level of ASP erosion in notebook PCs due<br />

to the netbook.<br />

Netbooks could give way to the smartphones over time<br />

The biggest advantage of netbooks is that it is a mobility device with easy internet<br />

access but it may have to face some competition from iPhone and similar devices,<br />

which are simplifying internet access in mobile phones. A certain segment of<br />

consumers might prefer using a handset device, instead of a sub-notebook, as their<br />

mobility device. Acer’s and ASUS’s move to co-operate with operators and bundle<br />

3.5G data cards in low-cost PCs is an indication of this potential convergence. Over<br />

time, we think there is risk that the netbook could cede whatever market presence it<br />

captures to smartphones. The netbook is intended to be an ultra-portable device that<br />

provides the end-user some software applications with the focus more on email and<br />

internet browsing—and in our view, this is the problem. For now, the netbook does<br />

not pack enough processor and software capabilities to have the look and feel of a<br />

PC. Instead, it feels more like a smartphone, but with a more expensive price point<br />

and without the telephone calling capabilities.<br />

How Apple could introduce a netbook-like device<br />

The following section up to ‘All-in-one PCs’ has been excerpted from our US IT<br />

hardware and imaging analyst Mark Moskowitz's report, “Our Vision of How Apple<br />

Could Introduce a Netbooklike Device,” originally published on 13 March 2009.<br />

Please see MorganMarkets for the full report.<br />

We believe 2009 is the right time for Apple to enter the netbook PC market.<br />

Speculation about a netbook-like device from Apple has picked up in recent weeks.<br />

We think such an entry makes sense as the company could further cement its<br />

leadership in consumer electronics products. Here, we do not expect Apple to<br />

diminish its high-end stature, and we estimate a netbook-like device would be<br />

accretive to Apple’s gross margins.<br />

15

Bhavin Shah<br />

(852) 2800-8538<br />

bhavin.a.shah@jpmorgan.com<br />

The timing is right for Apple's<br />

entry into netbook-like devices<br />

Apple’s netbook-like product<br />

would be differentiated and not<br />

so cannibalistic<br />

Price points could be US$499 for<br />

32GB and US$599 for 64GB<br />

We think Apple’s “netbook” will<br />

be accretive<br />

Table 10: Comparison of 8GB iPod touch and 32GB and 64GB “Netbook-like” Devices<br />

16<br />

Given the momentum behind lower cost PCs, i.e. netbooks, and an increasingly price<br />

sensitive consumer, we believe it is important for Apple to introduce new CE<br />

products in the sub-$800 price range. Apple is more than a PC company, and with<br />

the introduction of a netbook-like device, the company would sustain its leading CE<br />

stature while addressing a new market having longer term growth potential.<br />

Apple, unlike other PC-related companies, has the platform to introduce a netbooklike<br />

device that is both differentiated and has limited cannibalization impact on its<br />

existing product offerings. In our view, a larger, enhanced iPod touch-like device<br />

could be a reasonable progression. The device could be a music player, netbook PC,<br />

gaming handheld, and a portable Internet device, all in one. We would expect the<br />

keyboard to be touch-screen, distinguishing from other netbook PCs.<br />

Our view on Apple’s potential netbook-like device includes all of the current iPod<br />

touch capabilities, plus a larger 10-inch touch screen, wireless (3G data and<br />

Bluetooth, in addition to Wi-Fi), and higher storage capacities. With any netbooklike<br />

device, we expect Apple to chose an elastic price band in the US$499-599 range<br />

(with the help of carrier subsidies) to keep enough separation from its entry<br />

Macbooks and iPhone/iPod touch lines.<br />

Given rapid component cost declines and a robust margin profile on the iPod touch,<br />

we believe that the addition of a new netbook-like device should be accretive to the<br />

model, at gross margins at or above 50%. Note that we assume that the 8GB iPod<br />

touch held close to 50% gross margins at its initial release. The 8GB product’s<br />

margins have improved over time due to supplier management, redesign, and steep<br />

declines in component pricing.<br />

8GB iPod touch 32GB Netbook-like device 64GB netbook-like device<br />

iPod touch components US$47 iPod touch components US$47 iPod touch components US$47<br />

Flash 8GB US$12 Flash 32GB US$44 Flash 64GB US$90<br />

Touch screen and LCD module US$35 Touch screen and LCD module US$106 Touch screen and LCD module US$106<br />

Additional BOM (3G, Bluetooth, camera,<br />

Additional BOM (3G, Bluetooth, camera,<br />

GPS, etc.) US$50 GPS, etc.) US$50<br />

Total iPod touch bill of materials US$94 Total 32GB “netbook” bill of materials US$247 Total 64GB “netbook” bill of materials US$293<br />

Manufacturing US$5 Manufacturing US$5 Manufacturing US$5<br />

Total cost of sales US$99 Total cost of sales US$252 Total cost of sales US$298<br />

Gross margin 57% Gross margin 50% Gross margin 50%<br />

Selling price<br />

Source: J.P. Morgan estimates.<br />

US$229 Selling price US$499 Selling price US$599<br />

Figure 3: MacBook Air<br />

Source: www.apple.com.<br />

Asia Pacific Equity Research<br />

20 April 2009<br />

Ultra-slim laptop: MacBook Air<br />

In January 2008, Apple launched an ultra-slim laptop—MacBook Air—which weighs<br />

40% less. It is also the first Apple notebook with Al casing, multi-touch touchpad<br />

and optional solid-state drive. The starting price point is US$1799. Macbook Air<br />

could set the trend for ultra-portable notebooks, which by our estimate have less than<br />

10% share of the overall notebook segment. At the CES 2009, Dell confirmed the<br />

launch of luxury laptop Dell Adamo. This much thinner notebook is likely to counter<br />

the Macbook Air, in our view.

Bhavin Shah<br />

(852) 2800-8538<br />

bhavin.a.shah@jpmorgan.com<br />

Table 11: Comparison of various Macbook models<br />

Macbook Air Macbook Macbook Pro<br />

Price Starting at US$1,799 Starting at US$1,099 Starting at US$1,999<br />

Weight 3.0 pounds (1.36 kg) 5.0 ponnds (2.27 kg) 5.4 pounds<br />

Height 0.16-0.76 inch (0.4 - 1.94 cm) 1.08 inches (2.75 cm) 1 inch<br />

Screen 13.3" LED backlight 13.3" TFT LCD 15"/17" TFT LCD<br />

Processor Intel Core 2 Duo processor 1.6 - 1.8 GHz Intel Core 2 Duo processor 2.0-2.2 GHz Intel Core 2 Duo processor 2.2-2.4 GHz<br />

Memory 2 GB 1 GB 2 GB<br />

Storage 80 GB parallel ATA hard disk drive (Optional 64 80 GB Serial ATA HDD 120 GB Serial ATA HDD<br />

GB solid state drive)<br />

Operating System Mac OSXv10.5 Leopard Mac OSXv10.5 Leopard Mac OSXv10.5 Leopard<br />

Casing Al casing in silver Plastic in white/black<br />

Wireless Built-in 11n WLAN + Bluetooth Built-in 11n WLAN + Bluetooth Built-in 11n WLAN + Bluetooth<br />

Battery Life 5 hours wireless, Lithium Polymer ~hours battery life, 55W Lithium Polymer ~hours battery life, Lithium Polymer<br />

Touchpad Solid state track pad with multi-touch gesture<br />

support for precise cursor control<br />

Source: Company, J.P. Morgan.<br />

Asia Pacific Equity Research<br />

20 April 2009<br />

Solid-state scrolling track pad for precise cursor<br />

control<br />

Solid-state scrolling track pad for precise<br />

cursor control<br />

All-in-one PCs<br />

A chance for NB ODMs to further cannibalize desktop vendors<br />

Netbook and all-in-ones are cheaper than their alternatives from a total cost<br />

perspective. Besides, they also offer significant upgrade in user experience, which<br />

makes them the most promising new product trends, in our view.<br />

Figure 4: Traditional PC set evolves into stylish all-in-one PC<br />

Source: http://www.pclaptop-review.com/.<br />

All-in-one used to be a niche segment. However, today if one goes to Dell or HP<br />

website, they have now put desktop and all-in-one PCs in the same category. Almost<br />

every brand is coming up with products on this front. We believe there are 15-20<br />

RFQ projects for 2009/10, tripled from 2008 level. An important catalyst for this<br />

take-off is the stabilization of LCD monitor size. When panel prices keep falling,<br />

people would like to replace the monitor separately. Now, with the monitor size<br />

likely to stabilize at 19"W or 22"W, it makes sense to combine the two systems; it is<br />

10%-15% cheaper than separate systems due to the elimination of mechanical parts,<br />

while importantly it saves some space as well. The touch function could also become<br />

an important enabler of this trend. Most of the models in the pipeline have some form<br />

of touch-screen functionality. Enabling touch-screen interface will necessitate an<br />

integrated design approach (notebook like), compared to the highly modular design<br />

approach which has been used in desktops so far. This could work in favor of all-inone<br />

configuration. Windows 7 could be quite important in this regard.<br />

Notebook ODMs: Order reshuffling in unusual manner<br />

Recently, brands have continued to reshuffle orders among ODMs in an attempt to<br />

induce more ODM price competition. HP will extend Wistron’s low-price consumer<br />

17

Bhavin Shah<br />

(852) 2800-8538<br />

bhavin.a.shah@jpmorgan.com<br />

18<br />

Asia Pacific Equity Research<br />

20 April 2009<br />

project (OPP) on the AMD platform until late 3Q, which is scheduled to end in April,<br />

thus cutting down Quanta’s share. Acer will debut its 10.2" Aspire One model with<br />

Compal in February, but now it will also launch another 10.2" slim-type model from<br />

Quanta in April, while increasing Inventec’s share in notebooks. Toshiba plans to cut<br />

Inventec’s share from 70% to

Bhavin Shah<br />

(852) 2800-8538<br />

bhavin.a.shah@jpmorgan.com<br />

Asia Pacific Equity Research<br />

20 April 2009<br />

For the virtualized PC, the end-user would still have a keyboard, mouse and display,<br />

but there would not be a physical PC system at the desk. To point, Figure 5 illustrates<br />

the end user accessing a virtual desktop (no PC asset on desk), which receives a<br />

unique desktop profile, applications, and operating system from the thin-client<br />

environment.<br />

Figure 5: Diagram of desktop virtualization<br />

Source: Citrix.<br />

It is clear that the thrust of desktop PC virtualization is to lower operational costs.<br />

Toward that end, we could see large enterprises deploying desktop PCs in a<br />

virtualized, server-centric environment for certain front-office and back-office<br />

functions. For instance, in banking, we could see a greater level of branch tellers and<br />

loan managers move to virtualized PC platforms. In insurance, claims and billing<br />

agents could take advantage, or at hospitals, doctors could access patient records<br />

through virtual PC kiosks. The net effect of desktop PC virtualization could be a drag<br />

on PC unit sales, but on the back-end, there could be upward pressure on servers due<br />

to capacity requirements to manage and serve the desktop profiles.<br />

19

Bhavin Shah<br />

(852) 2800-8538<br />

bhavin.a.shah@jpmorgan.com<br />

20<br />

Asia Pacific Equity Research<br />

20 April 2009<br />

Server market<br />

Servers are the workhorses of corporate networks and the Internet. Their major<br />

applications include computing the staggering number of calculations needed to<br />

serve web pages, access databases, and run networked corporate applications. After a<br />

sharp post-bubble recovery, the server market’s revenue growth has decelerated to<br />

low- to mid-single digits since 2004.<br />

Servers: A muted outlook<br />

According to Gartner, the global server market was ~$53.1 billion in 2008. Last year,<br />

server revenue and units declined by 4.1% and 2.6%, respectively. We think that a<br />

combination of macro pressure and the effects of virtualization could dampen this<br />

already meager growth profile in the long run. Looking to 2009, we expect the server<br />

industry’s total revenue and units to decline by 18.1% and 11.3%, respectively.<br />

In the near- to mid-term, all bands within servers could be impacted in case of a<br />

prolonged economic slowdown. In past downturns, the higher-end systems or “big<br />

iron” typically were most impacted. Also, we note that general ASP trends could<br />

come under pressure if the macroeconomic environment worsens and server vendors<br />

look to protect market positions with pricing actions.<br />

Figure 6: Macro environment and virtualization could dampen revenue growth prospects<br />

US$ in billions, units in millions<br />

$58<br />

$56<br />

$54<br />

$52<br />

$50<br />

$48<br />

$46<br />

$44<br />

$42<br />

$40<br />

2004 2005 2006 2007 2008 2009E 2010E<br />

Revenue($ billions) Units(million)<br />

Source: Gartner Servers Quarterly Statistics Worldwide Database, March 2009; J.P. Morgan estimates for 2009-2010.<br />

Analysis of market servers<br />

We analyze the server systems market in two tiers—Back-end and Front-end<br />

systems. Back-end systems are “heavy lifters” in the enterprise IT center, managing<br />

transaction-intensive software such as Enterprise Resource Planning (ERP) and<br />

database systems. Front-end systems reside on the edge of the network and tend to<br />

handle file-intensive applications such as file, print, and web serving, and other<br />

applications such as e-mail and collaborative business software. In this section, we<br />

also discuss blade servers, which are helping blur the line between commodity and<br />

proprietary systems. Finally, we discuss the impact of virtualization on the server<br />

market.<br />

10<br />

9<br />

8<br />

7<br />

6<br />

5<br />

4<br />

3<br />

2<br />

1<br />

0

Bhavin Shah<br />

(852) 2800-8538<br />

bhavin.a.shah@jpmorgan.com<br />

Traditional Mainframe and UNIX<br />

servers are the back-end of the<br />

datacenter; industry standard<br />

servers are more front-end<br />

Within industry standard<br />

servers, there are non-blade and<br />

blade architectures<br />

Asia Pacific Equity Research<br />

20 April 2009<br />

Back-end servers are the “big iron” within the datacenter. Big iron systems typically<br />

have a more proprietary look in terms of vendor-specific components (i.e.,<br />

microprocessors), operating systems, and firmware. Typically, these servers are<br />

Mainframe or UNIX platforms that perform the heavy-lifting of critical applications<br />

such as ERP, finance, database management, etc. The growth days of these system<br />

platforms have passed, in our view.<br />

In contrast, we define industry standard servers as sitting more on the front-end of<br />

the datacenter, running web, e-mail, and file applications. Industry standard servers<br />

utilize standard components, specifically, x86 microprocessors, and mostly run<br />

distributed operating systems such as Windows or Linux. Looking ahead, the growth<br />

of industry standard servers should far exceed that of big iron, but it could ease due<br />

to server virtualization.<br />

Within the industry standard server category, there are non-blade and blade server<br />

architectures. Blade servers have some proprietary features, while non-bladed servers<br />

do not. Both form factors typically utilize x86 microprocessors and run Windows or<br />

Linux workloads, which underpin the industry standard server category as we define<br />

it.<br />

With blade servers, the proprietary features are the chassis and firmware being<br />

vendor-specific. Despite these two proprietary features, blade servers possess better<br />

performance, power/cooling, cabling, and management metrics than non-bladed<br />

industry standard servers. We expect blade servers to exhibit increasing wallet share<br />

within the industry standard server category, and in general, the broader server<br />

market over the long run. We believe that incremental technology improvements in<br />

blade servers could eventually push the systems into more critical applications,<br />

historically a focus of back-end servers. (Please refer to the previous edition of our<br />

<strong>Supply</strong> <strong>Chain</strong> Guide for a detailed description of market servers.)<br />

Table 13: Worldwide total server vendor revenue and unit market share analysis<br />

Based on total worldwide server sales, US$<br />

2006 2007 2008<br />

Dell<br />

revenue share 10.5% 11.3% 11.6%<br />

unit share<br />

H-P<br />

21.7% 21.4% 22.7%<br />

revenue share 27.0% 29.1% 29.5%<br />

unit share<br />

IBM<br />

27.5% 29.8% 30.9%<br />

revenue share 32.0% 30.8% 31.0%<br />

unit share<br />

Sun Microsystems<br />

15.7% 14.5% 13.3%<br />

revenue share 10.8% 10.6% 10.1%<br />

unit share 4.5% 3.8% 3.8%<br />

Total Market $52,803,081,741 $55,387,729,664 $53,119,958,036<br />

Y/Y % change 2.3% 4.9% -4.1%<br />

units 8,233,964 8,840,812 9,069,410<br />

Y/Y % change 8.9% 7.4% 2.6%<br />

Source: Gartner Servers Quarterly Statistics Worldwide Database, 03/09.<br />

21

Bhavin Shah<br />

(852) 2800-8538<br />

bhavin.a.shah@jpmorgan.com<br />

22<br />

Asia Pacific Equity Research<br />

20 April 2009<br />

Table 14: J.P. Morgan’s global server forecasts<br />

US$ in millions, units in 000s<br />

2007 1Q08A 2Q08A 3Q08A 4Q08 2008 1Q09E 2Q09E 3Q09E 4Q09E 2009E 2010E<br />

Total server revenue 55,388 13,483 13,808 12,717 13,110 53,120 10,558 10,624 10,399 11,944 43,525 44,159<br />

Windows 21,192 5,255 5,115 4,994 4,714 20,078 4,043 3,969 4,008 4,330 16,350 16,701<br />

UNIX 16,876 4,074 4,322 3,650 4,074 16,120 3,292 3,367 3,034 3,669 13,362 13,391<br />

Linux 8,426 2,076 2,028 2,102 1,880 8,087 1,661 1,608 1,680 1,718 6,667 6,815<br />

Other 8,894 2,079 2,344 1,971 2,442 8,835 1,562 1,679 1,678 2,227 7,146 7,253<br />

% of total revenue<br />

Windows 38.3 39.0 37.0 39.3 36.0 37.8 38.3 37.4 38.5 36.3 37.6 37.8<br />

UNIX 30.5% 30.2 31.3 28.7 31.1 30.3 31.2 31.7 29.2 30.7 30.7 30.3<br />

Linux 15.2% 15.4 14.7 16.5 14.3 15.2 15.7 15.1 16.2 14.4 15.3 15.4<br />

Other 16.1% 15.4 17.0 15.5 18.6 16.6 14.8 15.8 16.1 18.6 16.4 16.4<br />

Y/Y % change<br />

Total server revenues 4.9 2.0 3.9 -5.4 -15.1 -4.1 -21.7 -23.1 -18.2 -8.9 -18.1 1.5<br />

Windows 12.9 2.3 1.3 -6.0 -17.2 -5.3 -23.1 -22.4 -19.8 -8.1 -18.6 2.1<br />

UNIX 2.1 3.1 4.4 -10.1 -13.7 -4.5 -19.2 -22.1 -16.9 -9.9 -17.1 0.2<br />

Linux 10.2 3.1 0.2 -1.8 -16.4 -4.0 -20.0 -20.7 -20.1 -8.6 -17.6 2.2<br />

Other -9.7 -1.7 12.9 2.2 -12.0 -0.7 -24.9 -28.3 -14.9 -8.8 -19.1 1.5<br />

Total server units 8,841 2,271 2,341 2,318 2,140 9,069 1,940 1,987 2,032 2,082 8,041 8,359<br />

Windows 5,906 1,523 1,574 1,561 1,443 6,100 1,299 1,338 1,368 1,403 5,408 5,620<br />

UNIX 632 152 157 149 148 605 130 130 132 139 531 548<br />

Linux 2,095 551 563 568 509 2,192 477 485 497 502 1,961 2,045<br />

Other 208 45 47 40 40 172 34 35 35 38 142 145<br />

% of total units<br />

Windows 66.8 67.1 67.2 67.3 67.5 67.3 67.0 67.3 67.3 67.4 67.3 67.2<br />

UNIX 7.1 6.7 6.7 6.4 6.9 6.7 6.7 6.5 6.5 6.7 6.6 6.6<br />

Linux 23.7 24.3 24.0 24.5 23.8 24.2 24.6 24.4 24.4 24.1 24.4 24.5<br />

Other 2.4 2.0 2.0 1.7 1.9 1.9 1.8 1.7 1.7 1.8 1.8 1.7<br />

Y/Y % change<br />

Total server units 7.4 7.5 12.2 4.4 -11.7 2.6 -14.6 -15.1 -12.4 -2.7 -11.3 4.0<br />

Windows 9.0 8.2 12.6 5.2 -10.8 3.3 -14.7 -15.0 -12.3 -2.8 -11.3 3.9<br />

UNIX -5.8 -0.3 -1.0 -4.7 -10.5 -4.2 -14.5 -17.2 -11.5 -5.7 -12.3 3.3<br />

Linux 9.6 11.3 17.5 6.6 -13.4 4.6 -13.5 -13.9 -12.7 -1.2 -10.5 4.3<br />

Other -11.4 -20.8 -7.3 -17.1 -23.7 -17.3 -24.1 -26.5 -12.5 -5.5 -17.7 2.7<br />

Source: Gartner Servers Quarterly Statistics Worldwide Database, March 2009; estimates for 2009/2010 are from J.P. Morgan.

Bhavin Shah<br />

(852) 2800-8538<br />

bhavin.a.shah@jpmorgan.com<br />

Based on inputs from primary<br />

research contacts, servers<br />

possess utilization rates below<br />

20%, versus 40-50% for storage<br />

systems<br />

Asia Pacific Equity Research<br />

20 April 2009<br />

Key segment themes to follow in servers<br />

We expect to hear a lot about server virtualization, blade servers, and how the<br />

Mainframe would remain vibrant in the next 12-18 months. There could be<br />

increasing adoption of server virtualization software, but its lasting impact on server<br />

units and revenues could be deflationary, in our view. The performance benefits of<br />

blade servers could blunt the sales velocity of non-bladed industry standard servers.<br />

At the same time, there could be increased focus on developing tools or standards to<br />

work around the proprietary backplane and software of blade servers. We expect the<br />

proprietary lock to persist, as vendors appreciate the renewed switching costs for<br />

customers. In UNIX, there could be an increasing level of pitched battles if the<br />

macroeconomic environment cools, as this market can be more vulnerable to tighter<br />

spending conditions.<br />

Table 15: Key segment themes to follow in servers<br />

1. Virtualization – early positive, long-term negative for servers<br />

2. Blade server momentum could partially counter macro<br />

3. Proprietary lock not likely to go into extinction yet<br />

4. UNIX could turn into a battleground if the macro cools<br />

5. Mainframe cycle could provide IBM a partial macro buffer<br />

Source: J.P. Morgan.<br />

Server Theme #1: Virtualization—Early positive, long-term negative<br />

We think the disruptive technology of server virtualization will continue to grab the<br />

attention of investors. There is an argument that virtualization could be a boon for<br />

hardware and related software and services sales. In early stages, virtualization could<br />

drive greater systems management complexity, requiring more hardware and postsales<br />

support.<br />

While debatable, we think that server virtualization will ultimately be a deflationary<br />