You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>TOLL</strong> GROup<br />

32 tOLL tOdAY<br />

Australian tax summary<br />

With the end of financial year around the corner, it is almost ‘tax time’…again! Australian toll<br />

employees and contractors should be careful when declaring all assessable income and claiming<br />

eligible tax deductions, particularly in light of significant data matching conducted by the AtO.<br />

We draw your attention to the eight most common<br />

tax return errors:<br />

• omitting interest income<br />

• understating income<br />

• incorrect or omitted dividend imputation credits<br />

• Capital gains / losses are incorrect or omitted<br />

• Home office expenses<br />

• Depreciation on rental property fixtures and fittings<br />

• Depreciation on income producing buildings, and<br />

• Borrowing costs associated with negative gearing.<br />

This article outlines the key areas of interest and handy end<br />

of year tax hints to assist taxpayers with their ongoing tax<br />

compliance obligations.<br />

Lodgement date – late October 2011 (TbC)<br />

Failure to lodge on time may result in non-deductible late<br />

lodgement penalties. Taxpayers lodging through a registered<br />

tax agent may have a later lodgement due date in line with<br />

tax agent lodgement programs, but should confirm with their<br />

tax advisor.<br />

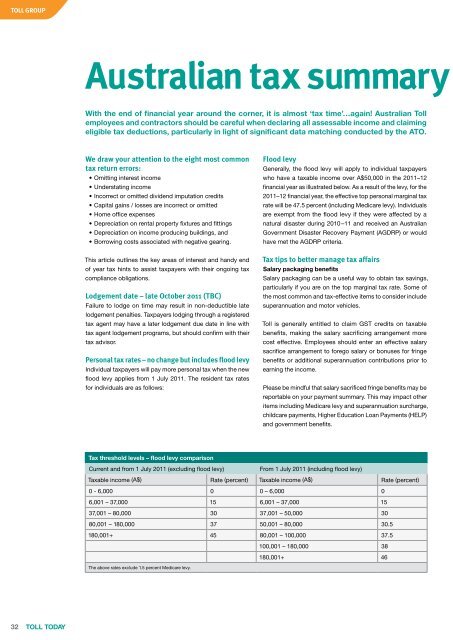

personal tax rates – no change but includes flood levy<br />

individual taxpayers will pay more personal tax when the new<br />

flood levy applies from 1 July 2011. The resident tax rates<br />

for individuals are as follows:<br />

tax threshold levels – flood levy comparison<br />

Flood levy<br />

Generally, the flood levy will apply to individual taxpayers<br />

who have a taxable income over a$50,000 in the 2011–12<br />

financial year as illustrated below. as a result of the levy, for the<br />

2011–12 financial year, the effective top personal marginal tax<br />

rate will be 47.5 percent (including medicare levy). individuals<br />

are exempt from the flood levy if they were affected by a<br />

natural disaster during 2010 –11 and received an australian<br />

Government Disaster recovery payment (aGDrp) or would<br />

have met the aGDrp criteria.<br />

Tax tips to better manage tax affairs<br />

salary packaging benefits<br />

salary packaging can be a useful way to obtain tax savings,<br />

particularly if you are on the top marginal tax rate. some of<br />

the most common and tax-effective items to consider include<br />

superannuation and motor vehicles.<br />

<strong>Toll</strong> is generally entitled to claim GsT credits on taxable<br />

benefits, making the salary sacrificing arrangement more<br />

cost effective. employees should enter an effective salary<br />

sacrifice arrangement to forego salary or bonuses for fringe<br />

benefits or additional superannuation contributions prior to<br />

earning the income.<br />

please be mindful that salary sacrificed fringe benefits may be<br />

reportable on your payment summary. This may impact other<br />

items including medicare levy and superannuation surcharge,<br />

childcare payments, Higher education loan payments (Help)<br />

and government benefits.<br />

Current and from 1 July 2011 (excluding flood levy) From 1 July 2011 (including flood levy)<br />

Taxable income (a$) rate (percent) Taxable income (a$) rate (percent)<br />

0 - 6,000 0 0 – 6,000 0<br />

6,001 – 37,000 15 6,001 – 37,000 15<br />

37,001 – 80,000 30 37,001 – 50,000 30<br />

80,001 – 180,000 37 50,001 – 80,000 30.5<br />

180,001+ 45 80,001 – 100,000 37.5<br />

The above rates exclude 1.5 percent medicare levy.<br />

100,001 – 180,000 38<br />

180,001+ 46